The market has a way of humbling even the most seasoned investors. Just a few weeks ago, we were navigating a landscape riddled with uncertainty: tech stocks were reeling from the unexpected rise of DeepSeek, and the broader market was bracing for the economic implications of President Trump's aggressive tariff policies. The culmination of these factors led to a dramatic sell-off post "Liberation Day,” with the Nasdaq plunging 11% over two days and the S&P 500 shedding 10% – among the largest two-day losses in history.

From the start of the year through early April, the major indices experienced significant declines. The Nasdaq Composite fell approximately 23% from its February high, the S&P 500 dropped around 19% from its previous high, and the Russell 2000 declined by about 24%.

But markets are nothing if not unpredictable. In a stunning reversal, the Nasdaq has surged 25%-ish from its lows, the S&P 500 has climbed 17%, and the Russell 2000 has rebounded by 19%. These gains were largely concentrated in brief, explosive sessions – Citi noted that owning the S&P 500 for just 60 minutes in the last month would have captured most of the recovery, highlighting the outsized impact of policy announcements on following market movements.

Adding to the bullish momentum, the S&P 500 recorded eight consecutive days of gains, marking its longest winning streak since August.

This rapid rebound has left many investors on the sidelines, grappling with the emotional toll of missed opportunities.

If you find yourself in this position, know that you're not alone. In the sections that follow, I'll explore the psychological challenges of investing, the importance of patience, and strategies for navigating volatile markets.

The Emotional Tax of Missing the Move

There’s something uniquely gutting about watching the market surge while you’re still sitting on the sidelines, paralyzed by indecision or clinging to the hope of even lower prices.

It’s not just about the money you didn’t make – it’s the psychological weight of watching others win while you hesitate.

This latest rally was particularly brutal in that regard. The rebound happened fast – almost too fast.

In just a few sessions, prices ripped higher, driven not by improving fundamentals or earnings revisions, but by narrative shifts and sudden macro / policy reversals.

It was almost theatrical. The administration’s walk-back of the “Liberation Day” tariffs was the spark, but it was the implied end of the drama – the “deal” with China – that truly set off the short covering and momentum-driven buying.

If you didn’t pull the trigger when stocks were down, you probably didn’t even get a chance to ease into positions before they were already up 10–15%. It was like showing up to a fire sale only to find the shelves already half-empty and prices creeping back to full.

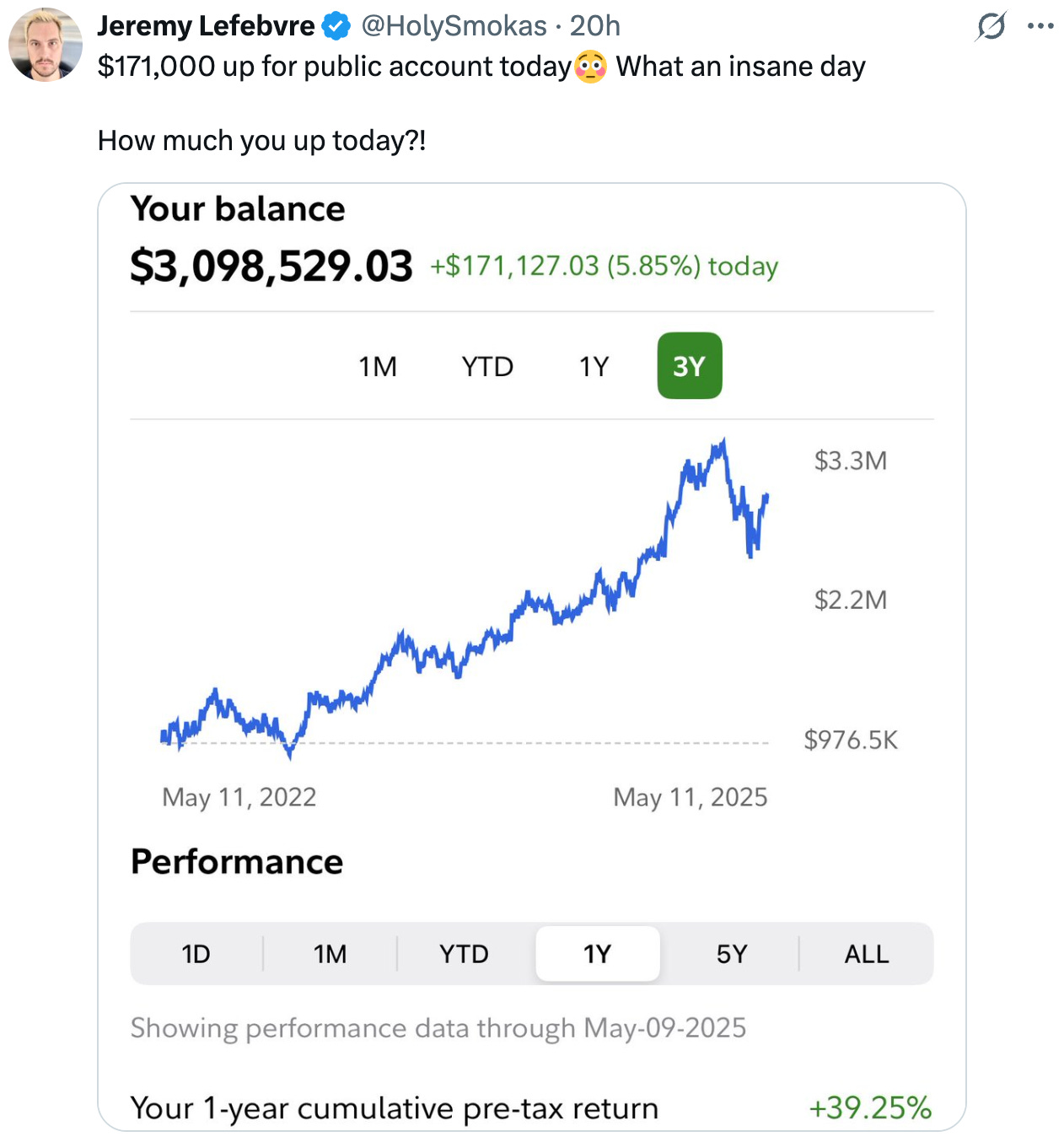

To make matters worse, if you’re anywhere near FinTwit, you were likely bombarded with screenshots of green portfolios, victory laps, and subtle (or not-so-subtle) digs at those who didn’t buy the dip. As the account Wolf of Harcourt Street aptly put it:

It’s hard not to feel like you missed something – like you failed in some way. And that feeling can eat at you if you let it, leaving you paralyzed.

But here’s the thing: that gut punch? That’s part of the game.

This isn’t a personal shortcoming. It’s just a consequence of how markets – and emotions – work. I’ll get into that next.

Regret Is Built into the Game – Deal With It!

Regret is baked into the investor’s experience. Whether you’ve been investing for six months or two decades, the feeling never entirely goes away. Sometimes it's a faint whisper; other times, it’s a full-throated scream. But it’s always there – lingering.

In fact, social media may amplify those emotions and you need to learn how to deal with them.

Regret is built into the game of investing as investing forces you to make decisions with incomplete information. You never have perfect foresight. You’ll sell too early, you’ll buy too late, you’ll hold something that tanks, or you’ll miss out on something that rips. And even if you get the general trend right – say, identifying a market bottom – you might still fumble the execution (e.g. not loading up big enough).

So yes, you'll always feel regret in investing. The key is learning how to live with it and, more importantly, how to not let it dictate your process.

I wrote about this dynamic in my earlier piece, “Everyone Thinks the Market Is Doomed! But The Data Says Otherwise…” In that post, I laid out why – even amidst the chaos – there were strong signals pointing toward a potential bottom in early April. Breadth thrusts, sentiment extremes, capitulation-like volumes. The market was flashing classic recovery signs. But the truth is: acting on that insight still wasn’t easy. You had to choose between buying quality names at fair – but not fire-sale – prices, or sitting on your hands and waiting for something closer to an actual “no-brainer.”

Personally, I chose the latter. Not because I thought the market wouldn’t recover, but because I didn’t see anything that truly screamed, buy me now. I’m not in the business of chasing 20% drawdowns that leave me feeling lukewarm about the business.

And I’ll be honest: I have to disagree with people like WastelandCapital, who tweeted:

“What an incredible gift that sell-off was. Imagine being able to buy quality compounders at sudden 20–50% discounts, just like that. Crazy, huh!? Except it happens over and over again, like clockwork.”

I don’t think that’s true. Sure, prices came down. But discounts aren’t the same thing as bargains. I think Sam Hollanders wrote in a WhatsApp chat recently that a $5 apple in a basket of more expensive apples remains expensive.

Similarly, this time around, most of what I saw felt like discounted multiples, not discounted businesses.

That’s a big difference.

For me, it comes back to how rarely truly compelling opportunities come around. I transact infrequently. And that’s by design. I believe patience adds more alpha than action does, especially if you zoom out. Most stocks aren’t true bargains even when they’re down. And when they are, it’s usually obvious – not in price action, but in the sheer disconnect between business value and market value.

Warren Buffett once put this beautifully:

“Understandably, really outstanding businesses are very seldom offered in their entirety, but small fractions of these gems can be purchased Monday through Friday on Wall Street and, very occasionally, they sell at bargain prices. We are impartial in our choice of equity vehicles, investing in either variety based upon where we can best deploy your (and my family's) savings. Often, nothing looks compelling; very infrequently, we find ourselves knee-deep in opportunities.”

And at this year’s Berkshire Hathaway Annual Meeting – his last as CEO – Buffett elaborated on that mindset in what I thought was one of the most instructive things he’s ever said. I’ve included the full quote below, because it captures not only his approach, but also why inaction is often a form of strategy in this game:

“When something is offered that makes sense to us and that we understand and offers good value, and where we don't worry about losing. And the one problem with the investment business is that things don't come along in an orderly fashion, and they never will. I mean, it isn't like every day. The long-term record is sensational, but that is not a product. And I've been… see, I've had 200 trading days times 80 years – 16,000 trading days.

It would be nice if every day you got four opportunities, or something like that. And, you know, they were expected to be equally attractive. If I was running a numbers racket, you know, every day would have the same expectancy, that I would keep 40% of whatever the handle was. And so the only question would be, how much was transacted? But we're not running that kind of business.

We're running a business which is very, very, very opportunistic. And Charlie always thought I did too many things. He thought if we did about five things in our lifetime, we’d end up doing better than if we did fifty.”

That’s how I try to operate, too. I’m not here to do fifty things a year. I’m here to do five great ones (or two, or just one for that matter!) when the stars align.

And if that means sitting tight through a rebound I didn’t fully participate in? So be it. I honestly don’t care.

The market isn’t a game of precision. It’s a game of process.

Obviously, it also makes a big difference whether you’re sitting on 10% in cash or 90% (but that would be another discussion).

More from the GOAT

There’s something uniquely calming about hearing Warren Buffett talk about market chaos – because he almost never sounds surprised. That’s not because he can predict the future. It’s because he doesn’t try. His worldview is built around the idea that chaos, volatility, and confusion aren’t exceptions in investing – they’re the norm.

This year’s Berkshire Hathaway Annual Meeting was a powerful reminder of that. It marked Buffett’s final meeting as CEO, and while there were plenty of reflective moments, it was his commentary on the recent tariff turmoil that stuck with me most. As markets were swinging back and forth in response to policy headlines, Buffett essentially shrugged and said: “Nothing new here.”

Here’s what he said, verbatim:

“What has happened in the last 30, 45 days, 100 days, whatever you want to pick… whatever this period has been, it’s really nothing. There’ve been three times since we acquired Berkshire that Berkshire has gone down 50%, and over a very short period of time… nothing was fundamentally wrong with the company at any time.

But this? This is not a huge move. The Dow Jones Average hit 381 in September of 1929. It got down to 42.”

“It’s really nothing“ … Just think about that for a moment. Buffett is telling us – again – that volatility is just noise unless the underlying business fundamentals are permanently impaired. Berkshire has dropped 50% three times, and in none of those instances was anything actually wrong. The same logic applies to the broader market.

When the Nasdaq shed 11% in two days earlier this year, it felt dramatic. And sure, in the moment, it was. But the violent recovery that followed – a 25% surge – shows how often these selloffs are more about sentiment than substance.

The market didn’t find its footing because earnings suddenly improved or economic growth reaccelerated. It bounced because the White House started reversing its own self-inflicted wounds. Tariff threats got watered down. A “deal” with China was floated.

Suddenly, risk-on was/is back in fashion.

And yet, if you had asked Buffett whether any of that changed the long-term outlook for businesses he admired, you already know what he would’ve said.

Markets move in fits and starts. Headlines come and go. Administrations flip their stances. Algorithms chase momentum. But the underlying principles of investing – buying great businesses at reasonable prices and holding them long enough for the market to catch up – don’t change.

So when I look back on this recent episode, I don’t see a failure to act. I see a reminder. A reminder that you don’t need to respond to every dip. That you don’t need to treat every swing like a signal. And that, most of all, you don’t need to predict what happens next.

You just need to be ready when it actually matters.

So What Now? It Depends Who You Are

When the dust settles after a sharp market rebound, the natural question becomes: what now? What should you do if you're still sitting on cash? Should you chase? Should you wait? Should you panic, pivot, double down, or disconnect entirely?

I understand that market movements can sometimes feel overwhelming.

Well – as unsatisfying as this may sound – it depends. Specifically, it depends on what kind of investor you are.

If You’re Passive

If you're a passive investor, your job is relatively simple: stick to the plan. Keep dollar-cost averaging. Keep allocating. Maybe increase your contributions when the market dips, but don’t try to time it. That’s the beauty of passive investing – your main advantage is consistency. You remove discretion from the equation, which also removes a lot of the potential for emotional error.

If you’re passive and still sitting on a large cash pile, that’s trickier. Research overwhelmingly shows that lump-sum investing tends to outperform dollar-cost averaging on average, over long time horizons. But unless you’re making that decision 500 times in your life (which you’re not), your personal sample size is 1 – and that means the trade-off between regret minimization and expected return becomes very personal. Personally, as expressed in previous posts, I also wouldn’t feel particularly comfortable putting a big lump-sum into a basket of US equities provided by ETF providers.

If you wonder why, read my article “Three Probability Lenses on America’s Market Outlook“ next.

So while the “textbook answer” might be to put that cash to work immediately, the more realistic answer is this: if you can’t stomach the emotional side of lump-summing right after a sharp rally, don’t force it. Invest part of it. Build a structured deployment plan. Just don’t freeze.

If You’re Active

If you're an active investor like me – especially one managing a concentrated portfolio – this environment feels different. You have choices. Lots of them. And that changes the entire calculus.

The first rule here is simple: don’t be a Johnny-come-lately as my friend Tiho Brkan recently put it in a privat interaction.

These are the fund managers and private investors who sold near the bottom – rattled by the volatility, overwhelmed by the headlines – and are now waking up to the fact that they’re lagging the S&P by hundreds of basis points. So what do they do? They rush back in. They chase the rebound. They “re-risk” at higher prices, just to avoid tracking error.

That’s not a strategy. That’s capitulation in reverse.

And it almost never ends well.

The second rule is a little harder to internalize: cash still has value – even now, after the rebound; maybe even more so.

The problem is that cash doesn’t scream its usefulness in real time. There’s no line item on your portfolio statement that says “optional future alpha stored here.”

There’s no dopamine hit. In fact, if anything, it feels like dead weight. And yet, I’ve found that some of the best returns I’ve made came not from what I bought – but from when I waited.

Let me give you a concrete example.

Back in late summer 2020, I bought Nintendo. The setup made sense. The outcome was decent. I made money. But in hindsight? If I had just sat on my cash and waited two more years, I could’ve bought it at a lower price.

That’s the lesson: sometimes, not deploying is the better move. Because patience isn’t about perfection. It’s about recognizing that you don’t need to swing at every pitch right away.

A successful investment that doubles over just 12 months can easily make up for sitting on cash for two years prior to that investment. Your compounded return over this 3-year period was still exceptional.

Especially if your portfolio is concentrated, you only need a few ideas every few years to make it work. You don’t need to be fully invested all the time. You just need to be ready when your pitch comes.

And it will come.

“Very occasionally, but it will happen again, [...] it could be next week, it could be five years off, but it won't be 50 years off, we will be bombarded with offerings that we'll be glad we have the cash for." "It'd be a lot more fun if it'd happen tomorrow but it is very unlikely to happen tomorrow. [...] The probabilities get higher as you get along.“ – Buffett (2025)

There will be another selloff. There always is. Maybe it’ll be deeper, broader, more panic-inducing. Maybe it’ll hit the specific sectors you love. Maybe it’ll knock the wind out of names you’ve been stalking for years (or those you already own). Maybe it won’t – not soon, anyway. But it will come. And if you have cash then, you’ll be in a position to act while others are licking their wounds.

Because as hard as it is to see the value of cash today – it becomes obvious the moment the market serves up a real fat pitch.

Closing Thoughts: Don’t Confuse Discount with Bargain

The phrase “the spring sale is over” has been thrown around a lot lately. And yes – prices did come down. For a brief moment, stocks looked cheapER.

But here’s the part I want to leave you with:

Discount ≠ Bargain.

Just because a stock is down 20%, 30%, even 50% – that doesn’t automatically make it a good buy. A lower multiple doesn’t mean a better business. And in this latest selloff, I didn’t see the kind of widespread mispricing that screams “load up.”

I saw markdowns – not misjudgments. Corrections – not capitulation.

That’s why I stayed patient. Not because I’m infallible. Not because I wasn’t tempted. But because I didn’t see my pitch. And when you’re playing a long game, when you’re trying to compound capital over decades – it’s not about how often you swing. It’s about how selective you are when you do.

As an aside, here is Dev Kantesaria on NOT investing in SBUX 0.00%↑ - the selectivity of Dev’s philosophy is inspiring:

So if you’re feeling frustrated right now – because you missed the bounce, because you were cautious, because others are flexing 30-day P&Ls like it means something …

… breathe.

This isn’t a race. It’s a craft. And like any craft, it rewards patience and process.

The truth is, markets will continue to offer moments like this. You’ll miss some. You’ll catch others. That’s okay. Regret is inevitable. But if you keep your head, stick to your principles, and refuse to let FOMO steer the wheel – you’ll do just fine.

You don’t need to be early. You don’t even need to be fast.

You just need to be right when it matters.

And in this game, that’s more than enough.

Excellent article!

The hardest thing to do is buy on the way down. Even harder to buy bigger the more the price falls.

This is a difficult market to navigate with the mad man in the Whitehouse, but made that bit easier by your insights 😁

Another quality post as usual!