Everyone Thinks the Market Is Doomed! But The Data Says Otherwise...

Why This One Signal Has Never Been Wrong Since 1943 And It Just Flashed Green

If you listen to the prevailing narrative right now, you’d think the stock market still has a long way to fall. Valuations are stretched. Economic uncertainty lingers. Everyone from retail investors to hedge funds seems hesitant to make a move. And to be fair, there are reasons to be cautious – the S&P 500 looks expensive by almost every traditional metric.

Bank of America recently published a table showing that the index is overvalued on 19 out of 20 valuation indicators compared to long-term averages, many of which span back over a century. That’s not nothing.

And yet… something doesn’t quite add up.

While the story being told is one of fragility and risk, the market’s recent behavior paints a more nuanced – even contradictory – picture. Beneath the surface, powerful sentiment indicators are flashing signals that historically point to a different outcome.

Since mid-April, we’ve seen unusually strong buying pressure, some of the rarest short-term rallies in decades, and, most notably, a confirmed breadth thrust – one of the most powerful, historically reliable indicators of future market strength.

The S&P ended April marginally positive after a deep -13.4% intra-month drawdown.

That’s one of the biggest intra-month comebacks ever recorded and shows a lot of resilience considering what’s unfolding on the macro stage.

It’s a strange place to be in as an investor. On the one hand, valuation metrics say “proceed with caution.” On the other, sentiment and breadth data – the kind of stuff that often matters at turning points – are telling a different story: that the market may have already bottomed, and we’re entering the early innings of a new bull trend.

So which is it?

This post is my attempt to explore that question in depth, not with gut feeling, but with data, history, and a bit of behavioral finance. I’ll break down what’s happening under the hood of this market, explain why some of these sentiment signals matter more than they seem, and lay out the two main paths I believe investors can take in the face of today’s uncertainty.

Because while the market doesn’t care how we feel, it does reward those who think probabilistically, weigh signals rationally, and act with intention – even when it feels uncomfortable.

Part 1: The Valuation Trap: Yes, the Market Is Expensive

Let’s get this out of the way: valuations are high. No one’s disputing that.

Bank of America’s now widely shared research piece laid it bare: on 19 out of 20 traditional valuation metrics, the S&P 500 is more expensive than its long-term average. These include forward and trailing P/E, CAPE (Cyclically Adjusted Price-to-Earnings), EV-to-sales, price-to-book, and others – many based on data going back 100 years or more.

And they are not just slightly elevated either; by some measures, we’re in historically rarefied air, only comparable to the dot-com bubble or post-COVID melt-up.

So yes, if you're purely valuation-focused, it’s tempting to look at today’s market and conclude: this can’t end well.

But here’s the trap – and it’s one I’ve seen investors fall into time and time again, myself included (!): high valuations do not automatically mean poor forward returns. We do not always require outright panic, for markets do bottom. And high valuation multiples certainly don’t imply an imminent crash.

Markets don’t move in straight lines, nor do they follow valuation logic in the short term. In fact, many of the best-performing periods in market history began from elevated valuations, because sentiment and positioning were bombed out.

Let’s remember: market valuation approaches (unlike valuation tools to value individual stocks) are blunt tools. They are powerful predictors over long time frames (7 to 10 years or more), but they’re notoriously unreliable over 3-month, 12-month or even 3-year horizons.

Why? Because valuation is just one input among many. Liquidity, sentiment, positioning, macro catalysts, and technicals often overwhelm pure valuation in the short term.

High Valuation ≠ No Upside

Consider these historical truths:

The S&P 500’s long-term average P/E is around 16–17. But it has traded above that level for most of the last 30 years.

(The S&P 500's price-to-earnings ratio including its rolling 20Y average)

In 1995, the S&P 500 was trading at a high P/E and then the index doubled over the next five years before the actual crash arrived.

What investors often miss is that markets don’t need to be cheap to go up. They just need to be less bad than feared, or simply positioned in such a way that even neutral news creates positive reactions. When everyone is on one side of the boat – say, expecting a crash – even a lack of bad news can trigger an upside repricing (and sometimes even bad news can lead to positive stock reactions; e.g. higher than expected unemployment rates could have investors anticipate a (more significant) rate cut).

This is what Sir John Templeton meant when he said:

“Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

By that logic, you have to ask yourself: where are we now? Because it sure doesn’t feel euphoric. If anything, it feels like skepticism at best and deep concern at worst.

Valuations as a Psychological Anchor

One reason the valuation trap is so potent is because it appeals to our innate desire for numerical clarity. “It’s expensive” feels like a definitive statement. But in reality, valuations can stay elevated for years, and bull markets can persist well beyond what feels rational.

In fact, there’s a behavioral element here: we tend to anchor our expectations to valuation-based reasoning because it feels more objective, more quantifiable. But markets are pricing mechanisms, not fairness meters. They often respond to marginal changes in expectations, not absolute notions of cheap or expensive.

That doesn’t mean valuations should be a concern for long-term investors – they always should be! But they aren’t the full story. In fact, when everyone is leaning into the “valuation is too high” narrative, that’s often when markets do something unexpected.

So rather than anchoring exclusively to price multiples, I believe it’s more productive to ask:

What is sentiment telling us? What are other investors doing or not doing? What does history say about these kinds of set-ups?

That’s where I’ll turn next because despite all this talk about valuations, there’s a powerful signal flashing beneath the surface that suggests the tide may already have turned.

Part 2: Signals That Suggest the Bottom May Be In

The market doesn’t shout its turning points. It whispers them – in the form of subtle behavioral shifts, rare statistical anomalies, and technical patterns that often go unnoticed in the noise of macro headlines.

Over the past few weeks, I believe we might have seen exactly that: the quiet but powerful emergence of signals that suggest we may have already bottomed.

These aren’t predictions. They’re probabilities.

And taken together, they form a compelling case that investors may be underestimating what’s happening under the hood of this market.

A Market Rebound Hiding in Plain Sight

Let’s go back to April 2 – “Liberation Day.”

We got two of the worst consecutive trading days for the S&P 500 in recent memory. Volatility was (and still is) high. Investors were retreating. But then something shifted.

Between April 22 and 24, the S&P put together three consecutive days of 1.5%+ gains – a rare event in any environment, and especially in one that had been weighed down by bearishness. We didn’t get a fourth, but if we had, it would’ve been the first such streak since 1982. That’s how uncommon this level of broad-based buying pressure is.

And it wasn’t just large-cap tech dragging the index higher. It was the breadth of the move – the number of stocks participating – that stood out.

Which brings me to one of the most powerful, yet underappreciated indicators in technical analysis: the Zweig Breadth Thrust.

What is a Breadth Thrust, and Why Should You Care?

The Zweig Breadth Thrust was developed by legendary technician Martin Zweig, and it measures the degree of participation in a market rally. Specifically, it looks at the number of advancing stocks as a percentage of advancing + declining stocks, smoothed over a 10-day moving average.

When that 10-day average moves from below 40% to above 61.5% within 10 trading days, Zweig considered it a “breadth thrust” – a powerful signal that momentum had shifted from bearish to bullish, and that a major low was likely in.

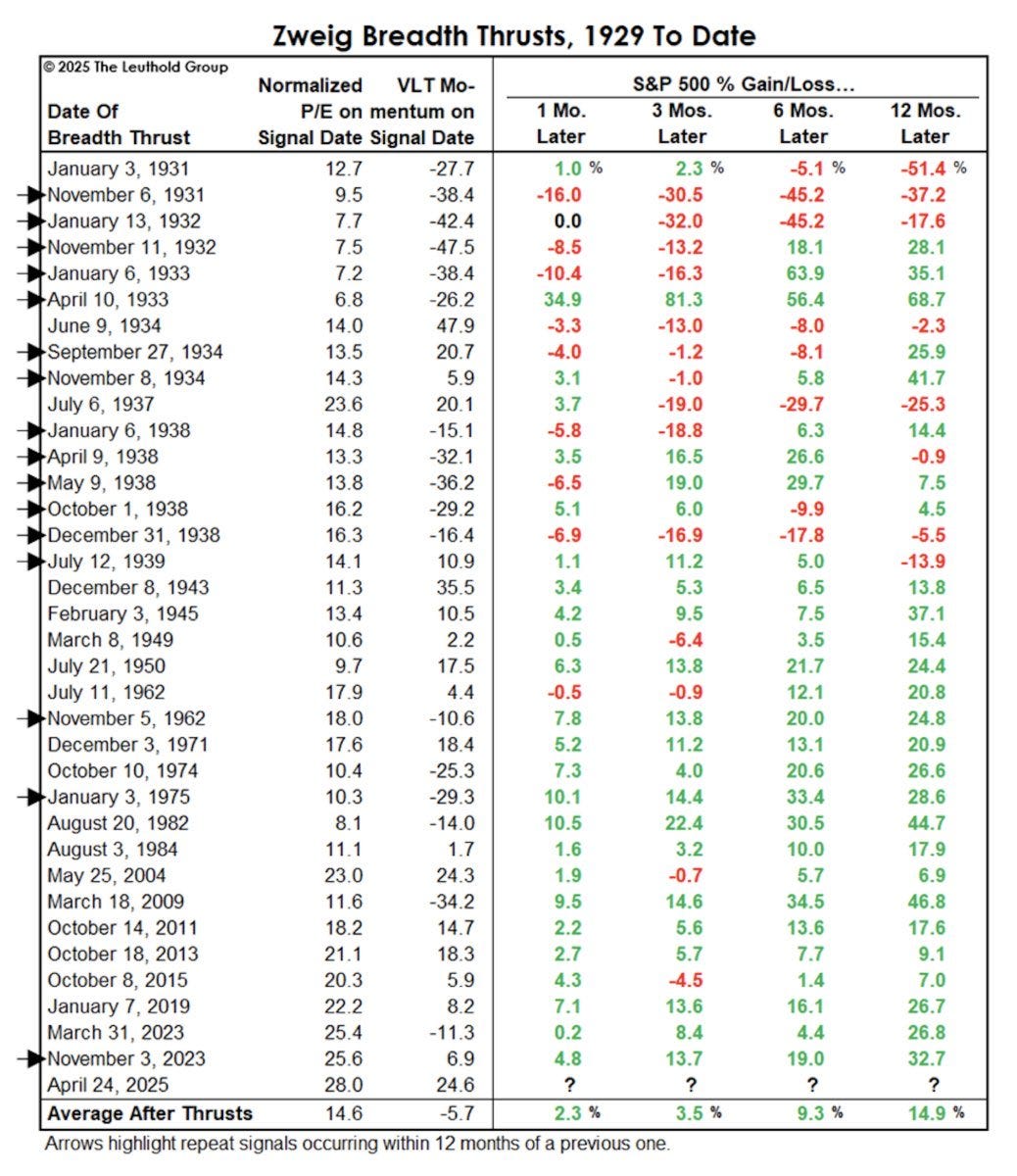

Since 1943, whenever a true breadth thrust occurred, the S&P 500 was higher 12 months later — 19 out of 19 times (see chart below). That’s a 100% success rate with an average return of over 23.6%!

It’s not just a bullish signal — it’s one of the most consistently accurate signals in market history.

There’s a caveat, of course. Many of these studies start post-WWII, conveniently leaving out the volatile 1930s. If you go back to 1929, the signal isn’t quite flawless, which is worth noting for transparency. But since WWII, when markets became more structured and liquid, the record is perfect.

That doesn’t guarantee anything, but it’s not something I’m willing to ignore.

And yes, we just triggered a Zweig Breadth Thrust in April.

So while the prevailing sentiment may still feel bearish or uncertain, the market internals are saying something very different.

Sentiment Indicators Are Flashing Contrarian Buy Signals

Here’s where things get really interesting. It’s not just market breadth suggesting a change in tone: sentiment indicators across the board are still flashing deep pessimism.

And in markets, as Templeton suggested, pessimism is often the soil in which bull markets grow.

Let’s look at a few of the most telling data points:

1) The Affect Heuristic: Why Feelings Fool Investors

Humans are wired to act on emotion. Psychologists call this the “affect heuristic.” We substitute feelings for facts because it’s easier, faster, and less cognitively taxing. In investing, that’s dangerous. We think we’re making informed decisions, but often we’re just reacting to how things feel.

Right now, it doesn’t feel like a new bull market. There’s no euphoria. No Reddit mania. No irrational buying. Which, ironically, is exactly why it might be the beginning of one.

2) Retail Investors (and Everyone Else) Still Don’t Believe

Multiple survey-based indicators support this view:

AAII Bulls vs. Bears: The American Association of Individual Investors survey continues to show muted bullish sentiment; far below levels typically seen at market tops.

Business & Consumer Confidence: Still deeply depressed relative to historical averages.

3) Analysts and Earnings Revisions

One of the more subtle but powerful sentiment shifts happens in analyst earnings revisions. We’re now seeing more and more downward revisions. As analysts should be considered “dumb money” this may be another signal indicating the bottom is near.

4) The Put/Call Ratio: A Gauge of Fear

The put-call ratio – which measures the volume of bearish option bets (puts) versus bullish ones (calls) – has spiked to elevated levels. A high ratio typically signals fear, hedging, and downside protection… not greed or complacency.

And when fear persists while the market climbs, that’s what technicians call a “wall of worry.” Bull markets love to climb those.

Part 3: Two Ways to Play This Market?

Assuming you're sitting on some cash right now, you've essentially got two main options I believe.

You can either start putting money to work, selectively and rationally, or you can sit tight and wait for opportunities that feel more obvious.

There’s no universal right answer here. Each approach comes with trade-offs, and the best choice depends on your temperament, time horizon, and how confident you are in interpreting the current signals. But here’s how I think about the decision:

Option 1: Selectively Buy High-Quality Stocks at Reasonable Prices

The idea isn’t to buy indiscriminately, but to find companies with strong fundamentals, pricing power, and durable business models that can compound value over the long run – and that are currently trading at reasonable (not bargain) valuations.

Think of it this way: you’re paying a fair price for a great business, betting that the next 6 to 12 months will bring a modest increase in earnings, and potentially a modest expansion of the multiple (as the market as a whole gets a boost); two small but compounding tailwinds.

Take Meta, for example. Their latest earnings were a reminder of how robust their underlying business is, even in a tough macro. Earnings per share grew 37% despite the challenging macroeconomic backdrop.

Google, Amazon, and S&P Global all fall into a similar category – dominant franchises, sticky revenue, strong balance sheets. Even something like Medpace, which flies a little more under the radar, has a long runway for growth and trades at a valuation that doesn’t assume perfection.

These aren’t screaming buys in the way that deep-value plays are, but they don’t need to be. If you’re buying businesses that continue to execute, a modest re-rating plus some EPS growth can get you a solid 10–15% (maybe more) return over the next 12 months without taking on much existential risk. That’s not flashy, but it may be a rational and data-driven approach.

Of course, the risk is that valuations are too high, that something breaks in the macro, or that the market’s strength is just a bear market rally. But by focusing on high-quality businesses with durable economics, you give yourself a buffer. You’re not betting on a macro call. You’re betting on long-term resilience.

On the other hand, stocks like Fair Isaac and Company FICO 0.00%↑ which undeniably are of the highest of quality but for the first time in four years reported a decline in its annual recurring revenue…

… and are still trading at 80x earnings, do not fall into the bucket of stocks I’m considering.

Option 2: Sit Still and Wait for the Fat Pitch

Then there’s the second option — do nothing. Stay in cash. Wait until valuations are screamingly obvious. Only swing when you see the fat pitch.

This is the camp that says: yes, sentiment is interesting, but it’s too dangerous to act on it when valuations are this high and uncertainty is this elevated. Why risk being early – especially if you think earnings estimates are still too optimistic, or that something unexpected could hit the system?

I have respect for this view. There’s wisdom in sitting out when you don’t feel you have a real edge. Warren Buffett has said repeatedly that you don’t need to swing at every pitch. And in a market that looks fully priced, it’s easy to imagine scenarios where even quality companies see multiple compression.

But here’s the catch: if you wait for perfect clarity, you’ll almost always be late. Fat pitches come rarely, and when they do, you have to be willing to act decisively, which is easier said than done, especially when those pitches usually coincide with widespread panic. Think March 2020. Think October 2022. They felt terrible in the moment.

Also, if you're holding cash and worried about downside, ask yourself: what would actually cause a large drawdown from here? Valuations alone aren’t enough. You need a catalyst – and most of the likely ones (recession, rates, geopolitical shock) are already well known. Markets don't typically crash on the known knowns. You need some sort of black swan event.

So while there’s no shame in waiting, the bar for that strategy to outperform gets higher the longer markets drift upward.

My Leaning?

Personally, I’m honestly unsure which option to lean towards. On the one hand, I absolutely do NOT think valuations are cheap, but on the other hand, the weight of evidence from breadth, sentiment, and positioning suggests the downside may be more limited than people think.

I might be adding selectively and in small-ish allocations. I want businesses with strong competitive advantages, capable management, pricing power, and a track record of navigating uncertainty. And I’m not going to pay 25x+ FCF for that. I’m looking for reasonable prices, not bargains. And I’m always thinking in probabilities, not certainties.

There’s no glory in being early if you get crushed. But there’s also little reward for waiting forever if the market has already turned and you’re anchored to a narrative that no longer fits.

This is the investor’s dilemma: act too soon and risk a drawdown. Wait too long and miss the meat of the move.

That’s why you need more than just price. You need context. You need signal.

You need to weigh, not feel.

Conclusion: The Market Doesn’t Care How You Feel

If there's one overarching lesson I keep coming back to, it's this: markets don’t reward how you feel. They reward how you think and assess the current setup.

Right now, it’s easy to feel like we’re skating on thin ice. Valuations are high. Geopolitics are unstable. Trump is unpredictable.

Hence, most investors are either nervous or disengaged. That’s a perfectly human response. But investing isn’t about being human in the emotional sense, it’s about being deliberate.

Look at the data, and you start to see a different story emerge. Breadth thrusts don’t happen in weak markets. Sentiment doesn’t stay this skeptical forever. Insider buying doesn’t ramp up (albeit just slightly) when they don’t see value.

In other words, the emotional fog many investors are stuck in doesn’t match what’s happening beneath the surface.

That’s not to say we’re off to the races. There’s always the chance that this is a bear market rally in disguise, or that some left-field risk derails everything. But if you're constantly waiting for clarity, you’ll find yourself investing only when it feels good – which is often when the best opportunities are already gone.

There’s wisdom in restraint. There’s power in patience. But there’s also danger in becoming paralyzed by narratives and forgetting to weigh evidence.

The market doesn’t price in how loud the warnings are. It prices in how surprised people will be when the outcome diverges from their expectations.

Personally, I still have to make up my mind. But I’m not letting market valuation ratios alone dictate inaction when so many historical and technical signals suggest something more bullish is at play.

You might disagree with my conclusion, and that’s fine. The goal here isn’t to convince you to buy or sell. It’s to encourage you to think. To sift signal from noise. To remember that feeling is not a strategy, and that the most powerful moves in markets often come when conviction is scarce, not abundant.

This could be one of those moments.