This is second part of my deep dive into DigitalOcean’s stock in which we will dive into the company’s competitive advantages and the management team.

In this second part, we’ll cover:

Whether DigitalOcean has a moat – and what it’s built on

The role of brand equity, switching costs, and customer goodwill

A breakdown of other potential moat sources (e.g. cost advantages, proprietary systems, weak network effects)

Pricing power and how it’s exercised without triggering churn

The durability and direction of the company’s competitive advantage

A full quality check: gross margins, FCF generation, CapEx intensity, and recurring revenue

The scalability and stickiness of its expanding product platform

Market positioning within the developer-focused cloud niche

Growth levers: ARPU expansion, upmarket motion, and GenAI infrastructure

Updated TAM and SOM considerations for long-term growth

A deep dive into management quality, alignment, and recent C-suite changes

A look at capital allocation decisions, from R&D to M&A and buybacks

Return on incremental invested capital (ROIIC) as a lens on future compounding

In part 1, we covered the business model of DigitalOcean, its customers, and unique selling points DOCN 0.00%↑.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Part 2 – Moat & Quality Analysis

Does DigitalOcean Have a Moat – Or Is It Just an Efficient Underdog?

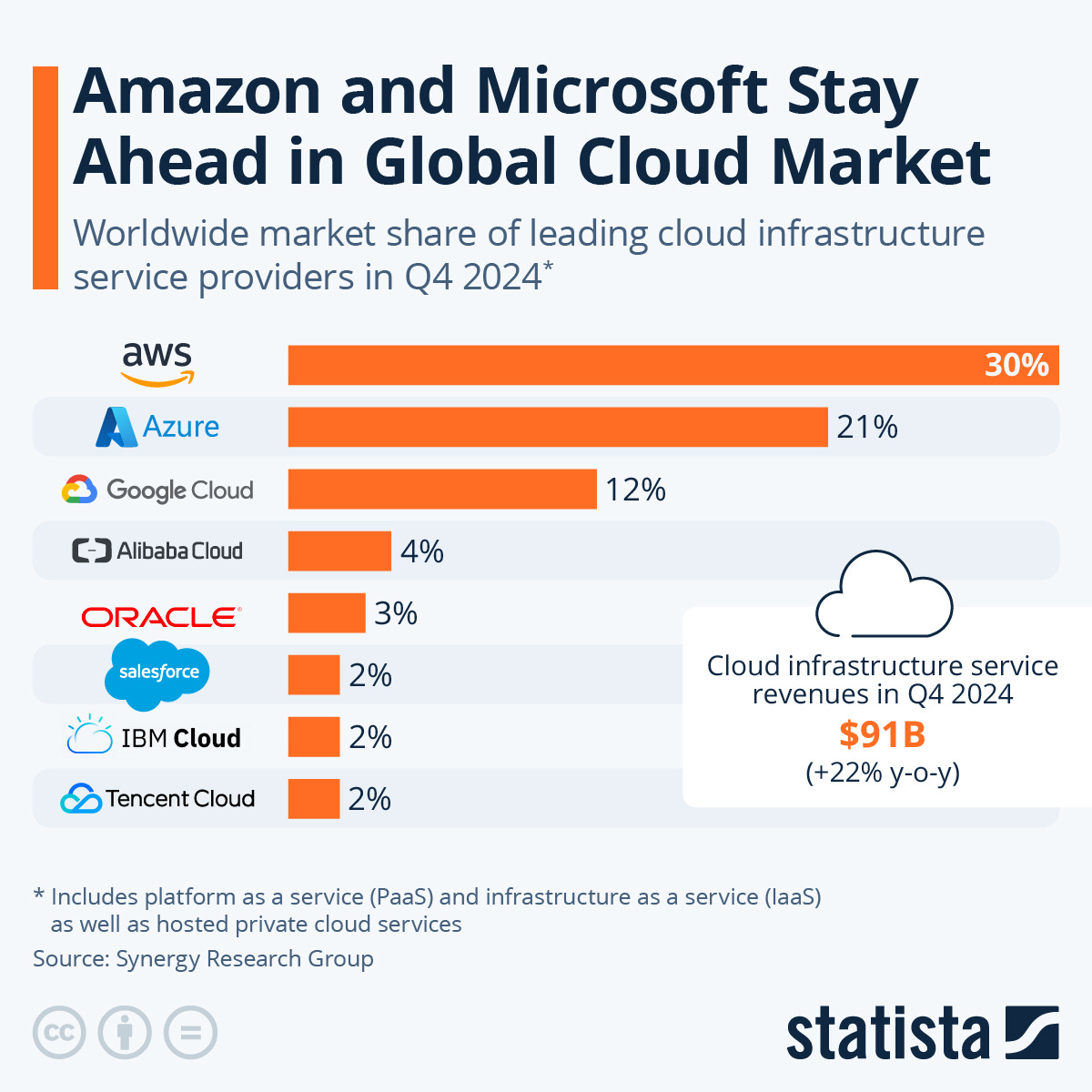

Let’s not sugarcoat it: cloud infrastructure is a brutal business. The three hyperscalers – AWS, Azure, and Google Cloud – collectively account for around two-thirds of global market share.

They compete on price, scale, reliability, and speed. Their annual CapEx budgets dwarf the market caps of most challengers.

So if you asked me whether most small cloud providers have a durable moat, I’d probably say no. Most are undifferentiated. Most don’t/won’t last.

But DigitalOcean is arguably different – and there’s a growing body of evidence that it does, in fact, possess a real, albeit narrow, moat – for now.

The key is that it has never tried to beat the hyperscalers at their own game. Instead, it built a focused, differentiated platform that serves a segment of the market those giants don’t seem to care much about: small teams, lean startups, and developers who just want to get things done without a week-long onboarding process and a 70-page billing PDF.

This customer-first orientation is part of what gives DigitalOcean its moat. The company has built real brand equity within its niche. Among developers, it’s become a trusted name – not in a prestige sense, but in a “this just works” kind of way. It’s the default recommendation for early-stage projects, MVPs, and bootstrapped startups. That kind of go-to status reduces search costs and confers real loyalty. It’s not a global brand in the Apple or Nvidia sense, but in its corner of the market, it is the brand. That’s the basis for a brand moat.

The second pillar of its moat, and arguably the stronger one, is switching costs. At first glance, you’d think these are low. It’s infrastructure – spin it down, move it, spin it back up elsewhere. But in practice, migrations are messy. Even small businesses don’t want to deal with DNS changes, database backups, configuration testing, and team retraining. Add in managed services, automation scripts, and multi-region setups, and the switching friction starts to look (very) real. It’s B2B, not consumer SaaS – which means more embedded workflows, more repeat usage, and more technical dependencies (similar to the switching costs I described in my Monday.com writeup, even though their switching cost moat is stronger in my view). The more services a customer uses – compute, database, storage, networking, GenAI – the harder it is to rip out and replace. These aren’t lock-in levels of Salesforce or Monday, but they’re significant enough to slow churn and discourage hopping.

Then there’s the question of cost advantages. DigitalOcean doesn’t benefit from hyperscaler-scale efficiencies, but it does benefit from being capital-disciplined and focused. Its unit economics are tightly managed. It doesn’t subsidize other business lines. It controls its infrastructure stack end-to-end. And it optimizes for a very specific use case – which means less bloat, fewer edge cases, and lower support costs. It’s not a cost leader in the classic sense, but its internal efficiency is something to be aware of nonetheless.

What about intangible assets? There are no critical patent driving this business. All I found in the 10-K was this: “As of December 31, 2024, we owned five issued patents and had one patent that is published in the United States.“ And that’s about it.

But there are real proprietary systems: a developer-centric control plane, years of accumulated UX learnings, support infrastructure tailored to SMBs, and a growing AI platform that abstracts away many of the complexities of ML deployment. These are not easily copied. They’re the result of iteration, cultural alignment, and long-term product focus. So while DigitalOcean doesn’t have IP in the classical sense, it does benefit from a kind of accumulated product capital – what you might call “compounded intuition” around what this specific customer base wants.

Network effects? They exist, but they’re weak. There’s no strong two-sided marketplace here. More users don’t make the platform meaningfully better for other users. There’s some value from community tutorials, third-party integrations, and API familiarity, but not enough to call this a flywheel business.

And then there’s the hidden moat – …