Deep Dive: DigitalOcean ($DOCN) - Part 1

DigitalOcean Might Be the AWS of SMEs – An Undervalued Opportunity Giving You Much-Needed AI Exposure?

In a cloud market dominated by trillion-dollar behemoths, it might seem irrational to bet on a company like DigitalOcean. After all, how can a subscale cloud provider realistically compete with the likes of AWS, Azure, and Google Cloud?

But that’s precisely the kind of flawed surface-level thinking that can create opportunity in public markets. DigitalOcean isn’t trying to win the same game as the hyperscalers. It’s playing a different game altogether – one focused on simplicity, predictability, and affordability for startups, indie developers, and lean teams at digital-native enterprises. That niche, while often overlooked, may be more resilient and more valuable than the market gives it credit for.

I’ve spent the last few days digging deep into DigitalOcean: reading transcripts, parsing analyst day materials, analyzing customer behavior, revisiting early VIC write-ups, and stress-testing the numbers. What I found was a business that has quietly reached over $800 million in annual run-rate revenue, serves more than 600,000 customers globally, and is steadily evolving its offering to retain customers that would have otherwise “graduated” to the hyperscalers.

At the same time – and that’s easy to overlook –, the company is building out a differentiated AI platform and strengthening its go-to-market motions. And yet, the stock still trades below its IPO price four years ago.

Since going public in March 2021 at $47 per share, DigitalOcean’s stock has had a turbulent ride. As of mid-May 2025, shares trade around $30 – down over 30% from the IPO and far below the 2021 highs above $130. In 2022 and 2023, macro headwinds, decelerating net retention, and investor flight from high-growth names hit the stock hard. The total return since IPO is negative, and compounded annual returns have been underwhelming – especially when compared to the broader Nasdaq or cloud indices (yes, unfortunately, opportunity cost is a real cost!).

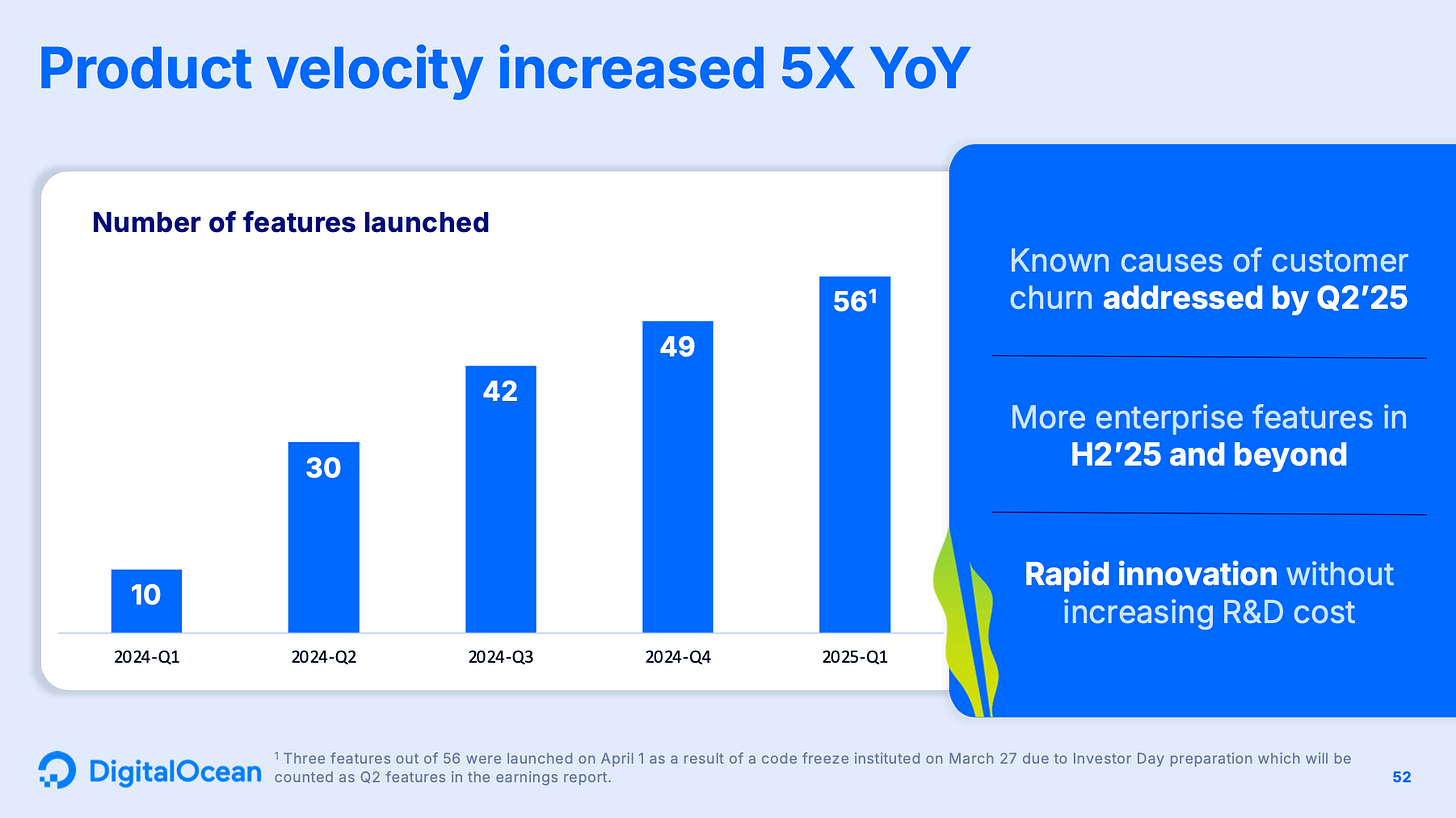

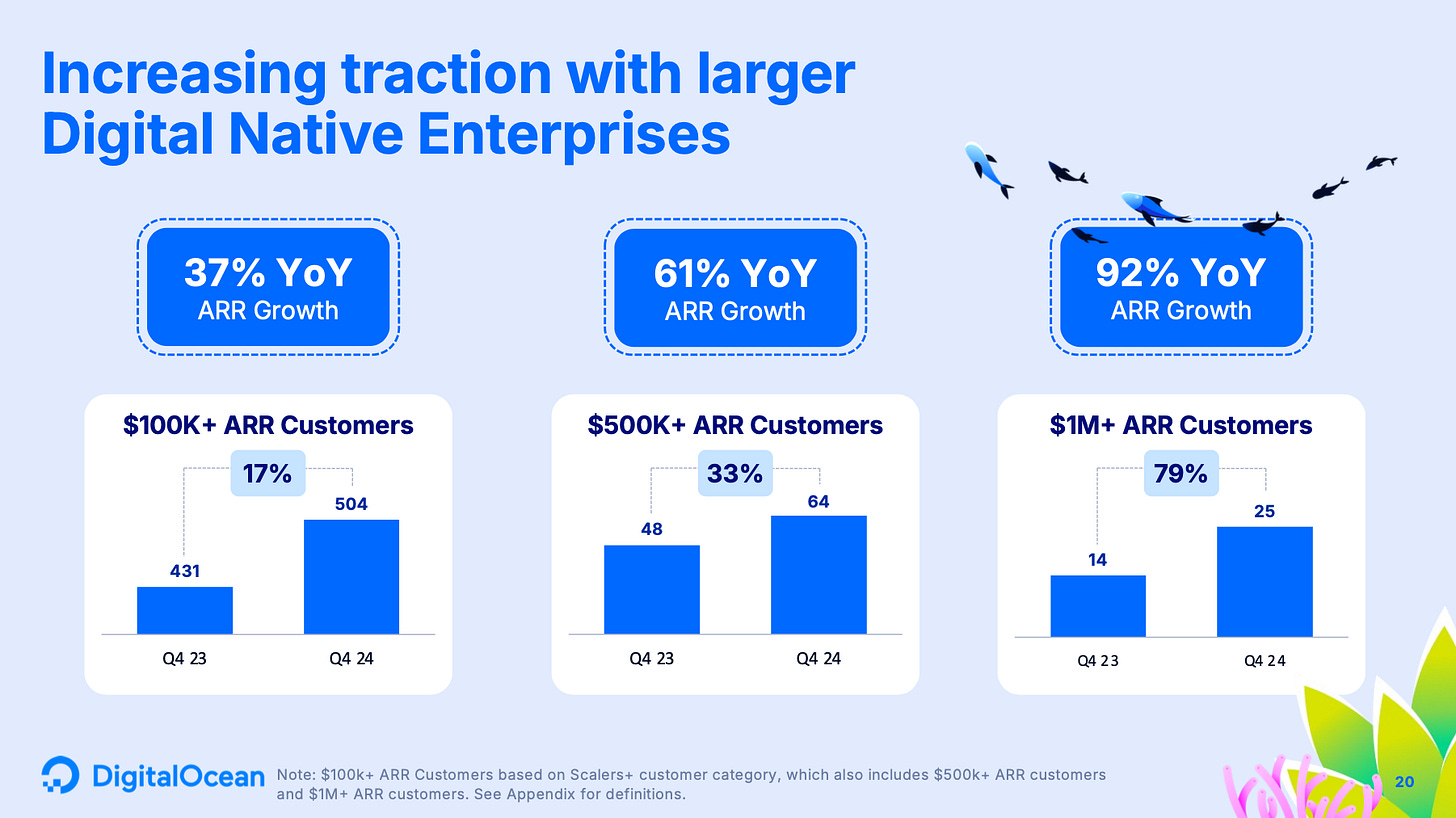

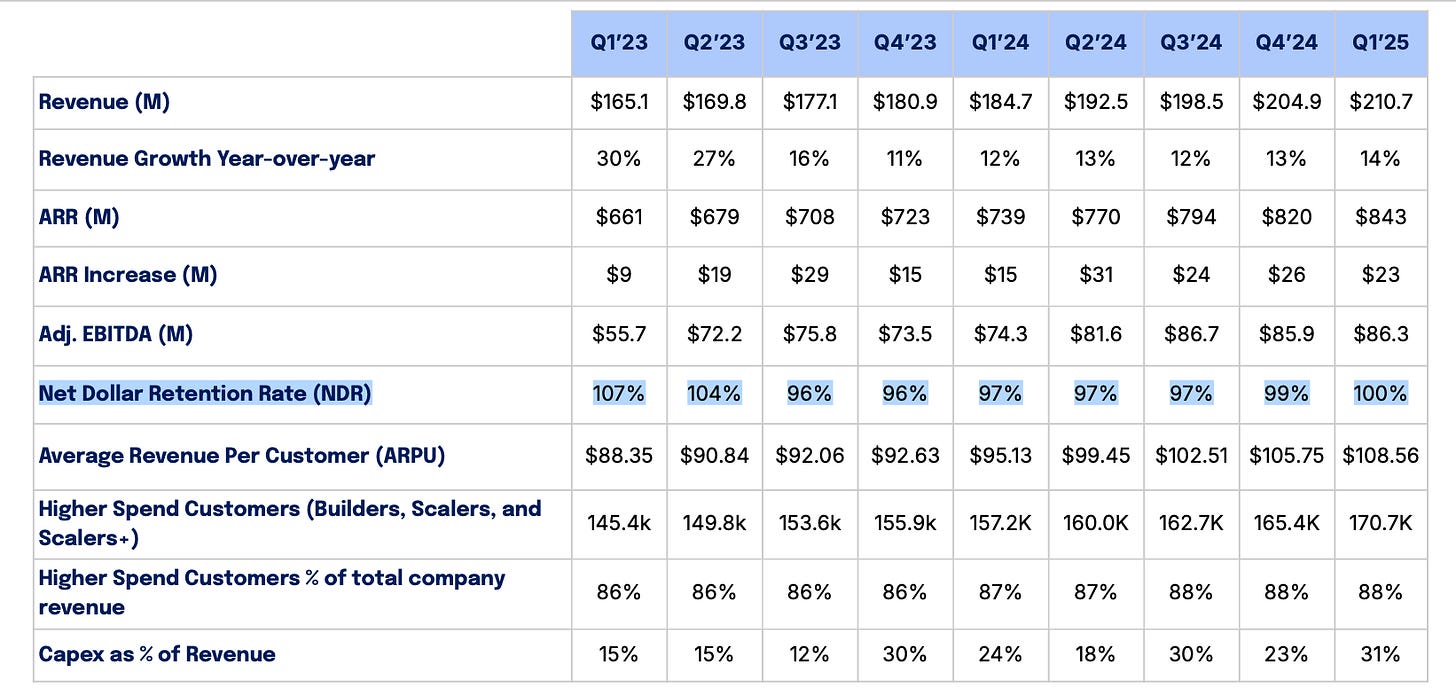

But more recently, the business fundamentals have started to turn a corner again: net retention is back above 100%, product velocity has ramped up materially, and the company is showing traction with $100K+ customers. Whether that translates into growth reacceleration and sustained multiple expansion is another question – but it’s one worth asking seriously. And that’s what I will do in this write-up.

Because that disconnect between perception and reality is what makes this an interesting stock to study – not just for potential upside, but for what it reveals about how investors often misjudge category design, capital intensity, and platform stickiness in infrastructure software.

In this multi-part deep dive, I’ll walk through the key pieces of the DigitalOcean puzzle:

What business is DigitalOcean really in – and why does its niche matter? (Part 1)

Does it have a durable moat, or is it just temporarily unchallenged? (Part 2)

Is the new leadership team making the right moves at the right time? (Part 2)

How should we value a capital-intensive cloud platform serving SMBs? (Part 3)

What could go wrong – and how much of that is already priced in? (Part 3)

Let’s get into it, starting with the business itself: What does DigitalOcean (DO) DOCN 0.00%↑ actually do?

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Part 1 – What does DigitalOcean Do?

A Brief History: From Developer Darling to Public Company

DigitalOcean was founded in 2012 with a simple but powerful insight: cloud infrastructure, at the time, was far too complex for solo developers and small teams. AWS was already dominant, but its interface and pricing model were built with large enterprises in mind. DigitalOcean came at the problem from the other side – offering a frictionless, transparent, and affordable way for individual developers to launch and scale apps. The company quickly found product-market fit by stripping away complexity. Deploying a server became a matter of seconds, not hours. Documentation was clear. Pricing was predictable. For a whole generation of developers, DigitalOcean became the default.

This clarity of focus propelled early growth. By 2015, the company added data centers in Germany and Canada and was reportedly the second-largest hosting provider by number of public-facing web servers, trailing only AWS. That developer-led growth, combined with smart community building and strong brand resonance, helped DigitalOcean scale without relying on enterprise sales teams. But the business had to evolve. As its customer base matured, so did its ambitions. It added managed databases, object storage, container support, and more.

In 2021, DigitalOcean went public – a move that brought new visibility but also new scrutiny. Since then, it’s faced the challenges of transforming from a niche platform into a broader infrastructure-as-a-service provider capable of serving not just developers, but full-scale businesses. That transition is still playing out – and how well it succeeds will shape the company's next chapter.

Understanding the Product Offering: The Cloud for the Rest of Us?

DigitalOcean isn’t trying to build the most powerful cloud platform in the world. It’s trying to build the most accessible one. That distinction is core to understanding the company’s product strategy and the customers it serves.

Unlike hyperscalers who offer a sprawling universe of cloud services optimized for the Fortune 500, DigitalOcean focuses on what small and mid-sized businesses (SMBs), startups, and independent developers actually need: simplicity, transparency, and ease of use. That’s what the company has quietly become known for in its niche – and that’s what its product offering is designed to deliver.

The core platform is a full-featured Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) stack.

It includes all the usual suspects:

virtual machines (called “Droplets”),

storage solutions,

managed databases,

container orchestration with Kubernetes,

serverless computing via Functions, and

core networking tools.

"Droplets is our basic unit of infrastructure, we have released half a dozen special variants of premium droplets. It could be droplets that have high compute. For example, we have V96 CPU variant of a droplet. We have high memory droplets now available. So these are all examples of innovations that are helping customers pick the right infrastructure footprint for their specific workload. If your workload is running in memory database, as an example, you need a large memory footprint on your compute environment. So now you can use that memory optimized droplet to run that workload. So these are fairly advanced sophisticated capabilities that we are releasing now for our customers to be able to run mission critical workloads on us." from the Morgan Stanley Conference appearance

These are foundational building blocks of any modern cloud platform. But what makes DigitalOcean’s offering unique is how frictionless it is. Launching a server takes only a few minutes. Billing is clean and predictable. Support is included – even for small customers. For lean teams or solo developers, that kind of accessibility is both rare and deeply valuable.

Where DigitalOcean really breaks away from the competition is not in the raw technical specs, but in how it packages and delivers its infrastructure. Many competitors offer similar services on paper – compute, storage, networking – but their platforms are dense, opaque, and built with enterprise buyers in mind – just watch the section starting at the 36-minute mark of the video below in which DO’s CTO explains what steps you ahve to go through to set up a some basic computing power with a hyperscaler (“you literally have to go through thousands of decisions“).

DigitalOcean’s interface, by contrast, is intuitive. The documentation is friendly. The pricing is transparent. You don’t need a FinOps team to make sense of your bill, and you don’t need to fill out a sales form to talk to support. These seemingly small decisions add up to a product experience that feels entirely different from AWS or Azure – and that difference is precisely the moat.

To truly understand how DigitalOcean differentiates itself from competitors, I recommend watching the entire segment with DigitalOcean’s CTO from the recent Analyst Day starting at around the 34-minute mark:

This isn’t a bare-bones cloud either. Over time, the company has expanded beyond the basics. The App Platform lets developers deploy full applications directly from GitHub with minimal configuration, handling everything from infrastructure to runtime environments. The acquisition of Cloudways brought a managed hosting layer to the stack, allowing users to outsource much of the underlying operational work while still choosing DigitalOcean infrastructure as the foundation. And more recently, the company has been investing heavily in its AI roadmap – which has emerged as both a growth vector and a potential differentiator.

Importantly, in the last few quarters, product velocity has picked up meaningfully. Under new leadership, the company has shipped a range of features aimed at “Scalers+” – the subset of customers spending $100,000 or more annually. These customers had historically outgrown DigitalOcean, but that’s starting to change.

Larger Droplet sizes, enterprise-grade SLAs, more advanced networking options, and enhanced Kubernetes scalability (now up to 1,000 nodes) are helping retain these high-value accounts. The company has also built out secure multi-cloud connectivity and deeper access controls – areas where it had historically lagged behind.

And these new product features are helping to reaccelerate growth, contributing around $8 million to the Q4 quarterly revenue.

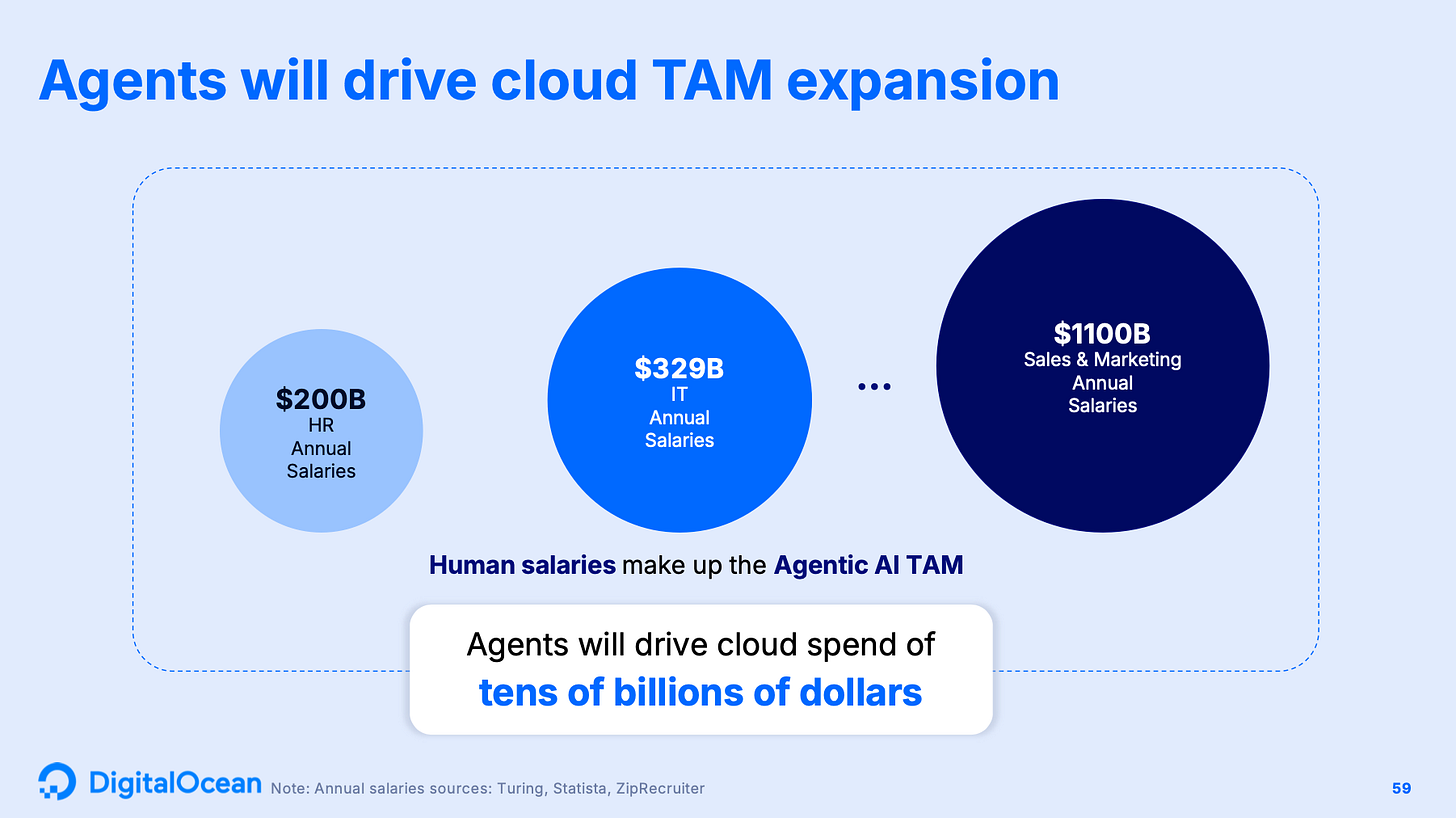

Perhaps the most ambitious product initiative to date is the new GenAI platform. This stack spans infrastructure (including GPU-enabled Droplets), a developer-facing AI platform layer, and a set of pre-built agentic applications for tasks like customer support and site monitoring.

In just a few months, over 5,000 customers have begun experimenting with it, and many are deploying actual workloads. DigitalOcean’s positioning here is consistent with the rest of its product strategy: make AI tools accessible and manageable for smaller teams that don’t have the resources to wrangle hyperscaler complexity.

The partnership with AMD to power inferencing workloads with EPYC CPUs and Instinct GPUs further reinforces this direction.

So what is DigitalOcean actually selling? In simple terms: a cloud platform that trades raw power for usability, speed, and affordability. It’s a non-consumable product offering – customers pay for persistent access to compute and storage rather than purchasing one-time services. And while infrastructure can, in theory, be commoditized, the company’s differentiation comes from how it reduces the friction to build, run, and scale smaller businesses in the cloud. That’s not something AWS is incentivized to do, because the large enterprise market is more attractive, and it’s not something many smaller providers are capable of doing well at scale.

In terms of market placement, I’d classify DigitalOcean’s offering as squarely in the mid-tier: affordable enough for side projects and indie devs, yet powerful and scalable enough for many production-grade applications. It’s a balancing act – and not an easy one – but one that the company has managed with increasing confidence.

Ultimately, this is not a “me too” cloud platform. It’s a purpose-built solution for a segment of the market that values simplicity over scale, predictability over power.

And not only is DigitalOcean’s offering simpler, it’s often also much cheaper. Let me share how the company’s CTO explained this advantage during the recent Analyst Day:

“I would say hyperscale begets hypercomplexity. […] What do I mean by that? Suppose you are a hyperscaler, your business model requires you to address the needs of every large enterprise in the market. Now suppose you are a Goldman Sachs or JPMorgan or General Motors or a Wallmart. You have decades of IT legacy. You have decades of IT legacy from even before the cloud was invented. You have decades of IT legacy from even before modern IT was invented.

And so the only way that a hyperscaler can actually service the needs of all of the customers is to provide a building blocks approach because then your customers can go in and build any configuration they want. That's the only way to be able to support the zillions of IT configurations that arise from the legacy IT enterprise sprawl.

But on DigitalOcean, we really just focus on the digital native segment of the market. By definition, these have modern IT systems. It's still a very large segment. Mind you, it's still $140 billion. But by being able to focus on the Digital Native segment, we are able to escape the complexity of the IT sprawl, and that enables us to provide a product that works way better for this segment.

So you get product complexity. It turns out product complexity drives cost complexity. Over here, I've given just one example of cost on a hyperscaler. So I've just taken the networking example, the data ingress and egress and want to show how that works in the 2 kinds of clouds. If you look at this example, say, for example, you're using classic load balance, one kind of a load balancer, the price is about $0.01 per gigabyte.

If you use a different kind of a load balancer, then the price is different and variable. So if you use the application load balancer, the price is between $0.03 and $0.09. If you use a different service, like, let's say, you use a database, the price is again different and variable. It varies between $0.05 and $0.09. Now if you, of course, have to talk to the external world, you need a gateway. Well, the gateway is another variable incremental cost. And what you need, you also need a CDN. Well, that's another variable incremental cost. Let's contrast that with DigitalOcean. A single, flat monthly charge, a single flat monthly charge, free inside the data center.

So this difference, numerous incremental variable costs in one case and a single flat monthly predictable bill in the other case is the reason why -- if you're a customer on a hyperscaler, you need a dedicated FinOps team. This team isn't building infrastructure. They are not building software. They're just looking at your bill and trying to optimize it. So if I have to summarize this, it really boils down to this.

Hyperscale drives high product complexity and that high product complexity drives high-cost complexity. Now that high product complexity also drives a high CloudOps cost and that high cost complexity also drives a high FinOps cost.

And so it's no surprise that in a recent survey by Flexera of all cloud customers, TCO emerged as the #1 problem for cloud customers, by far. And it turns out that almost 70% of customers need a FinOps team to manage their cost, 70% of customers need a FinOps team to manage their cost. And that is why DigitalOcean has a unique position in the market segment because we go in and address the #1 problem of cloud customers because according to a study by Forrester, DigitalOcean reduces customers' TCO by at least 30%. Now some of this, of course, comes from a lower infrastructure cost, but a lot of it comes because customers are more productive and because they don't have to manage all of this overhead of CloudOps and FinOps and so on. Forrester also found that when a customer migrates from a hyperscaler to DigitalOcean, their payback period is less than 6 months, less than 6 months. To learn more about this, let's listen to this video from Market Circle. They produce CRM applications and productivity applications so that their clients can manage their projects and sales and customers in a single integrated platform that is also integrated with Apple software. [Video Presentation] Trust me, I feel happy as well when I'm saving costs.“

Understanding the Business: A Recurring Revenue Machine – With Real Infrastructure Underneath

At first glance, DigitalOcean’s business model seems refreshingly simple: it’s a cloud infrastructure company that makes money by charging for access to compute, storage, and platform services. But to truly understand how the engine works – and what kind of investment case it offers – you need to dig into the mechanics, the economics, and the constraints that come with being a smaller player in a scale-heavy industry.

Revenue is primarily generated through a subscription-like, usage-based model. Customers pay monthly for resources they consume – whether it’s a virtual server (a Droplet), object storage, AI tokens, a managed database, or Kubernetes clusters. The pricing is transparent and predictable. Unlike AWS, there are no egress surprises or unpredictable line items. That simplicity is part of the value proposition, especially for the company’s core audience of indie developers, startups, and SMBs.

While the company offers multiple services, compute remains the economic center of gravity. A Droplet, which is DigitalOcean’s term for a virtual machine, is the fundamental unit of consumption – and the core driver of revenue. These Droplets vary in size and performance, and are priced accordingly, ranging from a few dollars per month for the smallest instance to hundreds for high-performance options.

“So from a pricing perspective, I think more about the packaging than pricing. So, a good example of this is the premium droplets that we've been launching over the last several weeks. And, we've been very pleasantly and positively surprised by the uptick rate of customers choosing, like we don't make it a default. Customers choose into these premium droplets, which are obviously significantly more expensive than the base droplets. But what it tells us is customers are willing to pay extra for a different type of performance and they are willing to make the trade off themselves. And it, of course, cannibalizes our base droplets, but we are happy to make the trade off any day if it helps our customers. So there are a lot of other packaging innovations that we are doing and we'll continue to do that.“ – from the Morgan Stanley Conference appearance

While the company doesn’t publish Droplet-level profitability, gross margins have typically ranged between 55% and 60%.

This suggests that even after accounting for the infrastructure costs tied to compute, bandwidth, and storage, the unit economics are quite healthy – especially given the relatively low customer acquisition costs enabled by the company’s self-service model.

On the cost side, each unit – be it a Droplet or a database node – carries meaningful infrastructure expenses. These include server depreciation, power, bandwidth, and data center leases.

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

Thank you for your support!

DigitalOcean owns much of its hardware and leases space in colocation facilities globally. As a result, while revenue scales with usage, infrastructure-related costs (data centers, networks, security, R&D, etc.) scale too – but arguably at a slightly slower pace. A key source of operating leverage is increased utilization of existing infrastructure), plus software-defined services that run atop of the core compute/network/storage stack and offer greater leverage. As customer usage grows, the company’s fixed costs (data center space, servers, engineering headcount) become more diluted. But the key constraint here is capital intensity. This isn’t a pure software business. Every growth wave needs to be financed with real metal – either through upfront CapEx or via vendor financing and longer payback cycles.

Over time, if the mix shifts toward managed services, platform products, and GenAI workloads, we could see EBITDA margins expand toward the mid-30s – perhaps even low 40s in a best-case world.

So far, DigitalOcean has been able to walk that tightrope effectively. It remains free cash flow positive and capital disciplined, even during periods of slower growth. But the margins further down the income statement are a balancing act.

And in a world where the hyperscalers can outspend them 100-to-1, capital allocation and pricing discipline become strategic levers, not just accounting footnotes.

Geographically, the company is unusually international. As of the latest filings, roughly two-thirds of revenue comes from outside the United States.

That kind of global footprint is rare for an infrastructure platform of DigitalOcean’s size. It provides diversification – but also introduces risk. Emerging market exposure, currency swings, local tax regimes, and geopolitical events all show up in small but real ways. We saw this play out in 2022, when usage declined across certain crypto-heavy geographies and during the Russia–Ukraine conflict. The company managed through it without major disruption, but the sensitivity is there.

“Our infrastructure is offered to our customers across 16 data centers worldwide that are connected by a high-speed private backbone, enabling our customers to deploy their solutions across nine different geographic regions. We lease data centers in the New York, San Francisco and Atlanta metropolitan areas in the United States, as well as in Australia, Canada, Germany, India, the Netherlands, Singapore and the United Kingdom. We plan to open our new Atlanta data center in 2025.“ (10-K)

The value chain is relatively straightforward. DigitalOcean designs and controls the software stack, purchases and configures its own servers, installs them in leased data center space, and delivers services through its proprietary control plane. Customers interact directly with the platform via the web interface or API. Most usage is self-service – developers or teams provision infrastructure without needing a salesperson. This gives the company one of the leanest go-to-market operations in the cloud space. Only recently has it started layering in more traditional sales motions – outbound efforts targeting AI-native startups, named accounts for larger “Scaler+” customers, and partnerships with resellers and cloud consultants (I recommend watching the segment with DO’s chief revenue officer at the 2025 Analyst Day).

Legally, this is a U.S.-based public corporation (Delaware C-Corp), operating under the ticker DOCN since its IPO in 2021. Operationally, it behaves more like a modern software-native infrastructure provider than a traditional telco or hoster. But it’s still very much a hybrid business – half software, half real-world metal.

From a cyclical standpoint, the business is exposed to macro softness, but not in a catastrophic way. During the 2022–2023 downturn in startup funding, DigitalOcean experienced a real deceleration in growth. Net dollar retention dropped below 100% for several quarters.

“Across the broader set I looked at (n = 32) the average drop was 7%, and the median was 5%. But that doesn’t tell the full story. Usage based companies (and historically top quartile standouts) Snowflake, Digital Ocean, Zoominfo, Elastic, DataDog, and MongoDb all experienced double digit declines. So what’s going on? If I were to summarize: Hiring declines, optimization pushes, and buyer’s remorse. Hiring across the tech industry, which also happens to be its largest buyer, fell. That means there’s less opportunity for license growth.“ (from the above writeup by CJ Gustafson)

Customers churned or downsized workloads. But the company never entered a cash burn phase. Gross margins stayed steady, opex was managed, and free cash flow remained positive. That kind of resilience is telling. This isn’t a recession-proof business – but it doesn’t melt down when the cycle turns either. There’s some elasticity in demand, but not existential exposure.

Zooming out, the business is arguably in its mid-growth phase. The original PLG-fueled land grab was mostly considered done (PLG stand for product-led growth) but as discussed, the new leadership team is determined to make product innovation a key pillar of the company’s culture again.

The company is no longer a scrappy developer darling. It has real revenue scale, institutional ownership, and public-market scrutiny. But it hasn’t yet reached full maturity; the runway is still massive.

But the playbook is shifting – from growth at all costs, to scalable growth with operating discipline. New management is pushing hard to evolve the company into a platform that can retain large customers, upsell more services, and capture higher-value AI workloads.

The GenAI platform and premium droplet GPU offerings are just the beginning. But they signal the direction: more value per customer, not just more customers.

Finally, one of my favorite questions to ask when studying a new business is “what are the KPIs that really matter here?”

It comes down to three in my view:

net dollar retention (a proxy for customer satisfaction and monetization),

the number of Scalers+ accounts (a sign of moving upmarket), and

(true) free cash flow margin (the scoreboard for operational maturity).

Add in growth in GPU workloads and GenAI usage as an emerging fourth – and you have a solid dashboard for judging execution of the new team over time.

The takeaway? DigitalOcean is a real business with real infrastructure, real cash flows, and a niche that still feels misunderstood. It won’t ever be AWS. But it doesn’t have to be. If it continues executing on this playbook – customer-focused, capital-disciplined, and focused on serving the segment the giants ignore – there’s a compelling story still being written here.

Understanding DigitalOcean’s Customers: And Do They Really Love the Product?

To understand DigitalOcean’s business, you have to understand its customer base – not just demographically, but emotionally. Who are they? What do they care about? Why do they choose DigitalOcean over bigger, “better” clouds? And perhaps most importantly – would they care if DigitalOcean disappeared?

Let’s start with the pain point. The traditional hyperscalers – AWS, Azure, GCP – offer astonishing breadth and scale. But they’re built for enterprises. The onboarding is complex, the billing is opaque, and the user experience assumes you have a full-time DevOps team. For early-stage companies, lean SMBs, or solo developers, it’s just overkill. What these users want isn’t more features – it’s fewer complications. They want to spin up infrastructure in minutes, not hours. They want pricing that doesn’t punish experimentation. And they want to actually understand the bill at the end of the month.

DigitalOcean solves this exact pain. It removes friction. It offers just enough power, without the sprawl. And for many customers, it becomes the default platform they start with – not necessarily only because it’s cheaper, but also because it’s the easiest to understand and the quickest to get value from. That’s a critical distinction. Price matters, yes – but predictability and simplicity matter more in the early stages of a project.

If DigitalOcean disappeared tomorrow, many customers could migrate to AWS, Azure, or GCP – but at a real cost. They’d lose the simplicity, the clarity, the focus on SMBs and developers. More importantly, many just wouldn’t want to bother migrating.

Over time, the hope is that customers don’t just use DigitalOcean because it’s easy – they use it because they grow with it. This has historically been the company’s Achilles heel. As customers scaled, they’d “graduate” to hyperscalers that offered more advanced networking, enterprise SLAs, or deeper compliance tooling. That’s the churn problem DigitalOcean has been trying to fix over the last 18 months – by building the product depth required to retain higher-value customers, while still keeping the core experience intact.

And arguably, it’s starting to work. In Q1, the number of customers spending over $100K annually grew 41% year over year, “driving 23% of revenue.“

The total number of $1M+ customers is also rising. These aren’t small projects anymore. And yet they still choose to run on a cloud built for simplicity.

Who are these customers, exactly? The majority are corporate and organizational – small tech companies, bootstrapped founders, venture-backed startups, indie SaaS businesses, dev shops, e-commerce vendors, and more. It’s a broad spectrum, but unified by a common theme: teams that want to move fast without being buried in infrastructure complexity. Many are global – as mentioned earlier, roughly two-thirds of DigitalOcean’s revenue comes from outside the United States. There’s no clear gender skew in the business itself, but its core user base (developers, startup founders, tech enthusiasts) still tends to be disproportionately male, especially in emerging markets. Income levels vary widely, but many customers are value-sensitive – not necessarily price-sensitive, but focused on ROI, simplicity, and support.

What these customers care about is speed, cost-predictability, control, and support. And this is where DigitalOcean really excels. It has long been known for its high-quality documentation, responsive support (even for small accounts), and open-source ethos. That builds trust – and in some cases, even emotional loyalty. There is a subsegment of customers who do love DigitalOcean, in the cult-like way that developers once loved Heroku or Basecamp. It’s not a mass-market cult, but it’s real. The platform enables a certain kind of creator to just get stuff done – and they remember that.

So what about retention? The company has historically struggled to keep customers as they scale. Net Dollar Retention (NDR) dropped below 100% in 2023, triggering concerns that the platform was merely a “starter cloud.” But that trend has started to reverse. NDR is back above 100%, and churn among larger customers is decreasing as the company builds out features that allow them to stay rather than leave.

For smaller users, churn is inherently higher – side projects get abandoned, early startups fail, and hobbyists move on. But the key is monetizing the long tail while retaining the high-potential accounts. DigitalOcean seems to be leaning into both sides of that equation now – with self-serve for the tail, and direct sales and account management for the Scalers+.

From a customer lifetime value (CLV) standpoint, the numbers are promising. According to estimates from investor materials and independent research, the average customer generates around $20/month in revenue. But that figure is deeply skewed by the long tail. High-value customers can generate $100K–$1M+ in ARR, with multi-year lifetimes. CAC has historically been low thanks to product-led growth – often under $200 per customer, and even lower in self-serve channels. This creates healthy payback periods, even for lower-spend cohorts. That said, as the company moves into more sales-assisted and AI-targeted motions, CAC will likely rise – and the CLV math will become more nuanced.

So, is this a product customers are addicted to? Not in the sense of a consumer app or a social network. But it is something many of them depend on – and in many cases, it’s something they actually appreciate. In a world of bloated enterprise software and nickel-and-dime billing, DigitalOcean feels like a throwback to customer-first simplicity. That’s a competitive advantage you can’t easily replicate with money or scale. It has to be earned – and kept.

Is This a Simple, Predictable Business – or a Minefield in the Making?

When it comes to investing, the character of the industry often matters as much as the company itself. Even a great operator can struggle in a structurally bad industry – just as a decent business can thrive with a favorable tailwind. So where does DigitalOcean fall?

“The world is always changing and you have to evolve with it. If you don't evolve you'll probably stay behind, very slowly but surely. You have to accept that you have to always rethink everything and do postmortems on investments on what went well and what went wrong.” – Francois Rochon

The company operates in the cloud infrastructure and platform services industry – essentially, it sells compute, storage, networking, and developer tools delivered via the cloud. In economic terms, this is a capital-intensive but highly scalable industry, with recurring revenue characteristics and strong network effects. At the top end, it's been one of the most attractive sectors of the past two decades.

Amazon Web Services (AWS) has grown into a $100B+ juggernaut with operating margins of 37% recently (up from 27% just a year ago), while Microsoft Azure and Google Cloud have used their cloud arms to drive operating leverage and cash generation across their broader ecosystems.

But those economics aren’t uniform. The hyperscalers benefit from enormous scale advantages – multi-billion-dollar CapEx budgets, custom hardware, and an ability to cross-subsidize. The rest of the field operates under a different set of constraints.

DigitalOcean sits in that second camp: a focused niche player with no illusions of competing on brute force. And that makes its segment of the industry more nuanced.

The economics can still be attractive, but only if the company avoids going toe-to-toe with the giants and stays disciplined about who it serves, how it prices, and where it deploys capital.

So is this a good industry? For DigitalOcean’s niche, the answer is: conditionally, yes. Gross margins in the mid- to high-50s (trending upward again) are solid for infrastructure. Churn can be high at the low end, but customer stickiness improves as businesses scale:

Recurring revenue is real. Pricing is transparent and tends to favor predictability over deep discounting. There is some pricing power, especially when services are bundled and customers optimize for developer experience. But the competition is intense, and anyone entering this space needs to carve out real differentiation – or risk being crushed under falling unit economics and rising CapEx.

The good news is that DigitalOcean’s niche has historically been underserved by the majors. The big clouds don’t cater well to small customers. Their documentation, UX, support tiers, and billing complexity are designed for the Fortune 500 – not for a five-person SaaS company. That has given DigitalOcean room to breathe and grow, and to build something valuable on top of what is essentially a commodity substrate.

In terms of industry evolution, cloud infrastructure has followed a fairly stable path over the past decade. It began with basic compute and storage, layered in containerization and orchestration (Kubernetes), moved up into serverless and managed services, and is now moving into AI-native infrastructure. This is not a “winner-take-all” market, but it is a market where scale and focus both matter.

That said, the core cloud primitives have remained remarkably consistent. Droplets are still Droplets. Customers still need to deploy code, store data, and connect services. The tools are getting more powerful, but the fundamental needs haven’t changed.

This makes the industry’s rate of change manageable – not slow, but not so fast that it undermines long-term predictability. DigitalOcean doesn’t need to reinvent itself every two years. The core mission – helping lean teams deploy, scale, and manage infrastructure easily – hasn’t changed. If anything, it’s become more relevant as more companies adopt remote-first models, ship software faster, and look for tools that don’t require a DevOps army to operate.

That brings us to the heart of the question: Can we reasonably predict DigitalOcean’s cash flows 5 to 10 years out? I think we can, at least directionally. The company has a stable base of long-term customers, usage-based pricing that scales with their success, and improving retention metrics. If execution continues to improve – particularly with larger accounts and AI-focused workloads – revenue visibility will only increase. The company is already free cash flow positive, CapEx is trending more efficient (especially with GPU economics improving), and the margin structure is solid. It’s not a perfectly predictable compounding machine, but it’s not a black box either.

Of course, competitive pressures are real. The top three players are the hyperscalers: AWS, Microsoft Azure, and Google Cloud Platform. Each has its own strengths – AWS is the most mature and feature-rich, Azure wins on enterprise integration (especially with Microsoft-heavy IT stacks), and GCP shines in data and machine learning. What these players offer is power, breadth, and deep integration – but not simplicity. That’s the gap DigitalOcean has exploited.

“Yes. So it's hard to go away from the hyperscalers because they have such a dominant presence in the market. And as I explained, we are (not? – I think there’s a mistake in the transcript) competitor obsessed. We are absolutely competitor aware, but we are obsessing on what our customers need and that's what we are focused on. And the reality of today's software world is that most companies are multi cloud and which means surely there is some hyperscaler presence in most of our large customers anyway. So it's a long winded way of saying we are really focused on what our customers need and delivering that value to them and taking care of them and we don't really obsess over what competitors are doing." – from the Morgan Stanley Conference appearance

Beyond that, there are smaller competitors like Linode (acquired by Akamai), Vultr, and Hetzner. These companies compete more directly with DigitalOcean on price and simplicity, but few have the same blend of self-service UX, developer community, support quality, and emerging AI capabilities. Most lean heavily into price or raw compute power. DigitalOcean, by contrast, sells a productized experience – and that’s harder to replicate.

Still, the space is crowded at the low end. Hosting, cheap VPS, and DIY infrastructure is a messy field, and it’s easy to get dragged into race-to-the-bottom pricing if the value proposition isn’t clearly articulated. That’s why DigitalOcean’s shift upmarket – toward Scalers+, managed services, and platform abstraction – is not just a growth strategy. It’s a survival strategy.

So again, is this a simple, predictable business? Relative to the rest of the software world – yes. It’s not a platform with 17 revenue streams or a marketplace juggling buyer/seller dynamics. It’s a focused infrastructure business with strong recurring revenue, high visibility into customer usage, and stable (if lumpy) cost structures. Unlike many software peers, the AI disruption risk seems low and AI is rather a tailwind than a headwind.

There’s some noise in the early-stage churn and some risk in the capital cycles. But this isn’t a “reinvent-the-wheel-every-year” kind of business. If the company just keeps doing what it’s already doing – serving its customers well, expanding usage, and layering in new tools at the margin – the next ten years are likely to look a lot like the past ten. And that’s a feature, not a bug.

That wraps up part 1 of this multi-part deep dive. In the next post, I’ll discuss DO’s competitive advantages and management team. Make sure to subscribe to receive it in your inbox in the next few days.

This is great. It's hard to believe this is part 1. You will finish with a book to publish.

I have been waiting for years for digital ocean to take off. I see their sga and R&D expenses seemed to have leveled out. The amount hasn't increased with increased sales. I was looking to understand if the TAM for their niche can ever bring in enough revenue to grow this company much bigger than it is. I have some doubts here.

Great read, Sir!