Deep Dive: DigitalOcean ($DOCN) - Part 3

Valuing DigitalOcean in 2025: Mid-Teens IRR or Value Trap?

This is the third part of my in-depth analysis of DigitalOcean’s stock. In this part, we will examine the company’s balance sheet and liquidity, discuss the major risks that investors should be aware of, and finally, arguably the most important part, we will carry out some valuation work to highlight the potential returns that investors can expect in various scenarios.

More specifically, in this third post, we’ll cover:

A comprehensive analysis of DigitalOcean’s balance sheet, including debt structure, liquidity, and working capital

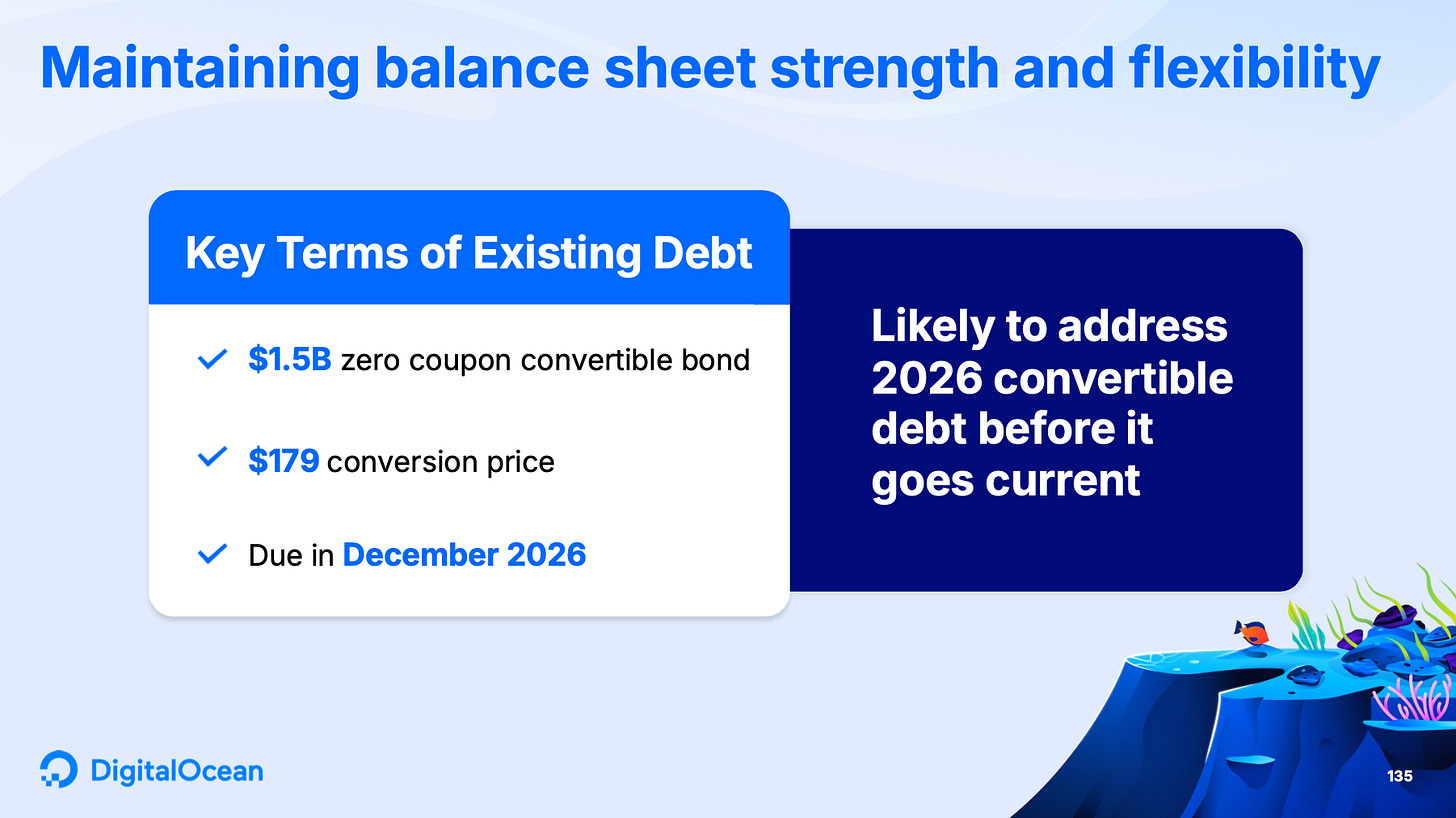

Key risks related to the company’s $1.5 billion in convertible notes and the upcoming 2026 maturity

The implications of recent refinancing efforts, including the new $800 million credit facility

Assessment of the company’s financial flexibility, debt-to-FCF ratio, and potential dilution scenarios

Insights into how DigitalOcean’s asset and liability structure reflects its infrastructure-heavy business model

Discussion of working capital efficiency, recurring revenue dynamics, and cash flow predictability

Evaluation of whether the current balance sheet represents a liability or a strategic asset

A forward-looking valuation analysis based on long-term margin assumptions, revenue projections, and free cash flow generation

In part 1, we covered the business model of DigitalOcean, its customers, and unique selling points DOCN -0.45%↓. Read it here (part 1 “DigitalOcean Might Be the AWS of SMEs – An Undervalued Opportunity Giving You Much-Needed AI Exposure?“).

In part 2, we discussed the management team and the barriers to entry of the industry. Read it here.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Part 4 – Balance Sheet Analysis

Can DigitalOcean Survive a Storm?

At a glance, DigitalOcean’s balance sheet does not scream “fortress.” This isn’t a net-cash, ultra-conservative capital structure – arguably, not at all…

The company and its management team walk that delicate line between prudent risk-taking and disciplined financial management – and, so far, it’s done so with a clear sense of where the boundaries are, but I expect the future to be a little more challenging (as discussed below).

Liquidity: Solid, But Not Excessive

DigitalOcean DOCN 0.00%↑ ended Q1 of 2025 with roughly $360 million in cash and equivalents on its balance sheet. That’s not a war chest for a fairly capital-intensive business, but it’s enough to run the business, fund CapEx, and withstand modest demand shocks without running to the market. And of course, we cannot simply ignore the liabilities segment on the balance sheet.

As discussed before, the company is free cash flow positive, generating around $150 million in FCF – and has remained consistently cash generative even through the 2022–2023 tech pullback.

However, DigitalOcean carries about $1.5 billion in zero-interest long-term debt, primarily from a term loan facility raised during its post-IPO expansion phase.

“The Convertible Notes have a fixed annual interest rate of 0.0%, and accordingly, we do not have economic interest rate exposure on the Convertible Notes.“ (Most recent company 10-K)

That sounds like a lot relative to market cap and FCF – and it is; this absolutely cannot be denied by any fundamental investor.

If the company were to settle the debt by issuing new shares at the current price, it’d have to issue around 50 million shares (more than 50% of the current shares outstanding).

Compared to free cash flow, the debt-to-FCF ratio is ~10x (a little less if you account for cash & cash equivalents) – very high, arguably we should see this trending down over the next few years though as debt is paid down and revenue goes up, and as a result of the operating leverage effects discussed in my previous post, FCF should increase too.

So far, this thesis still has to play out though as long-term debt is unchanged over the last couple of years:

Now, more recently, management has clearly flagged deleveraging as a strategic priority, and free cash flow is currently being directed toward paying down debt rather than buybacks or dividends.

“Previously, I've stated a range, a target range of 2.5x to 3x is our long-term target. As we've evaluated our opportunities and taken a look at the market, we think that we can safely drive leverage under 2.5x, and we think that's a good target for us to have. People ask, and I'm sure there's a bunch of folks in this room that are going to ask in just a few minutes. Well, what about your current debt? You've got $1.5 billion that's due at the end of 2026. And again, every time I get this question, I start with this is the best debt instrument I've ever seen in my entire life. We have $1.5 billion of debt with 0 coupon, so we pay nothing. In fact, we make money on -- interest that we keep that cash in the bank. So people are paying us to borrow their money. I don't know if we'll be able to do that again, but it's a great thing to have.“ – CFO Matt Steinford during the 2025 Analyst Day

Ideally, you’d want to see a debt-to-FCF ratio below 3–4x. But context matters: DigitalOcean isn’t bleeding cash. For now, it’s managing its liabilities deliberately and predictably. Importantly, there are no signs of liquidity stress – no covenant breaches, no reliance on equity issuance, no asset fire sales. Management seems relaxed about the required refinancing of the debt that the company has started tackling more recently (more on this below). It’s a growth company managing through a leveraged expansion phase – and so far, it's doing that quite responsibly (although the old management team certainly expected a better operational performance over the last 3-4 years).

Debt Maturity: This Has Me Worried …

One of the more worrying aspects of the company’s debt profile is the maturity ladder. The Convertible Notes mature in 2026, not giving the company much breathing room to deleverage organically before refinancing becomes an issue.

And while the majority of debt is in Convertible Notes, there’s a key nuance worth understanding. Holders of these notes can choose to convert their debt into equity at a fixed rate – specifically, each $1 of principal is initially convertible into 5.6018 shares, implying a conversion price of ~$178.51 per share. But with DigitalOcean currently trading around $30, the notes are deeply out-of-the-money – so conversion is extremely unlikely unless the stock sees a major rally.

What happens if the notes aren't converted and simply mature in 2026? Despite language in the 10-K stating that the company may, “at its election,” settle a conversion in cash, stock, or a mix of both, this flexibility only applies if the noteholder actually chooses to convert.

"Upon conversion of the Convertible Notes, the Company will pay or deliver, as the case may be, cash, shares of common stock or a combination of cash and shares of common stock, at the Company’s election." (Company 10-K)

If no conversion occurs and the notes reach maturity, the company must repay the principal in cash. It cannot choose to "repay in stock" unless the indenture (the legal agreement governing the notes) explicitly allows for it – and there’s no indication that’s the case here.

So the repayment obligation is real. The company can't escape it with dilution based on a higher share price of $179/share. And if DigitalOcean were to face financial distress, convertible noteholders would behave like any other creditor – likely pushing for recovery through cash in a default scenario. This would spell serious trouble.

But again, the company seems to be aware of the problem (of course, they are!) and very recently announced the following:

“We announced this morning that we have taken the first step in addressing our outstanding 2026 convertible debt, having entered into a new secured 5-year credit facility agreement of $800 million, with a $500 million Term Loan A that we will leverage to refinance a portion of our existing convertible notes. […]

We will use the proceeds from this facility to refinance a portion of our existing convertible notes that are maturing in December 2026. This loan is the first step in 2025 to fully address the 2026 convert before the existing facility goes current. With our strong balance sheet, growing adjusted EBITDA and cash flow generation, we have multiple attractive options available to us that we are considering, including convertible debt, term loan B and high-yield options. We will continue to evaluate these options over the balance of this year to fully address the 2026 convert and optimize our long-term cost of debt.“ – Padmanabhan Srinivasan during the 2025 Q1 Call

So DigitalOcean recently announced a key step in managing its upcoming 2026 convertible debt maturity by securing a new $800 million credit facility, including a $500 million Term Loan A. This shift from no-interest convertible debt to a more traditional secured loan structure has important implications for the company’s financial profile. Term Loan A facilities are floating-rate instruments that currently command interest rates closer to maybe 7–9%, depending on credit conditions and company risk profile.

This means DigitalOcean will likely face a significantly higher cash interest burden going forward, with annual interest payments potentially rising by tens of millions of dollars.

While this move eliminates the dilution risk tied to the convertibles, it does increase short-term cash outflows. I expect the soon-to-come ongoing principal repayments to significantly depress FCF.

Overall, the refinancing provides runway beyond 2026 but tightens the company’s operating leeway in the near term (and arguably also the medium term depending on the degree to which growth can reaccelerate).

Here’s another comment from management expressed during an investment conference in December 2024:

Analyst: “Just for you, Matt, just with the convertible note, a couple of years away still, but how are you assessing how you will approach that as we get near and near over the next couple of years? Like could you look at just term loans? Or are there any other financial mechanisms you're considering right now?”

Matt Steinfort: “Yes. We have -- we're in a great position with respect to our balance sheet. We've got a lot of cash on the balance sheet. We've got that note that doesn't -- 0 coupon doesn't mature until the end of 2026. We have a lot of different options, and we're in active conversations with bankers and talking about the various levers.

We could do a combination of a smaller convert and then a traditional data term loan or some other instrument and that's something that will pay, I think, more aggressive attention to as we get into 2025. [ So, have a ] year before it goes current. So we've got a lot of option value.“

I would strongly disagree with the statement that the company is in a strong position in terms of its balance sheet. Over the years, I have learned that carrying too much debt is risky – very risky – and it makes you dependent on the goodwill of others. If things turn south operationally, you can very quickly have very serious problems.