When Monday.com went public in 2021, many investors dismissed it as just another project management tool competing with the likes of Asana, Smartsheet, and Trello. In a sector flooded with flashy SaaS IPOs, it was easy to overlook a company that presented itself not with bold visions of "changing the world," but with a rather modest mission: making work easier and more transparent.

Fast-forward a few years, and Monday.com has quietly built one of the most impressive growth and profitability track records in the entire cloud software industry. Despite operating out of Tel Aviv – and weathering the enormous human and operational challenges of the ongoing conflict in Israel – the company has consistently posted strong top-line growth, expanded margins, and steadily grown its cash pile without relying on aggressive marketing spending or high leverage.

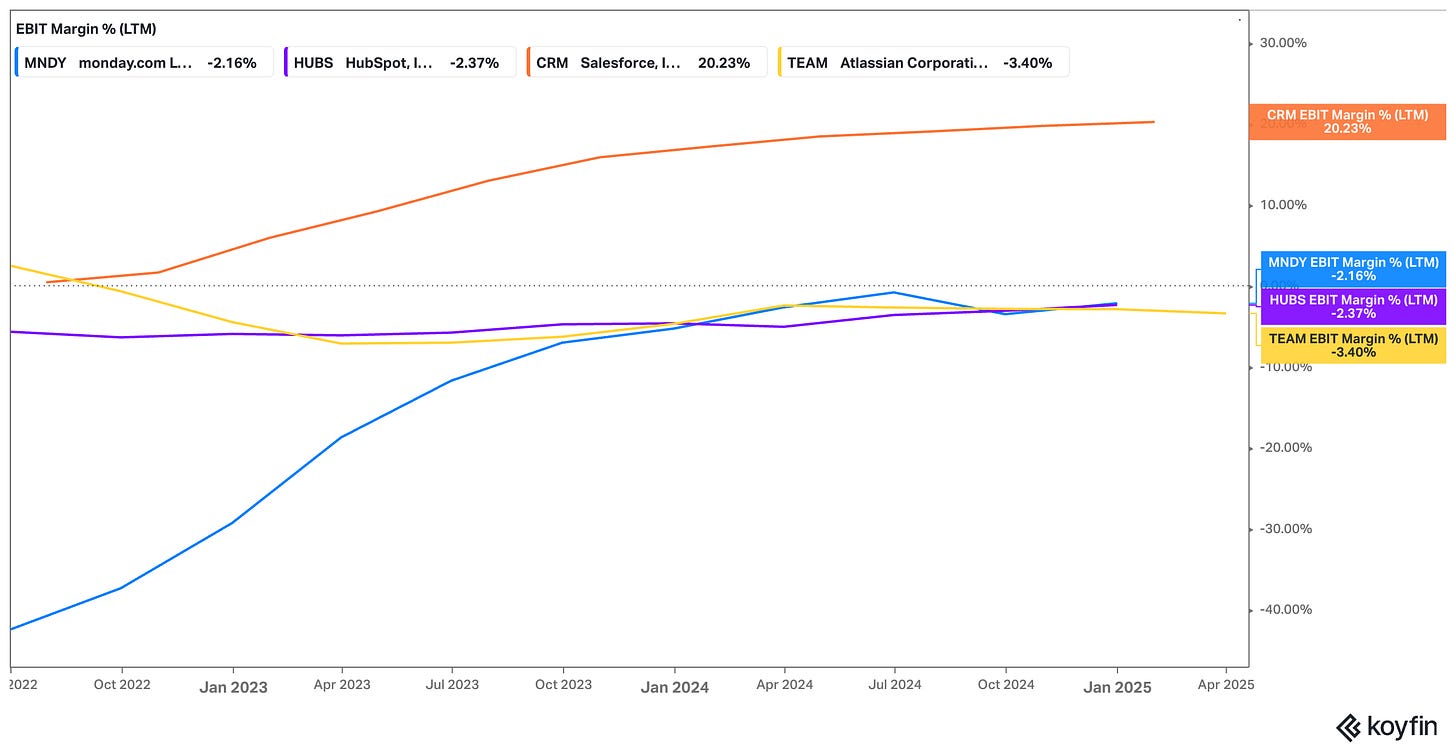

Today, Monday is far more than a project management tool. It has evolved into a flexible Work Operating System (WorkOS) that powers workflows across departments, from sales to software development to customer support. It's competing not just with legacy project management apps, but with giants like HubSpot and even Salesforce in broader enterprise markets. And unlike many of its SaaS peers, Monday has made this leap while maintaining a rare balance between growth and profitability, boasting a Rule of 40 score north of 44% (EBIT margin + 3Y revenue CAGR), a rule of X score of 64% ((2*1Y revenue growth) + EBIT margin) and gross margins approaching 90%.

Since going public in mid-2021, Monday.com’s stock has taken investors on a volatile ride. After initially surging post-IPO, the shares declined sharply during the 2022 Tech selloff, hitting a low below $90. Since then, however, the stock has rebounded strongly and more than tripling off the bottom as the company proved it could grow efficiently and generate real cash.

Yet despite a tripling of the stock price since late 2022, Monday.com still seems to fly under the radar compared to other names in the SaaS hall of fame as the stock, even after this impressive recovery, remains priced below its post-IPO high of around $379. Once could argue that many investors either don't fully appreciate the business model transition that has occurred or continue to lump Monday in with smaller, less scalable workflow tools. This presents an opportunity, but only if the story behind the numbers holds up to scrutiny.

In this deep dive, we'll explore how Monday built its competitive edge, whether the management team can sustain its momentum, and what the company's evolving strategy, including its new push into AI-driven workflow automation, means for the future.

We'll also examine whether today's valuation leaves enough margin of safety for long-term growth-oriented investors, and what risks could derail the story.

Monday.com may have started as a simple building block for project collaboration. But the way things are shaping up, it might just end up becoming the operating backbone for the future of work itself.

Buckle up for an exciting business analysis!

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Understanding the Business

1. Monday.com's Product: Building the Backbone for Modern Work

At its heart, Monday.com sells non-consumable, subscription-based software. The platform is not something corporate customers purchase once and discard – it becomes deeply embedded in the daily workflows of teams and organizations.

This creates stickiness!

Because of this stickiness, customers typically keep expanding their usage over time, which directly drives higher subscription revenues.

Importantly, Monday does not sell a commodity software solution. Project management and work collaboration may seem crowded markets at first glance, but Monday’s offering is highly differentiated. The company positions itself as an open, customizable Work Operating System (WorkOS), rather than a narrowly defined task management tool.

This distinction matters: instead of forcing customers to conform to rigid workflows, Monday enables organizations to design their own processes using modular "building blocks" – columns, automations, integrations – without requiring technical expertise.

This no-code/low-code flexibility is one of Monday’s core competitive advantages. It allows users to build CRM systems, software development boards, customer support dashboards, and more – all without writing a single line of code.

While traditional competitors like Asana or Smartsheet focus largely on pre-defined templates or narrower use cases, Monday gives users true adaptability across industries and functions.

In that sense, Monday is less of a direct Asana competitor and increasingly a broader platform play, able to serve companies across various industries and edging into markets traditionally dominated by Salesforce and HubSpot.

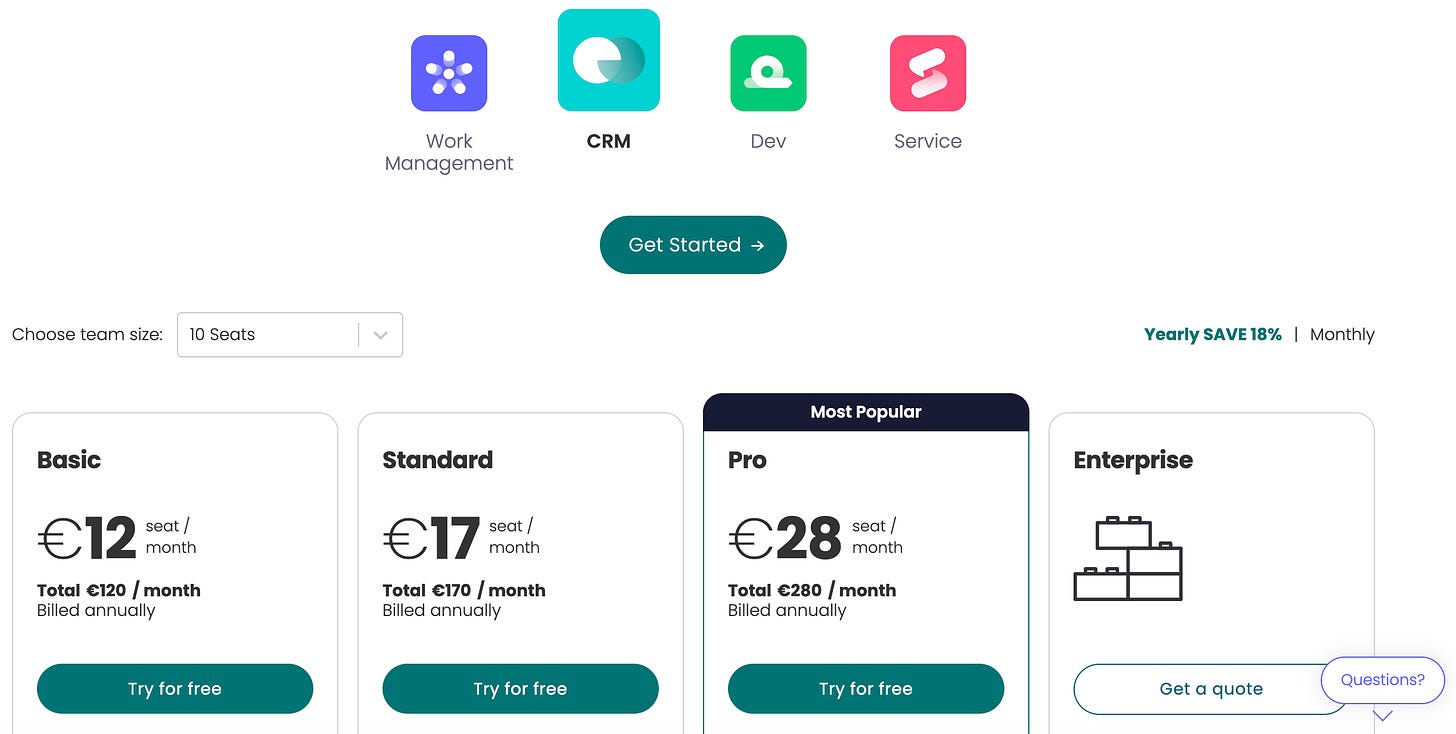

In terms of product tier, Monday.com would generally be considered a mid- to high-tier SaaS offering. It is priced well above mass-market task managers like Trello, but below the complex, enterprise-heavy CRM solutions offered by Salesforce.

The combination of strong product capabilities with relatively accessible pricing has allowed Monday to serve both SMBs and larger enterprises, a rare balancing act in the SaaS space.

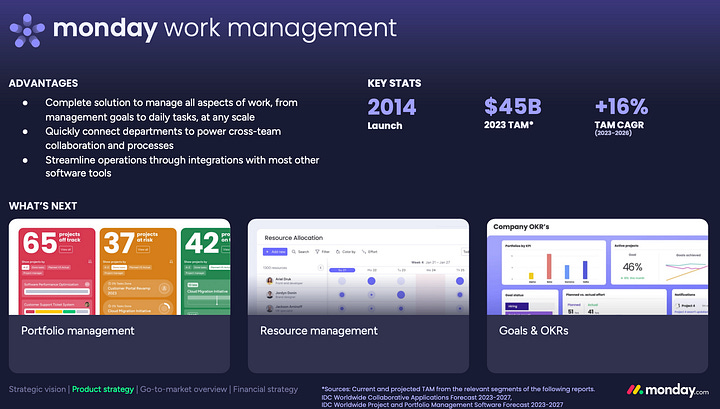

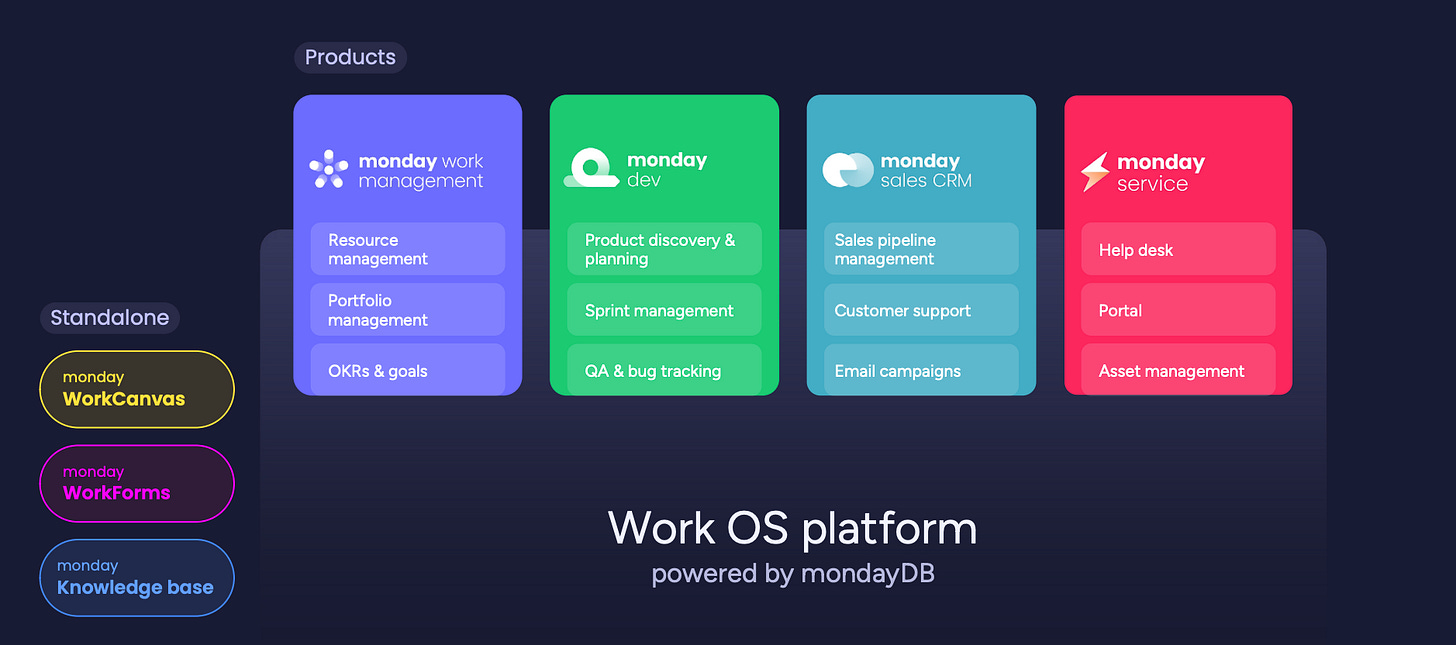

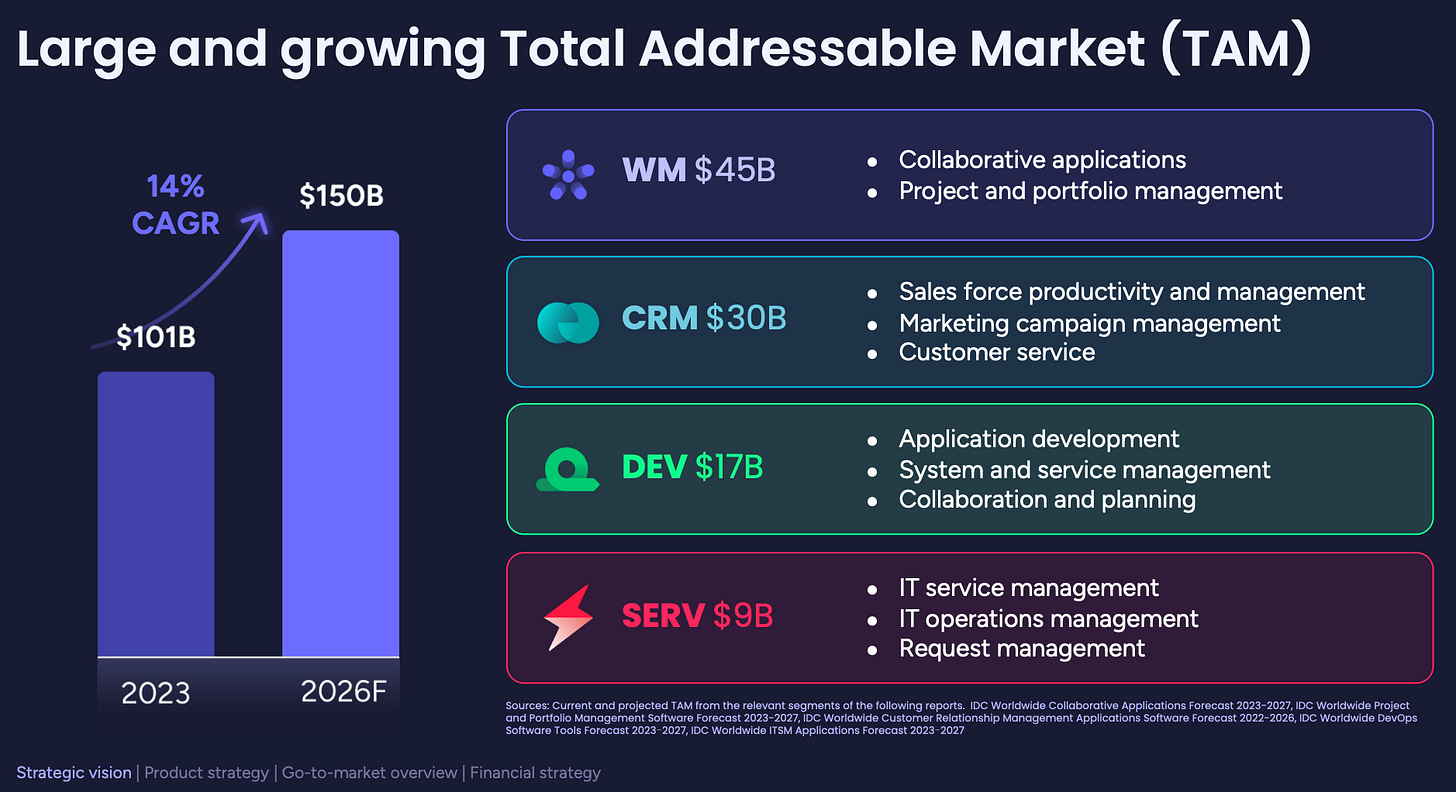

Product innovation has been a clear strategic priority for the company. Since 2022, Monday has significantly expanded its offering beyond its original project management roots. Today, the core WorkOS platform supports several dedicated solutions:

Monday Work Management – At the heart of Monday.com’s product suite lies Monday Work Management, the original and still primary solution that enables teams to plan, track, and execute a wide variety of operational workflows. This offering forms the backbone of the platform and is used across departments for everything from project planning to marketing campaign tracking and HR onboarding. While newer verticals like CRM, Dev, and Service are expanding Monday’s total addressable market, Work Management continues to drive the bulk of adoption and serves as the natural entry point for most customers. Its intuitive interface, flexible automations, and rich integration ecosystem are what first attract users, and what often lay the groundwork for deeper cross-product expansion.

Monday Sales CRM – targeting small to mid-sized sales organizations, positioning itself as a simpler, more flexible alternative to HubSpot.

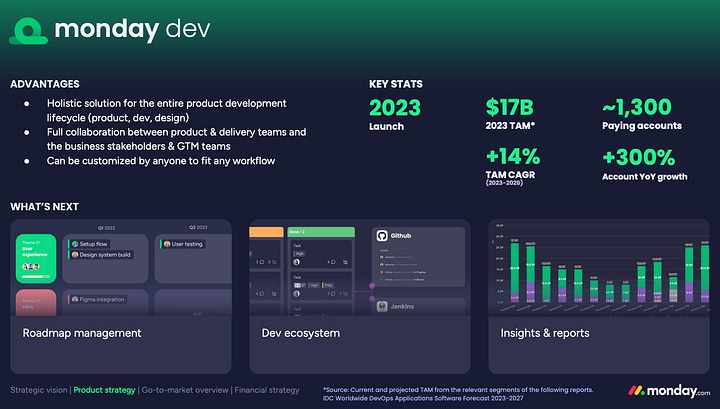

Monday Dev – aimed at agile software development teams, competing with Atlassian’s Jira.

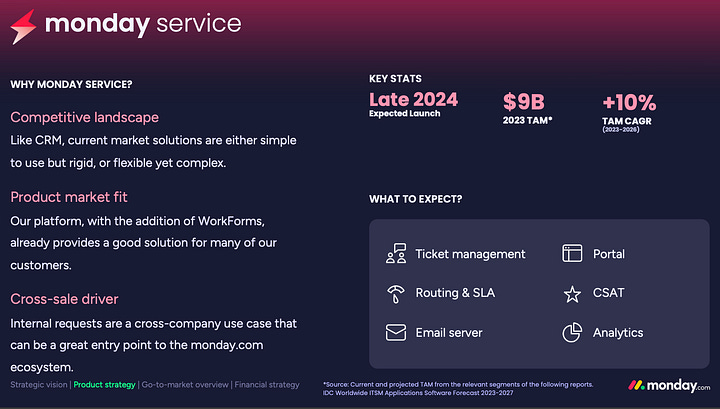

Monday Service – a newly launched product for service and support teams, entering a market adjacent to ServiceNow and HubSpot Service Hub.

Unfortunately, as of now, monday.com does not publicly disclose the percentage of its revenue attributable to these individual product segments.

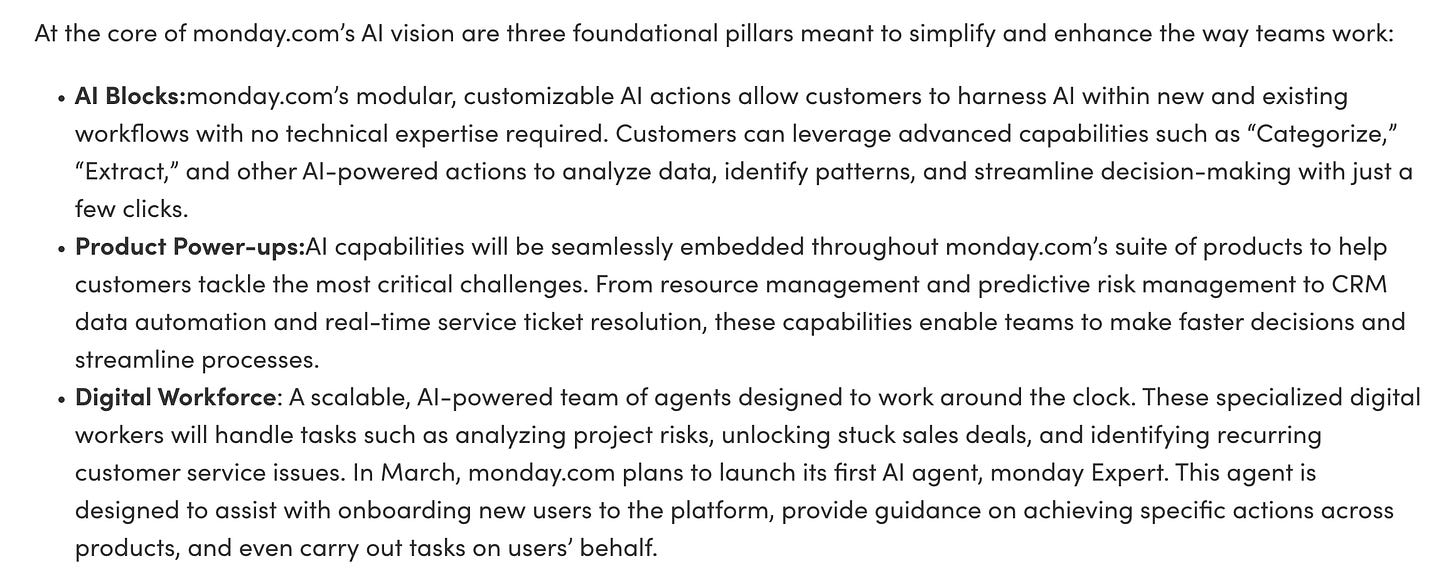

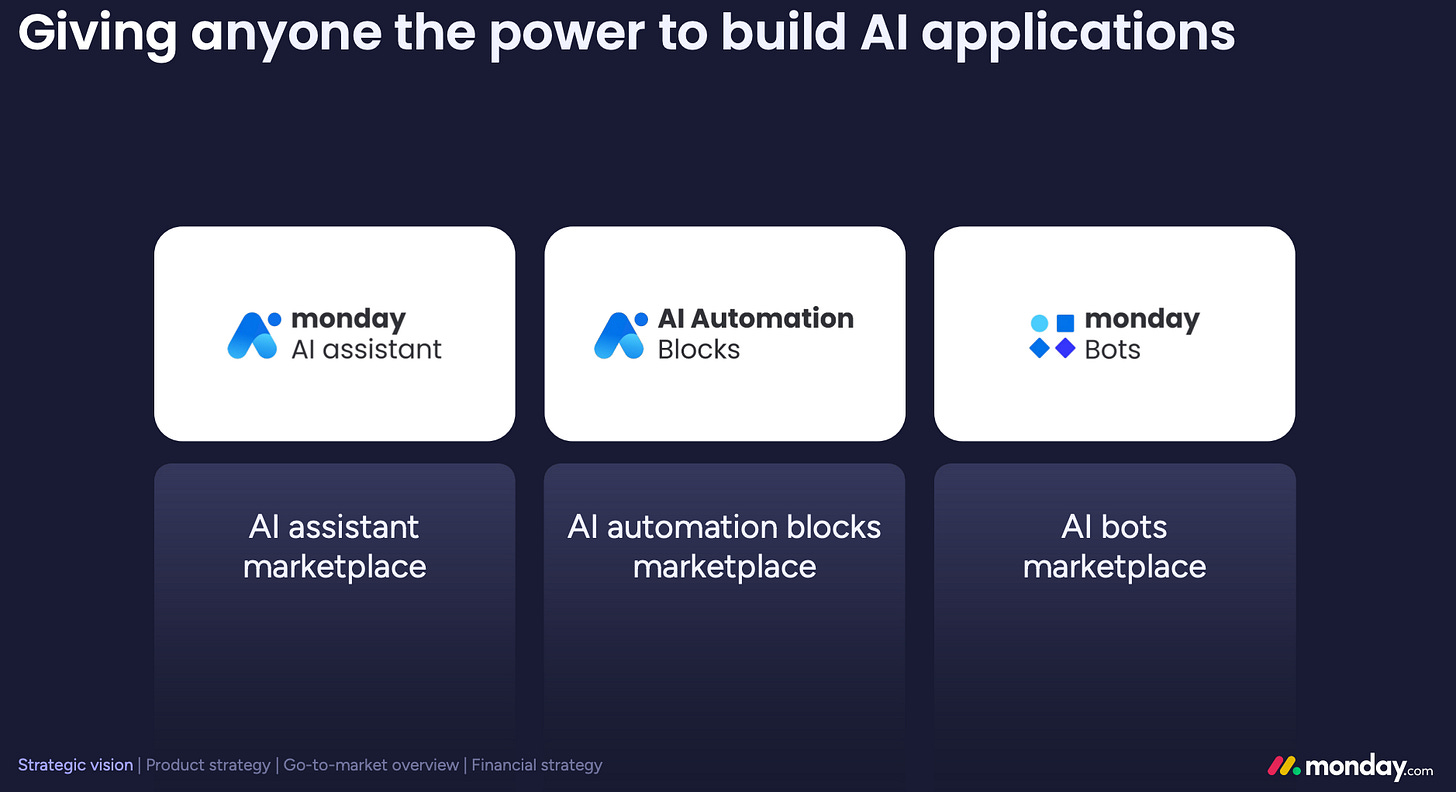

The company is also investing heavily in AI-powered workflow capabilities. Modular AI features – such as automatic data extraction, categorization, and predictive risk assessment – are being embedded across Monday’s product suite.

“In 2024, we made significant strides in our AI development unveiling several new capabilities, including AI Blocks. Since AI was integrated into the monday platform, users have performed approximately 10 million AI actions. This ongoing progress highlights our commitment to enhancing the user experience and driving greater efficiency through innovating AI solutions.“ – Roy Mann

The first dedicated AI agent, Monday Expert, launched in March 2025, promising further productivity gains for users.

This ongoing expansion of the product ecosystem suggests that Monday’s ambitions are far from capped. Rather than being a one-trick project management pony, Monday is methodically positioning itself as a multi-solution WorkOS platform capable of powering virtually every major workflow within a business.

2. Business Operations: How Monday.com Makes Money

Monday.com operates a subscription-based, recurring revenue model. Customers pay for access to the platform on a per-user, per-month basis, with pricing tiers depending on features and scale. This setup gives Monday a highly predictable, compounding revenue stream – the hallmark of successful SaaS companies. The company also employs a land-and-expand strategy: many customers begin with a small team subscription and expand usage over time as the platform becomes embedded into their workflows.

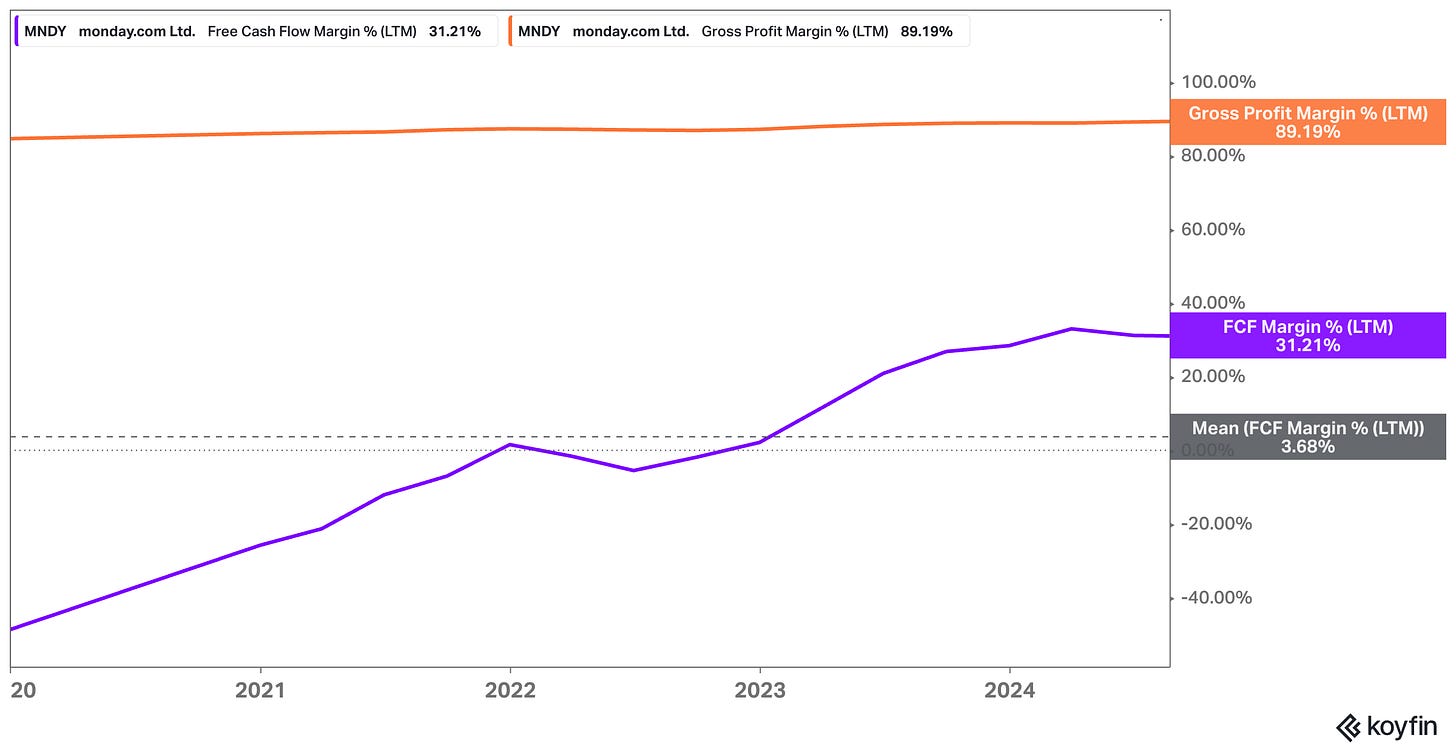

On a unit economics level, the key unit of analysis is the individual customer account, typically measured by the number of seats (users) and the average revenue per account. Monday.com has not disclosed exact per-customer profitability, but certain data points offer strong clues. Gross margins hover around 89%, meaning that almost every incremental dollar of revenue flows through with minimal cost, especially as the company scales. Major costs per customer come primarily from customer acquisition (sales and marketing) and ongoing support, but once a customer is acquired and onboarded, maintaining them is extremely inexpensive.

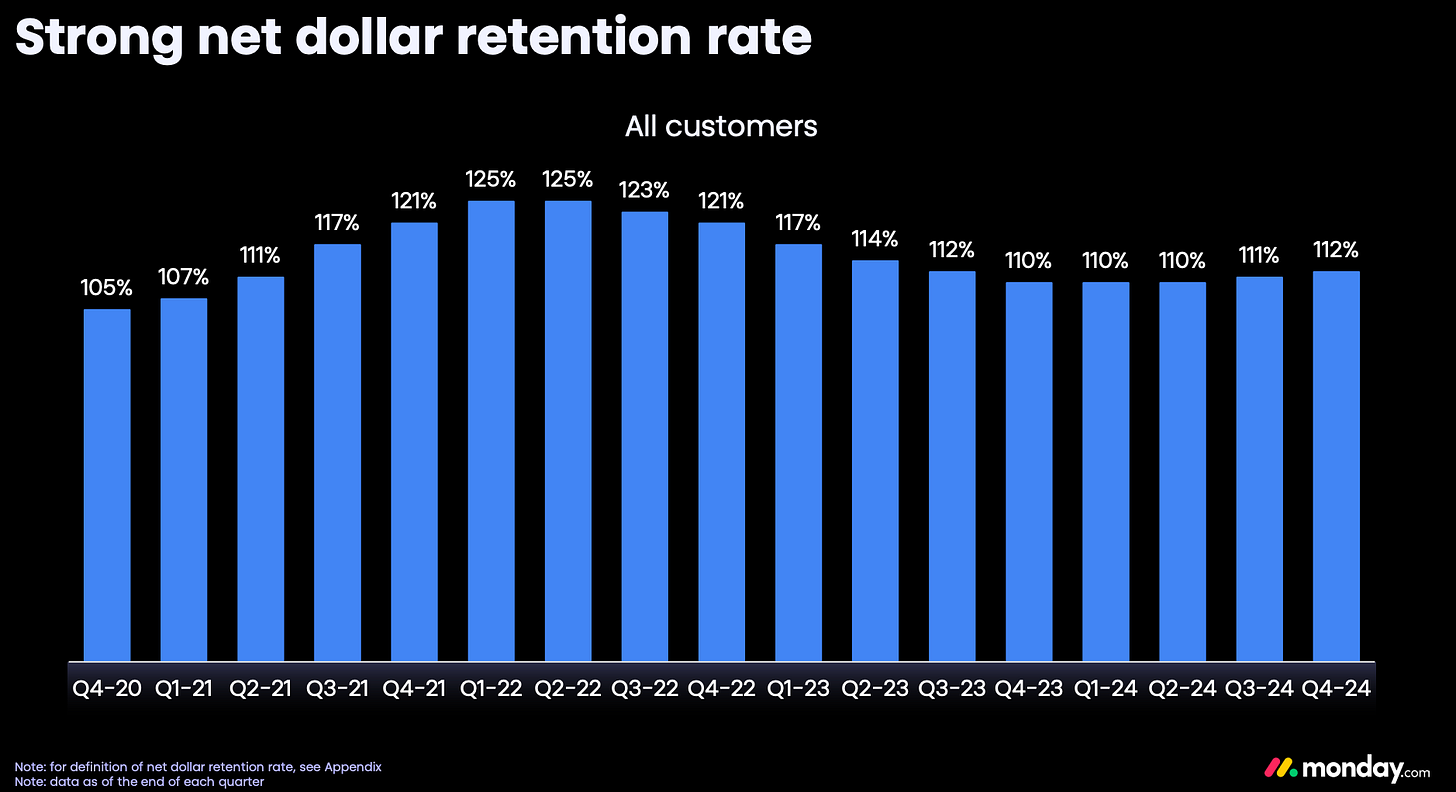

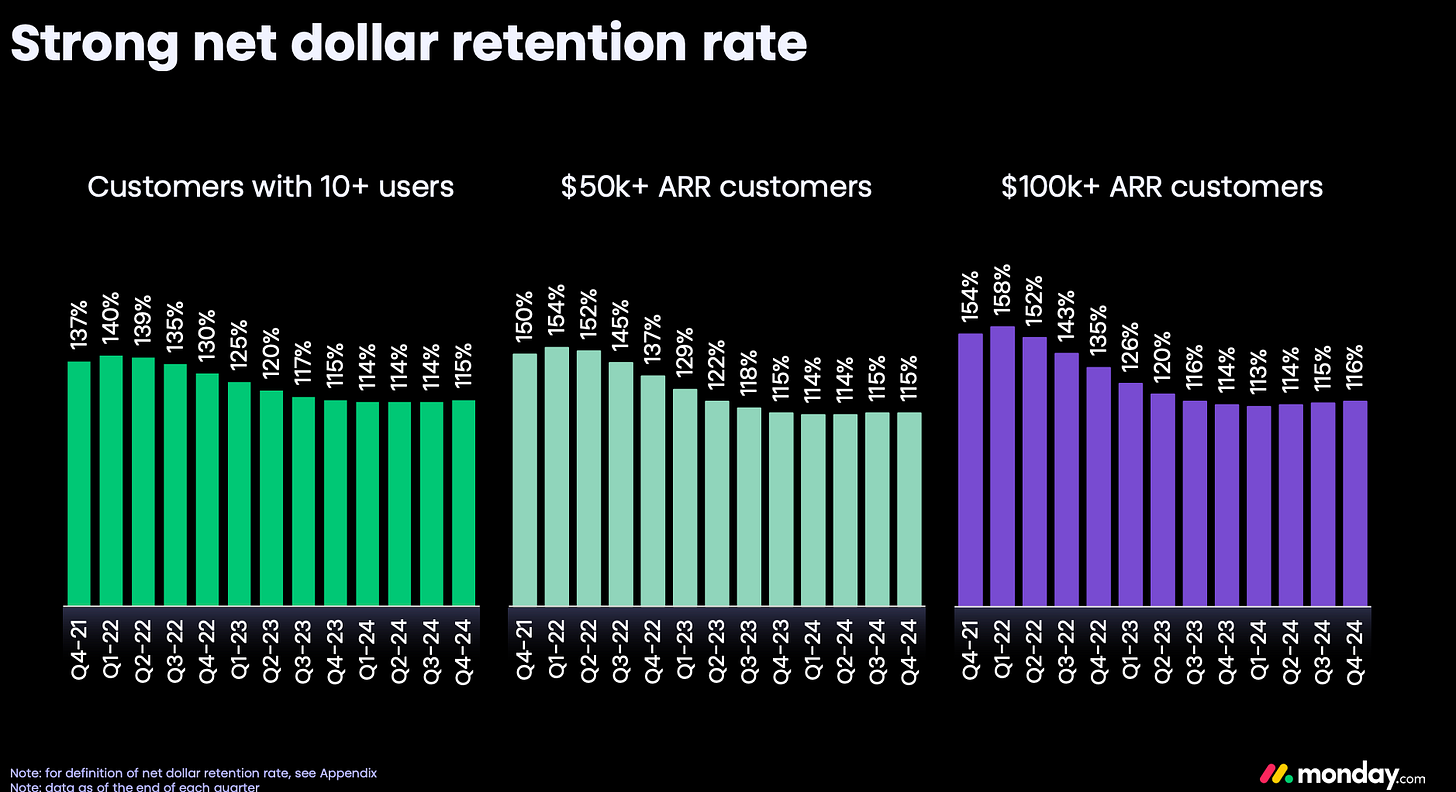

Moreover, the company's net dollar retention rate – which measures revenue expansion within existing accounts – stands at a healthy 112% (115% of customers with $50k+ ARR), indicating strong upsell dynamics and low churn. This combination of high gross margins, low servicing costs, and expanding wallet share per customer underpins Monday’s already impressive free cash flow generation (with further room for improvement).

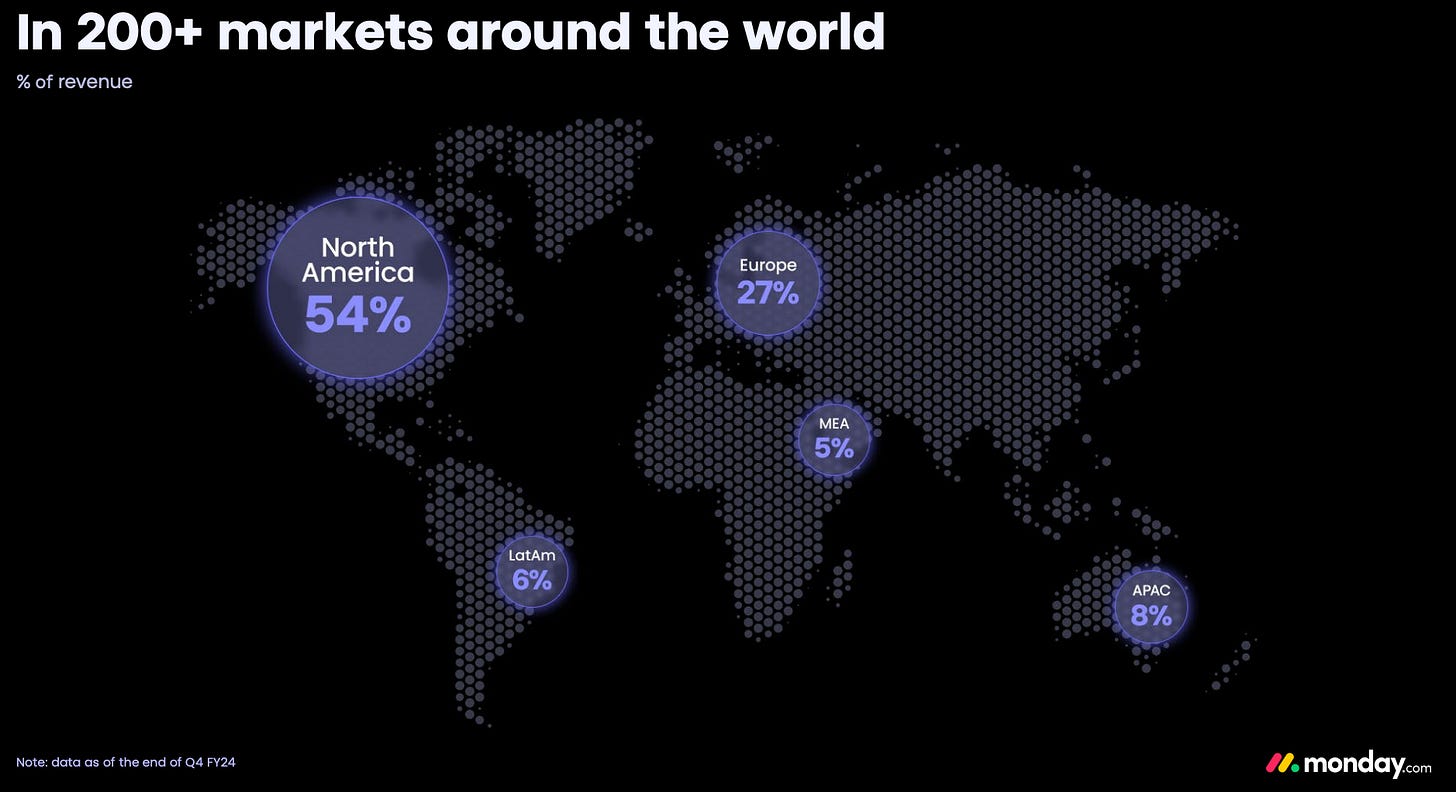

Geographically, Monday.com operates globally, but with important regional nuances. While the U.S. remains the largest single market, accounting for just over half of revenue, around 46% of the company's revenue now comes from international markets. Monday's platform is available in 14 languages, and its global cloud infrastructure is distributed across the United States, Europe, and Australia – keeping data storage well outside politically sensitive areas like Israel.

Speaking of politically sensitive areas, despite its headquarters being in Tel Aviv, the company has managed wartime disruptions remarkably well, maintaining operational continuity even during intense conflict.

Nonetheless, geopolitical risk remains a background factor. Although only about 7% of revenue is directly tied to Israeli customers, prolonged instability could affect talent recruitment, R&D operations, and global perception over time (more on this in the risk section).

The value chain for Monday.com is relatively straightforward: the company develops and updates its software centrally, distributes it via a self-service cloud model, and augments customer acquisition with inside sales and channel partnerships. Unlike companies relying on heavy field sales, Monday emphasizes digital marketing and product-led growth, keeping distribution costs relatively efficient. Customers typically sign up online, customize their workflows through intuitive onboarding processes, and scale their usage organically.

“You have the top of funnel, the kind of the online marketing channel that is very efficient, and we measure everything through an internal BI system called BigBrain. We measure the return on the investment. We get the customers into the platform and then they can expand and scale with us.

And in addition to the online marketing and top of funnel, we have the sales-led organization, which includes sales partners, customer success managers that basically are speaking with the customers and expanding across the segments.“ – Comments from the December 2024 Nasdaq London Investor Conference

Monday.com is legally structured as a publicly traded corporation, listed on the Nasdaq under the ticker symbol MNDY. It was founded in 2012 and went public in mid-2021. Operationally, it maintains a lean, centralized structure with hubs for sales and marketing in key global regions.

From a cyclicality perspective, Monday exhibits characteristics of a non-cyclical, relatively recession-resistant business. Collaboration and workflow tools are mission-critical for businesses in good times and bad. Even during macroeconomic slowdowns, companies usually maintain their software subscriptions to ensure operational efficiency – much like cloud infrastructure services.

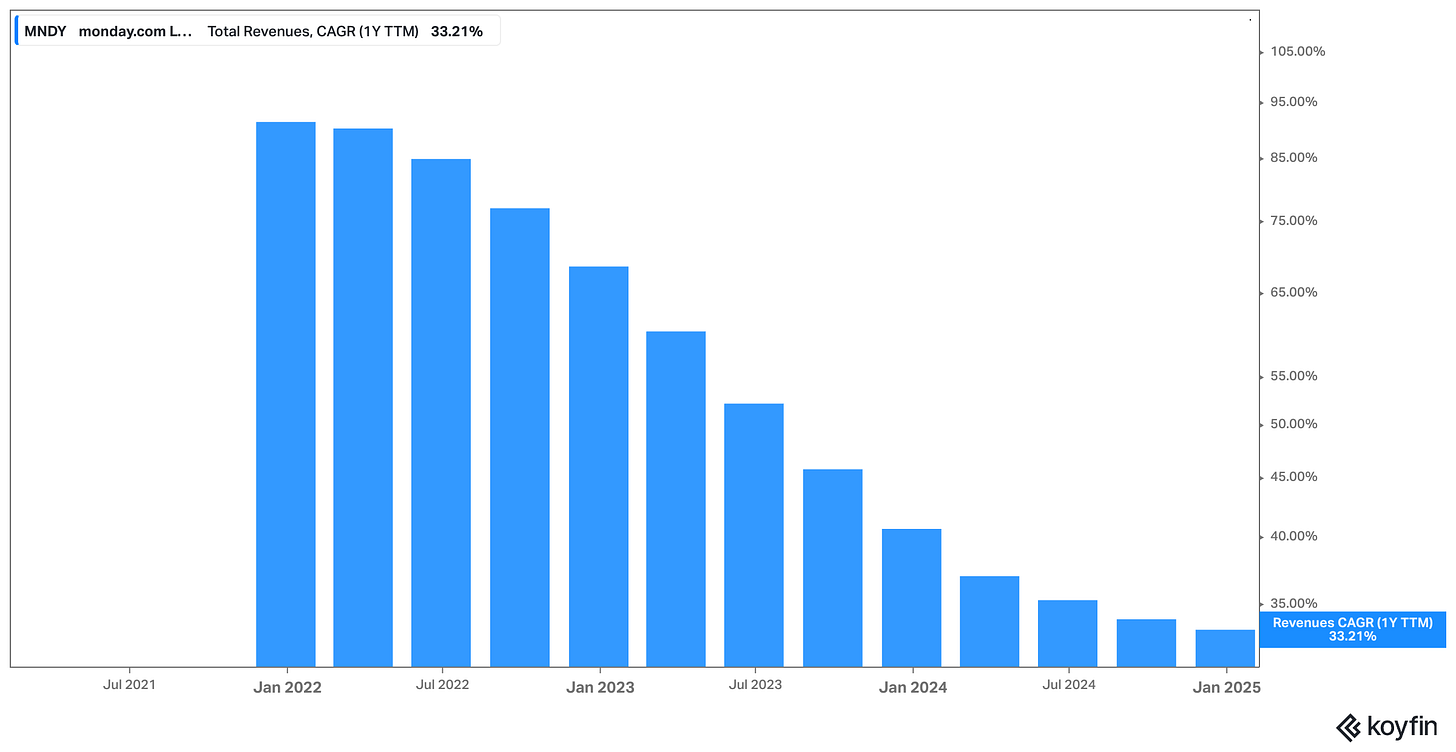

While the broader SaaS sector faced headwinds in 2022–2023 amid a tech selloff and economic uncertainty, Monday continued to grow revenue organically by an impressive clip and remained cashflow positive.

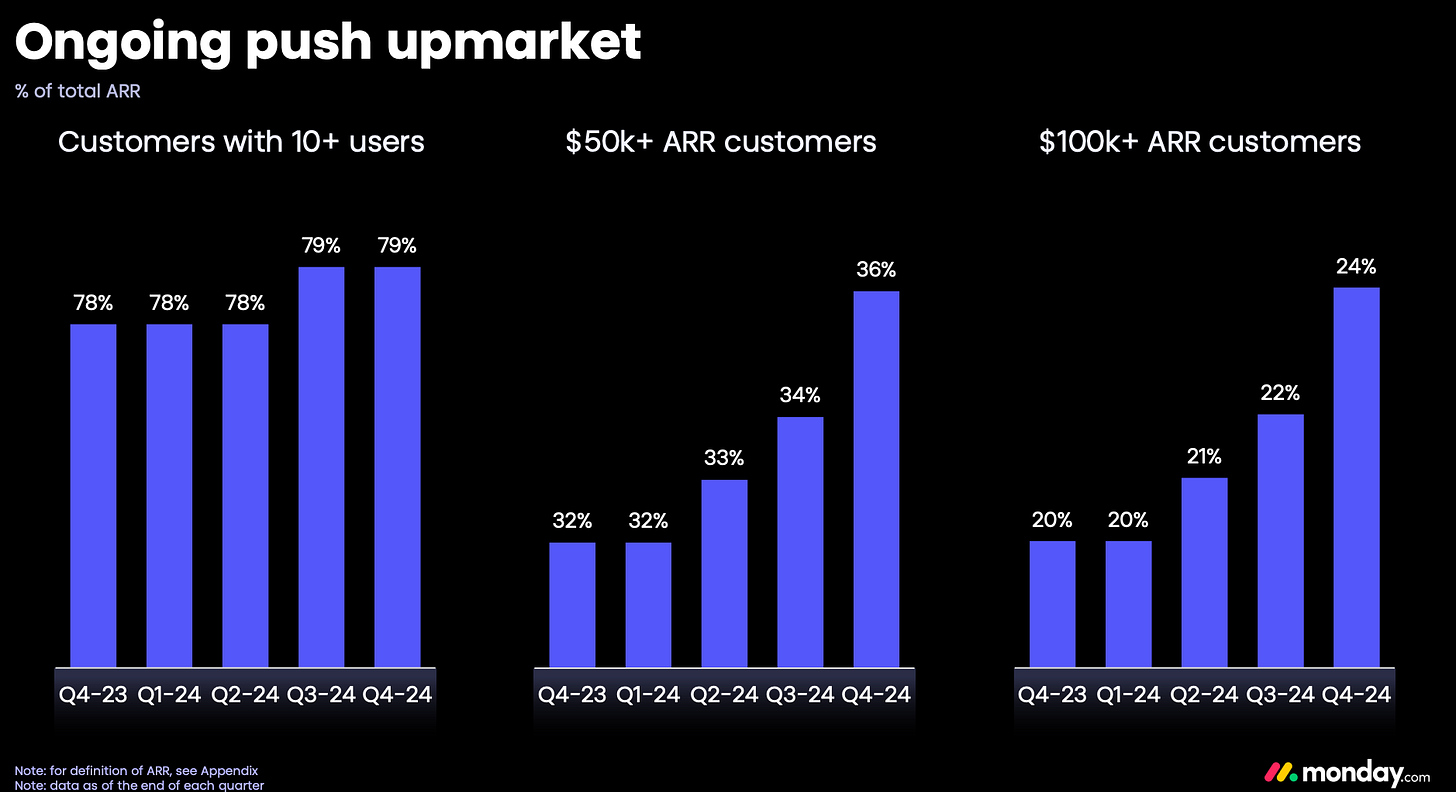

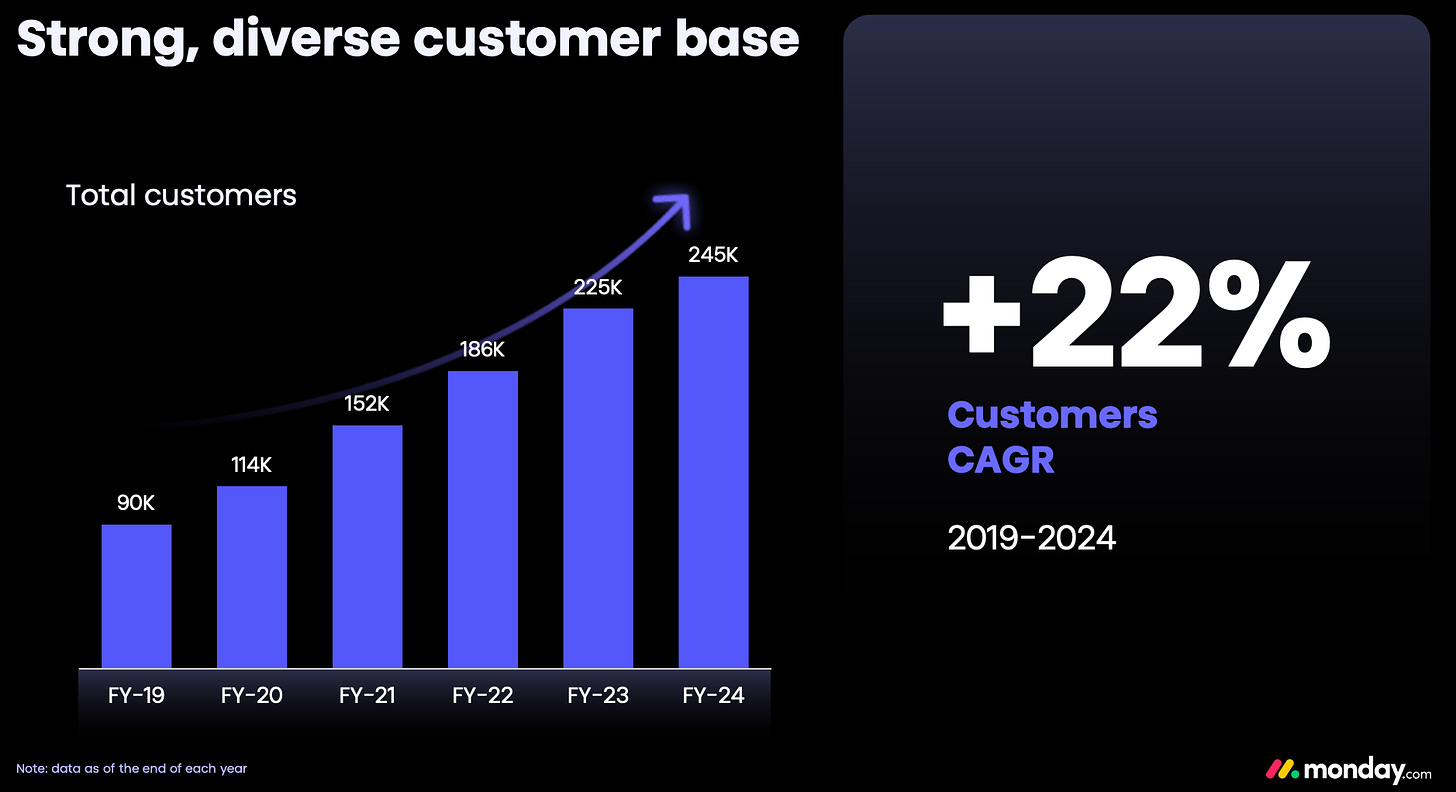

In terms of life cycle, Monday is best described as an emerging growth company transitioning toward maturity. With nearly $1 billion in revenue, rising profitability, and a customer base that includes both SMBs and large enterprises, the company has clearly exited the early startup phase. Yet it remains far from saturated, especially given its ambitions to continue expanding into adjacent markets like CRM and Service Management, and the new focus on/ambition to win larger enterprise customers.

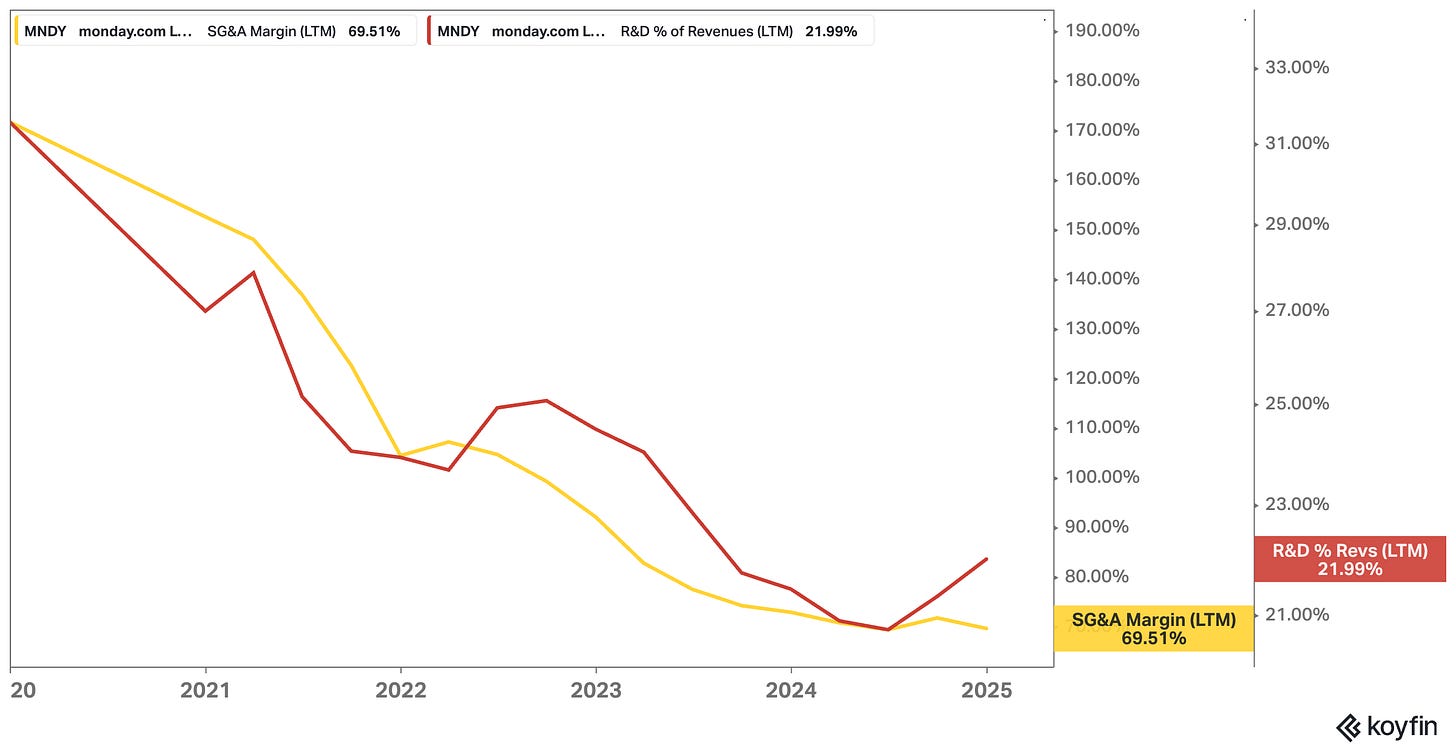

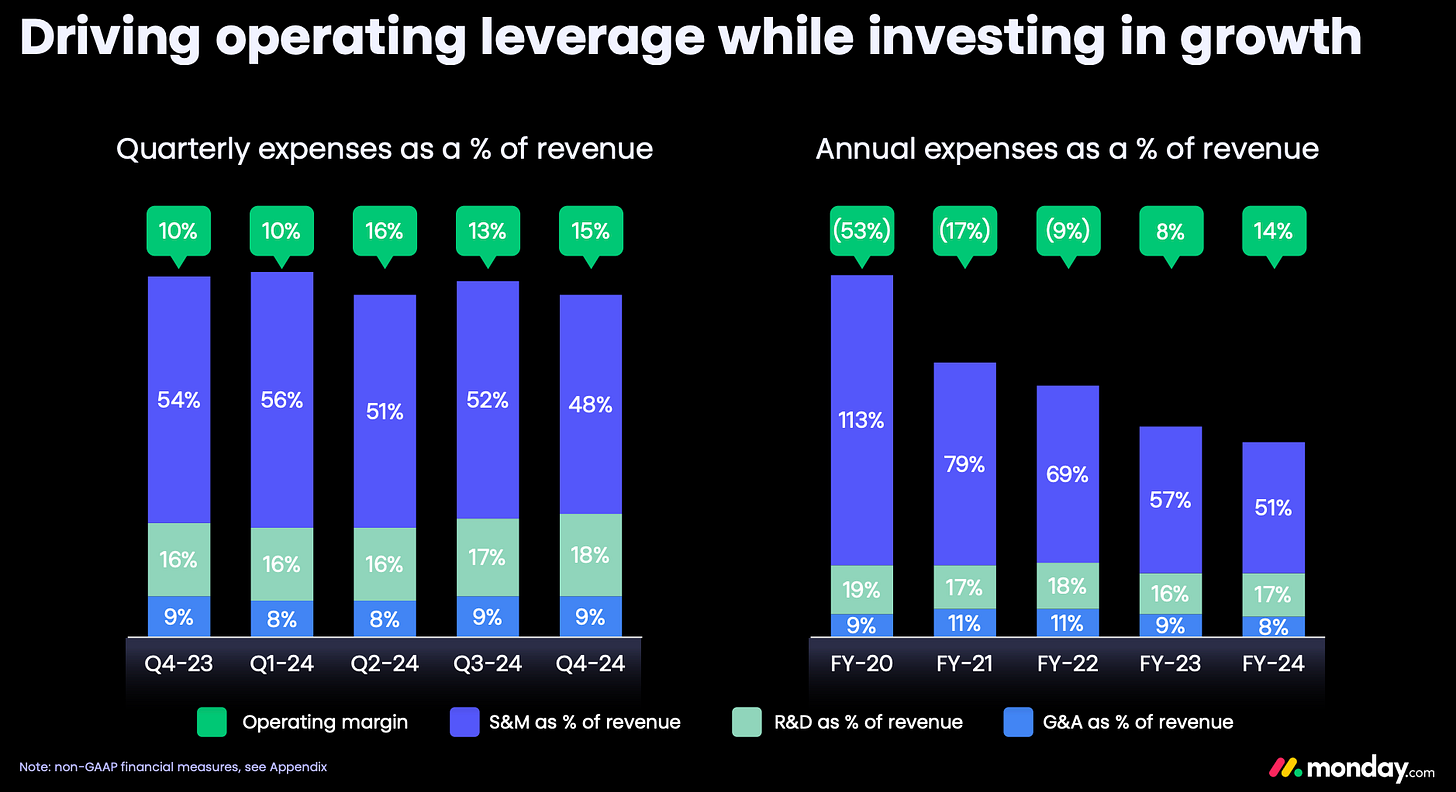

As a software business, the company of course exhibits high operating leverage as it scales. Major fixed costs include R&D (building new features and platform infrastructure) and sales and marketing (customer acquisition).

As revenue scales, these fixed costs become a smaller percentage of sales, driving margin expansion. Marketing expenses as a share of revenue have already declined in recent years, and management expects continued operating margin improvements as the customer base grows without a corresponding linear increase in fixed costs.

If Monday’s trajectory continues, it is reasonable to expect operating margins to expand into the 20–25% range over the next five to ten years.

Given the company’s near-90% gross margins and efficient cost structure, Monday has a real path to becoming a free cash flow powerhouse as it matures.

Finally, I’d like to highlight the most critical key performance indicators (KPIs) that I think investors should focus on for Monday.com:

Revenue growth rate – still critical as the company scales

Net dollar retention rate – a proxy for customer satisfaction, upselling, and product stickiness

Free cash flow margin (after SBC)

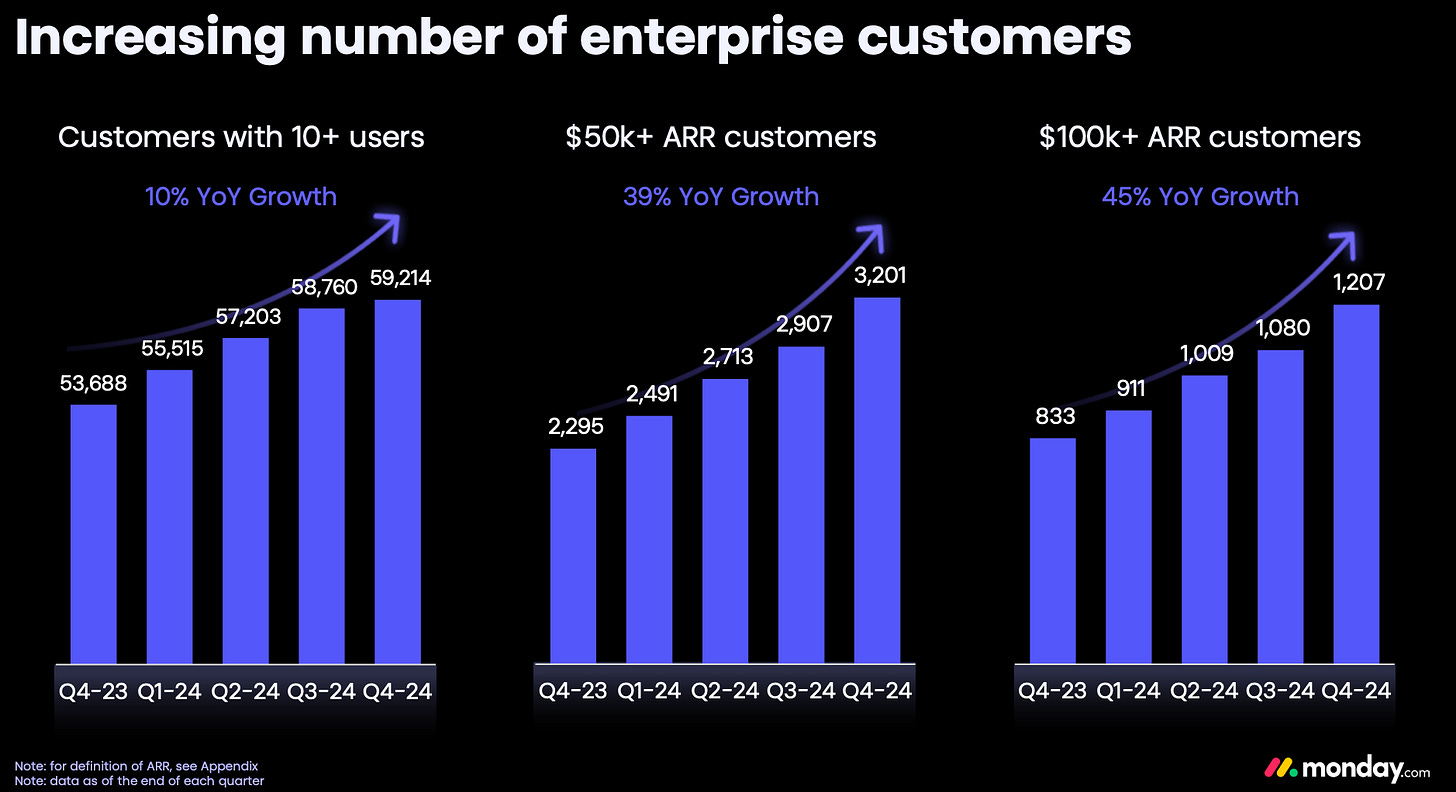

Number of $100k+ customers – a leading indicator of success in the (more) lucrative enterprise market

These metrics, more than vanity growth figures or flashy product announcements, will ultimately determine whether Monday can build durable, long-term shareholder value.

3. Customer Perception: Do Users Really Need Monday.com?

Every successful software business solves a real pain point, and Monday.com’s value proposition lies in reducing the chaos of modern work.

For thousands of teams across the globe, the company’s WorkOS provides a centralized, highly customizable, and highly visual way to manage processes, deadlines, responsibilities, and collaboration.

Whether it's a startup building its product roadmap, a marketing team running campaigns, or an enterprise sales org coordinating outreach, Monday offers a shared operating environment that replaces siloed spreadsheets, messy email chains, and disjointed tools.

Okay, if Monday disappeared tomorrow, maybe it wouldn’t cripple its customers the way AWS or Microsoft might – but it would cause serious disruption (and as a result cost a lot of money) to the day-to-day execution of countless workflows. Many teams now depend on Monday to function smoothly, and that dependence naturally only grows the longer the platform is used, the more users are onboarded, and as additional supplementary services are purchased.

Customers continue to buy Monday not because of technological lock-in, but because of process lock-in: entire internal systems, dashboards, and automations are built on it. Replacing Monday would mean rethinking not just the tool, but the way teams operate.

What I believe customers value most about Monday.com is its flexibility and simplicity. They want to adapt software to their needs, not the other way around, and they don’t want to spend a fortune on it.

This demand for adaptability explains why pre-packaged tools like Asana or Jira often fail to fully satisfy teams with cross-functional needs. Monday’s modular architecture – especially with features like drag-and-drop columns, automations, integrations, and now AI-powered building blocks – puts the power of customization in the hands of non-technical users.

That said, Monday isn’t operating in a vacuum. Alternatives – at least to some degree – exist (e.g. Asana, Trello, Smartsheet, ClickUp, Notion, and Airtable), but few combine Monday’s enterprise-grade scalability with its low-code ease of use. Even HubSpot, a more direct competitor in CRM and service software, requires more technical sophistication and onboarding support. Monday’s positioning in the middle ground, approachable but powerful, has created an unusually broad market appeal.

And that appeal isn’t just hypothetical. While Monday hasn’t published a Net Promoter Score (NPS) recently, signs of customer enthusiasm and retention are everywhere. Its net dollar retention rate sits at 115% for accounts with 10+ users, meaning existing customers not only stick around but spend more over time. The platform supports over 245,000 paying customers, including around 1,200 enterprise accounts spending over $100,000 per year. At the top end, the largest customer has deployed Monday for 80,000 users – a number that would have seemed unthinkable just two years ago. That kind of adoption doesn’t happen without genuine, recurring value delivered to users.

Who are those customers? Monday primarily serves businesses and organizations, not individual consumers. While its initial customer base skewed toward SMBs, the company has moved upmarket in recent years and larger enterprises continue to contribute more and more to overall revenue.

Its clients now range from fast-growing startups to Fortune 500 enterprises. This transition has been enabled in part by a stronger technical foundation (e.g. MondayDB), but also by broadening its product portfolio beyond project management.

Demographically, the user base is professional, digitally literate, and spans every function from operations to engineering. It’s not a male- or female-skewed product, nor is it tied to a specific age bracket – it’s used by 25-year-old marketers and 55-year-old IT managers alike. What unites Monday users isn’t who they are, but what they value: clarity, structure, and autonomy.

In terms of retention and customer lifetime value (CLV), Monday performs well by SaaS standards. The relatively low churn among larger accounts, paired with growing seat count per customer, means the lifetime value of each enterprise client is substantial, allowing the company to spend big dollars on marketing and customer acquisition. The company hasn’t publicly broken out CAC (customer acquisition cost) or CLV by cohort, but the operating data tells the story:

Sales and marketing spend as a % of revenue has declined over time

Net cash generation per customer is rising

Nearly all growth is organic, not acquisition-fueled

Put simply, this is a product that scales profitably. Of course, Monday does not have the same cult following as Apple or Tesla, but within the world of B2B software, it has the potential to become a quiet obsession. The more a team uses it, the more it becomes indispensable. And that – more than any spreadsheet model – is what makes customer perception such a powerful source of competitive advantages.

4. Simplicity and Predictability: Are We Looking at Good Business in a Good Industry?

Monday.com operates in the cloud-based enterprise software industry, specifically, the category known as Work Management or WorkOS platforms. On paper, it’s a highly attractive industry: it features recurring revenue, high gross margins, scalable distribution, secular tailwinds, and – when executed well – exceptional operating leverage.

Software is, after all, one of the few areas in business where you can build something once and sell it an infinite number of times at near-zero marginal cost. The economics of the sector explain why some of the world’s most valuable companies – Microsoft, Salesforce, Adobe – live here. Importantly, the sector has also proven to be resilient: even during economic downturns, companies rarely cut mission-critical software tools unless absolutely necessary.

However, not all software categories are created equal. Many are extremely crowded, with weak moats and short product lifecycles!

Monday.com’s category – work collaboration and operational workflows – is relatively young, but maturing fast. The challenge is that while the TAM (total addressable market) is massive, it has attracted dozens of players. This makes the competitive dynamics intense and competitive advantages all the more important.

That said, Monday has found a strategic niche between rigid enterprise software (e.g. Salesforce, SAP) and lightweight productivity tools (e.g. Trello, Notion). Its WorkOS strategy – as we learnt, offering a modular platform that adapts to the customer, not the other way around – gives it a powerful value proposition. Over time, this positioning has allowed Monday to move beyond its initial task-management use case and become a true workflow layer inside businesses; and management is finding ways to expand the TAM every year by adding new layers to the company’s offerings.

In terms of competitive landscape, Monday’s top listed rivals have historically included:

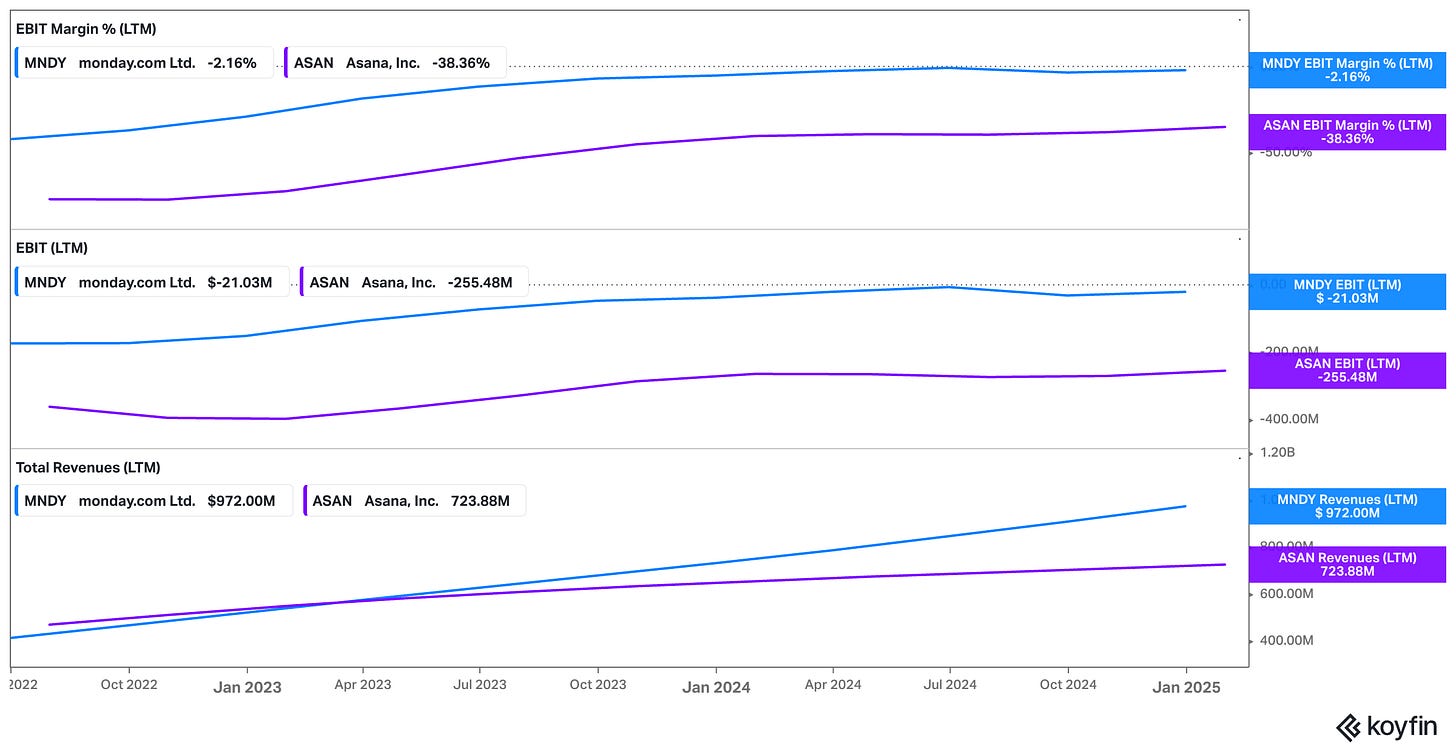

Asana, which offers strong UI/UX but remains loss-making and slower-growing

Smartsheet, which is being taken private and may lose visibility/public scrutiny

ClickUp, which remains private and more SMB-focused

HubSpot, a much larger player ($2.5B+ revenue) but more focused on CRM, not horizontal workflows

By most metrics, Monday has now pulled ahead of Asana in revenue and profitability, and is closing in on mid-sized CRM players like HubSpot in growth efficiency.

While HubSpot still holds a size advantage, Monday’s growth, Rule-of-40 scores, and customer expansion trajectory suggest it’s increasingly being taken seriously in enterprise discussions.

From an industry evolution standpoint, this category is shifting from "single use-case apps" toward platform solutions that centralize work across departments. This favors players with extensibility, scalability, and integrations – areas where Monday has been actively investing. While change is inevitable in tech, this particular shift is a continuation, not a disruption, of how Monday already operates. That adds to the company’s predictability.

So, is this a simple and predictable business? Not in the same way as a utility or a toll road. And in the age of AI, I’m not sure if I’d be comfortable owning this stock if I knew I couldn’t sell it for ten years…

But for a software company, Monday’s model is remarkably clean: subscription revenue, high gross margins, strong NRR, and growing FCF. There are no murky advertising algorithms, crypto tokens, or complex supply chains to decode.

You can model the business with a reasonable degree of confidence over the next five years. The near- and medium-term visibility into future cash flows – given the subscription nature and upsell potential – is unusually strong for a company still growing this fast.

Put differently: if Monday.com keeps doing what it’s doing today – winning mid-sized customers, moving upmarket, expanding its product set, and maintaining its discipline – it’s not hard to see where the next few years of growth will come from. That’s not true of every SaaS name.

TL;DR? To wrap up, let me try to explain the business in two to three sentences (an exercise I recommend to check if you truly understand a business you’ve been researching):

Monday.com is a cloud-based Work Operating System that helps teams build and manage workflows without writing code. It earns recurring revenue from subscriptions, serves over 245,000 customers globally, and is expanding into sales, service, and development software. If it continues executing well, it has the potential to become the backbone of work for the modern enterprise at a much lower cost base than traditional software giants.

Why Is Monday Winning and Can It Stay Ahead?

1. The Moat: Embedded Workflows and High Switching Costs

In the world of SaaS, having a good product isn’t enough. What matters is whether that product becomes indispensable; not just liked, but relied on.

This is where Monday.com shines. Its most important competitive advantage is the switching cost moat it has built by embedding itself deeply into its customers’ day-to-day operations. The key mechanism behind Monday’s switching cost moat is customization. Monday isn’t just a tool you use – it’s a tool you shape.

Through its no-code interface and modular "building blocks," users configure workflows that match their unique processes: campaign pipelines, sales funnels, product roadmaps, hiring pipelines, legal document workflows – you name it.

Once these processes are built inside Monday, the platform becomes not just a productivity tool but a process repository.

Because these workflows are often highly specific – and often interconnected with automations, third-party integrations (like Slack, Outlook, or Zoom), and internal terminolog– migrating away from Monday would require significant time, effort, and internal retraining.

This is not a spreadsheet you can export. It's infrastructure!

Moreover, as Monday moves further into vertical solutions (like Monday Sales CRM or Monday Dev), this customization deepens. A sales team may start with a simple deal board but soon layer on forecasting dashboards, automated lead assignments, and custom alerts.

The deeper the usage, the harder the ripcord becomes to pull.

The result? High retention and organic expansion. Monday’s net dollar retention rate of 115% among customers with 10+ users is a key signal that this isn’t a leaky bucket. It’s not just that customers stay, they usually keep adding users and broadening use cases over time. This flywheel makes Monday less reliant on constant new customer acquisition to fuel growth– a major advantage in the often CAC-heavy SaaS world.

“Having said that, like being part of the flywheel motion, what we see is that you have a team using a core use case with runs the core of what they do, and then they invite other people that are helping them or connecting to them. And the flywheel motion means that, over time, they will start creating their own core use case and then we scale there.“ – Roy Mann

This switching-cost moat also has second-order benefits. For one, it enables pricing power: once workflows are embedded and teams are trained, customers are less likely to churn over moderate price increases. It also allows Monday to expand its product surface area, adding more tools (like Monday Service) to an already-sticky platform, making it even harder to displace.

2. Cost Efficiency as a Strategic Weapon

Beyond product stickiness, Monday has another, less obvious edge: it’s structurally more efficient than many of its U.S.-based peers. With its R&D headquarters in Tel Aviv, the company benefits from a lower-cost engineering talent base without sacrificing quality. This has allowed it to consistently out-execute competitors like Asana, which still burns cash despite similar revenue scale.

As a result, Monday’s operating margins are expanding rapidly. In 2024, the company posted a (pre-SBC) free cash flow margin of 30%, nearly triple what it delivered the year prior.

Even in hyper-growth mode, it has managed to both grow and become more profitable, which is rare in SaaS. This operating discipline not only enhances resilience in downturns, but also gives Monday room to reinvest in product, AI, and go-to-market, effectively strengthening the moat/s over time.

3. A Scalable Distribution Engine

Monday also benefits from a hybrid go-to-market strategy that combines product-led growth (PLG) with targeted enterprise sales. Early customers often land via self-service – small teams signing up online and onboarding themselves. But as the usage expands internally, the company engages with sales and customer success to upsell and embed the platform more deeply.

This land-and-expand motion, paired with the stickiness of customized workflows, produces very attractive unit economics: low CAC (customer acquisition cost) up front, then increasing revenue per account over time. It’s no accident that Monday has scaled to over 1,200 customers paying $100k+ annually; that’s the result of this flywheel working exactly as designed.

“And then in addition to that, we have account managers that are already engaged with customers. And when they identify an opportunity for expansion, whether it's through our BigBrain system that identify new people joining the organization for one of the departments or whether it's by relationship and conversation, we have special functions called overlay, which basically helps them cross-sell with people that specialize in those area, whether it's CRM or service and so on. And they help them close kind of initial deals with the decision-makers in the organization.“ – Eran Zinman

What’s more, this strategy allows Monday to compete across the spectrum: winning SMBs through self-service and enterprises through higher-touch sales support.

That flexibility is a competitive advantage in its own right.

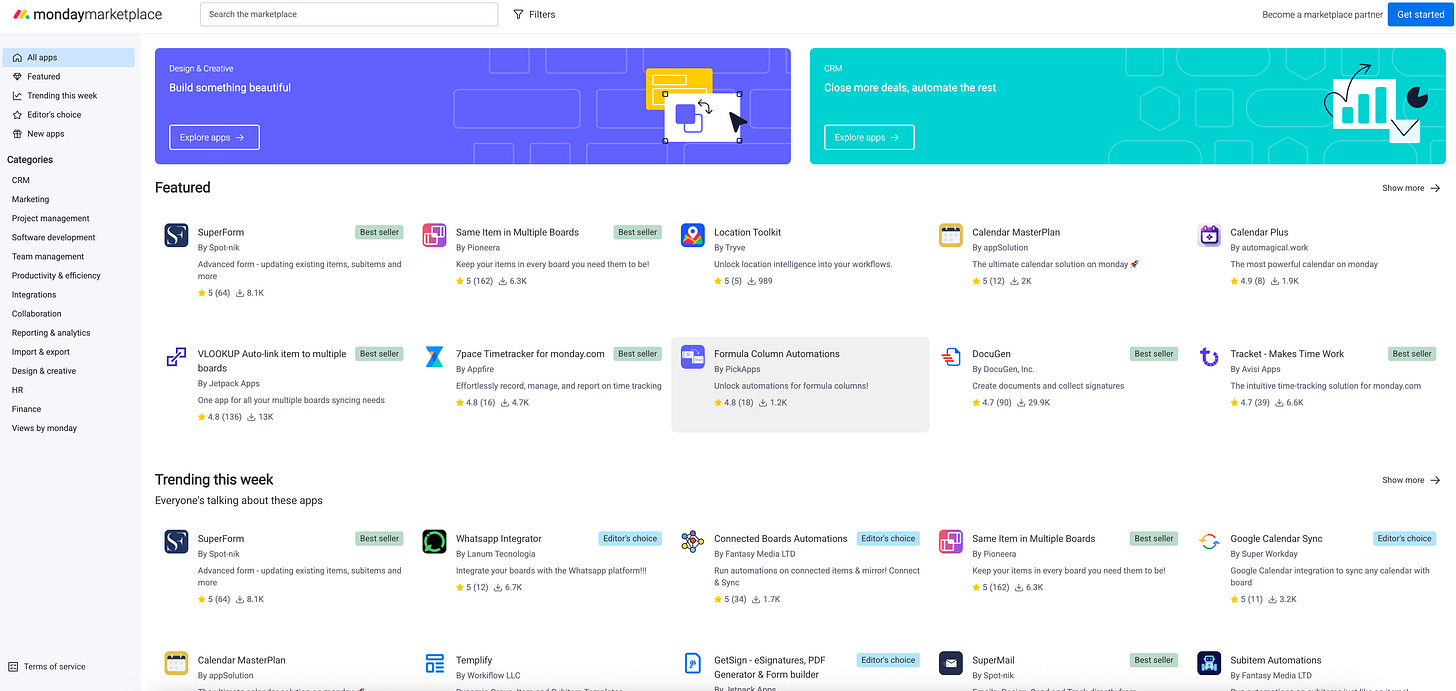

4. The Early Platform Advantage: Ecosystem and Extensibility

While still early, Monday is quietly building a platform layer that could compound its advantage further. The Monday Apps Marketplace allows third-party developers to build on top of the WorkOS, offering custom widgets, integrations, and workflow extensions.

While this ecosystem is not (yet) as rich as Salesforce’s AppExchange, it hints at the same kind of platform potential: the more developers build for Monday, the harder it becomes to leave and for competitors to compete (network effect dynamics).

This matters because it changes the game from “just a tool” to “a platform others depend on”.

If Monday can continue expanding its ecosystem – particularly with AI-powered tools and integrations – the network effects may grow stronger over time. It’s not a particularly strong moat today (in my view), but it’s an emerging layer worth watching.

5. A Pragmatic Approach to AI (Without the Vaporware)

Unlike many SaaS companies caught in the AI hype cycle, Monday is taking a more grounded approach. Rather than making grandiose claims about LLM-driven work reinvention, it has quietly begun embedding AI-powered features into its platform, in the form of modular “Power-Ups” like automatic task categorization, data extraction, and pattern recognition.

The planned release of Monday Expert, its first dedicated AI agent, was scheduled for March 2025. The agent should assist users with onboarding, offer guidance across workflows, and even perform some tasks autonomously. But Monday has made it clear: none of its 2025 financial guidance assumes any material AI-related revenue, which is a refreshing level of conservatism in a market full of hope-based projections.

This approach positions Monday well. If AI adoption is rapid, the company has the tools in place. If adoption lags or monetization proves elusive, there’s no downside baked into expectations. That asymmetry is what investors like to see (often dubbed as “free call options”).

6. Operational Grit: Execution in Tough Conditions

Finally, one of Monday’s more underappreciated strengths is its ability to execute through adversity. The company is based in Israel and, over the past 18 months, has had to operate through the complexities of war, including the temporary military conscription of some employees. Despite this, Monday has not missed a beat: product velocity remains high, customer satisfaction stable, and financial performance strong.

This kind of operational resilience is hard to quantify, but easy to overlook or underestimate.

In a sector where minor missteps can tank momentum, Monday’s ability to deliver quarter after quarter speaks volumes about its internal culture and leadership discipline.

The Moat Stack!

So where does Monday’s competitive advantage truly lie? It’s not just one thing, it’s a stack. Here’s how I’d rate these advantages in descending order of importance.

Switching costs from deep customization and workflow embedding

Emerging platform effects via the app marketplace (network effects)

Efficient cost structure thanks to geographic leverage

Proven operational excellence under stress

None of these moats are impenetrable alone (even though the switching costs are really strong). But together, they form a robust edge, one that has already allowed Monday to surpass competitors like Asana and challenge incumbents like HubSpot in adjacent categories.

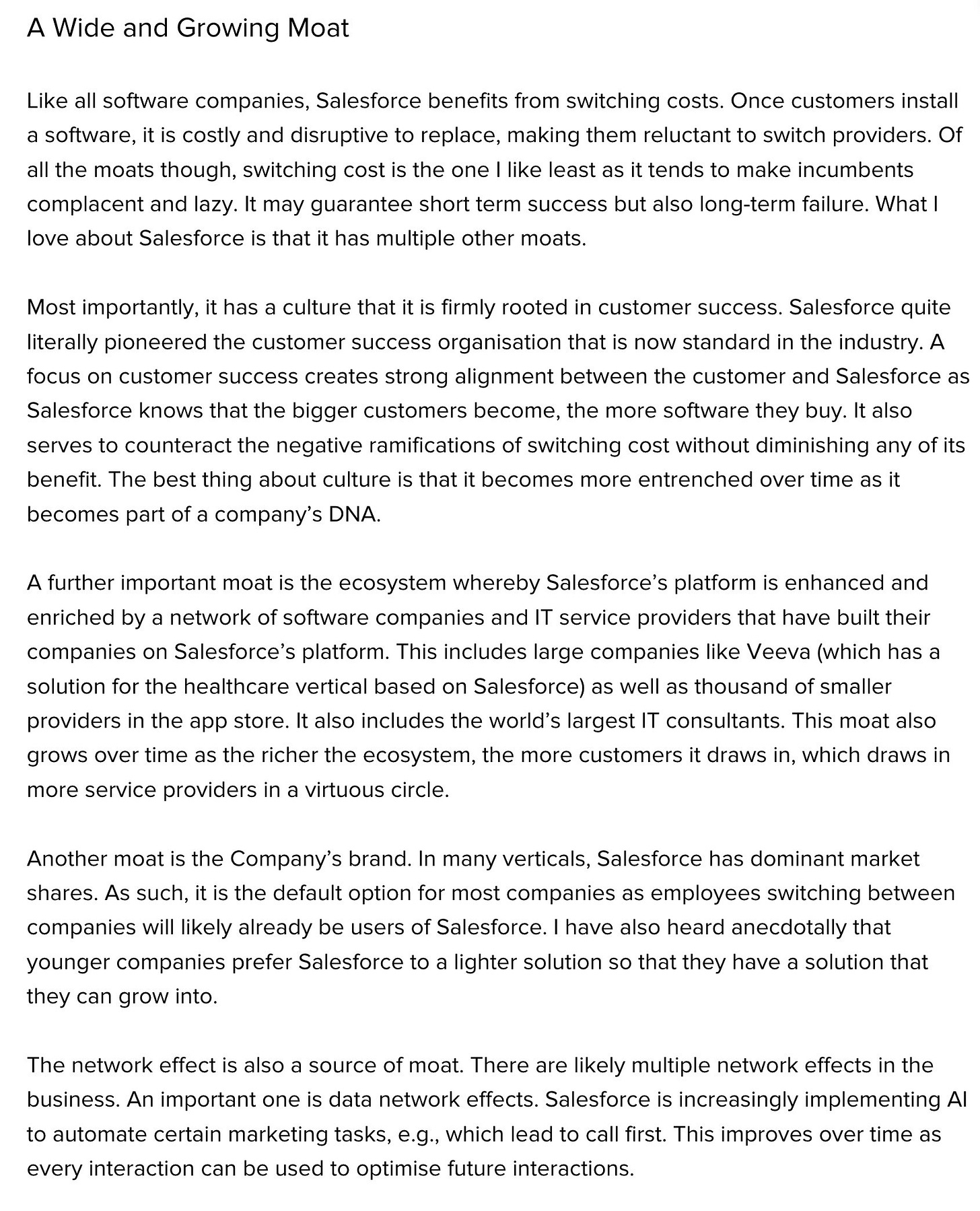

PS: I’ll also leave this part of Robert Vinall’s 2021 Salesforce pitch here as I believe the thesis for Monday is similar in many regard:

Can They Keep Delivering? A Look at Monday.com's Management

In a space as fast-moving as SaaS, execution matters just as much as strategy – and sometimes more.

Great ideas are easy to find in the software world. Great operators are not.

So far, Monday.com’s leadership has proven that it belongs in the second camp: disciplined, product-focused, and refreshingly understated.

Monday was founded in 2012 by Roy Mann (former Wix.com executive) and Eran Zinman (a developer by background), who were later joined by current co-CEO Eliran Glazer. Rather than taking a flashy, Silicon Valley-style blitzscaling approach, the company has grown deliberately, balancing product velocity with capital efficiency.

That mentality persists today.

(I enjoyed this 2024 episode with Eran Zinmann to get a feel for what kind of person we are dealing with here – very humble, down-to-earth (there’s also an accompanying video on Spotify)

Both Mann and Zinman still play active roles in the business. The presence of founder-operators at the helm is often a bullish sign in software (and generally) – it means the people making strategic decisions also understand the product at a deep level. And in Monday's case, that product-first culture is evident across the company’s decisions.

More importantly, the leadership team has earned investor trust by doing the one thing that’s always in short supply in tech: underpromising and overdelivering. Monday has developed a reputation for issuing conservative guidance, only to beat and raise multiple times throughout the year. For example, its initial 2024 forecast of 28% revenue growth was revised upward after a blowout Q1, and final results came in at 33% growth and $296M in free cash flow.

(Recent interview with Daniel Lereya - Chief Product Officer)

Monday has avoided the trap many SaaS peers fell into: hiring too fast, over-indexing on top-line growth, and delaying profitability indefinitely. Instead, it has scaled revenue while expanding margins, growing its cash balance, and keeping share dilution in check. That’s a management style more reminiscent of Atlassian or Adobe than of the typical VC-fueled software rocket ship.

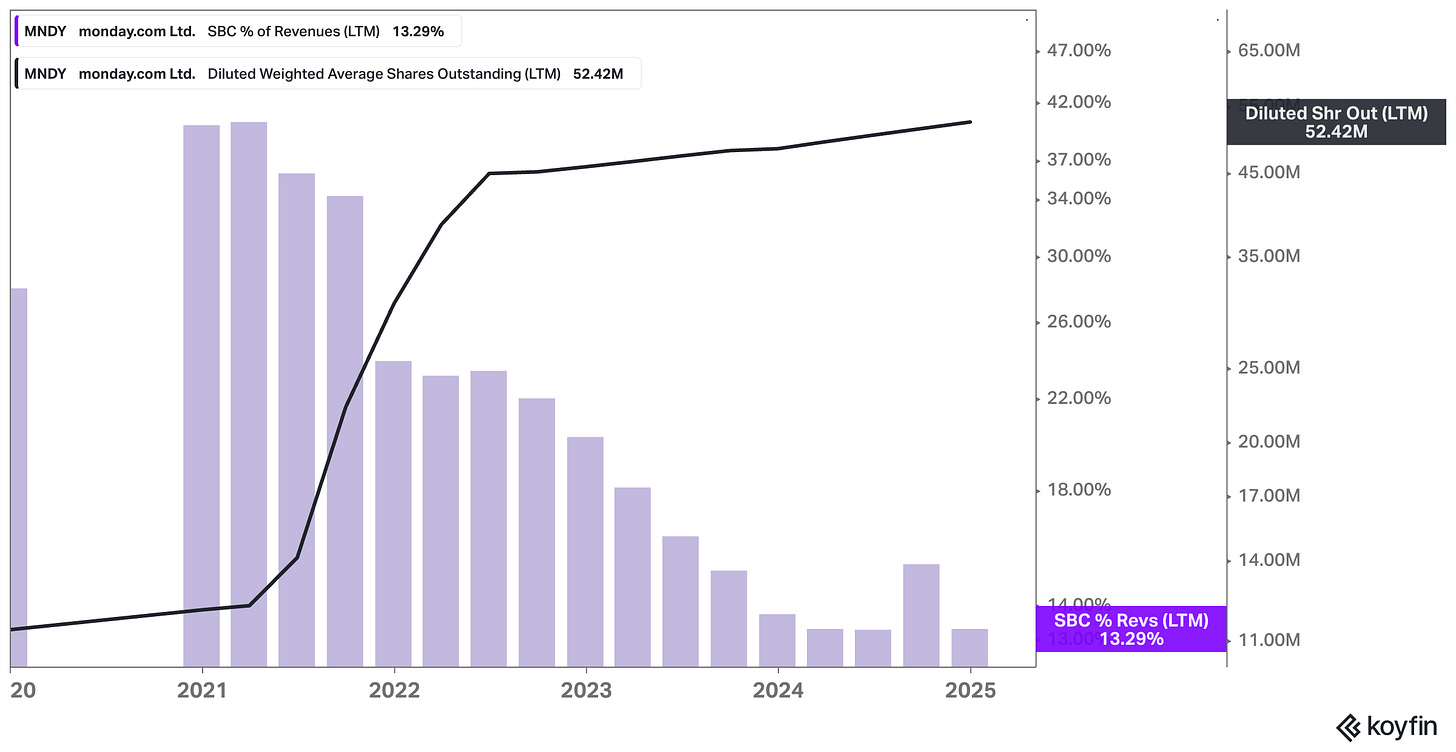

Still, the picture isn’t flawless. One area of concern has been share-based compensation (SBC) and the resulting dilution. In the past twelve months alone, total diluted shares outstanding increased by 8% – a level many long-term investors would consider excessive.

Management has signaled that this should moderate as post-IPO equity grants vest, but it’s a metric worth watching closely, and quite frankly, I find the answer below from a December 2024 conference quite underwhelming!

Rememer: High-margin SaaS businesses often mask dilution with headline free cash flow, but for true owners, share count, and “true FCF” matters!

Conference Attendee: Could you talk a bit about how you think about stock-based comp and your use of stock-based comp going forward based on where the stock price is? How you guys can maybe look at alternative ways to compensate your employees? […]

Roy Mann: I can take it. So first off, we're lucky because like we have IPO-ed and everyone who got like options are first above the water and then like way above the water because like it was pre-IPO that we -- so like everyone is really well retained on that aspect. […] So if you look at the ARR to headcount that we have, we have a lot of ARR per headcount. So it's easy for us to well compensate employees. And I can say, like everyone is like pretty happy because we have a very low retention rate -- very high retention rate, like really super high. So it's like not -- completely nonissue in that respect. And we're, again, hiring a lot.

What about the compensation packages of the management team you may ask? Well, executive compensation at Monday.com totaled approximately $31.2 million in 2024, including share-based compensation. That figure represents more than 5% of the company’s $296 million in free cash flow, a level that may (or should?!) raise eyebrows for investors who value tightly aligned pay structures.

While exact salaries and bonuses as well as bonus goals per executive aren’t broken out (which I really disliked btw), we know that both co-CEOs have received sizable performance-based stock option grants over the past three years, a structure that at least tilts toward outcome-driven incentives.

“Well, I think I’ve been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I’ve underestimated it. And never a year passes but I get some surprise that pushes my limit a little farther.).“ – Charlie Munger

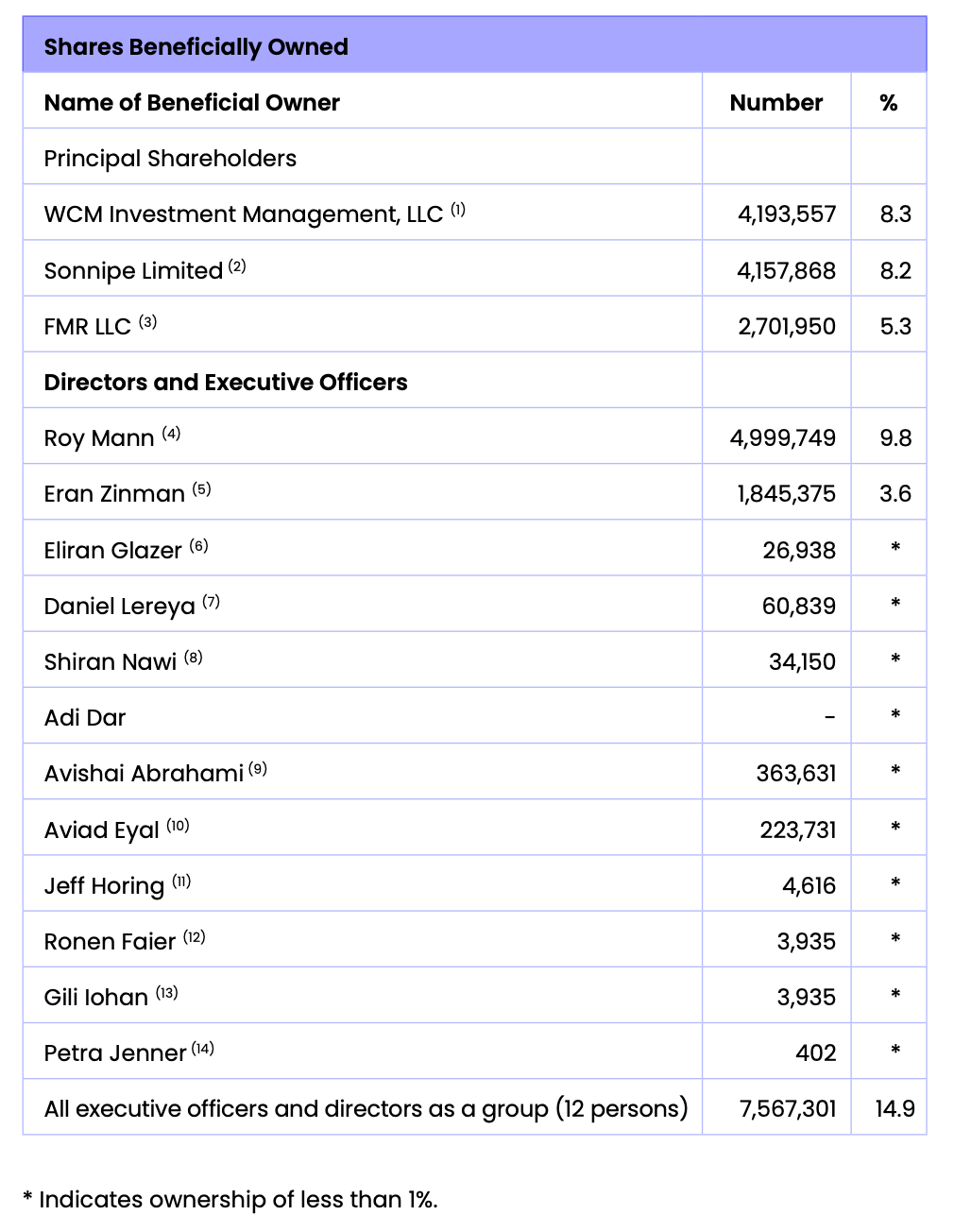

That said, management’s financial alignment with shareholders is substantial. Co-founder and co-CEO Roy Mann owns 9.8% of the company’s outstanding shares (4,999,749 shares), a stake worth roughly $1.14 billion at the current share price. Eran Zinmann, the other co-CEO, owns 3.6% (1,845,375 shares), translating to a position valued at about $421 million. These are not token holdings. The fact that both leaders still hold such significant equity, rather than just exercising and selling shares, sends a strong signal of long-term commitment and confidence in Monday’s future.

Unfortunately, I couldn’t get my hands on the targets the management team member had/have to hit to receive their bonuses. I’m not sure if I simply missed it, but I’m pretty sure it’s not included in the 2024 annual report, in which items that usually appear in proxy statements should appear for non-US companies listed in the US. I emailed the IR department about it but haven’t heard back so far.

Also worth noting: Avishai Abrahami, co-founder and CEO of Wix.com, sits on Monday.com’s board and owns a sizable equity stake himself. Abrahami’s presence adds a layer of strategic tech experience, particularly in building intuitive, modular, user-driven software platforms. His involvement also underscores the level of confidence leading Israeli tech founders have in Monday’s potential.

Another strength is the company’s global perspective. With R&D anchored in Israel and commercial operations spanning the U.S., Europe, and beyond, Monday has always operated with a degree of cultural and geographic decentralization. This has not only helped it access global talent, but also made it more resilient – as the company’s strong performance during wartime disruptions clearly showed.

So, is this a management team that can lead Monday through its next chapter, moving from a high-growth challenger to a long-term compounder?

The track record so far points to yes. But the management team is certainly richly compensated to do so. Also, as the company expands into more complex markets like enterprise CRM and customer service, the demands on leadership will grow. Scaling product vision is one thing. Scaling sales, partnerships, and ecosystem strategy – all without losing the product’s soul – is another.

The combination of founder-led operations, meaningful insider ownership, and experienced board members like Abrahami gives Monday a governance profile that’s at least better than many of its peers. However, the one area to watch is stock-based compensation: with dilution running at 8% in the past 12 months, the company will eventually need to taper SBC to maintain investor goodwill.

What Could Go Wrong? Key Risks in the Monday.com Story

Every investment carries risk! And while Monday.com checks many of the boxes investors like to see, it’s not without its vulnerabilities. Below are some of the key risks worth considering, both obvious and more nuanced.

1. Valuation Risk: Great Business, Fully Priced?

Let’s start with the most immediate: valuation. We’ll discuss the valuation of Monday.com more in-depth further down below, but I will already share that Monday.com is clearly no longer flying under the radar.

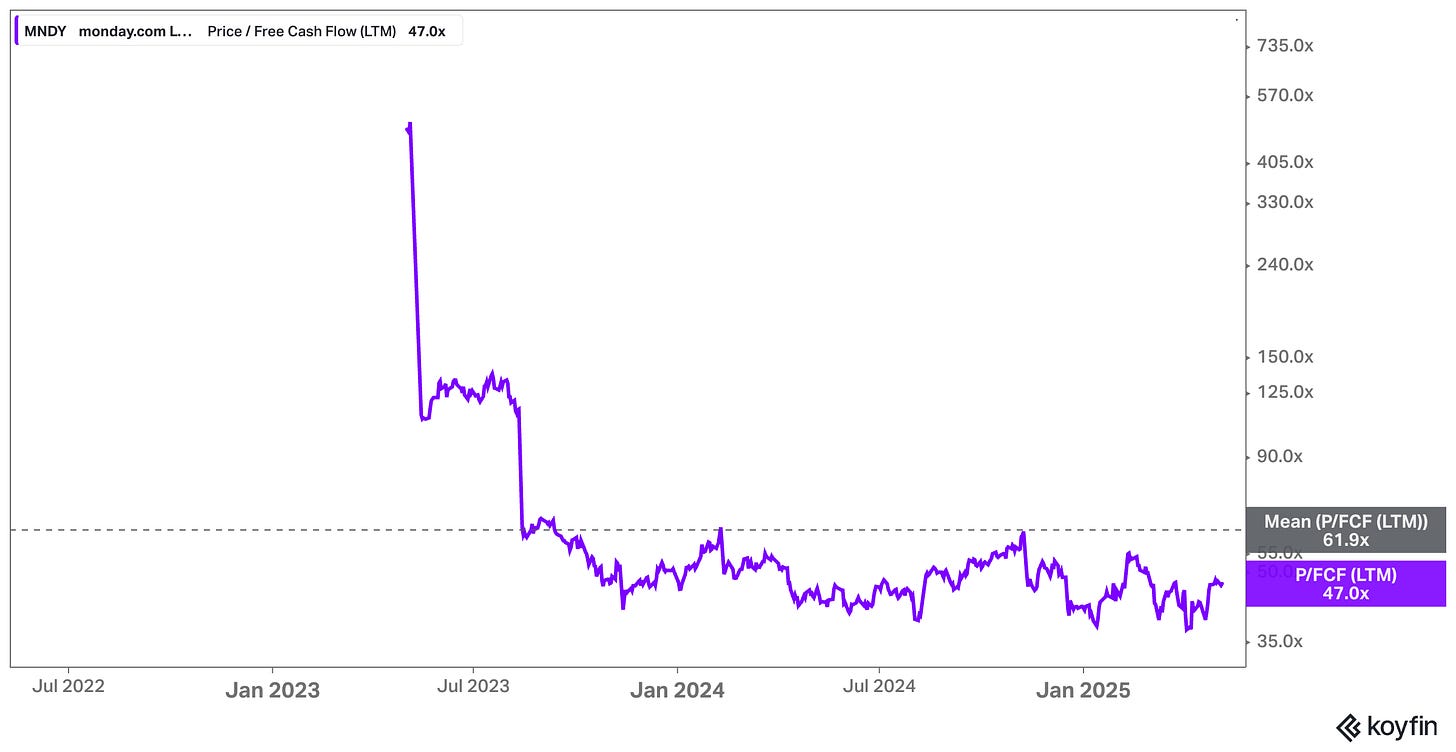

The stock has more than tripled since late 2022 and now trades at a ~50x (pre-SBC) free cash flow multiple based on 2024 results. Even assuming 25–30% annual growth in free cash flow going forward, that’s not cheap!

To justify today’s price – let alone deliver strong future returns – Monday needs to continue executing flawlessly: expanding into new products, moving upmarket, and keeping churn low. Any stumble, even short-term, could lead to significant multiple compression. For investors entering today, the risk isn’t that Monday is a bad business – it’s that it may be priced like a near-perfect one.

2. Share Dilution from SBC

As discussed, another persistent risk is share dilution through stock-based compensation (SBC). While some dilution is typical for a post-IPO company with aggressive hiring plans, it does chip away at long-term shareholder returns, especially if it remains elevated. Management has suggested dilution will moderate over time, but this is a clear number to watch. The business can be a free cash flow machine (even adjusted for SBC!) but still only deliver mediocre per-share results if share count growth outpaces value creation.

3. Execution Risk in New Product Areas

While Monday has proven it can move from project management into adjacent workflows (like CRM and dev tools), it’s now entering more competitive and complex categories, including customer service and eventually AI-driven automation. These aren’t greenfield markets; they’re well-defended by incumbents like Salesforce, HubSpot, and ServiceNow, and managing the different product offerings simultaneously is quite a task!

The company’s ability to sell into large enterprises, support more advanced workflows, and deepen its vertical integration will be tested. If new product rollouts underwhelm or customer adoption is slower than expected, the growth narrative could begin to fray, especially since Monday trades on forward-looking expectations.

4. Geopolitical Risk

As an Israeli-headquartered company with the majority of its R&D team based in Tel Aviv, Monday carries geopolitical risk that’s not present for most U.S.-based SaaS companies. While the platform itself runs on distributed cloud infrastructure (across the U.S., EU, and Australia) and only 7% of revenue comes from Israeli customers, sustained military conflict in the region could impair hiring, product velocity, or employee morale.

To their credit, Monday’s leadership has managed wartime conditions with impressive stability, but investors need to factor this location-based risk into any long-term thesis.

5. Category Risk: Competitive Pressure and Feature Convergence

The broader “Work Management” space remains crowded and fast-moving. While Monday is arguably ahead of most direct competitors, there’s always a risk that well-capitalized players like Microsoft (via Teams/Planner), Atlassian (via Jira + Trello), or even Notion/Airtable blur category lines and encroach on Monday’s territory.

Software is prone to feature convergence: what is a competitive advantage today can become table stakes tomorrow!

Monday must continue to innovate and differentiate without spreading itself too thin.

That means walking a fine line between becoming “the platform for everything” and losing product focus.

AI as an Existential Risk to EVERY SaaS Company Over the Next 5–10 Years?

Let’s address the elephant in the room when assessing various risk scenarios related to Monday:

How Real Is the AI Risk to Monday.com?

One of the more unsettling long-term risks for Monday.com – and frankly for many SaaS platforms, or more broadly, virtually every software company across the globe – comes not from a traditional competitor, but from a fundamental shift in how we interact with technology.

As generative AI accelerates, the very concept of using "apps" could become outdated.

Meta’s CTO Andrew Bosworth recently outlined a provocative thesis: in a world where users simply express intentions in natural language, the app layer disappears. You won’t open a calendar app to schedule a meeting or a CRM to update a sales lead – you’ll just tell your AI assistant what you want, and it will coordinate all the necessary actions behind the scenes.

That’s not just a UI redesign. That’s a redefinition of computing.

OpenAI, with its plans for agent-based operating systems, is already nudging in this direction. The endgame? A computing paradigm where the OS, apps, and interfaces dissolve into one seamless AI-native layer.

If that vision plays out, Monday.com could face an existential threat. After all, it’s a visually structured, user-driven platform. Teams log in, click through boards, customize workflows, and manually assign tasks. In a world where natural language is the interface and agents handle execution, the entire idea of logging into a dashboard might seem archaic.

But one could argue that the picture is more nuanced.

Platforms like Monday provide more than just task assignment. They offer shared structure, accountability, data storage, cross-functional visibility, and auditability – elements that AI assistants can’t fully replicate, especially in enterprise environments. Workflows inside Monday are not just visual aids; they’re living systems used by multiple stakeholders. They anchor business processes in ways that go far beyond natural language instructions. And they are mission-critical.

Moreover, Monday already integrates across dozens of third-party tools – email, Slack, Zoom, Salesforce – and functions as an orchestration layer. If AI agents need a system of record to plug into, Monday could still serve as critical infrastructure. And for larger organizations with compliance and security requirements, a centralized workflow platform may remain indispensable, even in an AI-native world.

That said, the threat is real. If LLM-powered agents can build, run, and maintain workflows entirely on their own – dynamically creating CRM systems or sprint plans on demand – then Monday's low-code proposition loses its edge. In such a scenario, the very act of building structured processes could become automated, and Monday might be abstracted away along with other SaaS interfaces.

Meta’s CEO Zuckerberg recently said, “within 12-18 months, most of the code is written by AI.“ Of course, if an agent can build internal tools dynamically – and companies no longer need to license Monday to build a CRM dashboard or sprint planner – then Monday could be disintermediated not by another SaaS competitor, but by the AI-enabled user themselves. Especially if that happens inside private agent ecosystems with tailored data models.

Mark Zuckerberg recently also talked about how Meta is working on very specialized agents for Meta’s very unique use cases. There’s a scenario in which Monday will simply do the same and offer the best agent for Monday-related tasks.

Monday seems aware of this. Its upcoming “Monday Expert” agent is designed to onboard users, automate routine actions, and provide intelligent guidance across the platform. But this is just a first step. To stay relevant, Monday will need to become not just a workspace for humans, but a controllable surface for agents. It must ensure that, in the AI-first stack, it remains part of the foundation rather than a relic of a UI-centric past.

Again, execution and internal agility will be of utmost importance.

So What Should Investors Watch For?

AI-native workflows: Is Monday becoming a front-end for AI agents – or is it at risk of being replaced by them? Their early work on AI agents (like Monday Expert) is promising, but they’ll need to keep innovating and go further. Over the medium- to long term, the platform must be agent-controllable, not just human-operable.

APIs vs. abstraction: If agents use Monday’s API in the background (e.g. to log tasks or retrieve CRM data), then Monday still wins – it becomes infrastructure. But if agents can create entirely new workflows without Monday, then things get dangerous! Observe carefully.

Developer ecosystem defense: If Monday’s building block ecosystem (marketplace, templates, integrations) becomes an agent playground, that’s bullish. If it becomes irrelevant, that’s bearish.

Enterprise data & compliance moat: AI may be fast and flexible, but enterprise-grade audit trails, access control, and workflow visibility still matter. This is a defensible edge, but only if Monday leans into it.

What’s the bottom line you may ask? We are in a transition phase. Right now, LLMs are augmenting existing SaaS. But if the vision from Boz and OpenAI materializes, and we move into an agent-first, OS-less world, then many SaaS companies, including Monday, will need to fundamentally rethink what they are; or go out of business...

Is Monday a workflow interface for humans? Or a programmable operating layer for AI agents? That distinction may decide whether the company compounds over the very long term or gets commoditized more quickly than many investors anticipate given the current valuation.

Final Risk Assessment

Individually, most of these risks aren’t a deal-breaker (with the eception of AI). But collectively, they form a “is there a qualitative margin of safety?”-challenge for investors:

Monday is a great business, but it’s priced like one, in a competitive market, with a bit more geopolitical volatility and dilution risk than your average SaaS name and considering that “AI is coming for software companies.”

As always, the key will be execution. If the team keeps doing what it has done so far – grow efficiently, build sticky products, expand sensibly – most of these risks will remain manageable. But for investors buying in at today’s levels, the cushion for mistakes has shrunk.

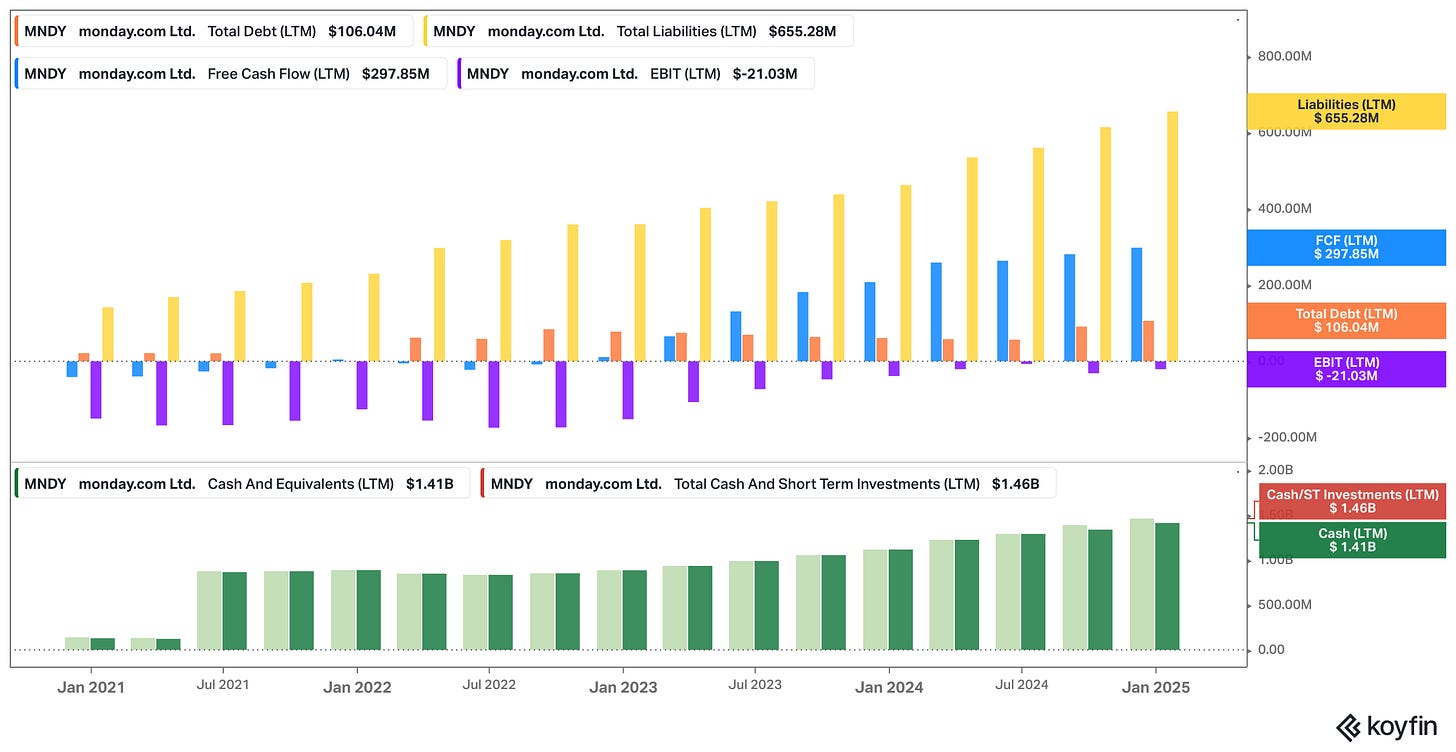

Monday.com’s Financial Strength: A Debt-Free Fortress with Billions in Cash

One of the standout features of Monday.com’s financial profile is its pristine balance sheet. As of the end of 2024, the company carries very little interest-bearing debt. This debt-free position grants Monday.com exceptional flexibility and reduces financial risk, especially in a volatile macroeconomic environment.

Rather than relying on debt financing, Monday.com has funded its growth through equity, via its IPO proceeds, early venture funding, stock-based compensation, and increasingly through its own free cash flow.

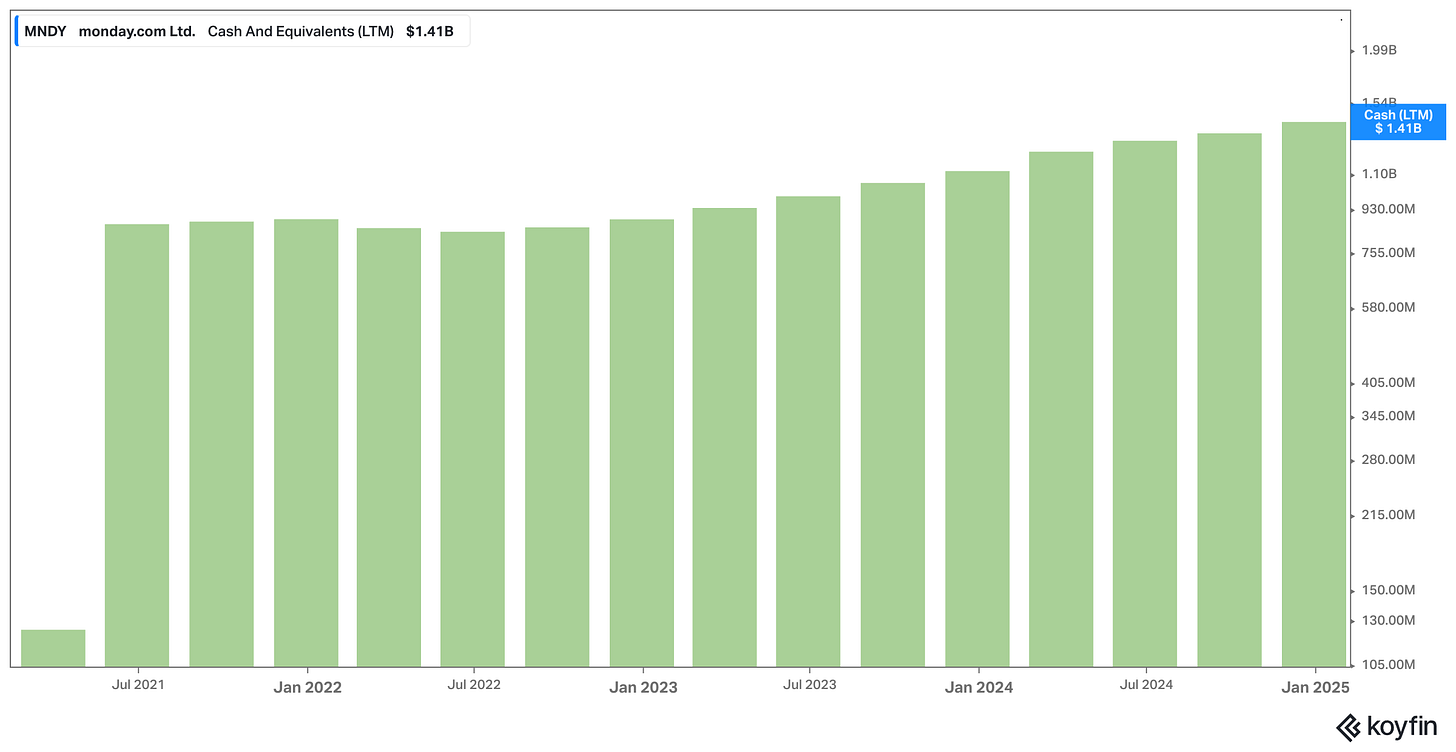

The company’s capital expenditures remain moderate, as Monday.com doesn’t require heavy investments in fixed assets. This lean operational structure has enabled it to accumulate a significant cash reserve:

$1.4 billion in cash and equivalents as of December 2024

Up from $1.1 billion just a year earlier

While the company doesn’t currently use excessive leverage, its financial strength gives it the option to strategically take on debt in the future, perhaps for a major acquisition, without doing so from a position of weakness.

Monday.com’s path to profitability has been both intentional and swift. In 2024, the company reported a GAAP operating loss of just $21 million (a slim -2% margin) and even recorded a small net profit for the full year. Now on the cusp of consistent GAAP profitability, Monday.com likely won’t require additional external funding going forward.

This financial discipline sets Monday.com apart from many of its peers. While some high-growth software firms issued convertible debt or leaned heavily on frequent equity raises, Monday.com avoided those pitfalls. For instance:

Asana had to rely on CEO Dustin Moskovitz’s major personal capital injections in recent years

Many tech IPOs from the 2020–2021 boom issued convertible notes at low interest rates, complicating their cap tables and future cash flows

In contrast, Monday.com’s clean capital structure and minimal interest expenses are a strategic advantage.

In a worst-case scenario, such as a significant slowdown in growth, Monday.com has the resources to sustain operations, pivot if needed, and avoid the kind of financial distress that burdens overleveraged peers. In a more likely scenario of continued growth, the company’s cash-rich, debt-free foundation opens the door to:

Opportunistic acquisitions

Increased R&D spending

Share repurchases to at least partly offset effects from dilutive SBC

In summary, debt is pretty much a non-issue for Monday.com. Its rock-solid balance sheet and clear path to profitability give the company both security and flexibility. For investors, this translates into reduced downside risk from a business point of view (valuation-wise the picture looks different) and greater confidence that Monday.com can not only weather economic turbulence, but continue funding its own growth without depending on external capital.

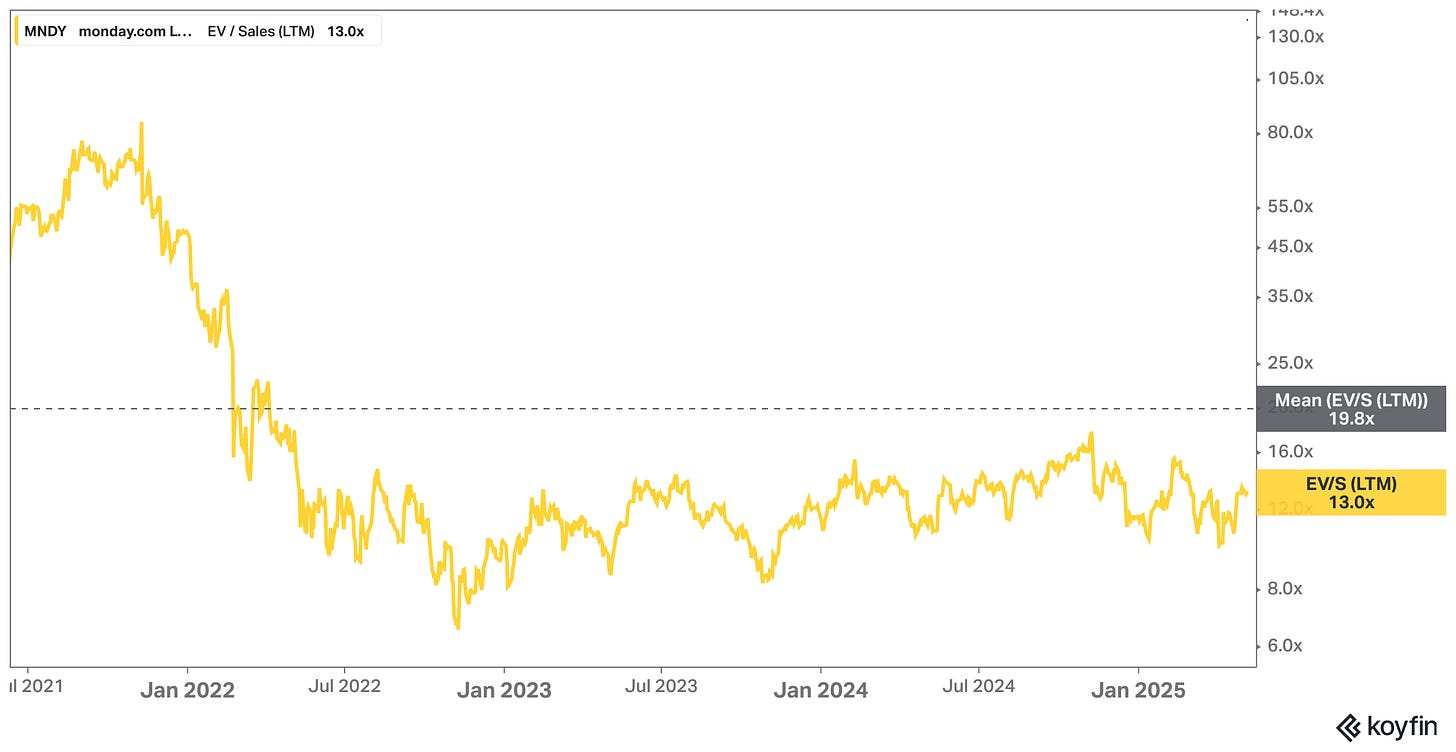

Valuation: High Quality, High Expectations – But Still Room to Run?

As outlined, Monday.com is no longer the overlooked SaaS bargain it maybe was in late 2022. But that doesn’t necessarily mean it’s expensive, at least not when viewed through the lens of growth efficiency, free cash flow generation, and long-term potential.

Let’s start with the basics. As of this writing, Monday.com trades at a market cap of $14 billion and an enterprise value of around $12.6 billion. Based on LTM revenue of $972 million, this puts the stock at roughly 13x EV/Sales.

That’s optically VERY rich at first glance, especially in a market where many software multiples have compressed, but arguably not outlandish for a company with nearly 90% gross margins, 30%+ free cash flow margins, and revenue still growing north of 30% annually.

On a free cash flow basis, the company generated $296 million in 2024, giving it an EV/FCF multiple of just over 50x. That may seem high – especially as this is not adjustd for SBC–, but bulls would argue that it reflects the rarity of high-growth SaaS names with this level of optionality going forward.

Monday is not buying growth through acquisitions or financial engineering. This is a pure organic growth story with a large TAM, and management continuously expanding the TAM, fueled by product expansion, upmarket motion, and disciplined execution.

A Sensitivity Check: What Could Monday Be Worth in 2027?

Of course, valuation is never just about multiples! It’s about what the business can become.

If Monday continues to expand its platform, capture enterprise wallet share, and integrate AI-driven automation in meaningful ways, the company could generate well over $2 billion in annual revenue by 2030 while reaching “true FCF” margins in the 20–30% range.

I’ve seen this play out before (especially as an investor in Wix.com which is becoming more profitable with every passing quarter): as software companies hit a certain scale and then continue to scale up, and as management becomes more focused on profitability (maybe due to external pressures forcing their hand), it’s almost like management can simply hit a switch and steadily (and quickly) increase “true” profitability.

If we consider Salesforce as a benchmark for example, according to Robert Vinall’s calculations, the business – which is of course much bigger – posted 40% EBIT margins per user back in 2021.

Even modest multiple compression in such a scenario still leaves significant upside for long-term shareholders; especially if Monday continues to execute beyond 2030..

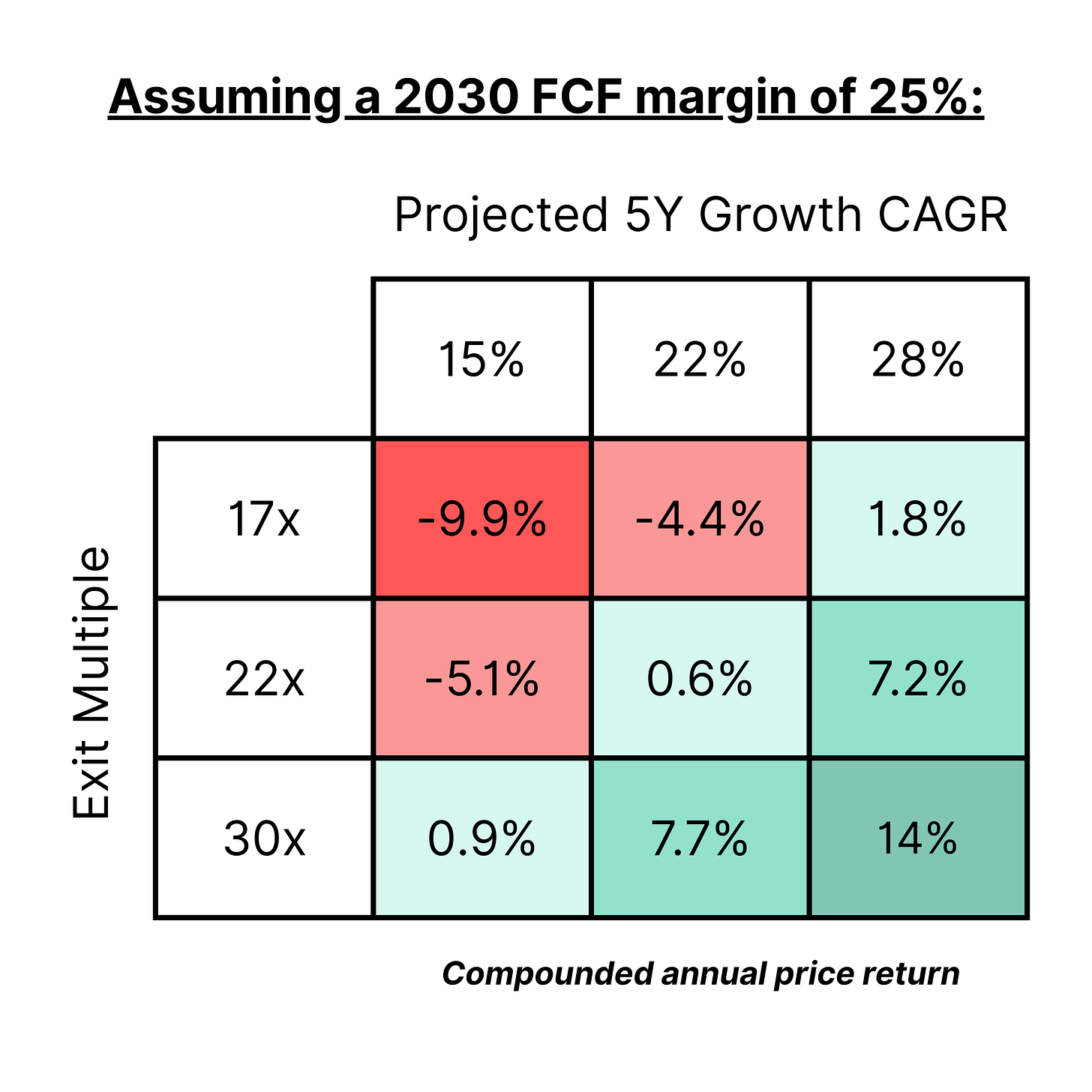

Rather than relying on a single-point (the multiples referenced above), let’s step back and look at a range of plausible outcomes for Monday.com's market cap five years from now.

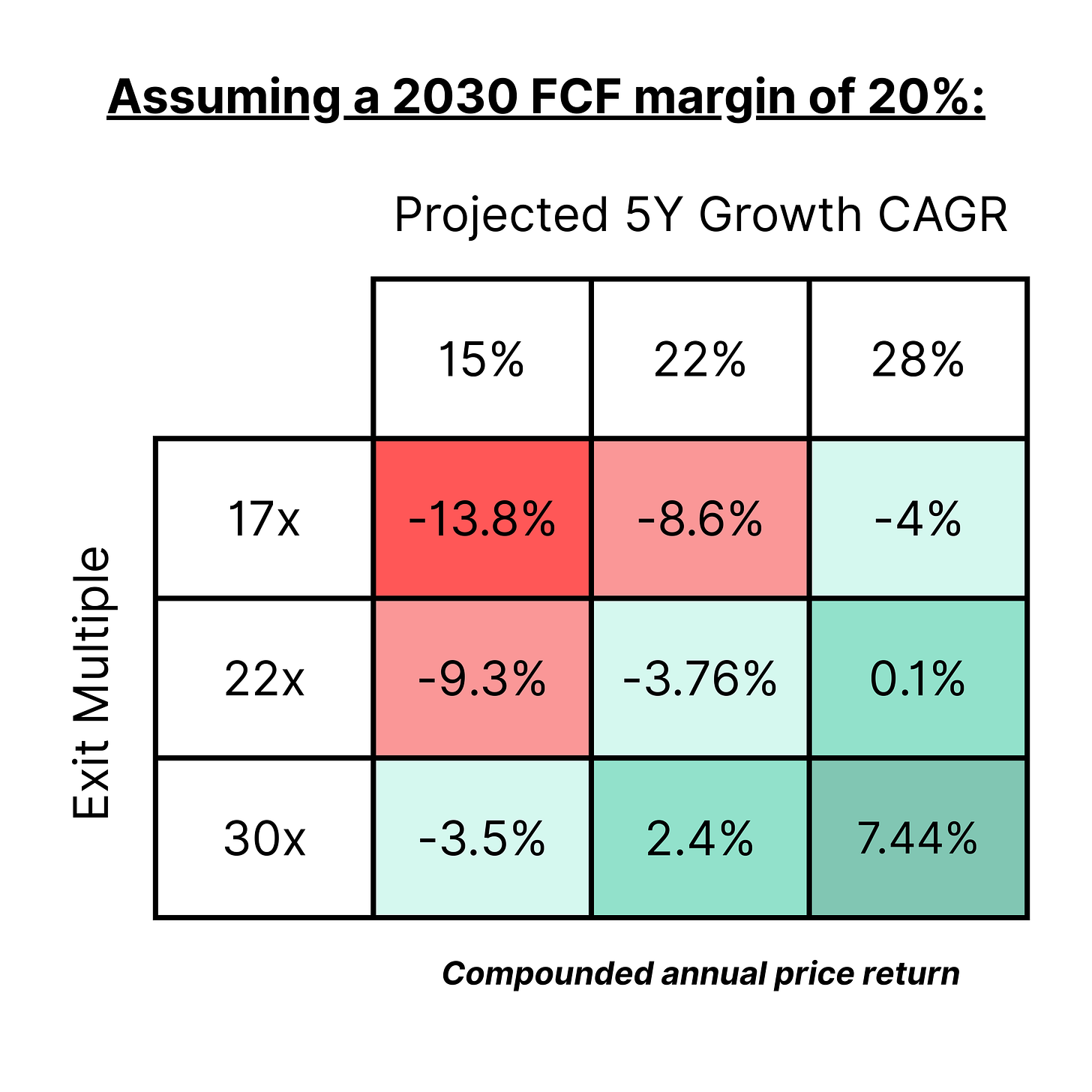

The two matrices below show how different combinations of topline growth, underlying “true FCF” margin, and exit multiples would impact the company’s valuation by 2030.

We anchor the model with Monday's LTM revenue of $972 million, then project it forward using compound annual growth rates of 15%, 22%, and 28%. We then apply a range of exit Market Cap/FCF multiples (based on two FCF margin scenarios) – from a conservative 17x to a more optimistic 30x – reflecting what the market might be willing to pay for a high-quality SaaS business with strong margins. Here’s the result:

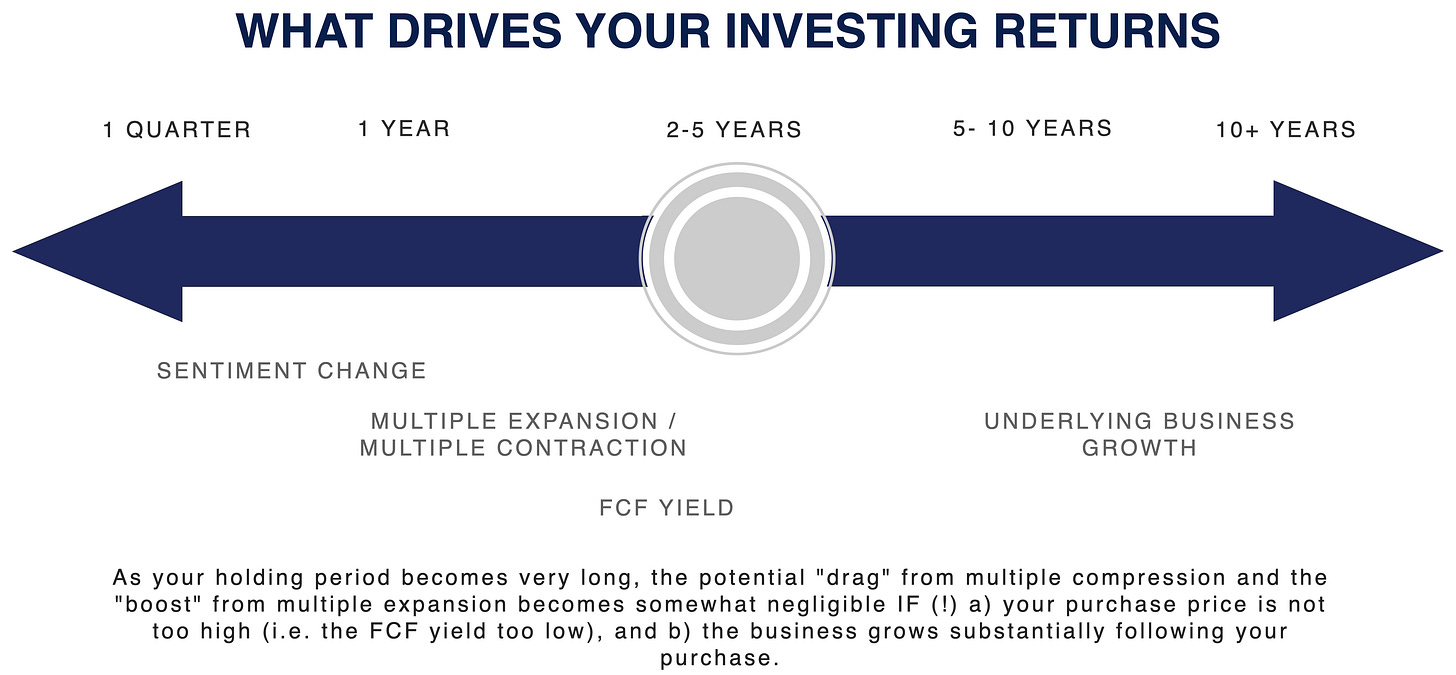

These matrices don’t predict the future, but they help frame expectations. Investors aren’t just betting on multiple expansion, they’re underwriting the company’s ability to sustain high growth while maintaining exceptional cash efficiency (you effectively have to bet on FCF margins exceeding 25%). If Monday keeps executing as it has, the math might still work. But it also might not …

You might be surprised that the expected returns based on these assumptions – which, by the way, I don’t consider particularly conservative – are rather sobering. But realistically, this shouldn’t catch anyone off guard. Suppose the business, in its current form, were already generating SBC-adjusted free cash flow (FCF) margins of 20% or 25%. At $972 million in revenue, that would translate into “true FCF” of $194 million or $243 million, respectively. Both figures fall well below the reported $297 million in FCF, which already implied a lofty 50x FCF multiple. Based on these more conservative estimates – which, to be clear, the company hasn’t achieved yet (SBC-adjusted FCF currently stands at around $150 million) – we’re looking at a 72x P/FCF multiple (at 20% margins) or 57x (at 25% margins). That implies a massive headwind from multiple compression over a five-year horizon – a force that’s extremely difficult to offset through topline growth alone.

One could argue, of course, that to make the Monday.com investment work, you need to extend your time horizon beyond 2030. The longer you hold, the less impactful multiple compression becomes.

So let’s consider a more optimistic scenario. Suppose Monday.com grows revenue at a 25% CAGR for the next five years, then slows to 18% annually between years 6 and 10 – an aggressive long-term assumption that’s hard to justify based on historical base rates btw. That would result in 2035 revenue of $6.79 billion (for context, Salesforce’s current LTM revenue is $38 billion). Even with this level of sustained growth, a valuation reset is inevitable. Let’s assume we exit at a generous 25x FCF multiple, and the company achieves 25% FCF margins by then. That would result in an 11.7% annualized return – not too shabby, all things considered.

I could definitely see a world in which Monday’s long-term growth is much more durable than base rates would suggest. But that’s just something I don’t feel comfortable betting my hard-earned money on. I’d rather wait for easier hurdles to jump over and continue observing this business executing its mission – pretty much flawlessly – from the sidelines; I’m okay with that as my job as an investor is basically to say “no!” to almost everything.

Conclusion? A High-Quality Compounder with A Lot to Prove

Monday.com has quietly become one of the most compelling operators in the SaaS space, combining strong product vision, disciplined execution, and a rare balance of growth and profitability. The company has transitioned from a niche project management tool into a scalable platform with serious enterprise ambitions, all while generating rising free cash flow and maintaining nearly 90% gross margins.

Valuation has caught up somewhat, and expectations are no longer low; quite the opposite.

But this is still a business with a long runway, strong economics, and a management team that’s shown it can adapt. If Monday continues expanding its product suite, capturing enterprise share, and embedding itself deeper into workflows – all while navigating the emerging AI paradigm – there’s a real path toward meaningful long-term compounding.

It’s not without risks. But in a crowded software market, Monday stands out for doing the boring things exceptionally well – and that’s often where the durable winners come from.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

The depth here is impressive. Nicely done.