The 3 Pillars of Smart Decision-Making! – And What Gold Teaches Us About Them

A deep dive into one of investing’s most polarizing assets

Note: The voiceover above is a custom-made, slightly adapted version of the blog post, edited for a smoother and more engaging listening experience. It’s one of the perks available to paid subscribers, as I’m always focused on adding as much value to my subscribers as possible. Enjoy!

One of the most underestimated challenges in investing isn’t finding opportunities – it’s deciding which opportunities to trust. Every day, investors are confronted with conflicting advice, seductive narratives, and data that can be bent to support almost any conclusion. Some of it sounds intuitively right. Some of it comes wrapped in impressive charts and statistics. Some of it is grounded in the theories of Nobel laureates.

The difficulty lies in knowing which signals matter and which ones should be ignored.

That’s why I’ve come to rely on a simple mental model: the best investment decisions tend to live at the intersection of three cornerstones – common sense, empirical evidence, and theory. Each of these pillars, on its own, can feel persuasive. Common sense keeps you grounded, evidence gives you confidence, and theory offers structure.

But when you lean too heavily on just one, you expose yourself to blind spots:

Common sense can turn into gut-level prejudice.

Evidence can be misread or cherry-picked.

Theory can become detached from reality.

Markets have a way of humbling anyone who relies too narrowly on a single source of conviction. But when all three perspectives align – when an investment makes sense intuitively, is supported by data, and is consistent with theory – you dramatically improve your chances of being approximately right, which is about as much as investing ever allows.

Here’s what we will cover in this post:

Why investing decisions often get lost in a sea of noise, narratives, and conflicting data

The three cornerstones of rational decision-making

How each pillar adds value on its own – and the blind spots it creates when relied on in isolation

Why the real insight comes from the intersection, where intuition, data, and reasoning align

A case study on gold, one of the most polarizing assets in investing

What common sense says about gold: an unproductive asset with no intrinsic value

What the evidence shows: decades of both spectacular returns and crushing drawdowns

What theory explains: diversification benefits, store-of-value logic, and the behavioral pull of gold

Broader lessons for applying the framework to other investment decisions

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

The Framework: Three Cornerstones of Rational Investing

Good judgment in investing doesn’t come from following a single rulebook. It comes from triangulating between different ways of making sense of the world. That’s where the framework of three cornerstones comes in.

By weighing decisions through the lenses of common sense, empirical evidence, and theory, you create a sturdier foundation than any one of them could provide on its own.

Each of these pillars plays a distinct role. Common sense forces you to ask basic, real-world questions. Empirical evidence grounds your thinking in historical reality rather than imagination. Theory gives structure, helping you see patterns and relationships that aren’t immediately obvious.

The magic doesn’t lie in any single one of them. It lies in their overlap – the intersection where intuition, data, and reasoning all point in the same direction.

A) Common Sense & Critical Thinking – Asking the Obvious Questions

Maybe the most underrated tool in investing is using common sense.

That might sound almost too simple, but the truth is that many costly mistakes come from ignoring what should have been obvious.

“Good investing is really just common sense.” Jim Rogers

Common sense doesn’t mean relying on hunches or following rules of thumb. It means asking straightforward, almost childlike questions that cut through complexity:

What does this business actually do?

How does it make money?

Why will it make more money in the future? How?

Who benefits from it?

What would have to happen for it to become more valuable in the future?

… etc.

Critical thinking sharpens this further by forcing you to question assumptions. Just because something is widely accepted doesn’t make it true.

Common sense might tell you that a company with explosive revenue growth is promising, but critical thinking asks whether that growth is profitable, sustainable, or built on shaky foundations.

Likewise, it challenges you to distinguish between assets that are productive and those that simply change hands at different prices.

“Just plain common sense is important. At times we find people who are brilliant but lack common sense.” Seth Klarman

“Organized common (or uncommon) sense — very basic knowledge — is an enormously powerful tool. There are huge dangers with computers. People calculate too much and think too little.” Charlie Munger

“We never know anything here except the most elementary common sense. It's amazing that it's sufficed for us.” Charlie Munger

This pillar matters because it’s easy to get lost in abstractions. Investors often fall in love with elegant models, complex valuation frameworks, or persuasive narratives (complexity bias … ding, ding, ding! 🔔).

Without common sense and critical thinking as a grounding mechanism, it’s all too easy to confuse noise with insight. Markets are full of sophisticated explanations for things that, on closer inspection, fail the simplest reality test.

The goal isn’t to dismiss complexity – investing is inherently complex – but to use common sense as a filter. It keeps you honest by asking whether your thesis ACTUALLY makes sense outside of spreadsheets and theories. In that way, it acts as the first and most basic safeguard against self-deception.

“It takes courage, it takes open-mindedness. I would say don’t get too narrow, I don’t believe it’s the most precise quantitative and modelling skills that will govern your success. It is common sense, logic, the ability to actually think for yourself and actually survive mentally when you think either you’re out of your mind – all by yourself - or the whole world is crazy and you’re saying how can that possibly be." Paul Singer

B) Empirical Evidence – Letting History Speak

The second cornerstone is empirical evidence – the raw record of what has actually happened in markets over time. Numbers don’t tell you everything, but they do tell you something important: how different assets have behaved, what cycles have repeated, and where popular stories have collided with reality.

Relying on evidence helps protect against the dangers of narrative-driven investing. A great story can make an asset sound irresistible, but the data might reveal long stretches of underperformance or extreme volatility. Conversely, an asset that seems boring or outdated may have quietly compounded wealth for decades. Looking at evidence forces you to reckon with reality rather than wishful thinking.

I want to encourage you to read the base rates guide I published recently – I promise it will make you a better investor:

The Ultimate Base Rates Guide – From Optimism to Realism in Valuation

Every investor knows that growth is the heartbeat of valuation – but few can forecast it with any consistency. Entire fortunes have been made and lost on the back of overly optimistic projections. Think of the countless “next big thing” companies that dazzled in their early years, only to slow down, disappoint, and punish shareholders who believed the story too literally.

Of course, evidence is not neutral. It can be sliced and presented in ways that support almost any argument. Cherry-picked timeframes, selective benchmarks, or ignoring inflation can make the same asset look like either a star performer or a complete dud. That’s why evidence has to be handled with care – the question is not just what the numbers say, but how and why they say it.

In the end, the role of evidence isn’t to replace judgment but to complement it. It tempers common sense by showing where intuition has been wrong before, and it keeps theory accountable by testing whether elegant models actually line up with reality.

Without evidence, you risk building castles in the air. With it, you give your decisions a grounding in how markets have behaved across time.

C) Theory – The Structure Behind the Chaos

The third cornerstone is theory. While common sense keeps you grounded and evidence shows you what has happened historically, theory gives you a framework for why things work the way they do. It’s the layer that ties together disparate facts and experiences into a system of reasoning. Without theory, you’re left with anecdotes and data points that don’t necessarily connect.

In investing, theory takes many forms:

Financial theory offers concepts like discounted cash flow, risk-adjusted returns, and portfolio diversification.

Economic theory explains forces such as supply and demand, monetary policy, and the impact of incentives.

Behavioral theory adds yet another lens, highlighting the biases and psychological traps that shape markets.

Each of these frameworks gives you tools to interpret evidence and challenge assumptions.

The importance of theory is that it helps you avoid being whipsawed by randomness. Markets are noisy, and it’s easy to mistake short-term patterns for durable truths. A theory gives you a way to test whether what you’re seeing is consistent with a broader principle or just an accident of timing. For example, understanding mean reversion can help you recognize when extreme valuations are unlikely to persist. Grasping the idea of opportunity cost clarifies why holding cash (or a specific security) has a hidden price even when it feels safe.

That doesn’t mean theory is flawless. The risk is always that it drifts into abstraction, becoming detached from reality. Beautiful equations can blind investors to messy details that don’t fit neatly into the model. Theories are tools, not truths. They are useful when they help you interpret the world, but dangerous when you let them dictate reality.

When used alongside common sense and evidence, however, theory adds depth. It transforms raw data into insight and anchors intuition in a structured framework. Together, the three pillars create a balanced lens for decision-making that is stronger than any single one on its own.

Join the private WhatsApp community!

Discuss stock ideas, ask questions, and get behind-the-scenes thoughts in real-time.

Available exclusively for paid subscribers. Want in? Choose the annual subscription plan + reply with your number (more details in the welcome email).PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.

Putting the Framework to the Test – Gold as a Controversial Asset Class

A framework is only useful if it helps make sense of messy, real-world debates. And in investing, few debates are as controversial as the one surrounding gold. For decades, value investors in particular have been split on whether gold deserves a place in portfolios. To some, it is a superstition at best and a waste of capital at worst. To others, it is a proven hedge and a vital store of value.

This makes gold a perfect example for applying the three pillars. It is emotionally charged, it inspires strong arguments on all sides, and it resists easy classification.

By running gold through the filters of common sense, empirical evidence, and theory, we can see how the framework works in practice – and, more importantly, what it reveals when those perspectives collide.

A) Gold Through the Lens of Common Sense & Critical Thinking

If the first filter for any investment is common sense, gold doesn’t make a strong case for itself. It is the quintessential non-productive asset. It doesn’t generate earnings. It doesn’t employ people. It doesn’t invent, distribute, or sell anything. It simply sits there, gleaming.

From a critical-thinking standpoint, that alone is almost a red flag. The core of investing is to allocate capital into activities that create value, that produce cash flow, and that thus can be valued. Gold doesn’t create value – it just changes hands at different prices.

That’s why so many legendary investors have dismissed it outright. Howard Marks once summarized the problem in stark terms:

“There is nothing intelligent to be said about gold. Nobody can tell you the right price for an ounce of gold. People will tell you it should go up or go down. To make any intelligent statements about investments you have to know what the right price is. You can’t do that with an asset like gold, which doesn’t produce any cash flow. So you can buy it out of superstition or ignore it because you are an atheist but you cannot buy it with an analytical foundation.”

Bill Ackman made the same point more colorfully when he contrasted gold with a business:

“I’ve never believed that gold is an investment asset. Would you rather have faith in that, or McDonald’s, which has 32,000 stores?”

The comparison is almost unfair – on one side you have a metal that produces nothing, on the other you have a global franchise machine generating billions in free cash flow each year.

Warren Buffett, as usual, offered a vivid image:

“If Martians were to observe the activity of human beings for many many years, they would not understand one of their activities: They are digging something yellow out from the ground, process them and put them in the vaults and never touch them again.”

His point was that gold fails the “what does this actually do?” test.

And finally, Charlie Munger – who always cut straight to the core – dismissed the entire idea of owning gold as irrational. François Rochon recalls him saying: “I don’t have the slightest interest in gold. I like to understand what works and what doesn’t in human systems. To me that’s not optional; that’s a moral obligation. If you’re capable of understanding the world, you have a moral obligation to become rational. And I don’t see how you become rational hoarding gold.”

Taken together, these views capture why, from the standpoint of common sense and critical thinking, gold looks like a poor investment. It produces nothing, has no intrinsic anchor, and can’t be valued in the same way productive assets can. On this first pillar alone, the verdict seems straightforward: gold is speculation, not investing.

B) Gold Through the Lens of Empirical Evidence

If common sense pushes us to dismiss gold, history and empirical evidence complicate the picture.

The raw numbers don’t align neatly with the “barbarous relic” narrative. In fact, depending on the timeframe you look at, gold has sometimes been an exceptional performer and other times a devastating disappointment.

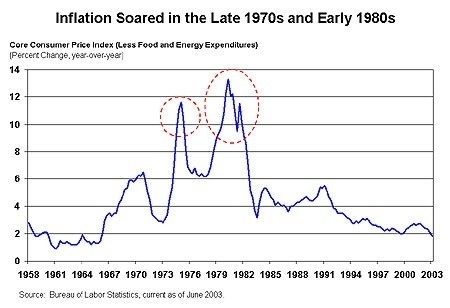

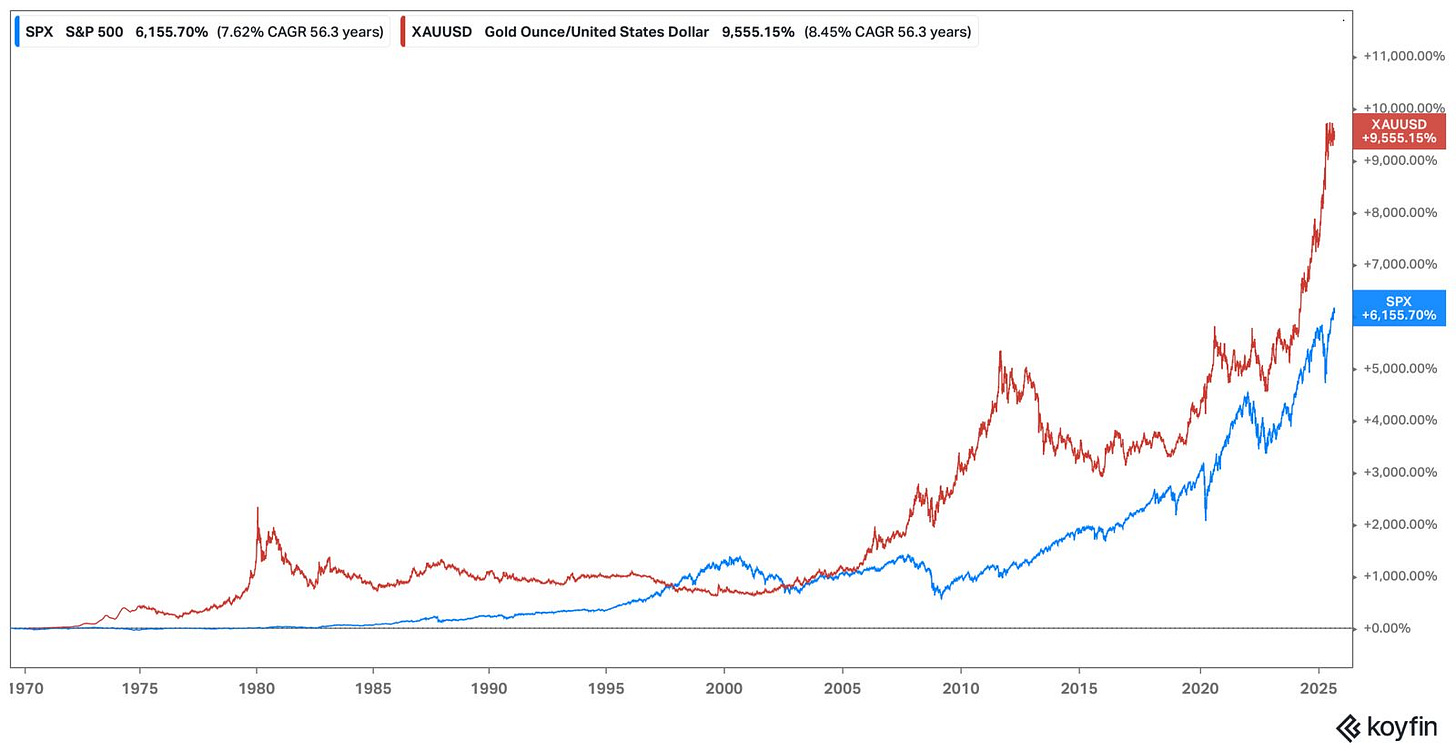

The key starting point is 1971. Before that, gold’s price was pegged to the U.S. dollar, which makes any long-term charts that start earlier misleading, or at best difficult to assess. Judging gold’s performance under a fixed price regime is like judging a sprinter’s speed by the years they spent chained to a wall. Once Nixon ended the Bretton Woods system and allowed gold to float freely, it became a true market-traded asset. And from that point forward, the story gets interesting.

Between 1970 and 1979, gold soared roughly 14-fold. Yes, 14-fold! Inflation was raging, the dollar was in turmoil, and investors flocked to the metal as a store of value.

In that decade, stocks barely moved. The S&P 500's performance in the 1970s was characterized by a long bear market and the challenges of stagflation. The result? Negative real returns during a good part of the decade.

But then came the long reckoning.

From its 1980 peak to its trough two decades later, gold lost more than 80% of its value in real terms. An entire generation of investors who bought into the 1970s mania spent decades underwater. In the same period, the S&P 500 – dividends reinvested – went up a lot.

That contrast highlights something essential about gold: timing has mattered enormously. Catch the right decade, and gold looks like the ultimate hedge. Miss it, and you could waste decades of opportunity.

And yet, dismissing gold entirely on that basis misses another chapter. From the early 2000s through the early 2020s, gold staged a remarkable comeback. Across those decades, it outperformed global stock indices and, over certain stretches, even beat the S&P 500. For many investors active in recent memory – including those of my own generation – gold hasn’t been a failure at all. It has quietly served as one of the better-performing asset classes.

The volatility – another empirical data point –, however, is undeniable. Many think of gold as a “safe haven,” but the numbers tell a different story. Gold has often been more volatile than equities, and its drawdowns can be brutal. The maximum peak-to-trough decline since 1980 was around 70%.

So the evidence forces us to rethink. Gold isn’t the useless lump its critics make it out to be, nor is it the ultimate haven its fans claim. Empirically, it’s been both brilliant and disastrous, depending on when you look.

The lesson isn’t that the data challenges our common sense take the reality is far messier than intuition suggests.

C) Gold Through the Lens of Theory

If common sense dismisses gold and empirical evidence complicates the verdict, theory may provide the missing perspective. Financial and economic theory doesn’t turn gold into a productive asset, but it does explain why it persists as a meaningful part of many investors’ portfolios across centuries.

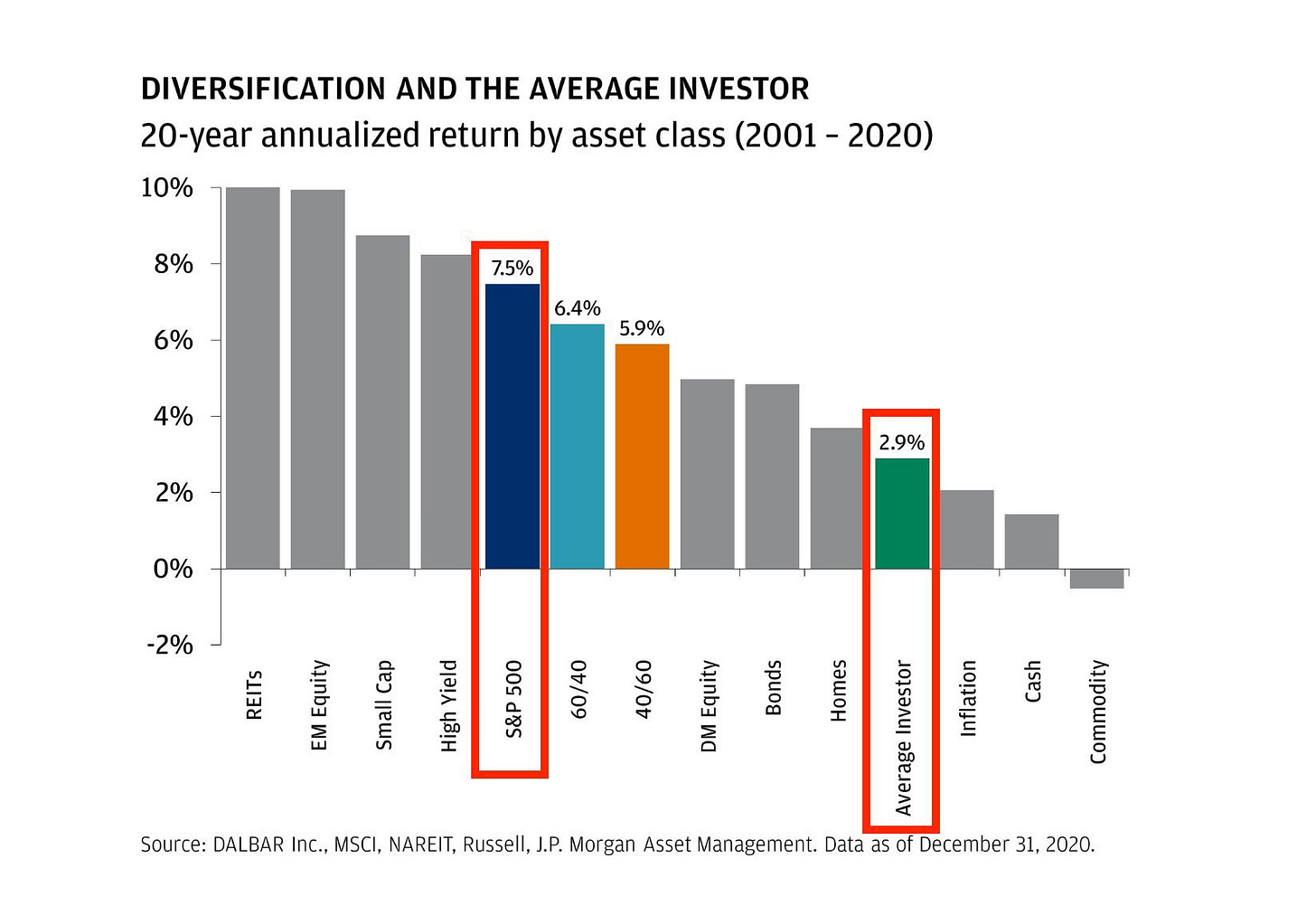

Start with modern portfolio theory. One of the core insights is that diversification improves risk-adjusted returns by combining assets that don’t move in perfect sync. Gold’s lack of correlation with equities and bonds has made it a valuable diversifier in certain market regimes. Even if its long-term return is not that much better than stocks, the smoothing effect on portfolio volatility can, in theory, improve overall outcomes.

That’s why central banks continue to hold gold and why many institutional investors allocate a small-ish portion to it. It isn’t because they expect it to compound like equities, but because it plays a unique stabilizing role, which in turn reduces the risk of making emotion-driven mistakes, improving many investors’ long-term outcomes.

Economic theory offers another angle. Gold has historically functioned as a store of value, particularly in periods of monetary instability. Fiat currencies are backed by governments, which can inflate or debase them. Gold, by contrast, is finite and difficult to produce. From a theoretical standpoint, that scarcity gives it a form of intrinsic monetary value, even if it doesn’t generate cash flows. This perspective is especially prominent in Austrian economics, which views gold as the ultimate hedge against the erosion of purchasing power under fiat money.

Then there’s behavioral finance. Humans have a deep, almost primal attachment to gold. Across cultures and centuries, it has symbolized wealth, security, and permanence. It seems to possess some “intrinsic” value, even though it’s hard to measure.

That psychological pull shouldn’t be underestimated. Investors are not purely rational calculators, and theory helps us understand why assets with symbolic or emotional significance can sustain demand regardless of their productivity. In this sense, gold functions not only as a financial asset but as a social construct that channels human fears and desires.

The theories don’t make gold a perfect investment. They don’t erase the fact that it produces no cash flow. But they explain why it endures and why, at times, it can play a rational role in a portfolio. Viewed through theory, gold is less of an anomaly and more of a tool – one with unique properties that, when understood, can serve specific purposes for investors.

The Intersection – A Nuanced Takeaway on Gold

Looking at gold through each pillar separately leaves you with conflicting conclusions.

Common sense tells you it’s irrational – a lump of metal with no productive capacity, impossible to value, and therefore speculative.

Empirical evidence muddies the water – gold has at times been one of the best-performing assets in the world and at other times a wealth destroyer.

Theory explains why it survives, showing its usefulness as a diversifier, a store of value, and even a psychological anchor for human behavior.

The point of the framework isn’t to let one pillar dominate but to force them into conversation. When you stand at the intersection of all three, a more balanced picture emerges.

Gold isn’t the “perfect hedge” its advocates claim, nor is it the “barbarous relic” its detractors dismiss. It is a tool – one with clear limitations but also undeniable utility under certain conditions.

Through common sense, you recognize it might never compound over the very long run like a business or a bond. Through empirical evidence, you see that its performance can shine in particular decades, crush the performance of equities as it isn’t anchored to cash flow, but disappoint over others. Through theory, you understand why it can still make sense as a small allocation, especially in periods of monetary instability or as a non-correlated asset in a broader portfolio.

This is the strength of decision-making at the intersection. Any one perspective on its own produces a distorted verdict: gold is useless, gold is brilliant, gold is timeless. Only by triangulating between all three do you arrive at a nuanced, rational conclusion: gold can be useful, but only if you understand what it is and, more importantly, what it is not.

And that lesson extends beyond gold. Every investment carries its own mix of intuitive logic, historical evidence, and theoretical justification. When those align, conviction is well-founded. When they don’t, skepticism is warranted.

Gold simply shows in stark relief what is true of all investing decisions – reality rarely fits neatly into one box, and only by integrating multiple lenses can you see it clearly.

What Gold Teaches Us About Decision-Making

The real value of looking at gold through this framework isn’t just about reaching a verdict on gold itself. It’s about seeing how the process exposes blind spots and forces balance. If you relied only on common sense, you’d dismiss gold entirely as a useless relic. If you relied only on the data, you’d conclude that gold is an underrated star performer with decades of strong returns. If you relied only on theory, you might decide it belongs in every portfolio as a diversification hedge. None of those positions, on its own, tells the whole story.

Gold highlights the danger of leaning too heavily on one pillar of reasoning. Common sense without evidence can lead to arrogance. Evidence without theory can lead to misinterpretation. Theory without grounding in reality can drift into abstraction. The strength of the framework lies in forcing those perspectives into tension until they produce a more measured conclusion.

This lesson applies far beyond gold. Every major investment decision involves a mix of intuition, historical data, and theoretical models. When all three line up, conviction can be strong.

When they diverge, caution is warranted!

In fact, the most useful moments often come when one pillar challenges the others. That friction doesn’t create confusion – it creates clarity. It highlights where assumptions need to be questioned, where evidence has been cherry-picked, or where a theory may not apply.

Gold’s story reminds us that investing is never about certainties, only probabilities. I discussed this concept in the piece below:

Thinking in Bets: What Poker and Horse Racing Teach Us About Markets

Most people wouldn’t naturally group stock market investing, poker, and horse betting into the same category. One has billion-dollar companies and earnings calls, another is played in smoke-filled card rooms (or sleek online interfaces), and the third involves animals, turf, and betting slips.

The goal isn’t to eliminate uncertainty but to approach it with a framework that keeps you rational. Whether you’re evaluating a commodity, a stock, or an entire asset class, the three pillars provide a way to avoid dogma and build decisions on a foundation that is more resilient than any single line of reasoning.

So the next time you face an investment decision – whether it’s a hot growth stock, a defensive utility, or yes, even a bar of gold – try running it through the three pillars. Ask yourself if it makes sense, check what the data says, and see how it fits within the broader theories of finance and economics. The conclusion might not be perfect, but it will almost certainly be stronger than if you relied on only one lens. And in investing, stacking the odds of being “roughly right” is about as close as we ever get to certainty.