The Ultimate Base Rates Guide – From Optimism to Realism in Valuation

Why Growth Forecasting Fails – and How Base Rates Can Save You

Every investor knows that growth is the heartbeat of valuation – but few can forecast it with any consistency. Entire fortunes have been made and lost on the back of overly optimistic projections. Think of the countless “next big thing” companies that dazzled in their early years, only to slow down, disappoint, and punish shareholders who believed the story too literally.

Why is forecasting growth so hard? Because it tempts us to trust our intuition. We fall in love with company narratives, impressive management teams, or disruptive technologies and project straight-line trajectories into the future. Yet history tells us that growth almost always slows faster than expected, and the exceptions – Amazon, Apple, Nvidia, Tesla – are exactly that: exceptions.

That doesn’t mean we shouldn’t forecast. It means we need tools that keep us grounded. One of the most powerful is the use of base rates – the statistical record of how similar companies (an appropriate reference class) have grown and matured over time. Base rates don’t kill your optimism, but they put it in context. They show you what’s typical, what’s rare, and what’s nearly impossible.

In this post, I’ll explore how base rates can transform the way you approach forecasting – be it forecasting growth, steady state margins, or ROIIC. I’ll show how base rates act as a reality check against the stories we tell ourselves and how, when combined with qualitative analysis, they can lead to far more balanced and accurate investment decisions.

Here’s what we’ll cover in this 5,000-word piece:

The challenges of forecasting growth – why investors systematically get it wrong and how optimism creeps into valuations.

What base rates are – and why they provide the “outside view” that tempers company-specific narratives.

Applying base rates in investing – how to combine the inside and outside views to build disciplined forecasts.

Regression to the mean – why extreme outcomes rarely persist, with examples across industries.

Practical applications in portfolio management – how base rates can guide diversification, asset allocation, and growth

An overview of key base rates – including sales growth, margins, and returns on capital, drawn from Mauboussin’s work.

Challenges and limitations – where base rates fall short, especially in fast-changing industries.

Integrating qualitative analysis – how factors like pricing power, TAM, and management quality allow companies to bend the rules.

Inside vs. outside views in practice – case studies that show how combining both perspectives leads to better outcomes.

The bottom line – why base rates are a guardrail, not a crystal ball, and how they help you invest with both humility and conviction.

Part 1: The Challenges of Forecasting & Understanding the Concept of Base Rates

Forecasting corporate earnings growth is one of the most critical – and most difficult – tasks in investing. Growth drives valuation, and getting it even slightly wrong can swing investment outcomes dramatically. Predict too little, and you may miss out on opportunities. Predict too much, and you risk overpaying, often with painful consequences.

In my experience, both professional and private investors tend to lean too heavily toward optimism. They build rosy forecasts, assume straight-line growth, and justify ever-higher multiples. Inevitably, this leads to overpayment and disappointing long-term returns.

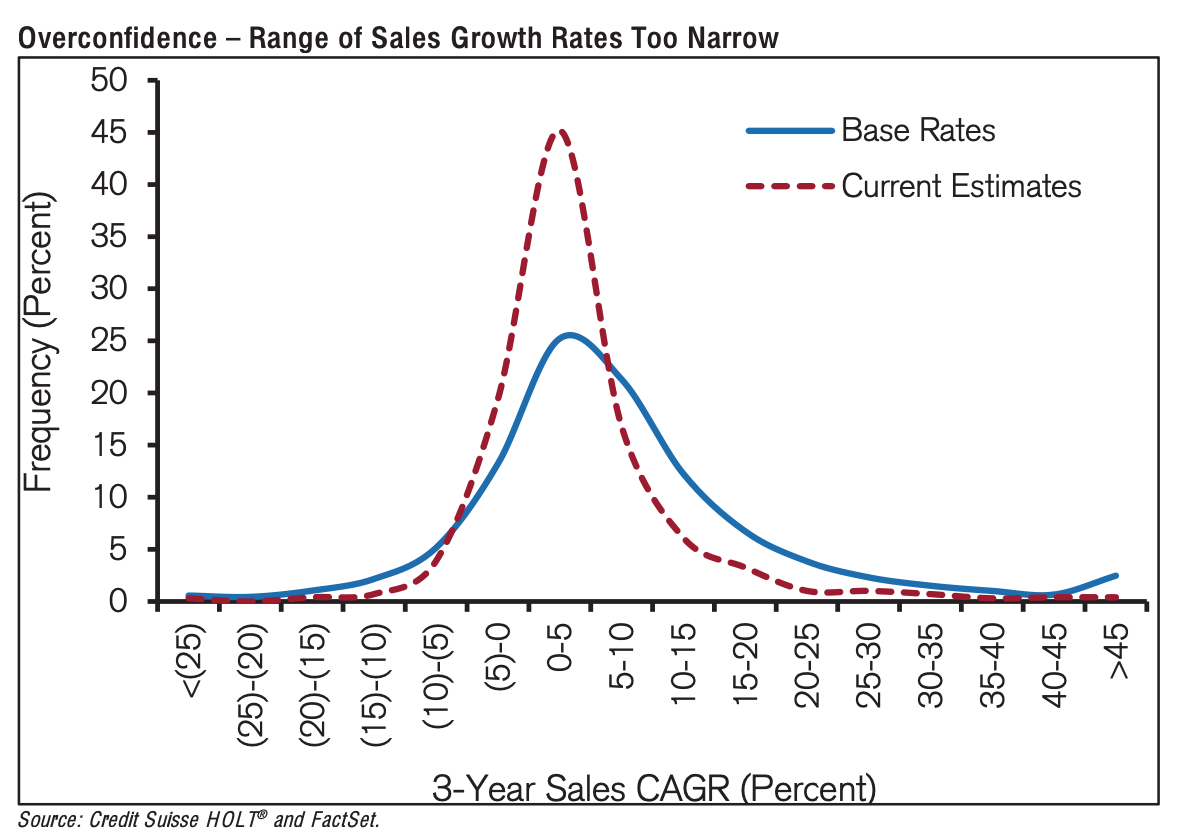

Michael Mauboussin has spent much of his career reminding investors of this bias. The chart above is one of his friendly reminders to embrace conservatism.

As Sean Stannard-Stockton of Ensemble Capital framed it well:

“The question at hand for investors is not whether they should forecast the future growth (or lack thereof) of corporate earnings power. Rather it is how should investors go about making those forecasts without being too optimistic, nor by naively ignoring growth potential.”

Traditional value investing has historically sidestepped some of these issues. By focusing on low valuations rooted in current or past financials, value investors implicitly assume the future will look more like the past than the optimistic scenarios baked into many growth stories. That conservative mindset has often been more accurate than the blue-sky forecasts that growth investors rely on.

That doesn’t mean one should never “pay up” for growth, though – in fact, this can be a very costly mistake. The last two decades have shown us just how quickly the future can diverge from the past. The rise of the internet, a global financial crisis, a pandemic, and now the explosion of artificial intelligence have reshaped entire industries in ways most investors failed to anticipate. Forward-looking investors who correctly spotted these divergences were rewarded handsomely.

Still, I believe history offers lessons. Using base rates – the statistical patterns of how similar companies have grown in the past – can help anchor expectations and keep investors from straying too far into fantasy. They don’t replace judgment, but they provide a much-needed reference point in a world that tempts us toward overconfidence.

Understanding Base Rates

At its core, a base rate is just a probability drawn from history. It’s a way of asking: “When situations like this have happened before, how did they usually turn out?”

For investors, base rates act as a statistical guardrail, helping us avoid two classic mistakes – overconfidence and ignoring the tendency of outcomes to drift back toward the average.

Think about weather. If I asked you to predict whether it will more likely rain tomorrow in London or Barcelona, and you had no access to forecasts, you’d probably guess London. And you’d be right: London averages 155 rainy days a year (around 42%), compared to Barcelona’s 78 (21%).

That’s the base rate – a historical record of how often something happens. Of course, if you were betting serious money, you’d also want to look at the sky that day. Dark clouds over Barcelona might outweigh the averages. This distinction between the broader statistical record (the “outside view”) and the specific, immediate conditions (the “inside view”) will come up again later.

“The base rate describes the probability of something happening based on the historical record. The ‘reference class’ describes the set of data you are using. Are you using the frequency of rain from last year or the last hundred years? Are you including only the city proper or the entire metro area when measuring rain frequency?” (Ensemble Capital)

Another example: suppose you meet a dentist at a party in New York City and are asked to guess his income. You’d probably anchor your estimate to the average dentist’s salary in New York, around $228,000 per year. If someone told you this dentist earns $29 million, you’d be skeptical – the base rate alone tells you that outcome is wildly improbable.

In investing, base rates serve the same function. Before projecting the future of a promising software startup, you might first study the historical growth rates of similar tech companies. That outside view won’t give you a perfect forecast, but it grounds your expectations. It helps you weigh the company-specific story against the hard reality of how most comparable businesses have actually performed.

Part 2: Applying Base Rates in Investing

When forecasting growth, investors need to blend two perspectives. The inside view digs into the specifics of a company – its products, strategy, competitive position, and management team. The outside view looks at what history tells us about similar companies in similar situations. Base rates are the backbone of this outside view.

The real insights start here:

The rest of this post covers the content outlined above. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks) is just a click away. Upgrade your subscription, support my work, and keep learning.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.