My portfolio is now down to just nine positions. That’s not a number I target in advance, but it’s where I feel most comfortable right now. I’ve always believed concentration isn’t about some magic formula – it’s about conviction in ideas I truly want to own through good cycles and bad.

Trimming down forces clarity. You can’t hide behind a long tail of “just in case” stocks when each holding has a meaningful weight.

The trade-off is obvious: when you concentrate, every decision matters more. And that’s where DigitalOcean came in – as an outlier to my usual approach (I’ve always been upfront about that).

It never ticked all my normal boxes. The price wasn’t screaming “back up the truck,” and the balance sheet had a very real $1.5 billion problem sitting in plain sight.

But in this case, I deliberately made an exception. I wanted exposure to a very particular type of growth story in the age of AI, and DigitalOcean was one of the more interesting, under-the-radar ways to get it – and while not screaming cheap, I think it provides decent value if they can successfully deal with the debt situation.

Ultimately, I ended up selling yesterday – selling at a slight profit made it easier. That decision had nothing to do with the company’s operational performance, which has been strong. It had everything to do with the complexity of the financing structure they chose to deal with that $1.5 billion wall of debt which we extensively covered in part 3 of our deep dive into D 0.00%↑ OCN. Before we get to that, it’s worth revisiting why I bought in the first place.

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

The Thesis: Why I Bought DigitalOcean

When I first added DigitalOcean to the portfolio, it didn’t fit the mold of my typical “obvious” investments – the kind where the valuation feels ridiculously skewed in my favor and the capital structure is boring enough to ignore. Here, the appeal was a mix of product momentum, early-stage AI exposure, and an improving go-to-market strategy under a refreshed management team.

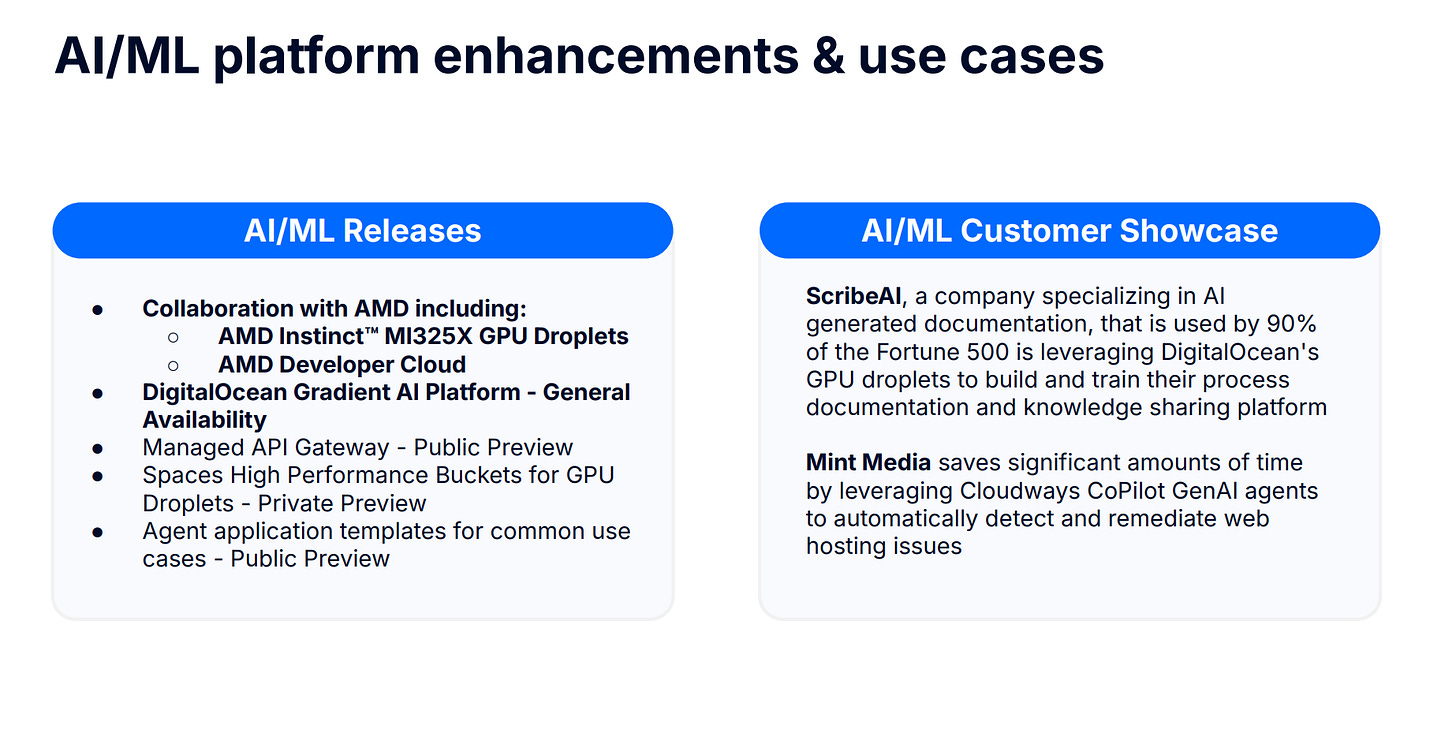

On the product side, their velocity stood out. More than 60 new products and features in a single quarter isn’t something you see every day in this segment of the cloud market. They were moving fast and hitting relevant trends – not just chasing buzzwords, but actually embedding AI/ML capabilities into offerings that mattered to their existing customer base. That’s a key distinction. Chasing the latest AI hype is easy; integrating it in a way that creates durable revenue is harder.

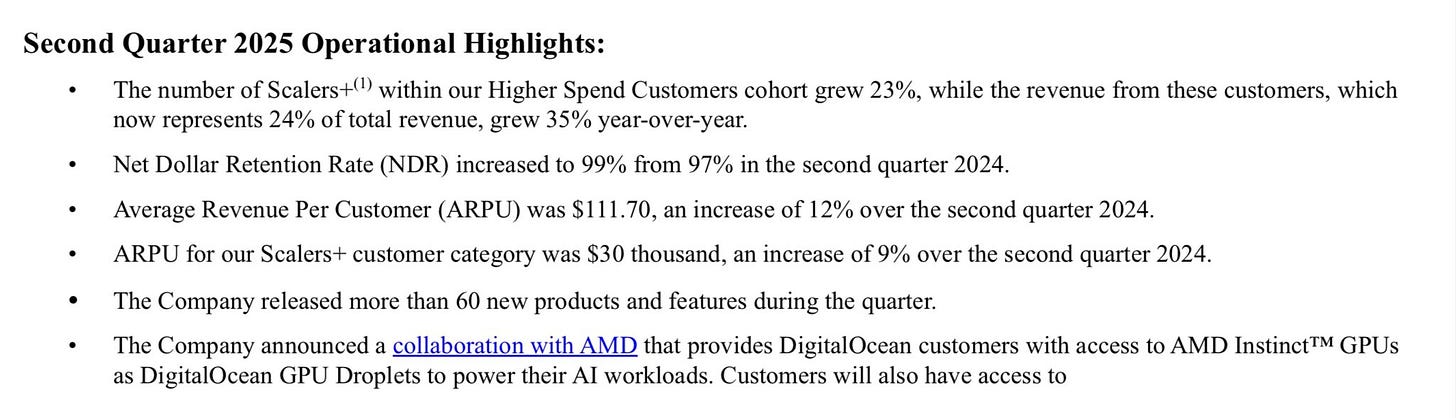

The Scalers+ segment was another reason I paid attention. These higher-spend customers, often scaling start-ups and mid-market companies, are the kind of base that will drive sticky, high-margin growth. Revenue from Scalers+ was up 35% year-over-year in the most recent quarter, and the cohort now accounts for almost a quarter of total revenue. That’s a healthy mix shift in the right direction.

And then there was the AI/ML momentum. Management reported that AI/ML-related revenue more than doubled year-over-year, and they were raising guidance off the back of it.

For a company this size, that’s meaningful. Combine that with net dollar retention ticking up to 99% and average revenue per customer growing double digits, and the operating picture was clearly strengthening.

Management is executing its plan. This was part of my thesus: I liked the fact that there was new blood at the top. The refreshed leadership team struck me as competent and pragmatic during the Investor Day, and they seemed focused on the right levers – unit economics, product-market fit, and operational discipline.

So, even though the debt load made me feel slightly uncomfortable, I was willing to take a measured position. This was never going to be a “core forever” holding, more of a shorter-term trade, but in the right conditions, it could deliver outsized returns. And in the age of AI, with so much investor attention clustered around a handful of mega-cap names, owning a smaller, more nimble player felt like a worthwhile bet.

There was more in the most recent quarterly report that reinforced my conviction – at least on the operating side. Revenue came in at $219 million, up 14% year-over-year, with annual run-rate revenue hitting $875 million. Gross profit rose 15%, margins held at 60%, and net income almost doubled. Adjusted free cash flow was $57 million, good for a 26% margin, up from 19% a year ago. In other words, the business is scaling and doing it with improving efficiency.

There’s also the “agentic cloud” narrative the company has been pushing – essentially building the infrastructure for more autonomous, AI-driven applications. While still early, it’s a logical extension of their positioning as a simpler, more cost-effective alternative to the hyperscalers. And given the cost sensitivity many AI start-ups face, that positioning could matter more as the hype cycle matures and budgets tighten.

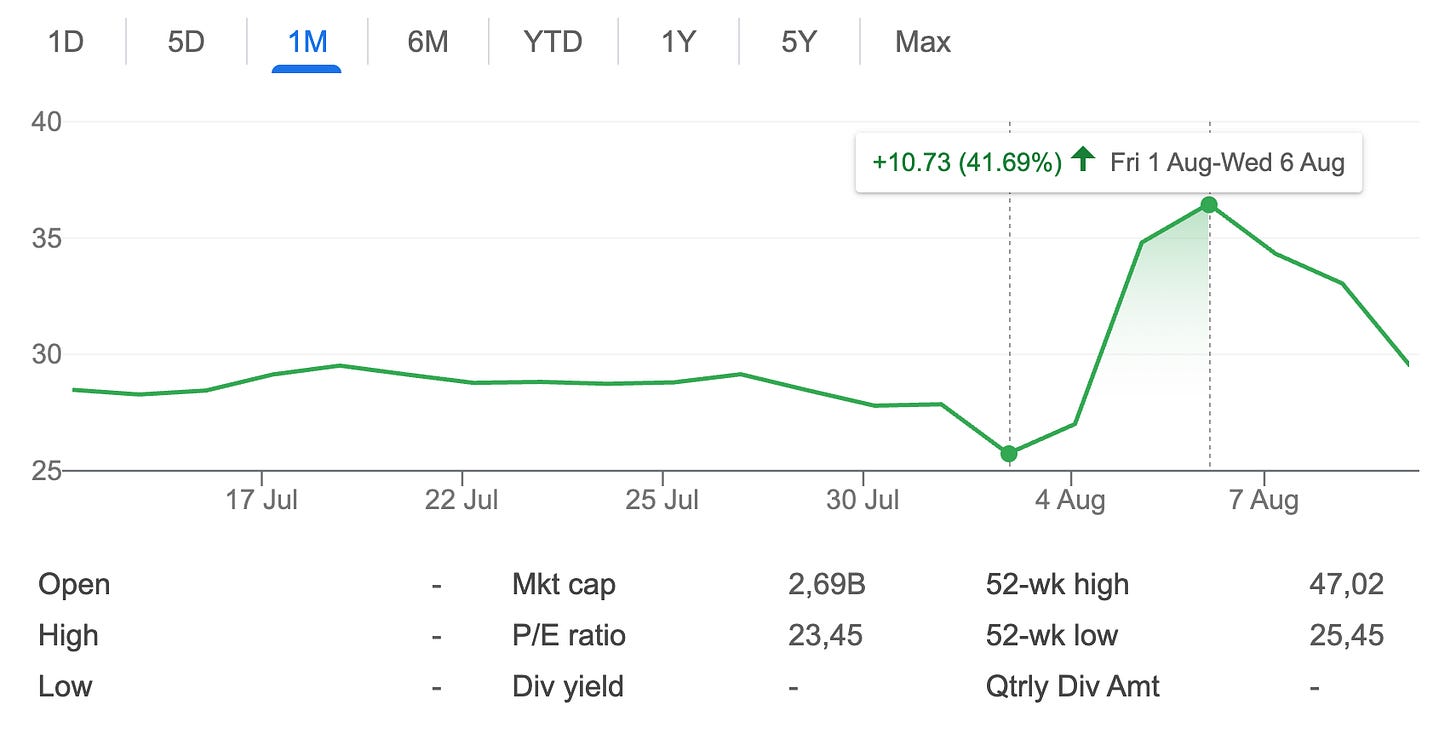

The market noticed. After the earnings release, the stock jumped almost 20% in a single day and was up more than 40% over a five-day stretch. That’s the kind of move you get when narrative and numbers line up. Unfortunately, as I’d soon be reminded, narrative alignment can be fragile – especially when a capital structure overhang is lurking in the background.

The Debt Wall

As much as I liked what DigitalOcean was doing operationally, there was always an elephant in the room – $1.5 billion in convertible notes maturing in December 2026. When you’re running a concentrated portfolio, you don’t get to relegate something like that to the “I’ll worry about it later” pile. It sits there, influencing every decision, because sooner or later the company will have to address it – and how they choose to do that can change the equity story overnight.

These weren’t just any bonds. They were 0% convertible notes – essentially a hybrid between debt and equity. From a cost-of-capital standpoint, 0% debt is about as sweet as it gets. But convertibles come with a catch: they can be swapped for equity if certain conditions are met, which means potential dilution for existing shareholders. And if they aren’t converted, the company has to pay them off in cash. Either way, the maturity date acts like a ticking clock, counting down to a forced decision.

Want the full experience?

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.