Deep Dive: Revisiting Timee ($215A)

How Timee's #1 Competitor Couldn’t Crack the Spot-Work Code: The Anatomy of a Winner-Takes-Most Marketplace

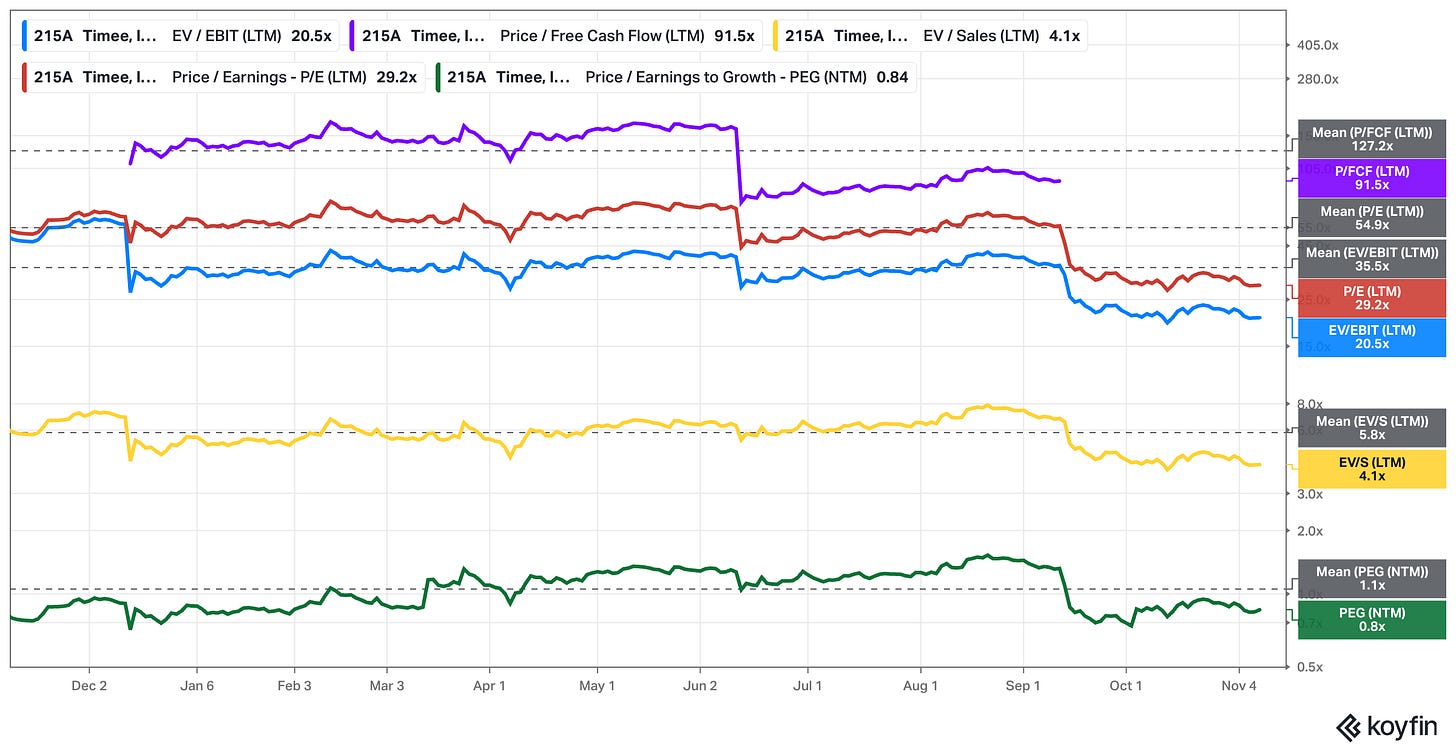

When I published my 23,000-word deep dive on Timee Inc. back in early October, I knew it would be one of the more polarizing pieces I’d written in a while. On the surface, it looked like another small Japanese tech company, one that is riding the wave of digitization in part-time labor, and one that is trading at quite a rich multiple compared to many of its Japanese peers.

But underneath, it was a case study in network effects, network liquidity dynamics, and the long-term value creation potential of marketplaces that solve real-world frictions.

Find the deep dive here:

Since then, Timee hasn’t released any new financial results – the next set will likely come out in December – but the absence of earnings news doesn’t mean the business has stood still. Quite the opposite. Over the past few weeks, two developments have emerged – and I think one of the developments says more about the company’s trajectory than any quarterly update could.

The first comes from Mercari, arguably one of the few players with the brand reach, user base, and capital to threaten Timee’s dominance in Japan’s on-demand work market. Mercari’s decision to exit the spot-work business marks a striking reversal after just two years of effort – and it raises fascinating questions about what makes this market so difficult to enter, let alone scale.

The second piece of news comes not from a company but from a sell-side analyst. A recent report by CLSA’s Jun Kato included a data point that, to me, perfectly captures the underlying power dynamics of this industry. It illustrates something I’ve believed for a while: that marketplaces like Timee, once they reach a certain level of liquidity, become almost impossible to disrupt – even by much larger players.

So in this update, I’m not going to rehash the numbers from Timee’s last earnings report or re-explain the basics of its business model. Instead, I want to zoom in on what these two new signals tell us about the state of the industry, the competitive landscape, and why I think Timee’s position is more durable than ever.

Before we dive in, here’s what I’ll cover:

How Mercari’s withdrawal from the spot-work market became one of the most important confirmations of Timee’s moat to date

What the failure reveals about the underlying physics of two-sided marketplaces – and why liquidity, not capital, is the ultimate constraint

How the latest data from CLSA quantifies network health in a way that explains why Timee has been so hard to challenge

What these industry signals might tell us ahead of Timee’s upcoming December earnings release – and what to watch next

Mercari’s Exit: The Competitor That Couldn’t Crack The Spot-Work Code

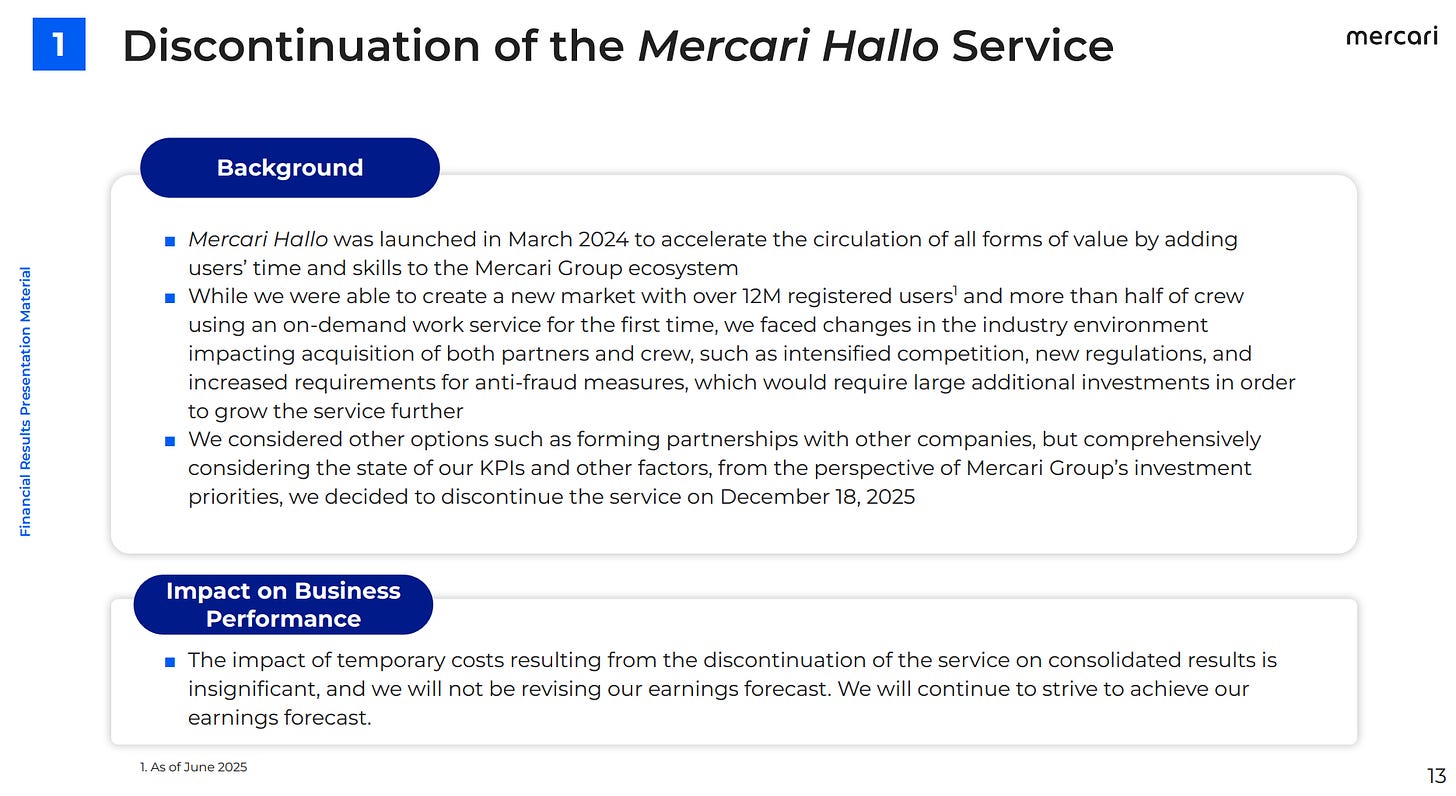

When Mercari entered Japan’s on-demand work market in 2024 with its new service Mercari Hallo, Timee’s management team of course paid close attention. On paper, it looked like one of the very few companies capable of giving Timee real competition. Mercari already has roughly 23 million monthly active users on its main marketplace app, deep pockets, and strong consumer mindshare. Adding a “Work” tab to its platform – where users could pick up flexible, short-term shifts at local businesses – seemed like a logical extension of its ecosystem.

At the time, many observers assumed this was bad news for Timee. If anyone could pull off a fast ramp-up in this segment, it was Mercari. They had the capital, the data, and the existing user funnel.

In our deep dive, we discussed the competitive environment and flagged how one of the most notable rivals may in fact be Mercari, which …

“[…] launched Mercari Hallo, a ‘quick and easy for anyone on-demand work service […] – users will see a “work” tab in the Mercari app.“ Mercari Hallo with apparently around 12 million registered users (just as many as Timee) and over 120,000 partner locations (vs. Timee’s 392k registered client accounts), brings consumer mindshare and a large user base but still lacks Timee’s depth of liquidity and enterprise traction. But they’d likely have the capital to cross-subsidize this new segment with their established business lines.”

And yet, I was skeptical in my analysis. Back in October I wrote:

“That said, I feel like Mercari’s headline numbers deserve some skepticism. The company reported reaching millions of users and tens of thousands of client locations almost immediately after launch (also by using promotions to get the business off the ground), which suggests the figures reflect cross-selling to its existing merchant base and very loose definitions of ‘users’ (for example, maybe anyone who clicked on the tab in the Mercari app?). The real active base appears to be far smaller, and by most accounts Mercari Hallo hasn’t yet meaningfully dented Timee’s dominance.”

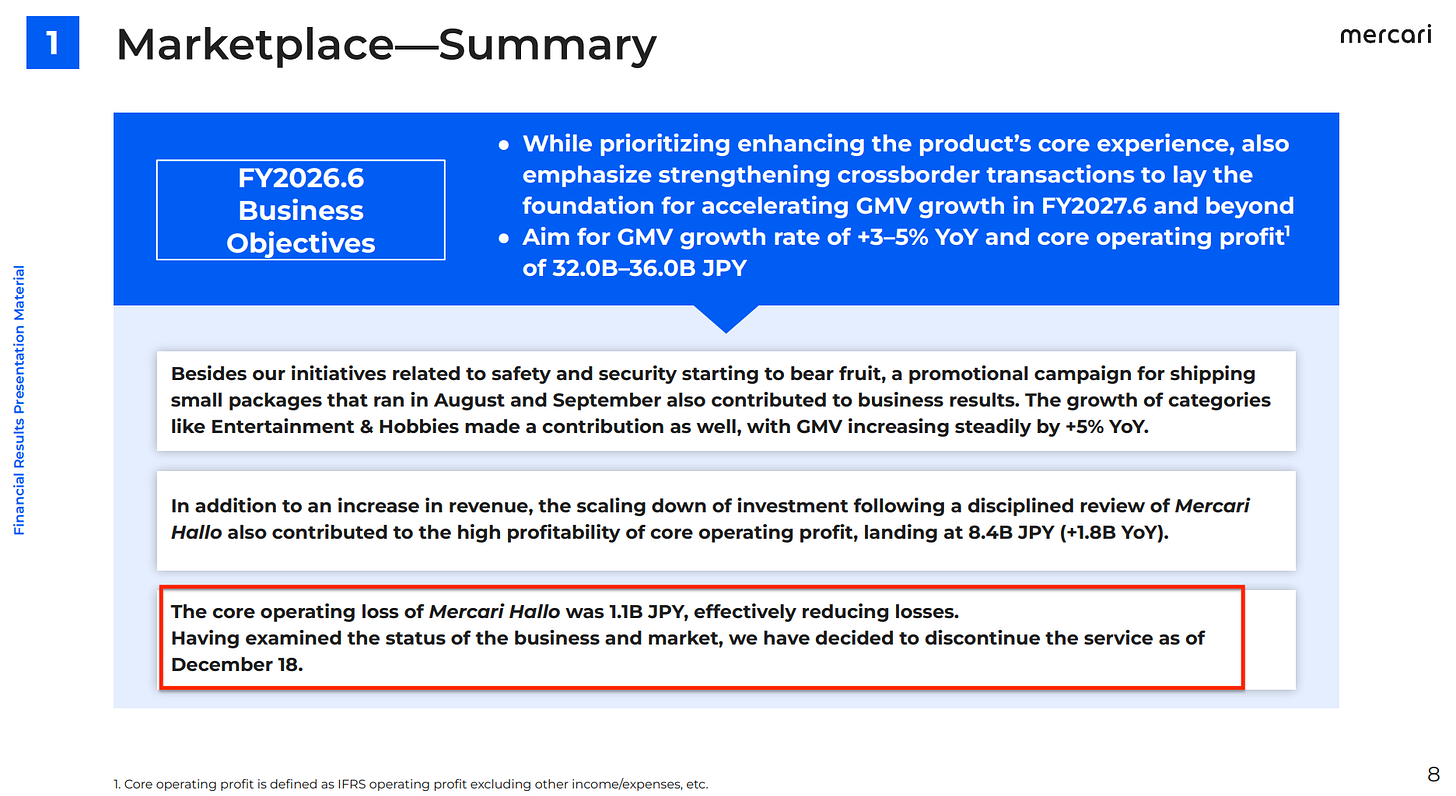

That assessment aged better than I expected. In late October, I came across a report by Nikkei that highlighted how Mercari would shut down Mercari Hallo in December, just two years after launching it.

This news can also be found in Mercari’s (Ticker $4385.T) Financial Results for the Three Months Ended September 30, 2025:

They even had quietly approached several companies to explore partnerships or potential buyers, but found no takers. The reason? Weak business traction and low worker utilization. The number of companies using the service wasn’t growing, and the activity rate of part-time workers remained low – roughly 1/20th that of Timee’s.

In other words, even with all its advantages – capital, brand recognition, cross-selling power – Mercari couldn’t solve the core challenge of a two-sided labor marketplace: liquidity & network activity.

This is the part that most casual observers underestimate. A liquidity-based marketplace isn’t just about matching supply and demand. It’s about doing so instantly and reliably, every single time. For Timee, the magic lies in its ability to ensure that when a restaurant, convenience store, or logistics hub needs a worker on short notice, someone actually shows up – and vice versa. The tighter that loop becomes, the more valuable the platform gets for everyone involved.

Mercari tried to brute-force this with its user base and promotions to get the business off the ground, hoping that some portion of its millions of app users would convert into active gig workers. But liquidity doesn’t scale linearly with users. It scales with relevance, trust, repeat usage, mind share, and matching efficiency. Timee’s workers are habituated; they know the system, trust the process, and have high repeat rates.

Mercari’s users, on the other hand, opened Mercari’s app for all sorts of reasons, but not necessarily for work. That mismatch proved fatal.

There’s also an underappreciated difference in customer acquisition strategy. Timee’s early growth wasn’t about blasting out marketing campaigns – it was about embedding itself deeply with corporate clients, removing frictions one by one (no interview, instant pay, tighter trust & safety), training field managers who are responsible for onboarding and training workers, and integrating scheduling, verification & reviewing systems (+ many more layers). This sort of experience for both employees and workers is hard to copy.

From an investor’s point of view, Mercari’s exit does two things. First, it eliminates one of the most credible threats to Timee’s market share in Japan. Second, and more importantly, it validates the structural moat around Timee’s model.

I’ve compared this dynamic to other winner-takes-most marketplaces – think Booking.com, Airbnb, or Uber. Once a platform reaches sufficient density, every new transaction further entrenches its advantage. For competitors, that threshold becomes a wall, impossible to overcome. Mercari’s short-lived experiment confirms this exact dynamic.

And that’s what makes this development so instructive. It’s not merely about Timee gaining a little more breathing room. It’s about observing a structural reality play out in real time: when a powerful entrant fails to gain traction despite all the apparent advantages, you learn something fundamental about the underlying market physics.

Network Health and the Evidence of Dominance

If Mercari’s withdrawal from the market confirmed the limits of capital and brand power, a fresh set of data from sell-side firm CLSA highlights why Timee’s moat keeps expanding.

In an in-depth report on Japan’s on-demand work ecosystem, analyst Jun Kato compared the number of annual job placements to registered workers across the major platforms. The result wasn’t even close.

Timee’s network was generating a placement-to-worker ratio several times (15-16x) higher than its nearest competitors (of which one, as we learned, will discontinue its operations), meaning its liquidity flywheel is spinning at a level of density and reliability others simply cannot match.

More specifically, Timee’s network generated roughly 18 million job placements from a base of about 11 million registered workers, translating to a placement-to-worker ratio around 1.6 times. The next-closest competitor – Sharefull by Persol – managed noten even one-tenth of that efficiency, while Mercari’s platform trailed even further behind.

In practical terms, this means that when a worker logs in to Timee, they’re far more likely to actually find work – and when a business posts a shift, it’s far more likely to be filled.

That sounds obvious, but it’s the essence of what makes these platforms so defensible. In a marketplace, liquidity isn’t a static asset – it’s a living organism. The more successful matches the system produces, the more trust it builds. That trust translates into more repeat users, which generates even tighter matching, which reinforces the moat.

Timee’s management understands this better than most. As they often emphasize, maintaining a high fill rate is the lifeblood of their product:

“To remain a service where clients can immediately find people available to work now – and where workers can immediately find available work now – maintaining a high fill rate is essential.”

That captures the operational philosophy that separates scalable networks from those that plateau. You can’t fake liquidity. You can subsidize it temporarily with discounts or incentives, but you can’t shortcut the process of organically balancing both sides of a market at scale.

The CLSA report’s findings fit neatly into the mental model I used in the original deep dive – one I’ve borrowed from years of studying other marketplace winners like Booking, Airbnb, Fiverr, Uber, or DoorDash. These are systems governed by non-linear feedback loops. Once a platform crosses a certain liquidity threshold, its value creation becomes asymmetric.

That’s exactly what we’re witnessing in Japan’s spot-work market. Timee controls roughly 70–80% of total market share, a figure that’s not just a snapshot of dominance but an indicator of where power naturally consolidates in such models. The company’s first-mover advantage, high repeat usage, and experienced enterprise sales team further compound this position.

When I read CLSA’s numbers, what stood out most wasn’t the scale itself but the structural implication: that the industry’s liquidity gravity has already tilted decisively toward Timee. And once that gravitational pull is established, competitors don’t just need to grow; they have to reverse a feedback loop already spinning in the opposite direction. That’s exponentially harder.

There’s also a subtle but important behavioral layer here. Workers who’ve successfully completed multiple jobs on Timee are not only more likely to keep using it but also more likely to be preferred by businesses – they have verified histories, ratings, and reliability data. This reputational layer increases matching precision, which in turn makes Timee’s marketplace more efficient and profitable over time. It’s the same evolution we saw with Uber’s driver tiers or Airbnb’s Superhost system – early friction eventually converts into a durable edge.

Conclusion

What makes this moment so interesting isn’t just that a major competitor exited the stage or that an analyst report confirmed Timee’s market dominance. It’s that these developments happen right during a broad selloff in the stock.

The most obvious reason for the stock decline is revenue growth decelerating. The company just posted slower top-line growth in Q3, revised its sales guidance downward, and the stock sold off.

I’m genuinely curious to see how the numbers will (eventually) reflect the structural trends we’ve been discussing in this post, even though Mercari’s exit will probably only become visible in the quarters of 2026 – and even then, Timee’s growth profile going forward will depend more on the trajectory of the spot-work industry as a whole.

For now, I see the recent signals as a quiet but powerful validation of the original thesis. Timee has built something that others, even those with far greater resources, have struggled to replicate.

How can I get Jun Kato's report?

By the way, I think many of the insights you share on Timee apply to The Trade Desk. TTD and Timee are in an almost identical situation. Except TTD has walled gardens who are scaling liquidity with eyeballs of their subscriber base rather than with trust, and relevance. Clearly walled gardens are a different proposition to Mercari - they aren't about to walk away from advertising. It is the advertising customer who will have to walk away from discounts used by walled gardens to lure them into a high liquidity (huge subscriber base) but low trust and relevance advertising platform. Hard but you can always count on the customer to act in his best interest over time. Time is the operating word here. Again, thanks for educating me.