Timee is not your typical Japanese tech company. Founded just a few years ago, in 2017, it has essentially created and scaled an entirely new labor category: instant, on-demand hourly staffing.

In a market dominated by traditional temp agencies and rigid employment structures, Timee built a digital two-sided marketplace where employers can fill urgent shifts and workers can pick up flexible jobs without the frictions of resumes, interviews, or long lead times. That combination – convenience for businesses and control + instant-payouts for workers – struck a nerve in a country facing chronic labor shortages and changing worker preferences.

The company went public in July 2024. The company did not receive proceeds from its recent initial public offering (IPO) because the shares sold were from existing shareholders (a secondary offering), such as the CEO Ryo Ogawa and the internet advertising firm CyberAgent. The total amount raised from the sale of these existing shares was approximately ¥46.8 billion (or about US$307 million), which was reported as the value of the international offering. In fact, since its founding, Timee has raised only ¥7.2 billion (about US$47 million) in outside money, which stands out relative to what the platform generates in profits today: In the first nine months of FY2025, ¥24.8 billion in revenue was generated with an operating profit of ¥5 billion (about US$32 million). Arguably, Timee is one of those rare marketplace businesses that reached self-sufficiency quickly: capital-light, already profitable, and still growing at a pace most software firms would envy.

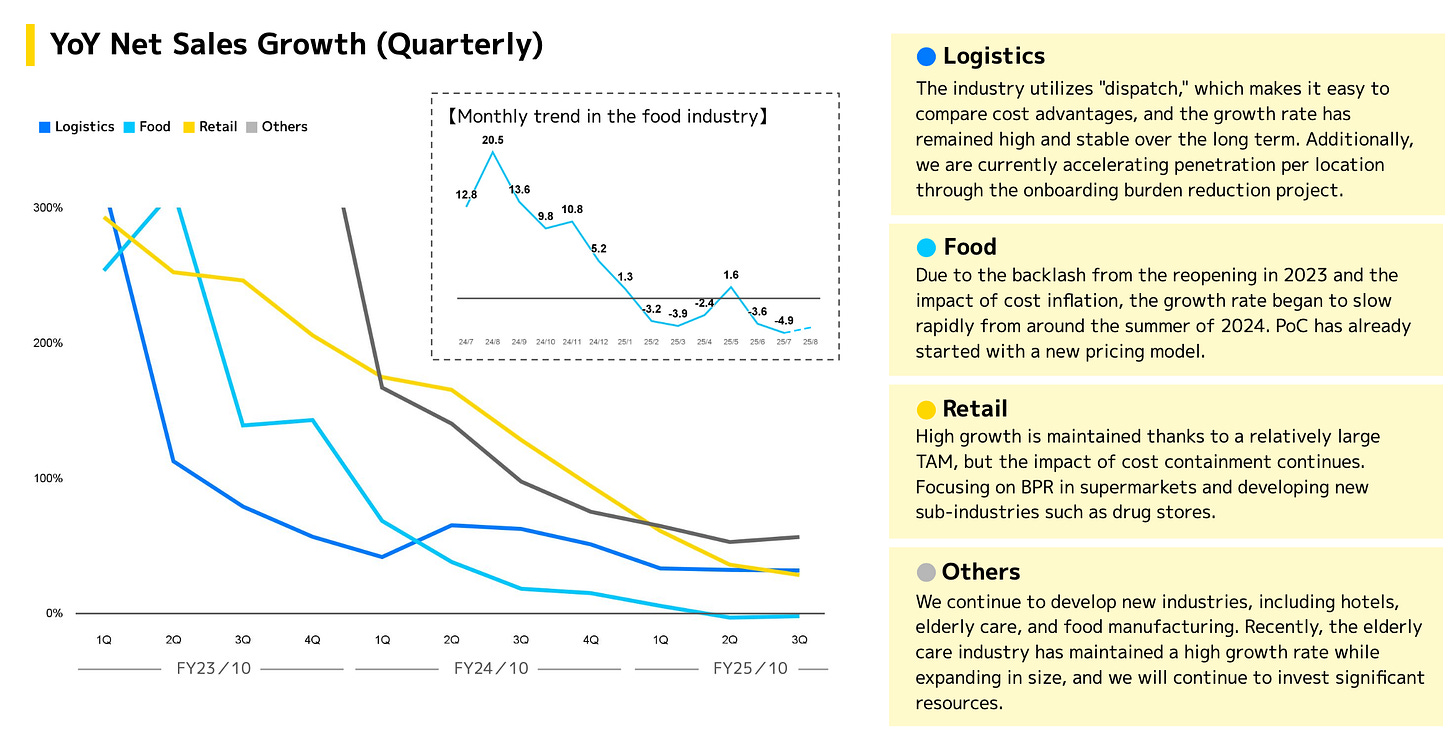

However, Timee’s story has reached an interesting pivot recently. Just a few weeks ago, the narrative was still “Timee is a high-growth labor marketplace rewriting how hourly work is staffed in Japan.” Investors loved the idea, and growth seemed unstoppable (with topline growth of >60% in FY24). As a result, the stock was up >140% between November 2024 and August 2025.

But then came the most recent quarter. Q3. Revenue slowed. Management cut sales guidance. And the stock, once priced for “above average compounding certainty,” fell sharply (down 43% from its ATH as I write this).

“In a way, Q3 is a transitional period.“ - CFO Yago on the Q2 Call

For many, that was the moment the shine came off.

But here’s the thing – the numbers tell a more nuanced story. While revenue disappointed, operating profit surged, margins expanded, and verticals like logistics and newer ones such as elderly care (transaction volume +147.0% YoY) showed strong traction. Countermeasures against misuse slowed onboarding, but those same changes also made the platform more credible in the eyes of regulators and large enterprise clients.

Arguably, it’s not often you see a company simultaneously criticized for slowing growth and applauded for improving profitability – yet that paradox is exactly where Timee sits today.

This raises some central questions:

Is the market overreacting to a temporary slowdown?

Or is it sniffing out deeper structural cracks in the model?

Has Timee already reached the inflection point in the growth S-curve?

Finding answers to these questions is what makes Timee so intriguing right now. The business is still founder-led, still asset-light, and still expanding into industries where labor shortages are chronic.

At the same time, its moat might not be as wide as bulls claim, competition is circling. In other words, the debate around Timee is not whether it’s a good business – it is – but whether it can stay great – and for how long.

That tension is what this deep dive explores – and as always I go incredibly deep. Over the next sections, I’ll unpack the bull case, the bear case, and everything in between: how the company makes money, why management’s capital allocation decisions matter, what the balance sheet reveals about hidden risks, and whether the competitive advantages are truly durable or just a mirage of good execution. Along the way, I’ll highlight the exact factors I’m watching – fill rates, enterprise adoption, regulatory creep – that will ultimately decide if this stock compounds or stalls.

Here’s a taste of what you’ll find in this deep dive (as always, we go really deep; around 23,000 words):

Breaking down what exactly Timee does, its customers, its products, it revenue base, past & future growth, etc.

Why a business that looks “capital-light” on the surface actually hides unusual cash-cycle dynamics.

The KPIs I believe will make or break the entire Timee thesis – and why the market isn’t watching them closely enough

A detailed analysis of Timee’s primary competitive advantages, including the moat built on network effects, liquidity, and high fill rates

A critical examination of multi-tenanting risk

How management’s decision to slow growth deliberately could strengthen the company’s moat, even if short-term oriented investors hate it

The real reason profitability is surging while revenue growth stalls – and what that tells us about long-term economics

A detailed analysis of the TAM and Serviceable Available Market (SAM), showing that Timee’s current penetration within its three core verticals (Logistics, Food, Retail) is still minuscule, implying a long runway for growth

A devil’s advocate short thesis on Timee that every bull needs to grapple with before buying the stock

Why Timee’s biggest risk may not be competition …

The nuances of the event that triggered the recent selloff – and why I think the market may be treating a temporary headwind as if it were terminal

A highly detailed assessment of the current valuation setup (featuring my new valuation approach)

And finally: the handful of signals I’ll be watching over the next 12–18 months that will tell me if this is a true compounder or just a passing growth story

This isn’t just another quick stock pitch – it’s an in-depth exploration designed to test both sides of the case.

If you’re a free reader, consider this a glimpse of the kind of analysis paid subscribers get regularly. This was around 1,000 words; another 22,000 will follow.

High-Level Thesis – The “Bam Bam Bam Bam Bam” 90-Second Pitch

The Full Analysis Starts Here

Become a paying subscriber to read the entire post (23,000 words) and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. Tiger Brokers, Nathan’s Famous, LVMH, Edenred, Digital Ocean, Zalaris, Ashtead Technologies, innoscripta AG, or Brockhaus Technologies), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.