The Explosive Rally in Chinese Equities: Is This the Start of a Long-Term Bull Market?

If you want the tl;dr answer to the question asked in the title, here it is:

I don’t know. No one knows.

But I do have some thoughts on this subject and want to share some interesting data points that I came across. Hence, in this blog post, we'll take a look at the current landscape of Chinese stocks, analyze the key factors behind the recent rally, explore what industry experts like David Tepper have to say, and discuss whether this might signal a long-term shift in the outlook for Chinese equities. Let’s get to work!

The Surge in Chinese Equities: Highlights

In the past few weeks, Chinese stocks have seen a remarkable surge as the Chinese government and central bank unleashed a powerful combination of fiscal and monetary stimulus. This move has injected renewed optimism into the market, leading to explosive gains across Chinese equities.

Here's a quick snapshot of the recent performance in Chinese stocks:

The KWEB 0.00%↑ CSI China Internet ETF has soared by nearly 40% in just two weeks.

JD.com JD 0.00%↑ has skyrocketed by an astonishing 60% over the same period.

The MSCI China Index surged 25% in September alone.

Even formerly unloved Chinese tech giants like Alibaba BABA 0.00%↑ and Tencent have outperformed U.S. benchmarks by a significant margin in 2024.

With this rapid rally, the key question for many investors is whether this surge is the beginning of a sustainable bull market or merely an overreaction to China's recent stimulus measures.

David Tepper’s Bullish Outlook on Chinese Stocks

During a recent interview on CNBC, prominent hedge fund manager David Tepper shared his thoughts on the Chinese stock market.

"My counter bet is that I don’t care."

His comments suggested a remarkable level of confidence in China's economic future, even going so far as to increase his portfolio's exposure to Chinese equities beyond previous limits.

Tepper has now allocated more than 12% of his portfolio to stocks like Alibaba, JD.com, and other Chinese assets, signaling a notable shift in his investment strategy.

Tepper’s decision is particularly noteworthy because his willingness to expand his exposure hints at a significant change in sentiment towards Chinese markets among professional and high-profile investors.

Tepper’s rationale for betting big on China lies in the valuation metrics of Chinese stocks, many of which trade at single-digit P/E multiples despite exhibiting double-digit growth rates. He emphasized that this combination of low valuations and high growth potential is what makes Chinese equities so attractive right now.

"You’re talking about single-digit P/E multiples with double-digit growth. Some of these stocks have 50% cash on the balance sheet."

Here’s a chart showing the forward PE ratio of both the CSI 300 Index and the Hang Seng Index as of September:

Both are trading below their 5-year averages, suggesting there's still room for further expansion in the valuation multiples of Chinese equities.

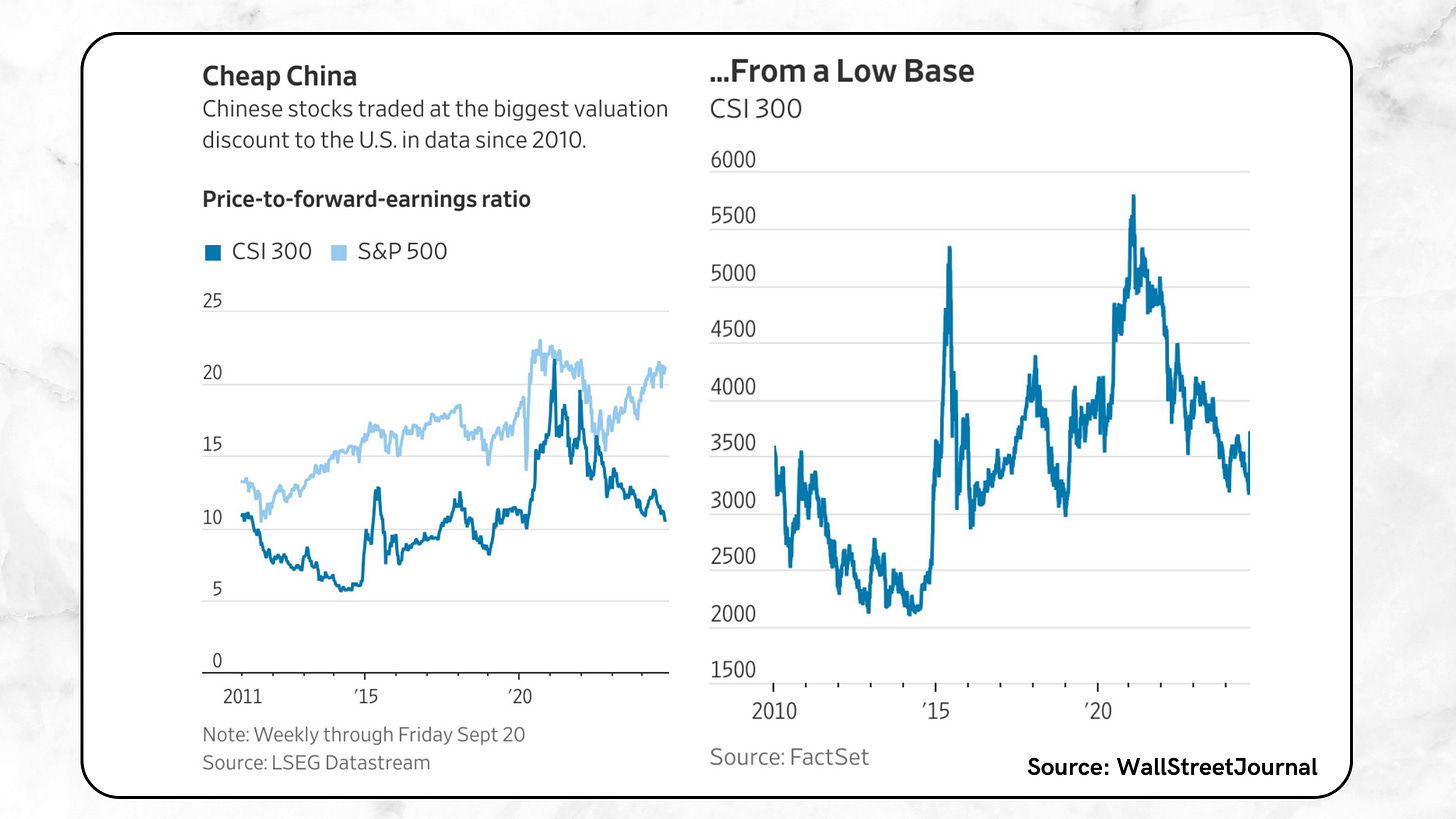

The chart below also shows that Chinese stocks are at least optically significantly cheaper than US stocks.

Now I deliberately wrote “optically” cheaper. Clearly, valuation multiples in isolation don’t mean anything, and whether Chinese stocks really turn out to be cheaper than US stocks at the current price levels remains to be seen (let’s come back in five years and compare the 5-year performance of the S&P vs. the CSI 300).