Deep Dive: Revisiting Novo Nordisk ($NVO)

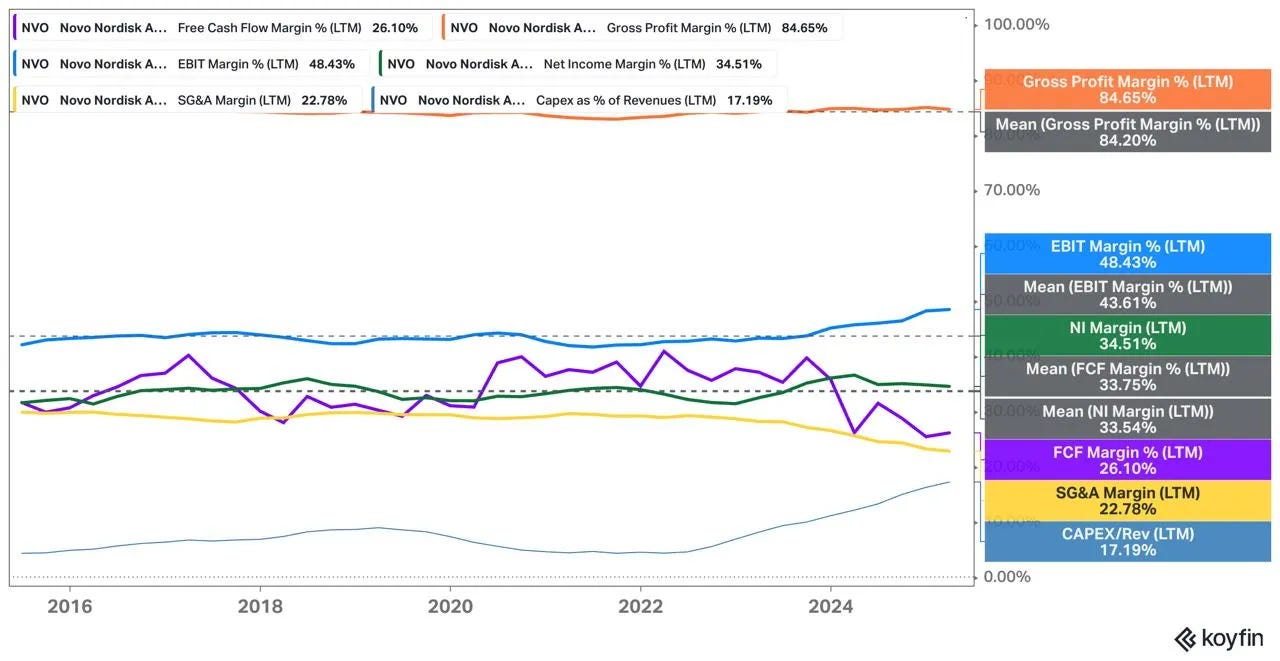

The Case for Novo’s Margins Staying Higher for Longer – Even in a Pricing War

One of the reasons I keep a blog is simple: it forces me to think. Not in the vague, half-formed way we sometimes mull things over in our heads, but in the structured, written, no-place-to-hide kind of way.

Once I put words down, I have to back them up with logic, data, and a coherent framework. That’s true whether I’m going deep on a stock I already own, kicking the tires on a new idea, or jotting down a quicker set of observations to revisit later.

Writing is my way of stress-testing my thinking – and in this case, I want to stress-test one of the market’s prevailing assumptions about Novo Nordisk.

If you’ve followed my recent posts, you’ll know that I’ve spent a fair bit of time looking at Novo from different angles. In my piece Novo Nordisk: 13 Fresh Insights That Might Change How You Think About the Stock, I laid out several reasons why the company’s historically high margins could face pressure over the medium term.

Novo Nordisk: 13 Fresh Insights That Might Change How You Think About the Stock

This post isn’t your usual clean-sliced writeup.

Those included political risks in the U.S., intensifying competition as Novo Nordisk moves from a niche (diabetes) to a mass market with a massive TAM (obesity care), and the potential commoditization risk of oral GLP-1 drugs.

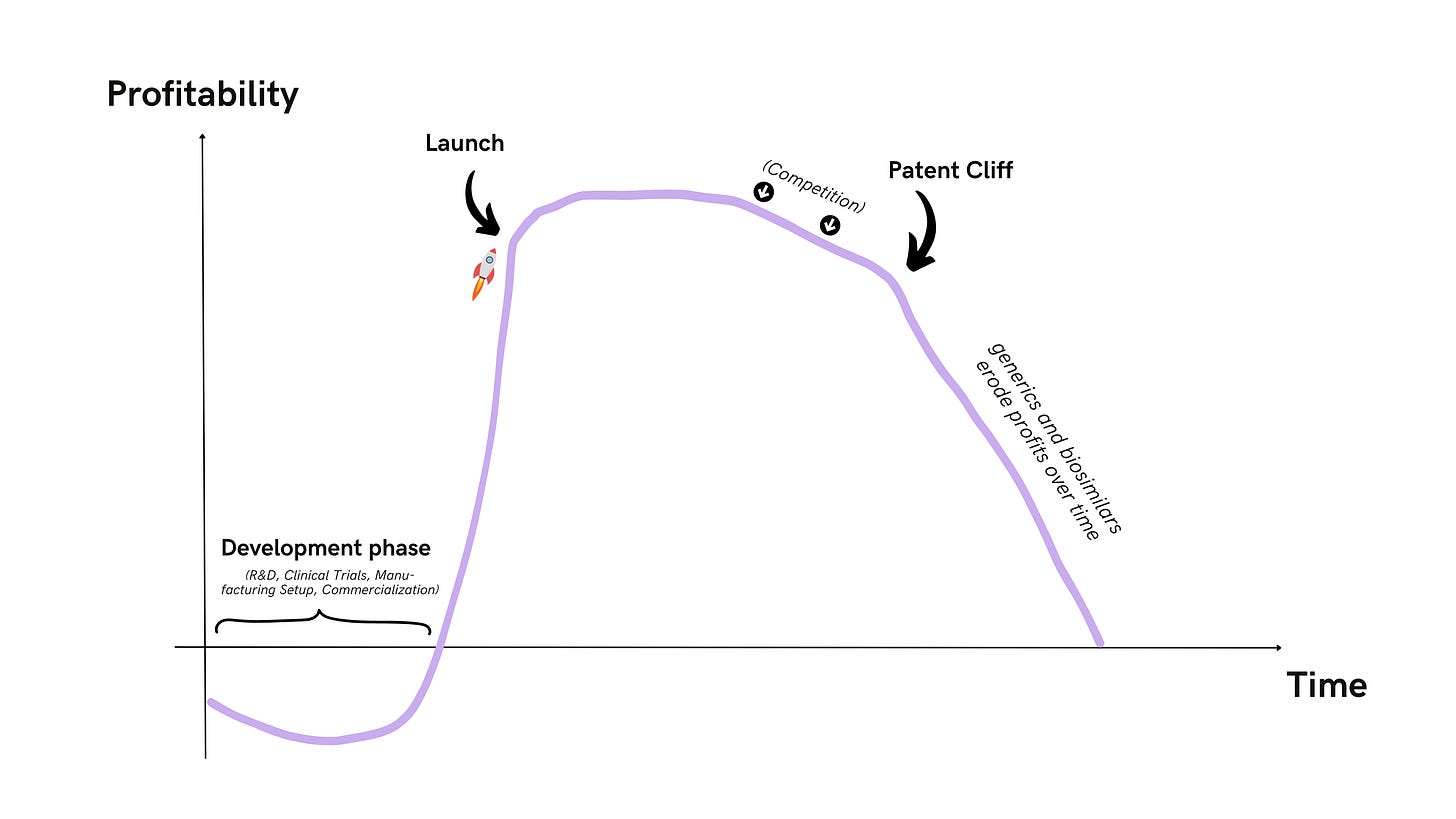

Add to that the usual pharma pricing lifecycle – high initial pricing giving way to gradual erosion as patents expire and competition steps in – and you have a pretty compelling bear case for margin compression.

But here’s the thing: in this post, I’m going to flip the perspective. The bear case is valid, but it’s not the whole story. There’s another set of forces at work, and they push in the opposite direction. Forces that could allow Novo to keep its margins higher for longer than the market seems to give the company credit for.

The interesting part is that both narratives can be true at the same time – it’s the interplay between them that really matters.

So here’s where I’m going with this: I’ll start by briefly revisiting those margin headwinds from my prior analysis – not to rehash them in full, but to make sure we’re clear on the context. Then I’ll explore the less-discussed counterweights: Novo’s operating leverage, the scale dynamics in pharmaceutical R&D and manufacturing, and the strategic ways companies extend the life of their profit pools. We’ll look at how those could offset some of the natural downward drift in margins over time. Finally, I’ll try to bring these threads together into a simple visual framework that helps reconcile the two opposing forces.

By the end, you might not agree with my conclusion. But you should have a clearer view of why the “margins must fall” consensus isn’t as one-sided as it looks at first glance. And if you’re like me, you might start thinking less about whether margins will fall, and more about how quickly – and by how much.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Part 1: Revisiting the Margin Pressure Case

In many ways, this post is a direct response to my earlier piece on Novo – Novo Nordisk: 13 Fresh Insights That Might Change How You Think About the Stock. In that write-up, I argued that the company’s enviable margin profile, which has sat near historical highs, is unlikely to stay there indefinitely. Not because Novo is suddenly becoming sloppy on costs or losing its grip on execution, but because the forces shaping the market are shifting.

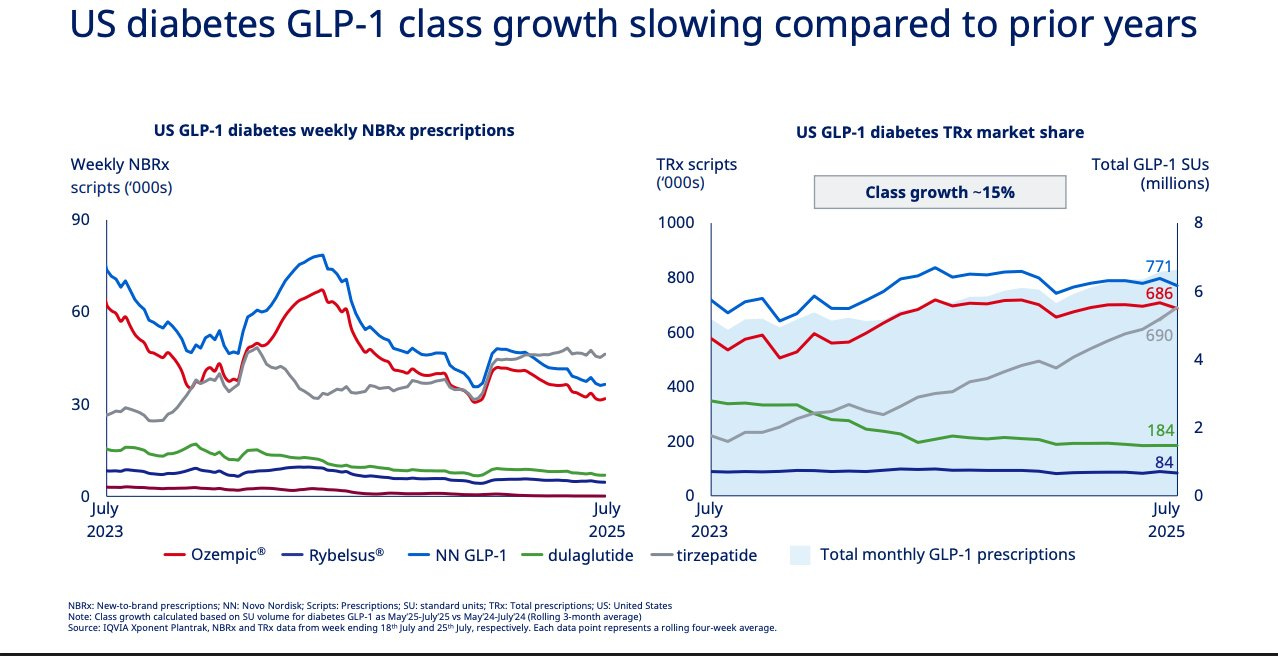

The first is political. With the U.S. being Novo’s most important profit pool, any shift in the pricing environment there has outsized consequences. And if Donald Trump keeps pushing for “fairer drug pricing,” Novo could find itself facing a much less forgiving reimbursement environment. The U.S. has long been the outlier in global pharma pricing, often paying multiples of what other countries pay for the same drug. That gap has been politically sensitive for years, but with Trump back in office and GLP-1s moving into the public spotlight as blockbuster obesity drugs, it’s now front and center. A concerted push to “level the playing field” internationally could compress prices faster than the usual post-patent erosion curve.

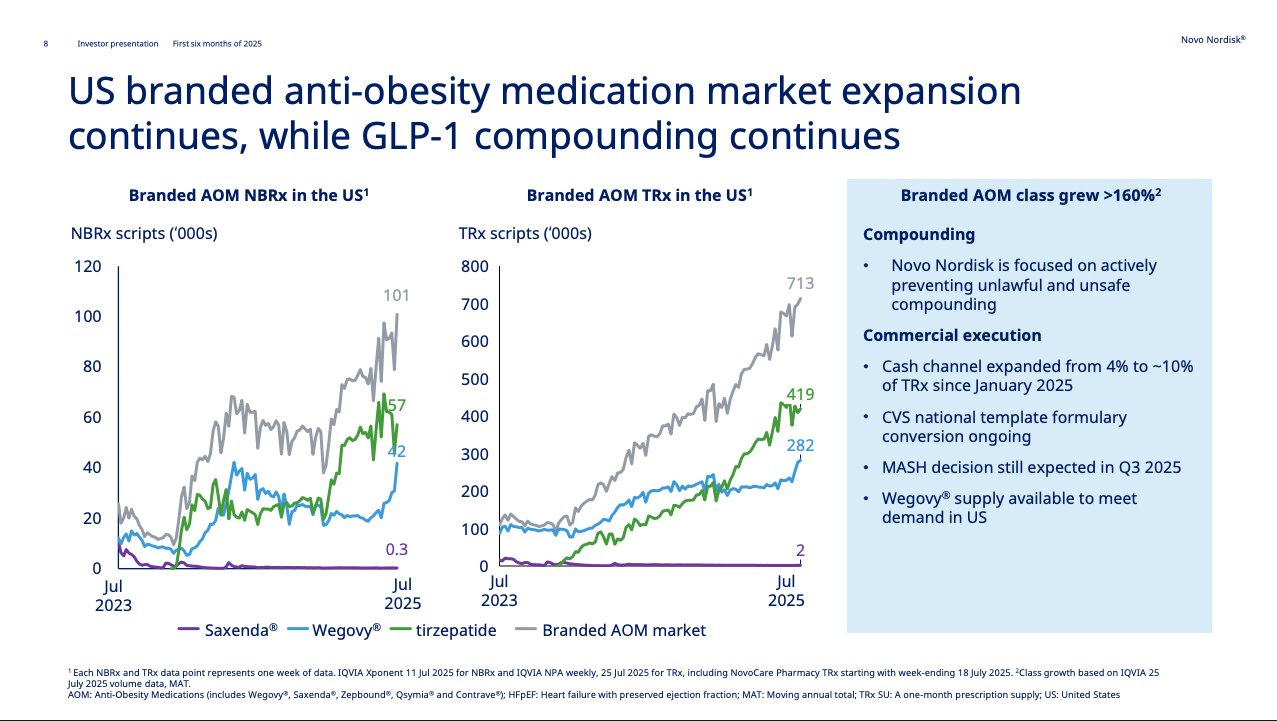

The second is what I’d call the capitalism effect. Diabetes care has always been a decently large market, but it’s historically been much more specialized than obesity care will be. Obesity is a far bigger addressable market – and the bigger the prize, the more aggressively competitors will fight for it and the bigger the target on Novo’s back. Eli Lilly is already making its presence felt, and the entry of other big pharma names is all but inevitable.

As more players jostle for share, payors will have the leverage to demand higher rebates and deeper discounts. You can already see this dynamic playing out in Novo’s recent U.S. pricing moves. The company launched NovoCare Pharmacy, a direct-to-consumer platform offering Wegovy for $499 a month to cash-paying patients – a steep cut from the list price of $1,349. Management has also warned of a “deeper erosion” in the U.S. market in the second half of 2025, driven by more aggressive rebates to insurers. That’s not the language of a company in full control of pricing; it’s the language of a company preparing for a fight.

The third is a more subtle, long-term risk – the seemingly inevitable form factor shift. Today, most GLP-1s are injectables. Wegovy, Ozempic, Mounjaro – they all require a weekly subcutaneous injection. For many patients, that’s a barrier. Pills are simpler. More convenient. They feel less medical, more lifestyle-friendly. And that’s exactly why they could also erode pricing power over time. Injectables carry more complexity – cold chain logistics, specialized fill-finish processes, patient onboarding – all of which raise barriers to entry. Pills, if they can be made to work with acceptable bioavailability, strip away some of those barriers. That opens the door to more competition, including from international generics manufacturers. It’s not a given – oral GLP-1s are still technically challenging to produce (proven by Eli Lilly's oral obesity treatment efficacy recently falling short of expectations) – but the potential long-term commoditization effect is real.

Layer on the natural price decay that happens across the industry as patents age, and the picture becomes even more challenging. In Novo’s case, semaglutide’s key patent expires in late 2031. The company will try to extend exclusivity where possible – through delivery mechanism patents or other lifecycle management strategies – but the clock is ticking. Even before legal generics arrive, the shadow market is already here. Compounded semaglutide, much of it low-cost and of questionable quality, has been spreading rapidly in the U.S., undercutting Novo’s pricing power. And when the patent cliff finally hits, payors will push hard for much lower prices.

None of this is speculative. You can already see Novo shifting its playbook. The incoming CEO has made cost control a priority and hasn’t shied away from warning about potential layoffs – a clear signal that the company is bracing for a margin squeeze. The near-50% operating margins of recent years look increasingly like a high-water mark, not a new normal.

So, if you stop the analysis here, the conclusion is obvious: Novo’s margins have nowhere to go but down. But that’s only one side of the story. The other side – and the focus of the rest of this post – is that Novo also has structural advantages that could allow it to defend profitability far better than the market is giving it credit for. Those advantages don’t eliminate the risks, but they could materially slow the rate of margin erosion.

Want the full experience?

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.