Deep Dive: Revisiting Novo Nordisk ($NVO)

13 Fresh Insights That Might Change How You Think About the Stock

This post isn’t your usual clean-sliced writeup.

Instead, what you’ll find below is a series of insights, mental models, quotes, data points, and perspectives – 13 in total – I’ve collected while digging deeper into Novo Nordisk over the past few weeks. Think of it as an intellectual scrapbook – organized, but intentionally non-linear. I didn’t sit down to write a full investment thesis – I’ve done that a few weeks ago (see freely available deep dive below):

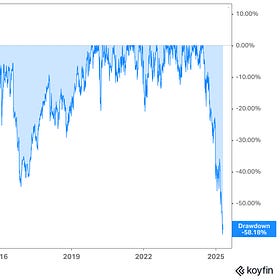

Novo Nordisk’s -58% Stock Crash: A Generational Buying Opportunity?

Novo Nordisk has long stood out among global healthcare companies, particularly in the diabetes care market. From groundbreaking treatments to a robust pipeline of new therapies, the company has been a magnet for investor attention.

But as I started connecting the dots, I realized there’s real value in the fragments themselves.

Some of these insights helped me reframe how I think about Novo’s competitive position. Others surfaced hidden risks or underappreciated tailwinds. And a few just gave me a deeper appreciation for how complex, messy, dnymic, and strategic this new era of GLP-1s really is.

My goal here isn’t to be exhaustive – it’s to be thought-provoking.

If you’ve followed Novo’s story from the sidelines (like I did), or even if you hold the stock, I suspect at least a few of these angles will shift how you think about the company. And if you’re still trying to understand how to value a business that could be reshaping not just pharma but potentially the healthcare system itself, you may find this especially useful.

Here’s what I’ll cover:

A look at the strange paradox of scale: why tapping into the billion-person obesity market might actually erode, not expand, Novo’s margins – and how pricing, access, and payer behavior could become major headwinds.

A mental model borrowed from Tiho Brkan that breaks down how drugs win or lose in this space.

Insight into the real gatekeepers: is it the patients or the doctors or the payers? As public systems and insurers start facing the full cost curve of widespread GLP-1 adoption, the definition of "demand" is going to change.

A reminder that this is a platform story, not just a product story. We explore how GLP-1s may only be the beginning of a broader wave of hormonal/metabolic therapies that Novo and its competitors will build into.

The uncomfortable truth about Novo’s margins: they’re heavily reliant on high U.S. pricing – $1,000+ per month vs. much less in Europe and the RoW. That kind of pricing asymmetry is rarely sustainable in the long run.

Amid all the obesity hype, we shouldn’t lose sight of diabetes. That’s still Novo’s bedrock business – and how it handles this transition will affect its financial foundation for years to come.

A deeper take on injectables: while they’ve given Novo an early lead, they might turn into a liability once more convenient oral formulations hit the market.

The U.S. commercial operation is no longer flawless. Recent earnings revealed cracks: legal fights with compounders, underwhelming direct-to-consumer performance, and execution gaps versus Eli Lilly.

What management is really saying in earnings calls – especially the new CEO. The tone has shifted from dominance to damage control, and it’s worth parsing the shift in language.

An overlooked angle in the GLP-1 narrative: what’s coming next, scientifically. We summarize recent research into oral agonists, dual- and triple-acting drugs, and safety trade-offs that rarely make headlines.

A trio of charts on valuation: EV/EBIT, FCF yield, and PEG. Novo may finally be looking fairly priced relative to peers, with some upside if execution rebounds. Charts and commentary included.

Finally, a high-level comparison of Novo and Eli Lilly. Lilly is winning in surprising ways. Is Novo behind the curve?

Some of these ideas are contrarian, some are confirmatory, but all of them aim to cut a little closer to the truth.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Insight #1 – Innovation Is the Lifeline: Why Novo’s Pipeline Is More Than Just Optionality

If you follow Novo Nordisk long enough, one truth becomes obvious: this is not a company that bets the farm on any single molecule. It’s a company that builds franchises (most fail and some become long-term value enhancers) – and that kind of long-term value creation only works if you keep innovating faster than your competition and faster than the margin compression catches up.

That’s why innovation isn’t just a competitive edge for Novo. It’s a lifeline.

Yes, GLP-1s like Ozempic and Wegovy are driving the current financial engine. But every investor in this space should keep 2031 and 2032 circled in their mental calendar – because that’s when (December 2031) key U.S. patents on semaglutide are set to expire.

That means biosimilars are coming, and with them, a classic pharma problem: the margin cliff.

But here’s the thing. That cliff is not fatal – if you have the right pipeline.

And Novo does.

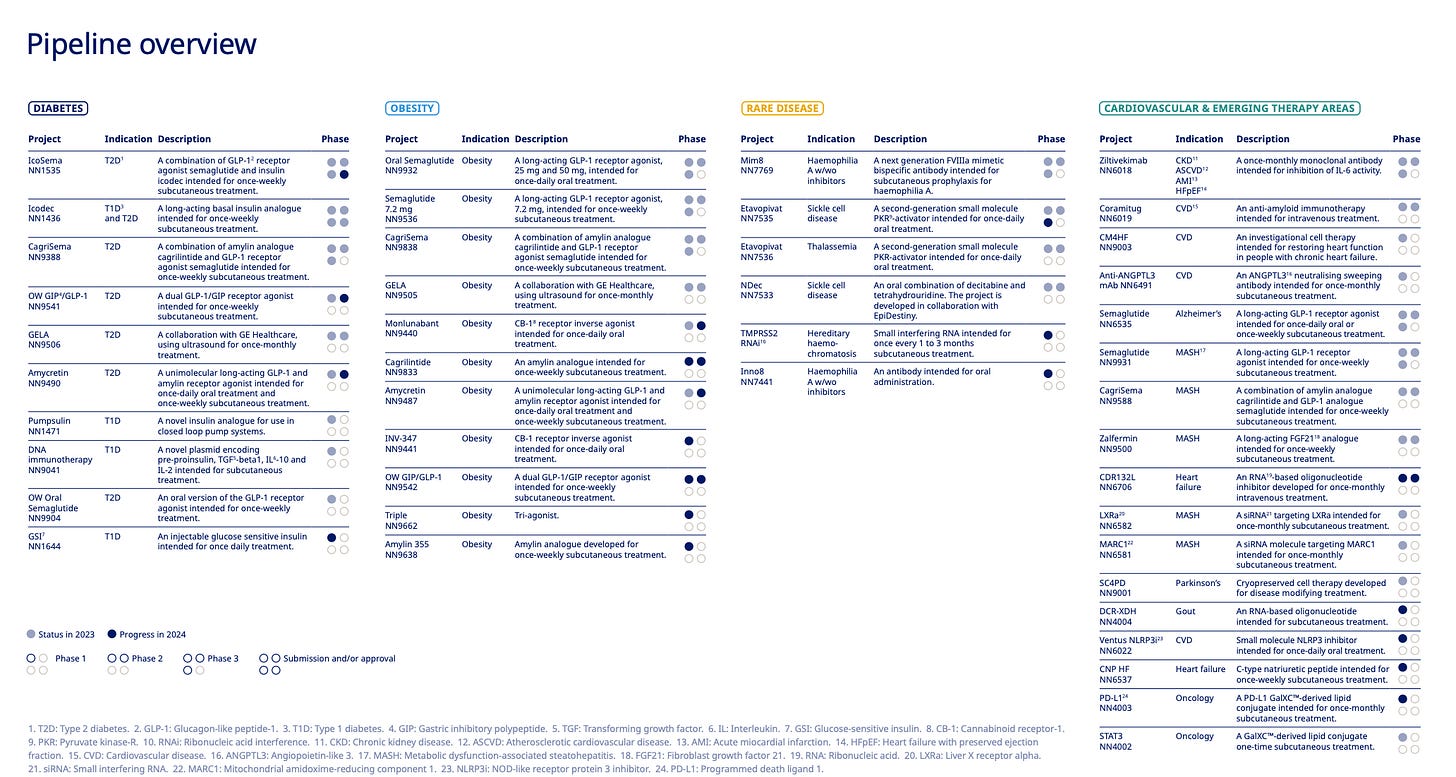

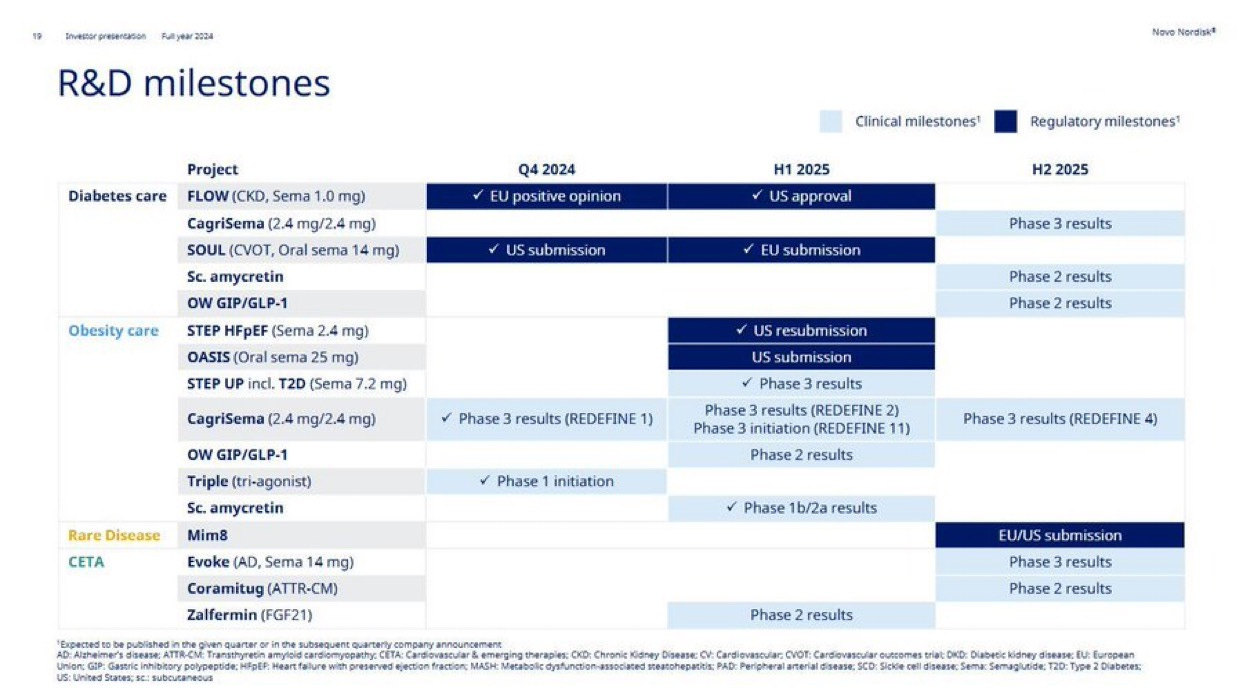

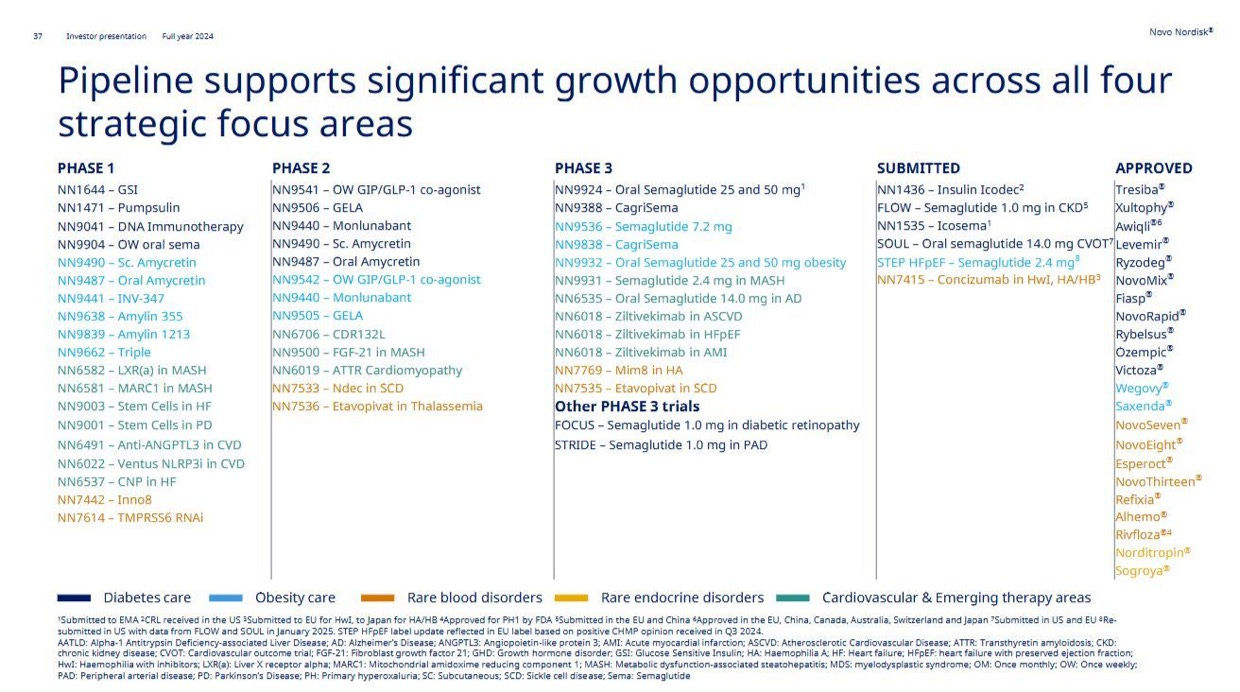

Just take a look at the company’s updated R&D milestones: more than 30 active clinical-stage assets, with deep programs across diabetes, obesity, cardiovascular disease, and rare conditions. But most of the near- and mid-term excitement centers around one name: amycretin.

Amycretin could be Novo’s next crown jewel. It’s a unimolecular agonist targeting both the GLP-1 receptor and the amylin receptor – and in Phase 2 trials, it delivered 22.0% weight loss over 36 weeks. To put that into perspective: Lilly’s much-hyped retatrutide showed 19% in a similar time frame, and Novo’s own CagriSema hit 22.7% – but over a far longer 68-week period.

It’s about next-generation positioning. Amycretin, if successful, gives Novo a fresh patent runway, an efficacy step-up, and a way to defend premium pricing in the face of generic encroachment. The timing could work out beautifully: as the semaglutide margins begin to erode in the early 2030s, amycretin (and possibly the GIP/GLP-1 triple agonist further back in the pipeline) could be picking up commercial steam.

Of course, there’s risk. Amycretin still has to survive Phases 3 and regulatory review. And superior weight loss alone won’t be enough – safety, tolerability, and real-world adherence will matter. But from what we know so far, this asset has blockbuster potential.

Zooming out, the rest of the pipeline is no slouch either. CagriSema continues to progress through REDEFINE trials, oral GLP-1s are inching closer to broader indications, and combination therapies – including those targeting cardiovascular endpoints – suggest that Novo is trying to build not just weight loss drugs, but (cardio)metabolic disease platforms.

This strategy helps Novo in two ways.

First, it may preserve margin structure by ensuring that the next innovation is always priced higher than the last. Even if semaglutide eventually becomes commoditized (and it will), the company won’t be stuck selling $20 generics. It will be selling the new “gold standard” – again.

Second, it reduces Novo’s reliance on U.S. pricing. A diversified, refreshed pipeline gives the company leverage in payer negotiations, especially in markets like Europe where authorities are more likely to reimburse new, differentiated therapies at acceptable prices.

Let’s not forget: Novo still earns money on insulins, even though they’ve been commoditized for years. It’s not margin profile alone that sustains a franchise. It’s operational discipline (what Novo is doing isn’t that easily replicated), thoughtful sequencing, and a willingness to disrupt your own cash cows before someone else does.

Insight #2 – The Five-Factor Mental Model: What Really Drives a Drug’s Success?

When I spoke with Tiho Brkan about Novo, he shared a framework that really stuck with me. It’s a simple five-factor lens to think about how any new therapy will do in the market. Not just will it work, but will it win?

Here’s the model:

Efficacy

Safety/Risk

Tolerance

Convenience

Pricing

Let’s walk through each of these – and then I’ll loop back to why I think Novo is still in a great position despite looming competition.

1. Efficacy: What Happens, and How Fast?

At the top of the hierarchy is efficacy – not just does it work, but how well and how fast. In the GLP-1 space, weight loss is the headline number, and everyone watches it like a hawk. But speed matters too. Patients and prescribers tend to favor drugs that show results quickly, even if the final endpoint is similar. There's also a stickiness factor: does the weight stay off without rebound after stopping?

In clinical trials, Eli Lilly's Zepbound (tirzepatide) has shown superior weight loss results compared to Novo Nordisk's Wegovy (semaglutide). Zepbound users achieved an average of 20.2% weight loss, while Wegovy users achieved 13.7% after 72 weeks in a head-to-head study. Lilly's drug also demonstrated a greater percentage of patients achieving significant weight loss milestones, such as 15% or more, according to PMLiVE.

But as outlined, with future drugs the status quo may change.

2. Safety/Risk: What Could Go Wrong?

The second lever is safety – especially in chronic conditions where patients may be on treatment for years. This isn’t just about black-box warnings. It’s about long-term tolerability, off-target effects, and second-order consequences. As more patients take GLP-1s, regulators and physicians are paying closer attention to subtle risks: muscle mass loss, nutritional deficiencies, potential cardiovascular events in off-label populations.

It’s too early to say which next-gen therapies will win this category, but any drug with major tolerability flags or safety overhangs – even if rare – will have a harder time crossing the adoption chasm.

3. Tolerance: Can Patients Actually Stay on the Drug?

Related to safety, but distinct, is tolerance. This is where GLP-1s have faced friction. The gut issues – nausea, vomiting, diarrhea – can be a deal-breaker. If 30–40% of patients discontinue due to side effects, that’s a major cap on commercial upside. Even a modest improvement in side-effect profile can be a competitive advantage.

This is where newer molecules like Amycretin may shine. In Phase 2, it showed strong weight loss without worse side effects compared to semaglutide. That balance matters – a drug can be highly effective but still lose market share if people can’t stay on it.

4. Convenience: Injection vs. Oral, Frequency, Friction

The GLP-1 space is mostly injectable right now, but oral formulations are coming. Novo’s own oral semaglutide is part of the pipeline, as are assets from Pfizer and others. Convenience matters more than people often admit – weekly dosing is better than daily, oral is better than injection, and frictionless access beats specialty pharmacy hurdles.

But convenience doesn’t exist in a vacuum. It’s almost always traded off against efficacy. If the oral version doesn’t deliver the same results, many patients (and doctors) will still go with the needle. If efficacy is equal? Oral wins, hands down.

5. Pricing: Who Pays, and How Much?

And finally: price. This one’s obvious – or so it seems. Lower price equals higher access. But it’s more nuanced. In the U.S., formulary access, PBM negotiations, co-pay assistance programs, and insurance tiering all distort the equation. In Europe and other public healthcare systems, price is directly negotiated – and must be justified with outcomes.

One important note here: pricing and positioning are strategic tools, not just commercial consequences. Companies often choose to price high initially to establish premium positioning, then drop price selectively to expand access once manufacturing scales.

Put all five factors together, and you get a framework for competitive edge – not just for Novo, but for any company playing in this space. Amycretin, for instance, looks compelling not just because it beats retatrutide on weight loss, but because it scores well across all five categories: strong efficacy, acceptable safety, solid tolerance, once-weekly dosing, and the potential for premium pricing (at least early in the lifecycle).

More importantly, this mental model also shows how no single factor is enough. A drug can have world-class efficacy and still fail if it’s poorly tolerated or prohibitively expensive. Orals can look sleek on paper but fall short if outcomes disappoint. Pricing wars can force access but wipe out margins.

For investors, this lens is a way to avoid getting swept up in single-metric enthusiasm. It forces you to ask: what’s the total package? And who can actually deliver it at scale?

Novo might not win on every factor for every drug. But it’s currently one of the only players positioned to run the full playbook – and refresh it again in five years when the next set of assets come through.

Insight #3: What Stood Out (To Me) In the Recent Conference Call

Want the full experience? Unlock the remaining 13 (!) insights

Members get deep-dive posts, portfolio updates, and investing frameworks that help you think clearly under uncertainty.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

Choose your level of commitment and unlock your next edge.