Deep Dive: Novo Nordisk ($NVO)

Novo Nordisk’s -58% Stock Crash: A Bet on the Future of Healthcare at a Reasonable Price?

Novo Nordisk has long stood out among global healthcare companies, particularly in the diabetes care market. From groundbreaking treatments to a robust pipeline of new therapies, the company has been a magnet for investor attention.

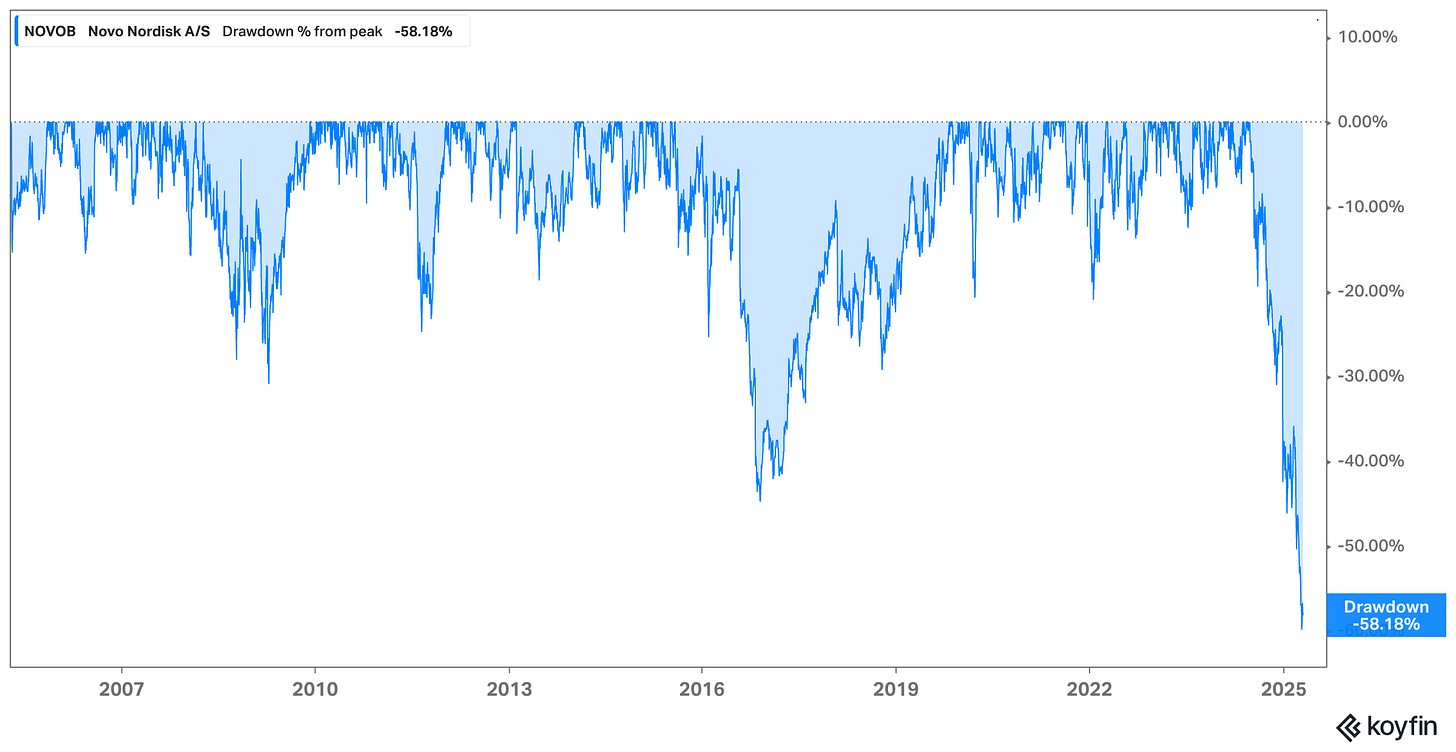

Yet, more recently, the stock of Novo Nordisk has been struggling, facing its biggest drawdown in its history as a public company.

Understanding whether Novo Nordisk is a solid long-term investment goes far beyond simply recognizing it as a leader in diabetes.

In this blog post, we’ll explore how Novo Nordisk operates at its core, where its true competitive advantages lie, how its leadership steers the ship, what the numbers say about its valuation, and, of course, the risks any savvy investor should keep in mind.

What Does Novo Nordisk Actually Do? Inside the Global Healthcare Giant

When you think of companies shaping the future of healthcare, Novo Nordisk deserves a front-row seat. This Danish pharmaceutical giant has carved out a dominant niche in diabetes and obesity care, with blockbuster drugs like Ozempic and Wegovy fueling explosive growth.

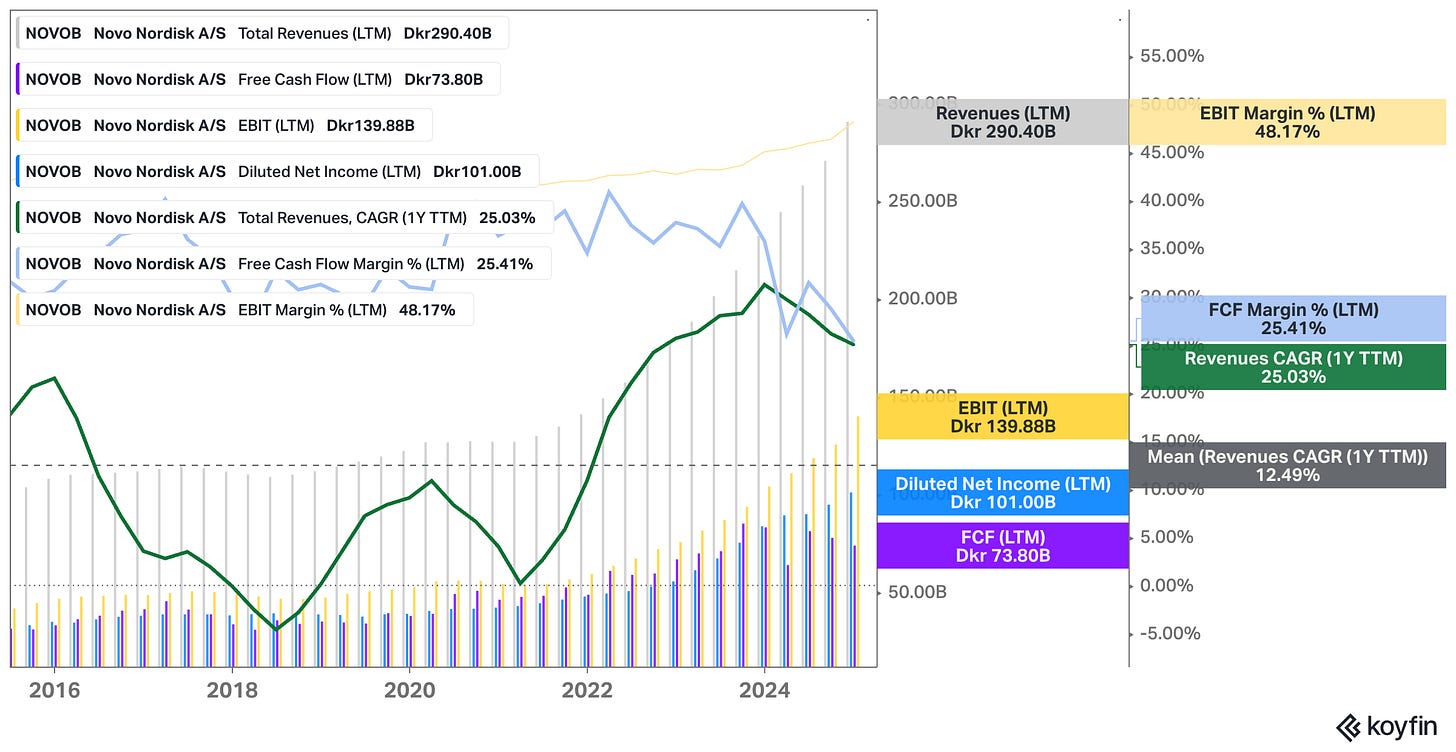

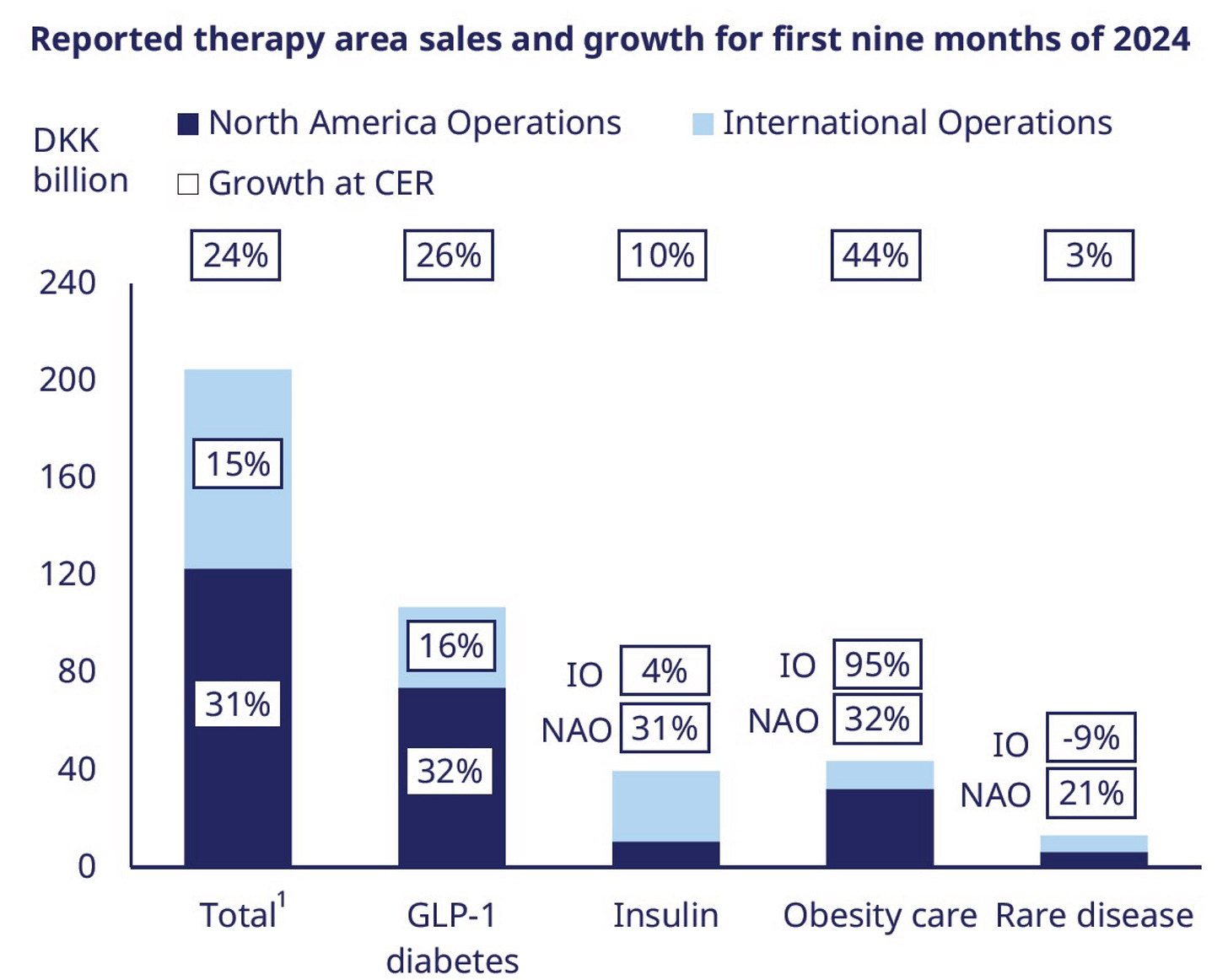

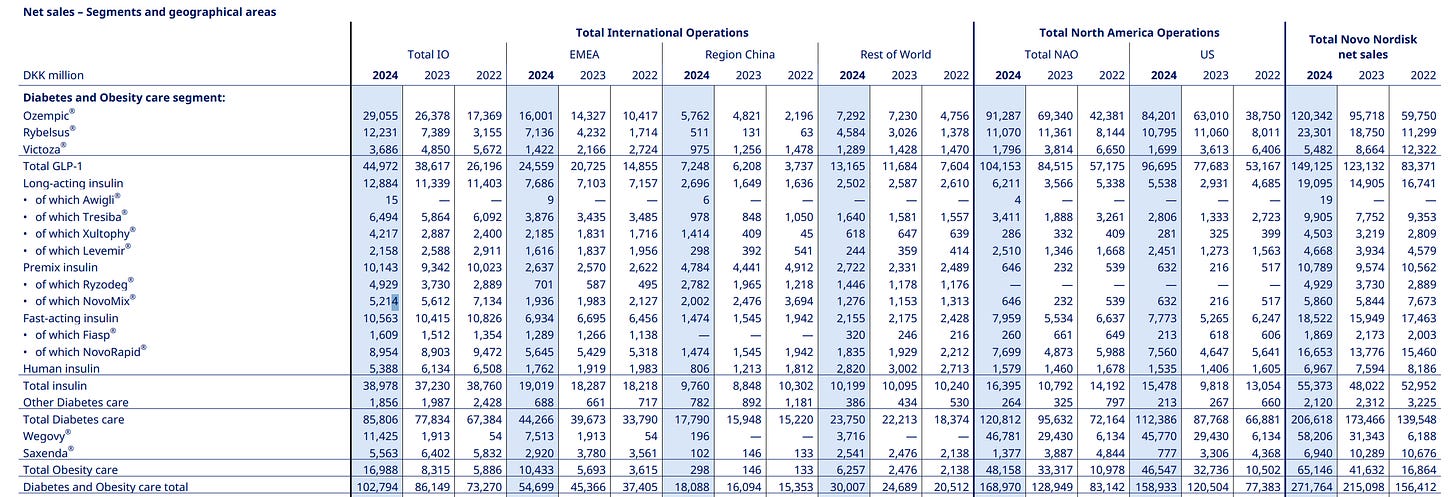

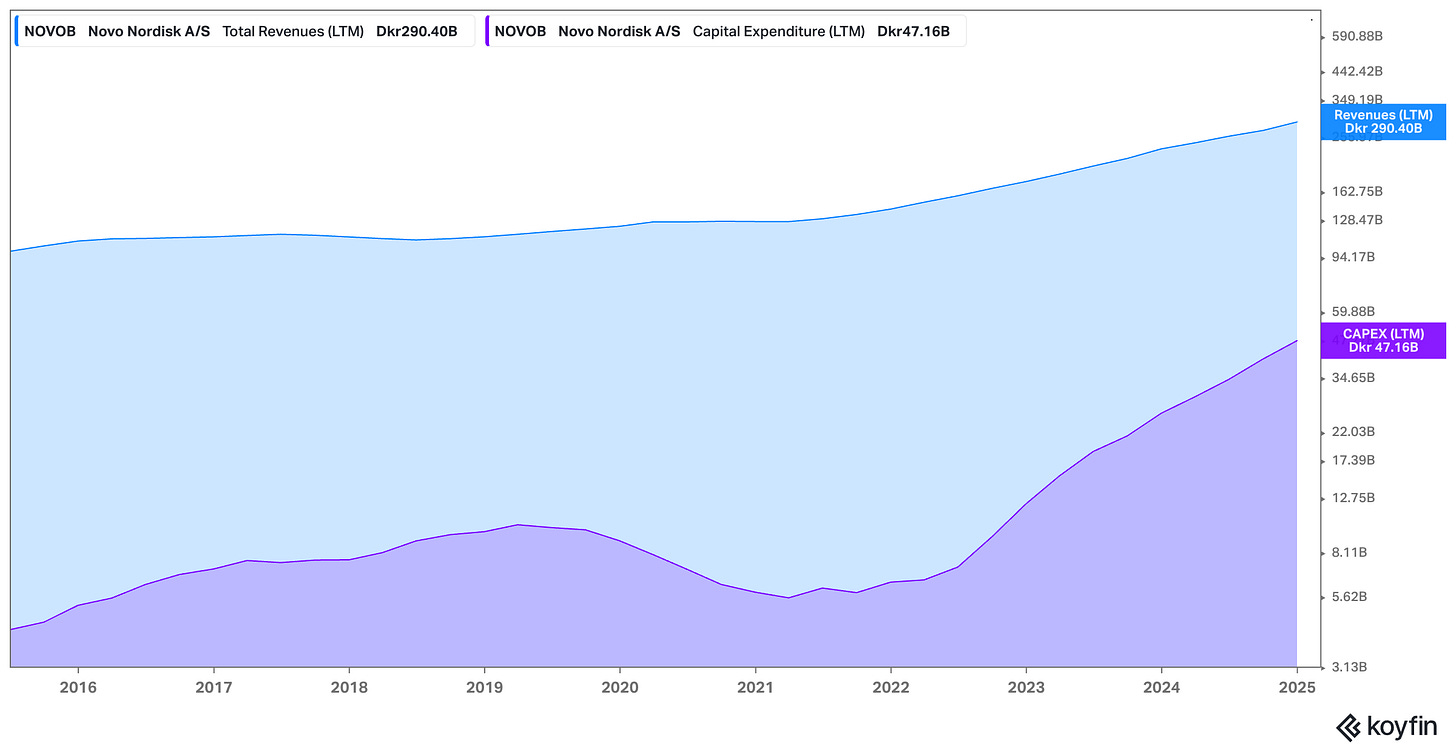

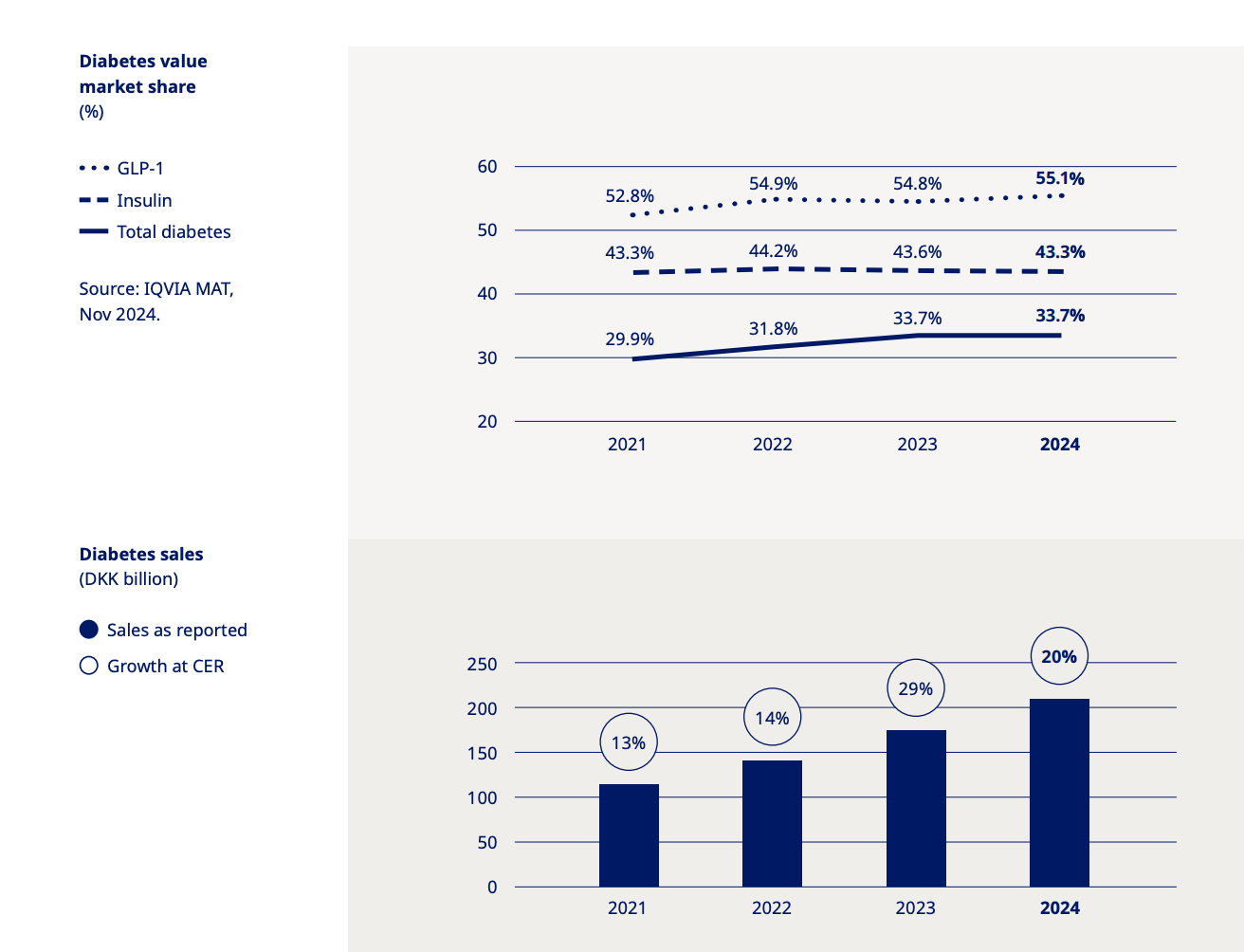

In 2024, the company reported a jaw-dropping 22% sales increase to DKK 290.4 billion (~$41 billion), with operating profits hitting DKK 140 billion (~$18 billion).

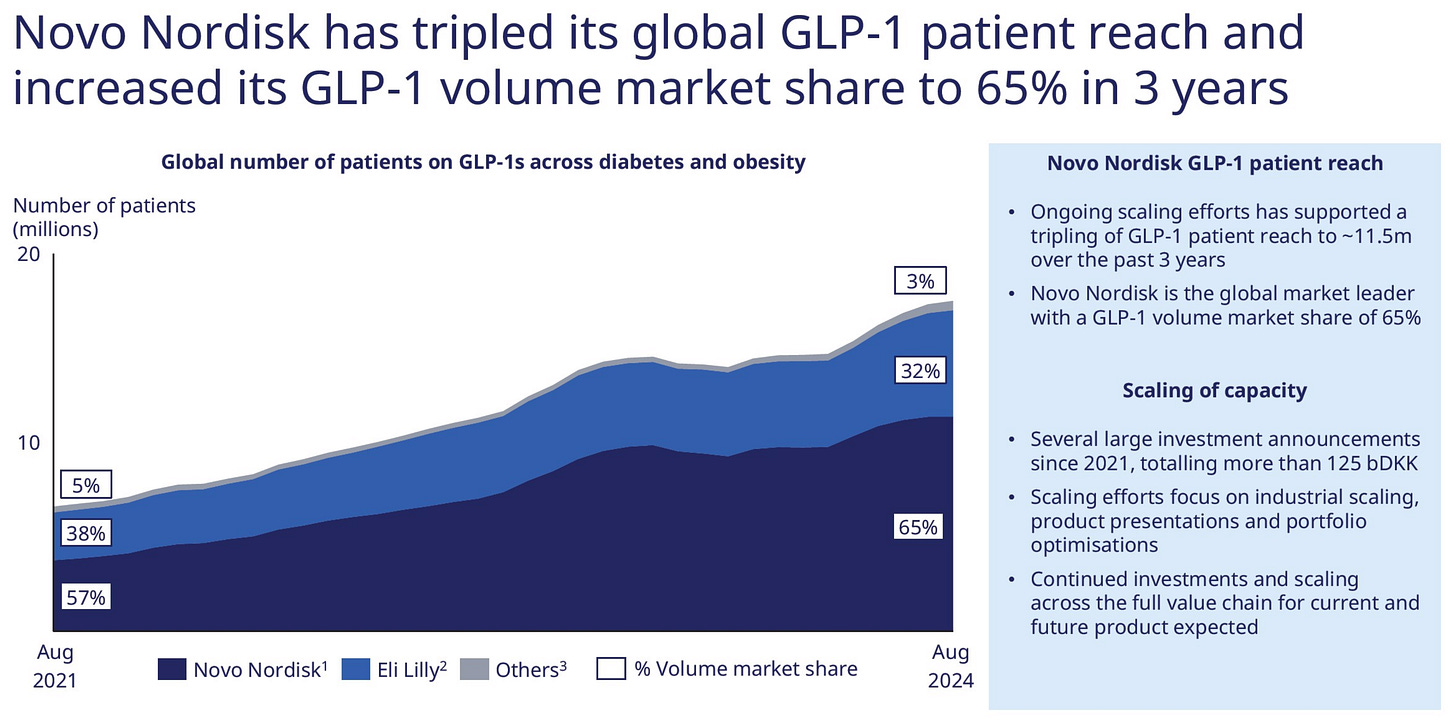

Its global diabetes market share now stands at one-third, and its GLP-1 franchise—led by the revolutionary semaglutide—commands roughly two-thirds of the worldwide GLP-1 market.

(Source: Novo Nordisk Q3 Presentation)

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.”

What Makes Novo Nordisk’s Engine Roar?

A Portfolio That Redefines Chronic Care

At its core, Novo Nordisk is a specialist in metabolic diseases, with a laser focus on diabetes and obesity treatments. Its product lineup is a masterclass in innovation, anchored by insulin analogues and GLP-1 receptor agonists.

Household names like Ozempic (a weekly injectable for type-2 diabetes), Rybelsus (the first oral semaglutide), and Wegovy (a higher-dose semaglutide for obesity) have redefined their categories. Semaglutide, the star molecule, delivers unmatched blood sugar control and weight loss—Wegovy’s clinical trials showed an astonishing ~15% body weight reduction, setting a new benchmark for obesity care. These drugs aren’t just effective; they’re convenient, with options like once-weekly injections or daily pills that make adherence easier for patients.

(Source: Novo Nordisk Q3 Presentation)

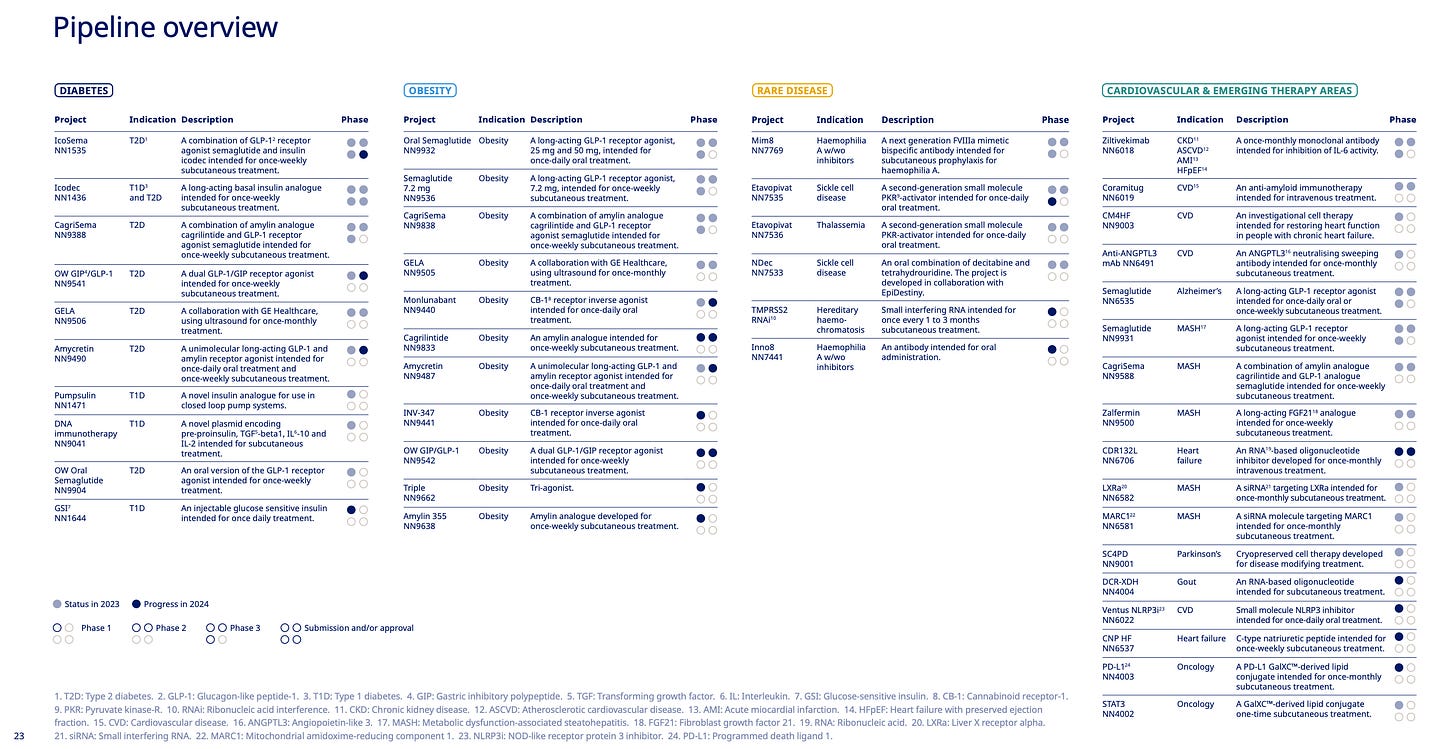

Beyond its current heavyweights, Novo Nordisk’s pipeline is brimming with promise. Candidates like CagriSema (combining semaglutide with cagrilintide for even greater weight loss), once-weekly insulin icodec, and amycretin (an oral GLP-1/amylin co-agonist) highlight a relentless innovation culture.

“In obesity, we completed the first phase 3 trial of CagriSema, currently in development for the treatment of obesity or overweight and type 2 diabetes. After 68 weeks, if all people adhered to treatment, CagriSema demonstrated a statistically significant weight loss of 22.7% vs 2.3% with placebo alone. This is among the highest weight reductions yet seen in a phase 3a programme for a GLP-1 combination therapy. We intend to further explore the weight loss potential of CagriSema in an additional study.“

The company is also exploring triple-agonist therapies targeting GLP-1, GIP, and glucagon receptors, ensuring it stays ahead of the curve.

While diabetes and obesity are the core focus, Novo also maintains smaller franchises in rare bleeding disorders (like NovoSeven for hemophilia) and growth hormone therapy, though these play supporting roles.

The result is a focused, high-impact portfolio that sets the gold standard in efficacy, commands premium pricing, and drives blockbuster sales—Ozempic and Wegovy alone raked in DKK 120 billion (~$17 billion) and DKK 58 billion (~$8 billion) in 2024.

A Business Built for Resilience and Scale

Novo Nordisk’s business model is a textbook example of how to thrive in pharmaceuticals. It develops, manufactures, and markets proprietary drugs for chronic conditions, creating a steady stream of recurring revenue. Patients with diabetes or obesity often stay on these therapies for years, if not decades, ensuring predictable demand.

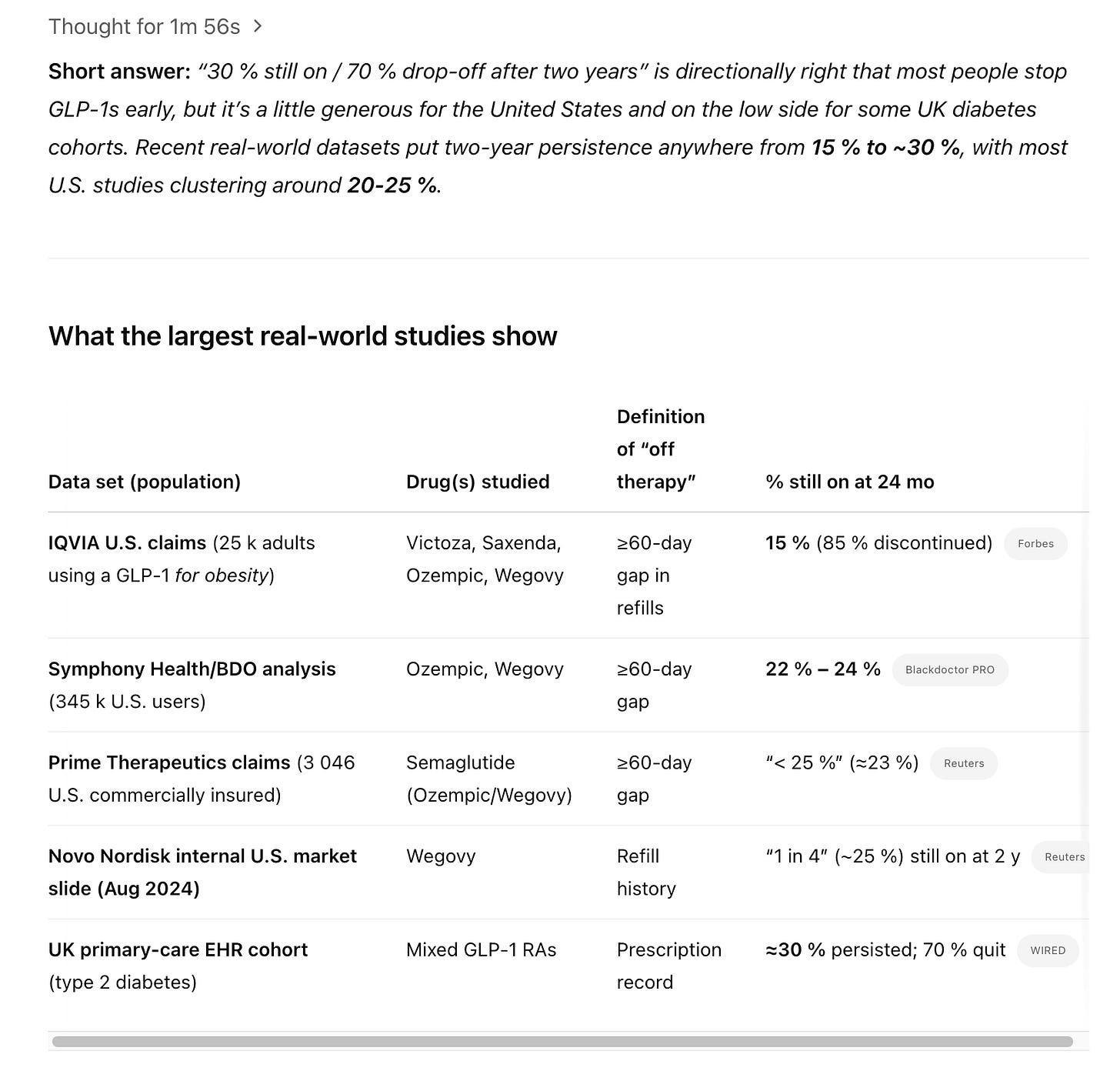

On the other hand, it's also worth noting that a surprisingly high percentage of patients don't stay on GLP-1 medication for several years (see findings below).

The company sells through wholesalers, hospitals, and government tenders, while programs like NovoCare enhance affordability for patients, particularly for high-cost drugs like Wegovy.

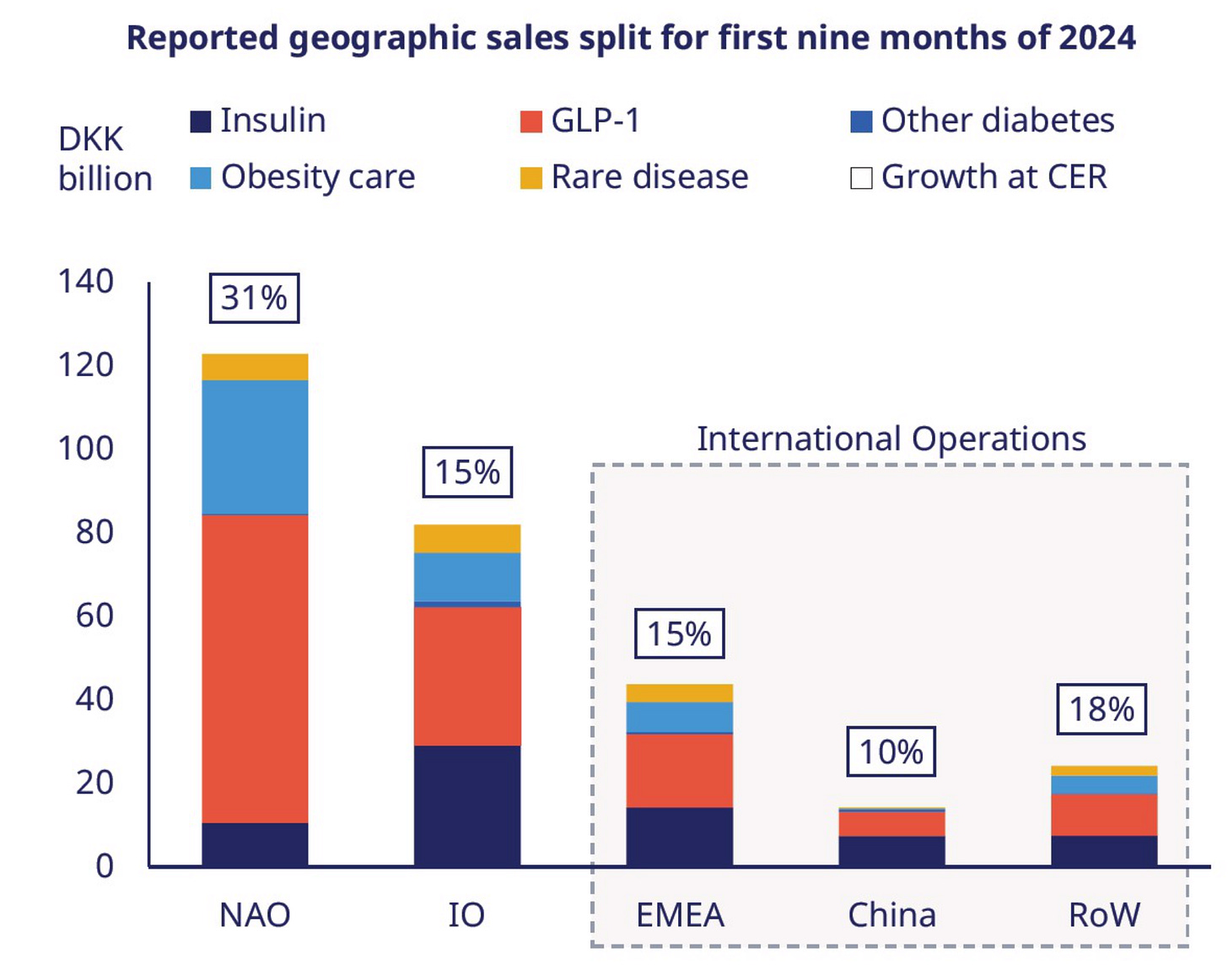

Geographically, Novo is a global player, operating in over 170 countries. The U.S. is its largest market, accounting for over half of sales, but Europe, China, and other regions provide valuable diversification, with strong double-digit growth across the board in 2023.

(Source: Novo Nordisk Q3 Presentation)

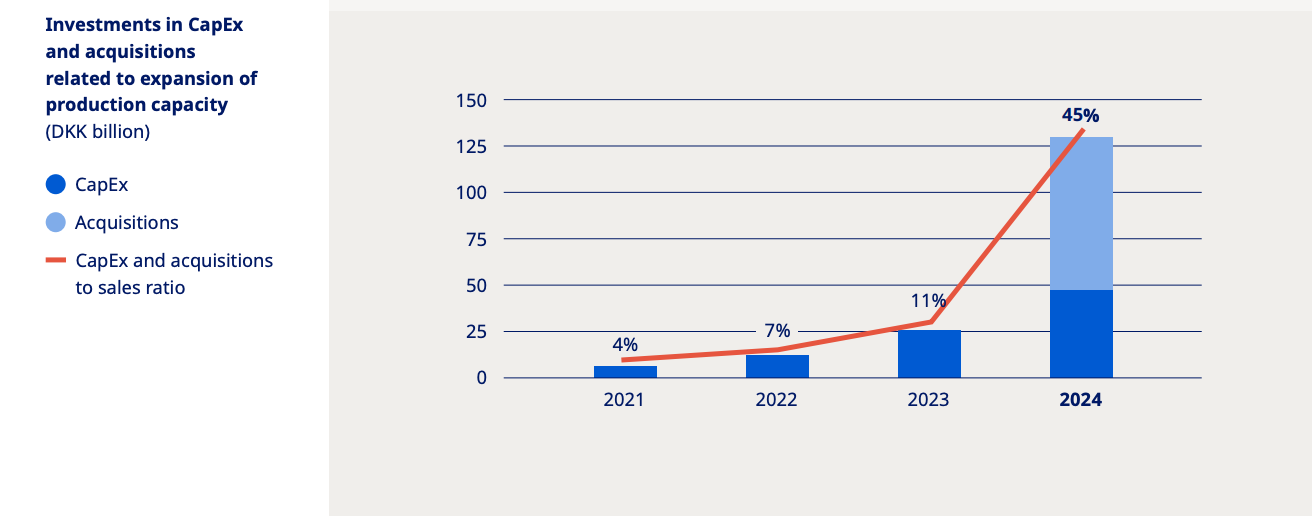

What sets Novo apart operationally is its vertically integrated value chain. It handles everything in-house, from R&D (spending ~$3–4 billion annually) to manufacturing at plants across nine countries. In 2024, the company went through a massive CapEx cycle and poured DKK 47 billion into capital expenditures to expand production capacity, addressing supply bottlenecks for Ozempic and Wegovy while preparing for future demand.

This manufacturing prowess is a key strength—analysts call it a “moat” because producing complex biologics like semaglutide at scale is a feat few rivals can match.

The business is also remarkably non-cyclical. Diabetes and obesity don’t take a break during economic downturns, making Novo’s revenue streams resilient.

However, the pharma game isn’t without challenges. Patent cliffs loom large, with drugs typically enjoying 10–12 years of exclusivity before generics or biosimilars enter. Novo counters this by constantly innovating, rolling out improved formulations like Ozempic to replace older drugs like Victoza, effectively resetting the patent clock.

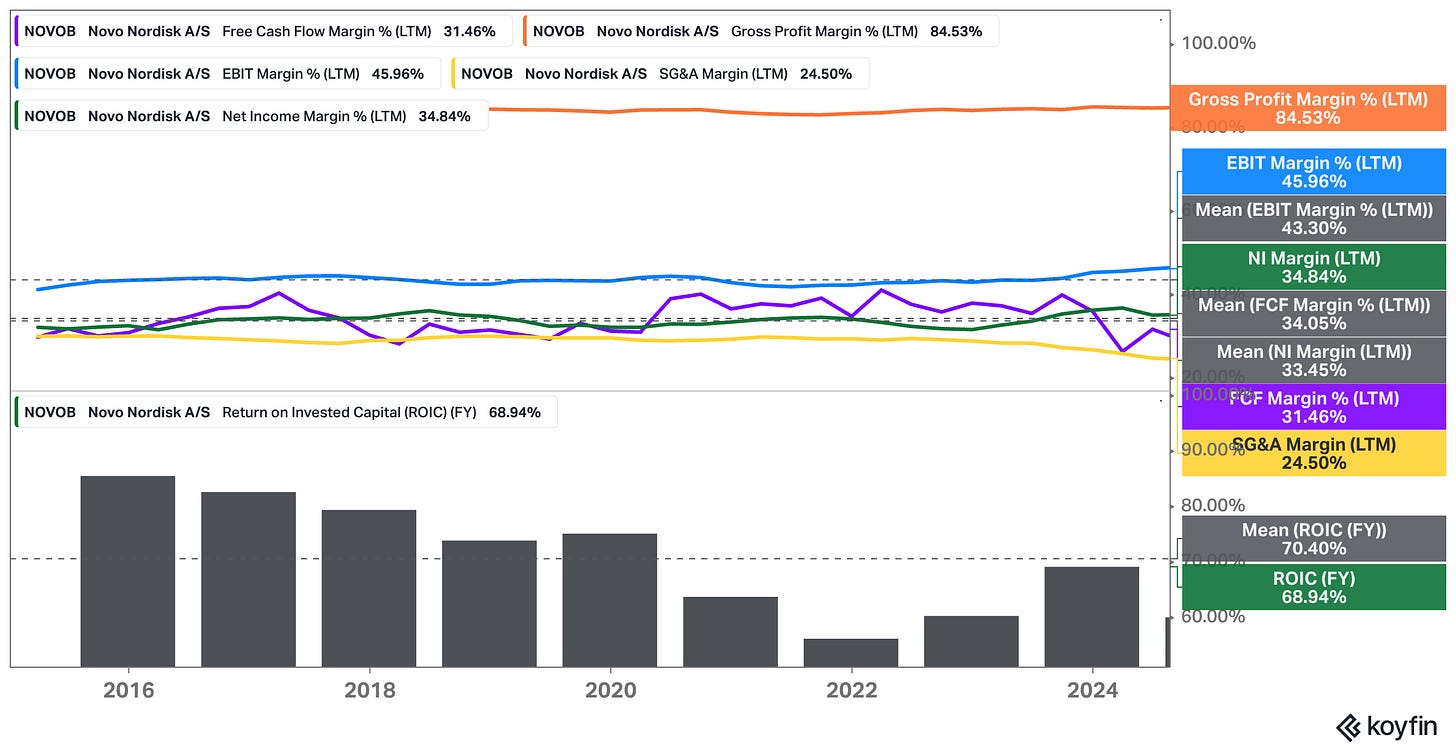

Financially, the model shines with gross margins around 85%—the cost of producing a dose is low compared to its price—though hefty R&D and marketing expenses keep net margins closer to 35%.

Still, the unit economics are compelling, especially for patented drugs like Wegovy, where demand far outstrips supply, preserving pricing power.

Winning the Hearts of Patients and Providers

Novo Nordisk’s success hinges on its ability to resonate with three key stakeholders: patients, healthcare providers, and payers.

For patients, the company delivers life-changing outcomes. Ozempic and Wegovy don’t just manage symptoms—they transform lives through better diabetes control and significant weight loss. This drives strong patient loyalty, as those who respond well to these therapies often stay on them long-term. Since diabetes and obesity are chronic conditions, patients often rely on medications like Ozempic, Wegovy, or insulin for years—sometimes a lifetime. This creates a sticky customer base, where retention rates are implicitly high, driving predictable, recurring revenue that’s the envy of many industries. Unlike businesses that must constantly chase new customers to replace churn, Novo’s model benefits from a growing pool of loyal patients, fueled by the rising prevalence of metabolic diseases. This stability lets the company focus on expanding its reach rather than plugging leaks, a dynamic that underpins its consistent revenue growth.

Furthermore. word-of-mouth buzz is palpable, with countless stories of patients achieving dramatic health improvements. While exact Net Promoter Scores aren’t public, Novo’s patient-centric mission—to “drive change in diabetes” and “defeat obesity”—resonates deeply, earning it a stellar reputation in healthcare.

Healthcare providers, too, hold Novo in high regard, prescribing its drugs as first-line treatments due to their superior efficacy and convenience.

However, payers—insurance companies and national healthcare systems—are a tougher crowd. While they recognize Novo’s innovation, high drug prices (GLP-1 therapies can cost hundreds of dollars monthly) have sparked criticism, particularly for insulin in the U.S. In response, Novo slashed U.S. insulin list prices by up to 75% starting in 2024, a move that likely bolstered goodwill.

Overall, Novo’s focus on quality, patient support, and addressing affordability concerns cements its strong stakeholder relationships, underpinning its franchise strength.

A Simple Story with Predictable Growth

Compared to the sprawling portfolios of some pharma giants, Novo Nordisk’s business is refreshingly straightforward. It’s pretty much all about metabolic diseases—diabetes, obesity, and related conditions—allowing the company to channel its expertise into a single domain.

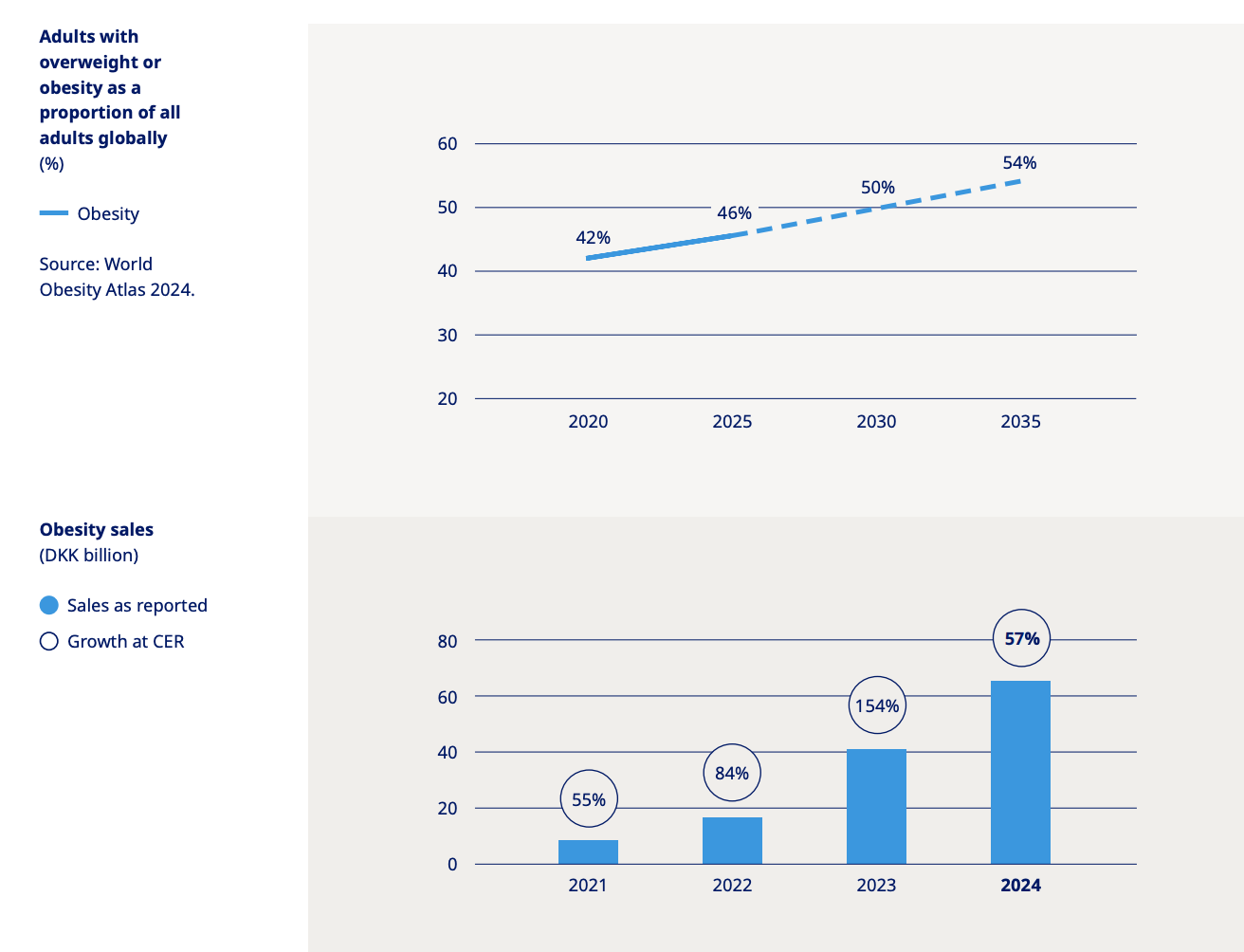

This focus drives efficiency, from R&D to sales, and makes the business easier for investors to understand. The diabetes and obesity markets are massive and growing, with over 40% of U.S. adults classified as obese. These trends provide a stable, expanding customer base that’s largely immune to economic swings.

The diabetes and obesity treatment industry is a haven of secular growth, with the global diabetic population expected to surge from 589 million in 2024 to 853 million by 2050, according to the International Diabetes Federation, driven by urbanization, aging populations, poor diets, and sedentary lifestyles.

(Source: International Diabetes Federation)

Over 1 billion people worldwide grapple with obesity, a number climbing steadily for the same reasons. This creates a predictable, long-term demand that’s insulated from economic cycles—people don’t stop needing insulin or weight-loss drugs in a recession.

The industry also boasts high margins and excess returns on capital, thanks to strong pricing power (GLP-1 drugs like Wegovy command premiums due to supply shortages) and meaningful differentiation through innovation. Novo’s ability to set the standard with drugs like semaglutide underscores the industry’s reliance on cutting-edge R&D to maintain an edge.

What makes this industry particularly resilient is its resistance to disruption. Regulatory moats, patent protections, and complex manufacturing processes create towering barriers to entry, while brand trust—built over decades—keeps doctors and patients loyal.

Even emerging technologies, like continuous glucose monitors or gene therapies, tend to complement rather than replace drug therapies, enhancing outcomes without dismantling the market. This slow pace of change gives incumbents like Novo time to adapt, ensuring their competitive advantages endure.

With high profitability and low cyclicality, the metabolic disease sector is a rare gem—an industry where growth and stability coexist, making it a fertile ground for companies like Novo to thrive.

The industry itself is characterized by high barriers to entry—think complex R&D, lengthy clinical trials, and sophisticated manufacturing. It’s an oligopoly, with Novo and Eli Lilly dominating the GLP-1 space and, alongside Sanofi, holding sway in insulins.

Competition exists—Lilly’s Mounjaro and Zepbound are formidable challengers, and players like Pfizer and Amgen are developing new therapies—but Novo’s early mover advantage and broad portfolio (injectable and oral GLP-1 options) give it a commanding 65% share of the GLP-1 market.

For investors, Novo’s story is clear: keep rolling out best-in-class drugs, expand indications (like using GLP-1 for heart or kidney benefits), and bring pipeline candidates to market as patents expire. There’s no conglomerate complexity or multi-industry exposure—just a focused bet on a growing healthcare need.

The main wildcard? Keeping pace with scientific and competitive advancements in a fast-evolving field.

Can Anyone Breach Novo Nordisk’s Fortress?

A Moat Built on Innovation and Scale

Novo Nordisk doesn’t just compete—it dominates, thanks to a wide economic moat that keeps rivals at bay.

The cornerstone of this moat is the unmatched efficacy of its drugs. Ozempic and Wegovy aren’t just treatments; they’re the gold standard in diabetes and obesity care, delivering superior glucose control and weight loss that physicians and patients swear by.

This clinical edge creates a powerful brand preference—once a patient is thriving on Ozempic, switching to a less proven alternative feels like a gamble. In obesity, Wegovy has become a household name, synonymous with transformative weight loss. This brand equity, backed by hard data, gives Novo pricing power and high switching costs, making it tough for competitors to steal market share without a clearly superior offering.

Patents are another pillar of Novo’s defenses. Its intellectual property, particularly around semaglutide, ensures legal monopolies through much of this decade. This gives Novo breathing room to rake in profits while competitors wait for patents to expire. By then, Novo plans to transition patients to next-generation drugs, a classic pharma strategy to keep the moat evergreen. The company’s pipeline, with candidates like CagriSema and amycretin, suggests it’s already plotting the next chapter.

Then there’s the manufacturing moat—a less flashy but arguably more durable and hence critical advantage. Producing complex biologics like semaglutide at massive scale is no small feat. Novo’s world-class production (and distribution) capabilities, from synthesizing active ingredients to assembling pen injectors, set it apart. Recent supply shortages for GLP-1 drugs showed that even big pharma peers struggled to keep up, while Novo’s ~$9 billion capacity expansion in 2025 is set to widen this gap. Its global distribution network and deep ties with healthcare systems further raise the bar for new entrants.

Scale also plays a starring role. With 77,000 employees and operations in 168 countries, Novo spreads its R&D and marketing costs over a massive revenue base, driving industry-leading profitability—gross margins hover around 85%, with operating margins at ~44% in 2024.

This financial firepower lets Novo fund aggressive clinical trials and marketing campaigns that smaller players can’t match.

Finally, a century of experience in diabetes care (since 1923) has earned Novo a reputation for safety and reliability. Doctors and regulators trust its track record, an intangible asset that’s hard to replicate.

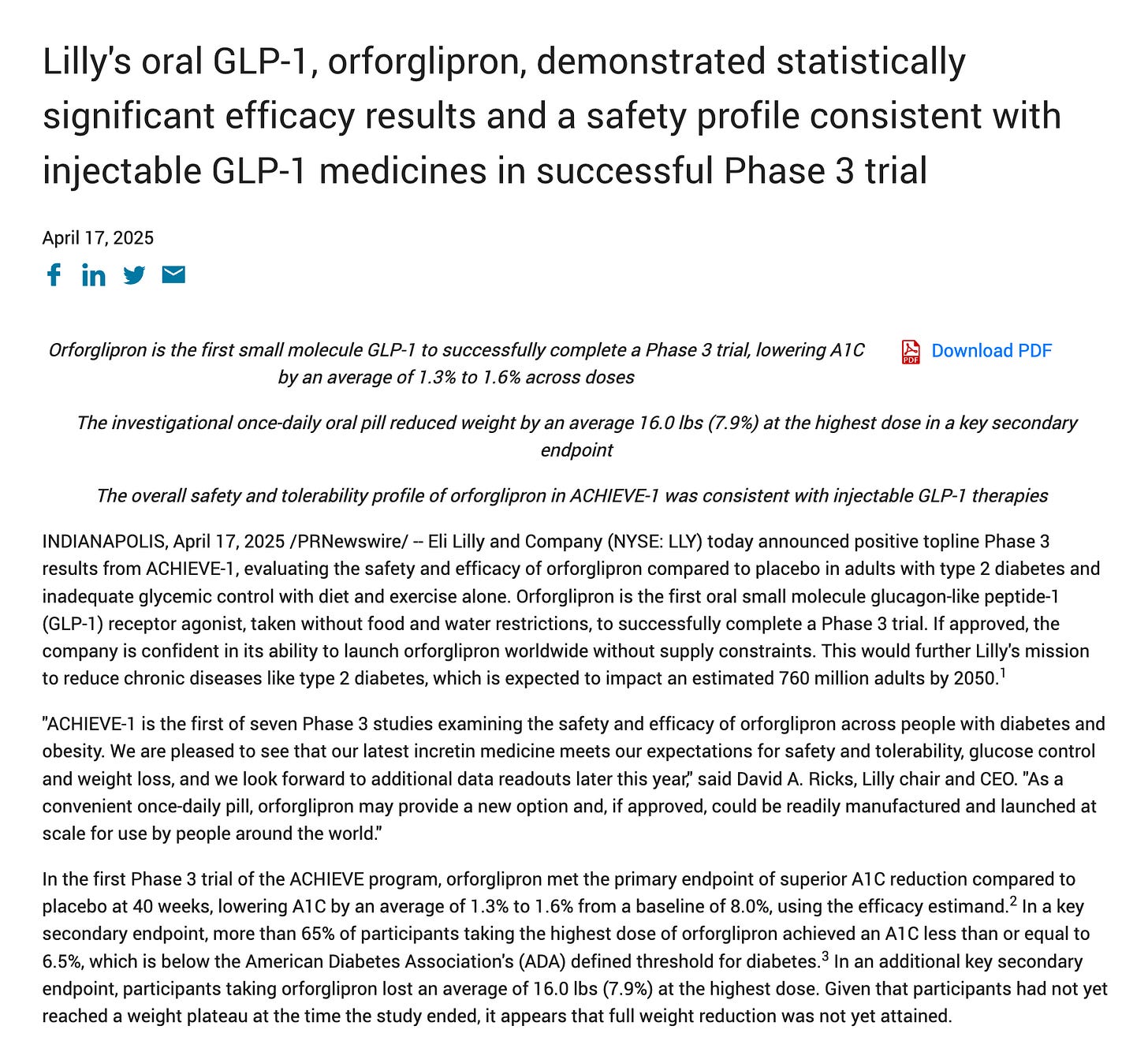

Is this moat invincible? Not quite. Its durability hinges on continuous innovation to refresh patents and stay ahead of competitors like Eli Lilly, whose Mounjaro and Zepbound are gaining ground.

In fact, this ad-hoc was released by Eli Lilly just today (I just updated this post):

(As a result, Eli Lilly is up 9% and Novo is down -7% as of right now)

It’s effectively a bet on Novo’s innovative culture persisting.

Pricing power could also face pressure as new rivals or generics emerge, but Novo’s strategy of launching new formulations and combinations keeps it one step ahead. For now, its blend of innovation, patents, scale, and trust makes Novo’s position look rock-solid.

A Cash Machine That Weathers Storms

If you’re looking for a business that prints money and shrugs off economic turbulence, Novo Nordisk – at least historically – fits the bill.

Its financials are a thing of beauty: robust free cash flow fuels dividends, share buybacks, and R&D without breaking a sweat.

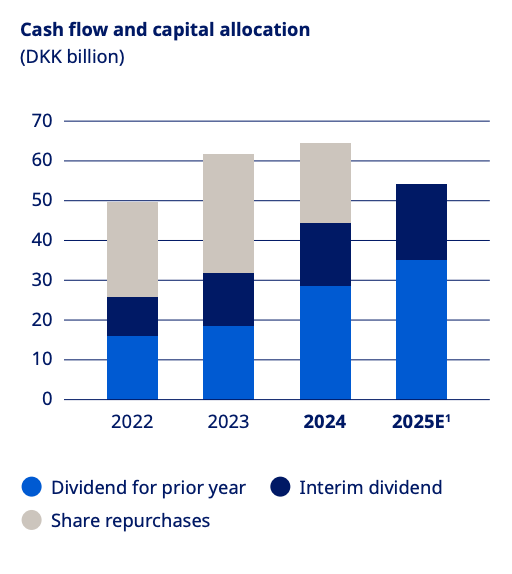

Historically, Novo’s capital needs were modest, with manufacturing costs a small fraction of sales. But the GLP-1 boom changed that, pushing 2024 capital expenditures to DKK 47.2 billion to meet skyrocketing demand.

Even so, this ~16% capex-to-sales ratio is expected to ease over time, mean-reverting back to historically lower levels and reflecting discretionary growth investments rather than ongoing maintenance costs.

Once these expansions are complete, Novo’s cash-generative nature should shine even brighter.

Novo Nordisk’s returns on capital have been on a tear, with return on invested capital consistently topping 60% (10-year mean of 70%!), a testament to its ability to turn reinvested capital into higher profits. This is largely driven by the explosive demand for GLP-1 drugs like Ozempic and Wegovy, which generate outsized profits relative to the capital deployed.

However, the company’s hefty investments in R&D—to fend off patent expiries with next-gen therapies—and massive capex to scale production could temper these returns over time; investors should watch how these investments play out.

Can Novo Nordisk Keep Its Growth Rocket Fueled?

A Decade of Acceleration and a Bright Horizon

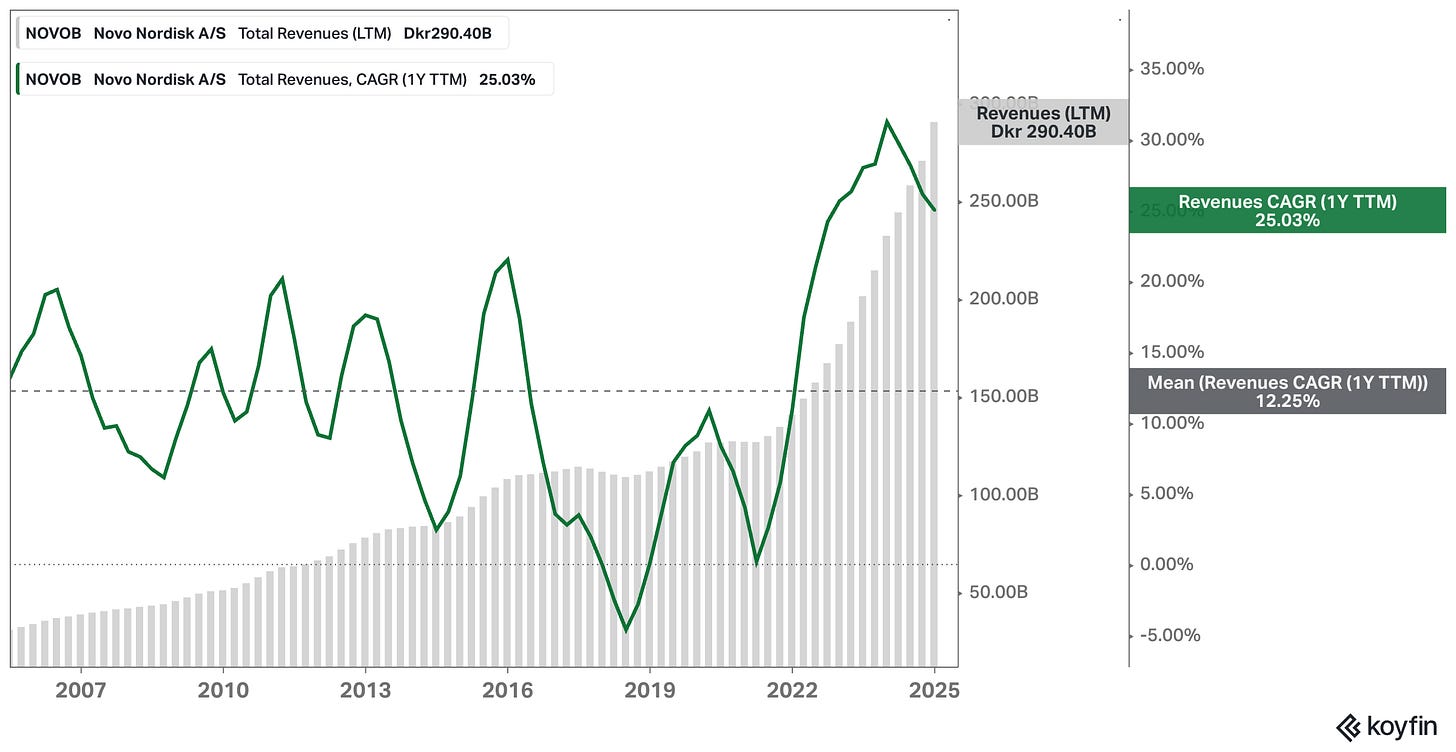

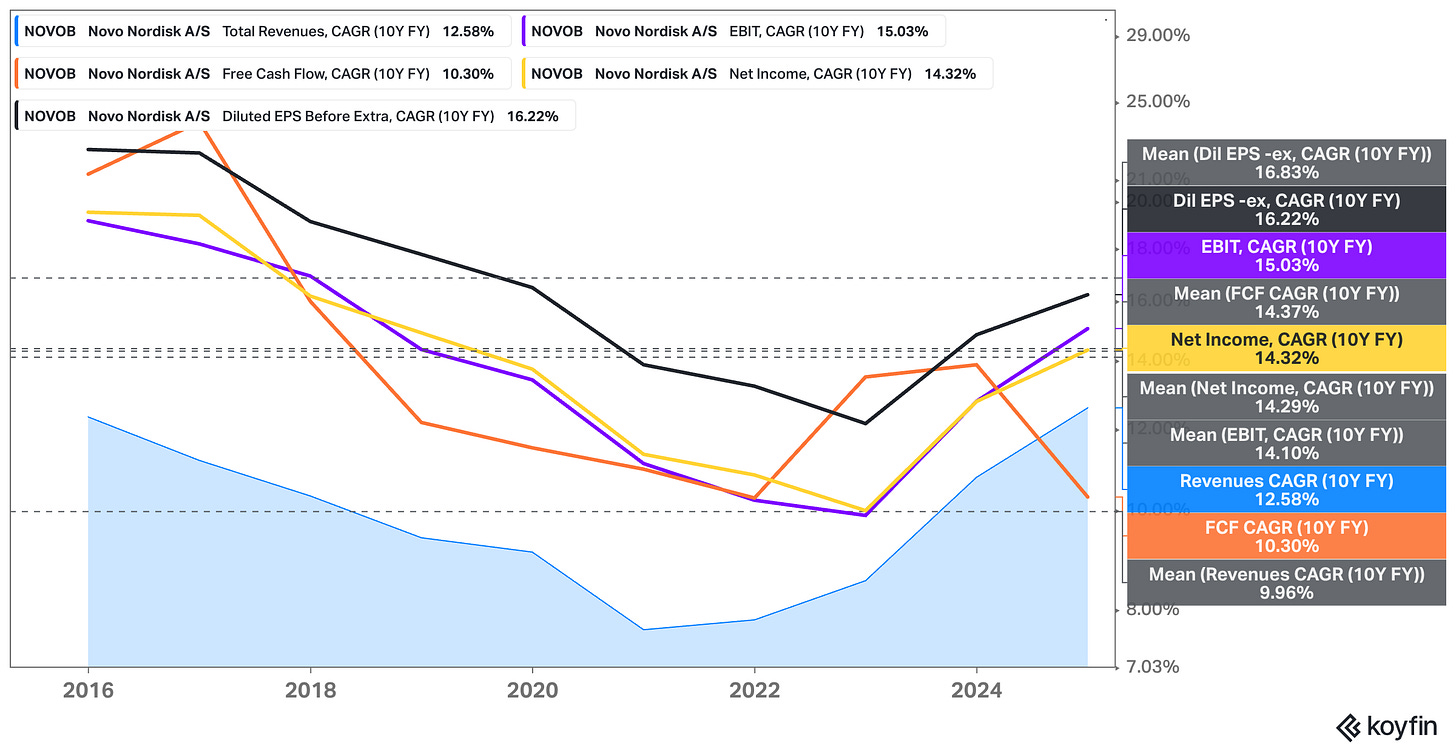

Novo Nordisk’s growth story reads like a case study in seizing opportunity. Over the past decade, the company has transformed from a steady performer to a growth juggernaut.

From 2011 to 2020, revenue growth chugged along at a modest 7-8% compounded annual growth, as insulin sales leveled off and the company navigated patent cycles.

Then came Ozempic in 2018, a game-changer that lit the fuse for explosive growth. By 2021–2023, Novo was firing on all cylinders, with revenue doubling from prior levels in the early 2010s.

In 2024, the company hit a new gear, posting 26% sales growth (30% in Q4 alone), driven by the runaway success of Wegovy and the obesity drug boom.

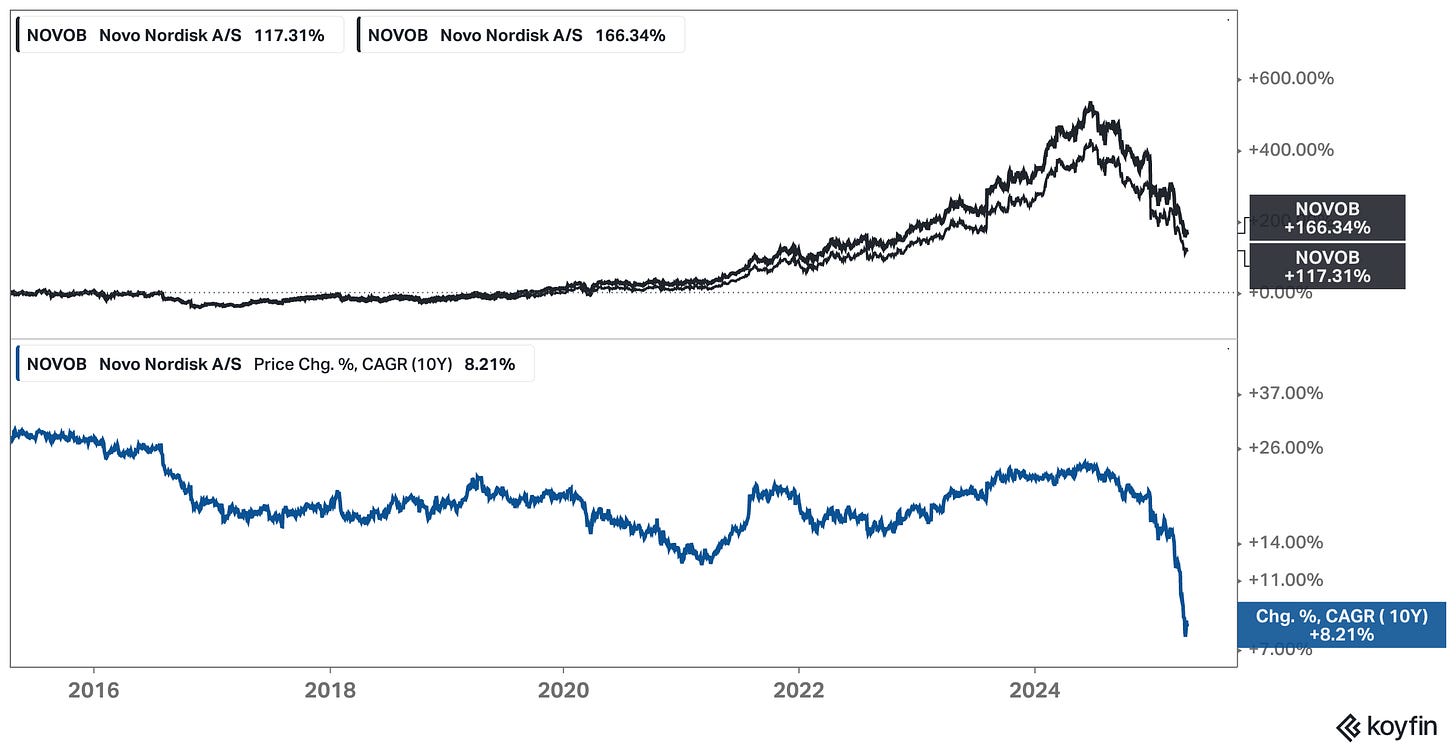

This growth hasn’t just padded the top line—it’s delivered for shareholders (at least before the recent share price slump).

Novo’s stock has been a star, roughly tripling from early 2022 to mid-2024, outpacing pharma indices. The 10-year price CAGR was comfortably sitting above 20%.

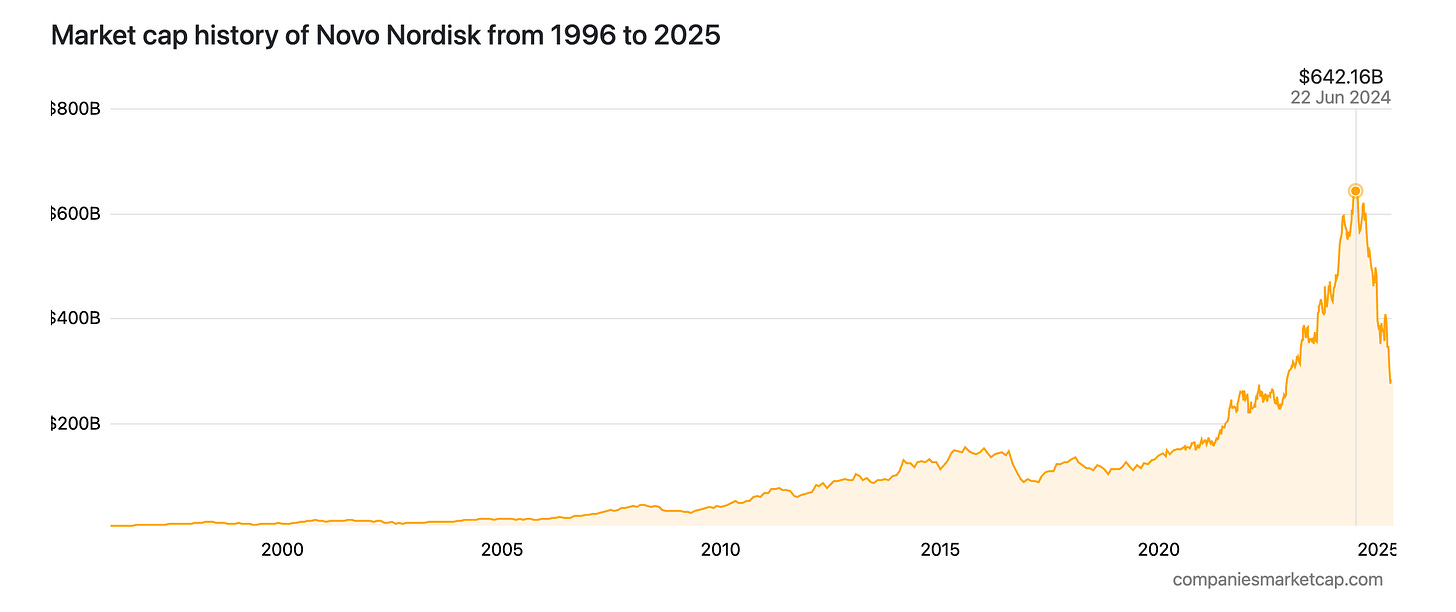

At its peak in mid-2024, Novo’s market cap surpassed Denmark’s GDP (World Economics estimates Denmark's 2024 GDP at $488 billion), a testament to the market’s enthusiasm for its obesity drugs.

Add in 37 years of consecutive dividend increases and consistent share buybacks, and long-term investors have reaped substantial rewards.

But since hitting an all-time high in June 2024, Novo Nordisk’s stock has been in a brutal free fall, shedding more than 58% of its value by April 2025. March 2025 marked the stock’s worst monthly performance since July 2002, with a 27% plunge, driven by a perfect storm of headwinds. Disappointing trial results for next-generation obesity drugs, particularly CagriSema’s underwhelming 22.7% weight loss compared to the expected 25%, sparked a 20% single-day drop in December 2024, wiping out €90 billion in market value. Fierce competition from Eli Lilly’s Zepbound and Mounjaro, which are gaining U.S. market share, has fueled fears that Novo is losing its first-mover edge. Softer 2025 guidance—projecting 16–24% sales growth, the slowest in three years—and concerns over potential U.S. tariffs on pharmaceuticals have further rattled investors. A declining net profit margin (34.8% in 2024, down from 36%) and flat Wegovy prescriptions in early 2025 have only deepened the gloom, leaving Novo struggling to regain its footing.

What these recent developments highlight is that past performance is only half the story—what matters now is whether Novo can regain momentum and protect its competitive position as the market leader.

Tapping into a Massive, Untapped Market

The good news? Novo Nordisk is sitting on a goldmine of growth opportunities. Its core markets—diabetes and obesity—are expanding rapidly, driven by secular trends like rising disease prevalence and aging populations.

(Source: Novo Nordisk Annual Report)

The diabetes market alone is vast, with hundreds of millions of patients worldwide, many still underserved in emerging markets. As diagnosis and access improve, Novo can capture more of these patients with its modern insulins and GLP-1 therapies.

(Source: Novo Nordisk Annual Report)

Obesity, however, is the real rocket fuel. Historically, only ~2% of the world’s ~764 million obese adults received pharmacotherapy, but drugs like Wegovy are rewriting the rules. Analysts project the global GLP-1 market (for diabetes, obesity, and beyond) could skyrocket from ~$40 billion in 2023 to ~$150 billion by 2032—a nearly fourfold increase. Novo and Eli Lilly, as the market’s pioneers, are poised to dominate this expansion. Wegovy’s success is just the beginning; as obesity treatment becomes mainstream, tens of millions of new patients could enter the market.

Novo’s not stopping at its current playbook. It’s exploring new indications for GLP-1 drugs, like cardiovascular and kidney benefits. The SELECT trial, for instance, showed a ~20% reduction in heart attack and stroke risk for obese patients on semaglutide. If regulators greenlight these expanded uses, it could open entirely new revenue streams, from heart failure to non-alcoholic steatohepatitis (NASH).

This optionality makes Novo’s total addressable market even harder to pin down—it’s massive and growing.

Innovation as the Growth Engine

As discussed, what keeps Novo ahead of the pack isn’t just market trends—it’s relentless innovation.

The company’s pipeline is a treasure trove of next-gen therapies, from CagriSema (promising even greater weight loss) to triple-agonist drugs targeting multiple metabolic pathways. Beyond its GLP-1 franchise, Novo is branching out into adjacent fields. Its 2023 acquisition of Inversago Pharma brought a CB1 agonist for obesity into the fold, while early research into liver disease and even Alzheimer’s (where GLP-1s might offer cognitive benefits) adds further upside. These bets may not all pay off, but they show Novo’s willingness to stretch its peptide drug expertise into new territory while staying anchored in metabolic diseases.

(Source: Novo Nordisk Annual Report)

In the near term, growth faces a hurdle: supply constraints. Demand for Wegovy and Ozempic has outstripped production, prompting Novo to acquire three manufacturing facilities in 2024 and ramp up capacity.

The company’s guidance for 2025—sales growth of 16–24%—reflects confidence in double-digit expansion, though it’s a step down from 2024’s blistering pace.

Over the next five years, mid-teens revenue growth seems achievable, fueled by market penetration and new product launches. Longer term, as markets mature, growth may settle into the high single digits—unless another breakthrough sparks a new cycle.

Are Novo Nordisk’s Leaders Up to the Challenge?

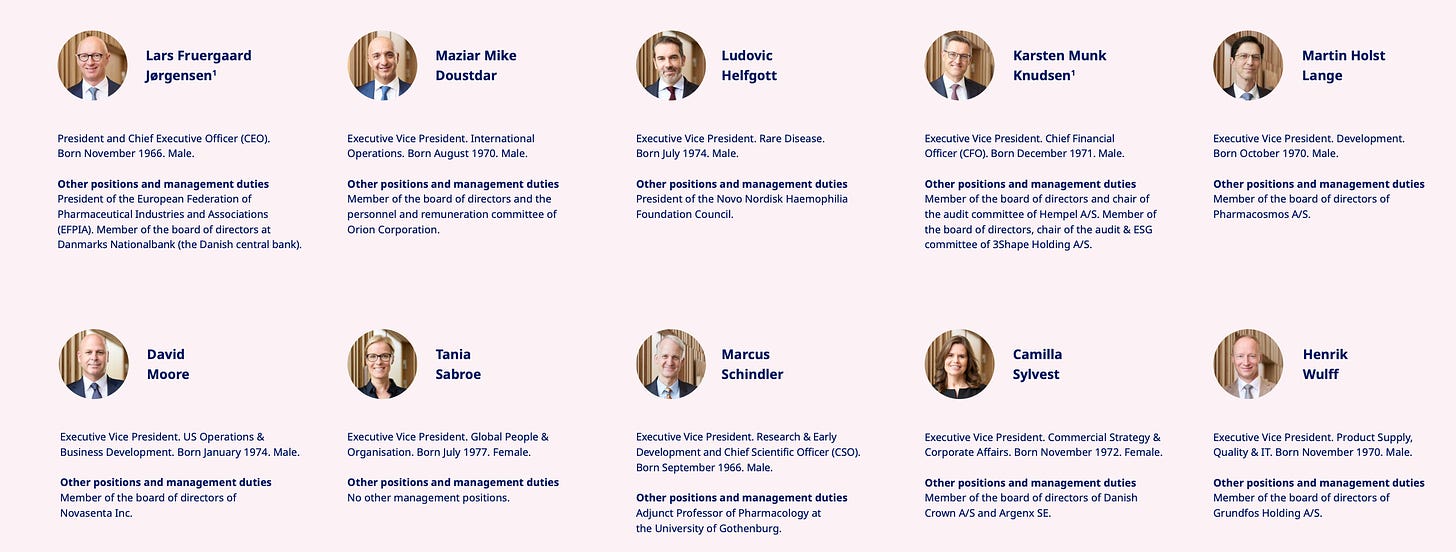

Great businesses need great leaders, and Novo Nordisk’s management team has been delivering. At the top is CEO Lars Fruergaard Jørgensen, a company veteran who’s been with Novo since 1991 and has led as CEO since 2017. With over eight years at the helm, Jørgensen brings continuity and deep institutional knowledge, honed through roles in IT, corporate development, and economics.

As outlined, under his watch, Novo has pulled off a remarkable pivot—from a traditional insulin powerhouse to a broader chronic disease leader, with blockbusters like Ozempic and Wegovy redefining the company’s trajectory.

(Source: Novo Nordisk Annual Report)

Jørgensen isn’t alone. He’s backed by a seasoned executive team, many of whom have spent decades at Novo, fostering a culture of internal talent development.

The board, chaired by Helge Lund (former CEO of BG Group and Statoil), adds global business heft.

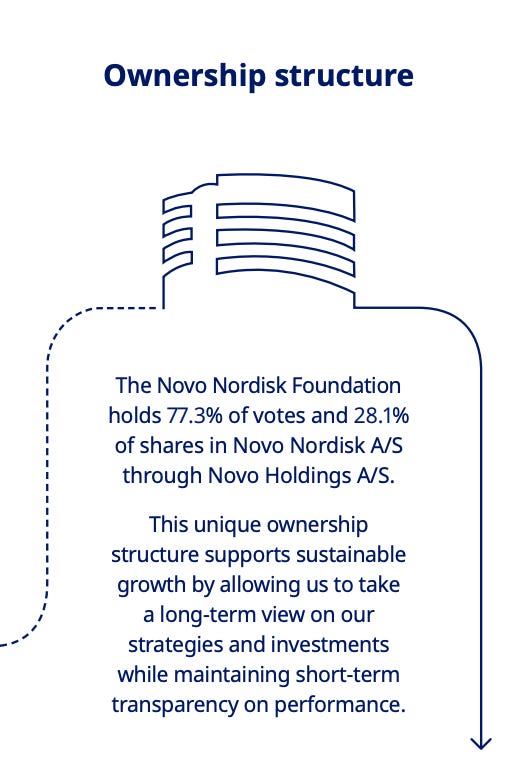

What makes Novo’s governance unique is its majority ownership by the Novo Nordisk Foundation, which controls 77% of voting power through Novo Holdings A/S. This structure, in place for decades, shields Novo from hostile takeovers and instills a long-term focus—management prioritizes sustainable growth and R&D over chasing short-term market fads. For investors, this stability is a rare and valuable asset.

Trustworthy leadership is non-negotiable in healthcare, and Novo’s management shines here. The company has a stellar reputation for integrity, consistently ranking high on sustainability and ethical indices—it was even named the world’s most sustainable company in 2012.

Management communicates transparently, offering clear guidance and openly addressing challenges like supply shortages or competitive pressures in earnings calls.

The foundation’s oversight reinforces this ethical bent; its mission isn’t just profit but also funding scientific and humanitarian causes, aligning Novo’s goals with broader societal benefits.

When it comes to shareholder alignment, Novo’s leaders walk the talk. While insider ownership is low (the CEO holds ~0.01% of shares), the foundation acts as a stable, long-term shareholder, prioritizing sustainable growth and dividends (current payout ratio: 43.7%)—music to the ears of patient investors. Management’s capital allocation is shareholder-friendly, balancing growth investments with returns.

Novo targets a ~50% dividend payout ratio (DKK 11.40 per share in 2024) and has a multi-decade history of buybacks, repurchasing DKK 20 billion (~$3 billion) in shares in 2024 alone.

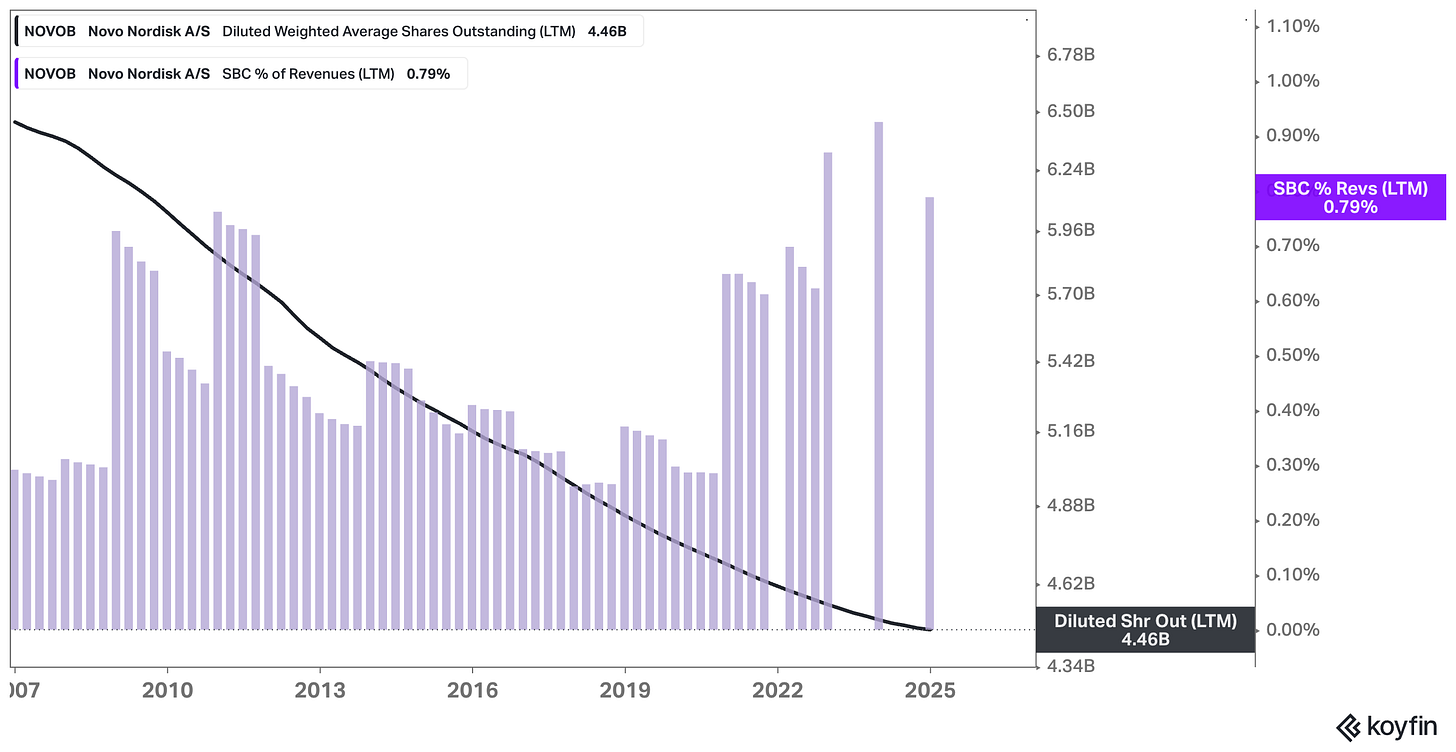

This discipline has steadily reduced the share count, boosting per-share value; the share count was almost cut in half over the last 20 years:

Executive compensation, while performance-based, appears reasonable compared to (American) peers, and there’s no history of reckless spending or empire-building acquisitions.

Finally, Novo’s focus on internal R&D over flashy deals reflects a rational, investor-focused mindset.

In short, Novo Nordisk’s management is a well-oiled machine: experienced, ethical, and laser-focused on long-term value. The foundation’s oversight provides stability, while strategic decisions—like pivoting to obesity and scaling production—have fueled Novo’s meteoric rise. With no major missteps or red flags, these leaders look more than capable of steering Novo through the challenges ahead.

Is Novo Nordisk’s Financial Foundation Bulletproof?

A Balance Sheet Built for Stability

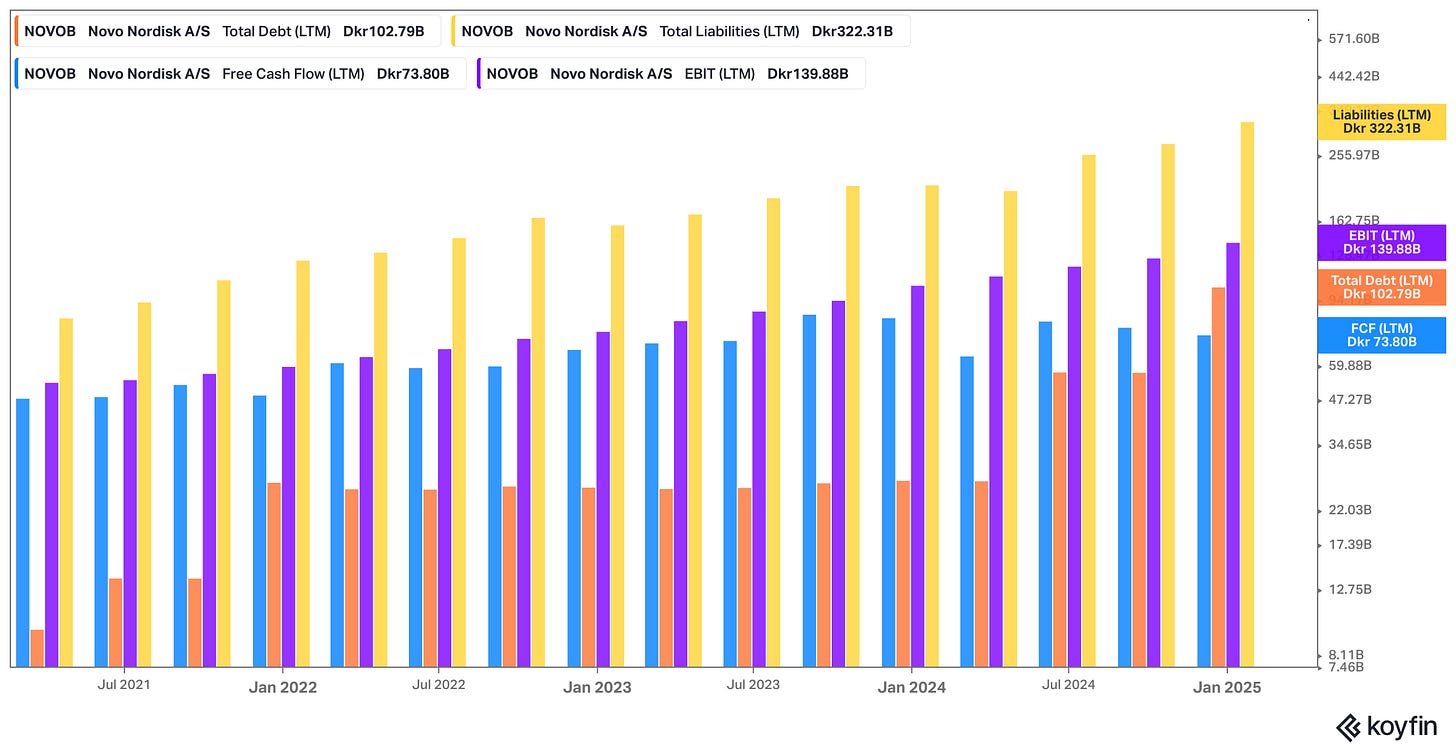

For a company riding a growth wave like Novo Nordisk, a strong balance sheet is critical—and Novo delivers. As of late 2024, the company carried about DKK 102 billion in total debt. That’s up from only 27 DKK billion the prior year, reflecting strategic borrowing to fund massive capacity expansions and acquisitions, like the debt-financed Catalent manufacturing sites deal.

While leverage has ticked up, it’s still modest for a cash-generating machine like Novo. With FCF of DKK 74 billion in 2024, the net debt-to-FCF ratio sits comfortably below 1×, signaling that debt is far from a burden.

Novo’s cash reserves—over DKK 26 billion—further soften the impact of its debt, keeping net debt low.

The company’s debt structure is also smartly managed, primarily consisting of long-term Eurobonds (like the €4.65 billion issued in 2024) and some bank loans. Maturities are staggered to avoid any near-term cliffs, and Novo’s investment-grade credit rating reflects the market’s confidence in its ability to service these obligations.

Interest expenses are a rounding error compared to earnings.

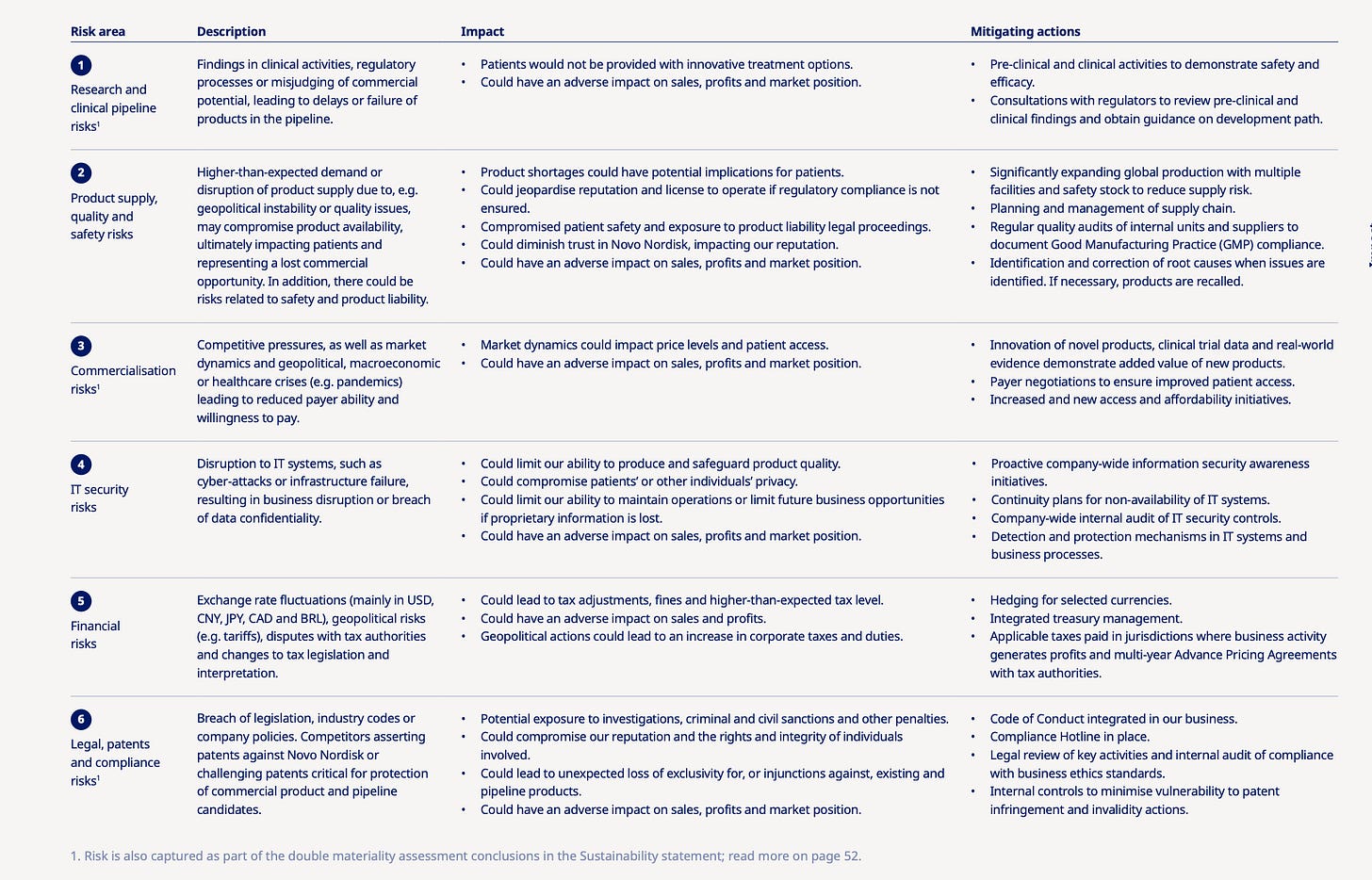

What Could Derail Novo Nordisk’s Juggernaut?

No investment is bulletproof, so let’s flip the script: what could send Novo Nordisk’s growth off the rails? Picture a world five years from now where sales stagnate or shrink. The biggest threat is competition outpacing Novo’s science. Eli Lilly’s tirzepatide (Mounjaro and Zepbound) is already nipping at Novo’s heels, and Lilly’s next-gen drugs, like the triple-agonist retatrutide, could steal the spotlight if they deliver better results. Beyond Lilly, heavyweights like Pfizer (with oral GLP-1 candidates) and Amgen (exploring sirtuin-based therapies), plus scrappy biotechs, are racing to flood the obesity market. By 2030, GLP-1 therapies could become commoditized, eroding Novo’s pricing power and market share.

Another nightmare scenario is a safety scare. GLP-1 drugs have been studied extensively, but rare, serious side effects—like long-term risks tied to semaglutide—could emerge, triggering restrictions, withdrawals, or lawsuits. Concerns about pancreatitis or certain cancers have lingered (though data so far supports safety), and a black swan event could crater demand. Novo’s heavy reliance on semaglutide also amplifies this risk; any hit to its flagship molecule would sting.

(Source: Novo Nordisk Annual Report)

Regulatory and Pricing Pressures

Governments and payers could throw a wrench in Novo’s plans. Obesity drugs are pricey, and as demand surges, regulators might push back. In the U.S., Medicare doesn’t cover obesity medications yet, but if it does with strict price controls, margins could suffer. Europe’s reference pricing systems could force discounts as Wegovy’s volumes grow, and some countries might treat obesity drugs as public health necessities, imposing special pricing rules.

Novo’s insulin price cuts in the U.S. show it’s not immune to political pressure—similar scrutiny could hit its GLP-1 franchise. On the approval front, delays or rejections for pipeline drugs like CagriSema could slow growth, though Novo’s track record suggests this risk is moderate.

(Current Patent Status; Source Novo IR)

Supply Chains and Execution Challenges

Novo’s breakneck growth has exposed vulnerabilities in its supply chain. Wegovy shortages highlighted how hard it is to scale complex biotech manufacturing. Despite massive investments—like acquiring Catalent facilities—disruptions like contamination, raw material shortages, or geopolitical trade issues could persist. Semaglutide’s intricate synthesis relies on specialized ingredients; any bottleneck could cede ground to competitors. As Novo ramps up production to meet tripled demand, flawless execution is critical—one misstep could cost market share.

The Threat of Disruption

What if drugs aren’t the future of obesity or diabetes care? Non-pharma alternatives, like less invasive bariatric surgery or advanced medical devices, could lure patients away. In diabetes, “artificial pancreas” systems—combining continuous glucose monitors and insulin pumps—might reduce the need for premium insulins. Farther out, gene editing or regenerative medicine could aim for cures, threatening chronic therapy models. Even novel approaches, like microbiome therapies or safe appetite suppressants, could disrupt Novo’s playbook if they gain traction.

Economic and Other Wildcards

While Novo’s products are recession-resistant, economic storms could still bite. A global downturn might tighten healthcare budgets, slowing adoption of pricey obesity drugs, which some view as elective. Currency swings—a stronger DKK against USD or CNY—could dent reported earnings, despite hedging. Inflation could raise costs if price hikes lag. Legal risks, like patent disputes or product liability suits, lurk in the background, though Novo’s clean history offers comfort. Talent retention is another soft risk—as metabolic disease research heats up, Novo must fend off poaching by startups or rivals.

Proposed U.S. tariffs on pharmaceutical imports, championed by President Trump in April 2025, loom as a new threat to Novo Nordisk’s growth story. Trump has vowed to impose “major” tariffs—potentially 25% or higher—on foreign-made drugs to boost U.S. manufacturing, a move that could hit Novo hard given its significant European production footprint, including plants in Denmark. While Novo produces nearly all its U.S.-sold products domestically, tariffs on active pharmaceutical ingredients or supply chain inputs from Europe or Asia could drive up costs, squeezing margins for high-margin drugs like Ozempic and Wegovy.

Industry experts warn that such tariffs could also disrupt supply chains, risking shortages of critical medications, especially if manufacturers struggle to relocate complex operations quickly—building new U.S. facilities can take 5–10 years and cost up to $2 billion. If Novo passes these costs to consumers, it could face backlash in a price-sensitive U.S. market or lose share to competitors like Eli Lilly, who are also ramping up domestic production. With the U.S. accounting for over half of Novo’s sales, navigating this policy shift will test management’s agility.

Then there’s public perception. The buzz around obesity drugs for cosmetic use (think celebrities chasing slimness) could spark backlash, prompting regulations to limit access to medical cases only. In emerging markets like China, local competitors, government procurement rules, or IP theft could chip away at growth. Even ingredient scarcity—specific amino acids or reagents for peptides—could become a bottleneck.

Novo’s not blind to all of these challenges. Its hefty R&D spending, capacity expansions, and proactive management aim to stay ahead of competitors and supply issues. The company’s diversified portfolio within diabetes and obesity, plus a robust pipeline, mitigates reliance on any single drug. Still, the biggest near-term risks—Lilly’s competitive pressure, pricing headwinds, and manufacturing execution—require vigilance. The bear case, where Novo loses its edge to a new entrant or sees margins crushed, isn’t impossible but feels unlikely given its track record. For investors, it’s about weighing these risks against Novo’s strengths and deciding if the growth story outweighs the what-ifs.

58% Drawdown! Is Novo Nordisk Finally Attractively Priced?

I find valuing a pharma company like Novo Nordisk particularly challenging because I have to acknowledge how little I truly know and how unreliable my growth forecasts may turn out to be. Hence, I want to demand an EXTRA large margin of safety.

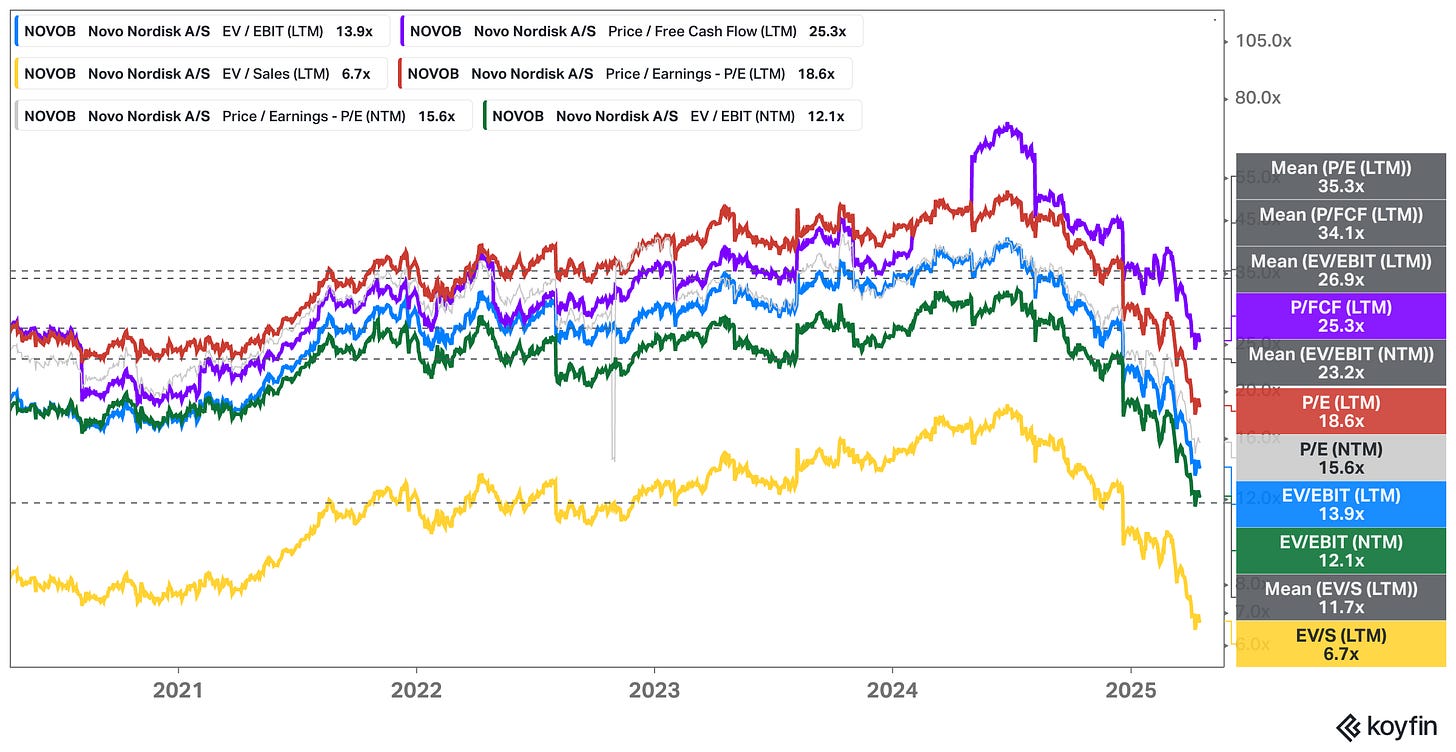

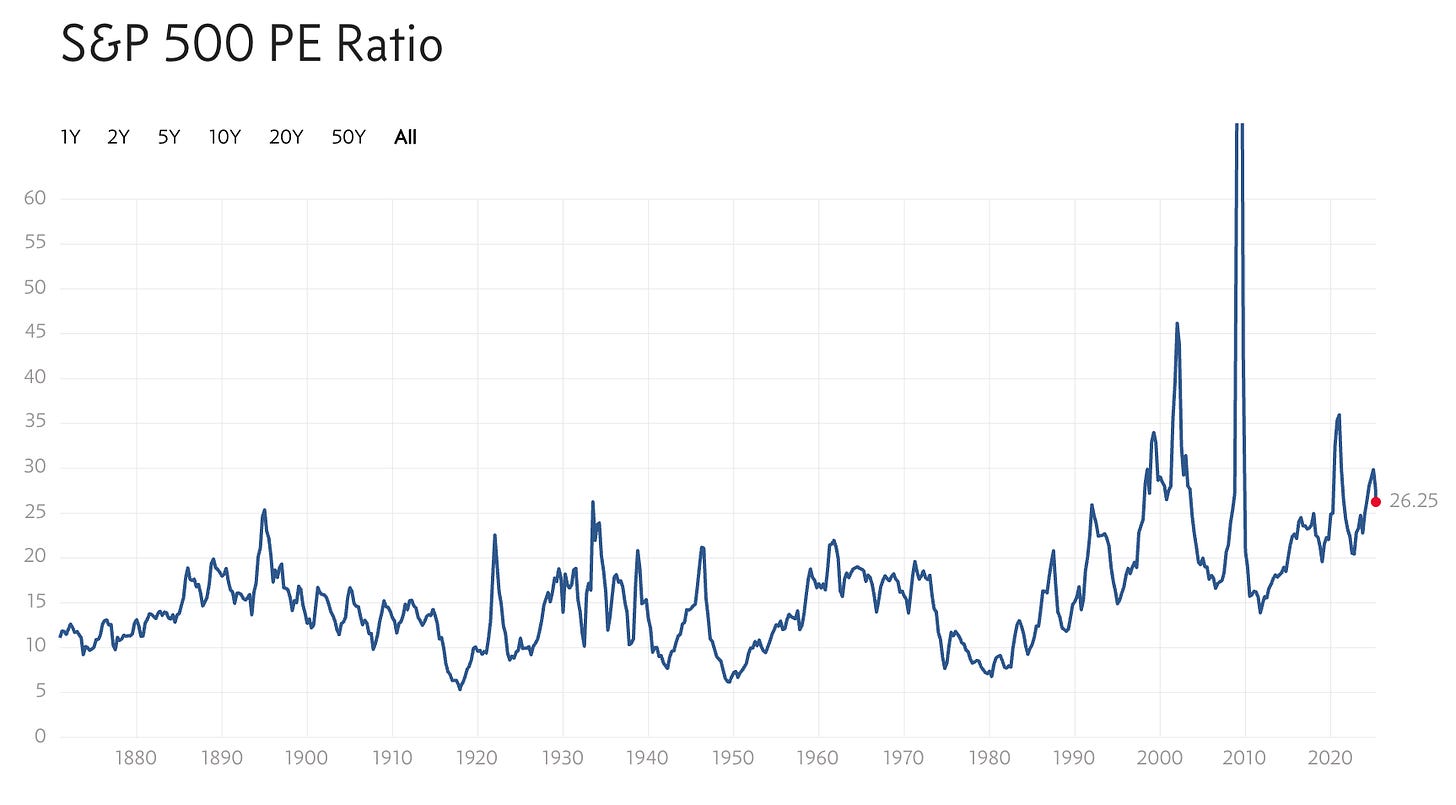

As of early 2025, the stock (NVO) trades in the low-to-mid-$60s per ADR, down from its 2023 highs when obesity drug hype sent it soaring. This translates to a trailing price-to-earnings (P/E) ratio of 18.6x, significantly below the 5-year mean of 35x and 10-year mean of 29x.

Looking ahead, analysts expect DSK 26.9 per share in FY 2025 (forward P/E of ~15-16x), and DSK 33.14 per share in FY 2026, giving a forward P/E of ~13x.

For a company projecting 16–24% sales growth in 2025 and likely mid-teens growth over the next few years, a P/E in this range feels more than reasonable—maybe even a touch attractive, especially if you compare the current multiple to the historical ones, baking in sky-high expectations.

However, I wholeheartedly believe that relative valuation has very little to do with actual business valuation.

The P/FCF ratio seems fairly high at 25x on a trailing basis, but you have to remember that the company is going through a CapEx cycle and likely trading at a (significantly) lower FCF multiple on normalized cash profits (the NTM EBIT multiple is 12x).

(Source: Novo Nordisk Annual Report)

Novo’s unique position—a wide-moat pharma with secular growth—argues for a premium over slower-growing peers, many of whom trade at 15x earnings or less. The current multiple only partly reflects optimism about Novo’s obesity and diabetes franchises and seems to fully account for competitive pressures, particularly from Eli Lilly. You can basically buy the company at an earnings yield of 5% and hence don’t need hyper-growth for the investment to work out.

The PEG ratio (P/E divided by growth) hovers around 1.3–1.5, suggesting a fair price for a high-quality business—not a screaming bargain, but far from bubble territory.

Add in a ~2% dividend yield and consistent share buybacks, and the total shareholder return sweetens the deal, offering growth well above the current US market average for ~26× earnings (and probably a low 20s multiple if you exclude the Mag-7).

Generally speaking, buying above-average businesses at below-market multiples works out in investors’ favor more often than not.

Personally, I’d want the stock to trade at a much cheaper price to account for the aforementioned industry-related knowledge gaps I inevitably have to acknowledge.

Disclaimer: I don’t own Novo Nordisk as of April 17. The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.”

Concluding Thoughts: Weighing the Upside Against the Risks

Novo’s valuation hinges on its ability to capitalize on a massive growth runway. If the GLP-1 market triples by 2030, as some forecasts predict, and Novo holds its share, earnings could follow suit, making today’s price look like a steal.

New indications—like cardiovascular or kidney benefits—could push the upside even higher.

But valuation isn’t just about dreaming big; it’s about the margin of safety. At 18× earnings, the stock isn’t dirt-cheap. Investors demanding deep-value discounts (say, single-digit P/Es) might pass, but those comfortable paying for quality growth will find Novo’s price justifiable.

It’s priced for success, not perfection, with enough room for upside if the company executes.

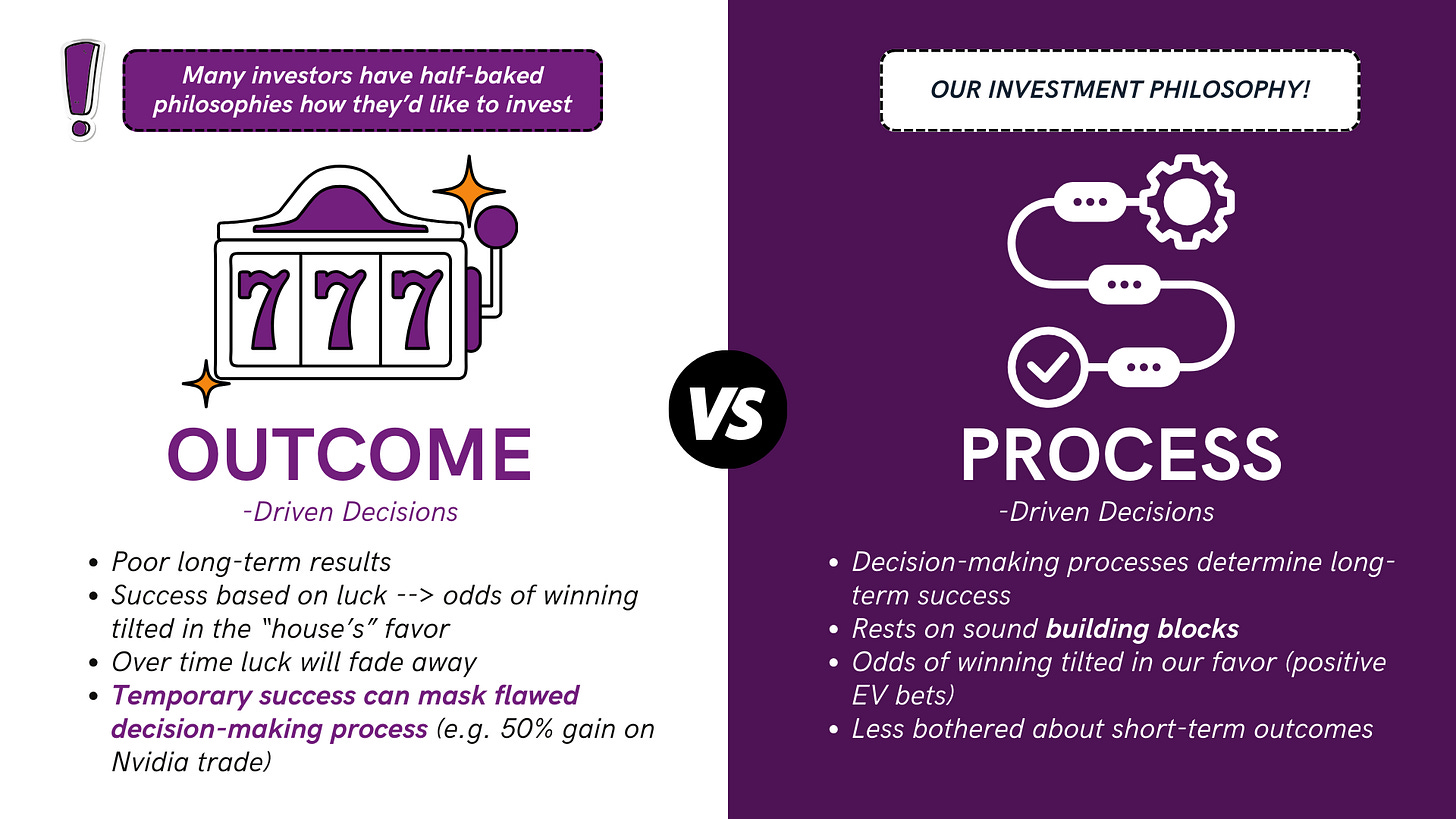

Process-Driven Success ⬇️

Everyone knows Buffett’s quips: ‘Buy low, sell high,’ ‘Be greedy when others are fearful.’ But without a process, they’re just shallow slogans. My Mental Models Investing Mentoring program hands you a robotic, step-by-step strategy—built on sound building blocks—that tilts the odds in your favor for positive EV bets.

It’s not about short-term thrills; it’s about long-term domination. I’ve watched outcome-driven investors chase luck—50% Nvidia gains masking flawed decisions—only to crash when the dice stop rolling.

Process-driven results? That’s where the real wealth lives. This program trains you to focus on decisions, not headlines, with a framework that’s disciplined, repeatable, and proven. It’s the highest-ROI investment you’ll ever make because it turns you into the house, not the gambler. Want to stack the deck? Click here to start at MentalModelsMentoring.com.

Many thanks for your in depth on Novo Nordisk. I could add two further risks which might already be in the price.

1. Donald Trump has promised to do whatever it takes to bring Greenland into US ownership. Greenland is currently part of Denmark. What of the possibility that Trump imposes massive tariffs on Danish products or Danish companies in order to extort Greenland from Denmark - "give me your island full of mineral resources or I'll burn your house down"

2. The US has a new Secretary of Health and Human Services. Robert F. Kennedy Jr. is known as a sceptic on traditional healthcare treatments and in particular as a sceptic re. vaccines. How do we assess the possibility that he halt the availability of Novo's obesity treatments in the US. Halting access to insulin would be more difficult but even there he could insist on US suppliers.

The combination of Trump and Robert Kennedy presents a serious unquantifiable risk to Novo. Having said which I have held for some time and expect to continue to do so. Your excellent analysis just confirmed much of what is good about the company

Great article! Update on Pfizer: they have closed trials for their obesity product and move on to other drugs.

Thus, there is Amgen as the only company to enter the duopoly market.