Deep Dive: Revisiting UP Fintech ($TIGR)

Further Regulation in the Chinese Brokerage Space! Is Tiger Broker’s Growth at Risk?

The Chinese brokerage space has never been for the faint of heart. For years, investors in names like Tiger Brokers and Futu have lived with one eye on earnings and the other on Beijing’s next policy move.

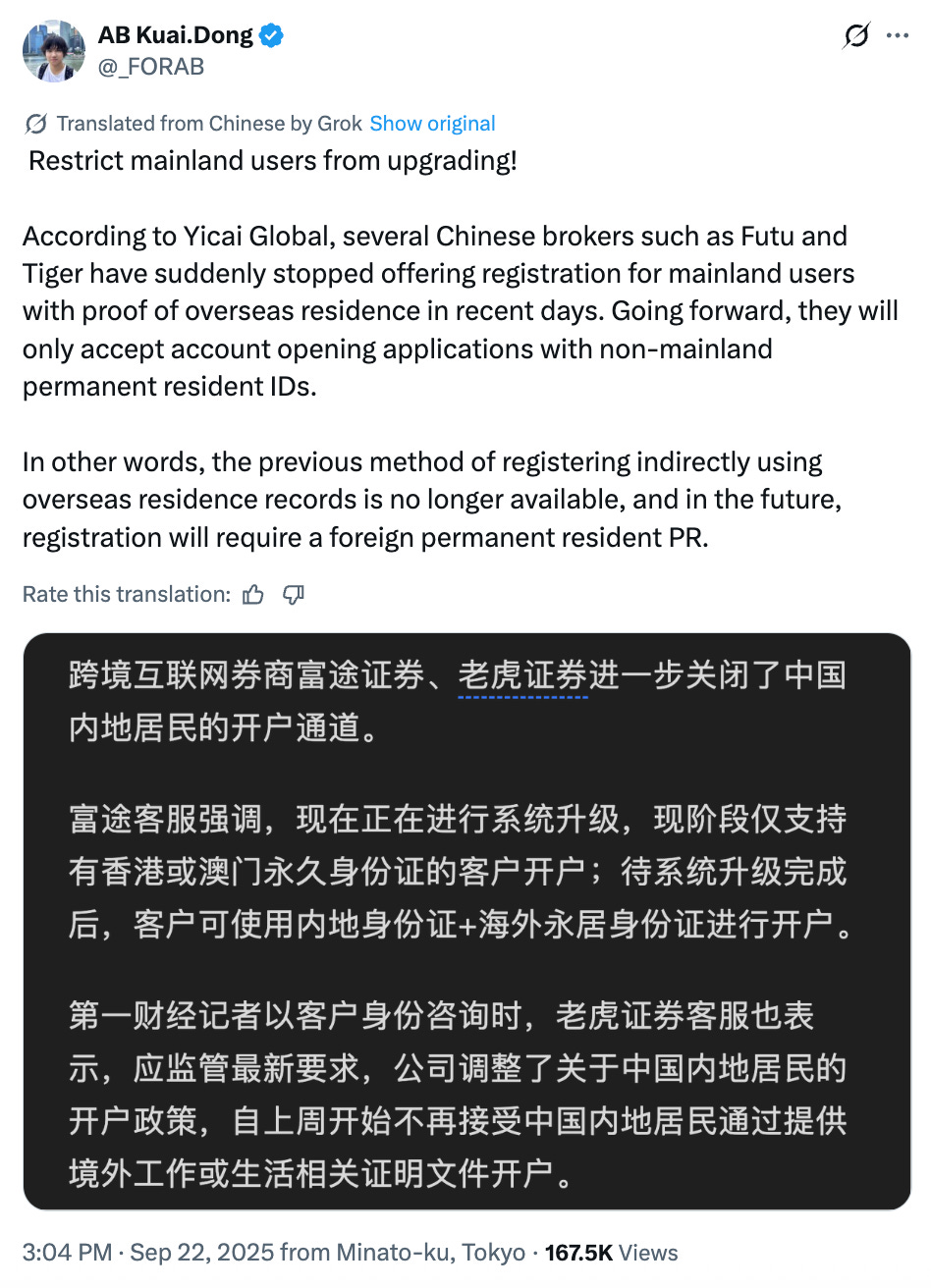

When the latest news broke – that mainland Chinese citizens can no longer open accounts using just proof of overseas residence, and must instead hold a foreign permanent residency ID – the reaction was a swift share price decline.

But here’s the thing: regulatory news out of China rarely lands cleanly. Sometimes the real impact is smaller than it looks. Sometimes it’s bigger. The trick is knowing how to separate noise from signal, and whether a headline that looks existential is actually just another incremental tightening.

That’s what today’s post should be about. I want to assess Tiger’s current situation in light of the recent regulatory news.

This isn’t the first time Tiger has faced restrictions. The 2022 app store removals were the true shock event. What we’re seeing now is different: it’s not a full shutdown, it’s a recalibration.

In this post, I’ll take you through what actually changed, why it matters, and how to think about Tiger’s position in a world where China is steadily plugging capital outflow loopholes. We’ll also zoom out to the bigger lessons – about regulatory risk, about market narratives, and about how to invest when the rules of the game can shift overnight.

Here’s what we’ll cover:

The specific rule change and why it rattled markets – what counts as valid documentation now, how it differs from the 2022 crackdown, and why ambiguity often triggers overreaction.

The broader policy arc – how Beijing has moved step by step from initial crackdowns to incremental capital control measures, and what parallels we can draw from other markets.

Tiger’s geographic footprint – why Singapore and Southeast Asia remain the anchor, why Hong Kong is a special case, and how residency rules make the impact asymmetric across regions.

The real business impact – what this means for new vs. existing accounts, why the quality of clients matters as much as quantity, and how to frame scenarios from bear to bull. This will be by far the most important part of this post.

The bigger lessons for investors – what this episode teaches about handling regulatory risk, distinguishing perception from fundamentals, and identifying moments when markets misprice uncertainty.

If you care about Tiger Brokers specifically, or about how regulatory risk gets priced more broadly, this is a story worth unpacking. Because as I’ll argue, the real lesson here isn’t just about Tiger – it’s about how to invest intelligently when rules can change overnight.

Read my Tiger Deep Dive here:

Chapter 1 – What Actually Changed, and Why the Market Flinched

When you’re looking at Tiger Brokers today, the headlines are quick to suggest a “new crackdown” that might not only impact their mainland China business but also business in Hong Kong and Singapore – and beyond. But the reality is more nuanced, and I think it’s worth unpacking what actually changed and why the stock sold off as a result.

The trigger was a policy tweak that at first glance looks small, but carries symbolic weight. Until recently, mainland Chinese citizens living abroad could often open accounts with Tiger or its rival Futu by providing proof of overseas residence or a work permit.

“Sept. 23 -- Chinese online brokerages Futu Securities and Tiger Brokers are making it harder for residents on the mainland to open new accounts and now require them to provide proof of permanent residency overseas, as Beijing gets tough on cross-border investments.

Futu Securities’ account opening rules have changed under the latest regulatory requirements, Yicai learned. Mainland Chinese customers must now show proof of permanent residency in another country to open an account.

Tiger Brokers’ customer service center echoed this message, saying that since last week the Beijing-based securities firm no longer accepts applications to open an account from mainland residents who provide documents proving that they work or live overseas. Only clients with non-mainland identification documents are eligible.

[…] The US’ Interactive Brokers, the world’s largest online brokerage, also started to make it more difficult for mainland Chinese to open accounts in August, and its app has been pulled from Chinese app stores, Yicai previously reported.” Yicai Global

It wasn’t the cleanest path, but it worked – a loophole that let many mainlanders gain access to offshore trading platforms without having to jump through the full set of regulatory hoops.

But that door now seems closed. Going forward, the only way a mainland Chinese citizen can open an account with Tiger is if they hold a non-mainland permanent residency ID. In other words, a foreign permanent residency or a Hong Kong permanent ID, not just a student visa, work pass, or overseas lease contract.

That may sound technical, but it matters for Tiger as the channel of “proof of overseas residence” was widely used, and in capital-controlled systems like China’s, every channel matters. It’s one more patch sewn into the quilt of regulations designed to slow the leakage of capital out of the mainland.

Nothing here implies forced closure of existing funded accounts – the friction sits at the top of the funnel. Existing users keep trading; the impact is about who can open or upgrade in the future.

Now, to put this in perspective: this is not the first time Tiger has had to adapt. The big shift happened back in 2021-22, when regulators forced both Tiger and Futu to pull their apps from Chinese app stores. That was a true crackdown moment – it cut off the broad funnel of mainland retail clients and made it crystal clear that Beijing would not tolerate unrestricted offshore brokerage activity.

Also, it’s important to underline what that earlier crackdown did not do. Neither Tiger nor Futu were fined, and no existing clients were deleted or forced to withdraw funds. Those accounts stayed active and could still trade. The focus was never on banning stock trading itself but on controlling RMB outflows; Beijing’s concern has consistently been about capital management, not erasing the brokerage industry.

What we’re seeing now is incremental rather than revolutionary. It’s a tightening of eligibility, not a forced exit. Existing accounts remain intact, and the business is still allowed to operate with non-mainland clients.

So why did the market flinch? Partly because ambiguity is always dangerous in China-related regulation. Investors know from history that a small rule change can sometimes precede a larger move. The fear is less about the exact letter of this restriction and more about what it signals: the authorities remain determined to close loopholes, and the ground under Tiger’s feet is never fully stable. In the absence of hard numbers, markets tend to extrapolate to worst-case scenarios.

But there’s another reason: when it comes to platforms like Tiger, growth expectations are deeply tied to user onboarding. Headlines that mention “restrictions on new users” hit directly at the heart of the growth story. Even if the actual impact is limited, the perception is that the funnel narrows again. And in markets, perception matters just as much as fundamentals – at least in the short term.

That’s why I see this as a classic case of overreaction to regulatory ambiguity. The news is negative, yes, but it’s not a repeat of 2022. It doesn’t mean the business in mainland China has been shut down entirely. It means one entry point has been blocked, and the company must lean more heavily on other regions – Hong Kong, Singapore, Southeast Asia – to drive growth.

This is where it gets interesting:

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.

Don’t miss this special, but limited offer:

Lock In Today’s Price Before October 1 (with a Discount): A Note to Readers

Starting October 1, subscription prices on my blog will increase. The annual subscription will rise by 16% (from 249€ to 289€), while the monthly plan will move from €79 to €99.