Deep Dive: Tiger Brokers ($TIGR)

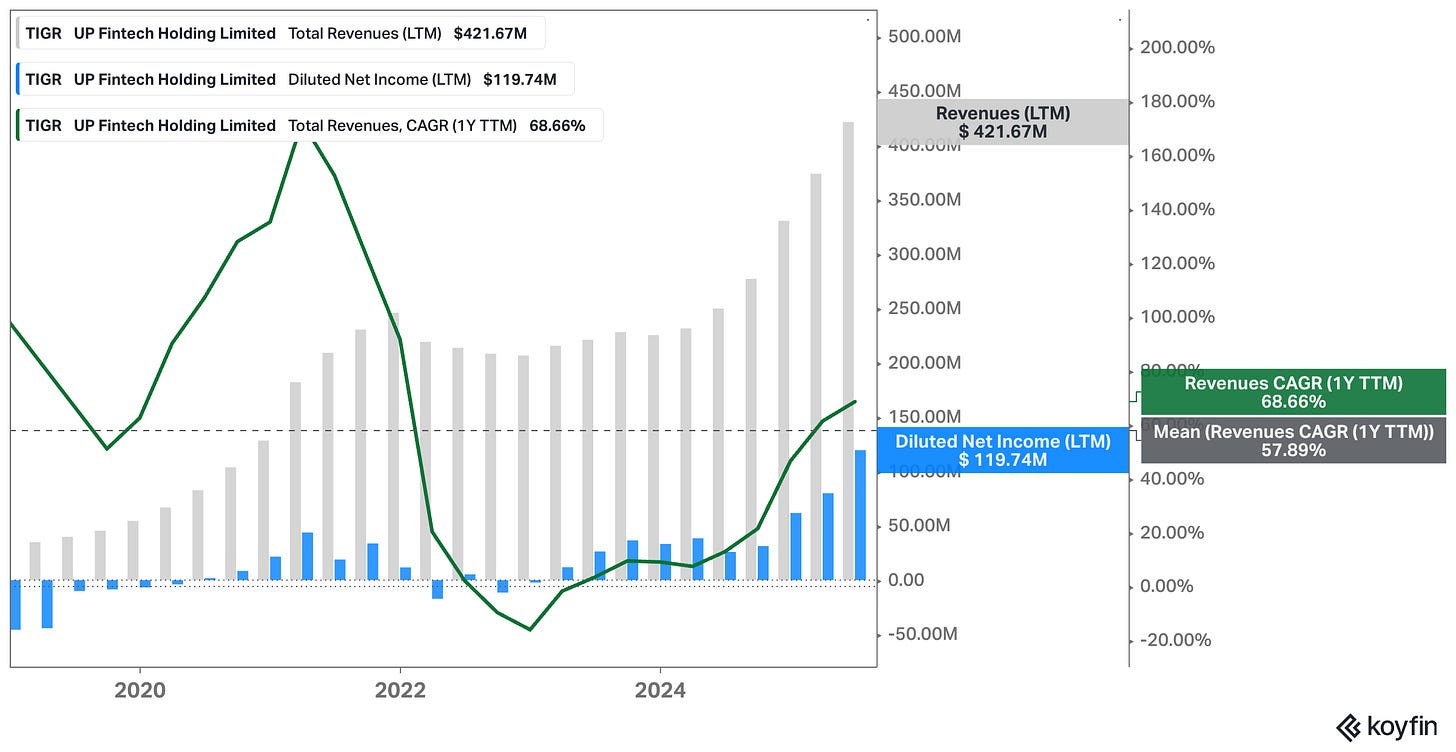

Early Innings in a Massive TAM? – 13x Earnings, 59% Revenue Growth

When you look at UP Fintech Holding – better known as Tiger Brokers – it’s hard not to notice the paradox. On the one hand, the company just reported record highs in revenue, profit, client assets, and funded accounts. Growth is high – very high! – international expansion is successful (so far) and paying off, and the balance sheet is cleaner than it’s been in years. On the other hand, the stock – despite a spectacular run – still trades at levels that imply a heavy dose of skepticism, arguably weighed down by lawsuits, China’s regulatory baggage, worries about peak earnings, and investor doubts about whether Tiger can ever catch up to rival Futu.

Just look at the chart below: after the post-Covid hype sent shares briefly above $30 in early 2021, the stock collapsed into obscurity, drifting around $3–4 for much of 2023 and early 2024. Most investors had written it off as another casualty of China’s shifting regulatory environment. Fast forward to today, and Tiger is trading at $12.50 – up 93% year-to-date and more than 240% over the past twelve months.

On the surface, that kind of move might scream “too late.” A stock that triples in a year rarely looks like a compelling entry point to me. But the numbers underneath tell a different story. Tiger has been posting record client growth, expanding internationally, and steadily widening its margins.

It’s a business that, in some ways, resembles Robinhood – a retail brokerage catering to the next generation of investors – but at a fraction of the valuation. Where Robinhood trades at a premium despite slowing engagement, Tiger’s profitability is accelerating, yet the market still treats it like a risky China-exposed play.

That’s the disconnect I want to explore. Has Tiger’s rally already priced in all the good news, or is this the early innings of a more sustained recovery? Is it a second-tier broker riding temporary tailwinds, or has it quietly built a foundation that could make it a long-term compounder? The answers aren’t simple, but they’re worth digging into. Because sometimes, the best opportunities hide inside the stories most investors gave up on too soon.

In this post, I go deep into Tiger Brokers – roughly 23,000 words – and cover:

The disconnect between Tiger’s recent business performance and how the market still prices the stock

A 90-second “Bam Bam Bam Bam Bam” pitch inspired by Bill Miller – what makes Tiger interesting now

An in-depth breakdown of the business model – how Tiger makes money, where the leverage lies, and how that’s changing

A close look at the core product: how differentiated it is, who it serves, and what role it plays in customers’ financial lives

A closer look at customers: demographics, account quality, retention dynamics, and why average balances matter more than headline account numbers

A detailed operating perspective based on balance sheet structure – what the numbers reveal about scalability and risk

A full-blown competitive advantage analysis: what moat (if any) exists, and whether it’s widening, shrinking, or still forming

The risk of false moats – and why great execution doesn’t automatically mean defensibility

A nuanced view of the customer base, customer acquisition costs & payback periods, retention profile, and embedded stickiness

My framework for assessing management quality – based on actions, not words – including capital allocation discipline and founder alignment

An inversion of the entire thesis – where I challenge myself to kill the idea, pressure-test assumptions, and spotlight the real downside scenarios

A wide-ranging risk analysis that doesn’t just list uncertainties but ranks their potential to break the thesis

Valuation framed simply – long-term user and asset growth, normalized margins, and why entry multiple matters less than execution

Scenario analysis: what Tiger looks like in ten years if margins converge with peers, and why consensus estimates understate earnings power

Relative valuation versus Robinhood, Webull, Futu, and IBKR

A synthesis of why I think the risk/reward setup here could be asymmetric, and what would need to happen for this to become a long-term winner

Before we dive back in, a quick note…

If you're a free subscriber, this might be a good time to consider upgrading. These deep dives are written with full transparency, high analytical depth, and zero fluff – and they’re designed to help you sharpen your own process, not just follow someone else’s opinion.

Disclaimer: I own UP Fintech shares. The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

90-Second Pitch: Bam Bam Bam Bam Bam – Why Tiger Brokers, and Why Now?

Bill Miller once said that if you can’t pitch a stock in 90 seconds, you don’t really understand it. You should be able to say: “It’s trading at X, it’s worth Y, and here are five reasons why.” Simple. Punchy. Conviction in bullet form.

So here’s my attempt – not to oversimplify, but to crystallize what makes UP Fintech (Tiger Brokers) interesting right now, after a 240% run in twelve months:

This is a misunderstood brokerage business, currently firing on all cylinders, emerging from years of regulatory uncertainty, now hitting its stride operationally and structurally mispriced relative to both its fundamentals and peers.

Here’s what I’d say in that 90-second window:

BAM: Tiger has just posted its strongest quarter in company history – record revenues, record profit, record net asset inflows. This isn’t a bounce-back; it’s an inflection.

BAM: Over 70% of new funded accounts now come from outside the Greater China area, and the international business is higher-margin, higher-ARPU, and growing faster than the legacy base (“For the first question about the regional breakdown of new funded accounts, in the second quarter, about 50% of newly funded accounts came from Singapore and Southeast Asia region, approximately 30% were from Hong Kong and the Greater China area, 15% from Australia and New Zealand market and around 5% from the U.S. market.“ – Q2 Call).

BAM: The business is scaling with operating leverage, and Tiger is closing the profitability gap to Futu quarter by quarter.

BAM: It still trades at a steep discount to Robinhood – despite better customer economics in some key markets, and a more global, asset-rich client base.

BAM: The risk profile has changed dramatically. China’s crackdown is in the rear-view mirror, the mainland business is shut, and Tiger is now building around regulated hubs in Hong Kong, Singapore, Australia, and the U.S.

So why now? Why bother writing about this stock after such a huge run? I’d say that’s atypical for me.

Because apparently, despite the rally, the market still sees the old Tiger – the China-exposed brokerage with headline risk, legal overhang, and meme-stock clients. It doesn’t see the new Tiger – a profitable, increasingly global, tech-driven platform with long-term optionality in crypto, wealth management, B2B, with margin expansion and a focus on high-quality clients (i.e. decently large account sizes; more on the importance of this metric further below in the deep dive).

That misperception creates the opportunity. Tiger is behaving like a business that deserves a higher multiple – but it’s still priced like one waiting for the other shoe to drop. The core of the bet is that fundamentals have changed faster than sentiment, and price hasn’t caught up yet.

Part 1: Understanding Tiger

What Exactly Does Tiger Sell?

At its core, Tiger is a brokerage. But that label doesn’t quite capture the full picture of what it actually sells – or how differentiated its offering has become. Tiger offers a fully digital, mobile-first investment platform aimed at retail investors, primarily outside the U.S., and increasingly outside of China.

“Regarding total client assets, net asset inflows remained robust, reaching USD 3 billion in the second quarter, over 70% of which came from retail investors.“ - Q2 Call

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.