Deep Dive: Revisiting Wise ($WISE)

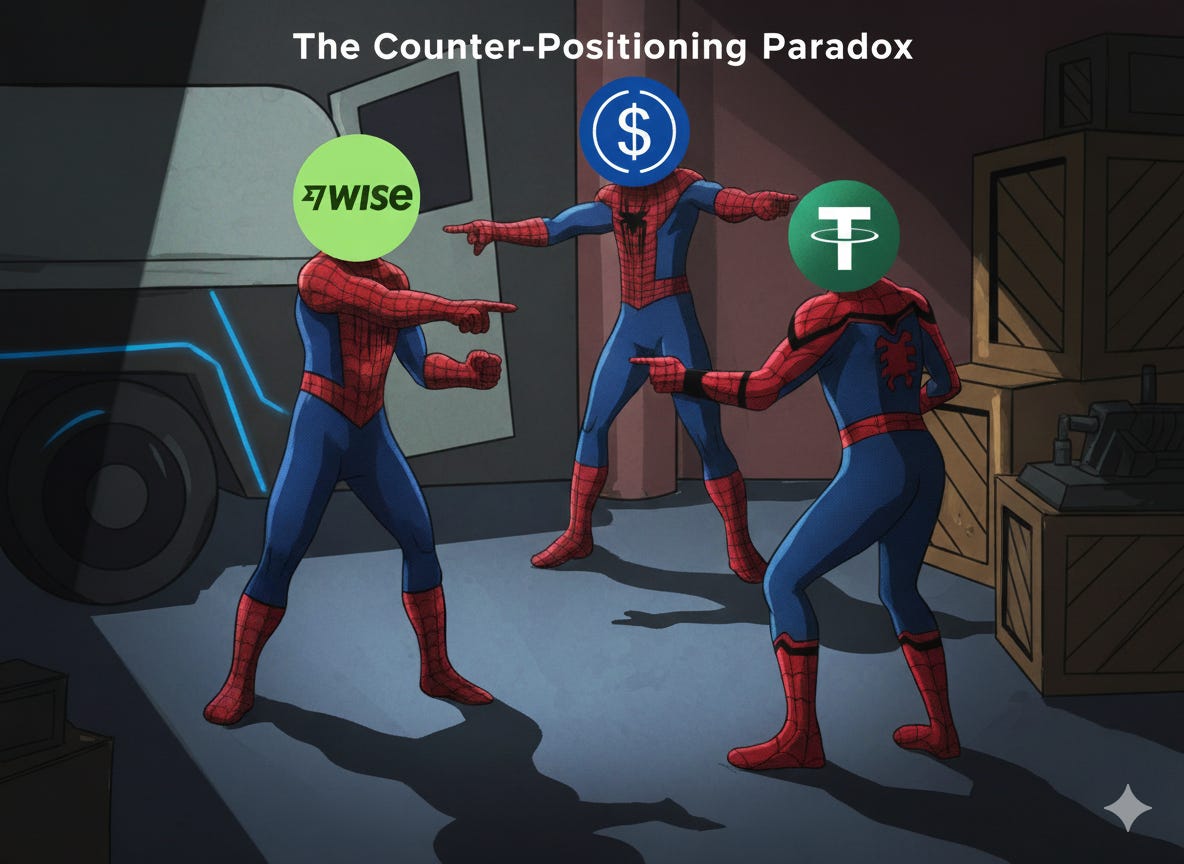

From Counter-Positioning to Being Counter Positioned: Wise, Stablecoins, and the Psychology of Pivoting

A few days ago, a subscriber reached out and asked whether I’d ever written a full deep dive on Wise. I told him, truthfully, that I hadn’t – and probably wouldn’t. Not because Wise isn’t fascinating (it is), but because there are already lots of excellent pieces out there that cover the key pillars of the business and investment thesis in great depth. And two in particular:

One is a comprehensive write-up by Money Flow Research (+ a 2024 thesis update)

And the other a more concise but equally sharp analysis by Jake Barfield.

On top of that, Ennismore recently shared a succinct investment thesis on Wise, and on VIC a new write-up recently surfaced as well.

In short, there’s no shortage of great foundational research on Wise. Enjoy reading it!

What I find more valuable at this point is tracking the thesis – how it evolves, how it’s being tested by new developments, and what could reshape the path toward the company’s much-discussed $100 billion potential valuation.

Because the deeper I follow this story, the more it feels like Wise is entering an entirely new chapter – one in which it faces a competitive vector that looks very different from anything it’s encountered before.

I published the piece below in June:

Will Stablecoins Kill Wise, Visa, and Mastercard? A Deep Dive into the Real Threat – and the Hype

The term “Stablecoin” surfaces everywhere right now. Not just on crypto Twitter or niche Telegram groups – they’re now dominating the conversation at the highest levels of politics, policy, and payments.

This post began with a private conversation I had with Mike Kytka from Money Flow Research (I linked his work above). Mike has been one of the most thoughtful Wise analysts I’ve come across, and in a recent exchange, he brought up an idea that’s been echoing in my head ever since:

What if Wise – once the quintessential counter-positioned company – is now being counter positioned itself?

That framing immediately clicked with me. It connects two powerful threads. On one hand, the strategic concept of counter positioning from Hamilton Helmer’s 7 Powers, which describes how a new entrant can adopt a superior business model that incumbents can’t or won’t copy because it would destroy their existing profit pools.

On the other, the rise of a new technological vector – stablecoins – which could, at least in theory, undercut Wise’s model in much the same way Wise once undercut the banks.

The irony here is hard to ignore. Wise built its entire identity around disrupting a slow, opaque, and fee-heavy system. Now, a decade later, it possibly finds itself in a similar position to the institutions it once disrupted – facing a challenger that claims to be faster, cheaper, and more scalable.

But this isn’t a simple David-and-Goliath story. Wise isn’t your typical incumbent, and the stablecoin ecosystem isn’t a typical startup threat. The emerging competition operates on a new layer of financial infrastructure that doesn’t seek to mimic Wise’s model – it seeks to bypass it. That’s what makes this dynamic so interesting.

In this post, I want to unpack that idea step by step.

First, I’ll revisit the original concept of counter positioning and how Wise embodied it in its early years. Then, I’ll explore what it means for a company like Wise to face a counter-positioned competitor – including the psychological and strategic challenges that come with that. From there, I’ll argue that Wise’s corporate DNA may actually make it more adaptable than most incumbents in such a situation. And finally, I’ll close with a reflection on what this all means for investors tracking the stock.

This isn’t meant to be a conclusive analysis. It’s food for thought – a continuation of an ongoing discussion. Mike and I might even explore this further on an upcoming podcast, where we’ll try to dissect the question from both sides. For now, though, let’s start at the beginning – with the idea of counter positioning itself.

The full analysis starts here:

The rest of this post covers the structure of the brokerage business. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more) and powerful investing frameworks. is just a click away. Upgrade your subscription, support my work, and keep learning.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.