Deep Dive: Wise ($WISE)

Will Stablecoins Kill Wise, Visa, and Mastercard? A Deep Dive into the Real Threat – and the Hype

The term “Stablecoin” surfaces everywhere right now. Not just on crypto Twitter or niche Telegram groups – they’re now dominating the conversation at the highest levels of politics, policy, and payments.

And when I say everywhere, I mean it:

Last week, news broke that Amazon and Walmart are mulling over launching their own.

Earlier this year, Stripe acquired a stablecoin infrastructure startup for $1.1 billion (“It’s been incredible hearing from users just how big of an impact stablecoin infrastructure is already making. We believe stablecoins will play a critical role in turbocharging cross-border commerce.“).

Paypal continues to push forward with its own token (PayPal USD (PYUSD)).

Visa has started settling transactions in USDC long ago.

And now, the US government is making stablecoins a national priority.

The Trump administration – in a sharp break from its predecessor – has decided to lean hard into digital assets. Treasury Secretary Scott Bessent has been out in front of this policy shift, tweeting with the energy of a startup founder and the conviction of someone who sees the window of opportunity closing fast. In one post, he declared that “stablecoins could grow into a $3.7 trillion market by the end of the decade,” pointing to the GENIUS Act as the legislative vehicle to get there. In another, he argued that “crypto is not a threat to the dollar – in fact, stablecoins can reinforce dollar supremacy.”

These aren’t offhand remarks; they’re the foundation of a concerted push to establish the US as the global epicenter of digital finance.

And while some of this rhetoric feels a bit ironic – it’s hard to demand regulatory clarity with a straight face when the President is simultaneously launching memecoins for personal gain – there’s real legislative movement here. The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) proposes a streamlined federal framework for issuing and regulating stablecoins. It failed to pass the Senate back in May but cleared that hurdle just this week.

“With this bill, the United States is one step closer to becoming the global leader in crypto. […] Once the GENIUS Act is law, businesses of all sizes, and Americans across the country will be able to settle payments nearly instantaneously rather than waiting for days or sometimes even weeks.“ – Tennessee Senator Bill Hagerty

For the first time, there's a serious attempt to bring stablecoins into the heart of the U.S. financial system with bipartisan backing and institutional momentum. If passed by the House and signed into law, the act could remove one of the biggest friction points for stablecoin adoption: regulatory uncertainty.

The Stablecoin Tsunami: A Macro Shift?

Meanwhile, the private sector isn’t waiting. The Wall Street Journal recently reported that Amazon and Walmart are exploring how to issue their own stablecoins.

That alone was enough to trigger a sell-off in Visa and Mastercard shares, down 5% on the day the news broke and down 8.5% over the last five trading days.

Their reporting highlighted a key threat: stablecoins could bypass traditional payment rails entirely, saving large merchants billions in processing fees. Other players, like Expedia and several major airlines, are also testing the waters. It’s not a stretch to imagine a future where stablecoin-based systems run in parallel to – or even compete with – existing card and bank networks.

Stripe’s acquisition of Bridge may end up being just as significant. Bridge is arguably the leading orchestration platform for stablecoins – making it easier for companies to integrate stablecoin functionality into real-world financial workflows. Stripe’s founder Patrick Collison described stablecoins as “room-temperature superconductors for financial services,” which, hyperbole aside, captures how transformational they might be. In his own words, the top use cases for stablecoins already span treasury management, remittances, savings in unstable currency environments, and global payments infrastructure. Think: SpaceX repatriating funds from Starlink sales in Argentina and Nigeria. Or DolarApp helping workers in Mexico receive USD payroll. Or Airtm distributing freelance income across Latin America. These are live use cases, not blue-sky projections.

The transaction volume of stablecoins is certainly trending upwards:

According to this article, Stablecoins are now even processing over $15 billion in daily transactions.

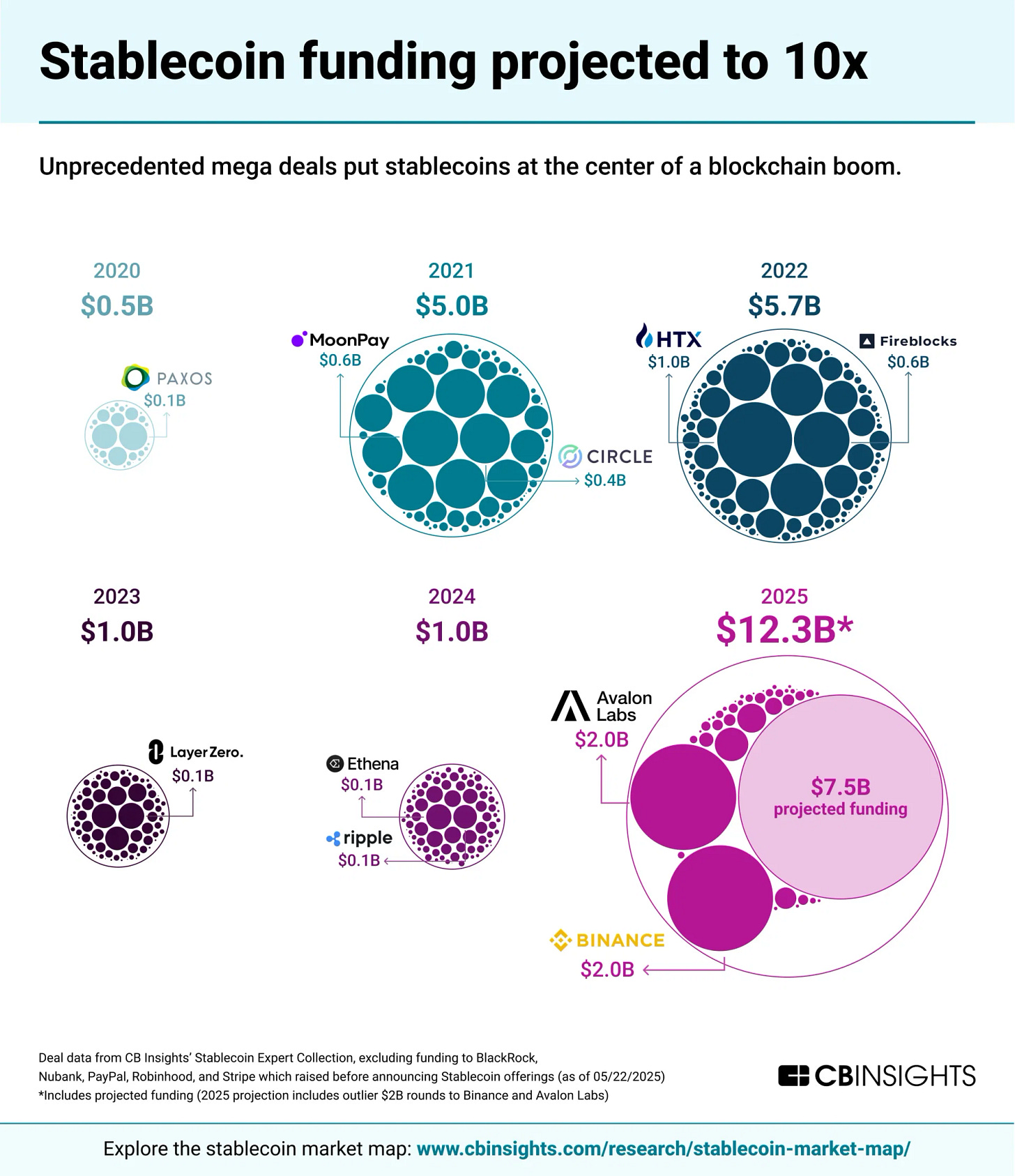

The funding environment reflects that shift in sentiment. In 2024, stablecoin startups raised around $1 billion. In 2025, that number is expected to jump to $12.3 billion. That’s not a typo. A 10x increase in funding year-over-year. Analysts attribute this to four overlapping forces: institutional entry from big names like Mastercard and Visa; regulatory clarity from bills like the GENIUS Act; expanding use cases beyond just transfers; and the increasing role of stablecoins in cross-border finance. Put differently, the floodgates are open.

So where does this leave Wise (we’ll later also discuss the implications for Visa and Mastercard)?

The idea that stablecoins could disrupt Wise isn’t new. It’s been floating around the edges of fintech discourse for a few years now. But the recent flurry of activity – legislative, corporate, technological – gives that risk more weight and I believe rightfully demands more attention from investors in Wise and its peers.

Stablecoins aren’t just a crypto curiosity anymore. They’re evolving into a genuine competitor to traditional financial infrastructure. And if that’s the case, Wise – a company built on rethinking how money moves globally – could be in the crosshairs.

Now, I should disclose that Wise is a major position in my portfolio. Which is precisely why I want to analyze this carefully. Is the risk overblown? Is it underestimated? What would have to happen for stablecoins to materially erode Wise’s business model? And is Wise in a position to adapt – or even benefit – if this trend keeps accelerating?

This post is my attempt to unpack those questions.

Here’s what else I’ll explore in this post :

Why stablecoins have become the hottest trend in the digital asset space – and what Stripe, Walmart, Amazon, and even the U.S. Treasury have to do with it

How the GENIUS Act and recent regulatory shifts could supercharge stablecoin adoption

To what extent stablecoins offer frictionless global payments

Why Wise’s domestic payment rail model may still beat blockchain-based alternatives

How Stripe’s Bridge platform works under the hood – and why it might be more complementary than competitive

Insights from Wise’s management team on blockchain, crypto, and when they’d actually integrate it

What former employees, investors, and analysts like FermatCap are saying about crypto’s disruption potential

The market structure question: one dominant stablecoin vs. many fragmented merchant coins – and what each means for Wise, Visa, and Mastercard

Why Visa and Mastercard may benefit from stablecoin growth – not suffer from it

And ultimately, whether stablecoins represent a true existential threat to Wise… or just another overhyped innovation wave

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

Thank you for your support!

Part 1: What Stablecoins Actually Are – The Dollar’s Digital Doppelgänger?

Before I dive into how serious a threat stablecoins might be to Wise, we need to be crystal clear on what they actually are. It’s one of those terms that gets thrown around so often – in newsletters, earnings calls, Twitter threads – that it’s easy to forget how opaque the mechanics still are to most people. And if you want to seriously assess whether this technology could upend a company like Wise, you have to understand how the plumbing works.

At the most basic level, a stablecoin is a digital token designed to maintain a stable value – typically pegged 1:1 to a fiat currency like the US dollar, the euro, or increasingly, even tokenized T-bills. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, which can swing wildly from one day to the next, stablecoins are built for predictability. They’re not speculative assets; they’re meant to behave more like digital cash.

So how do they stay stable?

There are different models, but most of the large-scale stablecoins today are fully backed by reserves of government-issued currencies and short-duration investment grade sovereign debt securities (Fiat-Collateralized Stablecoin Model). Take USDC, issued by Circle, or USDT (Tether) – the two dominant players in the space. When someone buys $100 worth of USDC, Circle takes that $100 and places it in a mix of short-term US Treasuries, cash, and other conservative instruments. The token you receive is essentially a digital IOU – a written acknowledgment of a debt, often used as a temporary substitute for a more formal loan agreement (IOU It stands for "I owe you").

You can redeem it at any time for fiat. It’s not all that different from how eurodollars or money market funds operate – except now it’s programmable, blockchain-native, and globally accessible.

There are also more experimental versions like algorithmic stablecoins, which attempt to maintain a peg without external reserves by manipulating supply and demand. These, to put it mildly, haven’t worked well. Terra/Luna’s spectacular collapse in 2022 wiped out tens of billions of dollars and obliterated investor confidence in anything “algostable.” Since then, the market has mostly coalesced around the collateral-backed model.

To make all of this work, stablecoins live on public blockchains. That’s what makes them interoperable, borderless, and programmable. Whether they’re running on Ethereum, Solana, or Avalanche, stablecoins can – in theory – be transferred globally in minutes, settled 24/7, and integrated directly into other applications from payroll platforms to decentralized finance protocols. The infrastructure is permissionless and composable by design, which gives developers (and, increasingly, businesses) a wide array of use cases.

And those use cases are proliferating fast.

Stablecoins are already being used for cross-border payroll (e.g. Deel via DolarApp), global contractor payments (e.g. Airtm, Request Finance), treasury management (e.g. Stripe Treasury, Ondo Finance), yield farming (e.g. MakerDAO, Yearn), and even interbank settlement (e.g. JPMorgan’s Onyx, Signet by Signature Bank before its shutdown).

Companies like Circle and Paxos are issuing compliant, transparent stablecoins with full audits and regulatory oversight. Governments are starting to take notice too – not just with legislation like the GENIUS Act, but with pilot programs that explore tokenized cash and central bank digital currencies (CBDCs). The distinction is blurry, but important: most stablecoins today are privately issued, not central bank money – but they exist in the same conceptual universe.

Let’s take a quick look at the major players:

USDC (Circle): Known for regulatory compliance, transparency, and strong partnerships (Visa, Stripe, BlackRock). Backed by short-term U.S. Treasuries and cash.

USDT (Tether): The OG in the space, with the highest trading volume by far. More opaque historically but increasingly trying to clean up its image.

DAI (MakerDAO): Decentralized stablecoin backed by overcollateralized crypto assets. Algorithmically managed, but backed by real value.

PYUSD (Paypal): The first stablecoin launched by a major payments player. Early days, but represents a significant bridge to mainstream finance.

EURC (Circle): A euro-denominated stablecoin issued by the same group behind USDC – aiming to offer parity in European markets.

Now, if this all feels a little abstract (honestly, I’m way out of my circle of competence here too), here’s a quick analogy that may help simplify things:

Imagine you walk into a casino and exchange $100 for 100 chips. Those chips can be used anywhere inside the casino – to bet, to tip, to pay for drinks – but they always represent $1 each. You can walk up to the cashier at any point and trade them back for cash. That’s a stablecoin. It’s casino chips for the internet. Except instead of one casino, you’ve got thousands of apps, wallets, and services that all agree on the value of your chips. And instead of walking up to a human cashier, the redemption happens digitally, instantly, and globally.

Now extend that metaphor to payroll, savings, international trade, remittances, or even sovereign reserves, and you start to see why people are calling stablecoins the most viable crypto use case to date.

But this brings us back to the key question: Does that actually put pressure on Wise? And if so, how much?

Part 2: Why Stablecoins Aren’t Frictionless (Yet) – The Case for Wise’s Resilience

Stablecoins are often marketed as the antidote to everything that’s broken in global payments. No bank middlemen, no expensive wire transfers, no timezone-dependent delays. Just fast, cheap, and borderless value transfer. But that pitch – elegant as it sounds – tends to gloss over a much messier reality. Especially when we zoom in on cross-border FX.

Curious what’s how stablecoins will impact Wise, Visa, Mastercard, and other peers? The best part is just ahead — unlock the full post to continue.

My paid posts are designed to be reference tools – not just interesting reads. Templates, checklists, case studies, valuation breakdowns – it’s all there. Unlock the rest of this post and the full archive with a subscription.