[FREE] Everything You Thought Was Safe… Isn’t Anymore! – Jeffrey Gundlach Unpacks the Shift

Gundlach on Gold, Stocks, the US-Dollar, Treasuries, and the Quiet Collapse of Private Credit

When Jeffrey Gundlach speaks, I listen. Not because I expect him to be right about everything – no one is – but because he has an uncanny ability to see the deeper shifts behind the noise.

Over the past couple of months, I’ve come to respect Gundlach as one of the very few people regularly appearing on CNBC, Bloomberg and the likes, who consistently operates outside the herd. He’s not just reacting to headlines or chasing lagging indicators. He’s thinking long term. And he’s reasoning by foresight – connecting dots, thinking in second- and third-order consequences, and surfacing signals that rarely make it onto mainstream investing TV networks.

There’s a clarity to his thinking that I find both refreshing and rare. Of course, not all of his predictions will be accurate, but more often than not, he’s been directionally right, which is why it’s worth listening when he speaks.

At the recent Bloomberg Global Credit Forum in Los Angeles, Gundlach once again did what he does best: step back from the chaos and offer a brutally honest view of where he thinks the macro winds are shifting.

His message this time? The old playbook is broken. The U.S. fiscal path is no longer sustainable. The so-called “safe” assets – long-dated Treasuries, the U.S. dollar – are starting to behave in strange and disturbing ways. Capital is beginning to move differently. And gold, once the province of doomsday preppers, is suddenly getting shelf space at Costco and headlines in mainstream finance.

“There’s an awareness now that the long-term Treasury bond is not a legitimate flight-to-quality asset,” Gundlach said bluntly. “A reckoning is coming.”

And that reckoning, if it plays out as he suggests, could reshape asset allocation in ways we haven’t seen since the dot-com bust or the global financial crisis. This interview was packed with so much hard-earned wisdom that I found myself taking notes just to make sure I internalize the key lessons. So what follows is not just a recap – it’s my own attempt to learn from it.

You can watch the interview yourself (linked below), or if you prefer a written summary of his key insights (I’ve identified seven in total) with added charts, read on!

Insight #1: The Debt Spiral Nobody Wants to Talk About

The first – and arguably most pressing – insight Gundlach hammered home is that the U.S. government’s interest burden is spiraling out of control. Of course, he’s not the first one to bring this up, but this really isn’t a theoretical future problem anymore.

It’s happening now, invisibly compounding in the background while quite a few market participants still treat Treasury bonds as risk-free assets.

“What people fail to appreciate,” Gundlach said, “is how much the average Treasury payment has gone up.” And he’s right. The average coupon on the Treasury market was below 2% not long ago. Now, it’s pushing 4%.

That sounds manageable until you consider the sheer size of the debt rolling over. Bonds issued in the ultra-low rate era of 2008/09 or even 2019 are now maturing, only to be refinanced at rates 300 to 400 basis points higher.

“There are trillions and trillions of dollars in debt maturing—much of it issued back in 2009, and in other periods like 2019. Some of that debt is now coming due. It was originally issued with coupons of just a quarter percent, and now the refinancing rate is around four and a quarter percent—400 basis points higher.

This problem continues to build. And there’s growing awareness that the long-term Treasury bond is no longer a legitimate flight-to-quality asset. It’s not responding to lower interest rates, and it’s not really reacting to an inflation rate of 2.5%. That inflation rate will probably go higher.”

The result? A compounding interest bill on trillions of dollars.

Gundlach called it “untenable,” and it’s hard to argue with that characterization. If current deficits and interest rates persist, the U.S. will be spending staggering amounts just to service its existing debt. That crowds out future spending, policy flexibility, and eventually even the credibility of Treasury bonds as the global safe haven.

“I think what we have is a recognition that the interest expense for the United States is untenable if we continue running this budget deficit and continue to have sticky interest rates.“

He added a key line that stuck with me: “We have to somehow figure out how we’re going to deal with $37 trillion.” Not in theory – but soon. The national debt is accelerating toward that number at a pace that should make any long-term investor uneasy.

“It will not take ten years. It won’t take five years. The panel before me said—and I think it’s true—that 2027 and 2028 are likely to be a window of tremendous opportunity. I think by then, the Treasury problem will be even more in focus than it is today, and it will weigh heavily on market behavior.

We need to restructure a lot of things in our system. We need to restructure institutions. We need to restructure political parties. We need to restructure our finances. All of these things have been in place—these are the waves of history.

Neil Howe calls it the Fourth Turning. He wrote the book that predicted the credit crisis around 2006. Pretty good. I know him fairly well, and we talk about the same concepts. That is, societies start with a pact: they have the means of production, and then they have the property system that allocates rewards.

Right after World War II, or the Civil War, it starts out with everybody buying into how the system works. But there’s a fundamental problem with the duality between property relations and the means of production. The means of production change in revolutionary ways—steam engine, radio, television, telephone, internet, AI. These are explosions of innovation.

But property relations don’t change very quickly. They evolve slowly, if at all. And over time, wealth inequality emerges—something we are now seeing in extreme form—where the people who benefit from the existing property relations resist any change because they are winning.

We now have a tremendous concentration of wealth and power. Property relations have become calcified, while the means of production are causing massive disruption, intensifying wealth inequality. At some point, the whole system says: this doesn’t work. We have to realign property relations to avoid slipping into a feudal system with lords and serfs. That’s essentially where we are, and we need to reconfigure everything.

The rising interest expense and unaffordability of government debt are just another offshoot of this. It’s all connected. We need institutions that people actually believe in.”

This is where Gundlach’s thinking becomes especially valuable. He doesn’t stop at describing the current data – he connects it to second- and third-order consequences. And one of those consequences, in his view, is that global capital is starting to reconsider the dollar.

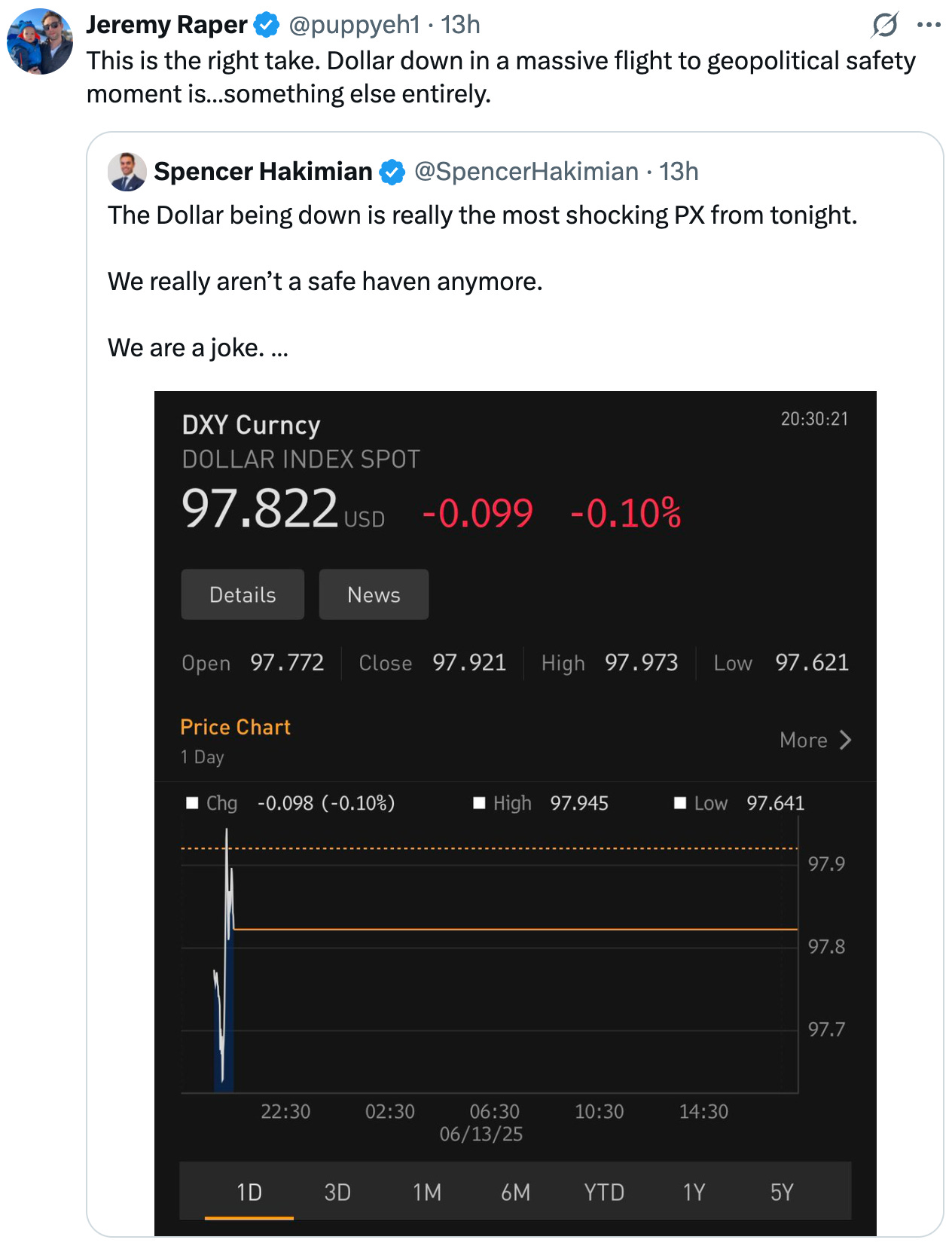

“When the S&P fell 20%,” he noted, “the dollar usually would’ve gone up. This time, it went down. That’s strange.” Strange, and possibly telling. It suggests that we may be entering a phase where the market begins to price in not just short-term volatility, but long-term fiscal unsustainability.

If Gundlach is right, then the old assumption – that the U.S. can run perpetual deficits with no consequence – may soon be tested. And investors who still see Treasuries as a no-brainer ballast in a diversified portfolio might be in for a shock.

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

Thank you for your support!

Insight #2: The Death of the Long Bond as a Safe Haven

One of the most striking parts of Gundlach’s thesis is his argument that the long bond – once the cornerstone of any flight-to-safety strategy – simply doesn’t work anymore. And not in a vague or hypothetical way. It’s already breaking down, in real time.

“There’s an awareness now,” he said, “that the long-term Treasury bond is not a legitimate flight-to-quality asset.” That line deserves to be underlined. Because if Treasuries no longer serve that role, the implications are enormous – not just for portfolio construction, but for how markets behave during moments of stress.

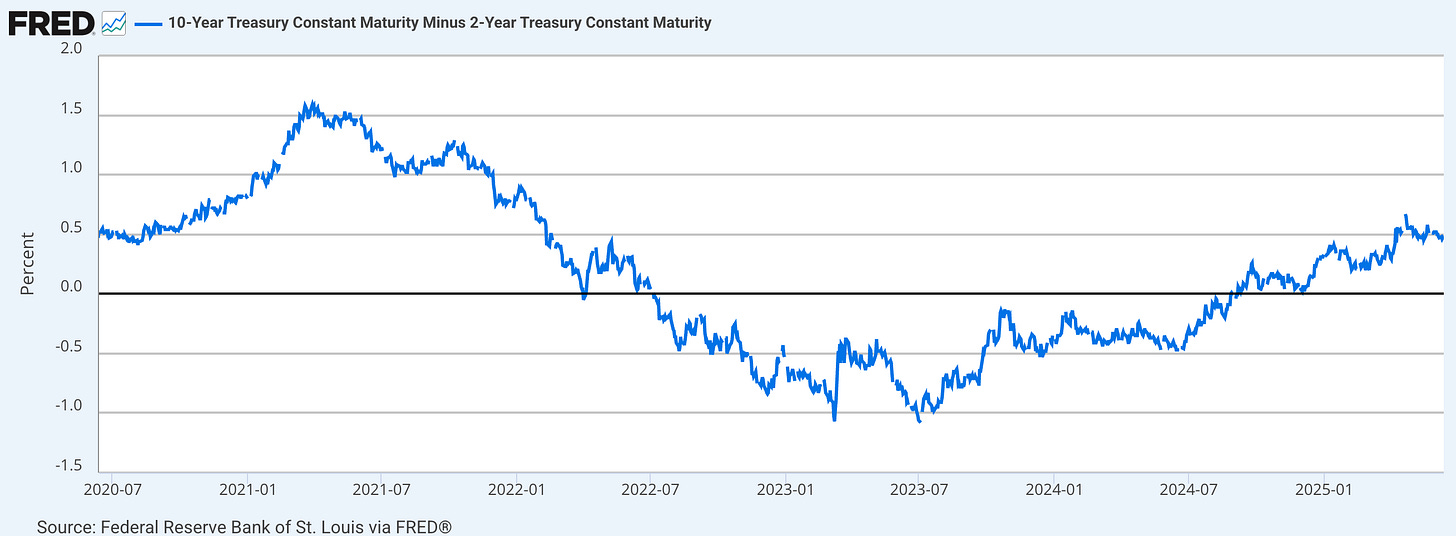

Traditionally, when equities sold off and the Fed started cutting rates, yields would fall across the curve, especially at the long end. That dynamic created a powerful hedge: as stocks went down, bonds rallied, cushioning portfolios. But that’s not what we’re seeing now. Gundlach pointed out that after the Fed’s first rate cut in late 2023, the 10-year yield rose. And it’s continued rising since. “The yield curve is steepening,” he said – and not for the right reasons.

In Gundlach’s view, the market is starting to price in long-term structural risks. Rising deficits. Uncontrolled interest expense. A shrinking buyer base for Treasuries. There’s a growing realization that the U.S. might have to issue trillions in new debt every year just to stay afloat.

And if investors are no longer confident that those bonds will hold their value, especially in real terms, then demand starts to shift elsewhere.

That’s already happening. “Money is not coming into the United States the way it used to,” Gundlach said. “The dollar is falling. The long bond is no longer responding the way it’s supposed to.”

If you zoom out, what we’re seeing is a slow erosion of trust. The kind that doesn’t show up all at once – but chips away at fundamentals until the break is obvious to everyone. And by then, of course, it’s too late.

For long-duration bonds, the warning signs are flashing. Gundlach sees a potential setup where yields rise to 6% before the Fed is forced to step in with quantitative easing – and when that day comes, the rally could be explosive. But in the meantime? He’s staying away from the long end.

“The leading candidate,” he said, “is that they will announce quantitative easing on buying long-term Treasuries.”

“It’s a paradigm shift.” And that paradigm shift, in his view, could eventually force the Fed into an uncomfortable corner: resume quantitative easing not because the economy demands it, but because the bond market does.

So, if Treasuries are no longer a source of safety, then what is? That’s where gold enters the conversation.

Insight #3: Gold Isn’t for ‘Lunatic Survivalists’ Anymore

Gold has always occupied a strange space in the investing world – admired in theory, dismissed in practice. For years, it was treated like a hedge for preppers and pessimists. But according to Gundlach, that era is over. Gold is no longer a fringe asset. It’s become the new flight to safety.

“We have a tremendous paradigm shift going on,” he said. “The long bond is not a flight to quality asset. Gold is suddenly the flight to quality asset.”

Gundlach sees gold as reclaiming its role in the global financial system – not because of some conspiracy theory or apocalyptic scenario, but because of how broken the alternatives have become. When Treasuries no longer hedge risk, and when the dollar’s strength is suspect, the market starts to look for a new anchor. And that anchor, in his view, is gold.

It’s not just talk. Central banks have shifted from net sellers of gold to net buyers. That’s a major turn, after more than a decade of divestment. “They sold it at $300,” Gundlach said. “And now they’re buying it back at $3,000.” That may not make them savvy long-term investors, but it does reveal something about the direction of global capital.

Retail demand is also spiking. Costco can’t keep gold bars in stock. Once gold broke above $2,000, it didn’t drift higher – it ripped. It’s now treated as a liquid, legitimate, and increasingly desirable asset class.

Gundlach has owned gold for decades – since it was $300 an ounce. But this is the first time he’s talked about it like this: not just as an inflation hedge, or a portfolio diversifier, but as the replacement for Treasuries in moments of fear. That’s a radical shift in positioning.

He even made a quick comparison to Bitcoin. If you’re in it for volatility and potential upside, he argued, you might be better off simply leveraging gold. Over the last year, gold and Bitcoin are both up over 40% – but one of them has been around for millennia, and the other is still figuring out how to scale transactions and fight off regulators.

“I think gold has proven to be a source of growth. If you are a Bitcoin person, I would recommend instead of being a Bitcoin person, you take the same volatility and get gold and leverage it twice. Gold has outperformed Bitcoin year to date even though Bitcoin has done well. They are both up 40-plus percent. That's the place to be.“

To Gundlach, gold is now the real asset class. Not a speculative trade. Not a relic. But a core pillar for any investor questioning the durability of the dollar or the credibility of U.S. debt.

In a world where the old hedges are faltering, gold is doing exactly what it’s supposed to do. And more investors are finally taking notice.

Before we dive back in, a quick note…

I started this blog because most investing content either overwhelms or oversimplifies. I wanted to build what I wish I had ten years ago: a resource that teaches how to think, not just what to buy. If that resonates, becoming a paid subscriber isn’t just support of my work, it’s also a ticket to deeper insights, mental models, and decision frameworks that can change how you invest forever.

Insight #4: Private Credit Is the New CDO

Gundlach didn’t mince words when asked where he sees cracks forming next. Without hesitation, he pointed to private credit – and the comparison he made couldn’t have been sharper. “Private credit today is analogous to the CDO market in the mid-2000s,” he said, referencing one of the most toxic epicenters of the global financial crisis.

That should make every allocator stop and think.

What worries him isn’t just the massive issuance – though there’s certainly been plenty of that. It’s the tremendous acceptance of the product. The universal buy-in. The marketing spin. The misplaced confidence. Gundlach described a recent private credit panel he listened in on: same language, same structure, same blind spots as CDO conference panels from 2006–07. That kind of déjà vu usually doesn’t end well.

His concerns are layered. First, the performance argument: private credit had great returns – but that was five to seven years ago, when it was still cheap and niche. Much of the performance data that gets cited today comes from that period. In the current environment, he pointed out, public credit has actually outperformed private credit for several quarters.

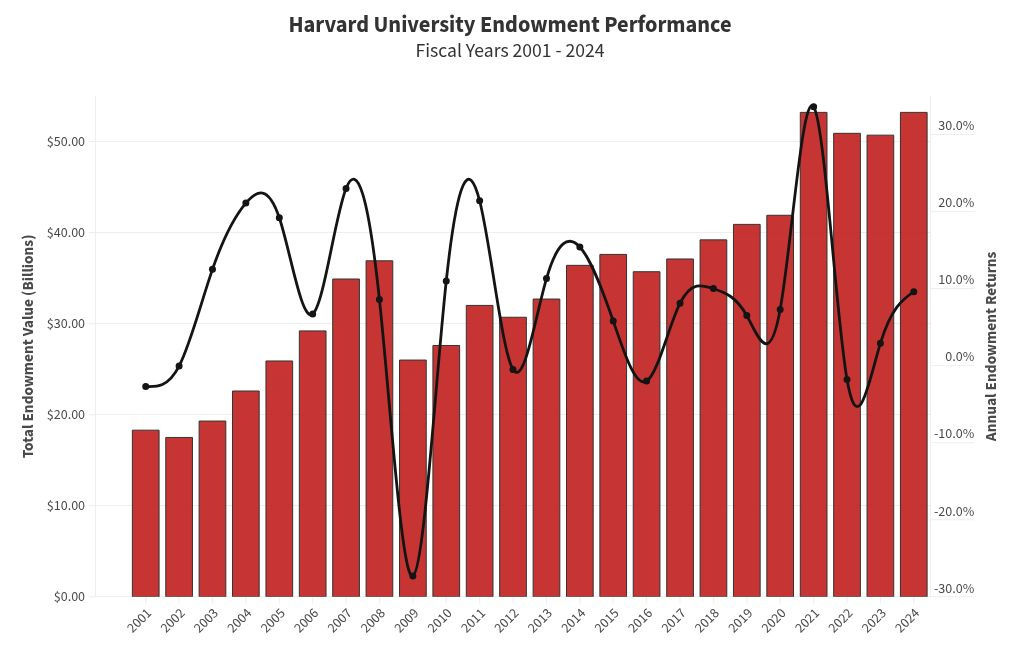

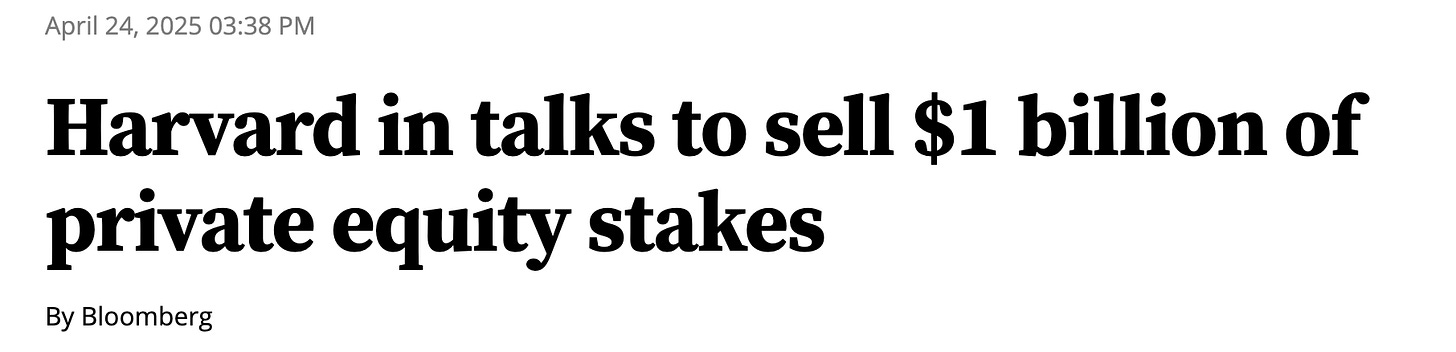

Second, the illiquidity. For instance, Harvard University, with its massive endowment – at $53.2 billion, Harvard's endowment is the largest in the world, with more than 70 percent of its portfolio given over to interests in hedge funds and private equity (PE representing around 40% of the fund) –, has had to issue debt twice recently to manage cash needs.

Now they’re reportedly looking to sell chunks of their private equity portfolio – at a discount. “If Harvard is publicly acknowledging liquidity problems,” he said, “I’ve got news for you – if there’s one cockroach in the kitchen, there’s never just one.”

“Private credit is extremely heavily invested in. Harvard University has the $53 billion endowment supposedly, but they had to come to the bond market twice because they didn’t have enough money. They have $53 billion in the campaign for repairs and operating expenses. They came to the bond market looking for a couple billion dollars and then came back again. Last week, I think it was announced that Harvard is thinking about selling some of their private equity interest at a discount.“

That’s the problem with overinvestment in illiquid assets. When the selling starts, it doesn’t matter what the price is – some sell because they have to. Not because they want to. And as Gundlach reminded us, the strongest driver of investment behavior sometimes isn’t fear or greed – it’s need.

He’s seen this before. In 2008, he was raising money for distressed mortgage securities that were yielding north of 20% IRRs even under brutal default assumptions – but institutions had no cash. “I don’t have $10 million,” a Stanford endowment manager told him. “I have no money. We’re all locked up.”

That’s what happens in a forced-selling cycle. Prices fall not because value disappears, but because liquidity does. Gundlach sees the setup forming again. Too many allocators crowded into a space that promises yield without showing its risk – until it does. “The excess reward,” he said, “isn’t even close to what it used to be.”

If he’s right, private credit could be the next shoe to drop. And when it does, it won’t be polite or orderly. It’ll be fast, messy, and unforgiving. Just like last time.

Insight #5: Momentum, Mania, and the AI Echo Chamber

One of the more philosophical – and in many ways most valuable – parts of the interview came when Gundlach reflected on the nature of bubbles.

He wasn’t just talking about AI stocks. He was talking about how narratives metastasize, how expectations race ahead of reality, and how long it takes for promised revolutions to actually deliver.

“I feel the environment feels a lot like 1999,” he said. “AI – just map over dot-com.”

That’s not to say the underlying technology isn’t real. It is. Just like electricity was real in 1900, or the internet in 1995. But markets don’t price in reality – they price in imagination. The story takes over, and the multiples stretch until they no longer make sense. Then something breaks.

Gundlach even went historical: electricity was hailed as the future in the early 20th century – and it was. But the outperformance of electricity stocks peaked in 1911, long before the productivity gains fully arrived.

“That happened with dot-coms,” he added. “Some of those were great investments, but the enthusiasm becomes very excessive.”

That’s what he sees now. Not just in AI stocks themselves, but in the ecosystem forming around them – the suppliers, the credit flows, the capital formation based on ideas that haven’t yet materialized. It’s momentum on momentum. Until it isn’t.

“It’s a momentum trade,” he said. “And when momentum breaks, the first loss is the best loss – and it turns into a seller’s market.” That’s the dynamic he’s watching for.

He’s not saying AI won’t change the world – just that it won’t do it on the market’s timeline. And that disconnect between narrative and reality, between price and substance, is often where the worst losses hide.

I found this part of the interview especially insightful. Gundlach’s gift isn’t just a random hot macro take – his thinking reflects pattern recognition. He understands how bubbles form because he’s seen enough of them. He knows how long hype can sustain itself. But more importantly, he knows that when the turn comes, it’s always faster than anyone expects.

This isn’t a call to short AI. It’s a call to think critically – to separate transformative potential from unsustainable price action. And to remember that even great ideas can make terrible investments when everyone is already in the trade.

Insight #6: Global Rebalancing – The Shift Away from Dollar Assets

Gundlach’s most quietly radical point wasn’t about debt or gold or even private credit. It was about capital flows – and the subtle, slow-moving shift that could change everything: the reversal of money moving into the U.S.

Since the early 2000s, foreigners have poured trillions into U.S. assets:

“The previous group talked about capital flows, and one of the reasons the U.S. is underperforming at this point is that so much money has flowed into the United States since around 2005—or maybe 2015. There was a net investment position where foreigners were investing more into the U.S. than the U.S. was investing abroad, to the tune of $3 trillion. That was about 15 to 17 years ago.

Today, that net investment position has grown to over $25 trillion. And now, the dollar is falling. It’s not inconceivable that some of that $25 trillion—which came in over less than two decades—could start to go out.

This is a moment where, finally, you have a setup where non-U.S. investment makes a lot of sense. Even if you're a dollar-based investor, you should be thinking about increasing your allocations to non-dollar investments.“

And the signs of stress are already showing. As Gundlach pointed out, during the recent S&P 500 selloff, the dollar didn’t rise as expected. It fell. That’s a significant break from four decades of pattern. The “dollar smile” trade – where the greenback rises on either strength or fear – may be fading. If global capital starts reallocating toward other regions or currencies, the U.S. could find itself in a much less privileged position.

Gundlach isn’t all talk here. DoubleLine is actively shifting. “We’re starting to introduce foreign currencies into our funds,” he said – even in those traditionally aimed at dollar-based investors. That’s a bold move for a U.S. fixed-income shop and a clear signal that the dollar’s role as the anchor currency is no longer sacred.

The portfolio implication is clear: U.S.-centric positioning isn’t risk-free. In fact, the risk may be greatest where it once felt safest. Gundlach believes investors should begin increasing their allocations to non-dollar assets. Not in panic, but as part of a deliberate long-term adjustment.

“The stats are very uninteresting in the credit market—just as the valuation of the S&P 500 is incredibly uninteresting. When we had the big selloff in April, we were kind of asleep at the switch. The market was overvalued, and we should have been thinking more cautiously.

Well, it’s even more overvalued today, because while the S&P 500 is only down one or two percent, earnings estimates have been cut significantly. If you look at the forward P/E ratio, it’s actually higher now than it was at the all-time high back in February or early March.“

This doesn’t mean the dollar collapses tomorrow. But it does mean the tailwinds of the past two decades – massive capital inflows, persistent reserve currency demand, foreign central bank support – might not be there in the next two.

If you’re a dollar-based investor and you’ve never owned anything outside that framework, now might be the time to start thinking differently.

Insight #7: India – Buy It and Don’t Check the Statement

While most of the interview centered around macro instability, Gundlach didn’t leave things in doom-and-gloom territory. He ended with one of the clearest long-term investment ideas I’ve heard in a while – and it had nothing to do with Treasuries, credit spreads, or the Fed. It was about India.

“In 30 years, this will be a success,” he said. “You should invest in India… just hold it for your grandchildren’s college fund.”

That might sound quaint in a world obsessed with short-term catalysts and quarter-over-quarter guidance. But it’s classic Gundlach: zoom out, think thematically, and bet on structural forces that don’t need perfect timing.

Why India? He laid out the parallels: a massive population, a young and growing labor force, supply chain tailwinds, and a reform agenda (however messy) that rhymes with China’s arc starting in the 1980s. India today, in his view, looks a lot like China did 35 years ago – chaotic, corrupt, legally tangled… but full of untapped potential.

Importantly, he’s not saying it’ll be smooth or easy. Quite the opposite. The advice he gave – don’t open the statement – is a nod to the volatility and headline risk that come with emerging markets. But it’s also a call for mental discipline. If you believe in the long-term fundamentals, you have to let them play out. And that means tuning out the noise.

I think there’s a deeper lesson in this, too. In a world where many of the dominant narratives are crumbling – dollar supremacy, Treasury safety, private credit as a cure-all – there’s real value in finding clean, asymmetric bets that don’t rely on the same assumptions.

You won’t get a press release telling you when India becomes investable. It’s already happening – slowly, unevenly, and without much fanfare.

What’s The Bottom Line?

What struck me most in this interview wasn’t Gundlach’s bearish tone or his trademark bluntness. It was the coherence of the message. Every point he made – from the ballooning U.S. interest expense to the mispricing in private credit and the rise of gold as a new safe haven – connects to the same core idea: we’ve entered a period where the things that once made investors feel safe are becoming the very things that may carry the most risk.

Long bonds, the U.S. dollar, even broad-based equity exposure in the U.S. – all of them are built on assumptions that feel increasingly fragile. That doesn’t mean we’re heading into some catastrophic collapse tomorrow morning. But it does mean we can’t afford to keep relying on old mental models just because they’ve worked in the past.