[FREE] 7 Timeless Takeaways from Peter Lynch’s First Interview in Years!

29% a Year for 13 Years – Peter Lynch Explains How He Really Did It (“Average people feel they can’t be good at this, but they can!”)

Every so often, an interview surfaces that feels like a must-listen. Episode 211 of The Compound and Friends – where Josh Brown sat down with Peter Lynch – is one of those moments. For anyone who follows investing, seeing Lynch in a modern setting feels almost surreal. He rarely gives interviews these days, and when he does, it’s not for nostalgia. It’s to remind people what actually matters in investing.

Josh Brown opened the conversation with the kind of introduction few guests could live up to – but Lynch isn’t just any guest. As Brown put it, during his 13-year run managing Fidelity’s Magellan Fund, Lynch achieved a 29.2% annual return, turning $18 million in assets into $14 billion. That record still stands as one of the greatest compounding streaks in market history.

One in every hundred Americans owned the fund. He doubled the S&P 500. Then, at the height of his success – at just 46 years old – he walked away.

Wow!

That alone would make him a legend, but what cements Lynch’s legacy isn’t only performance; it’s generosity. Long before the era of podcasts and Twitter threads, he spent years teaching ordinary investors how to think – not like traders, but like business owners. His books One Up on Wall Street and Beating the Street turned his philosophy into a blueprint for generations of stock pickers.

Before we dive back in, a quick note…

If you enjoy this piece, consider sharing it with a few investing friends – especially those who are still early in their journey. Peter Lynch’s wisdom is timeless, and the more people learn to think this way, the better off they’ll be as investors. It would mean a lot.

So when he sat down with Josh Brown after decades mostly out of the spotlight, it wasn’t just another podcast episode – it was a window into one of the sharpest minds the market has ever produced.

What’s striking is how current his ideas still feel. Amid AI mania, macro obsession, and a market increasingly dominated by institutions, Lynch’s principles sound almost rebellious in their simplicity.

In this post, I want to break down the key insights from that conversation – the lessons, anecdotes, and truths that still define his thinking today. Whether you’re new to investing or have spent decades in the market, it’s worth slowing down to absorb what Lynch had to say. The available tools have changed, but his wisdom and what truly matters hasn’t – and listening to him now feels like being reminded of how investing was meant to be done in the first place.

Insight #1: Know What You Own & Why the Individual Investor Still Has an Edge

Few ideas define Peter Lynch’s philosophy as completely as “know what you own.” It sounds deceptively simple, yet Lynch treats it as the bedrock of successful investing – the difference between conviction and panic.

In the interview, he retold a story that captures this better than any theory. When Barbara Streisand once called him in a panic about her portfolio, she confessed she was losing sleep and getting up at 5 a.m. to check her stocks. Lynch asked her to name five companies she owned. When she did, he followed up with a single question: what do they do? “She didn’t have any idea,” he recalled. “Here’s an incredibly talented person. She had no idea what those companies did… so what are you going to do if they go down 50%?”

His conclusion was blunt: “If you don’t understand what you own, you’re toast.”

When investors truly understand a business – its economics, products, and balance sheet – they gain the emotional stability to sit through volatility. “You’ll get shaken out if the stock goes from 10 to 8 and you don’t know what they’re doing,” he said. The point isn’t to be fearless but to be informed enough to act rationally.

That’s also why he urges people to be able to explain each holding “to an 11-year-old in a minute or less – not that this sucker is going up.”

If you can’t do that, Lynch insists, “you should buy a fund.”

The principle extends into his enduring belief that individual investors still have an edge. Lynch dismisses the idea that only professionals can succeed. During the interview, he described meeting an audience member who “shovels chicken poop” in New Jersey and yet became a serious, successful investor simply by working hard and studying companies.

“Average people feel they can’t be good at this, but they can,” he said.

The advantage, in his eyes, isn’t data or technology – it’s time, patience, and proximity. Ordinary investors see the world directly. They shop at stores, notice which products are selling, and hear firsthand what’s changing in their industries. As Lynch put it decades ago and reaffirmed here, the edge is right in front of you if you’re willing to look.

This is the mindset that allowed him to turn observations about pantyhose and tacos into major winners. It’s the same mindset he believes still works today. Professionals might have better tools, but the playing field of insight hasn’t vanished. “We were loaded with skill at Fidelity,” he said, “but average people… if they work hard, they’re careful.” The internet has only made that easier. “Now they have company presentations… it’s a lot easier to understand what you own today.”

The takeaway is timeless: knowledge breeds conviction, and conviction beats volatility. You don’t need a Bloomberg terminal, a sophisticated trading algorithm, or a seat on Wall Street itself. You just need to know what you own – and care enough to keep turning over the stones yourself.

Insight #2: The Real Risk – Getting Scared Out, Not Losing Money

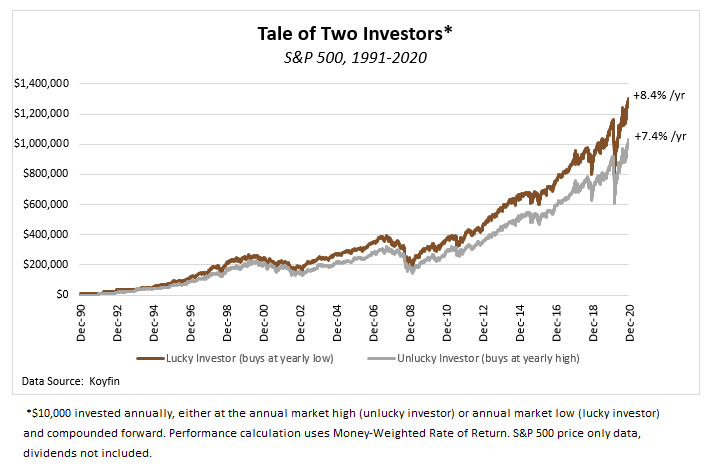

Peter Lynch has always believed that the market’s biggest risk isn’t volatility – it’s emotion. What destroys investor returns isn’t a bear market itself but the inability to endure one. In the interview, he repeated one of his best-known lines: “The real key to making money in stocks is not to get scared out of them.”

It’s the kind of statement that sounds almost too simple to matter – until you realize how few investors actually live by it.

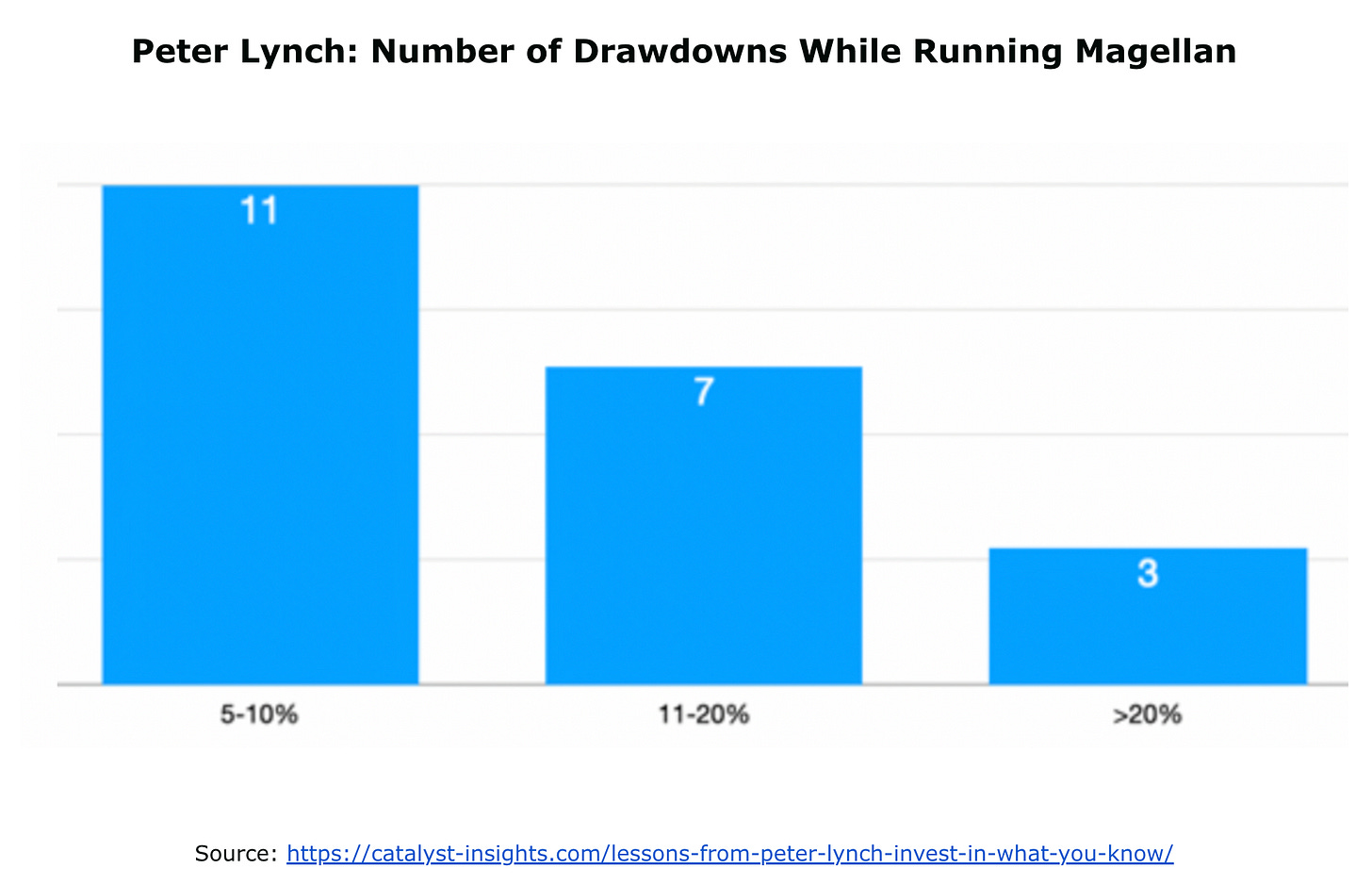

Lynch reminded the audience that during his 13-year tenure managing the Magellan Fund, “the market went down ten times… I went down more every time than the market. Every time.” Yet Magellan still compounded at nearly 30% annually. The point wasn’t that he avoided drawdowns; it’s that he survived them. Most investors, he argued, would have sold in despair. He didn’t, because he knew what he owned and why. Conviction is what separates volatility from permanent loss.

He illustrated the psychology of panic with data few people think about: “The average range for a stock on the New York Stock Exchange, the average high, average low every year, is 100%.”

A typical stock might start the year at 20, trade up to 28, fall to 14, and end at 20.

“There’s a 100% move every year,” Lynch said. “Most stocks you’re going to buy, they’re probably going to go down.” That reality – the inevitability of short-term losses – is something investors must internalize, or they’ll never hold on long enough for the thesis to play out.

His advice to younger audiences has always been to write down the reason for owning a stock – the simple story behind it – so when the price falls, you can remind yourself what’s actually changed in the business, not just in the quote.

That’s also why Lynch is skeptical of constant macro chatter and market timing. He knows that volatility isn’t an error in the system – it is the system. “You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready,” he told Josh Brown.

Investors who can’t accept that truth will forever be whipsawed by every correction. The great ones aren’t immune to fear; they just prepare for it in advance.

Before we dive back in, a quick note…

Want to compound your knowledge – and your wealth? Compound with René is for investors who think in decades, not headlines. If you’ve found value here, subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

Insight #3: Forget Forecasts – Deal With Facts, Not Predictions

Lynch has never had much patience for economists, strategists, or anyone who claims to know what the market will do next. He’s spent his career ignoring them – and the results speak for themselves. “If you spend more than 13 minutes analyzing economic and market forecasts,” he said, “you’ve wasted 10 minutes.”

The line drew laughter from the audience, but the underlying conviction is serious: forecasts are entertainment, not information.

During the interview, he expanded on why macro commentary is such a trap. “Economists predicted 33 of the last 11 recessions,” he joked.

The problem isn’t just accuracy – it’s distraction.

Investors who obsess over predicting downturns end up preparing for ghosts instead of opportunities. “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves,” he said in the same exchange.

The focus on when the market will turn blinds people to the far more important question of what is actually happening in the businesses they own.

Lynch’s process has always been rooted in observable reality. “I just deal with what’s now,” he explained. “What’s happened to used car prices? What’s happened to the price of oil?” He’s not dismissing data – he’s dismissing speculation.

Investors can and should pay attention to facts like employment trends, credit card debt, or savings rates, but trying to project those into the future is, in his view, a waste of energy. “I’d love to know what’s happened in the future,” he deadpanned. “It’s not available.”

He illustrated his point with an anecdote from the housing crisis: “Hats off to the people who did the big short. I had no idea how bad the housing market was, how bad people had second mortgages.” The lesson isn’t that he missed something – it’s that even the most diligent investors can’t consistently forecast macro outcomes. What they can do is assess reality as it exists today and react accordingly.

What I find striking about this mindset is how it scales. For Lynch, the antidote to macro anxiety isn’t ignorance – it’s focus. There’s a humility embedded in his process: the recognition that the future is unknowable, but today is measurable. The best investors, in his view, aren’t prophets; they’re observers who act on the evidence in front of them.

Insight #4: Turning Over Rocks – Where the Real Edge Comes From

When Peter Lynch talks about “turning over rocks,” he isn’t using a metaphor to sound clever – he’s describing a way of life. Research, to him, has always been an act of curiosity and endurance, not prediction. “The person that turns over the most rocks wins the game,” he said in the interview, quoting the line he once used to describe Fidelity fund manager Joel Tillinghast. “If you look at ten stocks, you’ll probably find one that’s mispriced. Look at twenty, you’ll find two. Look at forty, you’ll find four.”

The edge, in other words, comes from looking longer and harder than everyone else.

That spirit of investigative patience has defined his entire career. It began with his early days as a caddy, where he overheard golfers talking about the stocks they owned. “I’d look it up and a few months later they were higher,” he recalled. “This pretty good deal, you know.” That curiosity – the willingness to connect real-world observations to investment ideas – never left him.

Decades later, the same curiosity led him to Taco Bell and Hanes, two of his most successful early investments. He noticed what people were buying, saw how their behavior was changing, and connected the dots before others did. It wasn’t luck. It was legwork.

But turning over rocks is only half the story. The other half is where you choose to look – and for Lynch, that’s often in places others avoid. “Stocks are mispriced when there’s a lot of knowing in the class,” he explained, referring to how crowded ideas tend to be fairly valued. His solution? Look where no one else is looking. “I’ve had companies that were losing six dollars a share and things started getting better. They went from losing six to losing two – still not good, but not as bad. Then they went from losing two to making two. The stock quadrupled. It’s the same four dollars.”

It’s a beautiful example of how contrarianism and fundamental improvement intersect. Most investors only show up once the turnaround is obvious, but Lynch looks for early evidence of progress – the inflection point before the crowd notices.

He understands that when sentiment is universally negative, expectations are already priced for failure. “What were they doing when they went from losing six to losing two? Things didn’t improve, but they were doing something right.”

His story about Waste Management during the interview captured the same principle. “Nobody wanted anything to do with this stock,” he recalled. “Number one, they’re involved with garbage. Number two, everybody thinks the mafia controls it.”

But he saw a company with improving fundamentals and bought in. The stock became one of his big winners.

There’s a quiet defiance in Lynch’s approach. He doesn’t look for comfort; he looks for dislocation. The best opportunities, in his view, come from industries everyone else has written off, where sentiment is broken but business conditions are starting to heal. That’s the essence of turning over rocks – not finding perfection, but finding progress.

Don’t Miss My Latest Deep Dive

If Peter Lynch were investing in Europe today, he’d probably love InPost! A boring, easy-to-understand business, counter-positioned to its peers, trading at 8x look-through earnings, and compounding in value at very attractive rates.

Insight #5: Cutting Flowers, Watering Weeds – How Investors Sabotage Themselves

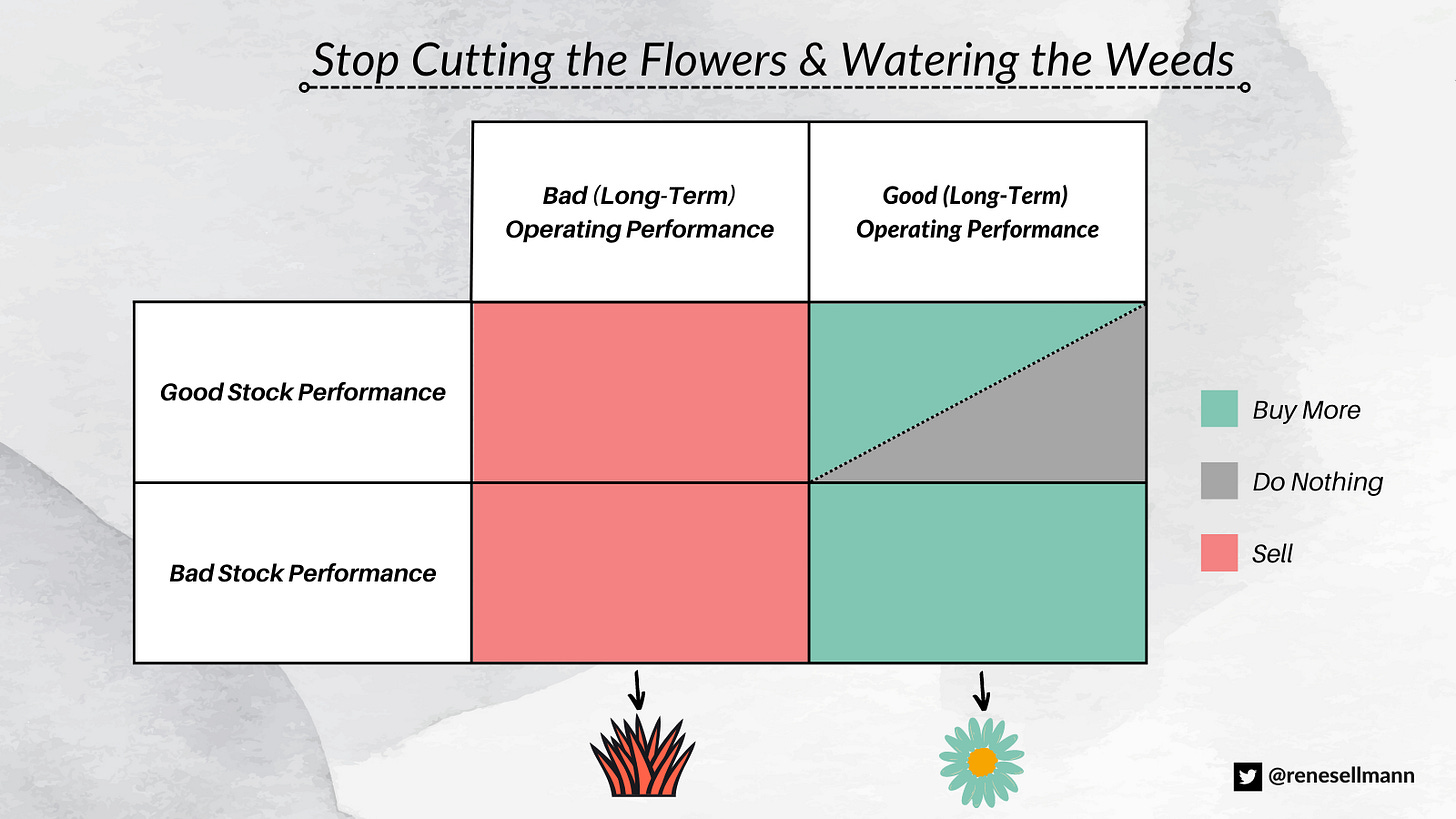

Arguably, one of the most striking moments in the interview came when Peter Lynch recounted how Warren Buffett once called him out of the blue. “This is Warren Buffett from Omaha, Nebraska,” Lynch remembered. “My annual report’s due in two weeks. I love a quote. Can I use it?” The quote was simple:

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

Lynch replied, “It’s yours.” Buffett later popularized the phrase, but it originated with Lynch – and the philosophy behind it remains one of the hardest disciplines in investing.

Lynch’s view is that human psychology constantly pushes investors toward the wrong actions. The moment a stock rises, people rush to sell so they can crystallize the feeling of being “right.” The moment it falls, they hold on, hoping it comes back to break even. What gets lost is the logic of compounding. A small winner, left alone, can become a multi-decade compounder. A persistent loser, left unexamined, compounds losses instead.

The irony, as Lynch pointed out, is that this behavior isn’t caused by ignorance but by emotion. “You have to have these winners offset mistakes,” he said. Even if you’re only right five times out of ten, a few big winners like “Costco or Walmart or Nvidia” can drive the bulk of returns. Selling them early just to feel safe destroys the math of portfolio growth.

A portfolio, like a garden, needs pruning – but not in reverse. The point isn’t to harvest the healthy parts early and cling to the diseased ones; it’s to let the strong flourish long enough to reveal their full potential.

He’s also quick to remind investors that even the best will be wrong frequently. “You’re terrific in this business if you’re right six and a half times out of ten,” he said. “Even if you’re right five times out of ten, if you own Costco or Walmart … that offsets your mistakes.”

Insight #6: The Modern Market – “I Have Zero AI Stocks“

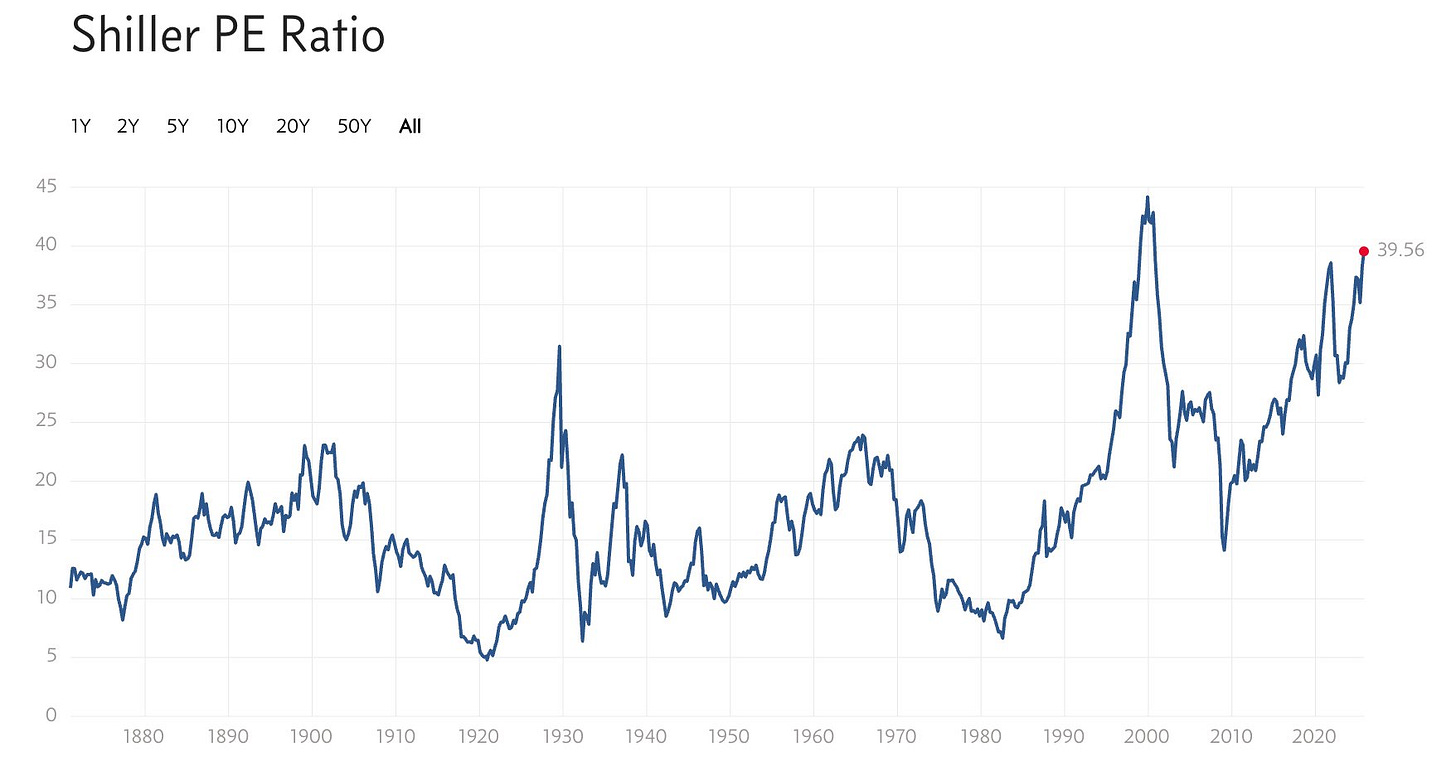

What made the interview especially fascinating was how Peter Lynch’s timeless discipline met the reality of 2025’s market – a world dominated by AI headlines, trillion-dollar companies, and historically high valuations.

Despite the changes, Lynch’s tone was the same as ever: skeptical of hype, respectful of facts, and completely uninterested in prediction.

“I have zero AI stocks,” he admitted. “I literally couldn’t pronounce Nvidia until about eight months ago.” The audience laughed, but the point wasn’t technophobia – it was humility.

Lynch doesn’t claim insight into things he doesn’t understand, and he doesn’t feel the need to chase what’s fashionable simply because everyone else is.

Instead, he emphasized that every cycle brings its own mania. He saw one in the dot-com era and now sees echoes of it again. “There were so many companies of no value,” he recalled of 1999. “Fortunately, Fidelity didn’t own those damn things.”

His observation about the present moment is subtler. He doesn’t say AI stocks are worthless – just that he has no idea how to value them. That, for him, is enough reason to stay away. It’s a discipline most investors find hard to follow.

Knowing when not to have an opinion is its own form of edge.

He also spoke about valuations with a mix of admiration and disbelief. “Costco has an AI stock multiple, but they sell paper towels,” he said.

The line drew a laugh, but the deeper message was that even great companies can become risky when their excellence is already priced in. He mentioned Walmart trading at 70-year highs in valuation terms, and the broader market hovering around 22 times earnings. To him, this isn’t a doomsday scenario, but a warning: the price you pay still matters, no matter how dominant the business.

And yet, he’s not cynical about big companies. In fact, he expressed open admiration for them. “Facebook or Meta is an incredible company,” he said. “Microsoft’s a great company. Google’s a great company. Amazon’s a staggering company.” What Lynch rejects is the idea that being a great business automatically makes something a great stock.

It’s a subtle but crucial distinction – one many investors ignore during exuberant periods.

He also pointed to structural changes in public markets as another reason for today’s distortions. “Fifteen years ago there were 8,000 public companies. Now there’s about 3,000.” Fewer listed firms means fewer 10-bagger opportunities for stock pickers and more concentration in mega-caps that already dominate indexes. That, in his eyes, explains part of the valuation inflation: the pool of investable ideas has simply shrunk.

Insight #7: Faith in Progress – Why the System Works

If the interview had a quiet emotional crescendo, it came toward the end, when Peter Lynch shifted from stocks to society.

After a lifetime of watching markets panic, recover, and then hit new highs, his worldview has only grown more optimistic. He doesn’t see fragility everywhere – he sees resilience.

That conviction wasn’t naïve cheerleading. It was built on historical perspective. Lynch reminded the audience that the Great Depression was an entirely different world: no Social Security, no unemployment insurance, no SEC, and an unregulated banking system. “One percent of Americans owned stocks in 1929,” he said. “We had a Federal Reserve that was asleep.” The result was catastrophic. But since then, he noted, every major stress test – oil shocks, inflation, wars, financial crises – has reinforced the system’s strength. “We’ve had eleven recessions,” he said, “and no one’s ever got worse than a five or six percent decline in GDP. There are a lot of cushions now.”

His optimism also extends to technology, particularly the fear that artificial intelligence and automation will destroy jobs. “Automation has been dramatic the last fifty years,” he said. “And we’ve gone from 100 million jobs to 153 million.” He sees innovation as a creator, not a destroyer, and credits the U.S. system for enabling that evolution. “All the growth in this country is entrepreneurs starting a little shop, starting something else. That makes our country great. And the important thing is banks will lend to them.”

Lynch’s humor remained intact even as he addressed existential concerns. He recounted a recent company call where a CEO kept mispronouncing “AI” as “A1.”

“My eleven-year-old grandchild knows it’s artificial intelligence,” he laughed. “There must be people saying it’s not A1, it’s AI!”

His most striking reflection came when he compared the breakup of AT&T in 1984 to the current fears about job displacement. Back then, a million people worked for the company – “one out of every hundred Americans.” Forty years later, the telecom industry employs fewer people, but total U.S. employment is vastly higher. “This has been one of the greatest growth industries,” he said. “We went from a million to 400,000 employees, and yet we added 53 million jobs overall.”

The pattern, in other words, is clear: innovation shifts labor, but it doesn’t erase it.

What makes Lynch’s closing thoughts so powerful is their consistency. He has lived through every modern panic – from inflation in the 1970s to the internet bubble to the financial crisis – and he still sees reason for confidence. Markets correct, economies wobble, but human ingenuity compounds just like good investments do.

His final summary might be the purest distillation of the Peter Lynch worldview: “America creates, China duplicates, and Europe legislates.”

Conclusion

Listening to Peter Lynch today feels like watching investing wisdom compressed into its purest form. The world has changed – algorithms, AI, and trillion-dollar companies dominate headlines – but his framework hasn’t aged a day.

Know what you own. Ignore forecasts. Do the work others won’t. Let your winners run. Stay patient when fear spreads. And above all, keep faith in progress.

Lynch’s greatness wasn’t just in his returns; it was in how simply he approached a complex world. The tools evolve, but the temperament that drives long-term success remains the same.

It's interesting how timeless Lynch's philosophy remains. You really captured the impact of his teaching, not just the numbers. That 29.2% return is a wild dataset, but his generosity truely built his legacy. This piece, like your insight on long-term value, is so sharp.

Great article! I really liked your line, “The best investors, in his view, aren’t prophets; they’re observers who act on the evidence in front of them.”