Deep Dive: InPost ($INPST)

InPost at 8x Look-Through Earnings! Building Europe’s E-Commerce Infrastructure, One Locker at a Time (a 30% CAGR Setup)

Few European stocks have polarized investors quite like InPost. Since its 2021 IPO on Euronext Amsterdam, the Polish parcel-locker pioneer has seen its share price soar, crash, and then claw its way back as the market tries to decide what, exactly, it’s looking at. Is this a “one-country wonder” that struck gold in Poland and is now overreaching abroad? Or is it a quietly compounding logistics platform whose moat is only beginning to show outside its home market?

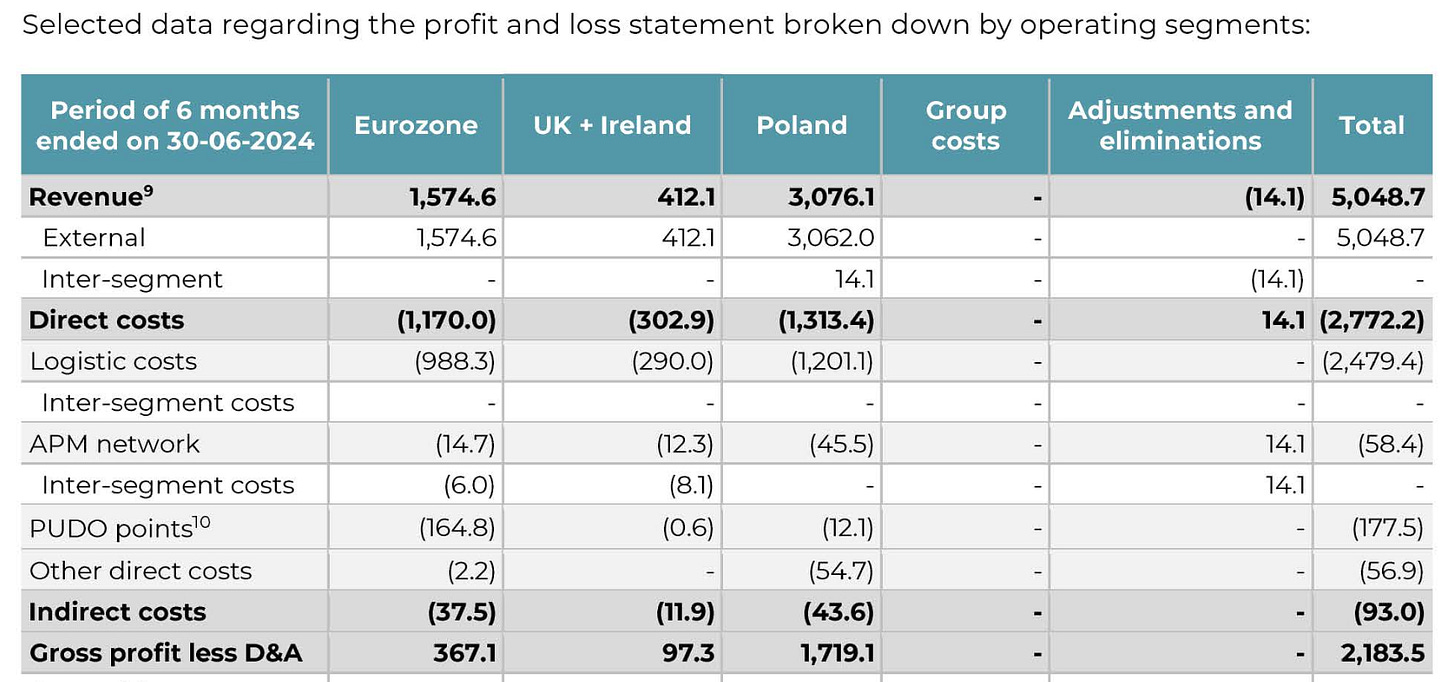

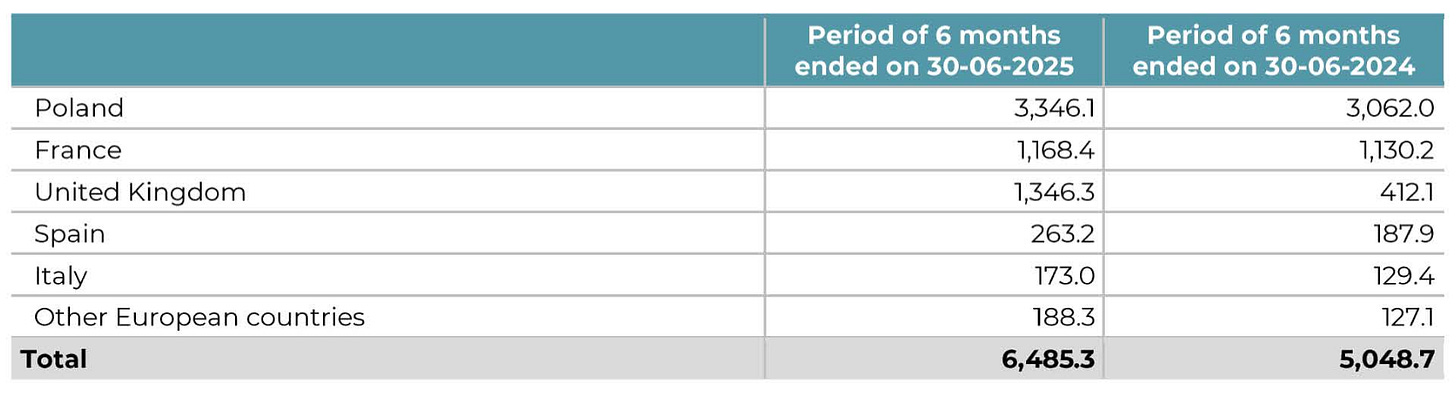

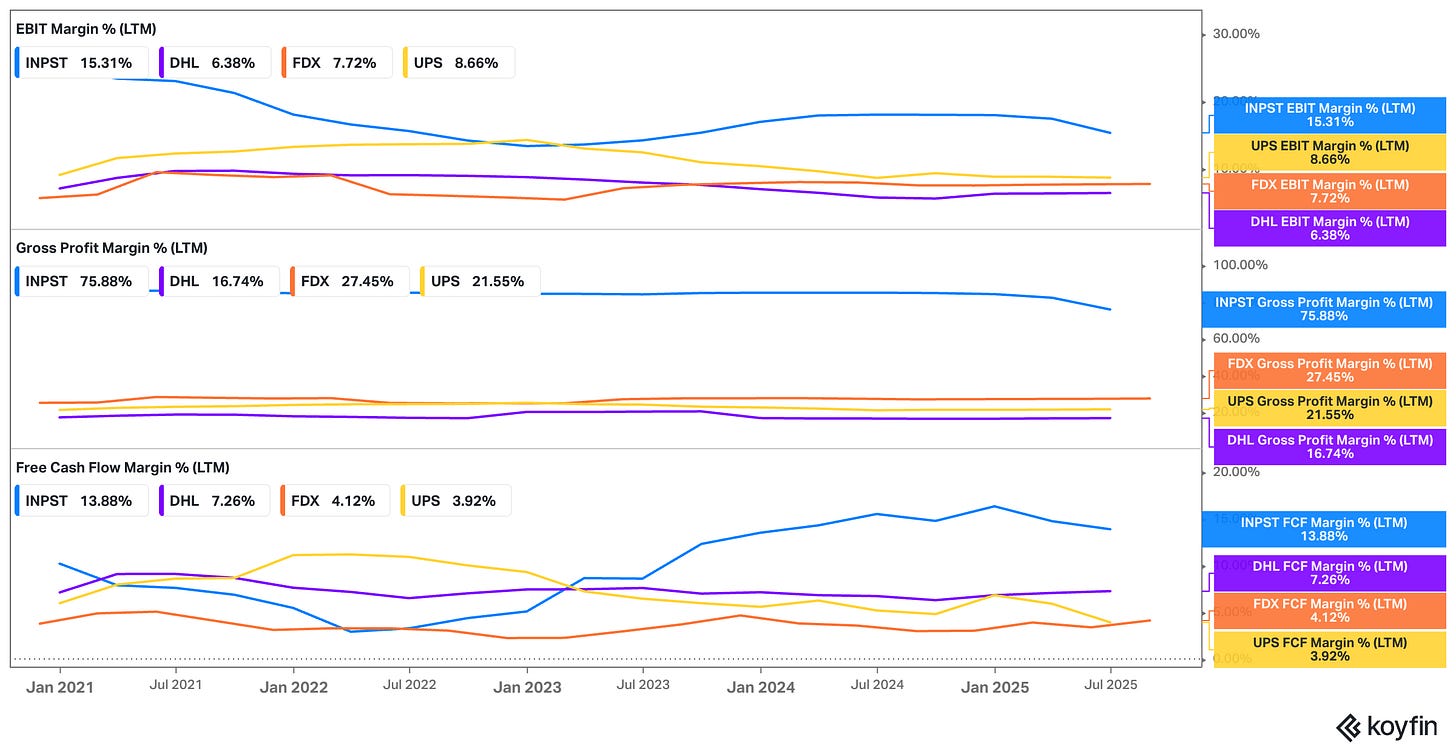

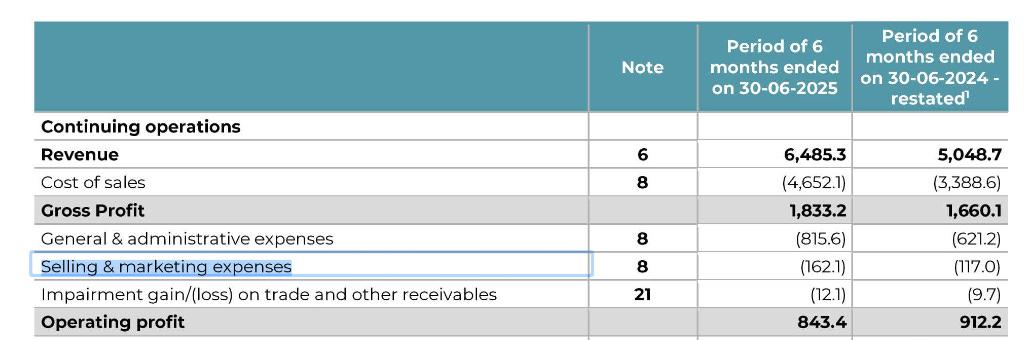

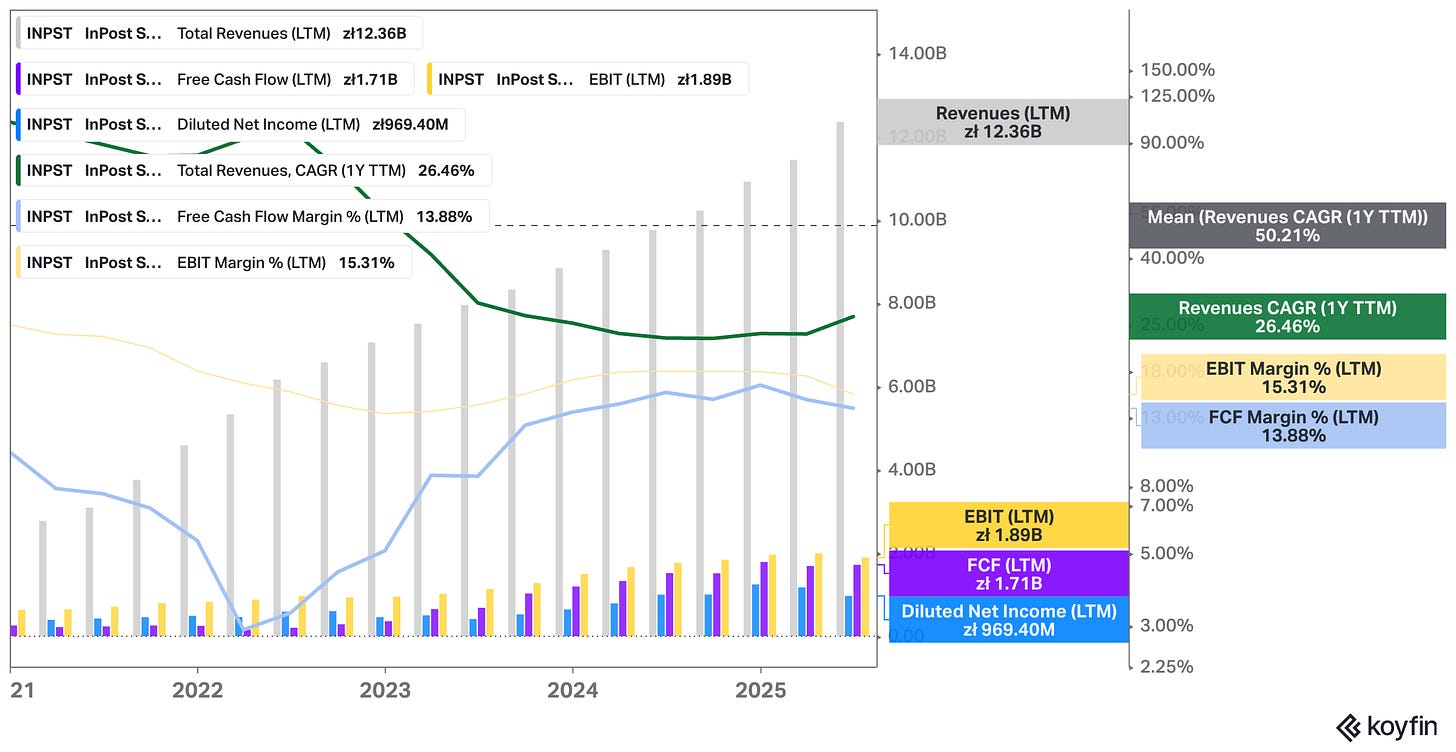

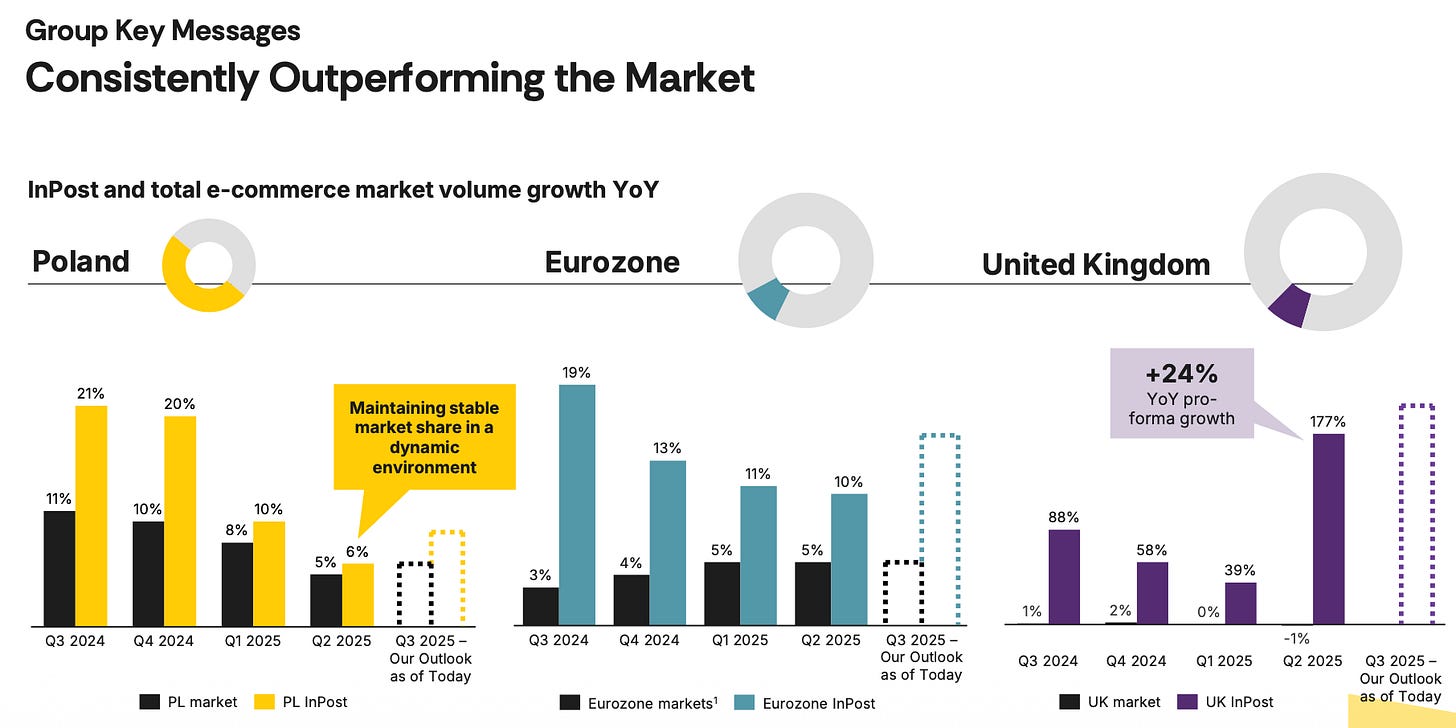

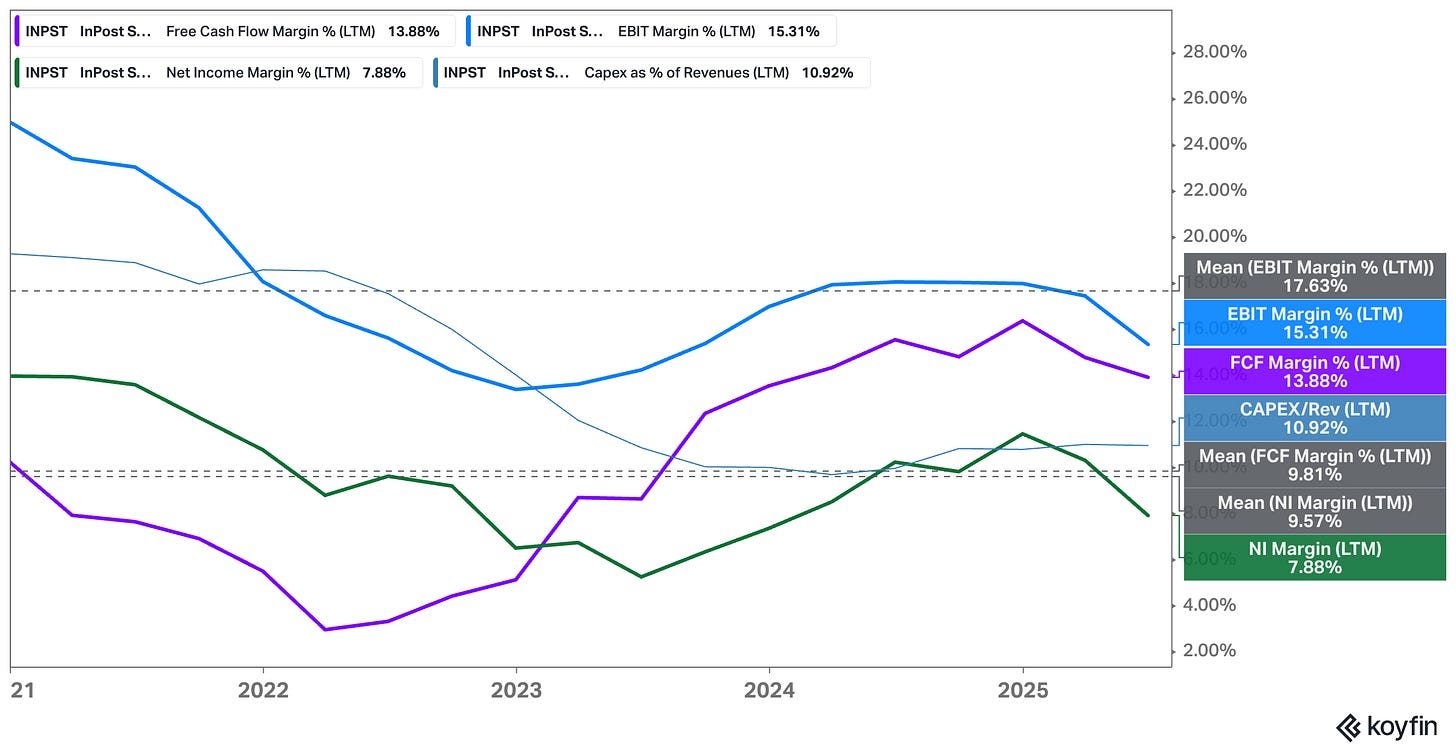

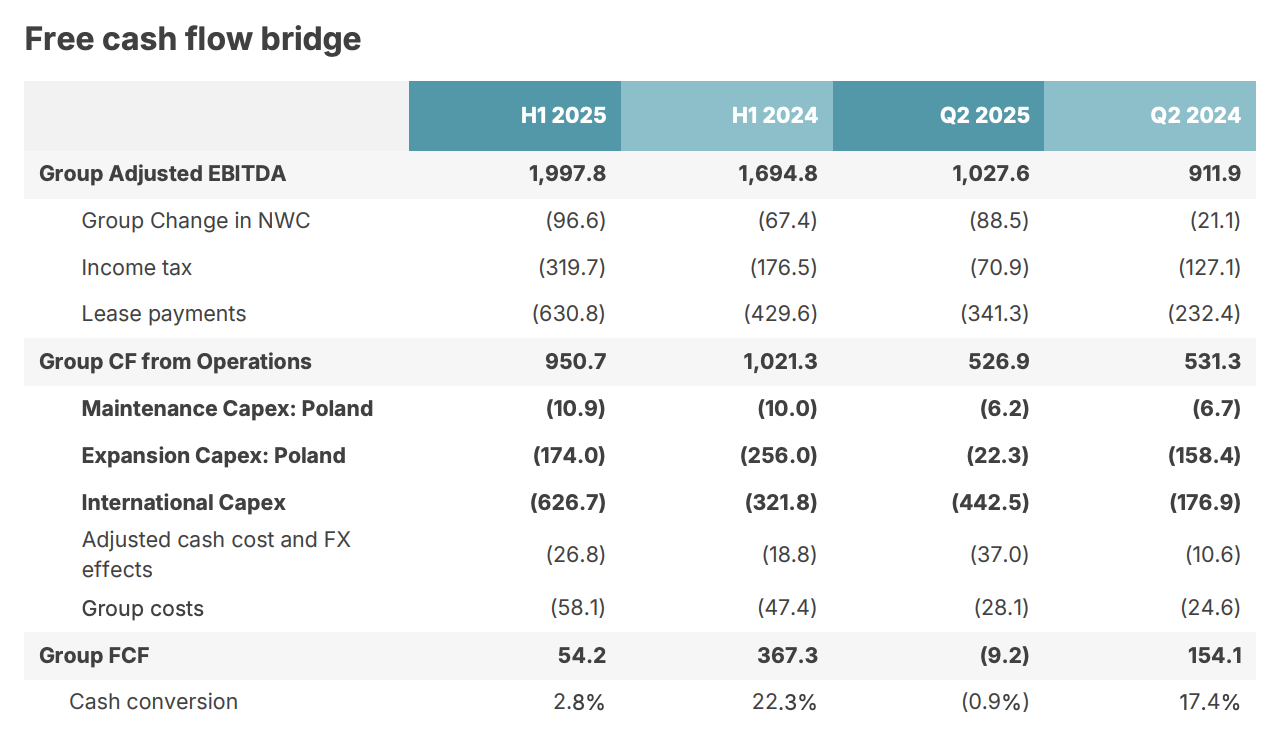

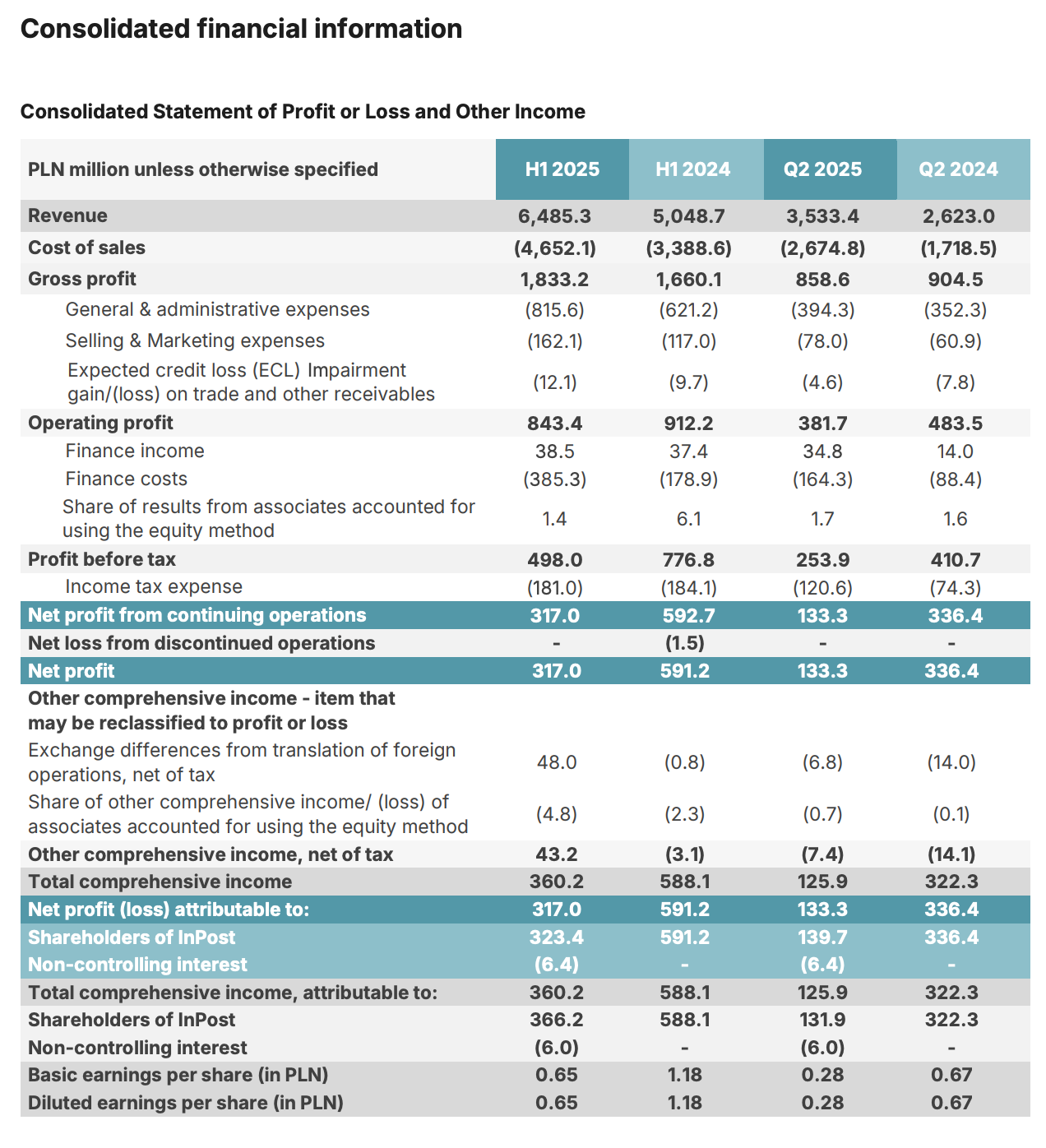

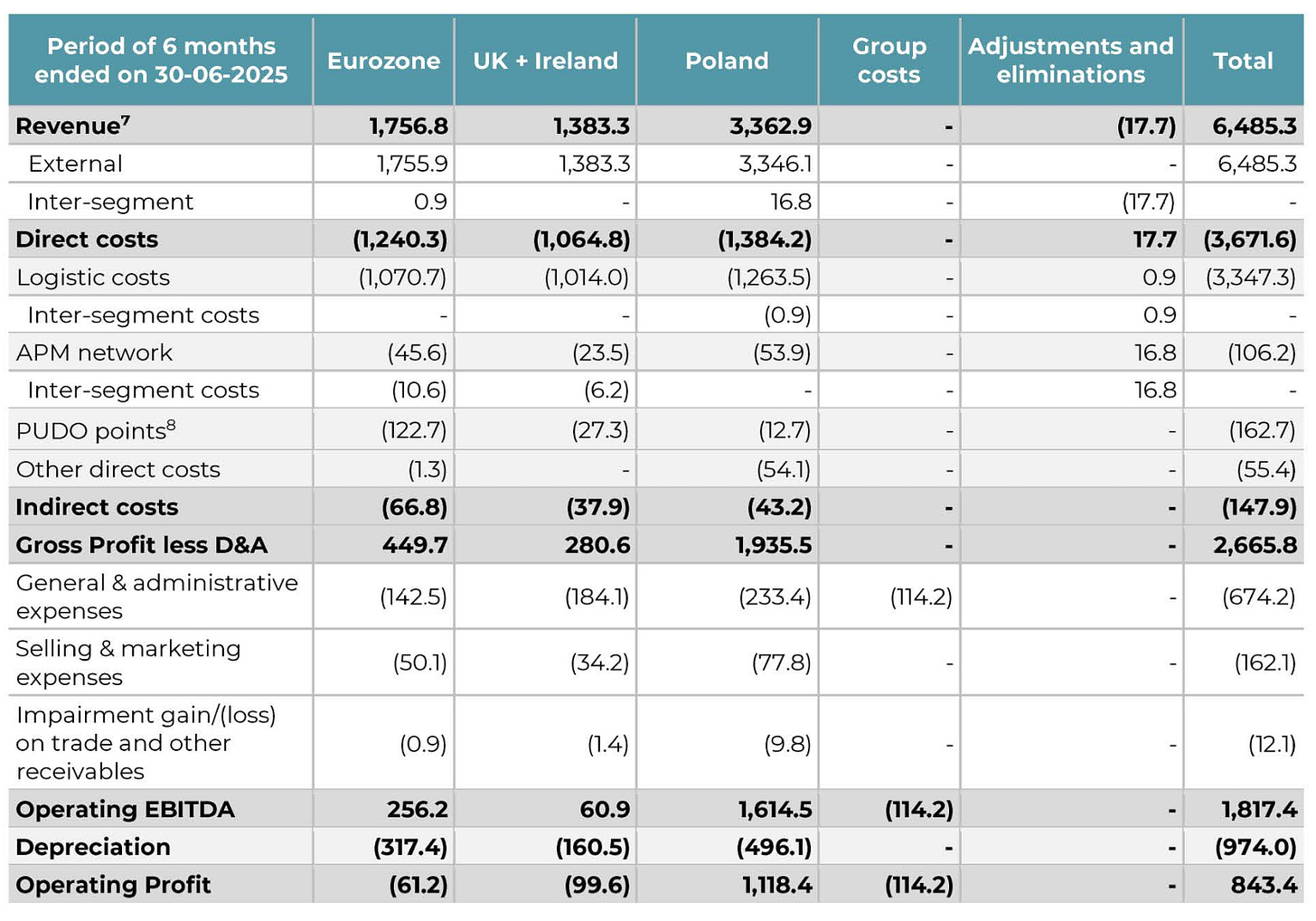

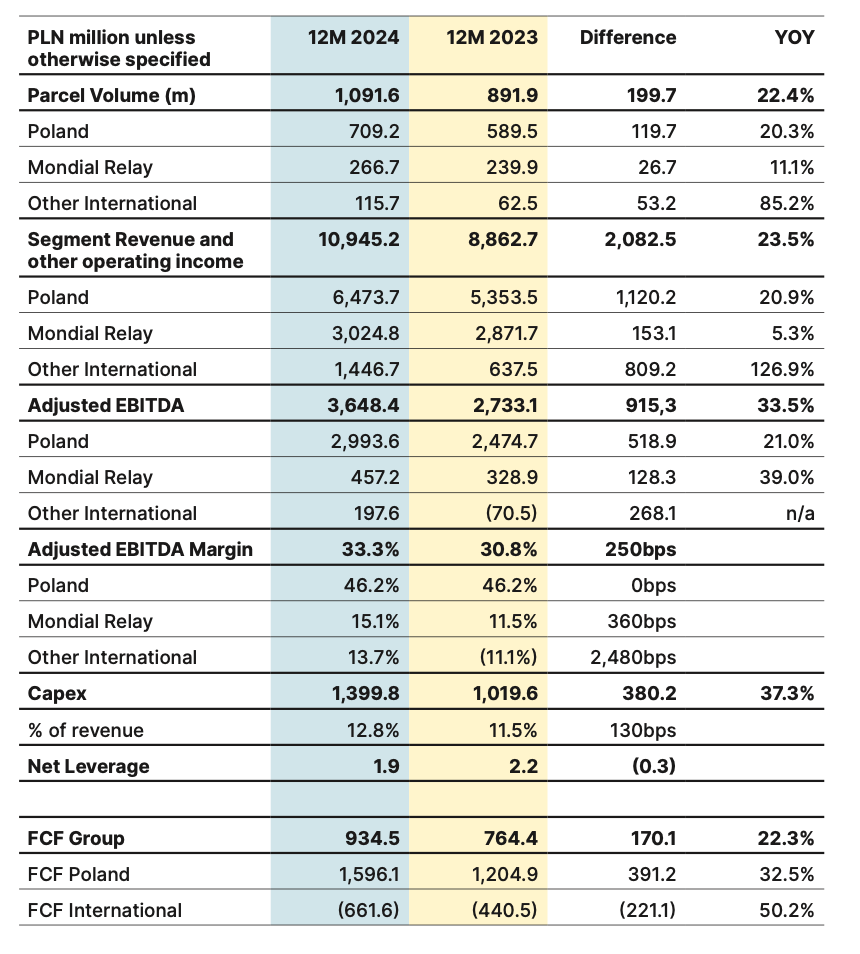

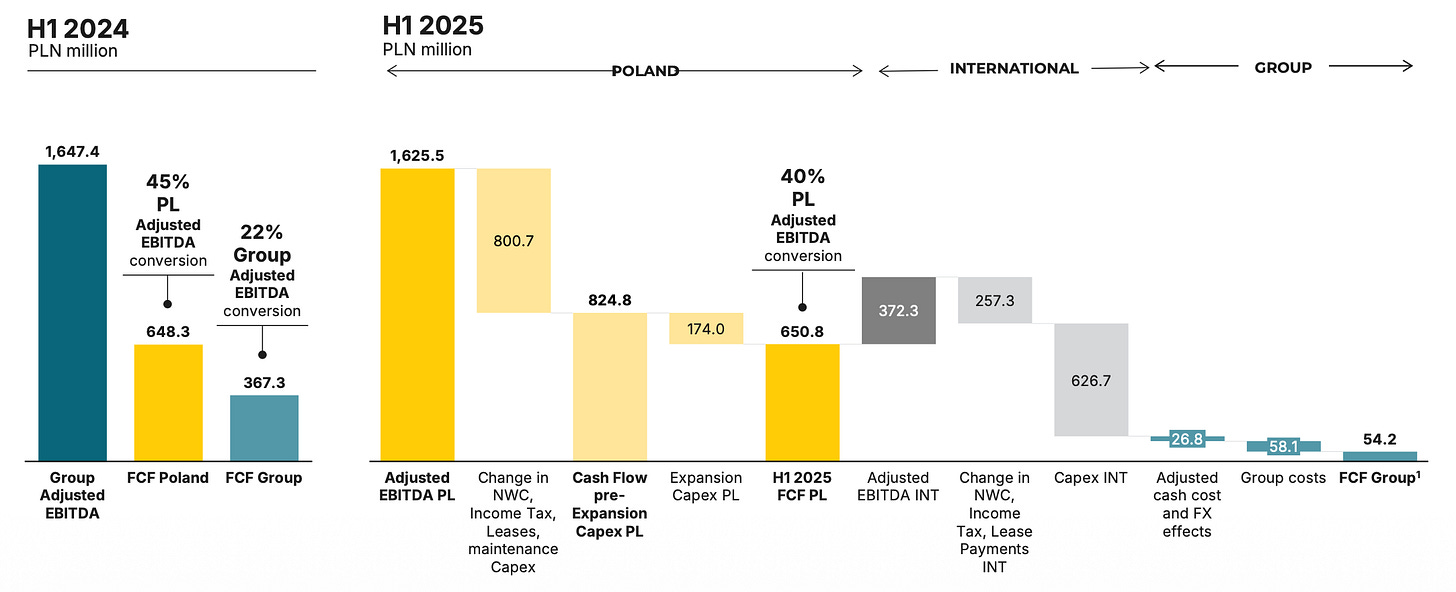

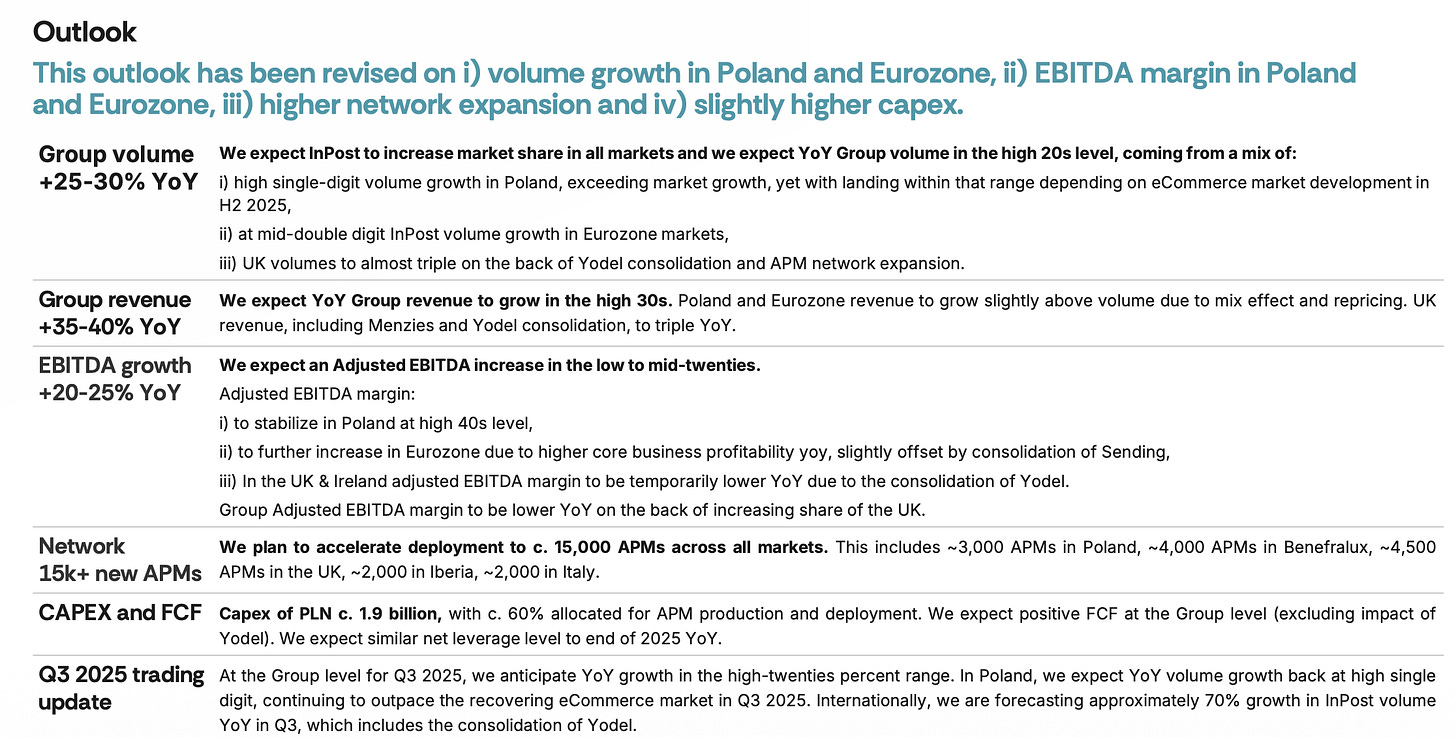

The past year has been a reality check. The stock rallied hard in early 2024 on the promise of accelerating international volumes, only to cool again as investors questioned whether profitability in France and the UK would ever resemble the Polish template. At the same time, management has been walking a tightrope: expanding across Europe while trying to prove that the model’s unit economics travel well beyond Warsaw. The company’s H1 2025 results show both progress and friction – revenue still rising double digits, margins stabilizing, but free cash flow weighed down by ongoing investment.

And yet, dig below the noise, and the story looks more intriguing than ever!

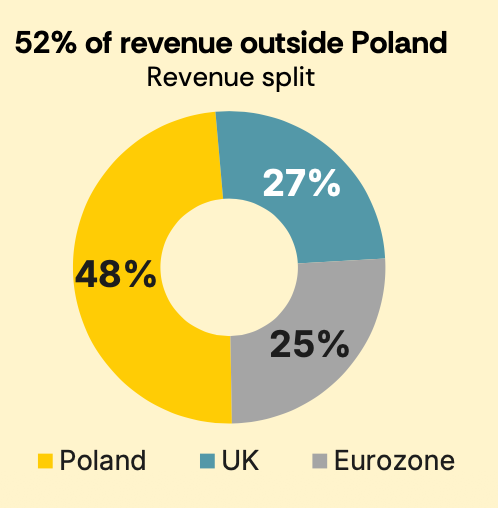

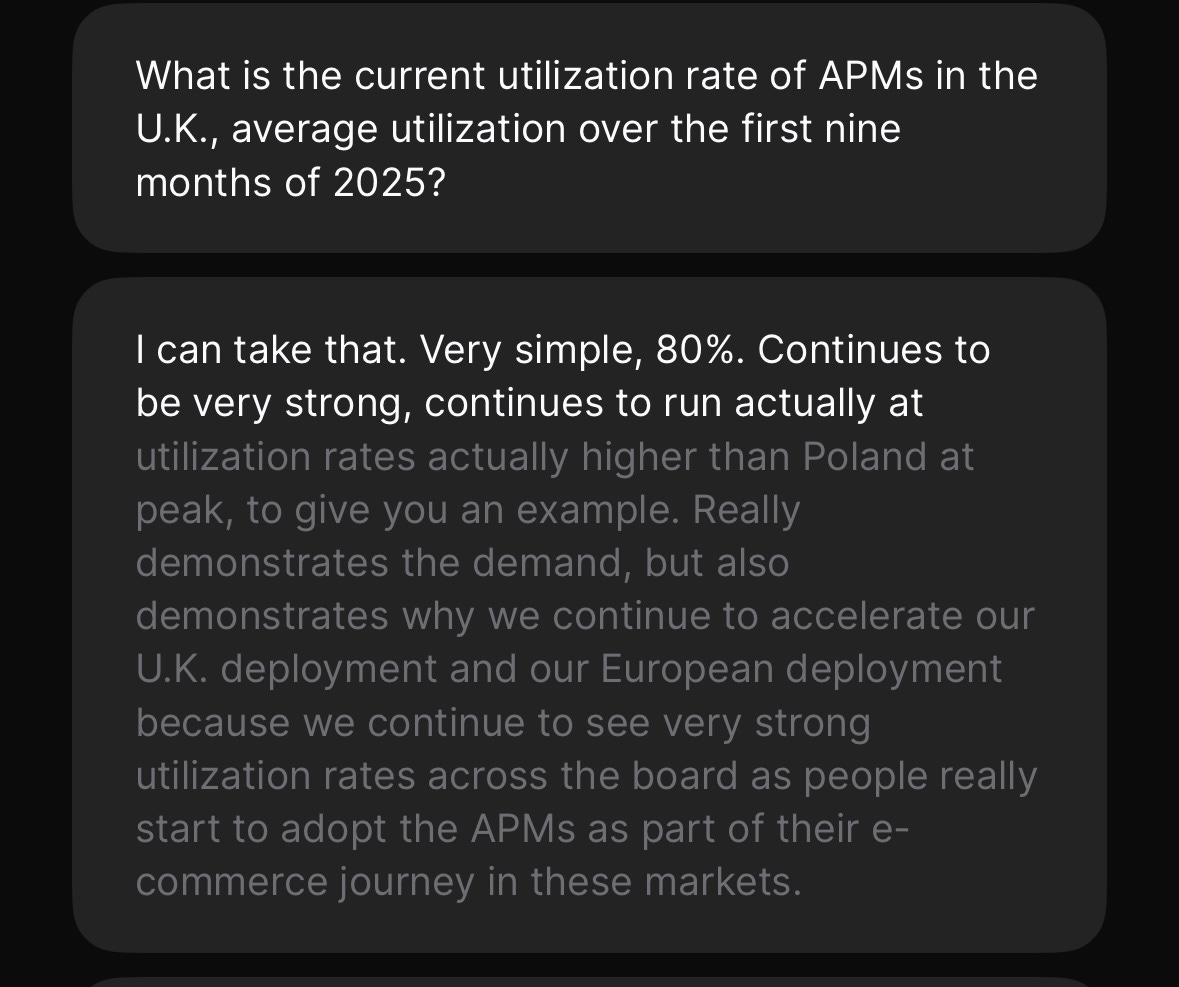

More than half of InPost’s business now comes from outside Poland. Locker utilization in the UK and France is hitting inflection points. EBITDA per parcel in mature markets keeps climbing, even as competition intensifies. The business remains misunderstood because it doesn’t fit cleanly into traditional boxes: it’s capital-heavy but scalable, infrastructure-driven but tech-enabled, transactional but habit-forming.

To me, InPost is the most “Peter Lynch-style” stock I’ve researched in quite a while. It’s a rather boring business at first glance – one that many investors might reject too quickly because it lacks an exciting narrative to wrap around it. Yet that’s precisely what makes it interesting. This is a company with a simple, easy-to-grasp model, predictable cash flows, and a structure that’s counter-positioned to incumbents weighed down by legacy courier operations. It’s a fast grower hiding in plain sight, operating in a space most investors would never call glamorous but that quietly compounds volume, habit, and efficiency year after year.

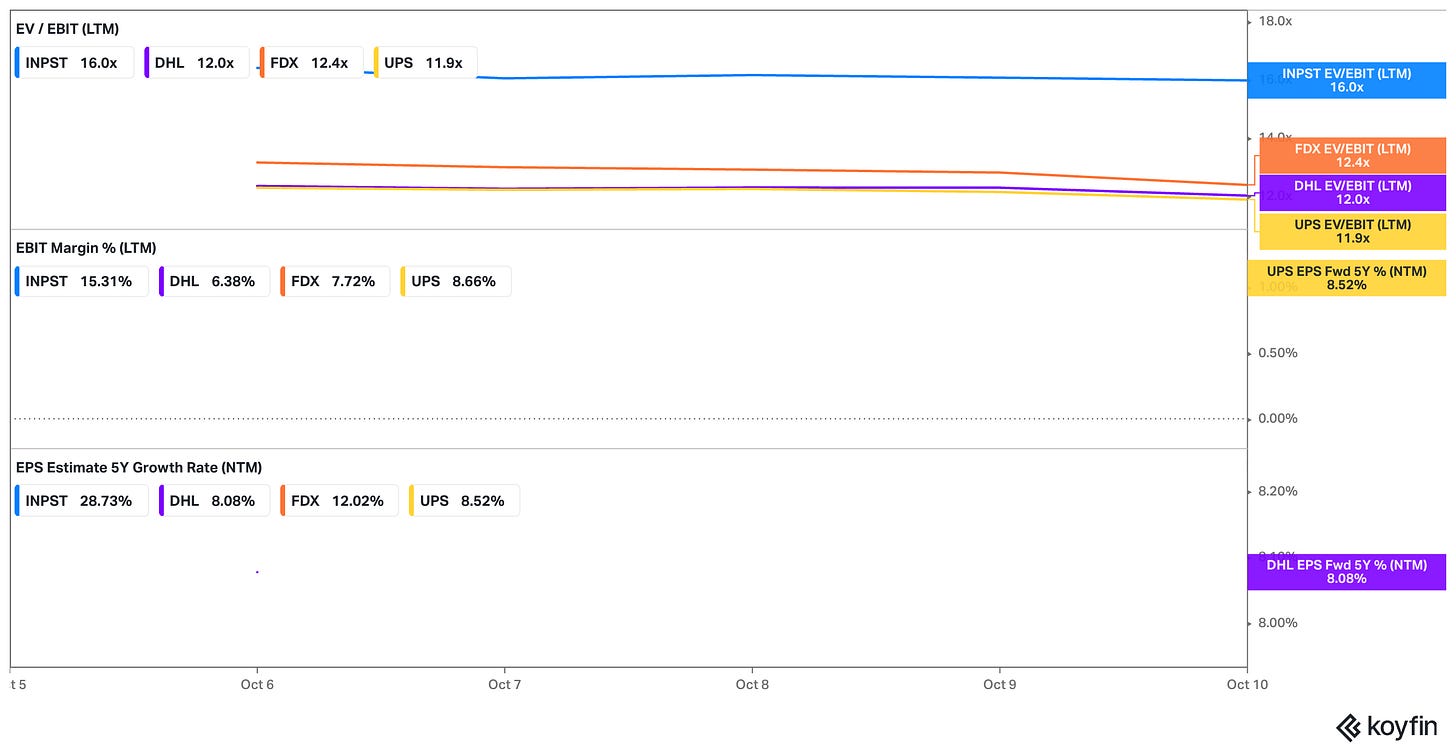

Lynch famously divided stocks into six categories: Slow Growers, Stalwarts, Fast Growers, Cyclicals, Turnarounds, and Asset Plays. InPost clearly sits in the Fast Grower bucket – small enough to be nimble, growing earnings north of 35–40%, and still with a long runway ahead. On a PEG basis, the stock looks strikingly attractive: strong double-digit growth with a multiple that hasn’t yet caught up to its potential. It’s the kind of setup Lynch loved – a “boring” business delivering extraordinary numbers, misunderstood simply because it’s not telling a sexy story.

In this deep dive, I’ll unpack why InPost’s economics are far more powerful than they appear on the surface – and why the stock’s volatility may be masking one of Europe’s most compelling compounders in the making. We’ll explore the core mechanics of the business model, how its competitive advantage really works (and where it might break), the quality of management and capital allocation, the leverage debate, and what the current market skepticism is getting wrong.

For investors willing to look beyond short-term cash-flow optics, InPost offers an interesting proposition: a company spending heavily today to own the infrastructure of how Europe shops tomorrow, and thereby earning very attractive returns on incremental investments that do not show in backward-looking numbers yet.

The question isn’t whether lockers – otherwise known as Automated Parcel Machines (APMs) – make sense. Somewhat counterintuitively, they do! It’s whether InPost can stay just far enough ahead of everyone else to make that advantage permanent.

Here’s what you’ll find inside this 28,000-word deep dive:

The 90-second “Bam Bam Bam Bam Bam” test – how the stock can be pitched in under two minutes, and what makes it intriguing right now.

Under the hood of the machine – how InPost actually makes money per parcel, why its economics look so different from a typical courier, and how those economics shift as lockers fill up.

Europe’s misunderstood logistics war – what competitors like Amazon, Royal Mail, and La Poste are doing, and why InPost is winning on the battlefield.

Why habit matters more than technology – the psychology of consumers who keep choosing lockers and how behavior – not pricing – locks in market share; and how InPost increases stickiness.

A candid look at the moat – which advantages are structural and which might be illusions; how fast the gap could close if incumbents finally get serious.

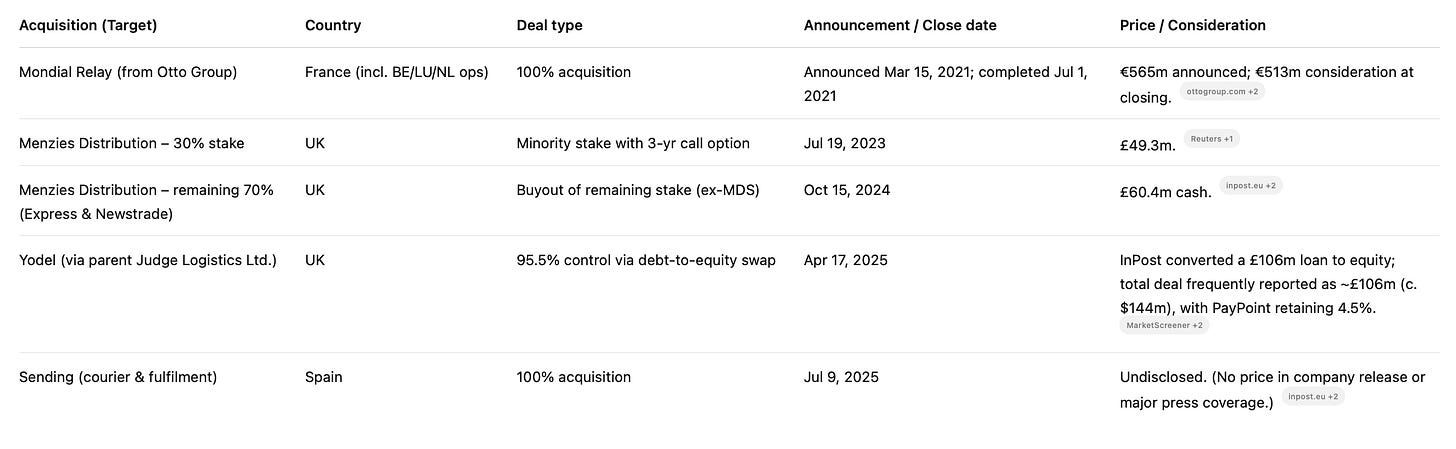

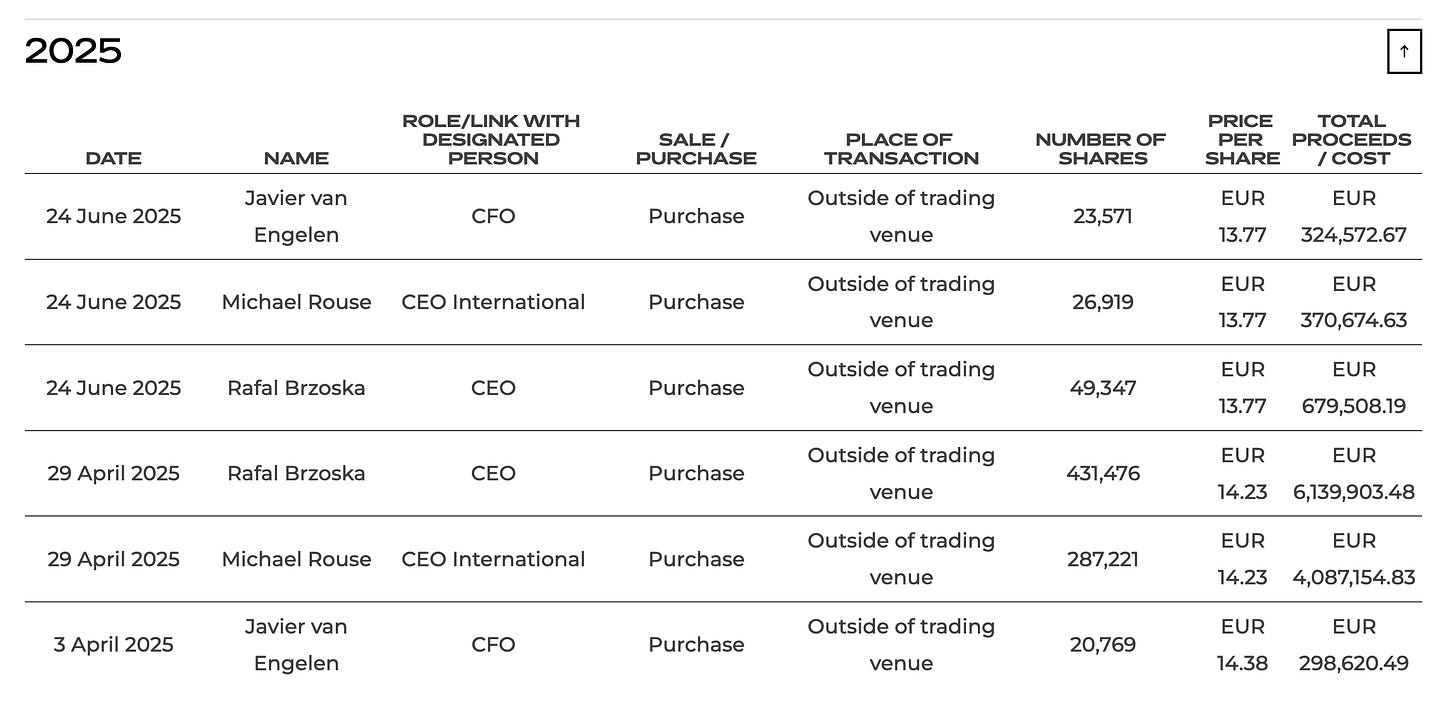

Management under the microscope – the double-edged sword of founder leadership under Rafał Brzoska, capital allocation discipline, and what past mistakes & past acquisitions (including Yodel) reveal about judgment under pressure.

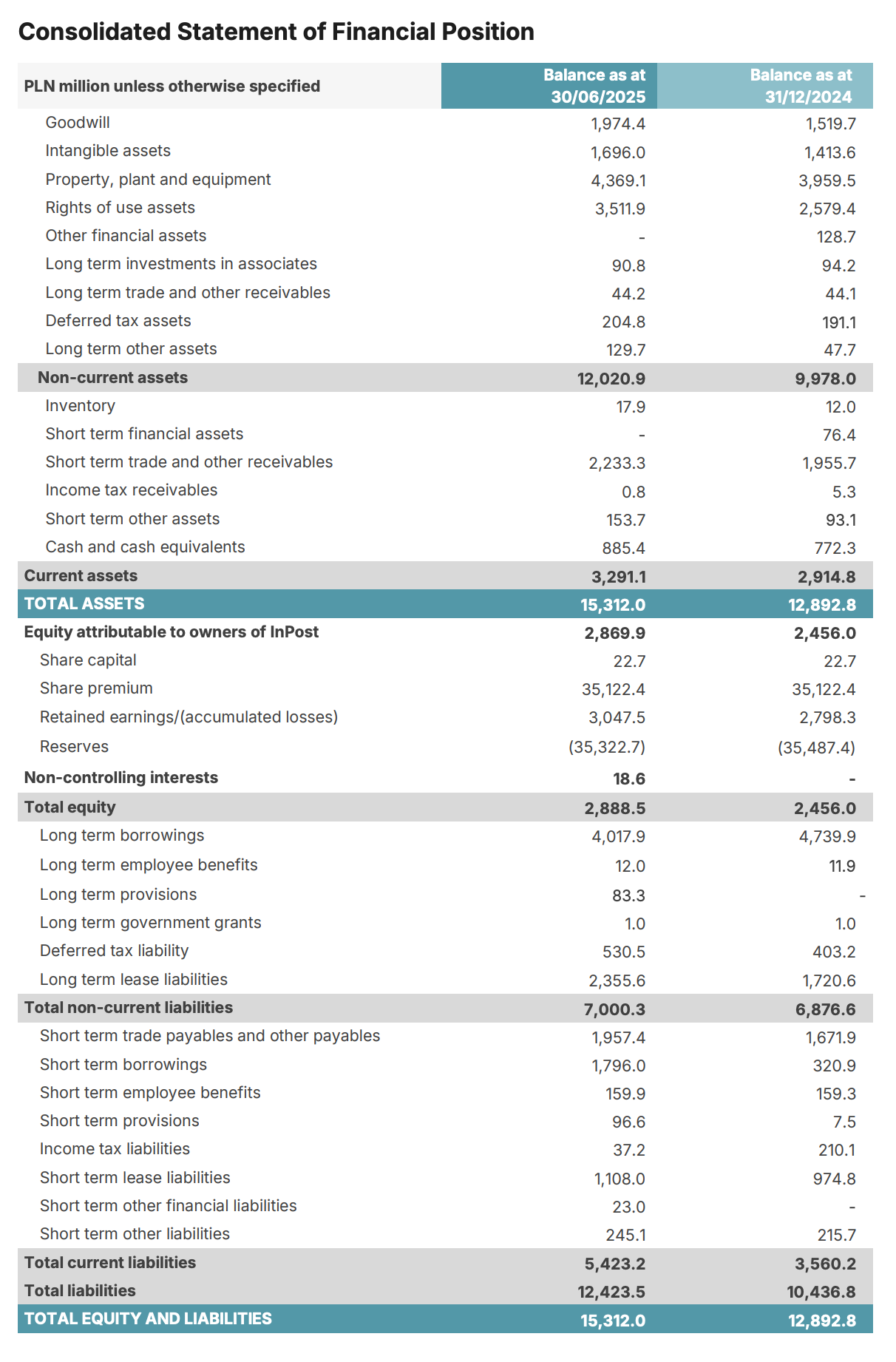

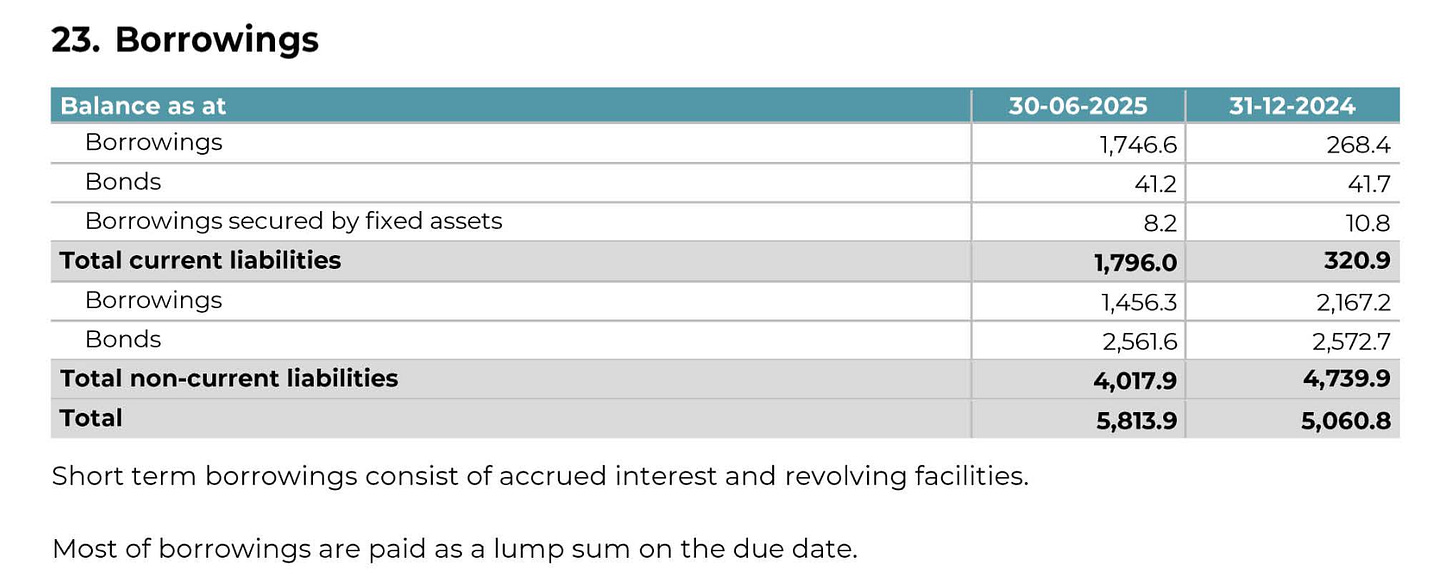

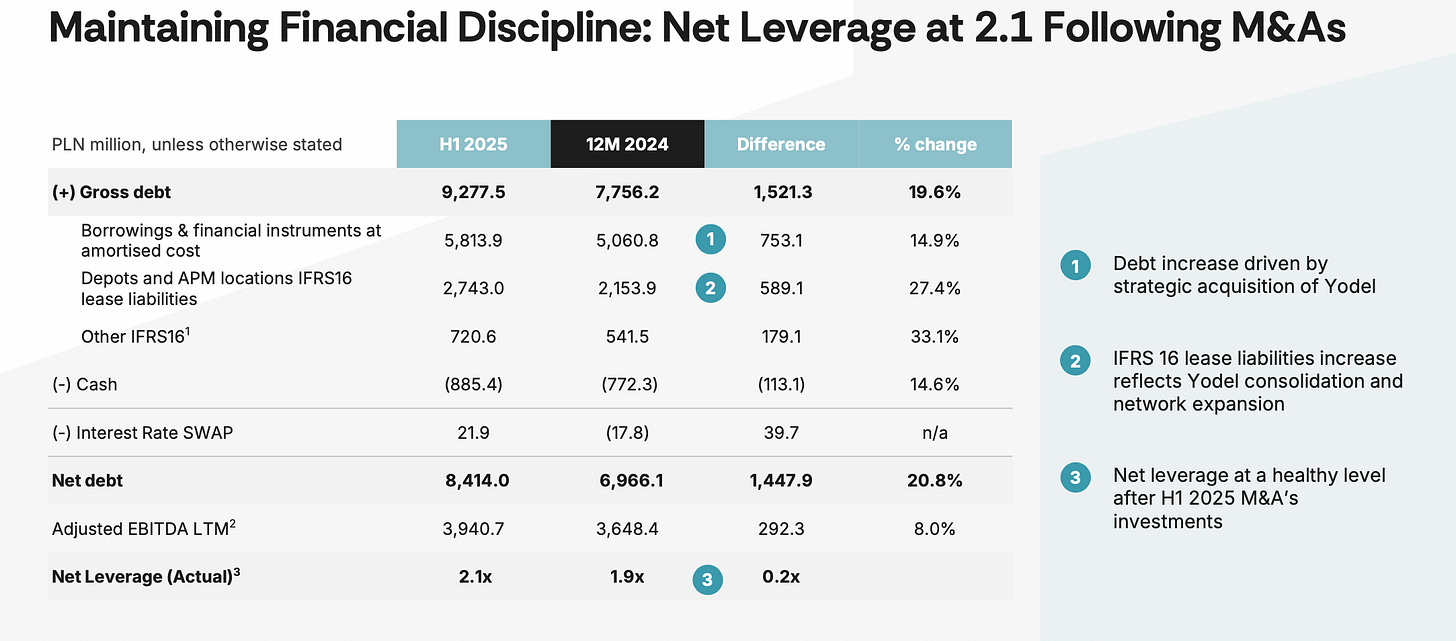

Balance sheet realism – separating genuine financial risk from the optics of expansion; what “moderate leverage” really means when capex slows.

The Allegro dispute decoded – how a long-term contract indexed to inflation turned a key customer into a competitor, and why that conflict might ultimately make InPost stronger.

Understanding APMs vs. PUDOs – why the distinction defines InPost’s strategy, the economics of both models, and how the transition to lockers unlocks the Polish-level profitability abroad.

A TAM analysis – a bottom-up look at the total addressable market across Europe, why parcel density and consumer behavior still give InPost a decade-long runway, and how the “lockerable universe” keeps expanding driven by four key structural tailwinds.

New products and innovations – how InPost is quietly layering software, convenience features, and value-added services (returns, payments, C2C) on top of its physical network.

The inversion exercise – a devil’s-advocate rundown of the most convincing bear cases and what conditions would have to align for them to come true.

Hidden fragilities

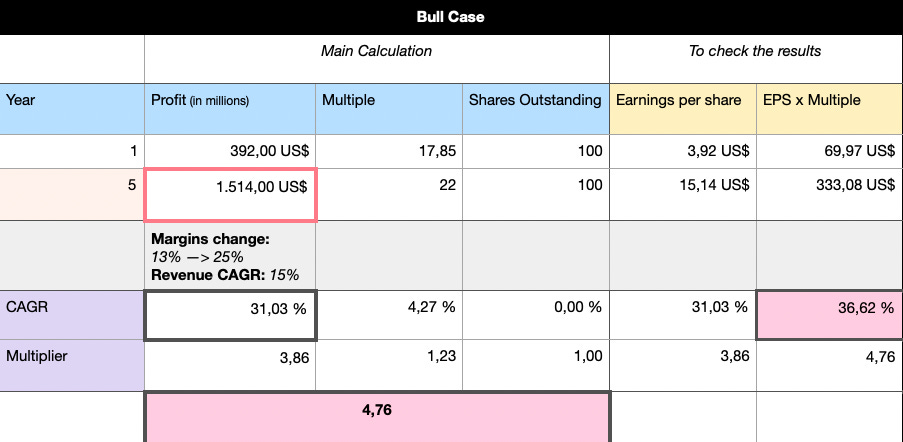

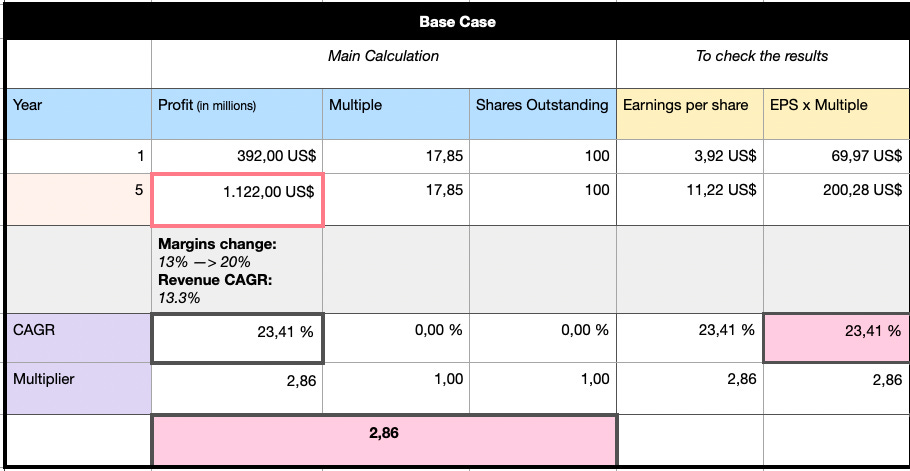

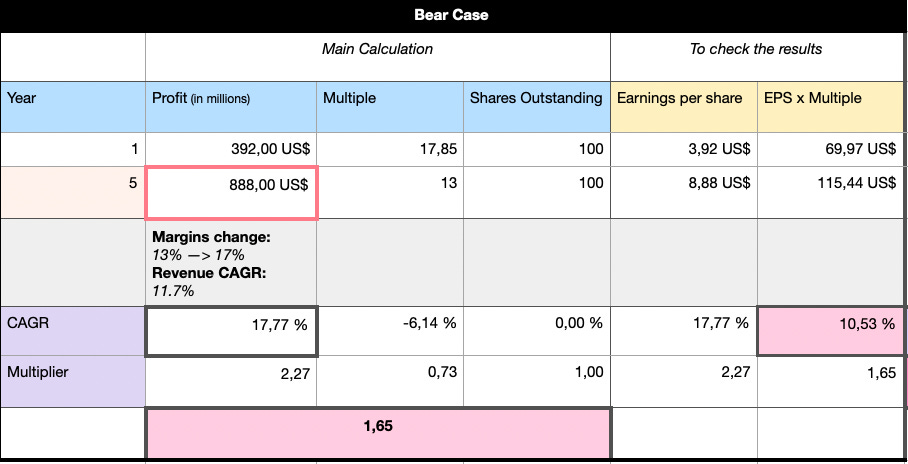

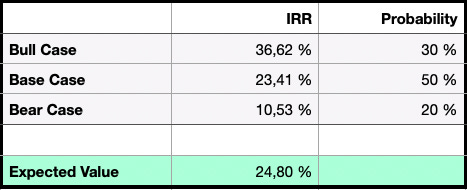

The valuation groundwork – what kind of growth I’m underwriting, how temporary fear has created mispricing, why the setup might resemble the early innings of other network-driven compounders, plus my valuation approach built on Poland’s mature economics alone, an 8x look-through multiple on group earnings, and a full scenario analysis mapping potential upside and downside paths.

The meta-lesson – what this case teaches about recognizing “moving moats,” balancing capital intensity with operating leverage, and keeping a probabilistic mindset in investing.

High-Level Thesis – The “Bam Bam Bam Bam Bam” 90-Second Pitch

The Full Analysis Starts Here

The rest of this post covers the content outlined above. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. Tiger Brokers, Nathan’s Famous, LVMH, Edenred, Digital Ocean, Zalaris, Ashtead Technologies, innoscripta AG, or Brockhaus Technologies), and powerful investing frameworks) is just a click away. Upgrade your subscription, support my work, and keep learning.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.

Let’s start with the Bam Bam Bam Bam Bam pitch. Bill Miller used to say that if you can’t distill the essence of your idea into 90 seconds, you probably don’t understand it well enough. Portfolio managers, he argued, don’t have the patience for fluff – they want five quick, compelling “bams” that get straight to why the idea matters.

So, if I were pitching InPost in that Lynch-style, egg-timer way, here’s how it would sound:

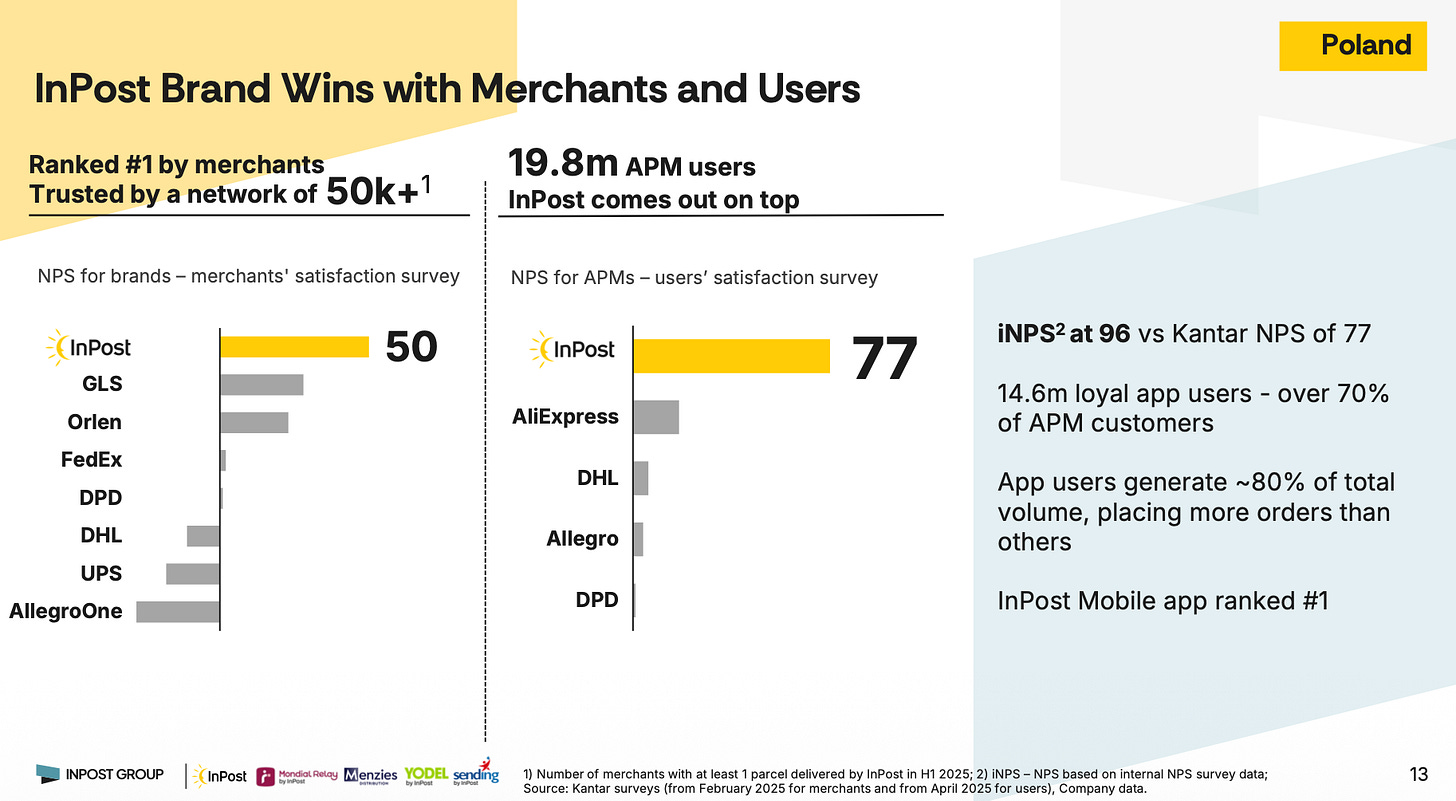

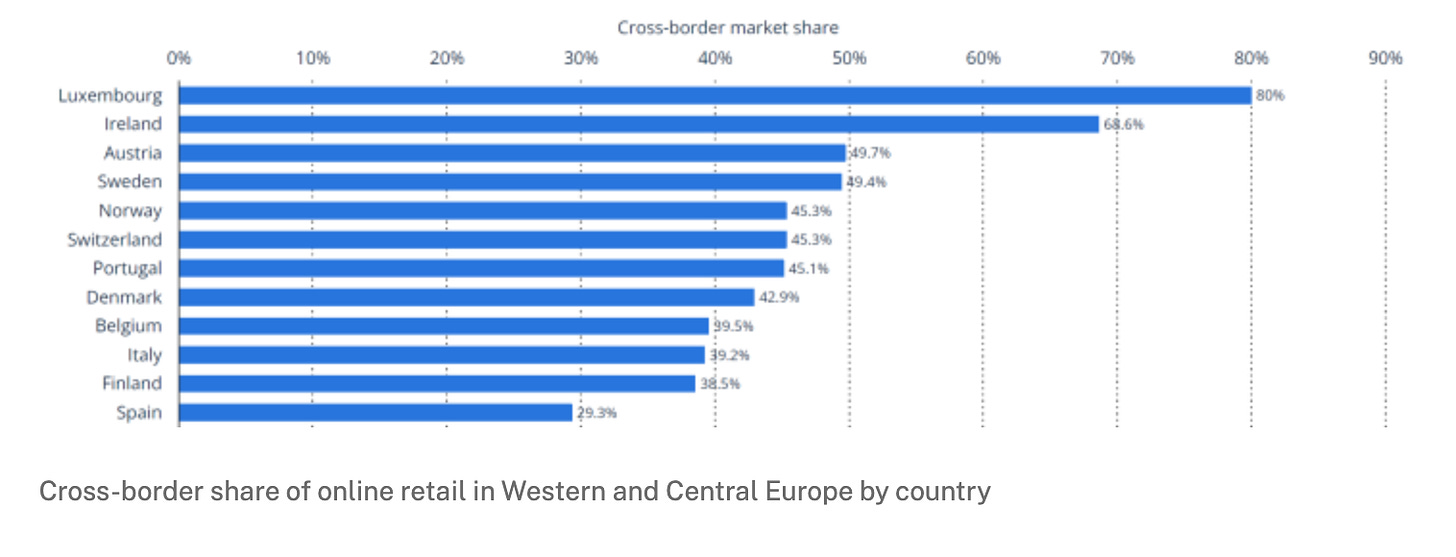

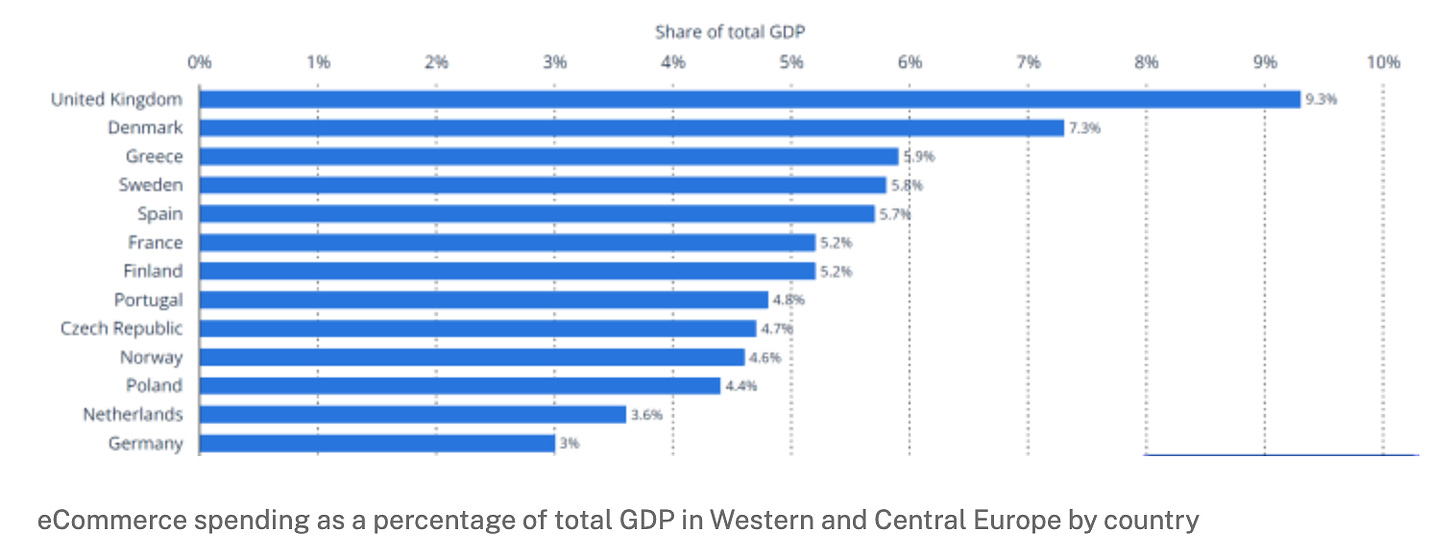

BAM: InPost is the clear market leader in out-of-home parcel delivery in Poland and is now also rapidly (and successfully) scaling across Europe, where the opportunity is massive (“France, Italy, Spain, combined, is another 8x bigger market opportunity than Poland“). Both customers and merchants love InPost’s service. And it’s a network effects story hiding in plain sight – the denser the locker network, the higher the convenience, the stronger the moat.

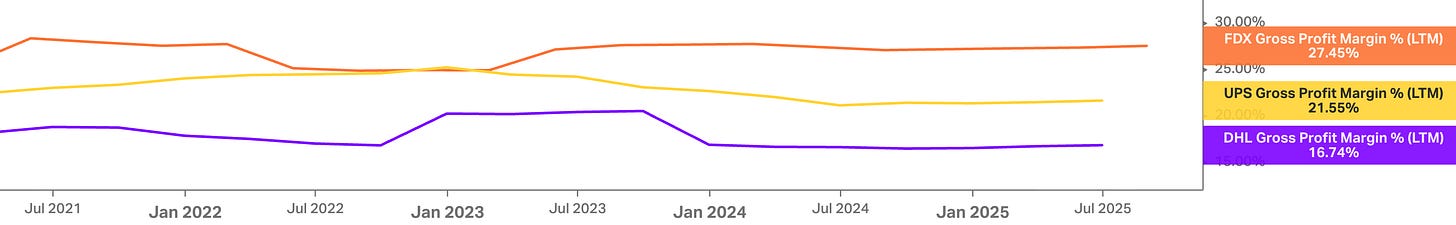

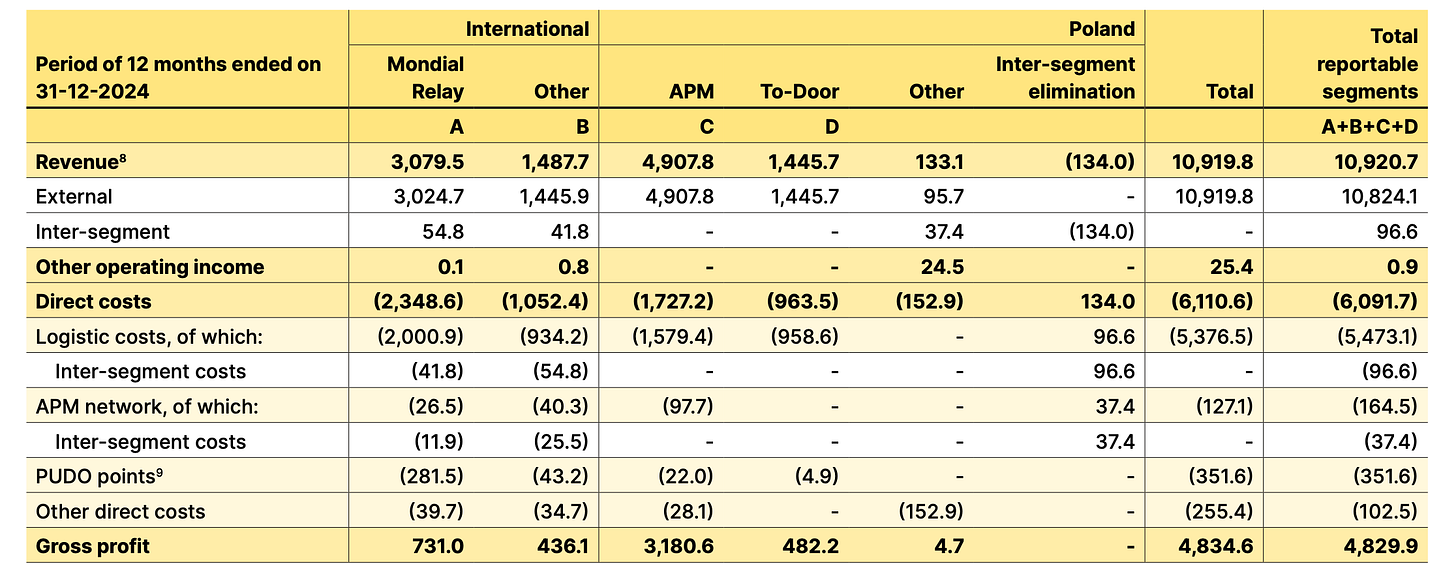

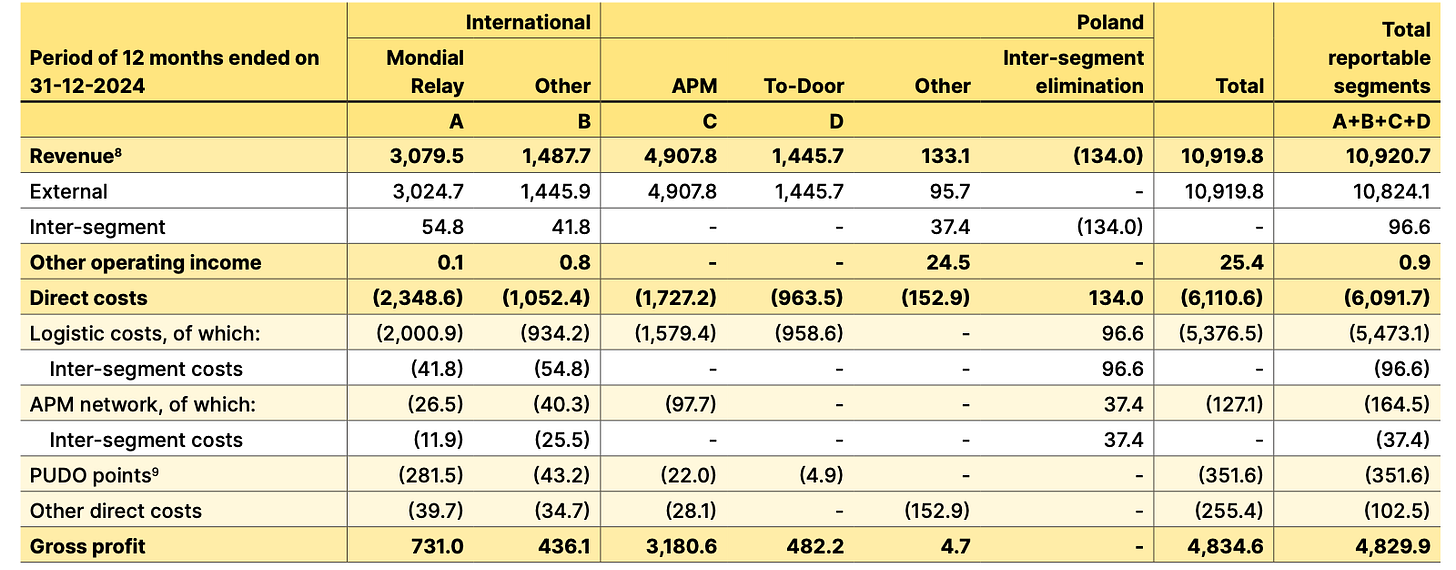

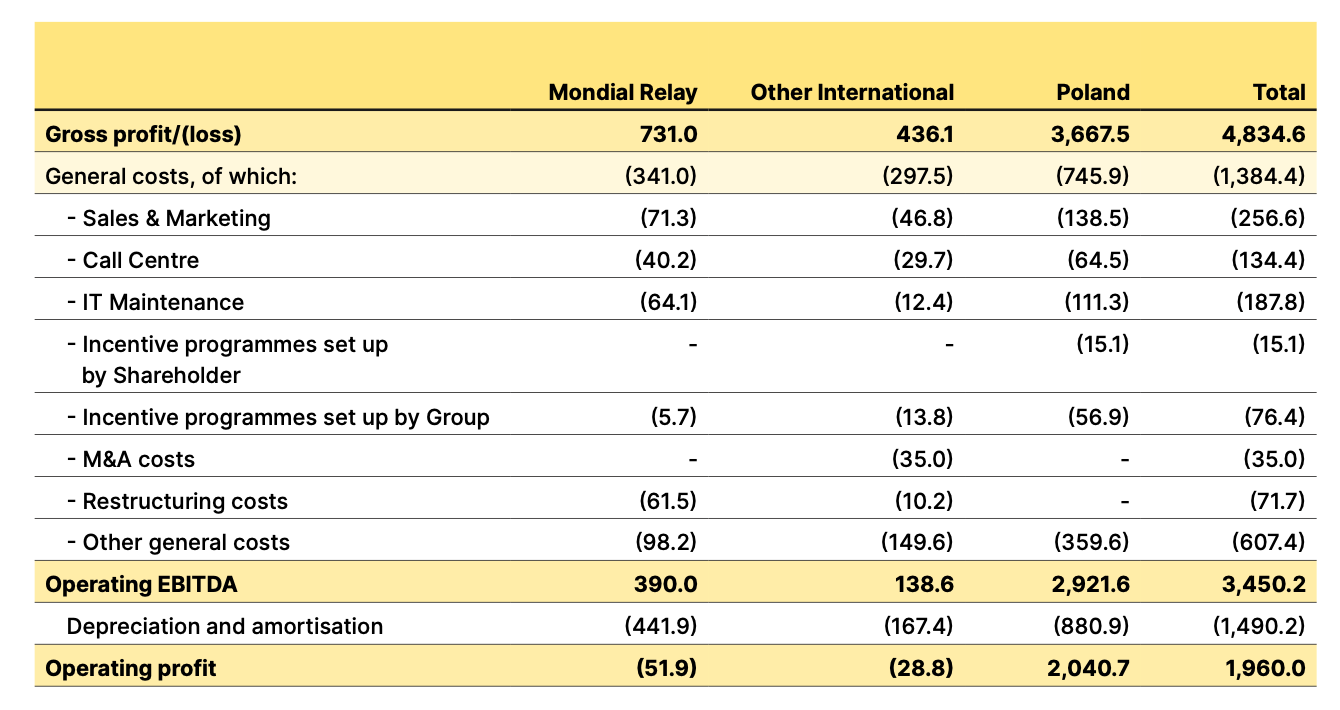

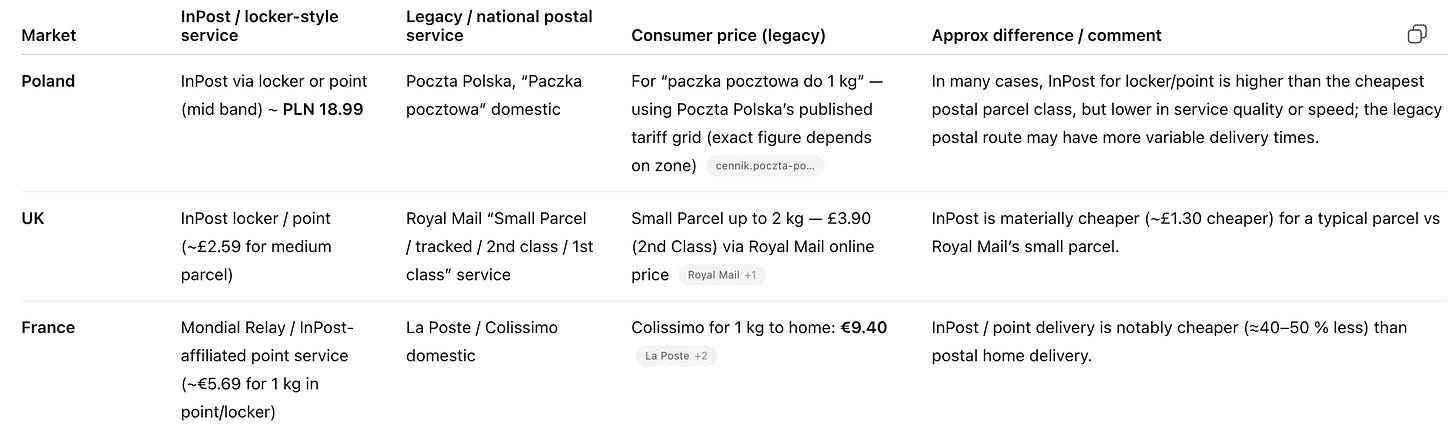

BAM: The business is structurally advantaged: parcel lockers are more efficient (couriers operating within an APM network deliver up to ten times as many parcels as those performing traditional home deliveries), thus cheaper to operate (roughly 20-30% cheaper than what to-door incumbents offer), more reliable, and more environmentally friendly than doorstep delivery. That translates into gross margins (64% for InPost’s APM business in Poland in FY24; 44% on group level) that are more than double those of traditional courier models – and those margins have proven remarkably resilient even amid European macro headwinds.

BAM: Growth outside Poland – especially in France and the UK – is reaching a turning point. After years of investment, volumes and utilization are inflecting upward, and InPost is moving from loss-making expansion to operating leverage.

BAM: The market still prices InPost as if it were a Polish parcel operator with foreign ambitions, not as a European infrastructure play that could dominate the next decade of e-commerce logistics. The valuation reflects skepticism about profitability abroad that’s increasingly disconnected from the improving data.

BAM: The capital structure is improving, the company generates solid free cash flow, and management is now prioritizing returns on invested capital over sheer footprint expansion. The setup is a rare mix of scale, efficiency, and underappreciated optionality.

If I had to summarize the thesis in one line: the market underestimates how powerful InPost’s network economics are once scale is reached outside Poland – and how quickly those economics are now taking hold.

Why this stock now? Because the stock is down roughly 45% from its previous high, and we’re at a moment where the operating leverage from past investments is beginning to surface in the numbers, while sentiment is still anchored in old narratives of capex intensity and regional uncertainty. That disconnect creates a compelling window – one that won’t stay open once the financials fully reflect the cross-market economics already in motion.

Credits where credits are due:

I also want to give credit where it’s due. Jake Barfield deserves a mention again – in a private discussion we had on Timee (my last write-up, which itself was inspired by his analysis), he brought up InPost as an example of how network activity is a critical metric to track and assess a network’s true strength. That idea stuck with me, since it applies equally well to both InPost and Timee. So, in true Pabrai fashion, I decided to be a “shameless cloner” and dig in – the more I looked, the more the opportunity excited me. I also want to thank the investors at Granular Capital, whose excellent 2024 deep dive (read it here) on the company helped me better grasp several of the finer nuances of the business. Finally, Wolf of Harcourt Street also put out a great update on the recent quarterly results.

Disclaimer: I own InPost shares. The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

One More Thing Before We Start … Listen on the Go!

I realize my deep dives truly go deep—they’re dense, detailed, and designed to be studied, not skimmed. Reading and digesting everything here is a proper commitment, and I appreciate everyone who takes the time to do so. But if you prefer a more convenient way to follow along, remember that you can listen to this piece directly in the Substack app. Every post is available in audio form, so you can catch up while commuting, walking, or doing anything else that doesn’t involve staring at a screen.

Part 1 – Understanding the Business

Product: What exactly does InPost sell?

At its core, InPost doesn’t sell goods at all – it sells convenience, efficiency, and time. The company’s flagship product is its automated parcel machine (APM) network – effectively a standalone unit consisting of individual compartments (see image below) –, which allows consumers to send, receive, or return parcels at any hour of the day (24/7) without having to wait at home for a courier.

It’s a logistics infrastructure play disguised as a consumer service. Unlike traditional couriers who rely on doorstep deliveries, InPost’s model is built around out-of-home (OOH) delivery – a structural shift in how e-commerce parcels move from merchants to customers. Basically, the end-consumer is doing last-mile delivery himself; and they can also do returns via the APMs.

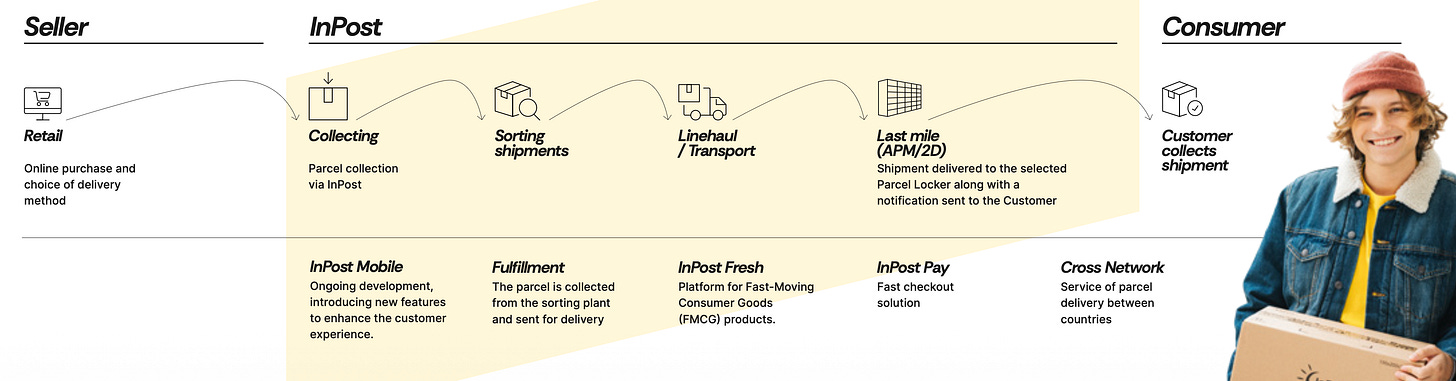

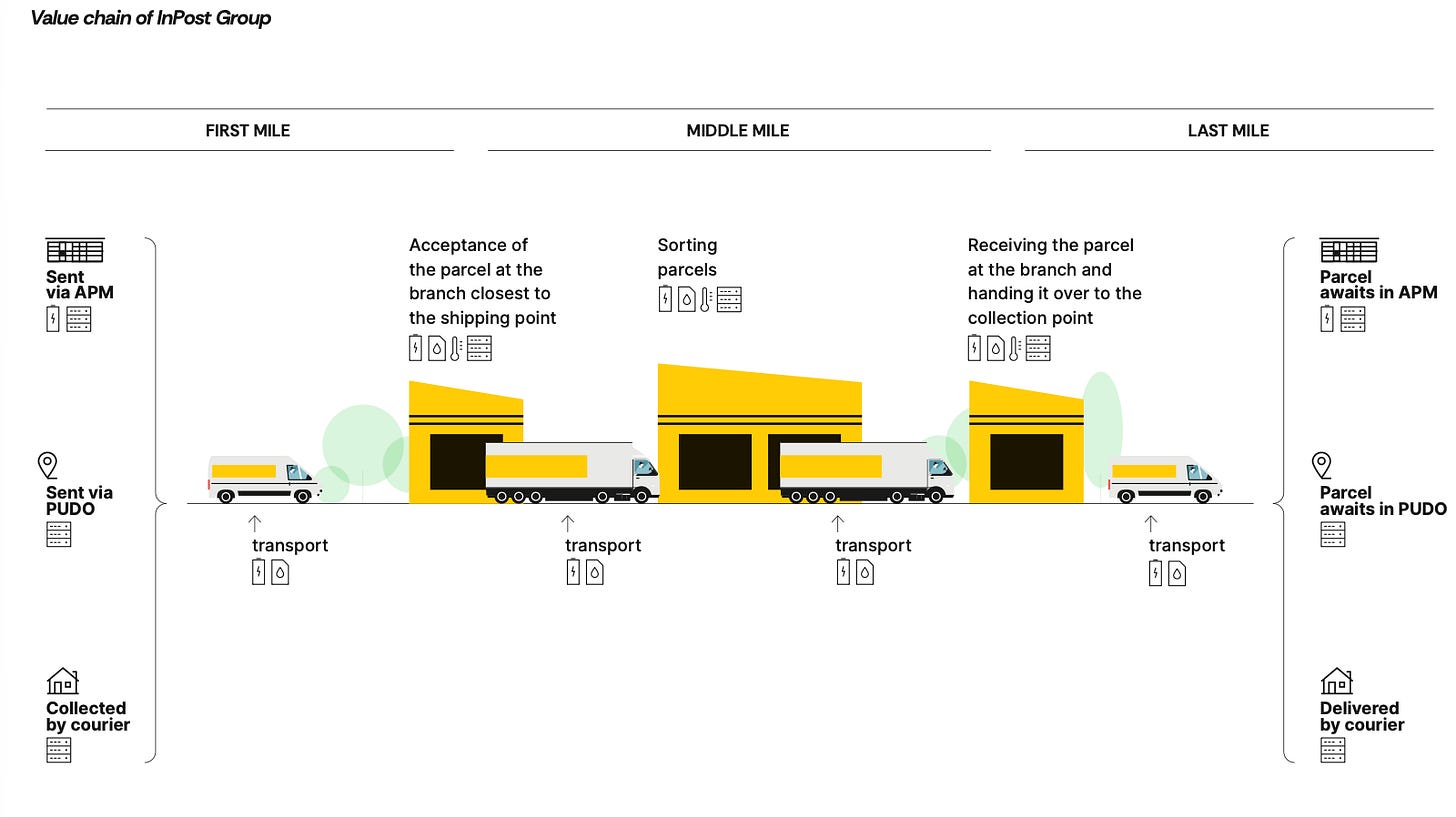

What’s important to understand is that InPost operates a fully integrated, end-to-end logistics network rather than “only” managing locker points or pickup shops. Beyond its extensive network of APMs and PUDOs (Pick-Up, Drop-Off points), the company owns and operates the entire supporting infrastructure – distribution centers, regional hubs, local depots, fleets of vehicles, and drivers – that make seamless parcel movement possible.

This vertical integration allows InPost to control quality, efficiency, and speed across every step of the delivery chain, from parcel induction to final drop-off. It also creates significant cost advantages and operational flexibility, as the company doesn’t rely on third-party carriers for key stages of the process.

A Win-Win-Win Proposition

What makes InPost’s model so powerful is that it doesn’t just work for end customers or merchants – it creates a genuine win-win-win across the ecosystem, including property owners (and arguably even society as a whole due to the environmental benefits).

Let’s start with the customers: At first glance, you may think out-of-home deliveries provide an inferior value proposition. But that’s not quite accurate! I’d just you take a moment and step back to think about this …

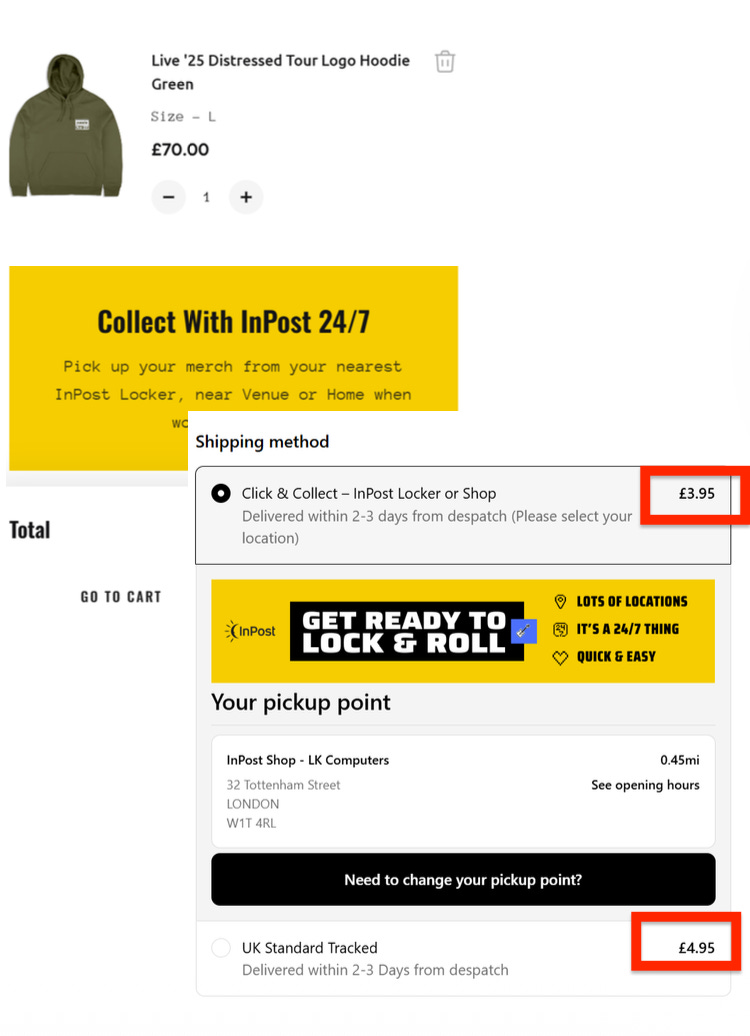

Let me walk you through the entire customer experience, which is really quite simple: an online shopper selects “InPost locker” at checkout, receives a notification (via email or in the app) when the parcel arrives, and picks it up from a nearby locker using a QR code or app. It’s often the faster (if the network is established, which takes time to build, as to be discussed) AND cheaper option for customers (if the merchant passes the delivery cost on to customers).

APMs offer the benefit of no waiting around for couriers, no pick up from the neighbors you don’t like, no scheduling conflicts, and no awkward drop-offs during work or online meetings (keep in mind that usually delivery windows are VERY wide, and if I just consider my wife as a benchmark here (don’t tell here), she is regularly expecting multiple parcels a day – you can simply pick up or send parcels whenever it suits you, often when you’re on your way to grocery shopping, on a walk, or when you’re outside anyway.

For merchants and logistics partners (as of Q1, 55,000 merchants), this means fewer failed delivery attempts (in fact, almost none), fewer incidents of theft (a somewhat unrelated fact: 54% of Americans say they’ve had a package swiped) or damaged parcels (I just received a damaged one yesterday via to-door delivery), higher delivery density, and dramatically lower last-mile costs.

“One driver during eight-hour shift visiting around 12 different locations with 12 machines may deploy up to 1200 parcels during eight-hour shift. Whereas normally a driver may deliver 60 to 75 parcels in traditional door-to-door way. […]

One machine, just to give you a comparison, a visual comparison, one machine in Warsaw, on a daily basis, saves as much CO2 as 1200 years old trees during the whole year. One day, 12 trees a year. Because people are passing by or going by walk, picking up their parcel, instead of having, you know, 12 or 15 vans delivering the same number of parcels directly to your home.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

And as discussed, for consumers, it means speed and flexibility. That combination of lower cost and higher convenience is what gives the product its edge – it’s cheaper to operate and better to use.

Finally, not only do customers and merchants benefit (faster & cheaper deliveries), no InPost’s APM network also delivers tangible value to the property owners hosting its lockers. These partners – often convenience store operators, transport hubs, or residential complexes – gain an incremental stream of rental income from space they already control, while simultaneously enhancing the attractiveness of their location for visitors. The presence of a frequently used APM drives higher foot traffic, which directly benefits nearby businesses. The investors of Granular Capital found out that up to 10% of locker visits result in additional in-store purchases, meaning that property owners/landlords naturally prefer to lease space to the operator with the highest utilisation. Because InPost’s lockers typically generate several times more footfall than competitors, the economic gap becomes self-reinforcing: a rival would have to pay many times more “rent per parcel” to compensate for the lower incremental profit their locker generates. In other words, InPost’s density advantage doesn’t just lower its own unit costs – it also makes it the most attractive and economically rational partner for property owners.

So in sum, customers get faster, cheaper, and more flexible parcel delivery; merchants gain a reliable, scalable logistics partner that improves conversion and reduces last-mile costs; and property owners hosting lockers benefit from an additional, low-maintenance revenue stream and higher foot traffic to their sites. This alignment of incentives reinforces network effects on all sides, strengthening InPost’s moat as the network scales.

Building a Network, One Locker at a Time

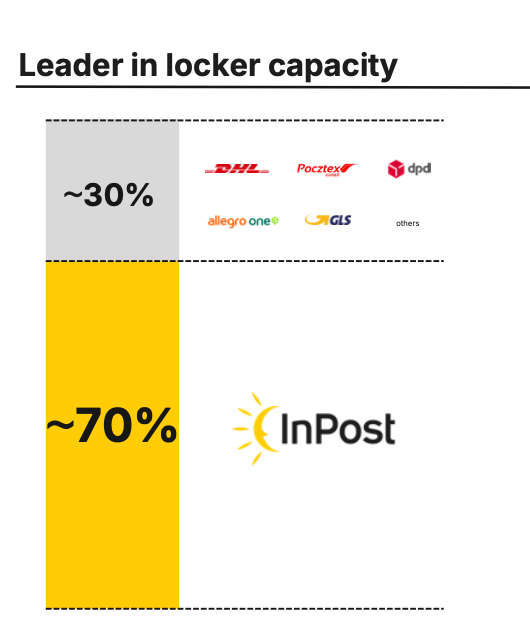

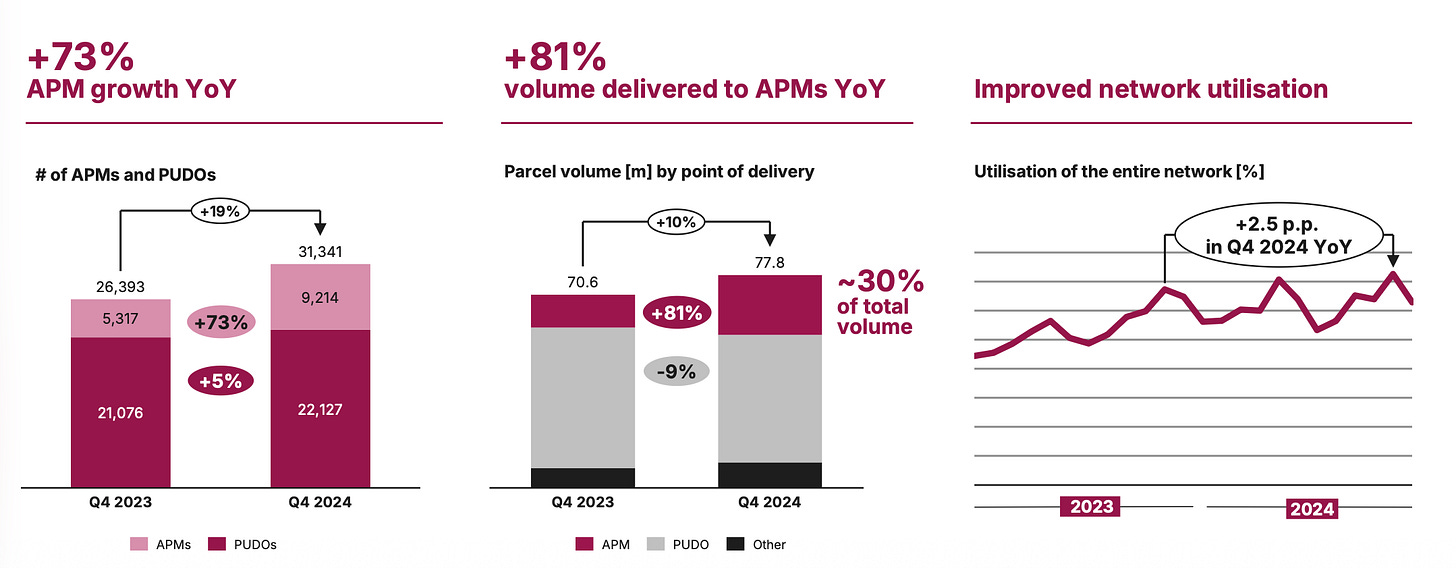

What makes InPost’s product truly differentiated is its network density. In Poland, where the company started, parcel lockers are nearly ubiquitous – more than 26,000 automated parcel machines (APM) locations cover the country, with roughly 70% of Poles living within a 7-minute walk of one. InPosts is the clear leader in terms of capacity in Poland:

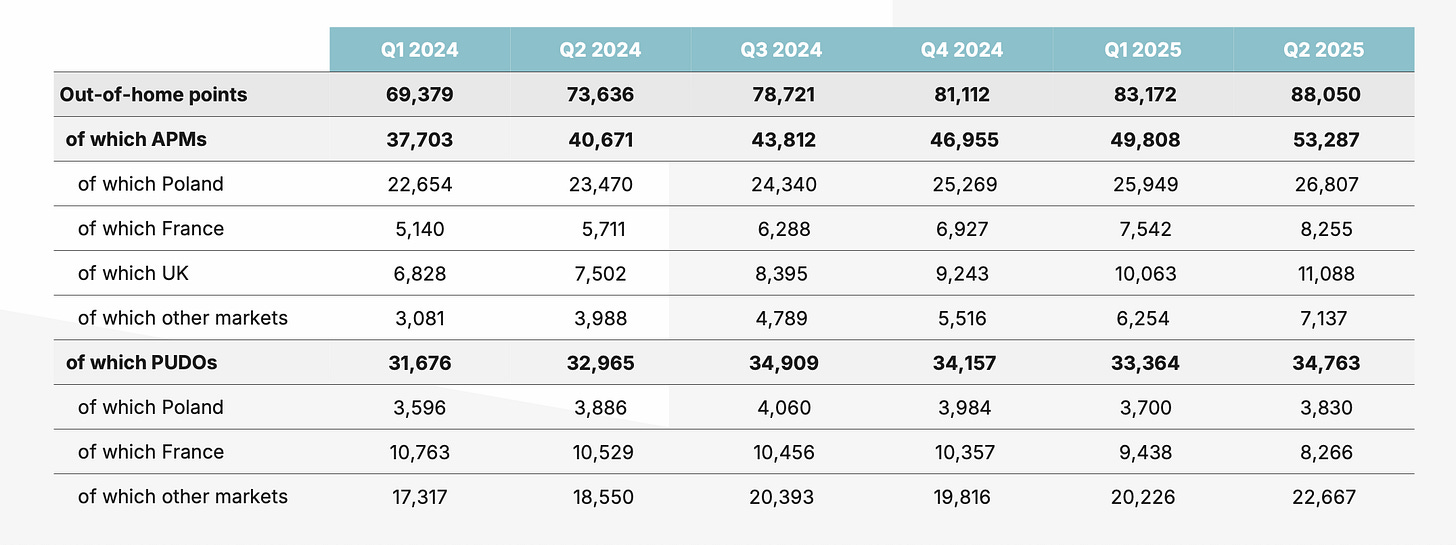

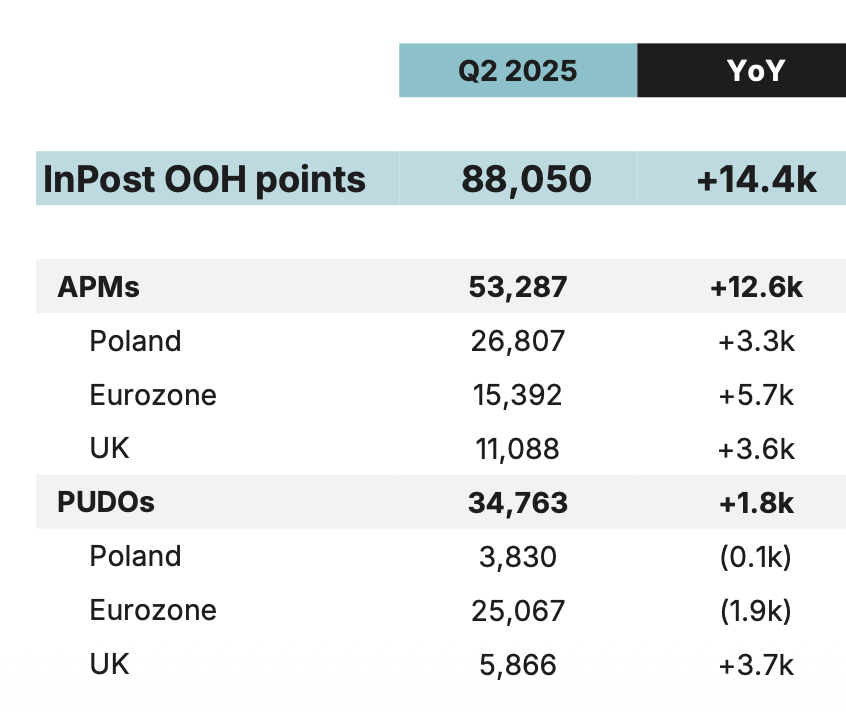

The total APM network encompasses more than 50,000 APMs as of Q2 and includes roughly 35,000 PUDOs (again, PUDO stands for Pick-Up, Drop-Off point, which is a human-staffed partner location) on top of the APM network.

“The different degrees of development can best be understood by looking at the number of OOH points per 10,000 residents. This is still indeed much higher in Eastern Europe and Scandinavia (around 15 in Poland and the Czech Republic; around 16 in Finland) than in Western European countries (around 8 in Germany and around 9 France), but growth is ubiquitous.“ - McKinsey (2024)

That saturation is nearly impossible for competitors to replicate, and it’s the backbone of the company’s moat (to be discussed in more detail further below).

The service feels premium because of its reliability and coverage (“it just works” - similar to Netflix in a way).

This places InPost squarely in the mid-tier segment of logistics – affordable enough for budget-conscious merchants, yet efficient and reliable enough to serve premium e-commerce players who can’t afford to compromise on customer experience. It sits in that sweet spot between cost and quality that few operators manage to occupy for long. At the lower end of the market, InPost’s just-in-time network is almost too good a fit. For example, with low delivery expectations among AliExpress customers, a hyper-efficient and convenience-led network like InPost’s is, in many ways, an “overkill solution.” These buyers value price over speed, and the economics of their cross-border shipments don’t demand (or reward) rapid fulfillment. That’s why the threat of Alibaba or AliExpress encroaching meaningfully on InPost’s home turf is often misunderstood.

Beyond lockers, InPost also operates courier and to-door delivery options – mainly as a complement for merchants who want hybrid fulfillment. However, these are strategically secondary. The locker network is the profit engine and main focus, and nearly all innovation and capital allocation revolve around strengthening and expanding that ecosystem.

Understanding the Difference Between APMs & PUDOs – and Why It Matters!

When investors talk about InPost’s expansion, the discussion often gets muddled by jargon: PUDOs, APMs, OOH, hybrid networks. Yet understanding the difference between Automated Parcel Machines (APMs) and Pick-Up Drop-Off points (PUDOs) in particular is central to grasping InPost’s strategy going forward – and its competitive edge.

The distinction isn’t just operational. It defines the company’s long-term profitability, scalability, and customer stickiness.

PUDOs are the legacy format of out-of-home delivery. They’re hosted inside partner shops – corner stores, kiosks, post offices – where customers collect or return parcels over the counter. PUDOs are cheap to set up but expensive to maintain. Each can only handle 50–100 parcels at a time, has limited opening hours, and depends heavily on the quality and reliability of individual shop owners. As one industry insider put it, managing a fragmented network of PUDOs means “thousands of feet on the street” and constant churn among mom-and-pop locations. The operational friction adds up: compliance issues, inconsistent service levels, and slower parcel turnover. Average parcel dwell time in a PUDO is around 1.5x longer than in an APM, meaning slower utilization and more working capital tied up in the system.

“Convenience stores aren’t that convenient for parcel collection, and particularly not during the pandemic.“ - David Kerstens, an analyst with Jefferies International

By contrast, APMs are InPost’s signature product – self-service lockers accessible 24/7, scalable through modular design. Each machine can hold 200+ parcels and be expanded by adding columns as volume grows.

“Unlike a warehouse or a pick-up-drop-off (PUDO) location, the size and therefore capacity of an APM can dynamically increase as demand grows - the APMs are modular and new columns of lockers can be added with relative ease. […] [In Poland] InPost has 1,000s of machines that have 200+ lockers.“ - Granular Capital Ltd. InPost Write-Up (2024)

For drivers, APMs are a logistics dream: a single stop can offload hundreds of parcels, and each route can include 7–10 APMs per day, translating to up to 1,000 parcels per driver. That’s an order of magnitude higher than a typical PUDO route. This scale efficiency compounds across two of the company’s largest cost centers – labor and transport – creating structural operating leverage that competitors without APM expertise simply can’t replicate.

From the consumer’s perspective, the difference is equally stark. A parcel pickup at a PUDO can involve waiting in line, limited opening hours, and sometimes disorganized backroom storage. By contrast, an APM pickup takes around 30 seconds, requires no staff interaction, and can be done anytime. That frictionless experience has made lockers the preferred choice wherever InPost operates, with satisfaction scores consistently above 90%. As Rafal Brzoska often emphasizes, “Our North Star is 100% APMs in out-of-home delivery… it’s not about the locker itself—it’s about the ecosystem that makes the locker experience seamless.”

“But clearly, we are working today in all those international markets with a legacy mixture PUDO business through sort of asset-light strategy and acquisition. And clearly, there’s also a unit economic advantage of converting from a legacy PUDO parcel rate to an APM rate where we don’t have that cost apart from, obviously, the CapEx and then we sweat that asset.“ - Q2 25 Call

“[…] what we’re really satisfied with is the flow rate to APMs that we have observed. In Q1 ‘25, almost 40% of all parcels were delivered to APMs. That’s compared to over 20% a year ago and 11% 2 years ago. That’s significant progress as we observed the parcels going to APMs as we continue to automate from our out-of-home network converting from PUDO to APM.“ - Q1 25 Call

“Q: I’m aware that PUDOs are less popular amongst online buyers than APMs if you look at MPS, but perhaps you can shed some more light on it. So Michael will comment the Eurozone dynamics, but I will comment generally.

A: Of course, for us in North Star is 100% of APMs in out-of-home. This solution provides best-in-class customer experience, 24/7 access to the service, localization, but also extraordinary good efficiency, operating leverage, which then translates into profitability. And I think this is the DNA of the company. Still even in Poland, we keep some PUDO points mostly for the locations where we cannot expand, extend our lockers, let’s say, in city centers. But -- this is our way. We know how to do it. We know how to transform it. And also looking at the consumer adoption on the new markets we developed from scratch, we see consumer preferences, and it’s hard to discuss with that. The preference is here, and it’s not about lockers itself. It’s all about the ecosystem we’ve built, giving our end users the confidence that this is the best solution, matching their expectations. […]

In fact, as we’ve gone through that journey and because our volume increased, we have actually increased initially some of the PUDO coverage to compensate for that volume. That was a good problem because clearly, our volume grew as we really went to market and revitalized the Mondial Relay offer. […] As Rafal said, we will keep PUDOs, right? North Star will be 100% APM, but there is a pragmatic reality in certain locations. We will still need PUDO coverage for one, because we can’t find a locker location for a variety of potential structural reasons or we need overflow capacity at a certain time of year that we feel that the PUDO can help us serve for that particular period. But again, that should be the less than the majority of what we’re really servicing through APMs.“ - Q1 25 Call

InPost’s current footprint still includes a mix of both. That’s by design, not weakness. In international markets such as France and the UK, where InPost inherited legacy PUDO networks through acquisitions like Mondial Relay and Yodel, the company uses PUDOs as a transitional bridge – a fast way to build coverage and brand familiarity before densifying with lockers. As utilization rises, management systematically converts PUDO volumes into APM flows. In Q1 2025, nearly 40% of all parcels in international markets were already delivered to APMs, up from 20% a year earlier and just 11% two years ago.

Strategically, this migration from PUDO to APM is at the core of InPost’s international playbook. It’s how the company turns what initially looks like a low-margin, asset-light entry model into a high-margin, asset-heavy network that compounds efficiency over time. The process mirrors how Poland evolved: start with reach, build habit, then optimize with density and automation.

Just to provide a personal anecdote to illustrate how hard it is to change consumer habits: when we moved to a new apartment last December, a DHL-operated APM was installed right across the street – a two-minute walk at most. A friend even pitched me on the benefits of using it, and intellectually, I completely understand them. Yet, I haven’t used it once. It’s a good reminder that behavior rarely shifts overnight. As Buffett once put it, “The chains of habit are too light to be felt until they are too heavy to be broken.” The same dynamic plays out with the adoption of new consumer technologies like self-checkout terminals in grocery stores – change does come, but it comes slowly, and only once social norms and routines catch up.

Internationally, for InPost, every conversion from a PUDO parcel to an APM parcel isn’t just a small operational gain – it’s a step closer to recreating the Polish economics abroad. The transition takes patience and capital, but the reward is clear: once lockers dominate, the business becomes self-reinforcing – higher utilization, lower variable cost per parcel, and a customer experience that’s almost impossible for incumbents to match.

“In terms of your question more strategically on expansion and PUDOs versus APMs, look, we don’t disclose individual numbers on those different streams, but it’s obvious that the efficiency of delivering a PUDO network versus an APM network is much more to the favor of an APM network.“ - Q4 24 Call

“Of course, it depends on the density of the APM network and utilization of the APMs, but we’ve proven in many markets that we know how to manage that. As Rafal said, it’s not just about putting APMs in place. It’s the expertise on how to run them, which makes a difference. On top of that, PUDOs also have separate fees you need to pay. So obviously, lower efficiency in the amount of parcels you can deliver logically to the PUDOS versus APM and the fees you need to pay make APMs clearly the preferred vehicle to go to and also from a profitability point of view. And therefore, also, there’s been a couple of articles on that. It’s clearly also for us that, when you look at the amount of touch points for the consumer, we will be building up APMs and you will see PUDO touch points going down over time because that is both from a consumer experience point of view, a merchant quality point of view and from a profitability point of view, the right way to go.“ - Q4 24 Call

New Products & Innovation

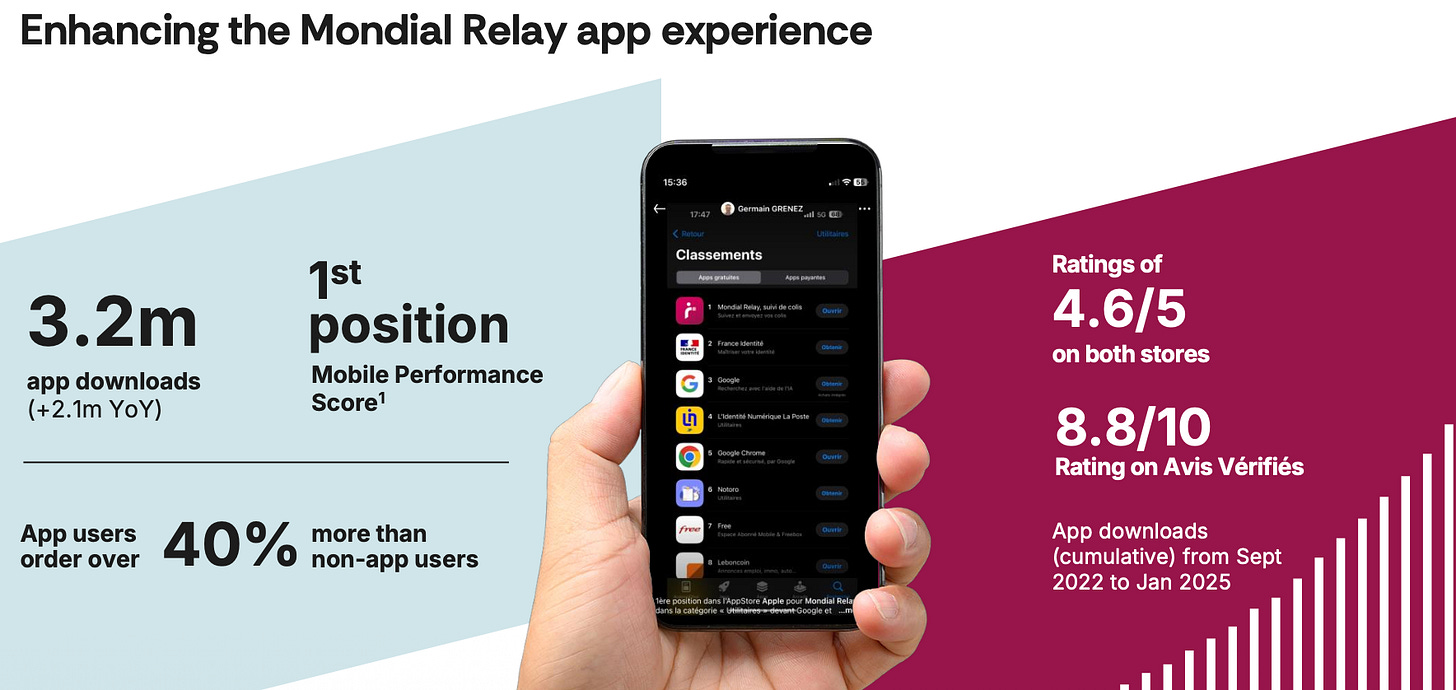

In terms of new products, InPost continues to evolve its ecosystem rather than branching into unrelated areas. Recent developments include returns and reverse logistics integrations (especially with major fashion retailers), EV-powered micro-depots that improve sustainability, and mobile app enhancements that increase customer stickiness through loyalty features and parcel tracking (14.6m InPost mobile app users as of Q2 (“a number that surpasses the number of households in Poland“), 3.2m Mondial Relay app downloads as of Q4, and 1.9m InPost app downloads in the UK as of Q4).

Some of the benefits of using the app include:

Contactless parcel collection – users can open locker compartments directly via Bluetooth without touching a screen, enhancing convenience and hygiene.

Real-time tracking – provides detailed shipment status updates and notifications for both senders and recipients.

Integrated shipment management – users can create, pay for, and send parcels directly through the app, without needing a printer or physical label.

Label-less returns – simplifies the returns process by generating QR codes for scanning at lockers or partner points.

APM locator and navigation – helps users quickly find nearby parcel lockers (APMs) or PUDO points with availability information.

Digital receipts and delivery history – stores all shipment and return data in one place for easy access.

Push notifications and reminders – ensures users never miss collection or return deadlines.

Loyalty and rewards integration – connects to InPost’s loyalty program (“InCoins”), allowing users to redeem or donate points directly in-app.

The company also experiments with advertising and data-driven services built around its app and locker network – small now, but indicative of long-term optionality beyond parcel delivery itself.

Let’s take a closer look at some of the innovations. As mentioned, InPost offers a printless/label-less returns option that allows customers to send back parcels without needing to print a return label. Instead, shoppers simply generate a QR code through the retailer’s app or website, scan it at any InPost locker, and drop the parcel into an available compartment. The system automatically links the return to the right merchant and handles the rest. This feature may sound small, but it perfectly captures InPost’s customer-centric and innovation-driven culture. By removing one of the most annoying frictions in e-commerce returns – the need for a printer – it streamlines the entire experience and appeals to modern, mobile-first consumers. It’s a good example of how InPost continuously uses technology and data to identify real-world pain points and simplify the logistics journey, reinforcing its brand as a convenient, digital-first, and environmentally conscious alternative to traditional postal services.

“And the same way it works with shipments. If you want to return some goods, you don’t need to go typically to the post office to ship it. You go to the nearest locker and you can ship the parcel directly in the machine within 10 seconds, even without having any label on it, because everything is label-less. End consumer centricity is the DNA of the company. We have extraordinary NPS, more than 80 points right now, and we measure that every single quarter with third-party serving agency. And they literally give us the guidance as well, what people expect, what are the new channels we may deliver even better service.

And that was, for instance, thanks to those surveys, we noticed that the label, printing out the label for the return is a hassle because people are using less and less printers at home. So we have invented, you know, a special functionality in our mobile app. By the way, our mobile app is in our home market right now, the most often used mobile app among 12 million users.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

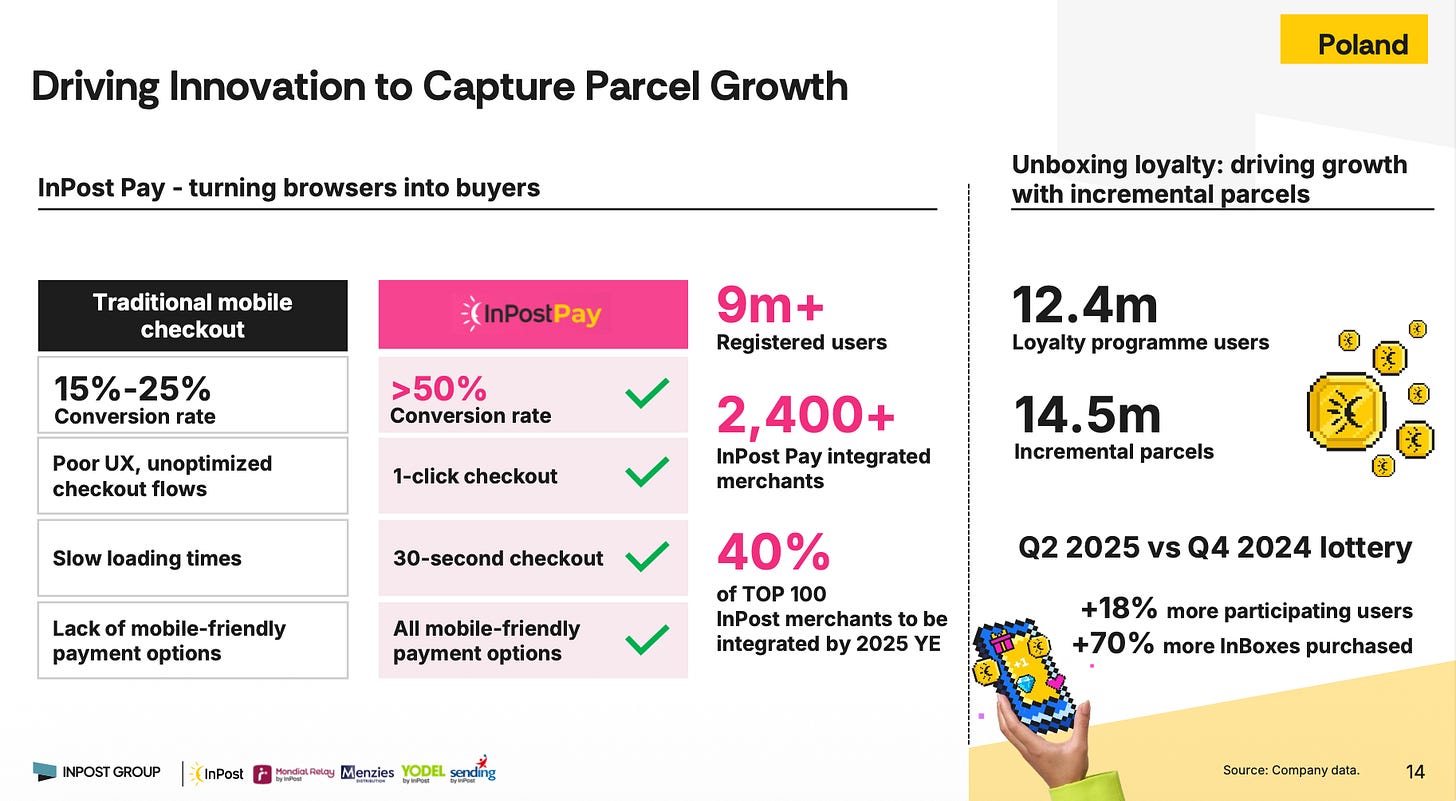

Another example is InPost Pay – I’ll simply attach some key quotes from management and the most recent slide deck on the progress that is being made:

“Inpostpay already has almost 8 million registered users and partnerships with over 1,600 merchants that already see a 30% plus increase in their checkout conversions.“ - Q4 24 Call

“I’m happy founder and shareholder of the company. But it’s led by a great, continuously working on the innovations. And our recent innovation, InPost Pay, it’s like Apple Pay, you most probably know, but including immediate checkout with delivery. You don’t need to log in. You don’t need to create your own profile on the website of the merchant. You can shop as a guest, and you just confirm the transaction in InPost mobile app. All your credentials, your cart details are in the mobile app. You don’t share it with multiple merchants. We have more and more data leakages right now, and people’s personal data you can buy everywhere. Here, it’s very secure. It’s just once left in our mobile app, and you can shop online on multiple of merchants’ websites without any hassle, and it takes you literally five seconds to close the transaction. So we provide extraordinary safety linked with extraordinary quality of the service and speed of finalizing the purchasing. And moreover, it’s always linked to your most preferred option of delivery, which is our InPost Loca. And this is another barrier to entry for the others. How to break such a wall, how to break such a relationship when you left some of your personal data to me. Why you want to share it with the others if that solution works? And this is all about the DNA of the company that continuously when we think about new services, we think in a way what we can do better or what we can create new, what’s not existing yet on the market. And that’s how the company is led and how the company develops their new services, how we strengthen our value proposition for end consumer, but also for the merchants.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

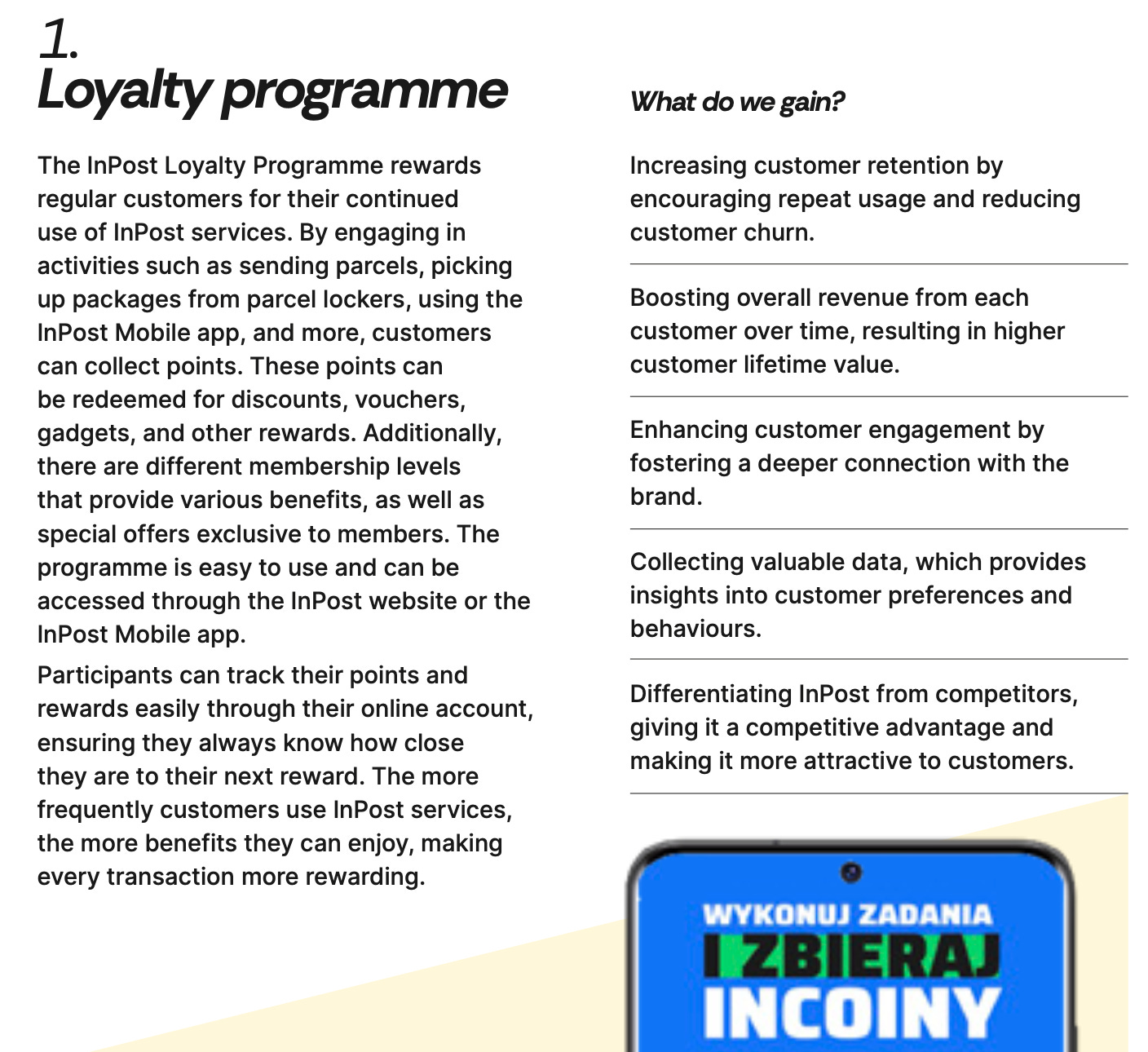

Further examples include the InPost Loyalty Programme, which “rewards regular customers for their continued use of InPost services” and already has 12.4 million users; …

“We’ve received a lot of positive feedback, and we plan to roll out loyalty program to other markets, too.“ - Q4 24 Call

“[…] the loyalty program we enrolled is the most successful loyalty program ever enrolled in Poland.“ - Q4 24 Call

… robotic solutions to optimize warehouse efficiencies …

… and similar initiatives; …

“By continually redeveloping and refining their operations, InPost has driven step-change improvements in efficiency. For example, initially, parcels were collected from APMs and taken to local depots and then sent on to sorting hubs where they were redistributed overnight and sent back to depots to be placed in APMs in the morning. Today, depots can sort so that where it is more efficient, parcels move from depot to depot and never have to go to a sorting hub. This significantly reduces the miles travelled by each parcel and greatly increases the efficiency of the operation.” - Granular Capital Ltd. InPost Write-Up (2024)

… or deploying more energy-efficient APMs, consuming 40% less energy.

Finally, this is another little anecdote from the Q2 2025 call, highlighting how InPost is embedding itself deeper into local communities and turning everyday logistics infrastructure into something socially meaningful:

“And one of recent example is our AED initiative. We’ve started deploying defibrillators next to our lockers and users can donate their loyalty points to help fund that. In just 1 month, users contributed over 100 million InCoins to support this life-saving effort. Innovations like this strengthens our ecosystem, deepens customer loyalty and captures more parcel growth. And this is just the beginning.”

Unit Economics

The most important unit of analysis is indeed one parcel delivery. The majority of revenue InPost generates is from the fees it charges merchants for delivery through its network, which the merchants may decide to pass on to consumers (directly or indirectly).

“Services are provided to customers through a “pay-as-you-go” model in accordance with standard price lists […]“

Prices per parcel differ based on the delivery method, and the size and weight of the parcels. Pricing is typically reviewed on an annual basis.

InPost also offers subscriptions, which come with a certain number of credits for parcel deliveries based on 1-2-year contracts:

“For subscription contracts, the customer pays an agreed fixed monthly fee for deliveries of a defined number of parcels per month. The performance obligation under the subscription contract – delivery of a parcel – becomes binding once delivery is requested by the customer. Unused deliveries (breakage) do not roll forward to the next month, and, therefore, the Group recognises the breakage amount as revenue at month-end.“

So the key elements of a per-unit economics analysis include:

the revenue per parcel (which varies by route and market) and

the cost per parcel (operating cost to transport and deliver that parcel through either a locker or courier).

For InPost, cost per parcel tends to decline as volumes increase, due to density and scale.

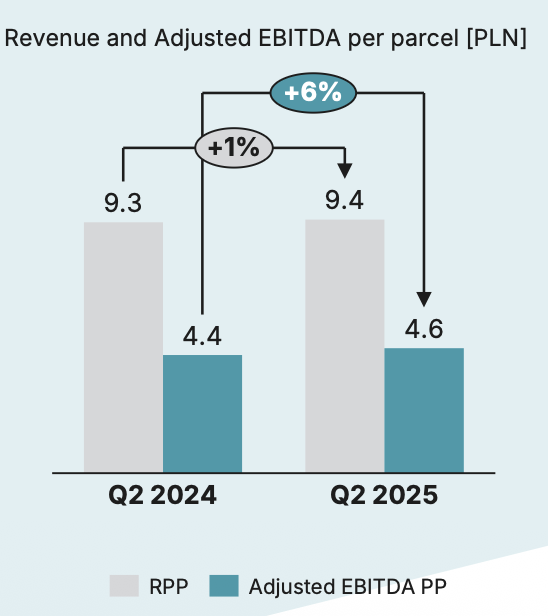

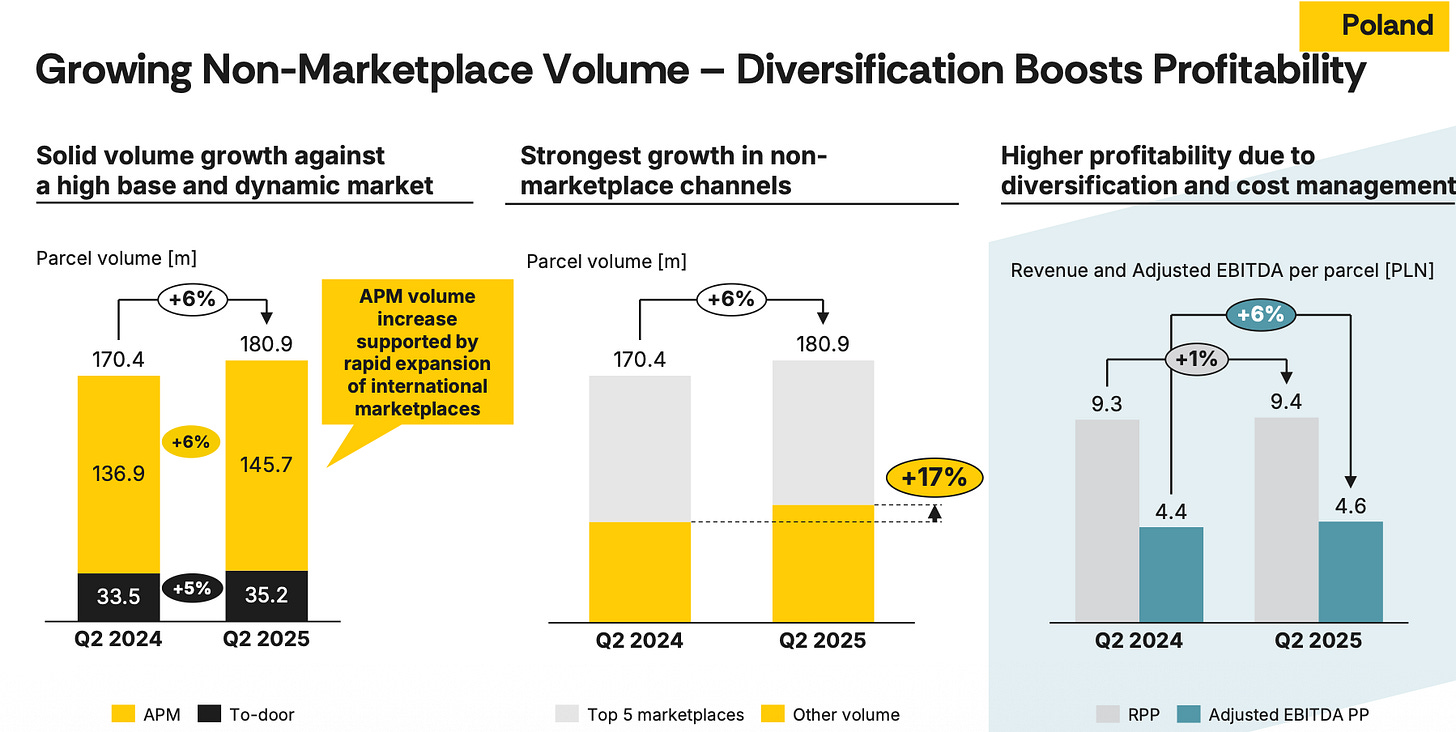

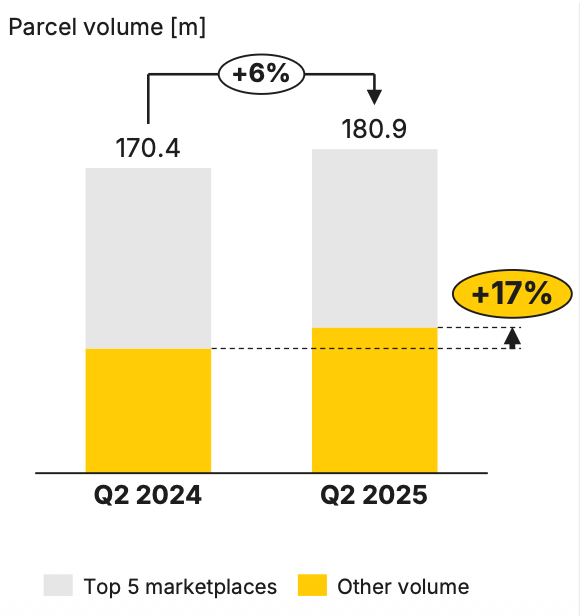

“While revenue per parcel grew 1%, adjusted EBITDA per parcel increased 6%, even as we continue to expand the network ahead of volumes.“ Q2 25 Call

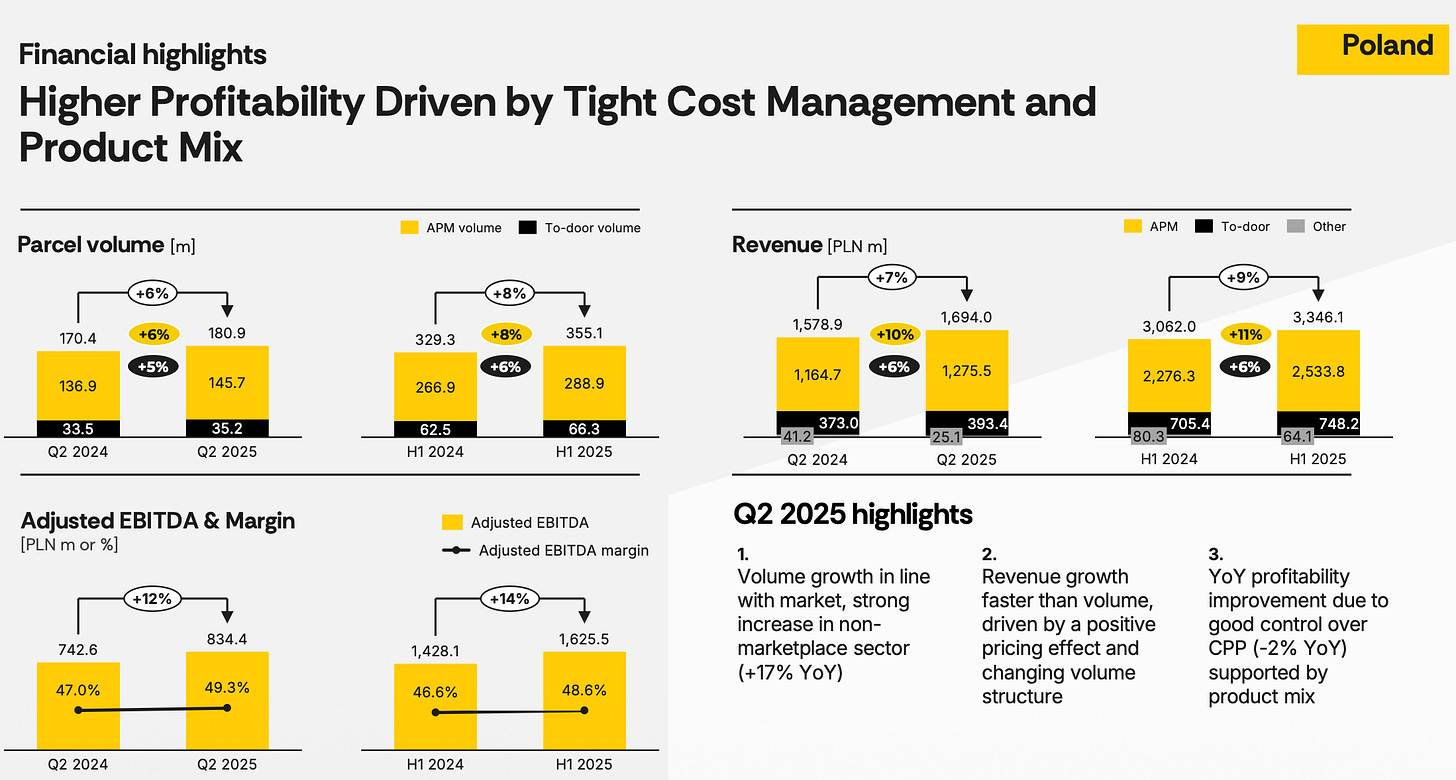

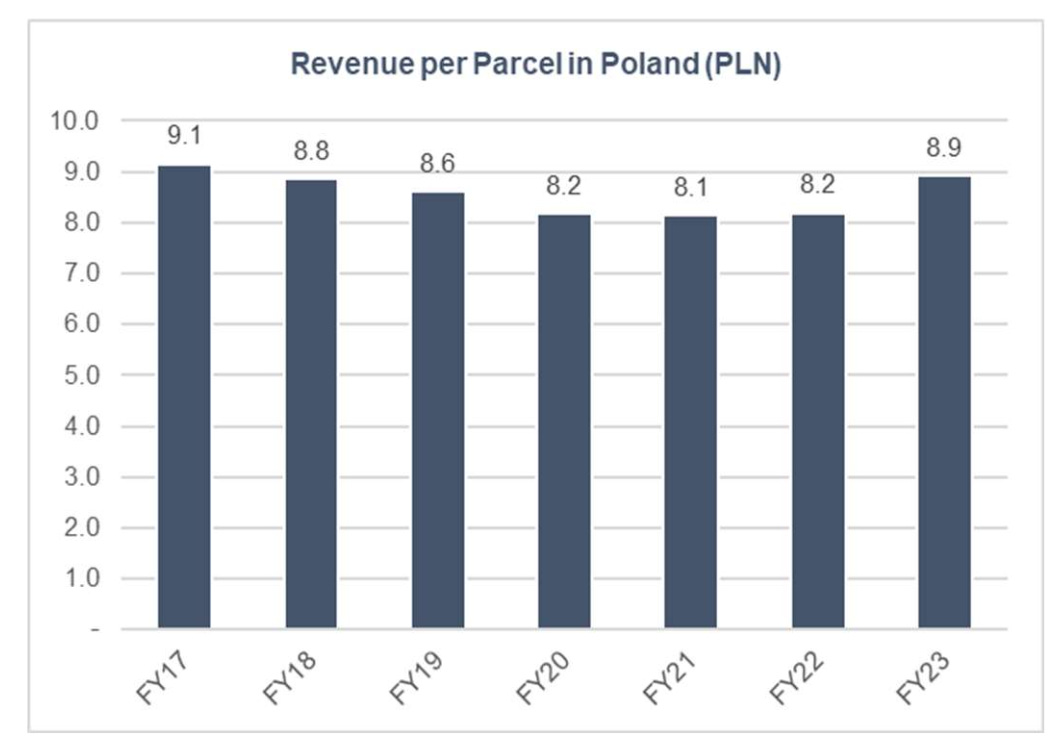

In its mature Polish network, the cost to handle an additional parcel is very low – once lockers are in place and routes are optimized, delivering more parcels mostly adds variable costs like a bit of labor and vehicle fuel, but not much overhead. This is evident in the company’s data: Poland’s cost per parcel has been managed down over time, contributing to the nowadays established high margins. InPost’s management noted that in Poland, they achieved a -2% YoY reduction in cost-per-parcel in a recent quarter through efficiency gains. On a longer-term basis, cost-per-parcel even declined by more than 40%!

In short, this isn’t a company competing on price in a commoditized space. It’s competing on infrastructure quality, speed, reliability, convenience, and data, and its “product” – the dense network of lockers – becomes more valuable with every new location added, and each APM throws off more profit per parcel as the utilization rate increases. Each locker installed isn’t just a delivery point; it’s a micro-node in a growing web of European e-commerce efficiency.

More on Business Operations & Economics

InPost’s story started in Poland, where a small local logistics player – founded in 1999 – made an early bet on something few others believed in: out-of-home delivery through automated parcel lockers. That decision, years before e-commerce reached critical mass, created a structural advantage that’s now spreading across Europe. The early years were about survival and building density; later came a turning point when scale economics kicked in and the company proved that a dense locker grid could be both cheaper and better for customers.

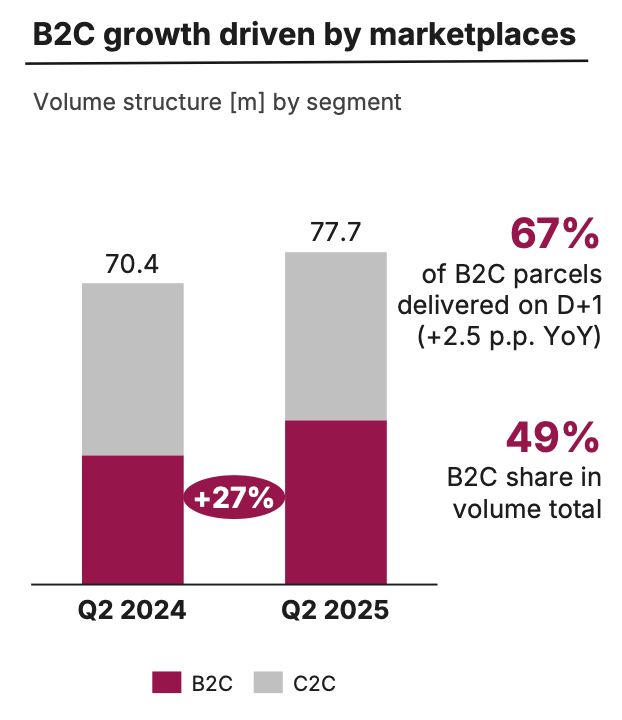

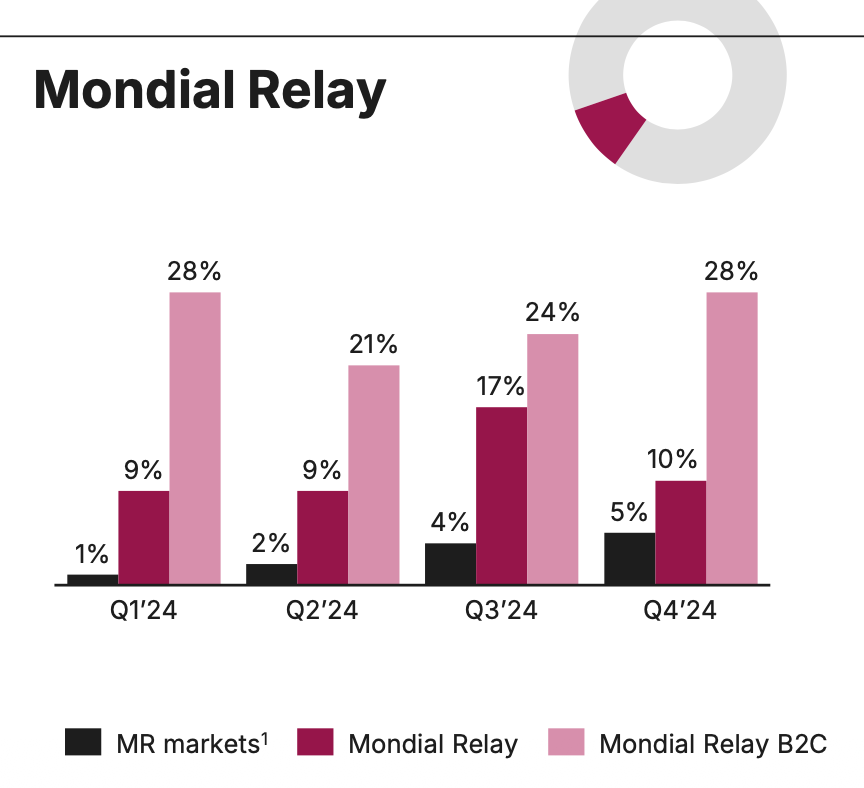

Acquiring Mondial Relay in 2021 gave InPost a bridge into Western Europe, particularly France, while the UK build-out added both scale and credibility. By 2025, the business had crossed a psychological milestone: more than half of total revenue now comes from outside Poland. That shift marks InPost’s evolution from a national champion into a truly European logistics platform.

The way the business makes money is surprisingly simple. Merchants and logistics partners pay per parcel delivered or returned through InPost’s network. Most of this revenue is transactional, linked to volume, but the economics improve dramatically with density. Once a locker is installed, the incremental cost of handling another parcel is tiny, which makes utilization the single most important metric.

Fixed costs – lockers, depots, leases, and IT infrastructure – dominate early on, but as parcel volumes fill each node, every extra shipment carries a high contribution margin. That’s why Poland’s mature network generates margins near the 50% range, while newer markets like France and the UK still lag but are steadily closing the gap. Management commentary and regional EBITDA trends tell the story clearly: when utilization rises, margins expand almost automatically.

Geographically, Poland remains the cash cow and operational template. Here, InPost is the clear leader “in terms of the number of APMs, but [they] have an even more clear leadership with over 70% of the number of compartments on the Polish market. Do note that the balance 30% is shared by many different brands with separate logistics, varying quality, separate IT systems and completely different strategies.” (Q4 24 Call) In total, InPost delivers around 50% of all parcels in Poland.

France has emerged as the second core market, and the UK has quickly become a major contributor after integrating recent acquisitions.

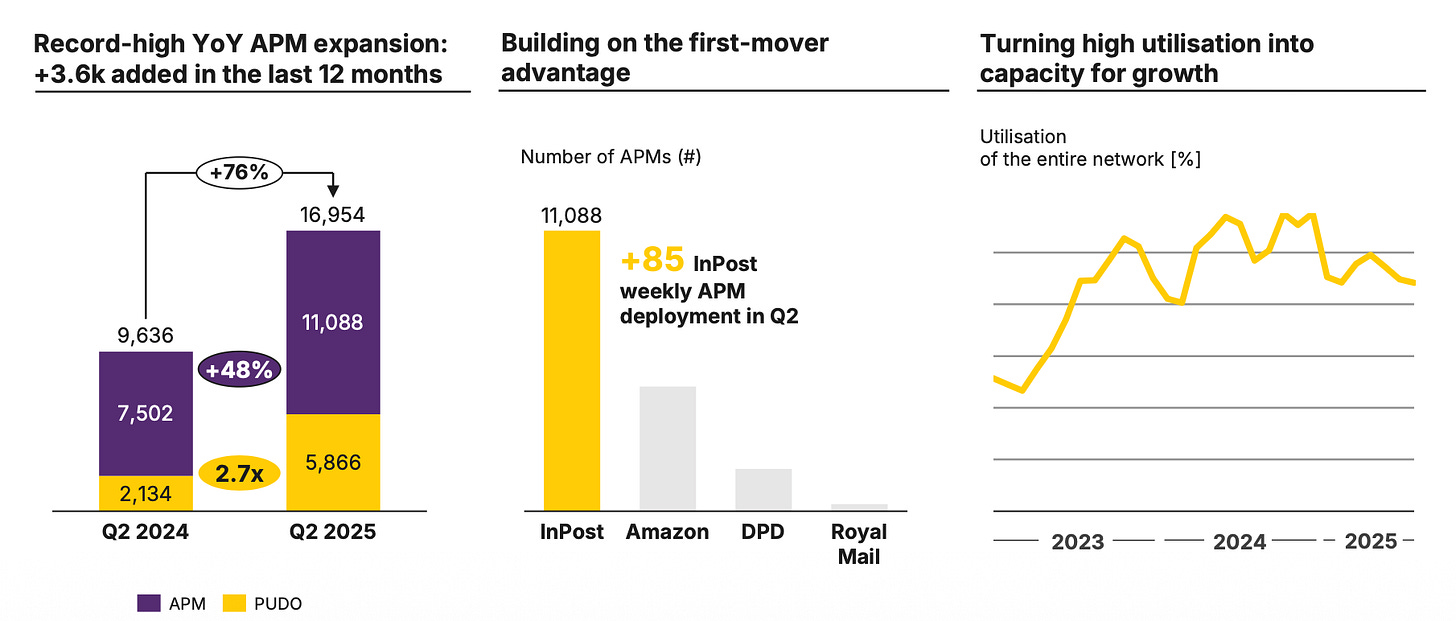

“In Q2, we deployed 85 APMs per week in the U.K., while key competitors averaged around 11.“ - Q2 25 Call

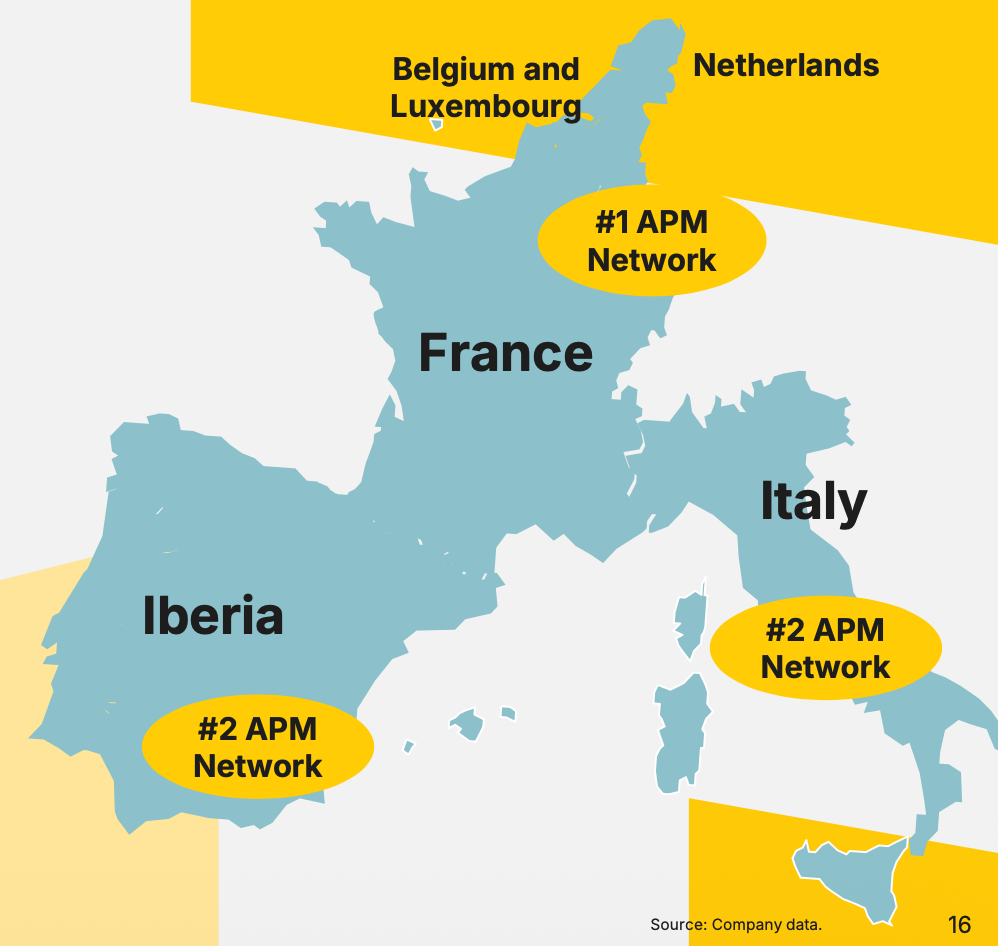

The rest of Europe – Iberia, Benelux, and Italy – is in earlier phases of rollout. As of today, InPost operates in nine countries:

Poland

United Kingdom

Italy

France (under the Mondial Relay brand).

Belgium (under the Mondial Relay brand).

Netherlands (under the Mondial Relay brand).

Luxembourg (under the Mondial Relay brand).

Spain

Portugal

The geographic diversification reduces dependence on any single economy, but it also brings new challenges: regulatory fragmentation, different labor structures, and varying e-commerce maturity levels. These are execution risks rather than existential ones, though, as the model’s appeal is universal – cheaper for merchants, faster for customers.

The value chain position is clean and hard to replicate. InPost sits between merchants and consumers, moving parcels from fulfillment centers to lockers and back through reverse logistics. Here’s another illustration from the annual report:

“And just to give you an example, we pick up in Poland from 130,000 places a day. 130,000 a day, we pick up parcels from the merchants, from the senders. 85% of those pickups is below 10 parcels. Now imagine that you want to send 2 or 3 different vans of 3 different companies to pick it up to deliver like InPost delivers next day, it means that one courier company will pick up maybe 2 out of those 10. The other one, the lucky one, maybe 4. And the last one, another 3 or maybe one. How will it change the cost of the first mile for those 3 players? And this is just the first one. Then you have the mid-mile where you have exactly the same problem. And then you have the last mile, where you split that utilization between a few parties. I mean, I don’t understand where the logic is behind, but only through consolidation of the full value chain, you may get to the point that something is better, cheaper, or at least comparable to what we do.“ - Q4 24 Call

The app is the digital layer that ties the system together – it notifies users, manages authentication, and nudges repeat use. Because the company controls both the physical grid and the customer-facing software, it captures valuable data and can optimize routes and locker placement better than competitors. Every new node strengthens the network’s convenience and lowers costs, reinforcing the flywheel. Moreover, app “customers order over 40% more than nonmobile app users, demonstrating the increased engagement driven by [the InPost] app’s convenience.”

Operationally, InPost runs a capital-intensive but cash-generative model once scale is achieved. Most of the expense base is fixed, so operating leverage is high. The company’s main variable costs are transportation (labour/courier & transport cost, APM maintenance), sorting, and handling. But what truly drives operating leverage, is APM utilization rates. As volumes and APM utilization rates climb, margins expand.

The best illustration of the operating leverage dynamics at work here comes from a write-up by Granular Capital, which broke down how parcel-level profitability scales with APM utilization. Their analysis modeled the economics per parcel under different utilization scenarios – from barely used lockers to near-full capacity – and the results clearly capture how powerful the fixed-cost leverage in InPost’s network can be:

At very low utilization (1–10%), each parcel delivered actually generates a significant loss. The APM gross margin sits deep in negative territory (roughly –100% to –50%), with contribution margins as low as –200%. Fixed courier and transport costs are spread across too few parcels, leading to heavy per-unit losses.

Around the 20–30% utilization mark, the model starts to show positive unit economics. Gross margins turn positive (roughly +12% to +33%), and contribution margins move closer to break-even. This reflects the inflection point where parcel density begins to cover most fixed transport and lease costs.

By 40–50% utilization, the economics look entirely different: gross margins rise into the high double digits (around 47–58%), and contribution margins reach roughly 30–45%. Each incremental parcel now adds disproportionately to profit as most costs are already fixed.

At 60% utilization, which Granular Capital noted as being consistent with InPost Poland’s disclosed levels, the contribution margin per parcel reaches roughly 55%, and the gross margin climbs above 60%. At that point, the business model effectively runs on operating leverage — every additional parcel drives high incremental profit with minimal additional cost.

In essence, their sensitivity analysis shows how APM networks behave like fixed-cost infrastructure: early-stage losses flip rapidly into strong margins once a critical mass of volume is reached. It’s a clean quantitative illustration of why network density – not headline parcel growth – is the single most important driver of profitability in this model.

That operating leverage also defines where the company is in its life cycle: Poland is mature (but still posting +6% parcel volume growth in Q2) and harvest mode, France and the UK are scaling into profitability, and newer markets are in the early investment stage.

Over the next five to ten years, I expect group margins to drift upward as international units approach the economics seen in Poland.

Revenue per employee in FY 2024 was 327,000€.

Cyclicality is moderate. Parcel volumes track overall e-commerce activity, which softens in downturns of course. However, during slower periods, InPost’s value proposition – lower delivery cost and higher reliability – often gains share because merchants look to save on logistics. It’s not recession-proof, but it’s far from a classic cyclical that burns cash in the down part of the cycle.

“Group business is subject to predictable seasonality, as the vast majority of our business serves the e-commerce retail industry, which is particularly active during the end-of-year holiday season that runs from mid-November, starting around Black Friday, through the end of December. As a result of these seasona l fluctuations, the Group typically experiences a peak in sales and generates a significant part of sales revenue in the fourth quarter of the year.“

When it comes to measuring success, I care about a few metrics:

the number of active lockers and their utilization,

parcel volumes relative to market growth, and

profit per parcel.

These indicators capture most of what matters – network density, pricing power, and operational discipline. As long as utilization climbs, volumes outpace the market, and per-parcel profitability expands, the business is doing exactly what it was designed to do: convert infrastructure scale into compounding cash flow.

Who Are InPost’s Customers – and What Makes Them Stick?

The best way to think about InPost’s customer base is to split it into two intertwined groups: merchants and end consumers.

The company’s economics are driven by merchants, but its moat depends on consumer loyalty. Both sides benefit from the same thing – convenience that’s cheaper, faster, and more reliable than the old way of doing last-mile logistics.

Some relevant data points on consumer loyalty and engagement:

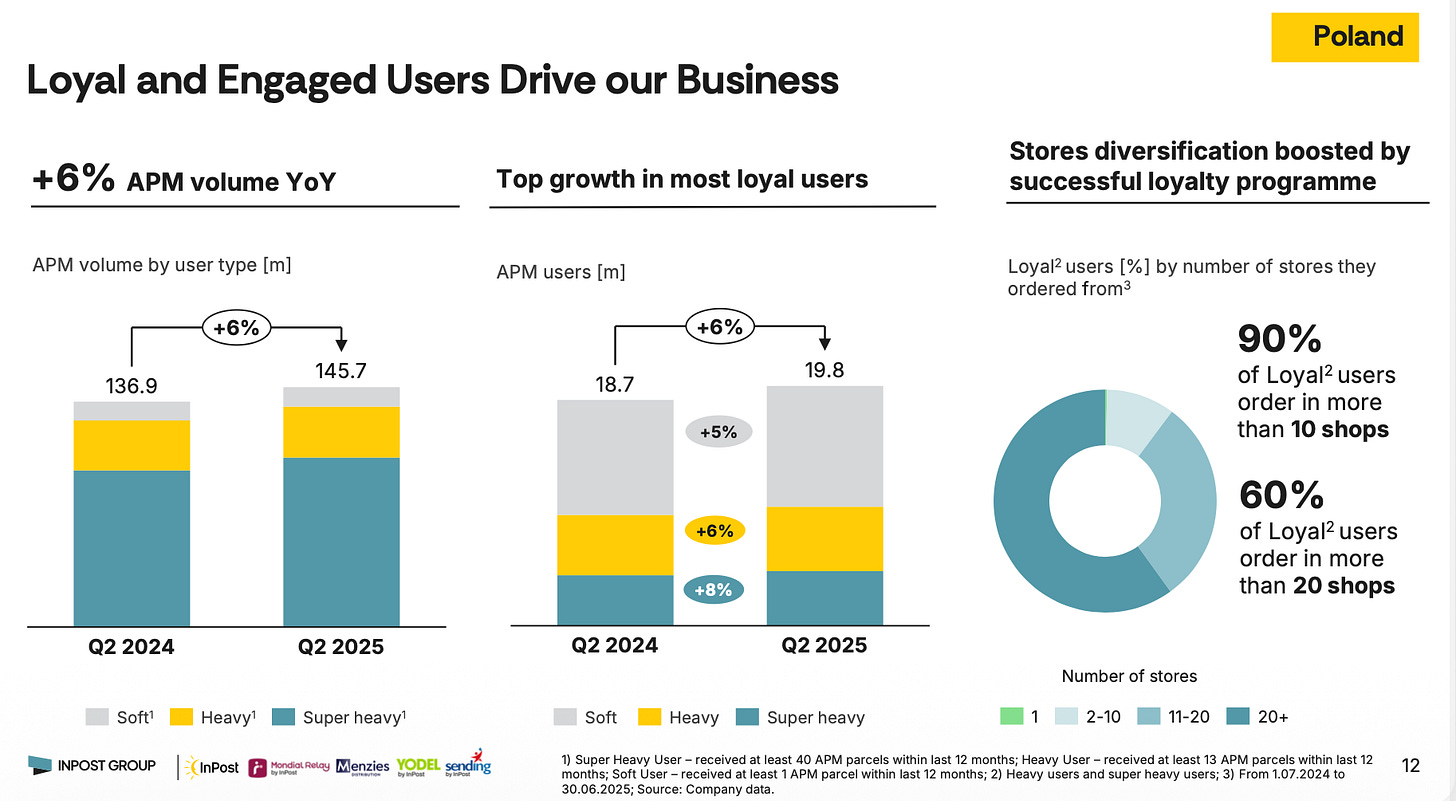

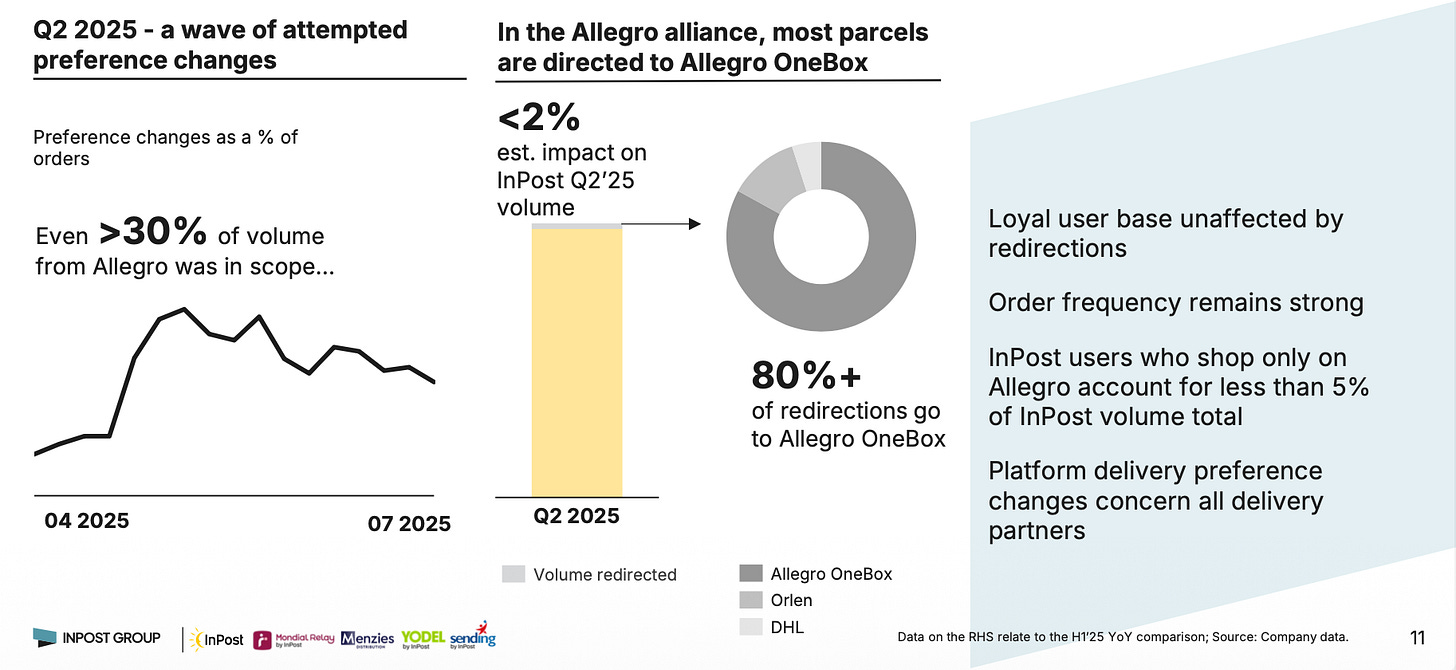

“It is important and very encouraging to see that our loyal user base is increasing year-on-year and that the majority of the users who switched delivery methods are lower frequency shoppers, so-called soft users. This means our business is very resilient, and it proves once again that our strategy, building a wide and loyal customer base, delivering top quality service and obsessing over user experience is not only sound, it’s paying off.“ Q2 25 Call

For merchants, the pain point is clear. Traditional home delivery is inefficient, expensive, and prone to failure.

Every missed delivery attempt adds cost

Every return drags on working capital

Every customer complaint erodes brand trust.

InPost solves all three problems at once.

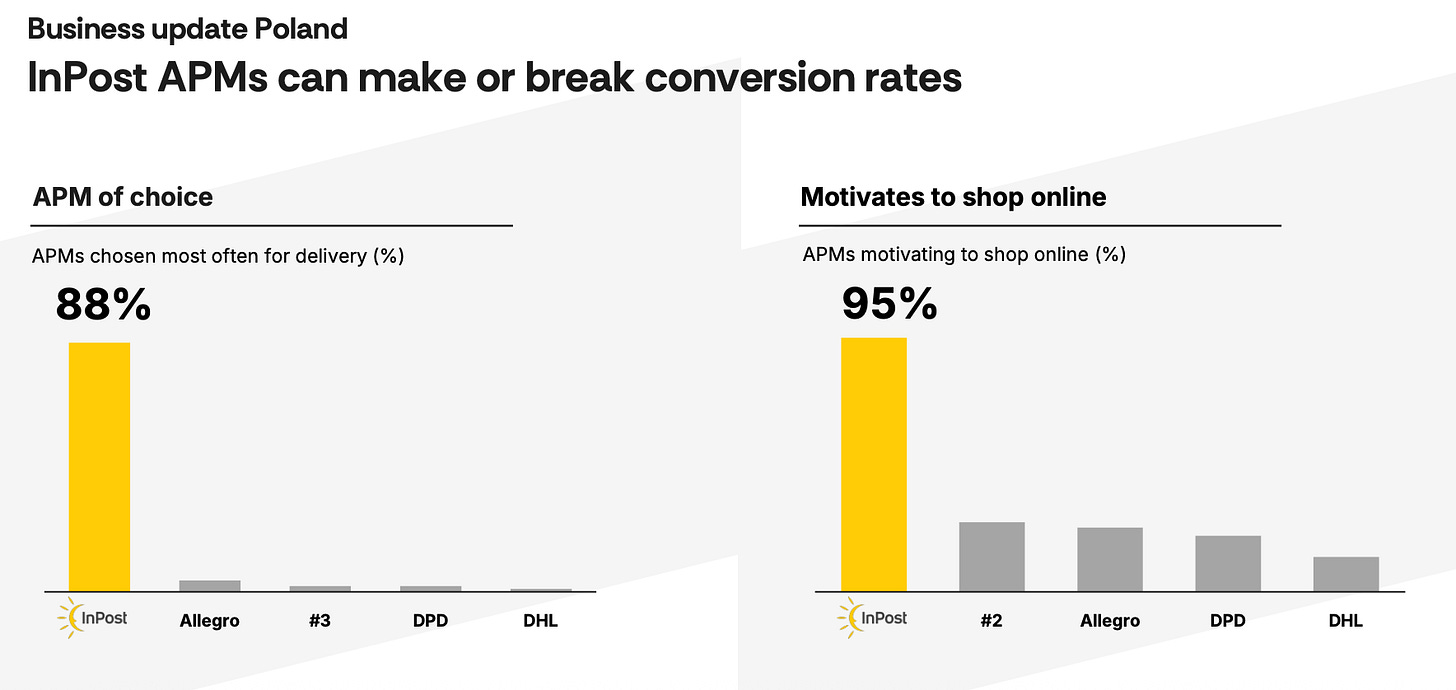

By consolidating multiple parcels into one locker stop, it eliminates the cost of repeated trips, shortens the delivery window, and overall improves conversion rates:

For returns, it provides a frictionless drop-off system that increases customer satisfaction while saving merchants from handling costs.

If InPost disappeared tomorrow, many retailers would scramble to find an alternative that could replicate both the cost advantage and the consumer experience. They’d likely revert to legacy couriers or fragmented PUDO networks, which would immediately inflate costs and slow down deliveries.

Consumers use InPost for different but complementary reasons. The core proposition is control. They can pick up parcels whenever they want, skip the waiting and missed-delivery notes, and handle returns without printing labels or visiting post offices. Over time, that convenience becomes habitual. This is a critical insight we discussed above already. Once people have opened an account with InPost and are used to having a locker within a short walk, it’s hard to imagine going back.

So unsurprisingly, InPost changed people’s behavior in Poland and is now trying to replicate this success formula elsewhere:

“When we started in Poland in 2010, there was zero out-of-home solutions on the market. The whole market was door-to-door. So we went that journey from 100% door-to-door to now more than 60% of the Polish market being out-of-home. We changed people’s behavior and their social habits.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

Again, they plan to run this playbook in other countries too – I believe this is something critical to understand, especially when assessing recent and future M&A activities:

“In France, for instance, when we bought Mondial Relais, France was already 40% out-of-home market, but to PUDO points, to manually handle PUDO points. So we don’t need to transform the society. We are building on that existing setup.

In the UK, it’s not 40%, but it’s 10% of the overall volume being out-of-home. But UK is 8 times bigger market volume-wise than Poland. Means if I have tomorrow in the UK, not my 7,000 machines I deployed so far, but 23,000 machines from Poland, I will provide capacity for less than 5% British volume.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

That behavioral lock-in is one reason utilization rates stay high even when e-commerce growth slows.

The emotional attachment is interesting to observe. In Poland, InPost has achieved something close to cult-like status, not because of branding flair but because the service works. It’s fast, reliable, and integrated with the app in a way that feels effortless (I’ve mentioned my Netflix comparison before; Netflix simply provides a smooth user experience that “just works”). Consumers don’t “love” it the way they might love a luxury brand, but they rely on it, sometimes daily – and that dependency creates real stickiness.

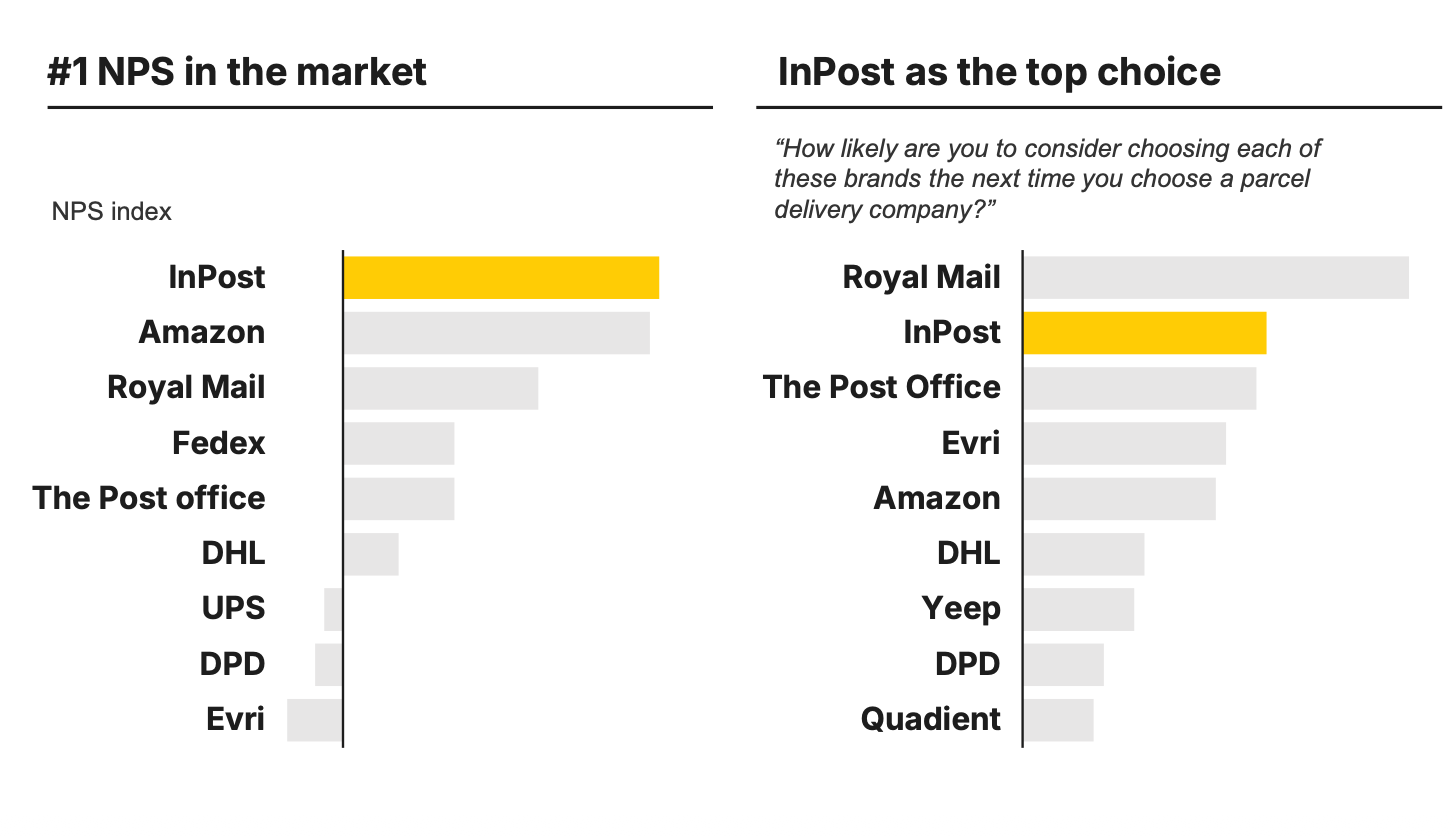

Surveys show consistently high satisfaction and net promoter scores well above peers in the delivery space. In Western Europe, that same dynamic is emerging as coverage grows. Locker proximity and reliability are the biggest predictors of repeat use, and InPost’s density advantage keeps both high.

On the merchant side, the customer base is broad but concentrated around e-commerce retailers – from large marketplaces and fashion players to mid-sized online shops.

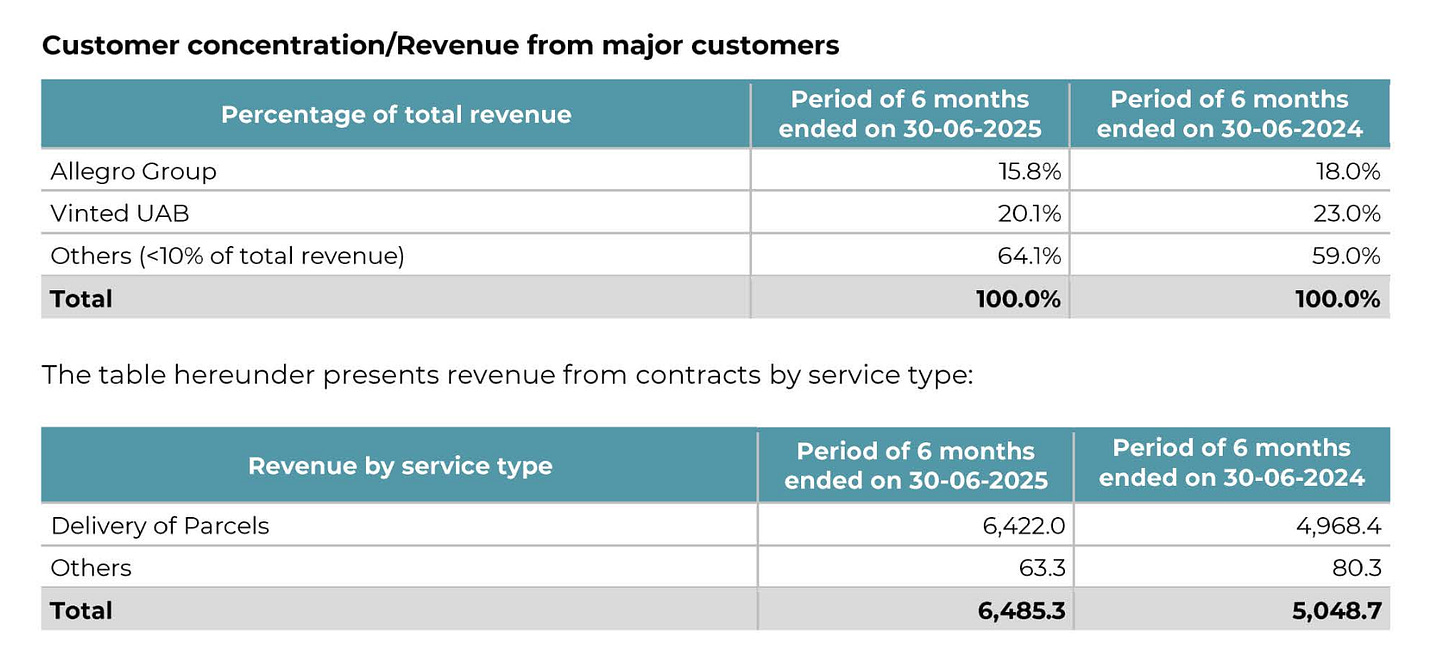

The level of customer concentration is reducing over time.

We’ll discuss the dispute with Allegro further below. Not too long ago, roughly a third of all InPost’s Polish parcel traffic came from Allegro’s “Smart!” Today, Allegro’s revenue contribution is still high, but down to around 16% (vs. 18% in the first six months of 2024).

“And in terms of the overall like picture for the short to midterm, we definitely want to steer our consumer base, specifically by boosting our International expansion into the moment that the largest client with another portfolio will be below 10% of our revenue. And that’s, of course, something what we want to steer and we want to have our testing in our hands, not someone else.“ Q4 24 Call

Retention, in this kind of business, doesn’t look like a subscription renewal but like consistent volume recurrence. Merchants rarely churn once they’ve integrated InPost into their checkout flow because it becomes a core part of their logistics chain. Consumers show similar inertia: repeat rates are high (especially among app and loyalty program users). It’s a flywheel where old users keep coming back while new users add incremental volume, improving utilization rates.

While the company doesn’t disclose classic CAC or CLV metrics, the economic logic is intuitive. The cost to acquire a new consumer is primarily tied to network expansion and marketing partnerships, but the marginal cost of keeping that user is minimal once a locker is within walking distance.

“[…] in our home market, which is Poland where we started, almost 70% of the population has got less than seven minutes walking distance to the nearest locker. So it’s really very dense network. Thanks to this, it’s 24 seven access. It’s very convenient. You don’t need to wait for the courier. Not all the people are living in single houses, which means, you know, it’s easy for the courier simply to leave the parcel there. But people are literally now taking care of the security over their parcels and they want to control it. So when courier arrives, typically people are not at home. So it’s much better to order to your nearest locker and you pick it up whenever you want using your mobile app. You just press the button and the machine is opening your certain locker with your parcel.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

The lifetime value, therefore, compounds over time as the same customer sends, receives, and returns multiple parcels per year. Each additional order increases profitability because the first transaction effectively pays for the acquisition. In mature markets like Poland, that repeat behavior makes the business predictable. The locker becomes part of people’s weekly routines – like a digital utility that quietly compounds cash flow behind the scenes.

Simplicity & Predictability – Is This Industry Built for Compounding?

InPost operates in last-mile e-commerce logistics, specifically the out-of-home segment built around automated parcel lockers and partner pick-up points. As industries go, this one is attractive when you own the densest, most convenient network in a market.

And it’s a much better business model than the incumbent companies run!

Economics tilt toward scale – fixed assets dominate, utilization drives unit costs down, and once density clears a threshold, incremental parcels fall through at high contribution margins.

The product is clearly differentiated from traditional to-door delivery: it’s cheaper for merchants, more reliable operationally, and often more convenient for consumers. Of course, competitors could, over time, try to copy the infrastructure, but there’s little incentive to switch if you’re happy with the service InPost provides and have built the habit. Pricing isn’t the lever; network quality is.

Change here is real but measured. Logistics doesn’t reinvent itself every two years; it compounds operational improvements and route density over time. The meaningful shifts in this category are strategic rather than faddish – e.g. a migration from to-door toward OOH, a steady rise in returns and C2C flows, and software layers that make selection at checkout effortless.

I believe I can say with high confidence that this business model will still exist a decade from now, because the core problems it solves – reducing last-mile cost and failure while giving consumers control – won’t go away. If anything, return intensity and consumer expectations harden the need for this infrastructure.

Cash-flow predictability stems from three places: recurring merchant integrations at checkout, repeat consumer behavior once lockers are nearby, and operating leverage that improves as volumes densify existing nodes. I can underwrite forward cash generation with a reasonable degree of certainty because the main inputs are observable – automated parcel machine (APM) footprint, utilization, per-parcel revenue and EBITDA, and market volume growth. None of these swing wildly quarter to quarter in mature markets. In earlier-stage geographies there is more volatility, but the path is still governed by the same mechanics:

Plant the grid, fill it, sweat it.

Competition is active but uneven across markets.

“From innovator to incumbent: While DHL – a classic incumbent – led network development in Germany, most countries saw innovative start-ups in the lead. For example, Poland’s InPost – founded in 2006 – has now reached a market share of almost 50 percent . In recent years, however, postal incumbents have begun investing in compelling out-of-home value propositions, given decreasing mail volumes and rising costs for home delivery.“ - McKinsey

In France, national-carrier brands cluster around a shared OOH network, yet price discipline and network density have been inconsistent, which leaves room for a specialist focused on lockers and PUDO quality. In the UK, large incumbents remain predominantly to-door or are late to lockers, while marketplace-tied networks are closed and therefore not directly comparable.

The pattern repeats elsewhere: broad players with legacy cost structures versus a focused operator pushing a simpler, denser OOH grid. Intensity exists, but the advantage accrues to whoever delivers the best coverage, the most reliable experience, and the lowest fully-loaded last-mile cost – simultaneously. That’s hard to copy without patience, capex, and operational consistency.

“This is a marathon. This is not a sprint. You can’t deploy 10,000 machines a year. You will not find locations. You will not prepare them. You will not sign all the contracts. You will not be able even to deploy more than... We deployed 6,000 machines in Poland two years ago.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

This is not a commodity race with a dozen indistinguishable carriers and razor-thin margins that evaporate in downturns. It’s an infrastructure game where the payoff starts small and becomes obvious only after years of compounding density.

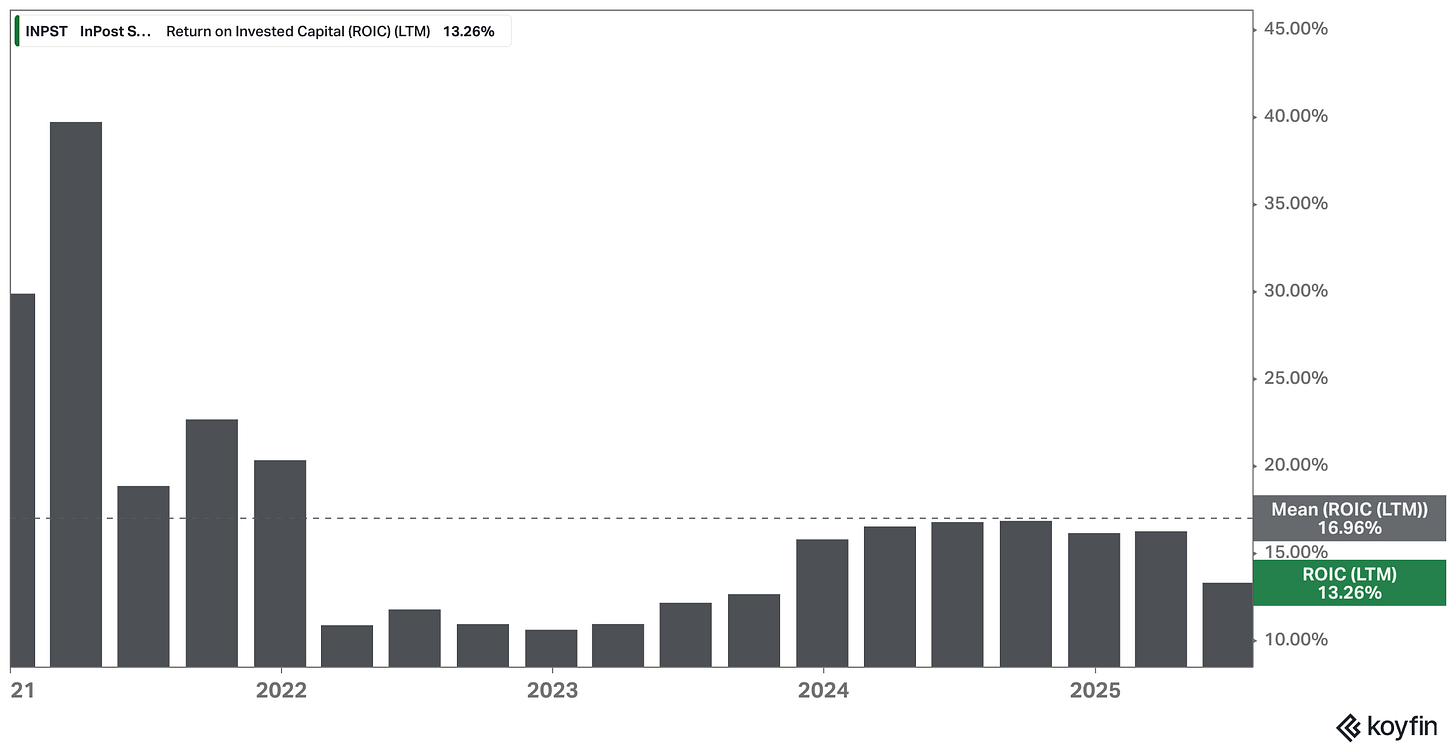

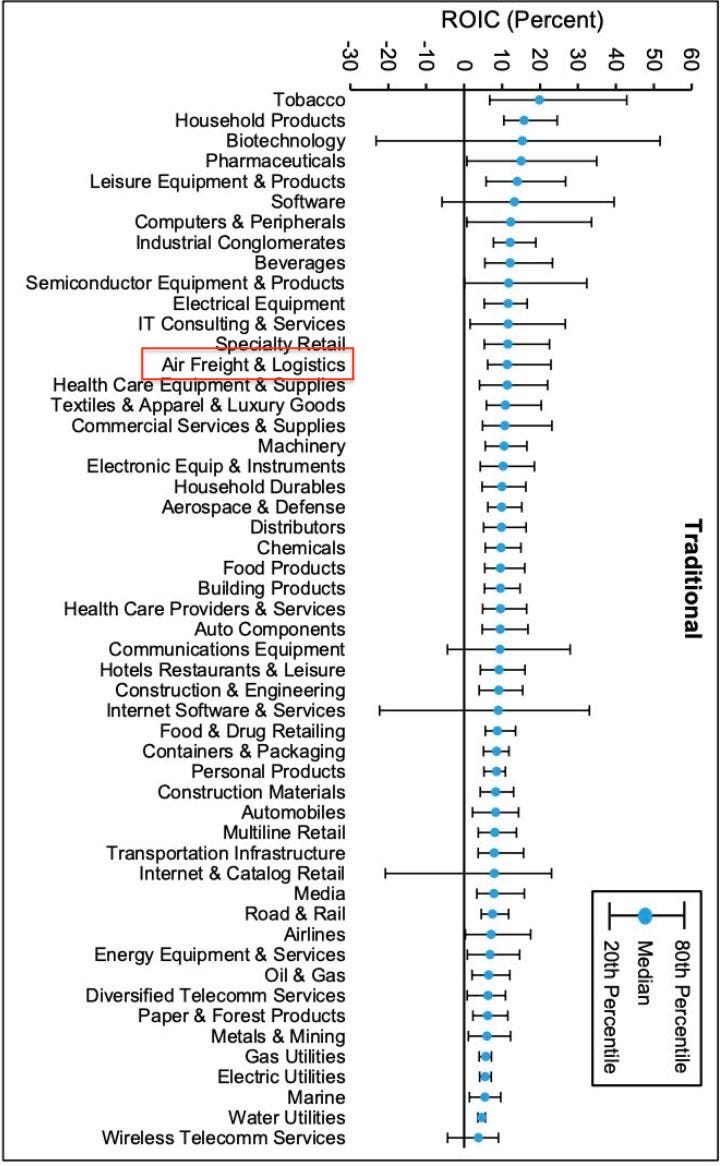

“I see this as a steady long-term compounder at 40+% returns on capital as capex intensity continues to decline as a % of the total business.“ - Jake Barfield

To sum up, if I had to explain the business in two or three sentences to a colleague or a family member, here’s what I’d say:

InPost runs Europe’s densest locker-centric infrastructure networks in core markets and gets paid per parcel to move deliveries and returns through that grid. The more lockers in a city, the cheaper each parcel is to deliver and the better the service feels, so utilization and margins rise together. I like it because those mechanics are simple, hard to disrupt, and increasingly visible outside Poland as international markets scale.

Part 2 – Competitive Advantage/s Analysis

I see a real moat here, built on upfront CapEx and physical density, and maybe most importantly, operational know-how and consumer habits.

It isn’t impenetrable – no moat is – but the barriers are large and getting larger in the markets where utilization is compounding.

The essence is simple: once you’ve planted thousands of lockers in the right places and tuned the trunking, sortation, and route plans around them, every incremental parcel is cheaper and faster to handle. That advantage is hard to copy quickly because the asset base, landlord relationships, app adoption, and merchant integrations all move together.

You’d need time, capital, and patience to dislodge it. Most rivals don’t have all three.

“Yeah, and that’s a typical step-by-step approach. You can’t go to 46% of your EBITDA margin without having the whole setup. When we bought Mondial Relay, even now after two years, almost three years of transformation, still we are not a next-day delivery service across France, which is essential for us.

In our end-consumer mindset, next-day delivery is super important. We can’t provide this setup, not because we don’t want to, it’s all because the dense network of depots, France is much bigger than Poland, and when we bought Mondial Relay, Mondial Relay had only 20 few depots across France. In Poland, we have currently 70.

So to decrease the driving time from the salting hub to the depot, from depot to the locker, you need to have a dense network of depots. You can’t buy depots off the shelf. This is a two-year time horizon for investment.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

The Power of Focus?

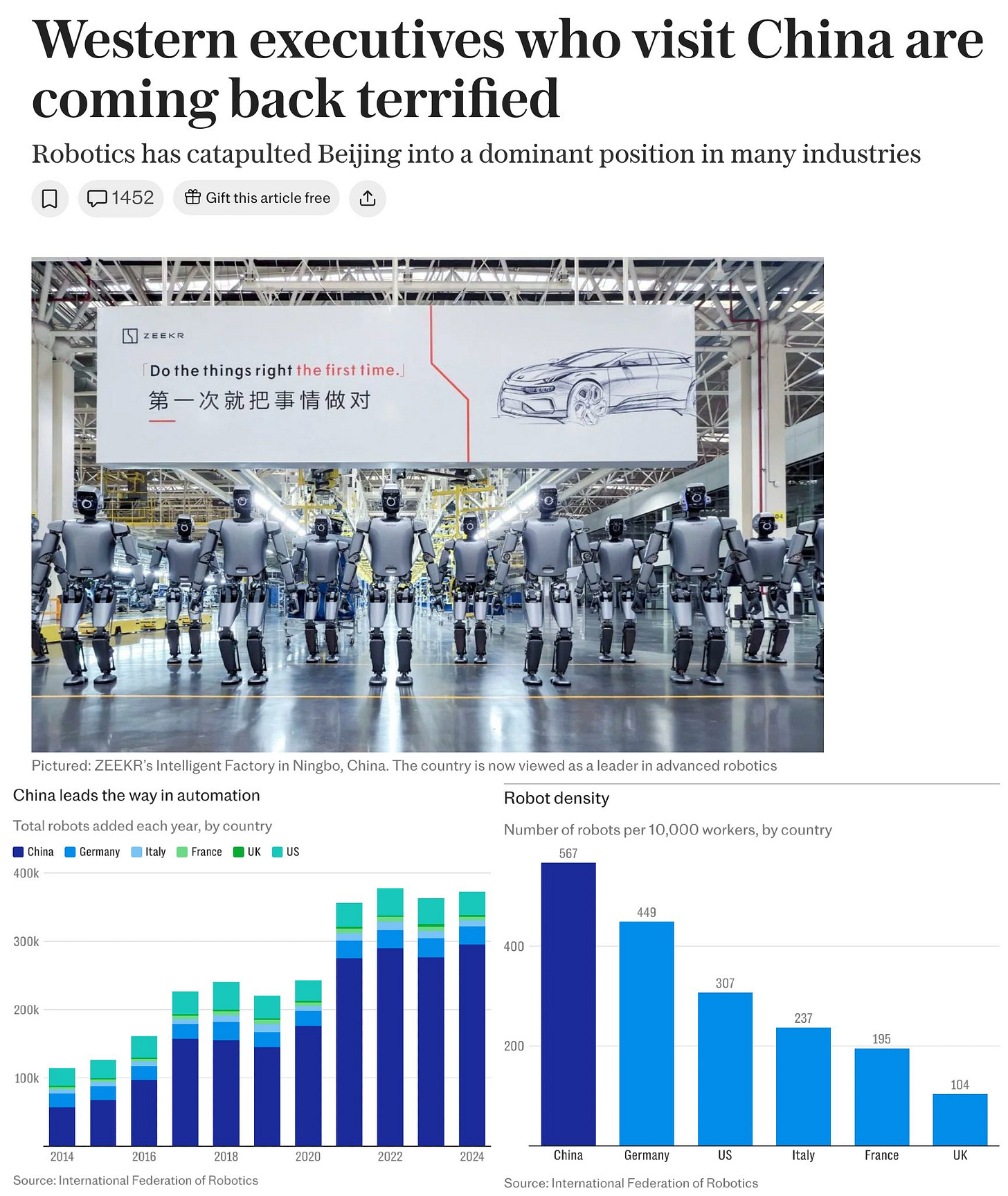

Bringing up some of the well-funded competitors is a fair challenge, though – what’s to stop a bigger player from simply copying the model? After all, many already have!

Allegro in Poland, Amazon in the UK, DHL across Europe – they all rolled out their own locker networks.

Yet the results speak for themselves: Allegro’s lockers often sit half-empty, Amazon’s remain primarily for its own parcels, and DHL’s growth outside Germany has been sluggish.

On Amazon:

“Q: What about some of the larger e-commerce players, like I’m thinking of Amazon and Allegro in particular?

A: You know, Amazon is a great example. They have created a network of lockers in five countries. They haven’t created in Poland. They started collaboration with InPost from day one, knowing that we have already created best-in-class service in this country. Amazon is going into own logistics only if the existing players can’t deliver quality they expect from them or the pricing they expect from them. So this was a kind of remedy for Amazon to counterbalance dependency on the postal operators that collaborated from the very early beginning of their journey, both in the US and in Europe.

And when Amazon started deploying their lockers, it was after our first lockers were deployed in Poland. They started slowly, slowly, but then they noticed that still they have created such a door-to-door culture among their end users using their prime value proposition that for the end consumers, it hadn’t played any role to door or out of home, Amazon locker. There was no price incentive. […]

And recently, they stopped deploying lockers in the UK, for instance. And at the end of the day, even if their setup was successful or would be successful, it’s just narrowed down to your own consumers, your own marketplace. Do you think that a fashion retailer, competing against Amazon, or any other retailer competing against Amazon, they will try to use Amazon lockers? They would love to redirect their own consumers to Amazon and vice versa? I don’t think so. That’s why us being agnostic players, open for every player on the market, including marketplaces and platforms like Shopify, Shopper and the others, it’s much easier because we are neutral and we are helping all the merchants to grow their value proposition, making their end consumers even more happy and even more loyal to certain players.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

Replicating InPost’s formula turns out to be a lot harder than it looks on a PowerPoint slide.

The first reason for this is focus. InPost lives and breathes this model (“Leading in APMs and compartments is one thing, but knowing how to operate them is something completely different“) – every euro of capital and every engineering hour is directed toward making the out-of-home experience smoother, faster, and cheaper. For most rivals, lockers are just one of many side bets competing for attention inside a sprawling logistics empire.

You don’t build a 50,000-locker network on the side; you build it because it’s the only thing you do.

On DHL:

“Q: To what extent are you concerned about competitors? I’m thinking particularly of DHL. You mentioned they have 3 billion package volume. It’s taken them a very long time to build that, and obviously they operate in a lot of different countries. Are you concerned about DHL or somebody who is already a scale logistics player from building something similar to what InPost has?

A: “I can give you one example, a kind of illustrative one. Imagine you have two big planes producers, Boeing and Airbus. Okay, let’s not comment about one or another, but they are true. They are literally now focused only on building big planes. Why don’t they create business jets? It should be easy. It’s just a smaller plane. On the other hand, such an attractive market. Why the producers of business jets like Gulfstream, like Dassault Aviation, like Bombardier, Embraer, a little bit, they are here and there. But why those three are not inclined to go into this much bigger market, especially that one out of two has got problems literally now. Because the whole setup of those producers, both the big white body planes and the business jets, has been created for two different products. You can’t shift your factory from small business jets into creating big planes.

Software is different. Technology is different. R&D is different. People’s setup is different. So if you look at the big old fashioned, kind of old fashioned door to door focused players, their whole setup is focused for door to door. They can’t shift it from next day to another setup. The depot’s design is different. Their software for the drivers is different. Their skill set is different. That’s why even DHL, I think in one of the reports, they admitted that they believe in out of home, but on the other hand, they understand out of home is not something that will have more than 5% of their volume. Our mindset is 100% out of home. Only in Poland we have door to door, because this was a kind of legacy when we were on the postal market as well, competing against the state-owned Polish post. So we maintain that, but in all other geographies, we are just out of home. And the whole setup is all about out of home. That’s why we are much more efficient […]” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

To add to that comment by CEO Brzoska above, here’s a quote from an expert interview with a former InPost director on this very same topic:

“I think DHL was ensuring they could subsidize other parts of their business that have lower margins, especially the postal business, which was declining as letters were disappearing. They still needed to maintain postal services and didn’t have much flexibility. DHL also has a significant presence in supply chain and dedicated transport for sectors like pharmaceuticals and frozen goods. In contrast, InPost is a more general provider. Overall, we have lower costs because we don’t need to maintain expensive equipment within our warehouse solutions or divert streams to dedicated zones.”

The second reason is scale economics. A few thousand lockers may cost a manageable amount – $50–100 million depending on the size of each (one APM may cost around $20,000 to install) – but scaling to InPost’s density means billions in capital before utilization even starts to improve (and we also discussed that it takes time to build the network – many years of focused effort!).

“By accelerating our scale, we are providing increased convenience for millions of customers. And our total out-of-home network, including pickup points, now exceeds 88,000 locations.“ - Q2 25 Call

And utilization is the flywheel. A locker with 2–3 parcels a day bleeds cash; one with 100 parcels a day compounds efficiency and margins.

“Myth #4: “Just trust me, our investment will pay off in no time” – or: an OOH automated parcel machine network is less expensive than home delivery. Reality: While it is true that a well-utilized locker network will easily recover investments made to build it up, the problem for many players is in generating utilization in a way that really saves costs elsewhere. As McKinsey analysis shows, the last mile in a home delivery network generates 60 to 70 percent of overall parcel delivery costs. Increasing the average number of parcels delivered per stop from 1 (typical for home delivery) to 5 (i.e., dropping 5 parcels at once into a locker or PuDo) drives down delivery costs (labor and vehicles) by more than 50 percent. Achieving this drop-factor cost reduction with OOH, however, requires high OOH network utilization. Without high utilization, there is only the added cost of operating an underutilized OOH network, where a single APM can easily cost EUR 10,000.” - McKinsey

“Revenue per parcel is low – InPost averages PLN 8.9 / €2.1 in Poland – and profitably distributing these parcels requires huge volumes and extreme levels of efficiency, so that the marginal cost of distributing each incremental parcel becomes negligible. To have the capability to do this, vast sums need to be spent on equipment, people and infrastructure, and huge sums are also needed to fund losses across the network as it scales up, presenting yet another hurdle. All in all, with these challenges in mind it’s no surprise that the parcel distribution industry generally has very high barriers to entry and tends to be highly consolidated, with most markets having just 2-3 scaled players.” - Granular Capital Ltd. InPost Write-Up (2024)

InPost’s network already runs on those high-utilization nodes, which makes every incremental parcel cheaper to handle – while new entrants start from near-zero density and must subsidize underused capacity for years.

“Exactly. And you know, for the platform, spending money on hard assets, on CapEx, is going completely away from their asset-light business model, completely. If you want to invest in hard assets, in logistics, it will cost you billions.” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

Then comes the return calculus. For Allegro or DHL, building an independent network simply doesn’t offer the same return profile as partnering with InPost, whose infrastructure already exists and whose service quality merchants and customers already trust. It’s the same logic that drives enterprises to rent cloud capacity instead of building their own data centers, the same logic that drives oil companies to rent equipment from equipment rental companies like Ashtead Technology: the upfront cost, payback horizon, and operational complexity destroy the economics of going it alone.

“And nobody else, other than Amazon or Allegro or some of these other large e-commerce players, would have the volume to even justify building a logistics...” – From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

“So we are getting to, I think, an ever better coverage with the locker network by working with various other partners. Probably most strategically important, Allegro One, our own operation, is getting very close to cost parity on a cost per parcel basis in the catchment areas that they serve.“ - Allegro Q1 Call

Finally, there’s the customer habit. You can recreate the hardware, but you can’t easily recreate the ecosystem – the app experience, the 99%+ next-day delivery rate, the merchant integrations, or the consumer trust built over a decade.

So yes, competitors can and do deploy lockers. But the evidence so far shows that unless they’re willing to sustain years of subscale losses, they rarely reach the density or loyalty required to make it worthwhile.

“Q: So that anticipated my next question, which was, so InPost has this giant market share that people have their packages delivered to, and now you’ve talked a little bit about this ecosystem part, but the question was going to be, I can understand why a consumer might have a package delivered to an automated parcel machine, but why might a consumer choose to have it delivered specifically to an InPost APM? And you’re talking about this ecosystem. So I guess a second sort of follow up question, answered however you like, is why couldn’t a competitor create a similar ecosystem and backend infrastructure to what InPost has?

A: Of course, you can recreate that, but you need to recreate every single element of that flywheel. Means not only the machines network, and right now we have more than 23,000 machines in Poland, and we have like five different players trying to replicate that by deploying more and more lockers. Even very often the lockers are on the same real estate, and we see that in our cameras, how many parcels they deliver to their machines, versus our courier. And it’s like in our machine, it’s 100 parcels a day, for instance, and their machine is two, three parcels a day. Why is that? Because at the end of the day, who votes for the service? The end consumers vote. And they vote for InPost because we are delivering seven days a week. Next day delivery is more than 99% of the parcels. Moreover, the cutoff times we offer for our merchants, very often it’s midnight. So you shop online 11 p.m. at midnight. It’s shipped from our fulfillment center, located in the center of Poland, where the main sorting hub is located. Means it’s picked and packed during the night, shipped to the final destination, and early morning it’s delivered to one of our machines, one out of 23,000 machines, even in a very distant location in a small village. So state-of-the-art logistics, state-of-the-art technology, mobile app loyalizing the end consumers. Now new services like InPost Pay implemented in the mobile app, where you can have one single checkout point. So answering in a short sentence, yes, you can recreate InPost, but you need to recreate every single element, and then you need to have a hope that you can take that customer from InPost and drag him to your side.

Otherwise, you know, if there is Spotify, another edition of Spotify created by a Chinese player, I don’t think so I will migrate if they have the same what we have now.” From Quality Investing: InPost // Rafał Brzoska, 14. May 2024

Walking InPost Through My Moat Taxonomy

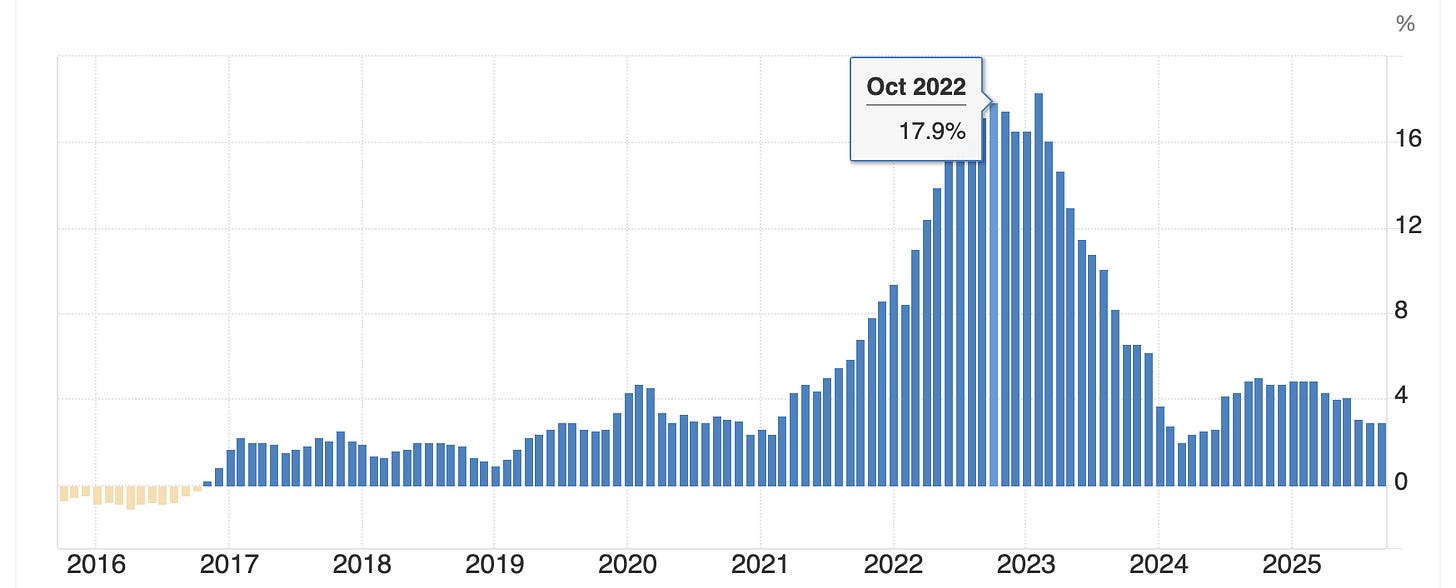

On pricing power, I’d call the company measured. This is not a luxury brand that can name its price. Merchants are cost-sensitive and care about reliability, speed, and failed-delivery rates. For instance, contractually determined price increases were the reason for the Allegro dispute (to be discussed further below).

I found the following excerpt on InPost’s pricing strategy quite illuminating, which hints at a scale economies share mindset / corporate DNA: