Everything You Need to Know! Who This Blog Is For (and What You’ll Get)

If you're new here, this is a must-read!

Let’s get straight to the most important points before I share more about myself and my philosophy:

1) What kind of companies do I cover?

I research high-quality businesses from all around the world – regardless of market cap. That might mean a German $200 million market cap serial acquirer, a small-cap quiet Canadian software compounder, or a well-known U.S. tech name like IBKR. I consider myself a generalist with few limitations. Dogmatic style boxes don’t interest me – flexibility is a superpower.

That said, there are a few hard and fast rules I try to stick to: I’m not interested in below-average businesses or structurally bad industries: no airlines, no commodity plays, mostly no retail, no auto parts manufacturing, no banks or insurance. I’d rather spend 40 hours up front understanding a truly great business – one I can hold for years – than chase cheapness for cheapness’s sake. Over time, I’ve learnt that a high-quality business at 18x FCF will often massively outperform a “6x cigar butt” and cause far less emotional stress along the way. I VERY rarely look at companies sub $100 million market cap.

TL;DR: I research high-quality businesses operating in above-average industries from all across the globe, regardless of market cap (but usually above $100 million in market cap).

PS: Always remember that the blog pays for itself – often several times over – with just one good investment idea. Similarly, one investing mistake that could’ve been avoided by becoming a better investor, costs more than a year of this blog.

2) How often do I publish?

As often as possible – without compromising depth or enjoyment. Some weeks, I’ll publish 4–5 shorter posts, quick pitches, new ideas, new quality stocks to put on your highly-selective watchlist, or portfolio updates. Other times, I’ll go quiet for a bit while I work on a deep dive that requires serious upfront research.

I will always prioritize quality over rushing out as many superficial posts as possible, because I believe you do too.

You can find a comprehensive overview of all previously published posts here:

3) Are these posts actually any good?

Best way to find out: check the “Free Sample Posts” section. You’ll see the depth, thought process, and clarity I aim to bring to every write-up.

Moreover, many of most of my posts for paying subscribers include some free sections before the paywall, so even if you’re on the free tier, there’s plenty to explore, and you should be able to develop a feel for the depth I provide (consider the table of contents I often include in the introductions).

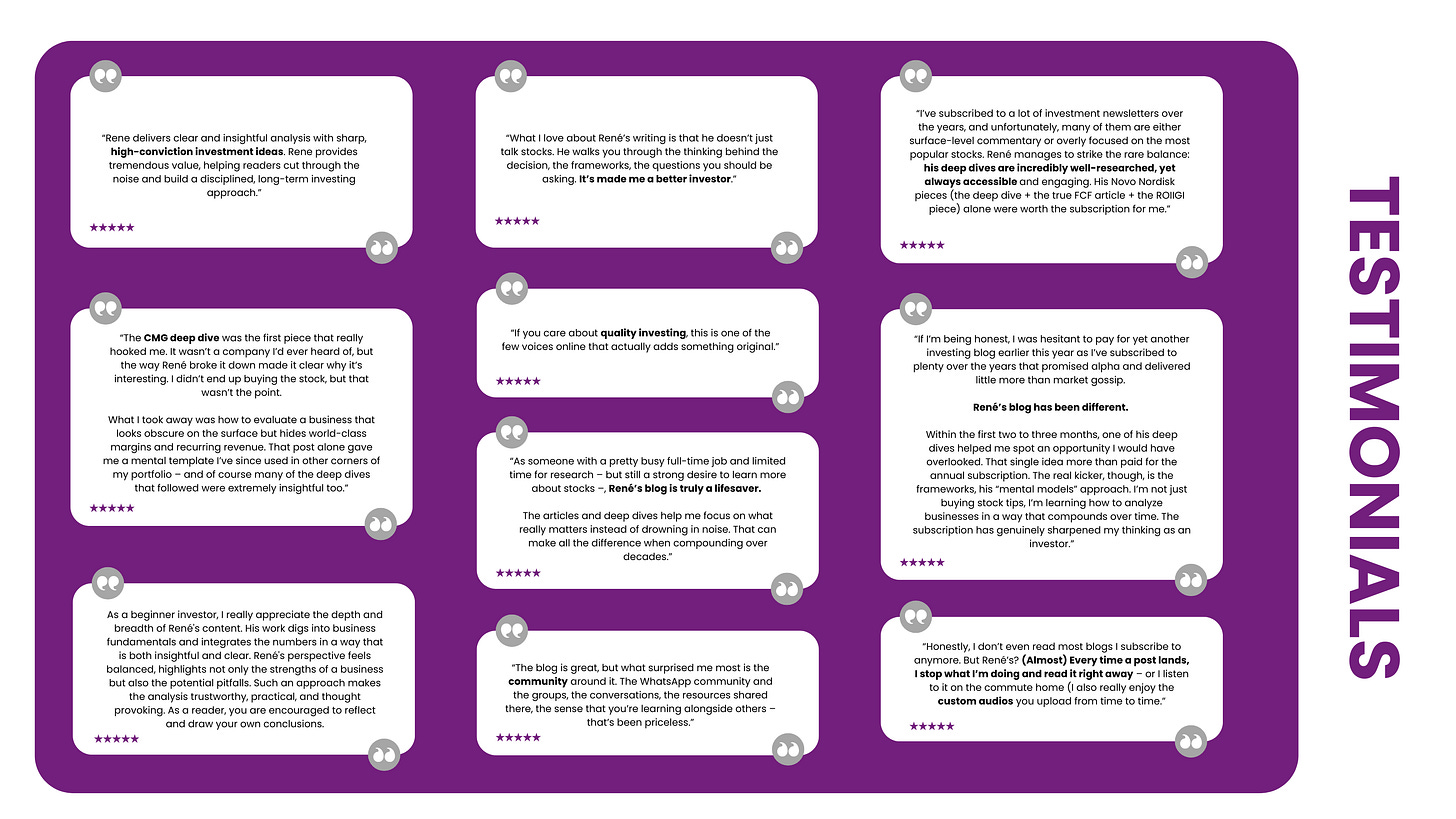

Below you also find some of the testimonials I have received more recently:

I will also attach one testimonial that meant the world to me when I first saw it because Jake Barfield is a professional fund manager whose philosophy is very much aligned with my own, and the analyses he shares are always of the highest quality!

4) Annual Subscriber? Join the Paid Subscriber WhatsApp Group (optional, but highly recommended):

Many of the best insights happen between the lines – in conversations, not just posts.

If you are on the annual plan and you'd like to connect with other serious investors and me, I run a private WhatsApp group for paying subs.

5) And one more thing (the most important of all ...):

While “turning over rocks” and bringing high-quality stocks from all across the globe to your attention is certainly a key focus of this Substack, this blog isn’t just about stock write-ups. It’s also about improving how you think. I regularly share mental models, decision frameworks, and process-focused pieces that will help you become a better investor over time – the kind of material most people ignore, but that compounds in ways stock picks alone rarely do.

Here’s one example, but there are plenty more in the “Processes & Mental Models“ section:

Thinking in Bets: What Poker and Horse Racing Teach Us About Markets

Most people wouldn’t naturally group stock market investing, poker, and horse betting into the same category. One has billion-dollar companies and earnings calls, another is played in smoke-filled card rooms (or sleek online interfaces), and the third involves animals, turf, and betting slips.

As my friend Tiho Brkan put it, this [focusing on improving your own processes] is where you get the “most bang for your buck”:

I firmly believe this is an area most investing blogs overlook. The majority of readers chase “quick fixes,” not realizing that, more often than not, the smartest move is to do nothing at all. The idea that someone can consistently produce new, “actionable stock ideas” every week is unrealistic – and setting that expectation in fact only reinforces wrong incentives.

Frequency feels good. It creates the illusion of control. But in investing, infrequency is where the real profits lie. Doing less isn’t laziness — it’s an acknowledgment that great ideas are rare, while noise is constant.

Rather than constantly transacting, I advocate for a different approach: build a curated watchlist of 200–300 best-in-class businesses from around the world, continuously refine it, and wait patiently for a few compelling opportunities each year. When Mr. Market misprices something truly exceptional, that’s when you act. That’s the philosophy Buffett and Munger themselves have always promoted:

"The trick is, when there is nothing to do, do nothing." – Warren Buffett

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.” – Charlie Munger

"You don’t get paid for activity, you only get paid for being right." – Warren Buffett

PS: Here’s another piece that showcases how I can help you elevate how you think about your investment processes:

Forget ROIC! This Metric Tells You How Well a Business Really Compounds

If you’ve been following my writing, you might’ve read my last post on Novo Nordisk’s “true free cash flow” – an attempt to adjust for some of the accounting noise and better isolate what a business is really generating after sustaining itself.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

Now, a Bit About Me

I’m René Sellmann. I live in Düsseldorf, Germany, where I split my time between teaching and thinking obsessively about investing. What began with a casual conversation about ETFs at a friend’s party quickly spiraled into a full-blown intellectual pursuit – one that’s now shaped nearly every day of my life for close to a decade.

I write, podcast, and post regularly to share ideas that help long-term investors refine their process, think independently, and stay grounded when the market isn’t.

What makes this blog different isn’t flashy predictions or clickbait takes – it’s clarity, rationality, and sharp analysis. I focus on the mechanics of compounding in ultra-high-quality stocks, stakeholder alignment, capital reinvestment, and durability.

My content is shaped by real skin in the game: I share my portfolio updates, mental models, and decision-making frameworks (including spreadsheets), all built over years of studying what separates enduring businesses from fragile ones. I gravitate toward companies that quietly compound, often overlooked but structurally advantaged, and I write for people who want to understand why compounding at a market-beating rate works.

If you want to know more about how I think – what I believe makes a quality business, how I’ve evolved as an investor, and what lessons I’ve learned from both wins and mistakes – I invite you to read the in-depth interview I linked below. It’s probably the clearest articulation yet of what my philosophy is all about: building conviction, avoiding noise, and compounding with intention.

Why Subscribe?

There’s no shortage of noise in the world of investing – hot takes, hype cycles, and surface-level analysis. This publication is about cutting through that noise.

Here, you’ll find …

deep dives into truly exceptional businesses from all across the world – from German small-cap serial acquirers to well-known US tech companies,

mental models and processes to improve your decision-making, and

honest reflections on my own investing process.

Whether it’s breaking down valuation frameworks, exploring macro shifts, or analyzing capital allocation through the lens of stakeholder dynamics, every post is crafted to help you think clearer and compound smarter.

I don’t write for speculators chasing the next pop.

I write for long-term investors...

✅ Who care more about process than predictions

✅ Who study businesses to build conviction, not just buy tickers

✅ Who treat portfolio management as a craft that can add material alpha

✅ Who believe valuation is both art and discipline

✅ Who understand that patience, clarity, and curiosity are a real edge

✅ Who think in decades – not news cycles

If that sounds like your kind of thing – no fluff, no gimmicks, just real-world investing insight – I’d love for you to subscribe.

What You Get as a Paid Member

Becoming a paid subscriber gives you access to everything I’ve built to help you compound better:

💡 Highly (!) in-depth analyses of the world’s best businesses — uncover unique investment opportunities that never show up on CNBC. You also unlock the full archive of previously published deep dives.

📈 Regular Portfolio Updates — complete transparency into my investing decisions and company-level updates, plus unique takes on macro developments, market dynamics, and exclusive interviews with operators and thinkers I trust.

🧠 Powerful mental models to refine your own investment process — from valuation frameworks to capital allocation principles, behavioral edges, portfolio sizing, risk management, and more.

🤝 Premium Plan Only: Access to an exclusive WhatsApp community where I engage daily. Join focused subgroups on valuation, compounders, capital allocation, or macro. Ask questions, share insights, and connect with serious investors who think like you.

🎧 Custom-made voiceovers of selected blog posts: With the help of ElevenLabs, I adapt and edit the original text to create a smoother, more engaging listening experience. Ideal for those who want to absorb the material while walking, commuting, or just prefer audio. It's one of the many ways I try to add real value for subscribers.

Choose the Membership That Fits You

🔓 Free Membership – Occasional posts and insights

🔐 Annual Membership (€249/year – €20.75€/month) – Full access to deep dives, portfolio updates, and mental models

🌟 Premium Membership (€479/year – €39.9€/month) – Everything in Annual + direct access to me, my community, and a like-minded investor community via WhatsApp

👉 Annual is 72% cheaper than going monthly and includes everything you need to sharpen your edge.

Stay Up-to-Date

Every new post lands directly in your inbox – spam-free, ad-free, and crafted to help you think better. For a richer experience with audio, archives, and community tools, get the Substack app.

Join the Crew

This isn’t about signals or “what to buy now.” It’s about building a system you can trust when markets get noisy.

Subscribe today and start compounding with clarity.

Disclaimer: The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.