Every now and then, a company flies under the radar while steadily checking off all the boxes you’d want in a quality business: recurring revenue, high switching costs, an underpenetrated market, founder-led execution, and improving financials.

A European payroll outsourcing and HR software specialist I recently came across in an investment letter of a German small-cap fund fits that profile – and the market has started to notice.

After years of modest returns and low trading volumes, which the management team and board recognized (“The strategic review was partly initiated due to the low daily trading volume […]“), the stock has surged more than 180% since 2023. Yet even after this rally, it’s still a relatively small company (140€ million market cap) in an industry dominated by giants like ADP, CloudPay, and Paychex.

So what’s driving this outperformance?

The company has been executing on all fronts. FY2024 revenue came in at a record NOK 1.346 billion, up 19% year-over-year, while margins continued to expand. Q1 2025 picked up right where last year left off: 16% revenue growth (with Germany leading the way with 27% YoY growth (40% YoY growth in Q3)) and an adjusted EBIT margin of 14.1%.

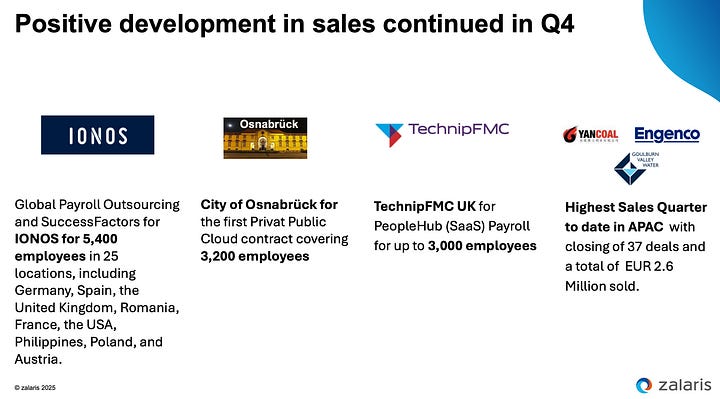

That margin figure is particularly notable for a company that, just a few years ago, was hovering around the 6–8% mark. More importantly, Zalaris has already laid out a roadmap to reach NOK 2 billion in annual revenue by 2028 – entirely organically. They are winning new customers and enjoying a lot of momentum in that regard. Here are some examples:

“In the fourth quarter, Zalaris signed a global contract with a new large German IT company for comprehensive payroll and HR services for 4,400+ employees in 9 countries“

“In Germany, our professional services organization sustained its success in the public sector. We signed an agreement to implement a complete success factory solution for the city of Osnabruck valued at approximately EUR 2.5 million over the next 3 years. We also finalized our long-term agreement with our long-standing customer, the Max-Planck Institute for a SAP HCM application maintenance services.

Additionally, we concluded an agreement to provide outsourced HR and payroll services to GALERIA Karstadt Kaufhof, one of the Germany's largest retail operations. Under the contract, Zalaris will assume full reality for payroll and other administrative HR tasks for approximately 12,000 employees in Germany.“

Even more examples:

Building on this momentum, our ambition is to achieve NOK 2 billion in annual revenue by 2028, driven by organic growth. In parallel, we have established a clear pathway to continue strengthening our EBIT margins over the same period.” - CEO Hans-Petter Mellerud

And yet, despite the numbers, Zalaris is still rarely discussed outside of Nordic investing circles. It doesn’t grab headlines. It doesn’t make splashy acquisitions. It didn’t jump on the AI hype train – though it is quietly rolling out machine learning tools to automate anomaly detection and speed up payroll workflows.

But there was one brief moment earlier this year when Zalaris did enter the spotlight: following inbound M&A interest, the company conducted a strategic review. For a while, investors wondered if Zalaris would be taken private or merged into a larger competitor. Instead, management doubled down. In June 2025, they announced they’re staying independent – confident that the company’s best years lie ahead.

“During the review period, the company received and evaluated acquisition proposals. The Board concluded that these offers [added comment: note the plural form] did not have a premium that adequately reflected Zalaris’ value, particularly considering its recent financial outperformance, strong growth trajectory and positive outlook.“

“We have overdelivered significantly on the growth and profitability trajectory we set out at our September 2023 capital markets day. With a proven strategy and positive momentum, we are strongly motivated and in a stellar position to continue delivering superior and sustainable value creation for our stakeholders.” - Hans-Petter Mellerud, CEO and co-founder of Zalaris

That decision says a lot. It hints at internal conviction, yes – but it also invites a serious question for investors: Can Zalaris deliver on its long-term ambitions and become a truly dominant European payroll platform?

That’s what I’ll explore in this deep dive (17,000 words). We'll look at how the business works, what makes it defensible, whether the financials back the story, and what risks could derail the ride. But more than anything, I’m trying to answer this: is Zalaris the kind of company you can tuck away for the next five to ten years… and just let compound?

Here’s what I cover in this deep dive (by far the most in-depth analysis of this name) – as in all of my deep dives, this isn’t just a surface-level overview, but a full breakdown built for serious investors:

A concise, portfolio-manager-style pitch using Bill Miller’s “BAM BAM BAM” framework to lay out the case for Zalaris in under 90 seconds

A deep look into what Zalaris actually sells – including whether it's a commodity service or a differentiated, mission-critical platform

How the business makes money, what its unit economics look like, and why its capital-light structure matters more than you’d think

Who Zalaris’s customers are, how sticky those relationships really are, and what it would take for clients to switch

The company’s exposure to risk, margin compression, platform dependencies, and geographic vulnerabilities – including a full inversion exercise

Whether Zalaris’s moat is durable or just temporarily wide – including a full “false moat” teardown to challenge the bullish case

Why the founder-CEO still being at the helm after 25 years is more than a feel-good anecdote – and what it says about long-term capital allocation discipline

An honest review of activist involvement, insider ownership, and why this isn’t your typical small-cap corporate governance story

A clear look at the balance sheet: net debt, cash generation, working capital stability, and whether goodwill is quietly inflating asset values

What makes this a non-cyclical, predictable business – and why the boring nature of payroll outsourcing can be a feature, not a bug

How I think about valuation: FCF multiples, margin of safety, organic growth expectations, and the mechanics of long-term value compounding

Why this opportunity exists, what fear or mispricing created it, and what would need to happen for the market to finally catch up

Let’s dig in.

Before we dive back in, a quick note…

If you’re reading this as a free subscriber and finding value in this kind of deep, idea-by-idea analysis, consider upgrading to the full version. I write these posts for long-term thinkers who want more than earnings call recaps and press-release summaries. If that’s you, I’d love to have you on board.

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks.