As 2024 draws to a close, I find it incredibly valuable to take time to reflect on the past year. This annual exercise of revisiting successes, analyzing mistakes, and realigning strategies has been inspired by some of my investing friends, like Andrew and Ruki, as well as renowned investors who diligently conduct similar reviews.

It’s my way of distilling key insights, fine-tuning my approach, and sharing a transparent overview of my journey. I plan to make this a yearly routine.

In this post, I’ll delve into a couple of lessons I’ve learned, the biggest mistakes I made, and my proudest decisions.

Lessons Learned in 2024

1. The Joy of Collaborative Learning

One of the most rewarding aspects of 2024 was the deepened connection with fellow investors. Whether through recorded discussions with Andrew, engaging with my growing investing community, or unrecorded yet profound conversations with like-minded individuals like Brandon from the New Money YouTube channel and Thio Brian (who you may know from X), I’ve realized the immense value of shared knowledge.

These interactions don’t just provide me with new perspectives—they also help refine my own understanding.

This year, I also conducted my first full year of mentoring. Seeing others progress in their financial journeys has been profoundly fulfilling, reinforcing the idea that investing isn’t just about personal gains but also about uplifting others.

If you want to learn more about what I have to offer, check out this website.

2. Compounding in Action

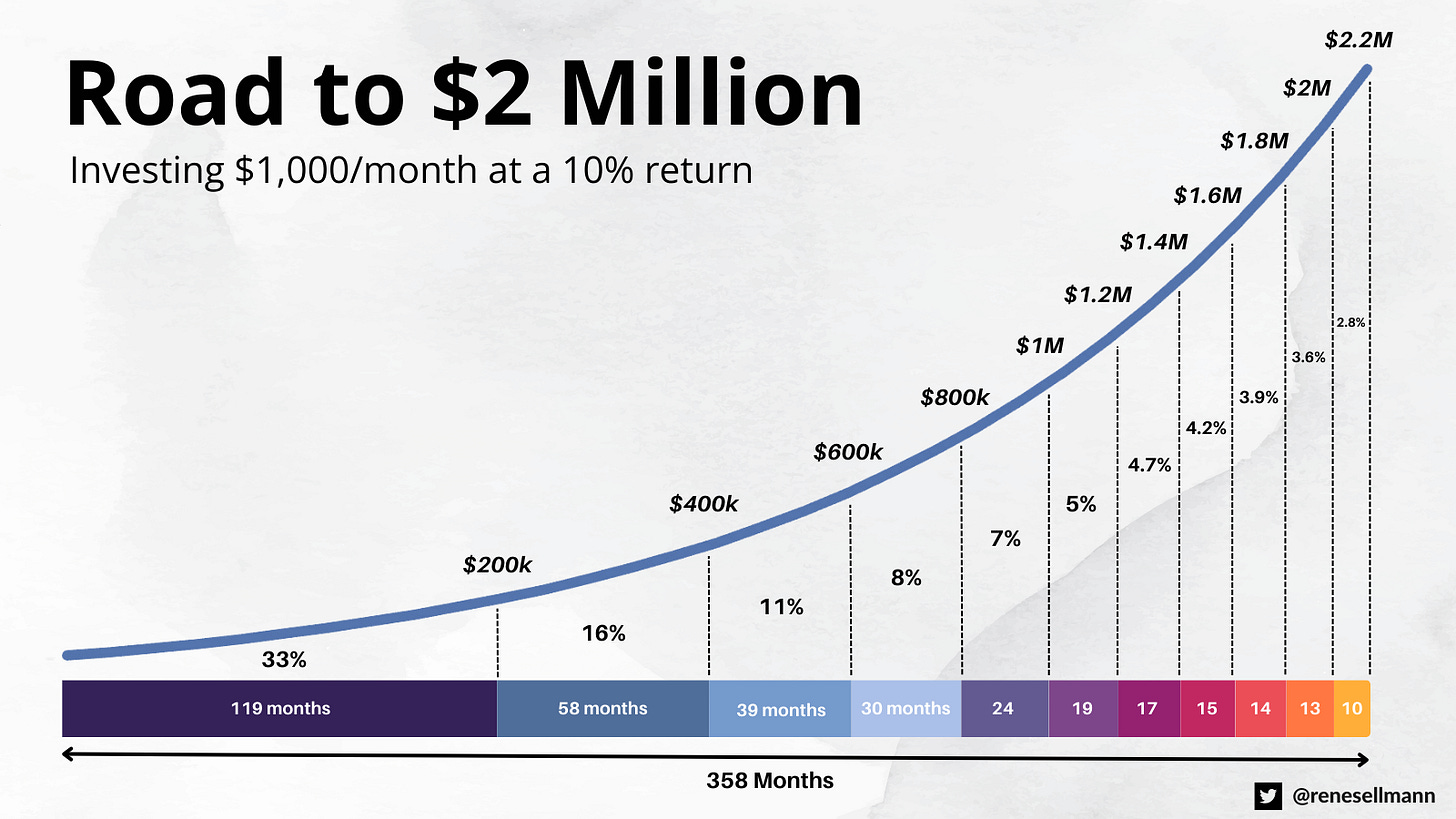

This year marked the first time I truly felt the power of compounding. While I’ve always understood it in theory—invest regularly, let time do its magic—2024 showcased the tangible impact.

My portfolio appreciated significantly in the second half of the year, growing in size by a factor of maybe 4-5x my annual savings rate. Seeing the much-talked-about “snowball effect” materialize in real numbers has been nothing short of exhilarating.

Here’s an infographic I once illustrated highlighting how compounding works.

Top Three Mistakes of 2024

Mistakes are inevitable in investing, but they’re also a treasure trove of lessons.

Inspired by Francois Rochon, who emphasizes rigorous reflection on errors, I’ve categorized my top three mistakes this year and created my 2024 ”podium of errors.”

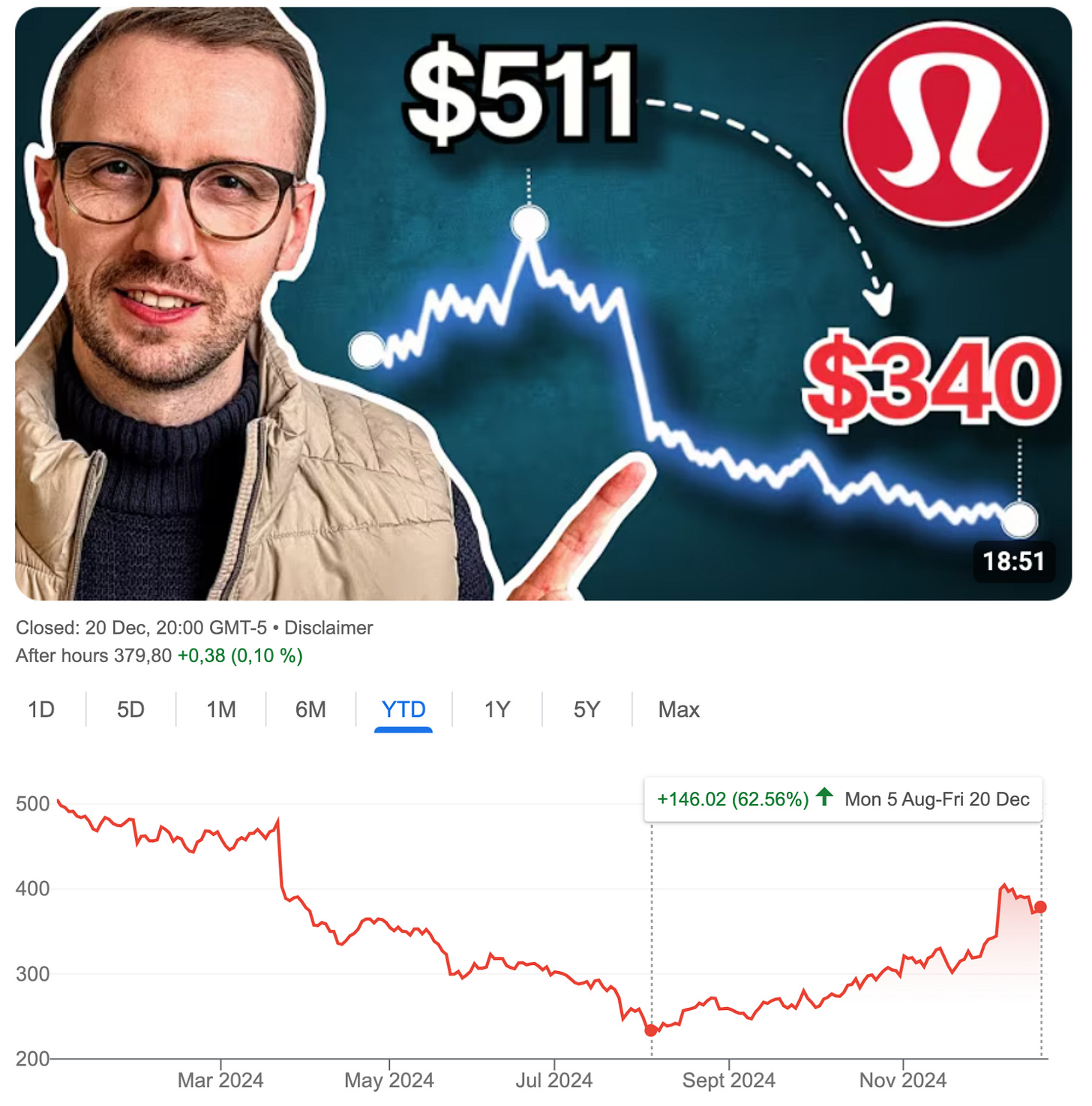

Bronze Medal: Missing the Opportunity with Lululemon

While I identified potential in Lululemon and discussed it in a video on my YT channel, I never acted on the opportunity.

The stock is up 62% from its August lows, an impressive annualized return.

While I remain (ultra-)cautious about apparel stocks, hindsight shows that my hesitance cost me dearly.

Silver Medal: Selling PayPal and Paycom Too Early

I owned both PayPal and Paycom at opportune moments, purchasing them near their lows (Paycom in the low $140s and my average cost basis in PayPal was below $60/share). I also recorded videos on both opportunities and, in fact, my very first Substack post was focused on Paycom (which I then turned into a 3-part series).

However, I sold both positions prematurely to fund other investments. While the reallocation was successful, I missed out on the massive gains these stocks subsequently experienced.

Paycom was up something like 43% from my selling price (it’s only up 21% from that level as of today) and PayPal, too, is up more than 30% since I sold my small stake.

Gold Medal: Endor AG – My First 100% Loss

My investment in Endor AG, a German simracing company, turned into a complete loss as the business faltered.

This experience taught me that even founder-led companies with seemingly attractive valuations are not immune to poor management decisions and external pressures.

Holding onto the investment because of its “cheap” price was a mistake. Read more on my reflections regarding this failed investment here on X.

With hindsight, selling earlier and taking the loss would have been the wiser choice.

Biggest Wins of 2024

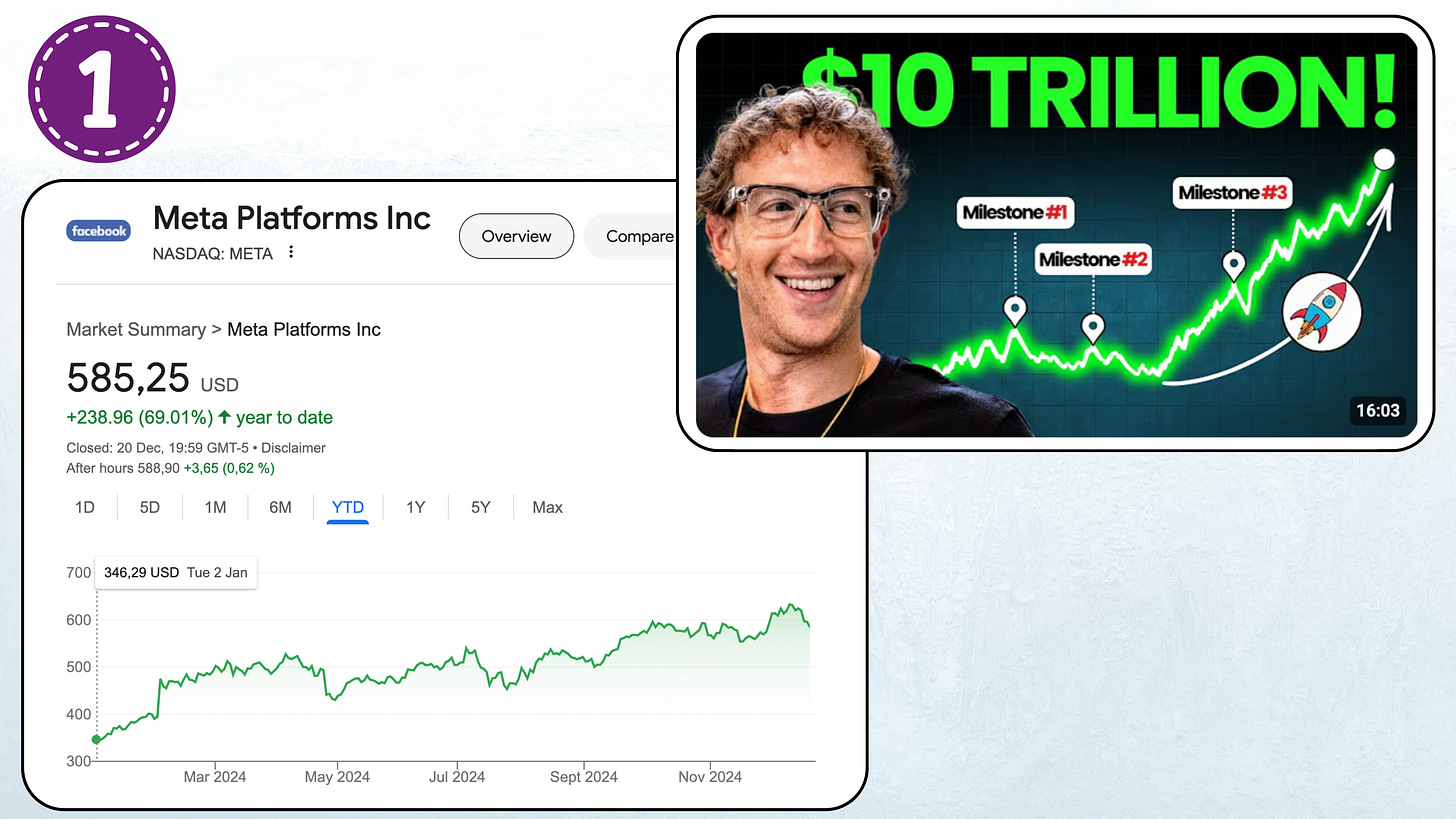

1. Holding Meta Through Its Rally

One of my proudest decisions was resisting the temptation to sell Meta Platforms as the stock surged in 2023 and continued to do so in 2024 and delivered impressive returns.

Since hitting its low in 2022, the stock has almost sextupled in value. Despite external advice to "take profits," I stuck with my conviction, and it paid off handsomely.

2. Investing Boldly in Wise

Wise has become one of my top portfolio holdings, representing around 20% of my allocation as of today. I’m confident in the company’s long-term trajectory, bolstered by recent developments like Morgan Stanley adopting Wise’s infrastructure. Starting with a sizable position (and icnreasing it by selling other positions such as Paycom and PayPal) was a decision rooted in conviction, and so far, it has been rewarding with the stock soaring >60% from the lows.

Portfolio Highlights and Concentration

Heading into 2025, my portfolio consists of nine positions, with 83% of the weight concentrated in the top five holdings: Meta Platforms, Wise, Wix.com, Interactive Brokers, and Nintendo.

This high level of concentration reflects my confidence in these companies and aligns with the approach championed by Dev Kantesaria of Valley Forge Capital:

“By the time we get out to our 15th best idea, we’re not really happy with the risk/reward proposition. A portfolio with a limited number of carefully-selected names is the only way to significantly outperform benchmarks over the long term.”

This approach underscores an often-overlooked truth: the better you know a company—its risks, opportunities, and leadership—the lower the actual risk. Truly understanding a business requires focus, and that’s achievable only with a concentrated portfolio.

Market Outlook and Caution for 2025

While 2024 delivered exceptional returns, I’m tempering expectations for 2025. Valuations for many of my holdings have risen, and the broader market exhibits signs of euphoria. While I remain confident in my portfolio’s quality, I may trim positions to increase cash reserves if valuations expand further.

Final Thoughts

Reflecting on 2024 has been an enlightening process and as I highlighted, I plan to make this an annual routine.

From mistakes that sharpened my approach to wins that reinforced the value of patience and conviction, this year has been pivotal in my investing journey.

I’m excited for what 2025 holds and look forward to continuing to share this journey with you!

How was your 2024? I’d love to hear about your lessons, successes, and challenges in the comments below. Let’s learn and grow together as we step into another year of opportunities.

Happy investing, and here’s to a prosperous 2025!