Some businesses just demand your attention. Quarter after quarter, they give you reasons to dive deep – margins wobble, customer growth stalls, strategy shifts. They keep you on your toes.

And then there are businesses like WISE 0.00%↑.

When a company executes this consistently, you don’t need to dissect every line of the income statement just to sleep at night. You glance at the numbers, sanity check a few key metrics, and move on. That doesn’t mean you stop tracking them – it means you’ve built a level of conviction where short-term noise doesn’t shake you.

Still, I think it’s good practice to pause occasionally and take stock. Especially after full-year results like the ones Wise just posted for FY2025. There’s nothing flashy in here, no grand narrative shift. But there’s quiet, powerful progress. And in investing, that’s often where the real compounding happens.

So, in this post, I want to walk through Wise’s recent results, share how I’m thinking about the business these days, and discuss why their decision to move the primary listing to the US – while logical in some ways – isn’t something I’m especially excited about.

Here’s a breakdown of everything I’ll cover in this post:

A quick summary of Wise’s FY2025 results – what stood out and what didn’t

Why Wise falls into the “quiet compounder” bucket in my portfolio – and why that might change one day

The importance of knowing your value drivers – and which ones I’m tracking closely for Wise

A look at the company’s proposed US listing and what actually matters about it

Thoughts on risk, drawdowns, and how even a well-executing business like Wise won’t escape volatility

A few quotes worth sharing from the earnings call that provide deeper insight into how management is thinking

A fresh perspective on Wise’s valuation, including Hayden Capital’s and Jake Barfield’s excellent breakdowns

Let’s start with the numbers.

The Numbers That Matter

Here’s the snapshot of Wise’s full-year results. No fluff, just the essentials:

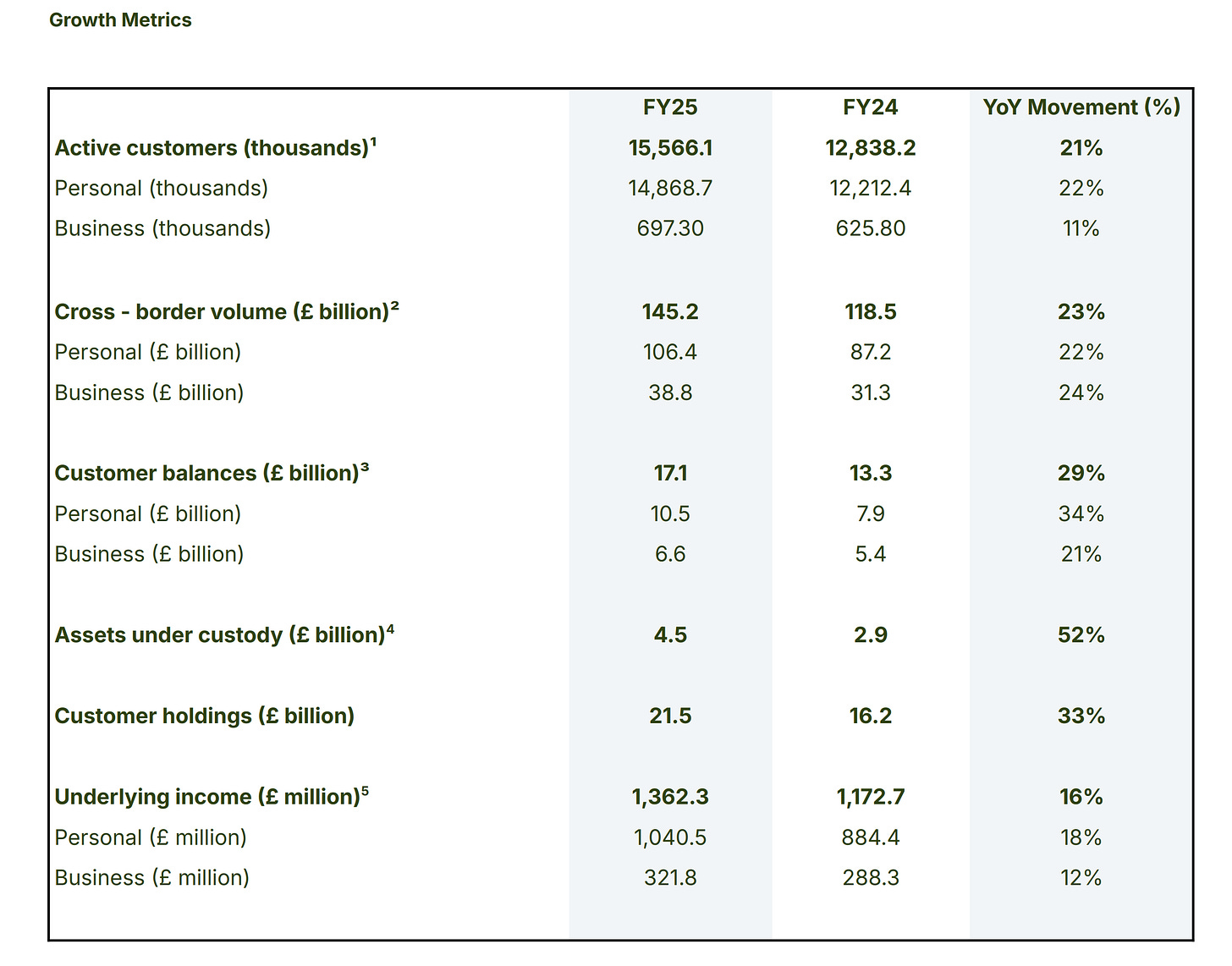

Cross-border volume grew 23% to £145.2 billion – a number that slowly and steadily keeps creeping toward the trillion mark over time (still a long way to go though!). Personal volume was up 22%, business up 24%.

Customer growth came in strong: 15.6 million active users by March 2025, up 21% year-over-year. And importantly, “Business customer growth sequentially accelerated in Q4 FY2025, as we resumed the onboarding of business customers in the US and UK, following the pause in H2 FY2024. Business cross-border volumes grew at a faster rate than active customers, driven by an increase in VPC.“

Account adoption keeps deepening. Around 50% of personal customers and 60% of business customers now use multiple Wise features.

Customer holdings jumped a whopping 33% to £21.5 billion. That includes £17.1 billion in balances and £4.5 billion in assets under custody (up 52%).

Revenue rose 15% to £1.2 billion. Total underlying income (which includes the first 1% of interest yield on balances) was up 16% to £1.36 billion.

Profitability held up well, even as they lowered prices: underlying PBT rose 17% to £282 million, reported PBT hit £565 million, and EPS was up 18%.

Take rate compression continued – now at 0.53% in Q4, down from 0.67% a year ago. More than 65% of payments now arrive in under 20 seconds.

Free cash flow was solid: £333 million, with a Underlying free cash flow (UFCF) conversion of nearly 118%.

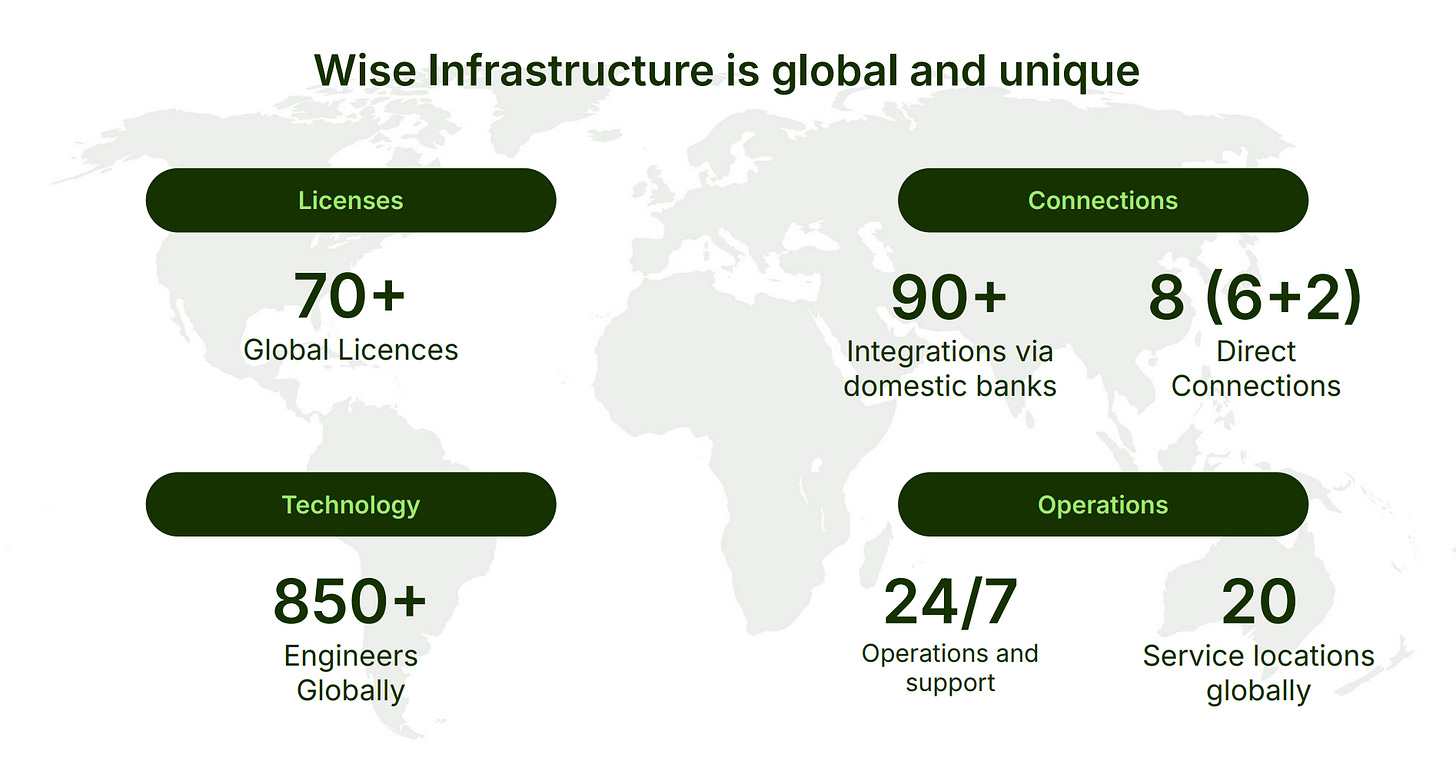

Regulatory footprint keeps expanding: new direct connections in the Philippines (InstaPay), approvals in Brazil (PIX) and Japan (Zengin). More direct rails = more control, more speed, lower cost.

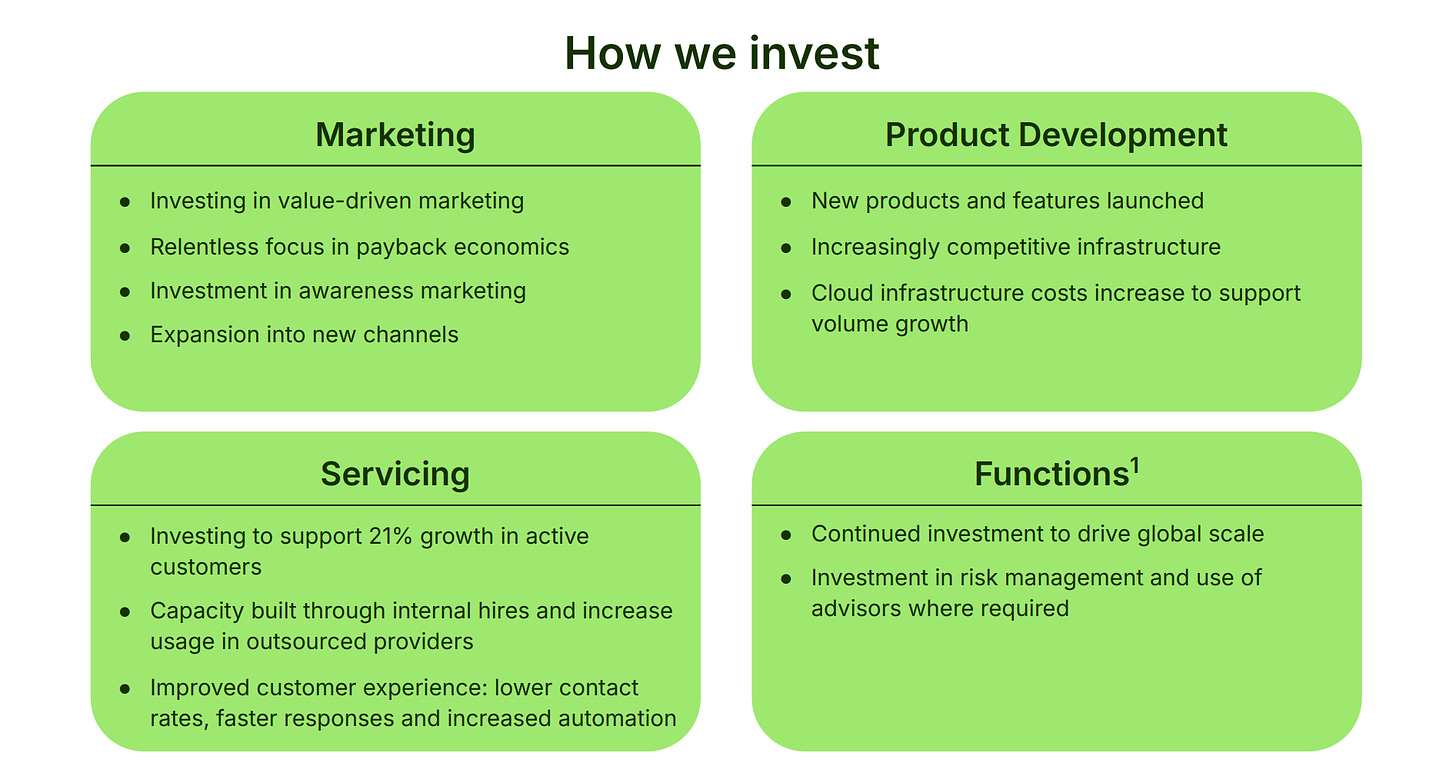

Investments are ramping up: £2 billion earmarked over the next two years for infrastructure, product, and marketing (“We have committed to investing around £2 billion over the next two years, across infrastructure, marketing and products, to capture even more of the substantial opportunity that exists for Wise.“).

And maybe most overlooked – the stream of small, incremental product upgrades that Wise keeps rolling out. In isolation, they don’t grab headlines. But over time, they compound. This past year saw the launch of QuickPay (a QR-code-based solution for businesses), removing a previous $5,000 transaction cap in India, the extension of return-earning “Assets” accounts to new countries such as Australia (now available in 30 countries). The product just keeps getting better – bit by bit.

That’s the operational side. The core engine keeps running – quietly, efficiently. But not all holdings require the same level of maintenance. And that’s worth unpacking.

Some Companies You Babysit – Others Just Do Their Thing

Every portfolio has its needy stocks – the ones that seem to require constant attention, where each earnings call might reveal a twist or signal a derailment. You watch them closely, read between the lines, scrutinize segment margins, and debate strategy with yourself. They're not necessarily bad businesses, but they often come with more moving parts, more competitive risk, or more volatility in execution (which may have led to an attractive valuation in the first place).

Then there’s the other bucket: the ones you don’t have to babysit. You check in, not out of fear something’s gone wrong, but out of habit and discipline. These companies quietly go about compounding intrinsic value. Wise fits squarely into this category.

I still read the full report. I still think critically about what might break the thesis. But the exercise is different. I’m not looking for a story to unravel – I’m tracking the same handful of long-term KPIs I’ve been following for months or sometimes years. And each time I check, I’m reminded why it’s in the portfolio.

For a business like Wise, the handful of drivers I focus on over time hasn’t changed much:

The number of direct integrations into domestic payment systems – this is their moat in the making (sooo hard to replicate), and every new connection tightens the grip.

Growth in active accounts, both personal and business (PLUS number of platform partners and actual adoption by the partner’s customers) – tells me whether adoption is broadening. Here’s one key quote from a recent VIC writeup, highlighting why this matters:

“Wise Platform is already established as a serious partner for retail FX, especially for challenger banks serving tech savvy and wealthier clients. But the commercial market is 20x bigger. Massive traction in the commercial market is the only way Wise has a chance to be a £100+ billion company. […] I think a lot of investors are skeptical that they can take significant share in the B2B space - in the quarter ending March 2024, Business volumes only grew 10% Y/Y. It was very ‘explainable’ - a pause in taking new business customers while they invested in better KYC/UBO onboarding. In the most recently reported quarter, that growth rate is back up to 20%, but a lot of doubts persist. With sub 1% market share, it seems like a world beating company could easily be posting 50% growth rates.“

The volume of cross-border transactions – a clean read on customer engagement and product utility.

Profit margins – important, but mostly to ensure they’re balancing reinvestment and pricing discipline sensibly.

Customer holdings and Assets under Custody – a decent proxy for wallet share and trust.

And, more recently I added the threat of disruption from stablecoins and blockchain-native payment players. Still early, but it’s a risk worth tracking on the edges.

That’s not to say these metrics are everything – no single dashboard captures the full narrative of a company. But in the case of Wise, they get you 90%+ of the way there. If those indicators are on track, the story is probably still intact.

An intern at Hayden Capital recently published a detailed piece on Wise that aligns with this mindset. He called out many of the same metrics I track. I don’t always agree with every piece of research I read, but this one was VERY solid. Worth your time if you want a framework to mirror (read it here).

The point is: knowing what to track lets you stop overanalyzing everything. And that’s part of what makes businesses like Wise so appealing to hold. They're structurally set up to let you breathe.

Now, just because Wise has been a "set it and forget it" stock so far doesn’t mean it’ll stay that way. If there's one thing public markets teach you, it's that every business eventually hits turbulence – sometimes it’s a bump, sometimes it calls the whole thesis into question. That’s just the nature of investing in real-world companies run by real-world people, operating in unpredictable environments.

At some point, I fully expect Wise to become more time-consuming. Maybe margins come under pressure. Maybe regulation bites harder than expected. Maybe a competitor – stablecoin-based or otherwise – eats into their network effect. Maybe the stock gets cut in half. Honestly, I expect that. Over the next five to ten years, I’d be surprised not to see Wise drop 50% at least once. Maybe more than once.

If you were an early IPO-investor in Wise, you already had to endure one -73% decline right after the IPO, and another -35% drawdown (bottoming in March 2024) which I actually used to initiate my position.

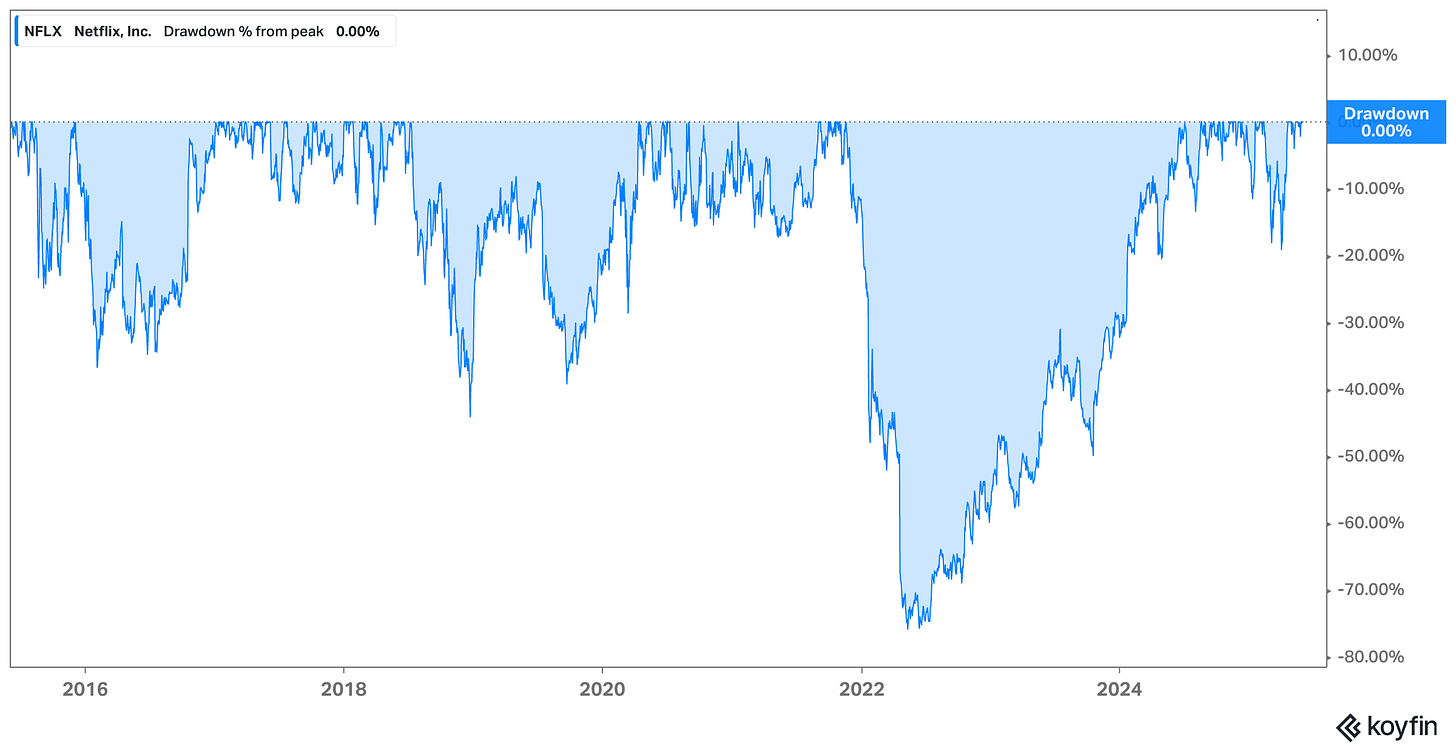

But that kind of volatility doesn’t scare me off – it’s the price of admission for long-term outperformance. Look at Netflix over the past decade (chart below). Massive drawdowns, multiple 40–70% corrections… and still, it’s been one of the best-performing stocks in the market. If the core value drivers stay intact, I’m usually more interested when things go wrong than when everything looks perfect.

So yes, Wise is in the "low-maintenance" bucket for now. But that status is earned quarter by quarter – it’s not permanent. And I’ll be ready when the story inevitably gets more complicated.

The Biggest News in the Update? It Wasn’t the Numbers

If there was one part of this full-year release that made me sit up and pay closer attention, it wasn’t the revenue line or the take rate drop – it was the announcement of Wise’s intention to move its primary listing to the US. This is by far the most noteworthy development in this update. Everything else? Steady-as-she-goes execution. But this one has potential long-term implications.

Now, under normal circumstances, I don’t spend much time thinking about listings. In most cases, it’s noise. Whether a stock trades in London or New York doesn’t change the cash flows of the business. It doesn’t affect the competitive position, the customer experience, or the efficiency of the payments network. Especially for a company that isn’t in the market raising capital, listing location is rarely material to the investment thesis.

But I’ll give Wise some credit here – they actually presented a few arguments that I think are worth considering. The most convincing one? Reputation.

“We're thinking about these listing updates very much in the long term, so in the next ten years. And the strategic impact, we expect to be soft and indirect. So there's no one thing that we can can't do today and we can do then. But it we expect this to raise our profile in the largest market of the world. And where our opportunity is is enormous. Already, I'll I'll skip the stats, but a a vast amount of our volumes touch the US dollar as as on one on one leg or one currency. So it is important for us to operate in in The US. It's a big part of our business already.

Maybe to add to that, there are 4,000 banks in The US for the Wise platform. This is a massive opportunity, and we think that it will also increase our brand awareness. That's one of the aspects.” (Wise’s CEO on the earnings call)

Moving the primary listing to the US could boost Wise’s credibility in its single most important growth market. That matters – especially on the B2B side. When US businesses are choosing a cross-border platform or financial partner, being a “US-listed” company might not be a dealmaker, but it removes a friction point. For personal users, too, there's a subtle signal of legitimacy in having a US listing that might increase adoption.

They also mentioned the depth and liquidity of US capital markets, and while I think that’s mostly boilerplate language (Wise stock has never struck me as illiquid), I understand the appeal of getting on the radar of US institutional capital. Over time, this could also be a step toward index inclusion, though that feels like a secondary or even tertiary benefit for now.

That said, most of the other reasons they offered don’t move the needle for me. Liquidity is already fine. Access to capital markets isn’t relevant when you're not looking to raise. And while alignment with US tech peers sounds nice in a press release, it doesn't really change anything operationally. If anything, there’s a subtle irony in pitching this move as a long-term value unlock while acknowledging that it's unlikely to lead to any near-term rerating.

And let me be blunt – I don’t expect a valuation bump here. Wise isn’t dirt cheap at today’s levels, and listing in the US doesn’t magically make it more attractively priced.

“Moving the listing also brings possible downside. Wise trades at 29 times consensus 2027 earnings – beating Remitly, Block, PayPal and others. Other metrics tell the same story: there’s no evidence of a valuation penalty because of the company’s UK trading venue. That means Käärmann has much to lose if the company ends up as one of the many “orphaned” pond-hoppers, which switch listing but never quite catch fire in the U.S. market. Research by think tank New Financial earlier this year found that just 44% of the 16 European companies that had moved across the Atlantic subsequently beat the performance of their home continent.“ – Reuters

In fact, if anything, this move reduces my chances of being able to add to the position at depressed prices. The more visibility a company has in the US, the tighter the discount window tends to be. That’s great for management, great for liquidity, maybe even great for employee stock comp. But for long-term shareholders trying to accumulate at attractive multiples? Not so great.

So overall, the listing shift is meaningful. It’s probably a smart move. It’s well timed. But it’s not some hidden alpha generator – and it’s not a reason to own the stock. The reasons to own Wise haven’t changed.

The full story starts here:

The rest of this post covers the content outlined above. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content) is just a click away. Upgrade your subscription, support my work, and keep learning.