After introducing the business model of Paycom in my first post on this blog, here’s I think why Paycom Software PAYC 0.00%↑ is an above-average business that is currently trading for a below-market multiple.

Chapter 1: Operating In a Challenging Industry!

I explained Paycom’s business model in my last post. Clearly, the market for HCM solutions rather challenging as it is …

fast-moving

highly competitive

subject to changing technology

subject to shifting customer needs, and

requiring frequent introduction of new products and services

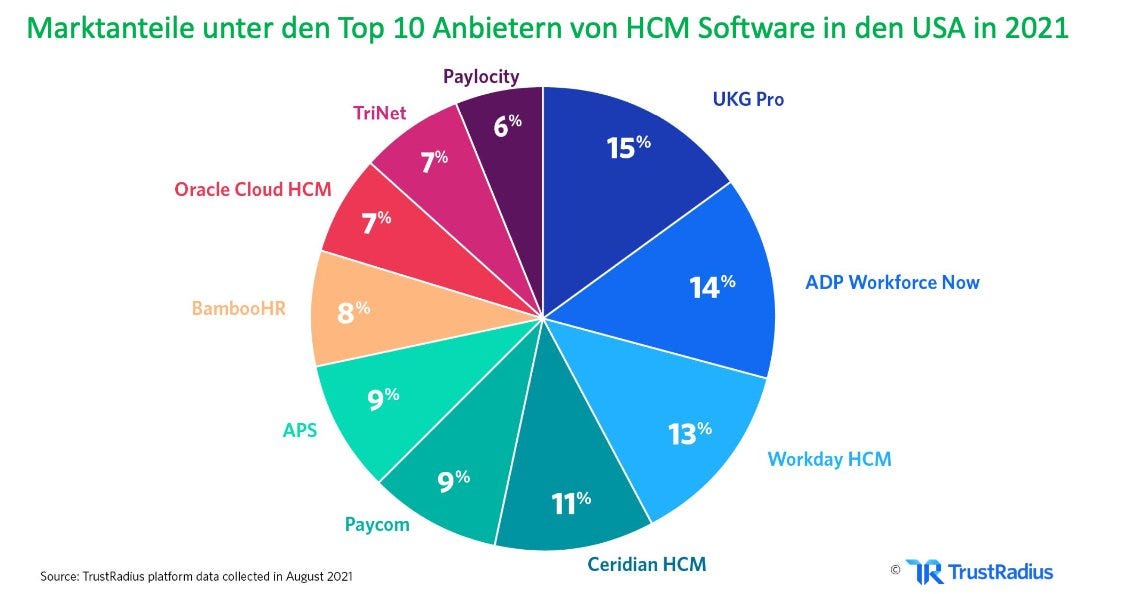

Even among the top ten HCM providers, the market shares are pretty evenly distributed:

Combine all of the factors above, and as an investor, predicting the future of Paycom’s business (which is required to value it!) is certainly challenging.

Hence, investors need to assess whether $PAYC possesses any structural competitive advantages (aka moats) that make the business’s future cash flow more predictable.

Chapter 2: Paycom’s Moats

I think two types of moats protect Paycom’s business. Let me explore both…