Why Not All Growth Is Created Equal: A Rule of Thumb for Pricing Power

Inelastic Demand, Uncloneable Products, and the Secret to Explosive Profits (5-20x Faster!)

Note: The voiceover above is a slightly adapted version of the blog post, edited for a smoother and more engaging listening experience. It’s one of the perks available to paid subscribers. Enjoy!

The Missing Link in Growth Analysis?

Growth is the oxygen of any business – and of most investor dreams. A company that grows is often seen as a company that's winning. Most of my readers probably understand that not all growth is “good” growth, and actually creating shareholder value. Growth only becomes value accretive if the returns on reinvested capital exceed the cost of capital.

Now, this shouldn’t be the core focus of this post. Recently, after watching a fascinating interview with investor Chris Hohn, I started asking a simple question that turned out to be surprisingly revealing:

What kind of growth are we actually looking at?

And more importantly, what’s the quality of that growth?

It was an offhand remark by Chris Hohn, founder of the Children’s Investment Fund, that I believe is worth exploring further. He said something to the effect that a 1% increase in price could lead to a 5% increase in profit (5x faster!), depending on your margin structure.

That line stuck with me. It sounded almost too elegant, too powerful to be true. But once I ran the math myself, it was obvious: the underlying logic was sound – and the implications are far-reaching, and I believe, you might gain a real edge if you comprehend the concept.

Most discussions about business quality tend to orbit around a familiar set of metrics: revenue growth rates, profit margins, returns on capital, and so on. These are useful, of course. But I think there's something even more fundamental that often gets ignored. Namely, where the growth comes from – and whether it's structurally repeatable, economically efficient, and strategically defensible.

This post is an attempt to unpack that. It’s not just about pricing power in the abstract or textbook definitions of inelastic demand. It’s about how even small shifts in pricing – when executed by the right kind of company – can result in exponential growth in earnings.

And, by extension, in shareholder value.

Here’s what I’ll break down in this post:

Why some types of growth are far more attractive than others – and how to tell them apart

How inelastic demand and uncloneable products create the foundation for real pricing power

A simple rule of thumb (inspired by Chris Hohn) that explains how a 1% price hike can supercharge profits

The math behind this rule, and how it plays out across different margin profiles

Real-world investing implications – including for which setups it matters & how to spot these setups before the market does

If you’ve ever wondered why some businesses seem to generate profit out of thin air – while others grind harder just to stay flat – this post is for you.

Not All Growth Is Created Equal

Growth may be the universal goal, but its underlying mechanics can be wildly different – and that matters more than most investors realize.

A company can grow in several ways. It might increase the number of units sold, launch new products, expand into new markets, acquire other businesses, buy back its own stock (increasing per share profits), or simply raise prices. On the surface, these all add to the top line – but the implications for the bottom line are very different. Some types of growth are capital-intensive, margin-dilutive, or hard to sustain (or the worst kind of growth: value-destructive).

Others are almost magical in how they flow through the income statement.

The kind of growth I’ve come to appreciate most is the kind that requires the least effort. Not because I’m lazy – but because the market often overlooks how elegant and powerful it can be. And that’s price-driven growth.

Let’s break it down:

Volume-driven growth can be fantastic – especially when there’s latent demand or geographic expansion potential. Especially, if you can sell more units without having to proportionally increase your costs, you tap into what’s known as operating leverage. Your fixed costs stay the same or increase immaterially while your revenue rises, so profits grow faster than sales. This is one of the most powerful effects in business, especially for companies with high fixed-cost infrastructures: software, platforms, etc.

But even volume growth has limits. It often comes with at least some rising variable costs – logistics, support, COGS – or with significant capital investment. You may need to spend on marketing to acquire more customers, or on CapEx to fulfill demand, and the return on these investments may be rather opaque.

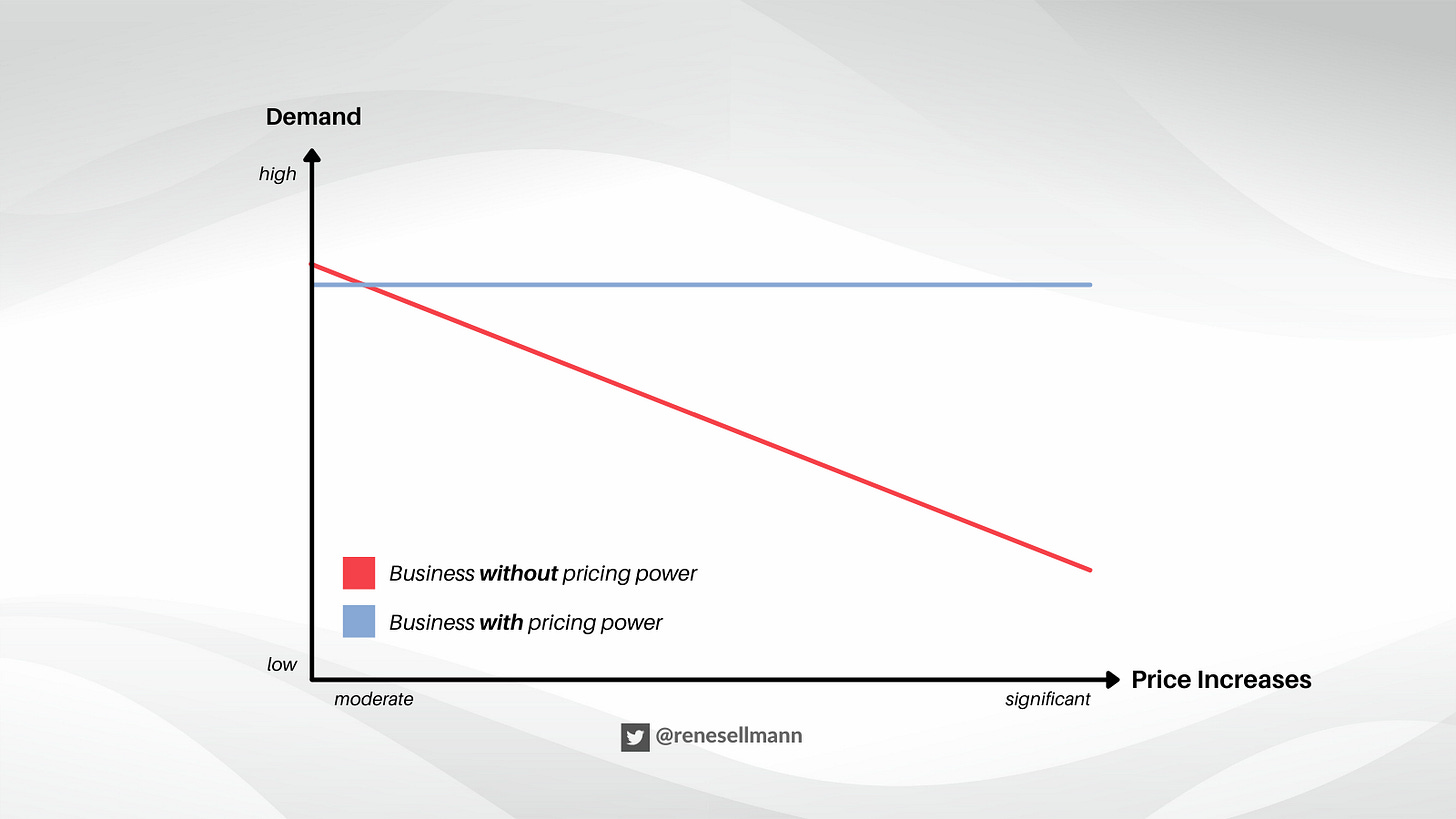

Then there’s pricing growth – when a company simply raises prices. No change in product. No increase in volume. Just higher prices for the same offering – ideally without losing (a material amount of) customers.

And this is where things get interesting.

If costs remain relatively flat – as they often do in the short term – every extra dollar from a price increase drops straight to the bottom line. That’s pure margin expansion.

And depending on the company’s starting profit margin, even a modest price hike can result in profit growth that far exceeds revenue growth (this is what we will explore further below!).

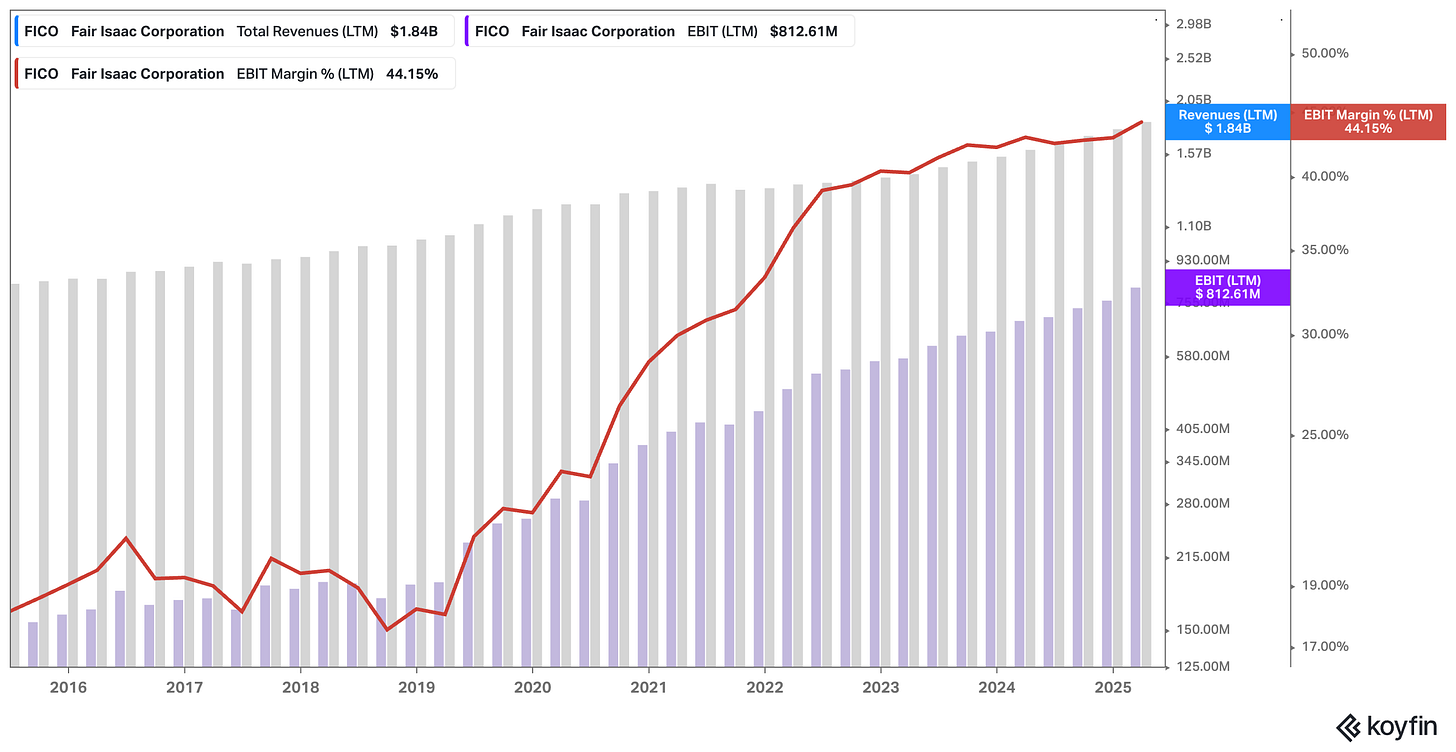

Some companies are masters at this game. FICO, the credit scoring provider, routinely raises prices for its core B2B products, and clients stay.

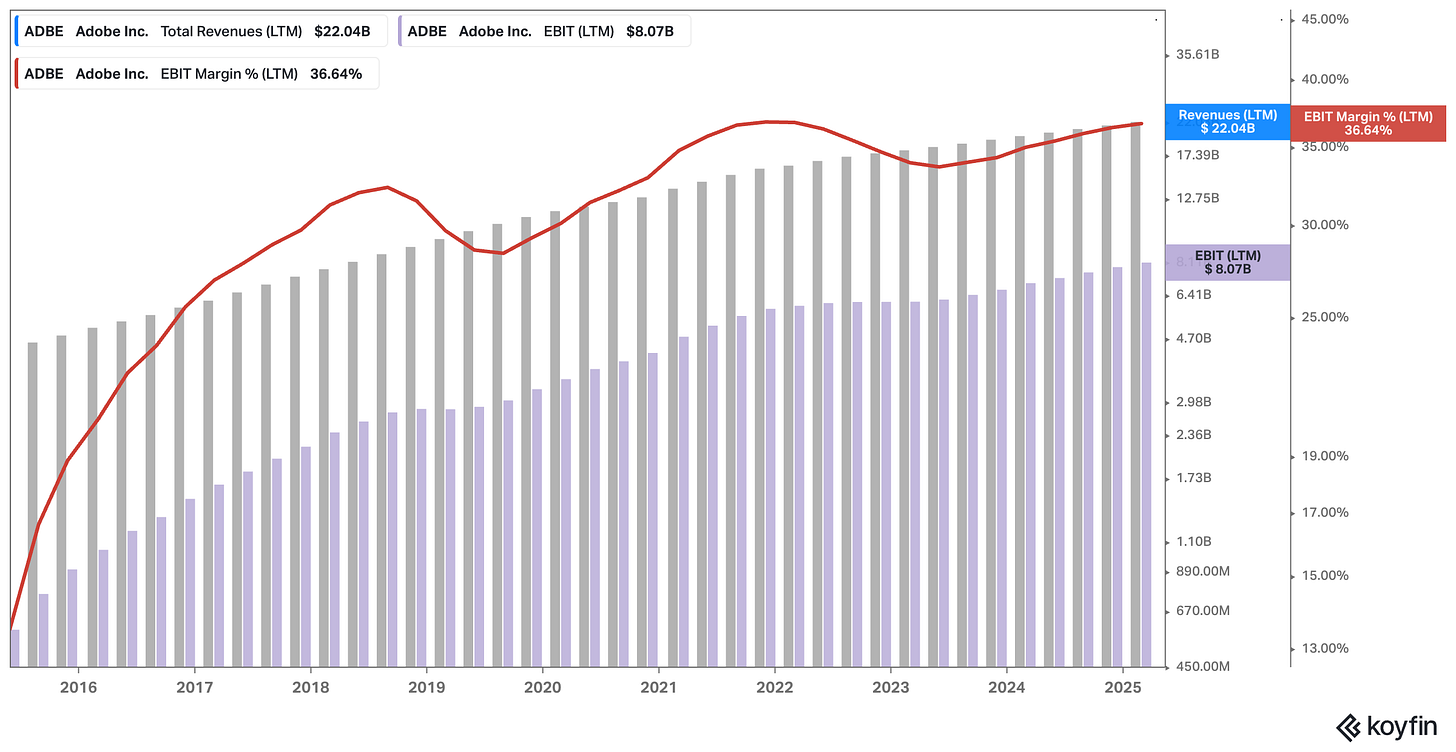

Adobe has done it with its Creative Cloud subscriptions.

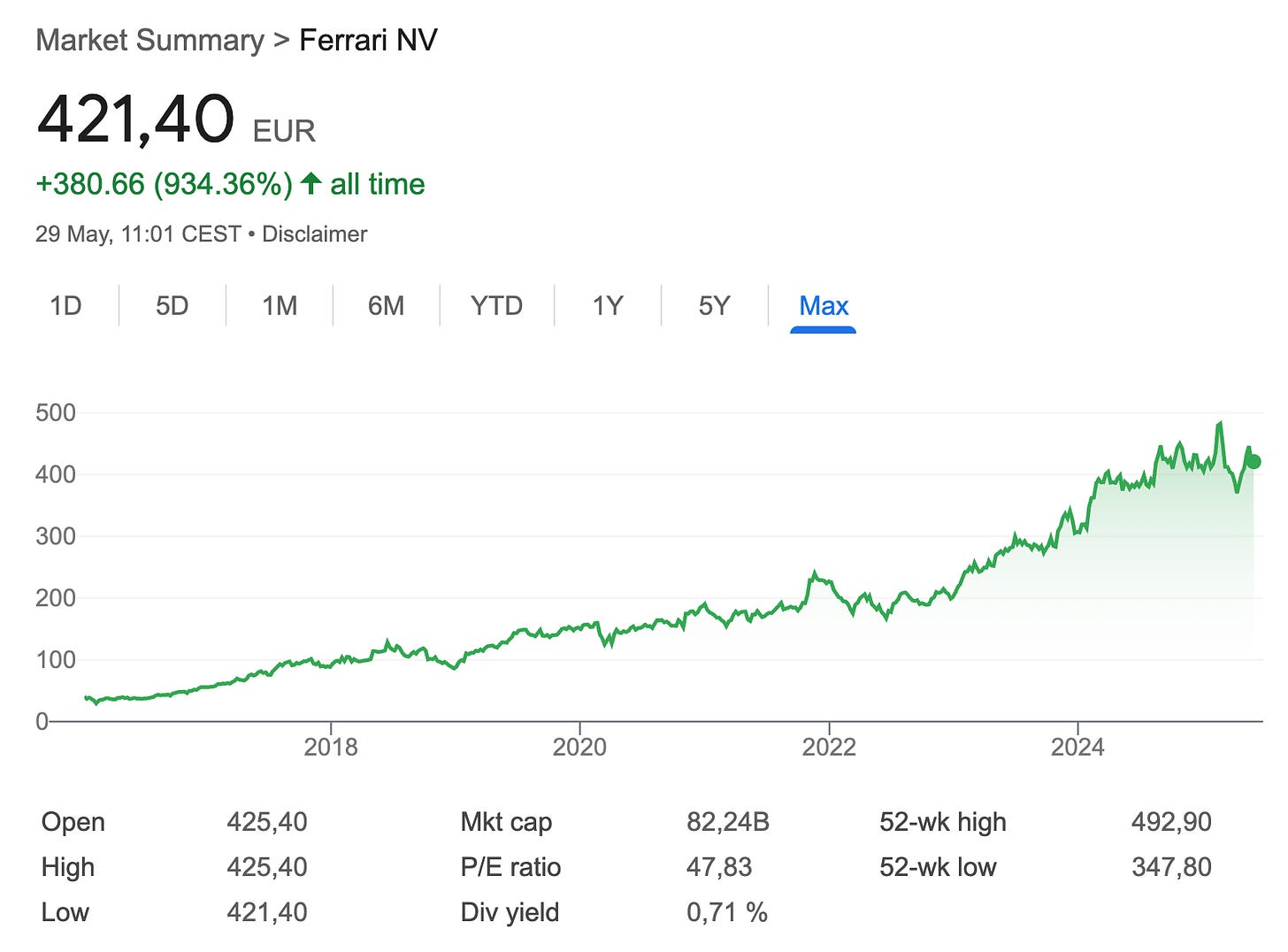

Ferrari doesn't need to increase unit sales to grow – it can simply raise the price of each car, and demand barely flinches.

Hermes can launch a new version of an existing bag, slap a higher price tag on it, and watch it fly off the shelves.

These are all companies that benefit from what economists call inelastic demand – where customer demand doesn’t meaningfully change even if prices go up. Whether it’s because the product is essential, mission-critical, or imbued with brand prestige, the result is the same: price hikes don’t lead to customer churn. They just lead to more profit.

As an investor, this is gold. And yet, it’s rarely modeled or discussed in most equity research. Analysts will spend hours projecting unit growth and margins, but gloss over the quiet power of a 1% price hike.

That’s a mistake.

Before we dig deeper into why this matters – and walk through the math behind how price-driven growth works for companies with different margin structures – we need to step back and talk about what gives a company that kind of pricing power in the first place. It’s not just about brand or distribution. It’s something more fundamental. Something qualitative. Something that’s hard to replicate.

And that brings us to the next idea: inelastic demand and the uncloneable product.

Inelastic Demand and the Uncloneable Product

A lot of investors obsess over quantitative signals. They build elaborate spreadsheets to compare gross margins, ROIC, free cash flow conversion, net working capital dynamics, and a dozen other metrics that are, no doubt, important. But I’ve come to believe that one of the most underappreciated traits of a truly high-quality business isn’t a number. It’s a qualitative dynamic rooted in the product itself – and how the customer perceives it.

At the heart of this dynamic is inelastic demand.

The basic idea, straight out of Economics 101, is simple: when a product’s price goes up, demand doesn’t fall by much – or at all. That’s inelasticity. We usually see it with things that are essential (like life-saving medication) or with products that occupy a unique space in the customer’s mind. And when a company sells something that customers need, love (that’s a big one!), or can’t find anywhere else, it suddenly gains the upper hand. It can raise prices, knowing that buyers won’t walk away.

Let me take it one step further.

The most valuable businesses, in my view, don’t just sell into inelastic demand – they sell something uncloneable. Something that can’t be easily replicated, substituted, or improved upon by a competitor. Sometimes that uncloneability is functional: the product is mission-critical or deeply embedded into a customer’s workflow. Other times it’s emotional: the product is aspirational, symbolic, or culturally iconic. In the best cases, it’s both.

Think about the Birkin bag from Hermès. You can argue all day about whether it’s “worth” the price – but that’s not the point. The point is, customers don’t want a bag like the Birkin. They want the Birkin. Same with Ferrari. People don’t want “a nice sports car” – they want a Ferrari. That’s not brand loyalty. That’s brand obsession. And when a company reaches that level, it has pricing power in the purest form.

On the functional side, you have companies like FICO. If you're a lender, there’s no real substitute (as of today at least). You need FICO scores, and you’ll pay what it takes, and the cost is immaterial anyhow and also often passed on to customers.

Adobe is similar. Sure, there are alternatives to Photoshop or Premiere, but if you're a creative professional, it's the industry standard. You're not going to overhaul your workflow to save $10 a month. That’s inelastic demand + lock-in. A powerful mix.

And this isn’t just about premium brands or legacy software. Even newer companies can earn this kind of grip. I’d argue that Wix, at its best, built a version of this with small businesses. For a certain type of user, Wix became the easiest, fastest, and most flexible way to get a site up and running for indivual users – and they are now building the same for professional website building agencies.

All of this matters because it leads to one simple outcome: pricing power without volume risk. And once you see it, you can’t unsee it.

You start to realize that inelastic demand and product uncloneability are upstream of most quantitative outcomes. High margins? Usually a downstream effect. Excess returns on capital? Often a result of this dynamic. Durable growth? More likely when pricing power is part of the story.

And yes, I know some investors would argue that management quality trumps all. That a strong team can build or repair almost anything. Maybe. Not disagreeing here. But if you have a truly uncloneable product, backed by inelastic demand, the company can survive a few bad decisions. Hell, it can even survive a donkey running it – as long as that donkey doesn’t destroy what makes the product essential or desirable in the first place.

"I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will." – Warren Buffett

In short, inelastic demand isn’t just an economic concept. It’s a lens. One that lets you see past the numbers and into the core of what makes a business special – and potentially unstoppable.

So now that we’ve explored the why (it matters), let’s get into the how (it matters). Chris Hohn gave us a clue.

Chris Hohn’s Rule of Thumb, Reframed (and Real-World Implications)

The full story starts here:

The rest of this post covers the content outlined in the table of contents above. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content) is just a click away. Upgrade your subscription, support my work, and keep learning.