Through the application process for my investment mentorship program, I speak with a wide range of individuals each year who are eager to succeed in the world of investing.

This unique vantage point lets me see the aspirations of many individuals but also their motivations, beliefs, and limiting beliefs that drive or hinder them. One common pattern I’ve noticed over time is the pursuit of shortcuts—many people want outstanding returns without dedicating the time or energy it truly takes to achieve them. This can be frustrating, as I genuinely believe, in the words of Charlie Munger:

"To get what you want, you have to deserve what you want. The world is not yet a crazy enough place to reward a whole bunch of undeserving people."

Achieving great returns requires more than just hoping for success, just copying the current "hot stock," just listening to gurus on X or YouTube; it demands a disciplined, informed, process-driven, and bottom-up approach.

I believe that a strategy focused on high-quality businesses, a low-turnover portfolio, and extreme patience doesn’t necessarily require an overwhelming time commitment. However, it does demand three key commitments: 1) You need to commit time and energy UPFRONT to truly understand the ins and outs of investing,

to learn how to read financial statements,

to learn what to consider in your qualitative analysis,

to learn what to look for in managers,

to learn how to value companies,

to understand the intricacies of portfolio management, position sizing, idea generation, buying/selling

... and much much more!

As Tiho Brkan pointed out in the tweet below, relying on simplistic metrics like P/E ratios alone won’t cut it.

The quickest and most cost-efficient way to do this is to have a mentor guiding you through the early years.

2) This process cannot be outsourced! Conviction in your investments comes from personal insight and deep understanding. Following others’ stock picks without comprehending the underlying rationale leads to panic during market turbulence or an inability to exit when valuations peak.

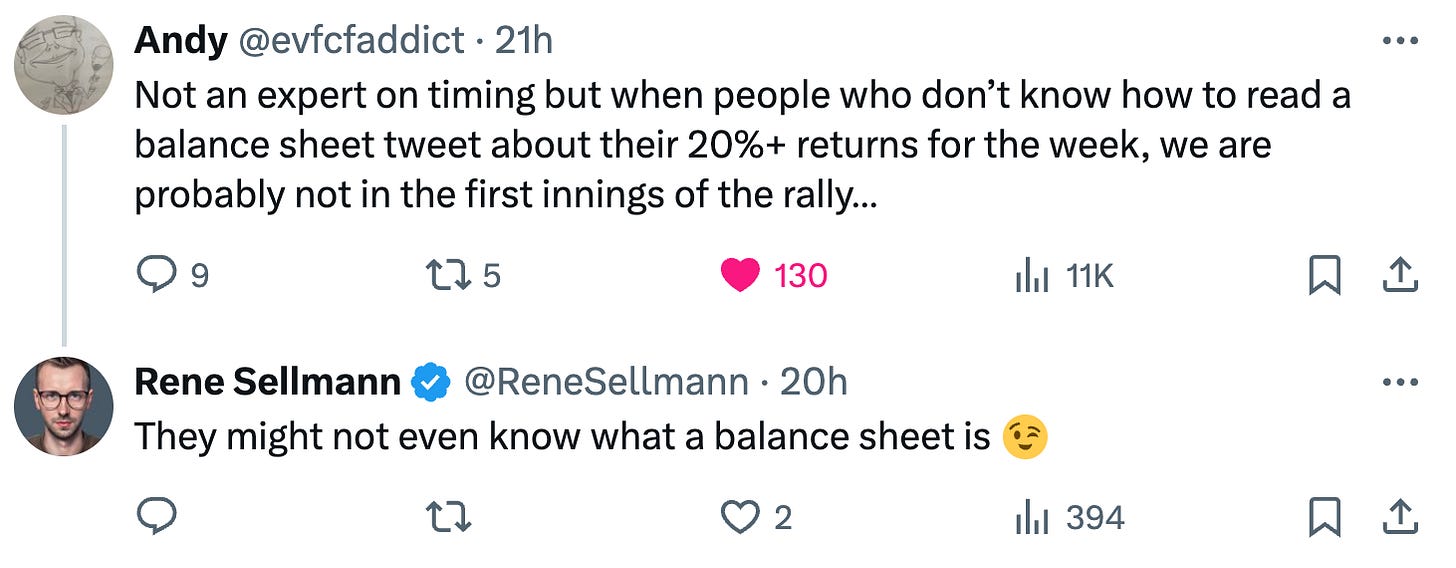

3) Finally, overconfidence is a significant risk, particularly in bull markets. Many investors mistake a rising market for personal skill, only to suffer losses when the cycle turns, exposing critical gaps in their knowledge and strategy.