I sold a software position last week at a low-teens percentage gain. It was not a core holding, and not the sort of trade that will make or break a portfolio. As I write this, my cash position sits at 7.7%, so this was not about de-risking in some dramatic, all-or-nothing way either – I don’t really do that anyhow.

On the surface, it could look like a fairly unremarkable decision. Yet for me it was surprisingly revealing, because the reasons for selling had very little to do with what the company achieved in the past quarters and much more to do with how I now view the sector (or more broadly “the business world”) that this business operates in. This post is therefore less a victory lap about getting a trade right and more a window into how my thinking has evolved (I hope you’ve read my perception change framework series) and it applied here.

We are living through one of the most intense debates about software, SaaS, and AI that markets have ever seen.

Hardly a week goes by without new demos, bold claims, and equally bold counterarguments about whether artificial intelligence will supercharge enterprise software, slowly erode it, or upend it entirely (major elevated tail risk).

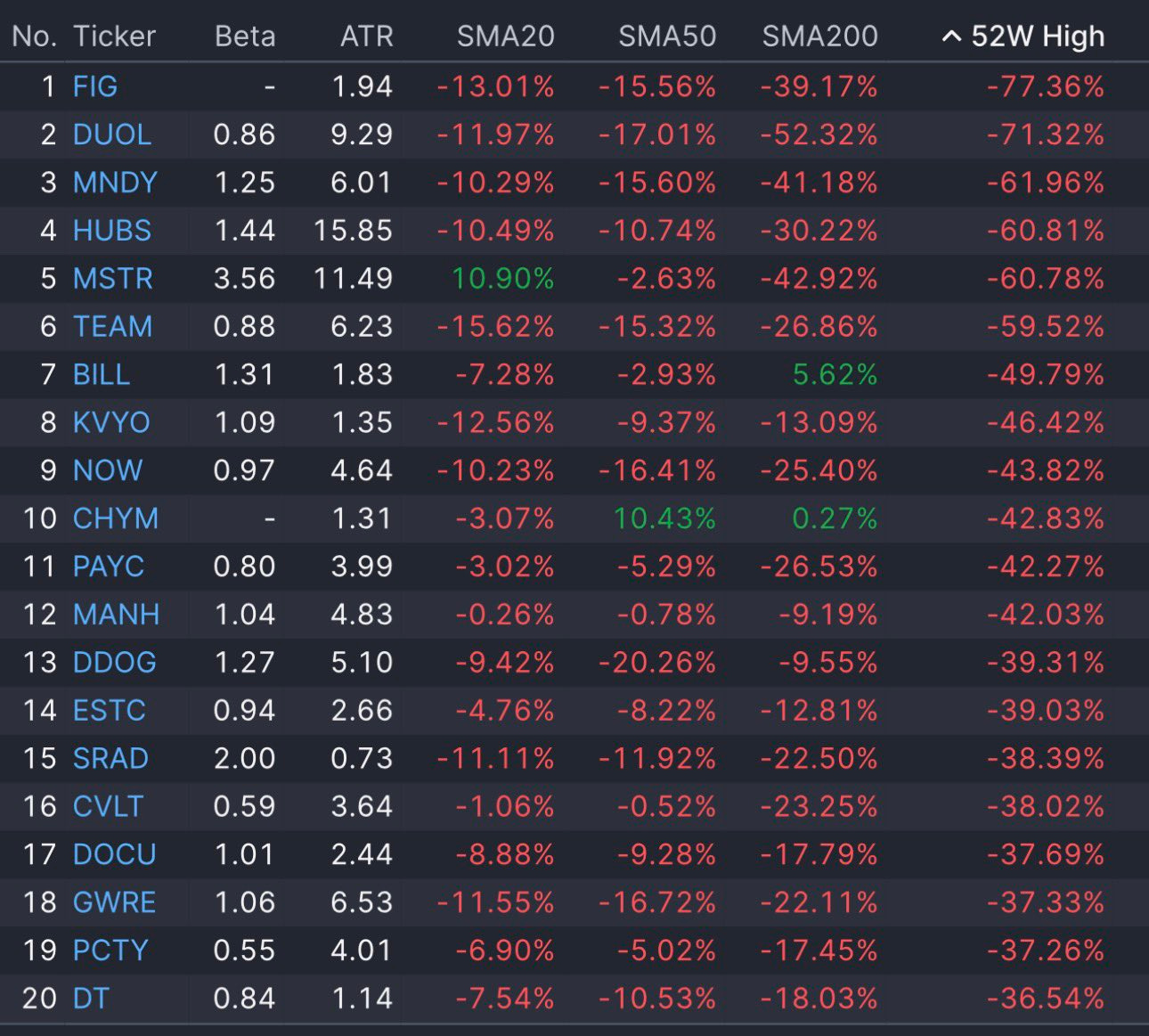

Prices across large parts of the software universe have already reflected a meaningful shift in sentiment (with Constellation possibly being the most trending case study; on X at least).

But, importantly, not every corner of the market has reacted at the same speed. Some smaller, quieter companies still trade as if the old playbook remains fully intact. Owning one of those businesses forced me to ask myself an uncomfortable question. If the market’s perception of the software landscape is changing (we’l discuss the how any why in this write-up) and has not yet caught up in every niche, should I make a decision now to get ahead of what’s potentially coming in 2026 in terms of a re-rating of this particular stock?

Selling this position was therefore not a statement that the company is broken or doomed. It was a reflection of how I weigh …

perception change,

technological acceleration, and

valuation

… when they pull in different directions.

Sometimes investing is about finding hidden winners. Other times it is about recognizing that your own framework has shifted and acting on it before prices do. In this post, I will walk through the three main reasons that pushed me to exit, but before getting there, I wanted to be transparent about my mindset. This was a modest sale in size, but it marked a meaningful change in how I think about software risk going forward.

This is where it gets interesting!

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.