Why Compounding Doesn’t Work the Way You Think It Does!

What the Investment Media Is Lying to You About

Most of the readers of this blog will be aware of the power of compound interest. It’s often referred to as “ the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it.” (allegedly a quote from Albert Einstein)

There is no lack of inspiring quotes from the world’s greatest investors on this subject. Here’s one of my most favorite ones from the GOAT Warren Buffett himself:

“It is obvious that a variation of merely a few percentage points has an enormous effect on the success of a compounding (investment) program. It is also obvious that this effect mushrooms as the period lengthens. If over a meaningful period of time, Buffett Partnership can achieve an edge of even a modest number of percentage points over the major investment media, its function will be fulfilled.” - Warren Buffett

I'm sure you've come across statistics and investing-related news article headlines that begin like this:

"If you had invested $10,000 in [asset / stock / ETF] [x] years ago, here's how much money you would have ..."

If you invested $10,000 in the S&P 500 in Jan 2003, it would have grown to $64,844 by Dec 2022 (+548% return)

If you'd invested $10,000 in Alphabet ten years ago, you'd now own $49,000 worth of Google stock.

If you'd invested $10,000 in Apple when Warren Buffett first bought it, and didn't sell any shares along the way, your investment would be worth nearly $66,000 today.

In the real world, however, compounding is not as powerful as you might think - because of four factors!

It seems to me that these four factors are often overlooked, so today I want to shed some light on why compounding doesn't work the way you think it does…

Assumptions

Let's start with some basic assumptions. We're looking at a young investor, Charlotte, who starts with no initial capital. However, she will invest $1,000/month ($12,000 per year) for 30 years. She earns a compounded annual return of 10% over this period.

After 30 years, Charlotte's net worth will have grown to $2,080,849,39!

Not bad for someone on a basic salary who just early on made the decision to consistently put some of her savings into the stock market.

But let's discuss why Charlotte's ACTUAL final net worth will be lower than the number above!

Factor #1: Fees

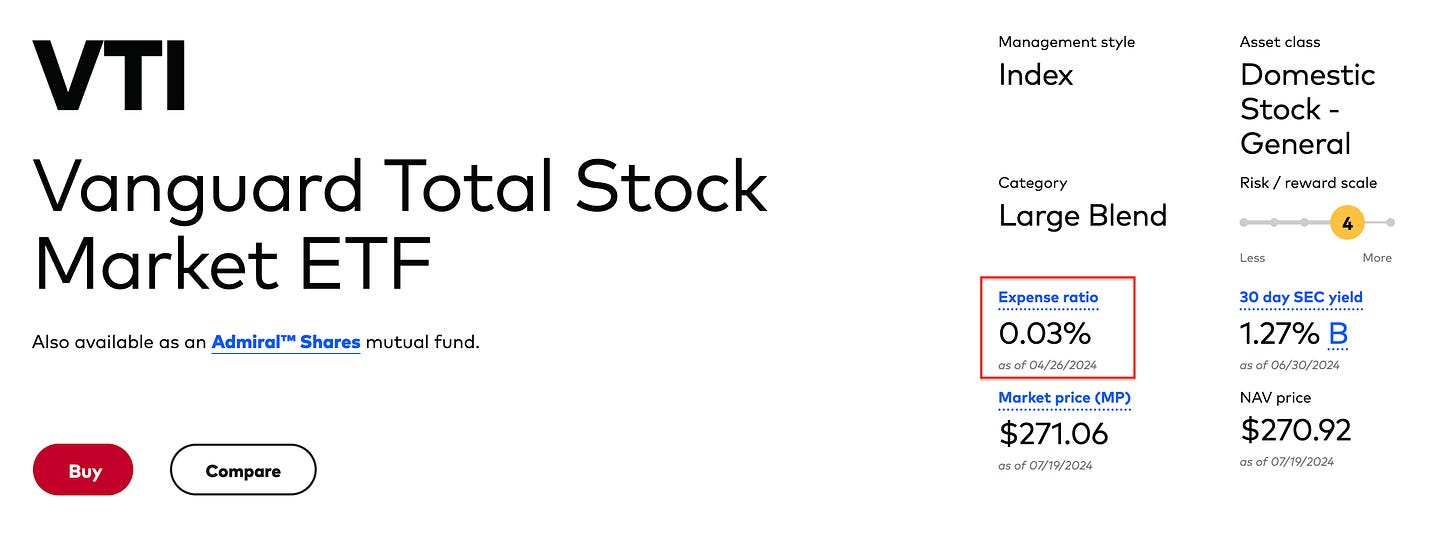

Let's say Charlotte invests in 1-2 ETFs. Of course, as an investment product, ETFs are unrivaled in terms of the fees that investors have to pay.

The amount of fees that investors have to pay varies considerably from one investment product to another though.

I just looked at JustETF – an ETF comparison website – and apparently the fees charged for MSCI World ETFs vary from 0.1-0.5%.

Let's take 0.2% per annum and do the compounding again (that 0.2% per annum is just gone!). Instead of around $2.08 million, she ends up with $80,000 less! (the final net worth is displayed in the bottom right corner of the chart below)

Of course, fees vary from product to product! I'm aware that there are ETFs that charge less than 0.1% p.a., but regardless of what the actual fees are, it's important to understand that they have an impact on investors’ real returns.