Who’s Next? The Inevitable AI Shake-Up Headed for the S&P 500

How AI is the quintessential agent of Schumpeter’s creative destruction

Few metrics capture the pulse of corporate America better than the S&P 500. For decades, being listed in this index has signified a company’s standing among the market’s most prominent and robust players.

As of today, the smallest S&P member, FMC Corporation, has a market cap of $4.8 billion and generates $4.25 billion in revenue!

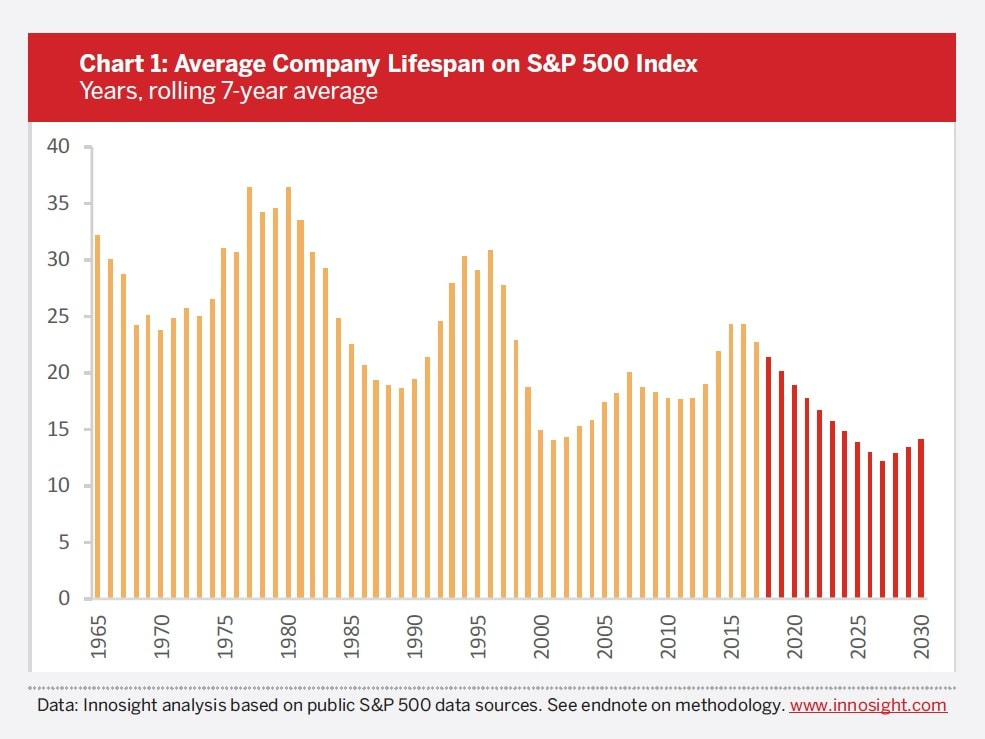

Yet, the lifespan of these corporate giants—once assumed to be measured in generations—has been shrinking at a startling rate. In the 1960s, the average tenure on the S&P 500 was over 30 years; by 2016, it had dropped to 24, and projections from 2016 suggest it could fall to just 12 by 2027.

(Source: Innosight)

Similarly, according to 2016 McKinsey research, up to 75% of the companies in the index back then could be replaced by new entrants within the next few years.

It’s tempting to dismiss these figures as mere consequences of competition and shifting consumer behavior. But technological progress—particularly artificial intelligence—is rewriting the rules of creative destruction.

AI’s leaps in capability, scale, and accessibility are lowering barriers to entry, leveling competitive fields, and toppling once-impregnable business moats.

As Satya Nadella recently hinted, AI agents may soon upend entire software categories, and this disruption likely won’t stop at tech; industries from agriculture to pharmaceuticals could face unprecedented change in the near term.

Of course, no one can see the full picture of how AI will reshape markets. As financial writer Morgan Housel wryly observes, “The most interesting part of new technology is realizing that no one has any idea what happens next.”

Hence, let this blog post serve as a thought experiment—a forward-looking exploration of how AI and other forces might accelerate the churn we already see in the S&P 500.