Many investors are talking about Paycom PAYC 0.00%↑ at the moment. Many of those highlight the historically cheap valuation Paycom’s stock is trading at (see graph below), but few spend any time analyzing the risks that come with a Paycom investment.

So let's change that and explore 5 key risks.

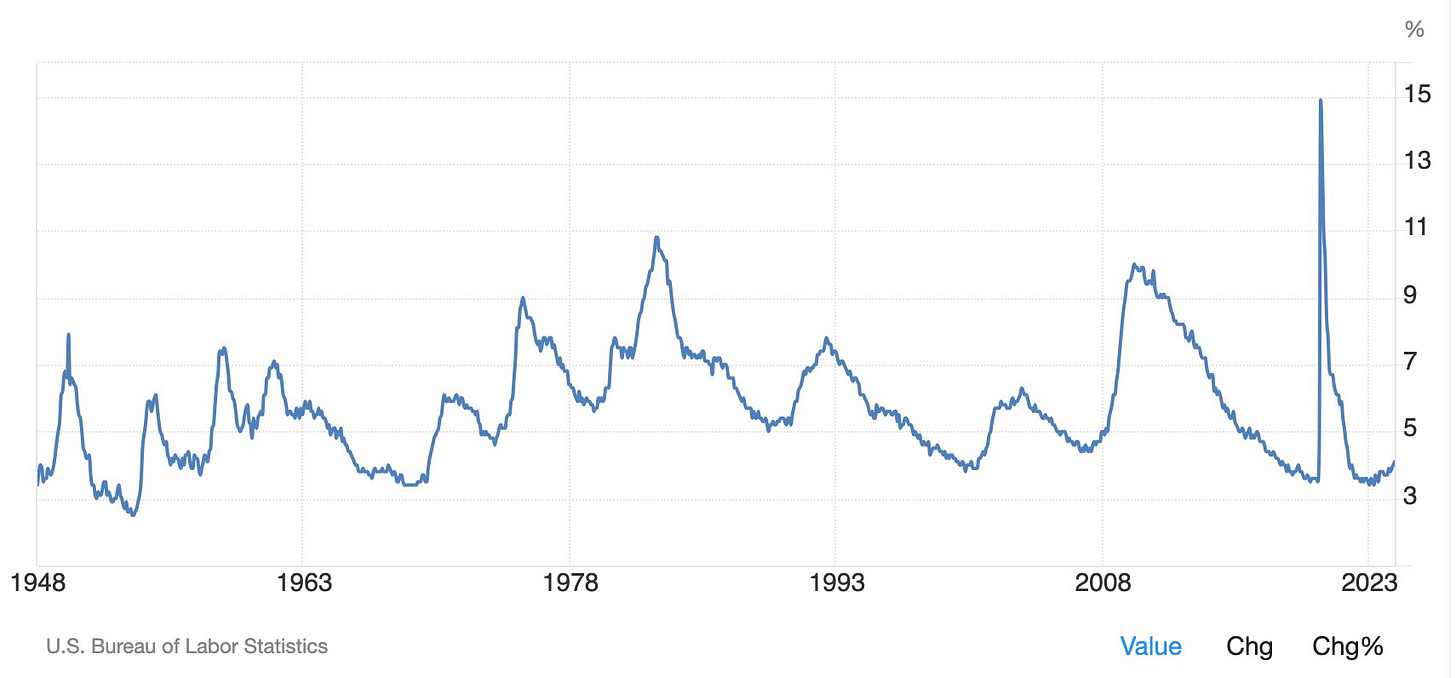

Risk 1: Any recession that leads to an increase in unemployment is going to hit all payroll firms

Considering the most aggressive tightening cycle in decades, …

…. a recession has been predicted for quite some time, but is yet to materialize:

During a recession, the market will likely sell down the stock of PAYC 0.00%↑ and other payroll solution providers. After all, an economic recession does in fact impact the business fundamentals of these businesses.

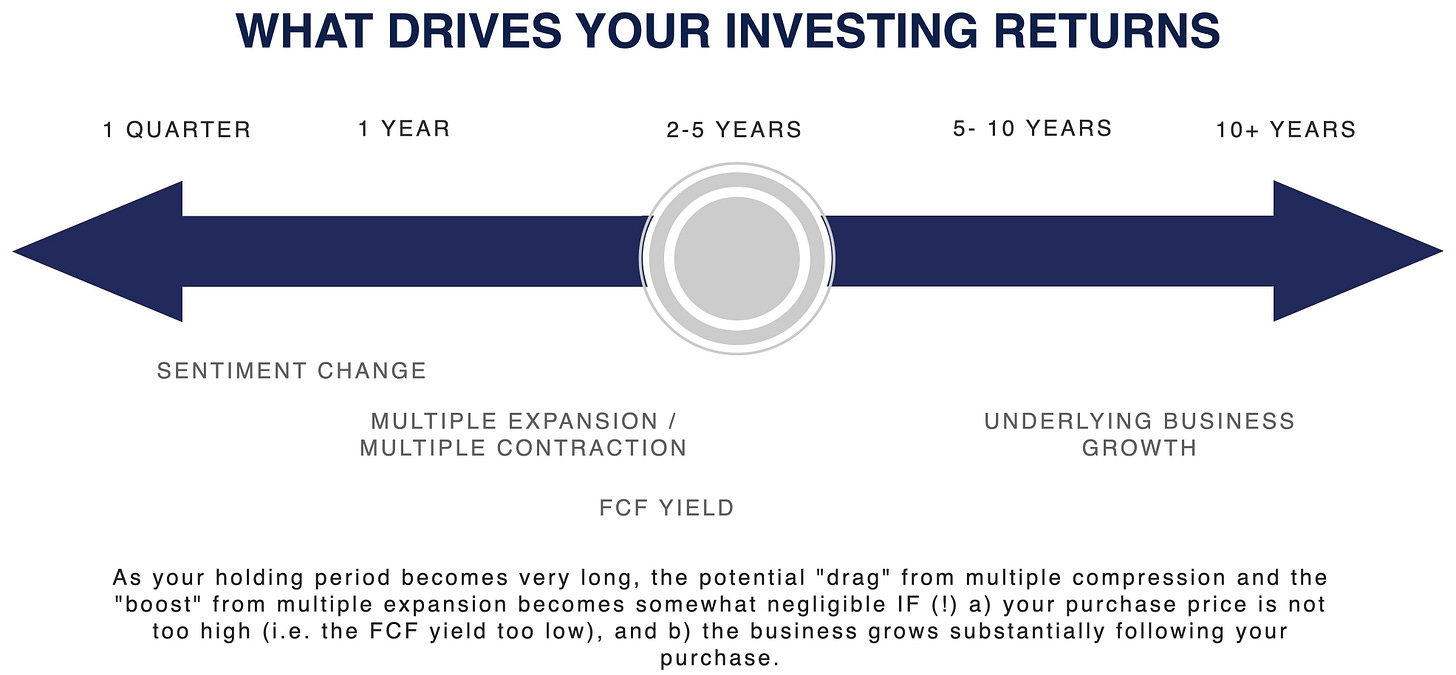

However, personally, I'm not too concerned about this risk as it is rather short-term in nature and I actually welcome business challenges if they lead to lower stock prices AS LONG AS they can be resolved over the medium term.

Over time unemployment rates will always fluctuate as they have in the past, and …

… as long as you’re optimistic about the long-term outlook of the US economy, and ….

… as long as you don’t believe artificial intelligence will fundamentally change the seat-based business model of Paycom, and …

… as long as you have the conviction that artificial intelligence will not fundamentally reduce the workforce required to keep the economy running …

… I’d argue you can largely ignore this risk.

A recession will possibly provide a better entry into the stock of Paycom, and there's not much Paycom can do about it anyway.

And who knows, maybe the stock of Paycom will not sell down further at all (!) during the next recession as the price may be considered quite depressed already. If the pandemic should’ve taught us anything, it is that regardless of how macroevents influence businesses, forecasting how a stock will react to those events is a “fool's game.”

Hence, predicting short-term stock price movements (in reaction to short-term news) is not an activity I engage in.