In stock investing, success isn’t about being right all the time—it’s about how much you gain when you are right and how little you lose when you are wrong.

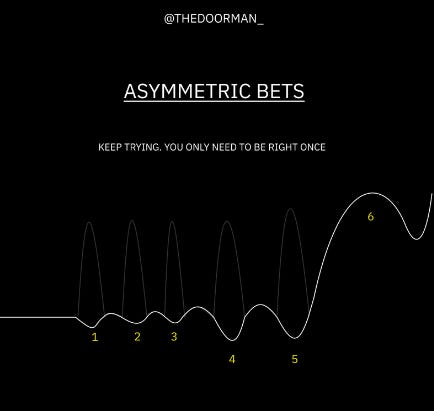

Asymmetric bets are opportunities where the potential upside far outweighs the downside risk.

(Source: @thedoorman_)

Even the best investors, with years of experience and rigorous analysis, often have a “batting average” of only around 50%. Some even succeed less frequently, hitting the mark only 45% or 40% of the time, yet they achieve phenomenal results.

This seems counterintuitive, doesn’t it?

This performance is possible because their few correct decisions yield outsized gains that overshadow the impact of their mistakes.

The first principle in identifying these asymmetric opportunities is focusing on the downside risk. Great investors are risk-averse and seek to limit losses—a stock’s downside must be minimal, ensuring any potential misstep doesn’t derail their portfolio.

Once this safety is established, they shift their focus to the upside. The ideal investment is one where the downside is limited, but the upside is significant.

“Heads I win, tails I don’t lose much“ Mohnish Pabrai in The Dhando Investor

For example, consider an equally weighted portfolio of 10 stocks. Over a decade, if nine stocks deliver flat returns while one stock grows 20x, the portfolio’s compounded annual return will be 11.2%, beating the market’s long-term track record.

If the winner increases by a factor of 30x, the compounded return will even be an incredible 14.6%.

Let’s say you make the winning stock not a 10% position, but a 15% position, sizing it a little bigger than the remaining positions, the CAGR jumps to over 18%!

As the examples highlight, a single winner can compensate for the lackluster performance of the rest (if sized accordingly), showcasing the power of magnitude over frequency.