Does this scenario sound familiar? You've carefully lined up your portfolio of ETFs, you're feeling confident, and everything seems to be going smoothly. It feels like you’ve successfully taken the easy road of passive investing, right? But what if I told you that you might actually be more of an active investor than you realize?

Yes, that’s correct. Most passive investors who believe they’re following a purely passive strategy aren’t quite as passive as they think.

In this post, I’ll break down why “passive portfolios”, filled with "passive" ETFs, may actually involve far more activity and decision-making than most realize.

Understanding Active vs. Passive Investing

Let’s start by understanding the broad distinction between passive and active investing.

Traditionally, passive investing refers to putting your money into an index or ETF (Exchange Traded Fund) - ideally at a low cost – that tracks a broad market index, like the S&P 500. You’re essentially buying the market, letting the ETF replicate the performance of the index without any stock-picking involved and you’re okay with an average market performance.

On the other hand, active investing is the approach where either you yourself select individual stocks or you invest in a fund that is actively managed by a professional. You or the managers attempt to "beat the market" by selecting stocks that you or the managers believe will outperform the broader index. The key goal of active management is arguably to deliver "alpha" – returns that exceed those of a relevant benchmark.

It sounds simple: passive investing involves buying the whole market, while active investing is about selecting stocks with the hope of outperforming. But the point I want to emphasize is that the line between passive and active investing is not as clear-cut as you might think.

Choosing ETFs: The First Active Step

One of the biggest misconceptions in passive investing is that the entire process is passive from start to finish. But the very first step in building a passive portfolio—choosing which ETFs to invest in—is itself an active decision.

Consider this: When you decide to invest in an ETF that tracks U.S. stocks, you’re making an active bet on the future performance of the U.S. economy. Similarly, investing in an ETF that tracks European or emerging markets, or an ETF focused on a particular industry or theme, is another type of active bet.

And of course, your choice of which geographic regions, industries, “factors”, or asset classes to invest in will have a profound impact on your long-term investment results.

Few passive investors recognize and acknowledge the active nature of these decisions. In reality, selecting ETFs is far from a "set-it-and-forget-it" action. It’s a conscious choice, and the outcomes of your portfolio will vary significantly depending on which ETFs you choose. For instance, a portfolio heavily weighted toward U.S. tech stocks will perform very differently from one that focuses on emerging markets or European industries.

This selection process, where you actively choose specific ETFs, is the first major sign that passive investing may not be as passive as it appears.

Allocation Between ETFs: Another Active Decision

Beyond selecting which ETFs to invest in, there’s another critical decision every investor faces: how to allocate your capital across different ETFs.

This step introduces another layer of active decision-making that can heavily influence your returns over time.

For example, do you follow the traditional approach of allocating 70% of your portfolio to developed markets and 30% to emerging markets? Or perhaps split your bets between U.S. stocks and international stocks and on top factor in companies’ market caps? Either way, this is not a passive decision.

Take this scenario: If you decide to invest 80% in a U.S. stock ETF and 20% in an international ETF, you’ve made a very active decision to favor U.S. companies. On the other hand, if you flip those percentages, heavily favoring international markets, that choice also represents an active stance. Each of these choices will have vastly different outcomes; your asset allocation between various ETFs is a key driver of your portfolio’s performance.

The Role of Market Timing

Many investors proudly declare themselves to be "passive" because they don’t pick individual stocks. However, market timing is another hidden element of activity that creeps into the behavior of many so-called passive investors.

Let’s face it: When the market goes through a downturn, it’s tempting to react. During periods of volatility—think back to March 2020 or the financial crisis of 2008—many investors who claim to be passive end up selling their positions out of fear. This instinct to buy and sell based on short-term market movements is the definition of active behavior. And unfortunately, selling in a panic and re-entering the market later at higher prices can severely impact long-term returns.

Of course, a truly passive investor sticks to his/her strategy through thick and thin, riding out the ups and downs without making reactive decisions. However, human nature often gets in the way, leading even the most disciplined investors to dabble in market timing—whether they realize it or not.

Rebalancing and Reallocation Within ETFs

Another hidden layer of activity lies within the ETFs themselves. Even broad-market ETFs undergo rebalancing as market conditions shift. Index providers frequently adjust the weightings of the individual stocks within an index, based on factors like market capitalization, sector changes, or even new IPOs. While this rebalancing happens automatically, it introduces a level of active decision-making on the part of the fund managers.

For example, if you invest in a broad-market ETF like the S&P 500, the composition of that ETF changes as stocks move in and out of the index. This reshuffling is an active process, though it’s done behind the scenes. Even though you might not be directly picking stocks, the ETF managers are doing so on your behalf through rebalancing.

While this rebalancing is often viewed as a minor detail, it’s still an active component of what many consider to be a passive strategy.

Are ETFs Really Passive? The Hidden Concentration Risk

Now, let’s address the core of the issue—are ETFs really as passive as they seem? The truth is, many (popular) ETFs are far more active than investors give them credit for. Let’s take a closer look at some examples to highlight this point. We’ll start with an index that by many is considered a “broad-market, low-cost index” – the Invesco Nasdaq 100 ETF QQQM 0.00%↑.

This ETF is often considered a "passive" way to gain exposure to the largest 100 non-financial companies listed on the Nasdaq. However, when you dig deeper, you’ll find that the top four companies—Microsoft, Apple, Nvidia, and Amazon—make up roughly 30% of the entire index. That’s an extraordinary level of concentration in just a handful of stocks.

What does this mean for you as an investor? If you’re holding this ETF, you’re effectively placing a large bet on the future performance of a few tech giants. While this may be fine for some investors, it’s certainly not as diversified as the term "passive" might imply.

Thematic ETFs: More Active Than You Think

Next, let’s take a look at thematic ETFs, which have grown in popularity in recent years. Thematic ETFs allow investors to focus on specific industries or trends, such as clean energy, artificial intelligence, or semiconductors.

For example, the MSCI World Semiconductors and Semiconductor Equipment Index ETF might seem like a passive way to invest in the global semiconductor industry. However, upon closer inspection, you’ll find that Nvidia alone represents almost 48% of the index.

That’s an incredibly high concentration in one stock—much higher than even Warren Buffett’s portfolio, where Apple accounts for around 30%.

If nearly half of your investment is going into a single stock, can you really consider this a passive strategy?

I’d argue that the level of concentration in some (!) thematic ETFs makes them much more akin to active stock-picking than a diversified, broad-based investment.

Actively Managed ETFs: The Active Choice Disguised as Passive

Lastly, we have actively managed ETFs, which explicitly go beyond the traditional definition of passive investing. These ETFs give managers the flexibility to choose the underlying stocks, usually with the goal of outperforming the market.

For instance, the Natixis Loomis Sayles Focused Growth ETF has 70% of its assets concentrated in its top 10 positions.

This clearly reflects an active management approach, yet many investors still view “ETF investing” in general as synonymous with passive investing.

Dividends: Another Layer of Active Decision-Making

Another often-overlooked element of activity in passive investing is how you treat dividends. If you’re investing in a distributing ETF, you’ll need to decide whether to reinvest those dividends back into the ETF or allocate them elsewhere. This seemingly small decision is yet another active choice that can impact your portfolio’s long-term performance.

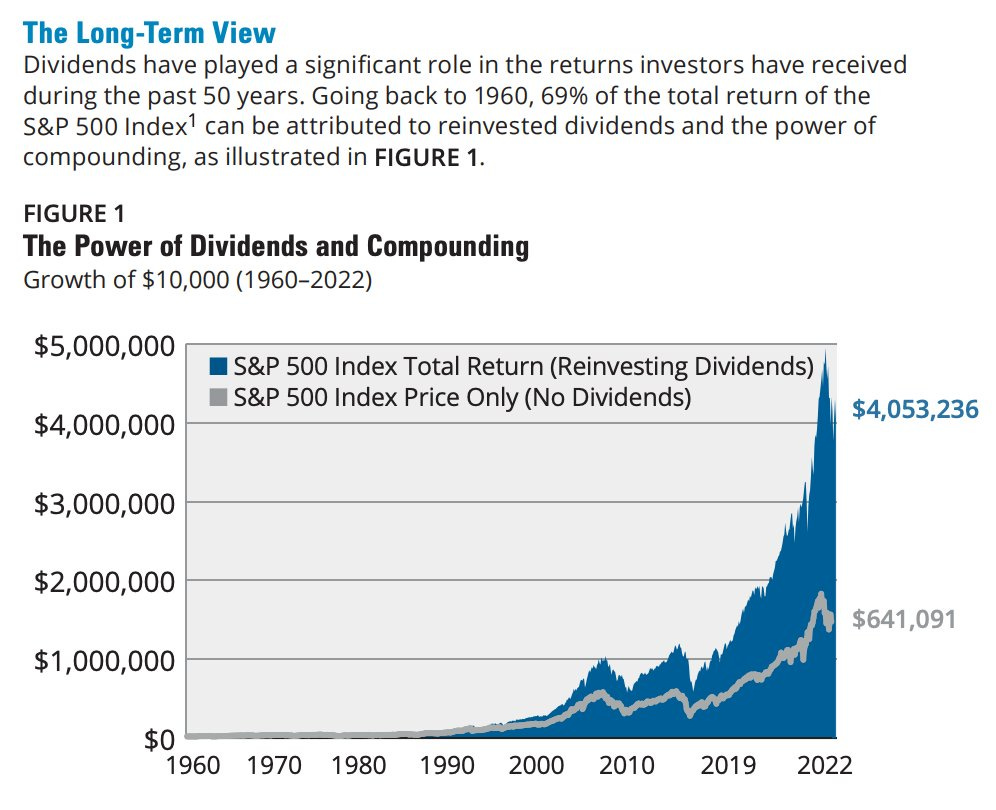

For instance, for the 42 years between 1680 and 2022, 69% of the total return of the S&P 500 Index can be attributed to reinvested dividends!

Reinvesting dividends helps compound your returns, while choosing to divert them to another asset introduces a new layer of portfolio management.

Conclusion: The Reality of Passive Investing

The world of ETFs is far more complex than it used to be. Today, there are over 3,300 ETFs available in the U.S. alone, offering exposure to various industries, themes, and geographies. Many of these ETFs, despite being labeled as passive, carry significant active elements—whether through their concentration in a few stocks, their thematic focus, or the investor's own asset allocation decisions.

So, the next time you review your portfolio, take a moment to dig a little deeper. Are you truly investing passively, or are there hidden active decisions at play?

Understanding the nuances of your ETFs and the layers of activity within them can help you make more informed choices and better manage the risks associated with your investments.

As always, I’d love to hear your thoughts. How do you approach ETF investing? Have you discovered any hidden layers of activity in your own portfolio? Let’s continue the conversation in the comments below!