The Evolution of ETFs: Are Active ETFs a Blessing or a Curse?

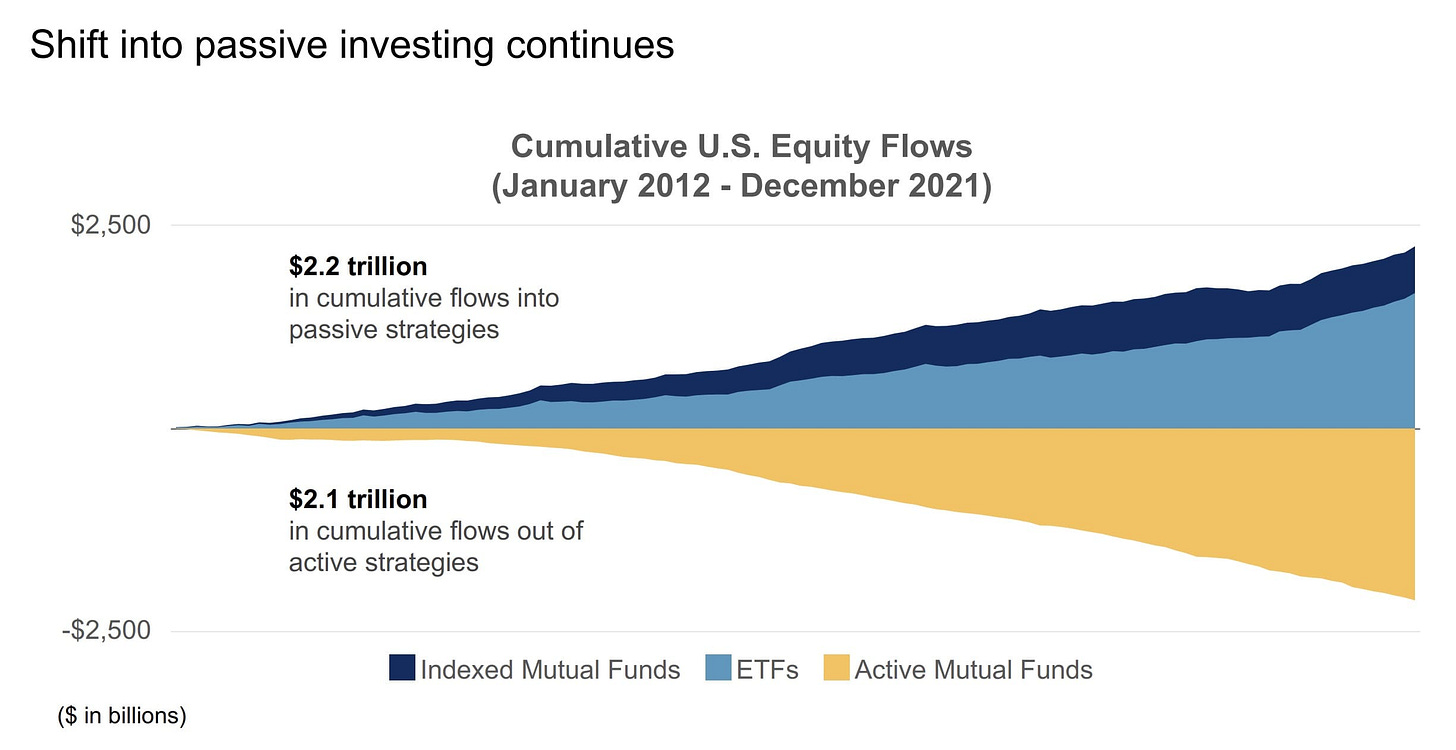

The Rise Of ETFs And Its Implications for Markets

Exchange-Traded Funds (ETFs) have revolutionized the investment landscape since their U.S. debut 31 years ago. From their humble beginnings, ETFs have grown into a massive financial vehicle, managing over $9 trillion across more than 3,300 distinct funds. They have become a preferred choice for many investors, offering a straightforward way to diversify portfolios with the added benefits of low fees, tax efficiency, and transparency.

In 2023, the trend continued with investors channeling around $600 billion into U.S. ETFs.

This marked yet another year of significant inflows, highlighting a growing preference for ETFs over traditional actively managed mutual funds.

However, the landscape of ETFs has evolved dramatically over the years. What was once synonymous with passive investing has now expanded to include a variety of products, including thematic and actively managed ETFs:

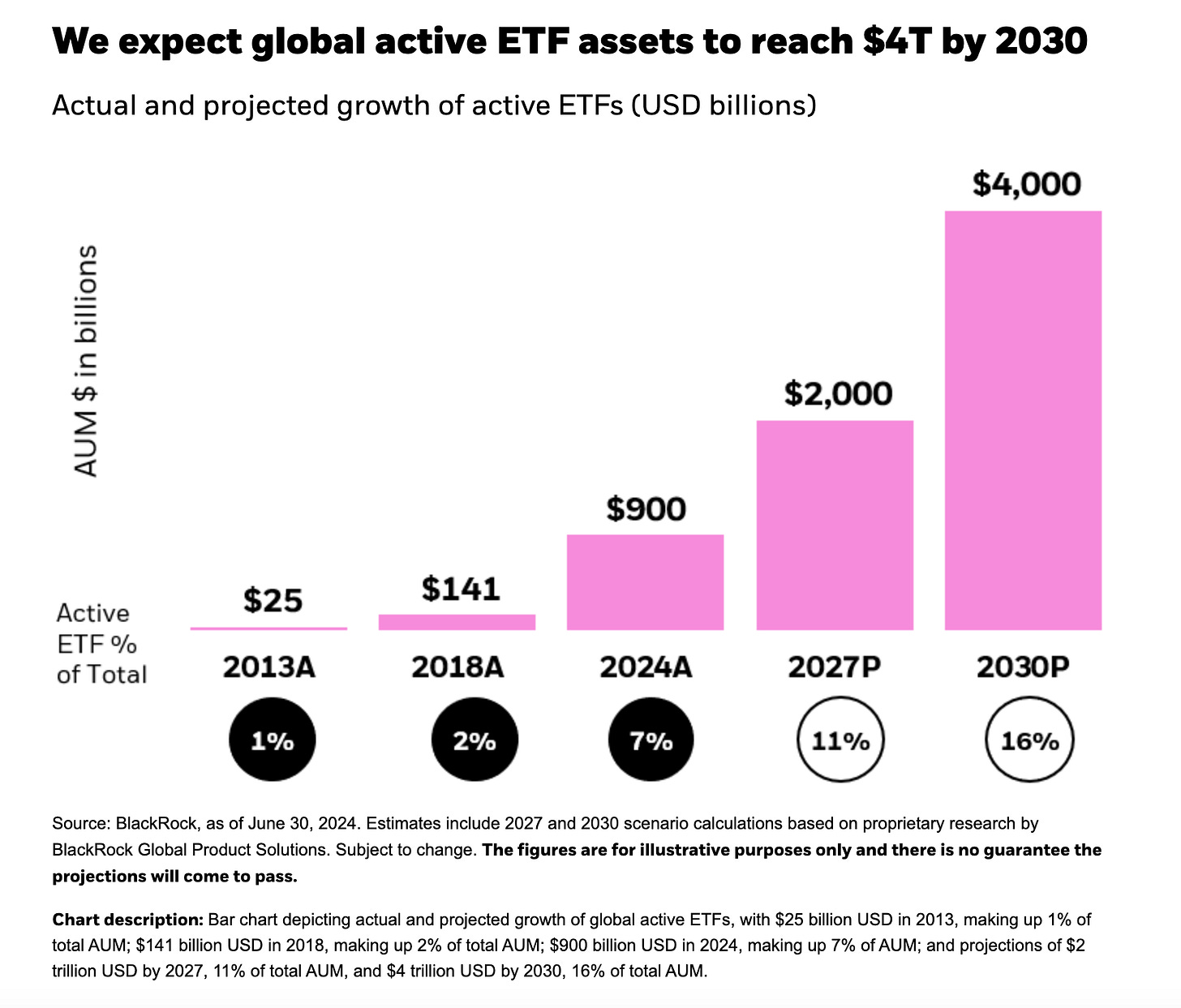

Overall, active ETFs have grown from around 112 billion US dollars in AUM in 2019 to almost 700 billion US dollars by the end of May 2024, a compounded annual growth rate of 40 percent, according to BlackRock data. According to Morningstar, the compounded annual growth rates of assets invested in active ETFs over the last five years even exceeded 50%, significantly exceeding the asset growth rate of passive ETFs.

To wrap up the numbers section, BlackRock anticipates that total assets under management in active ETFs will reach $4 trillion by 2030:

This shift towards active ETFs raises an important question: Are active ETFs a blessing or a curse for investors?

What Defines an Active ETF?

Before we discuss this question, let’s first clarify what an “active ETF” actually is. Unlike their passive counterparts, active ETFs are actively managed by a portfolio manager who makes strategic decisions about the fund's holdings.

This manager determines when to add, trim, or sell positions, similar to what occurs in an actively managed mutual fund. The goal is to outperform the market by focusing on a relatively concentrated portfolio of securities that the manager believes have the potential for superior performance.

One of the key benefits of active ETFs is their transparency. They provide daily disclosures of their underlying holdings, allowing investors to see exactly what they own at the end of each trading day. This level of transparency is rare in other actively managed vehicles, such as mutual funds or hedge funds, which may only disclose their holdings on a quarterly or biannual basis.

Another advantage of active ETFs is cost. While they tend to be more expensive than passive ETFs, they are generally cheaper than traditional actively managed mutual funds. This lower cost structure makes active ETFs an appealing option for investors who want active management without the high fees typically associated with mutual funds.

The Case of Cathie Wood and ARK Innovation ETF

Cathie Wood's ARK Innovation ETF (ARKK 0.00%↑) is arguably THE most well-known active ETF.

ARKK gained immense popularity during the COVID-19 pandemic, with its assets under management soaring to nearly $30 billion at its peak in 2020. The fund doubled in value during this period, driven by bold bets on disruptive technologies and companies like Tesla and Zoom.

However, the subsequent performance of ARKK has been less stellar. Many investors who entered the fund during its peak have since experienced significant losses. According to Morningstar, the average return for investors in ARKK has been a disappointing -17%, despite the fund delivering positive returns since its inception.

Considering these shocking numbers, it’s no surprise investors’ conclusions look like this one shared in a recent Barron’s article:

Wood’s performance highlights a critical issue with active ETFs: timing matters. Investors who enter at the wrong time or who don't hold their investments through market cycles may miss out on the returns they were hoping for.

Moreover, ARKK's expense ratio of 0.75% is also significantly higher than many other ETFs, though still lower than traditional mutual funds. The fund's concentrated portfolio in “disruptive” tech names and bold investment strategy has made it a high-risk option, but the volatility and recent underperformance have raised questions about the long-term viability of Wood’s approach.

A Comparative Look at Active ETF Fees

Active ETFs, while more expensive than passive ETFs, still offer a more cost-effective option compared to traditional mutual funds. The range of fees can vary significantly. For instance, the iShares Future Financials and Technology ETF charges an expense ratio of 0.71%, while the JP Morgan Active Value ETF charges 0.44%. At the lower end, the T. Rowe Price US Equity Research ETF has an expense ratio of 0.34%, and the JP Morgan Fundamental Data Science Large Core ETF charges 0.3%.