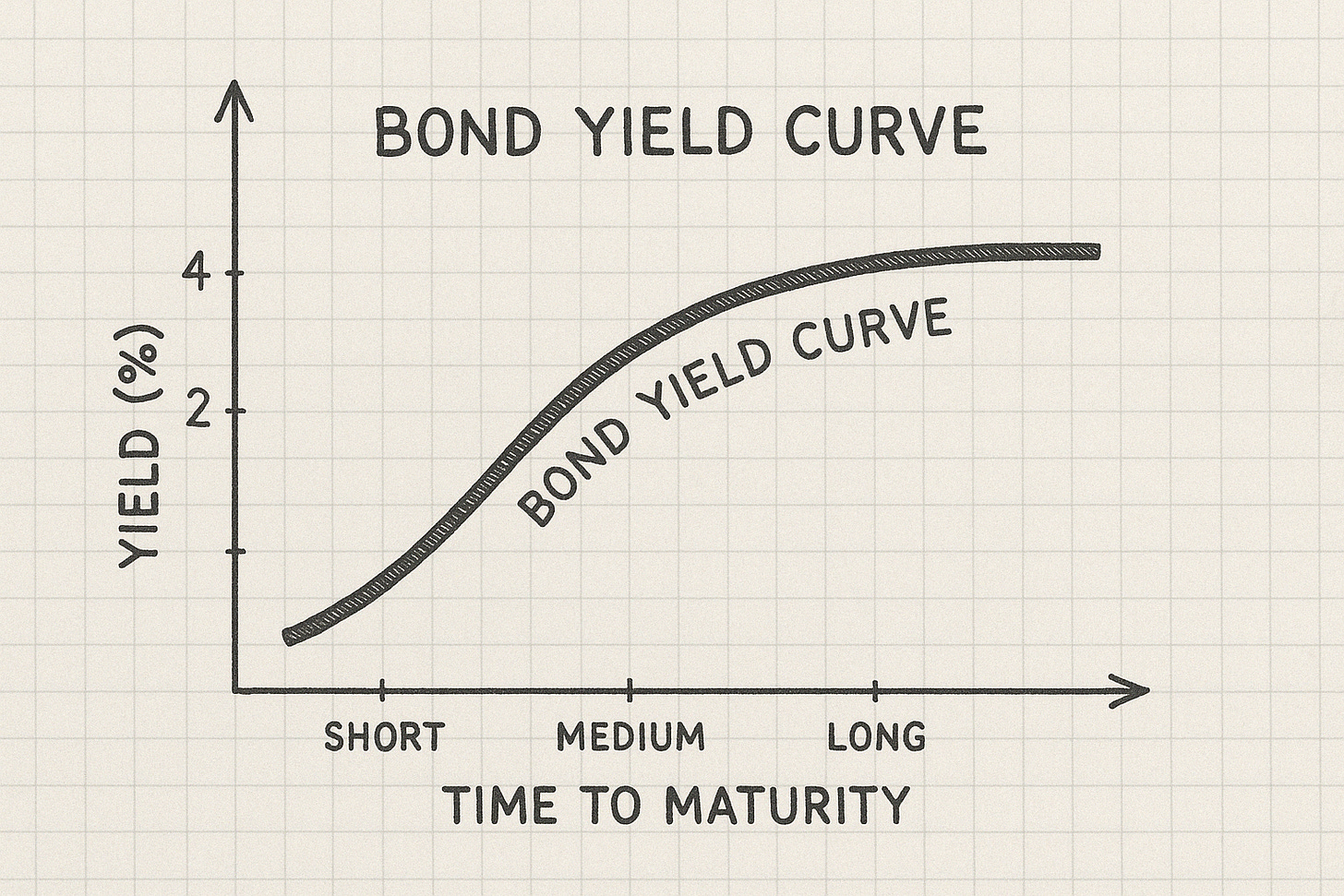

Most investors have a working knowledge of the bond yield curve. It's a basic concept of finance: under normal circumstances, the longer you lend your money, the more you expect to be compensated.

In bond markets, this shows up as a positively sloped yield curve. But what if a similar concept applied to equities? What if the very act of extending your investment time horizon could unlock outsized returns, not merely because of compounding, but because of actual market inefficiencies?

This is the idea behind the Equity Yield Curve. Though rarely discussed in mainstream finance, the concept has been explored—explicitly by Horizon Kinetics and implicitly through the track record and philosophy of Nick Sleep. Both recognize a pattern: the longer the holding period, the greater the potential annualized returns.

But the explanation goes far deeper than mere patience. To understand why, we first need to revisit the logic behind bond yield curves.

The Bond Yield Curve

A traditional bond yield curve plots the yield of bonds against their time to maturity. Under most economic conditions, it slopes upward. The reasons are straightforward:

Time risk: The longer the bond's maturity, the more uncertainty investors face—about inflation, credit risk, interest rate movements, and opportunity cost.

Liquidity preference: Investors generally demand more for tying up their capital for longer periods.

This basic financial structure assumes rational pricing and compensation for risk. It's one of the cornerstones of yield-based finance. But what happens when we apply the same structure to equity markets—markets where short-termism, volatility, and human behavior arguably play far greater roles?

Buffett’s Analogy: Stocks as Bonds with Variable Coupons

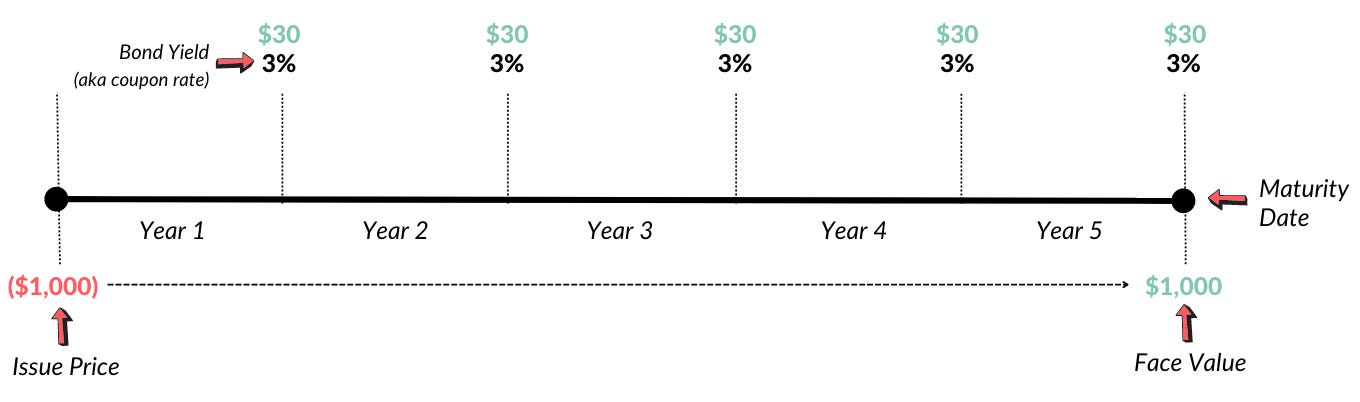

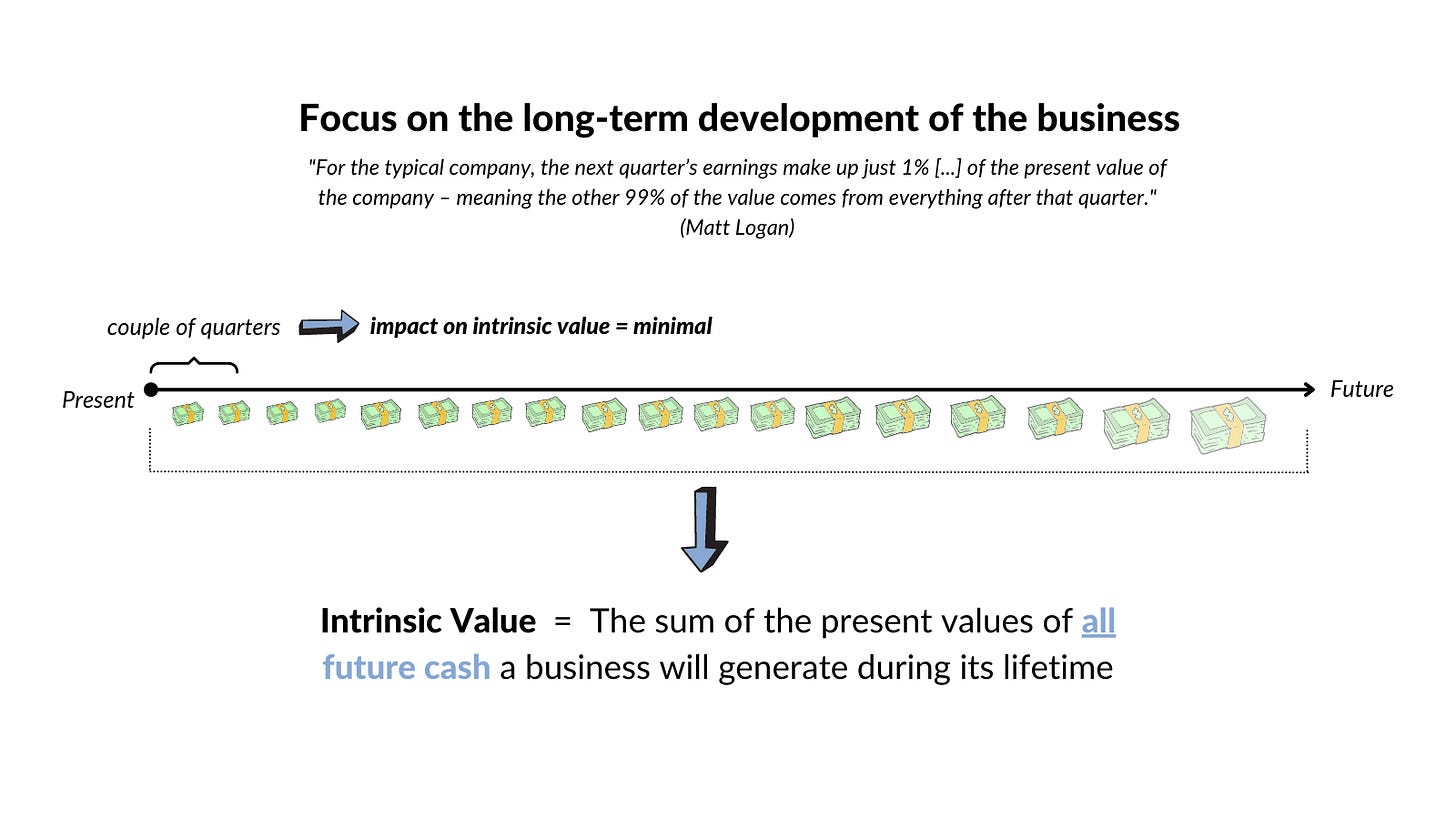

Warren Buffett has long encouraged investors to think about stocks the way they think about bonds — not as tickers that fluctuate in price, but as streams of future cash flows.

He’s even referred to equities as "equity bonds" — securities that, like bonds, offer a yield and coupon payments, but the cash provided by the investment is inherently variable.

In one of his shareholder letters, Buffett wrote:

"Investors should think of common stocks as small pieces of businesses, and evaluate them as they would a bond investment — looking at the future cash flows."

This framing helps ground the equity yield curve in fundamental analysis. If we think of stocks as bonds with variable, potentially growing coupons, then the longer the duration of those coupons — and the more they grow — the more valuable the asset becomes.

Yet, paradoxically, the market often discounts these long-duration "equity bonds" heavily, especially if near-term results are lackluster.