The S&P 500 has long been heralded as the quintessential tool for passive investing.

Its appeal lies in its perceived diversification, offering exposure to around 500 of the largest U.S. companies across a variety of sectors.

But a closer look at recent data reveals a troubling trend: the diversification investors think they’re getting is increasingly an illusion. Instead of spreading risk evenly across 500 companies, the index has become dominated by a small handful of stocks.

This post explores why this concentration is happening, why it matters, and what investors should consider in response.

The Rise of Concentration in the S&P 500

To understand the problem, we need to examine the data. According to a report from Apollo Global Management, the combined weight of S&P 500 stocks with a 3% or greater share of the index has recently skyrocketed, surpassing 30% in late 2024 (see chart below).

Historically, this figure remained below 10% and often hovered closer to 5%.

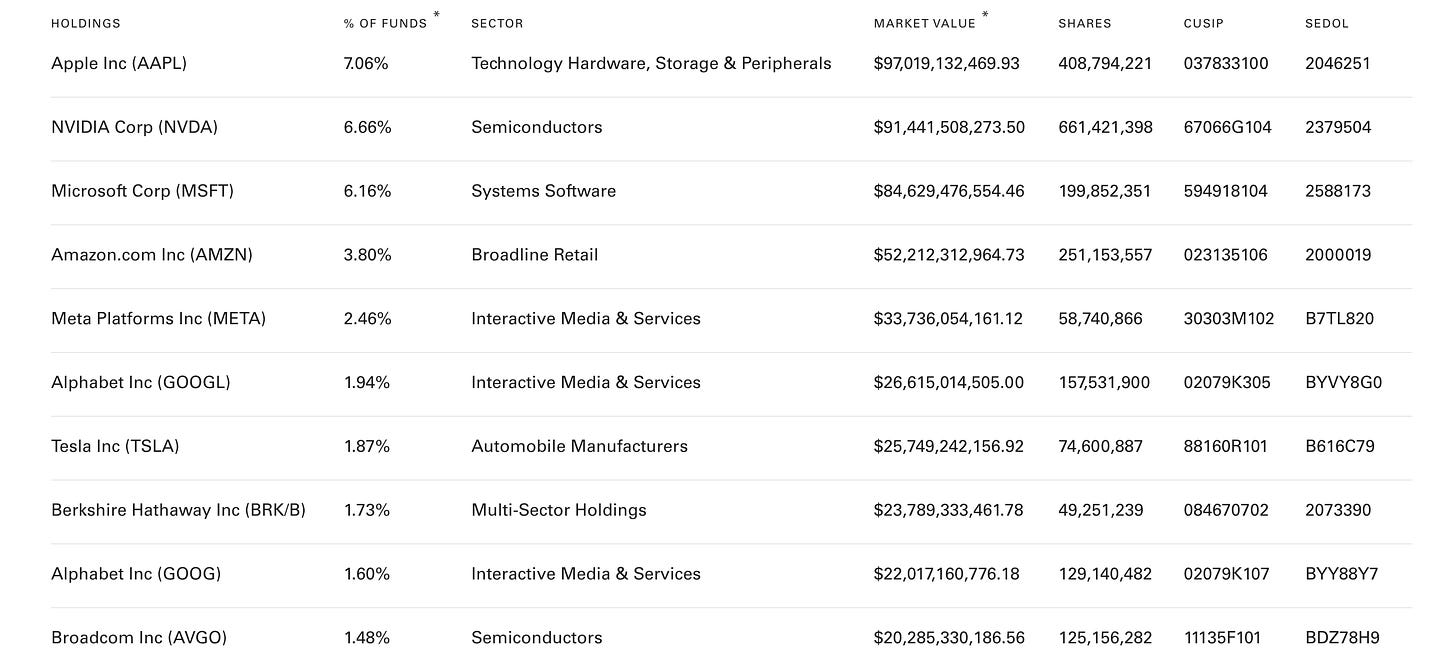

The top 10 holdings in the S&P 500—dominated by tech giants like Apple, Microsoft, NVIDIA, Amazon, and Alphabet—now account for a large percentage of the index’s total weight. For further perspective consider the Vanguard S&P 500 ETF. As of late November …

… Apple, Microsoft, and NVIDIA alone make up around 20% and …

… the five largest companies together represent around 28% of the index.

This means that nearly a third of the index's performance hinges on the fortunes of just a few companies. While these companies are undoubtedly industry leaders benefiting from strong secular trends (e.g., artificial intelligence, cloud computing), this level of concentration poses challenges, especially for passive investors who may not have the right psychological makeup to weather the volatility that comes with such a level of concentration.

Why Concentration in the S&P 500 Is a Problem

Those following my journey as an investor for quite some time will know that personally, as an active investor, I don’t consider concentration itself a problem. It only becomes a problem if a) an indivual investing in the product (here the S&P) is unaware of the level of concentration and what it means for the volatiltiy of returns and/or b) the highest weighted assets trade at elevated valuations.

1. Volatility and Behavioral Risks

Higher concentration increases the volatility of the index. When the fortunes of just a few companies dictate market movements, price swings can become more pronounced.

For active investors who understand what they own and are prepared for this volatility, this might not be an issue. However, for passive investors who rely on set-it-and-forget-it strategies, heightened volatility can lead to behavioral mistakes.

For instance, during periods of significant price declines, emotionally driven decisions to sell may result in locking in losses. This phenomenon, known as "behavioral drag," can seriously impair long-term returns.