Deep Dive: Evolution Gaming ($EVO)

When a Great Business Hits a Speed Bump - Regulation, Ringfencing, and Reality

It’s easy to write about companies when everything is going well. Numbers are strong, sentiment is high, and investors are happily watching their portfolios tick up. But I’d argue that it’s in the uncomfortable moments – when a thesis is tested, expectations are missed, or market reactions are visceral – that real analysis starts to matter.

This post is about one of those moments. And this is why I prioritized writing about Evolution Gaming, one of my smaller holdings, over updating my Meta thesis – a signifiacntly larger position – after Zuck & Co. shared their quarterly updated.

Zooming Out Before We Zoom In

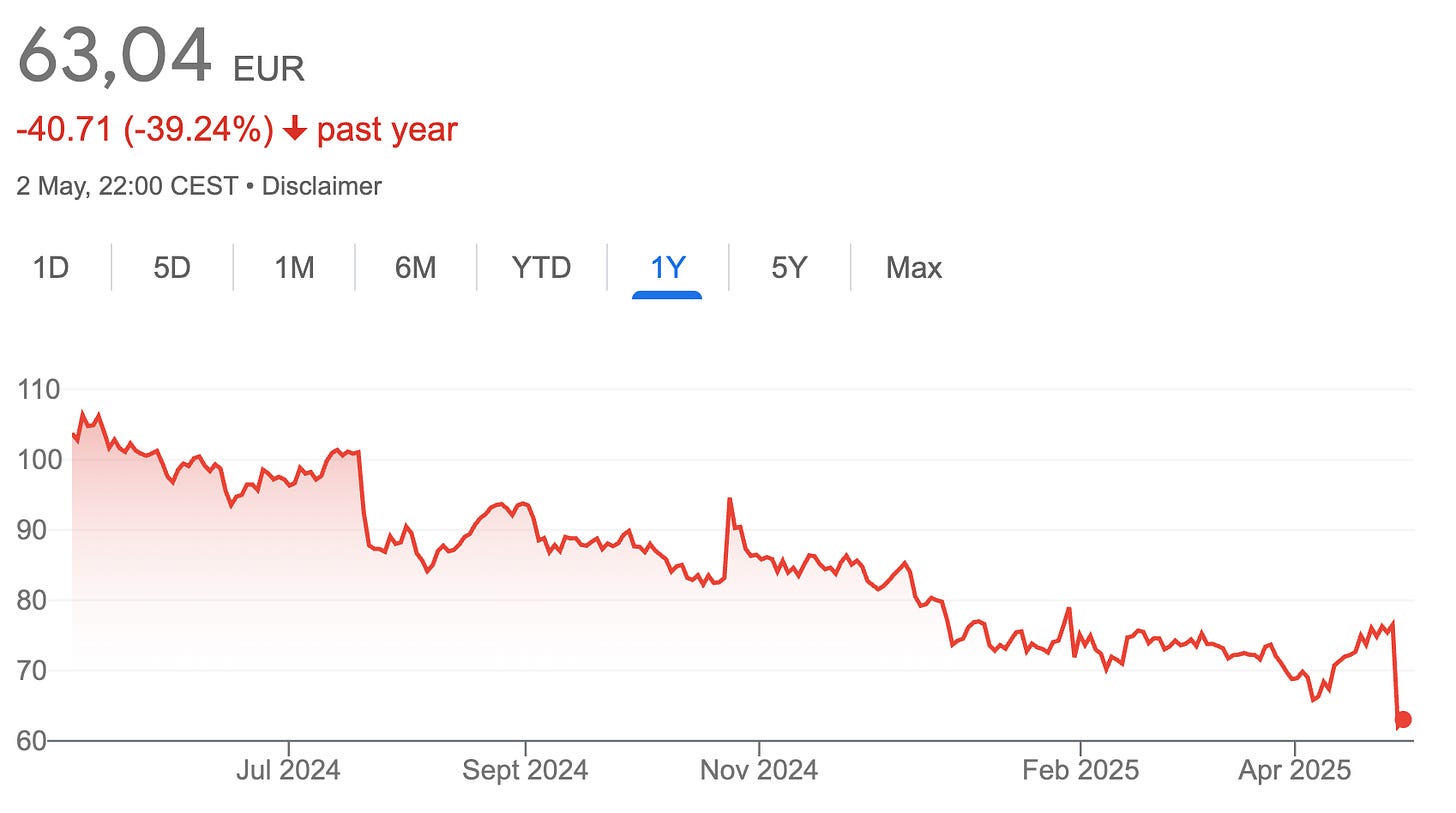

Recently, Evolution Gaming (EVO 0.00%↑ ), a company I own a relatively small and still new position in, released its Q1 2025 results. The stock promptly fell 20%. Disappointment was in the air, and the takes online ranged from confident dip-buying to full-blown thesis abandonment.

I hadn’t even read the full report yet when I first noticed the panic. But my instinct was simple: has anything truly broken? Has the long-term thesis fundamentally changed? Or is this just one of those quarters where short-term friction collides with long-term strategy?

“Am I unhappy with the overall development in the quarter? Definitely not, because everything that we have done support the mission to increase the gap to competition.” – CEO Martin Carlesund.

That quote stuck with me – not because it sugarcoated anything (it didn’t), but because it points to the deeper tension running through this quarter: short-term pain vs. long-term moat expansion.

And that’s exactly what I want to explore in this piece.

This post will be a detailed, balanced look at Evolution’s latest results, its strategic choices, the bear and bull cases that are forming, and how I’m personally thinking about the investment. I’ll break down not only what the company said, but how the market interpreted it – rightly or wrongly – and where I think the real signal lies beneath all the noise.

“We see strong underlying demand. But the revenue growth has simply been slower than what we have capacity for.” CEO Carlesund

More importantly, I’ll try to frame this as a case study in how to think through moments like these as investors, because let’s face it: every portfolio eventually contains a stock that goes through this kind of turbulence.

Sometimes, slowness is strategy. Other times, it’s the start of something worse.