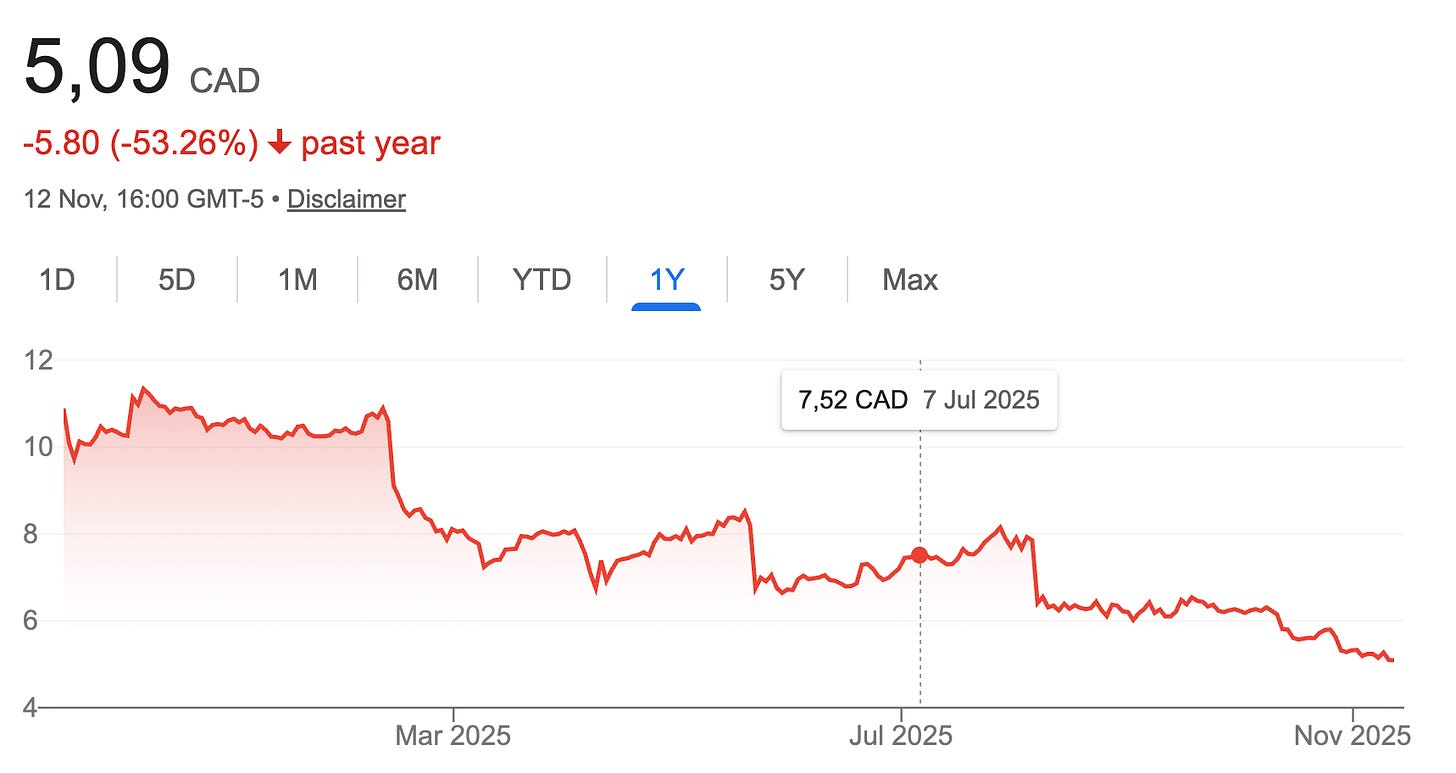

Deep Dive: Revisiting CMG ($CMG.TO)

Why this quarter could mark the bottom before a rebound

This quarter’s update from Computer Modelling Group (CMG) reads like a case study in contrasts.

On the surface, the numbers look disappointing, very disappointing, again (!) – organic revenue still in decline, margins under significant pressure, Free Cash Flow down sharply.

Yet underneath those headlines, there’s hope for some progress – finally. The business is becoming more recurring, its product portfolio broader, and its capital allocation framework more deliberate. CMG’s long-term vision remains intact, even if the financial statements don’t make that immediately obvious.

When I first went through the results, I found it helpful to organize my thoughts into three buckets – the good, the bad, and the neutral. This is how I’ll structure this post, too.

In that sense, this post is an attempt to understand whether CMG’s long-term transition plan – what management calls CMG 4.0 – is holding together under pressure. As a reminder, the company is trying to evolve from a single-product, high-margin niche player into a broader software platform that can compound Free Cash Flow through disciplined reinvestments, primarily in value accretive acquisitions.

That’s an ambitious goal. What follows is my read on how far along they really are.

Before we move on …

You may have noticed this already, but a growing number of Substack writers have been flagging a new issue: not all subscribers consistently receive email notifications when a new post goes live. Hence, the most reliable way to make sure you never miss an update is to turn on push notifications in the Substack mobile app. If you enjoy my posts and want to be notified the moment something new goes out, I strongly recommend enabling them.

Disclaimer: I own Computer Modelling Group shares. The analysis presented in this blog may be flawed and/or critical information may have been overlooked. The content provided should be considered an educational resource and should not be construed as individualized investment advice, nor as a recommendation to buy or sell specific securities. I may own some of the securities discussed. The stocks, funds, and assets discussed are examples only and may not be appropriate for your individual circumstances. It is the responsibility of the reader to do their own due diligence before investing in any index fund, ETF, asset, or stock mentioned or before making any sell decisions. Also double-check if the comments made are accurate. You should always consult with a financial advisor before purchasing a specific stock and making decisions regarding your portfolio.

1 – The Bad

1.1 Core Business Still Struggling

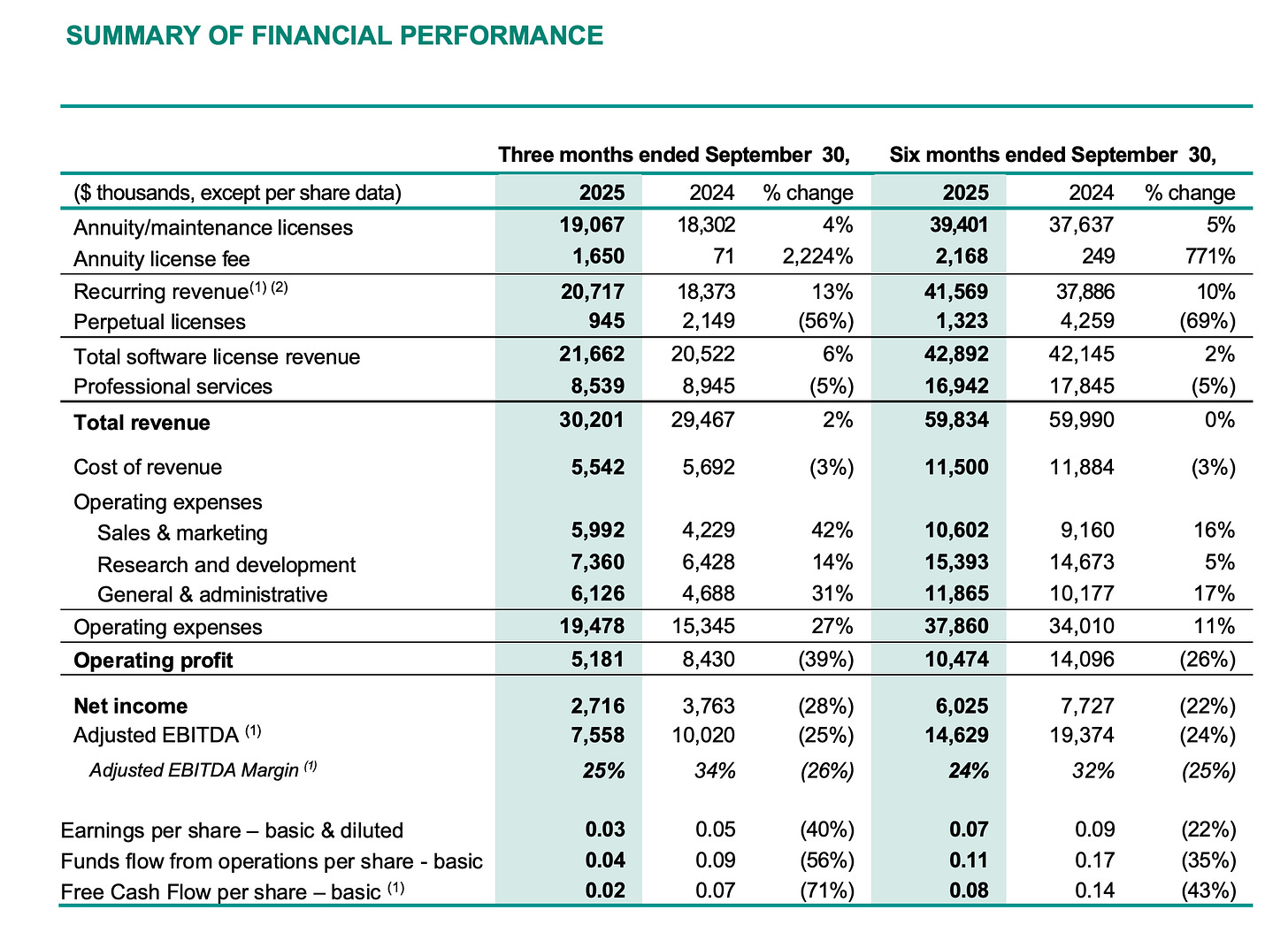

The headline numbers tell a simple story: the core is still under pressure. Total revenue in the second quarter grew 2 percent to $30.2 million, but that number hides the real picture.

Organic revenue fell 17 percent (-15 percent in Q1), recurring organic revenue was down 9 percent (down 6 percent in Q1), and so what looked like some growth came entirely from acquisitions (Sharp and Seisware), which added 19 percent.

“Sharp was acquired on November 12, 2024 (Q3 2025) and will start contributing to Organic growth/ organic decline on January 1, 2026 (Q4 2026) and SeisWare was acquired on July 30, 2025 and will start contributing to Organic growth/ organic decline on October 1, 2026.“ - Q2 Financial Report

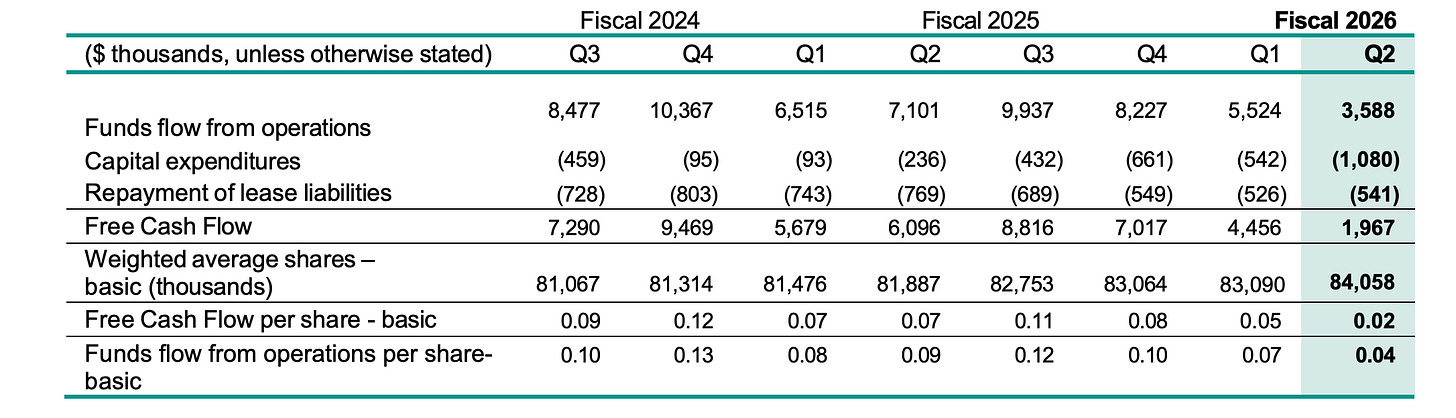

Adjusted EBITDA dropped 25 percent to $7.6 million, with margins compressing from 34 to 25 percent. Free Cash Flow fell 68 percent to $2 million – the lowest quarterly free cash flow generation in the last two years –, and earnings per share slid 40 percent to $0.03.

And of course, that’s a problem, because …

“Even as we successfully grow through acquisition, reservoir simulation remains the foundation of our business and a core driver of Free Cash Flow.” - Q1 Letter

Yet, if you only skim the results, it’s easy to think the business is shrinking, full stop. But it’s more accurate to say that CMG is continuing to move through a deliberately painful transition. The reservoir simulation segment – still the company’s foundation and historically its cash generator – is dealing with the unexpected fallout of the customer loss flagged last quarter.

“Adding to those issues, we were recently unsuccessful in negotiating a renewal with a long-standing customer in our reservoir simulaton business. Despite strong user advocacy and positive feedback on the software, we lost the renewal due to unusually aggressive discounting and competitive bundling by a global peer [note by the author: presumably Schlumberger]. As CEO, I need to answer for whether this speaks to lack of sales execution, changes in customer preferences, or a naturally competitive environment. While customers frequently flex their number of licenses up or down, it is rare for CMG to lose a client. [...]“ – Q1 Letter

That single contract didn’t just dent revenue (and I expect it to continue to be a headwind for two more quarters); it highlighted how dependent CMG remains on a small group of high-value and sophisticated operators who are constantly reassessing cost-to-value.

Management didn’t hide from this. In the shareholder letter, CEO Pramod Jain reiterated that the organic decline came from weaker simulation licensing and lower professional-services activity, which he had already warned about.

“This quarter’s organic decline in total revenue and recurring revenue were a result of anticipated reductons in professional services and a reducton in reservoir simulaton licensing that we had addressed last quarter.” - Q2 Letter

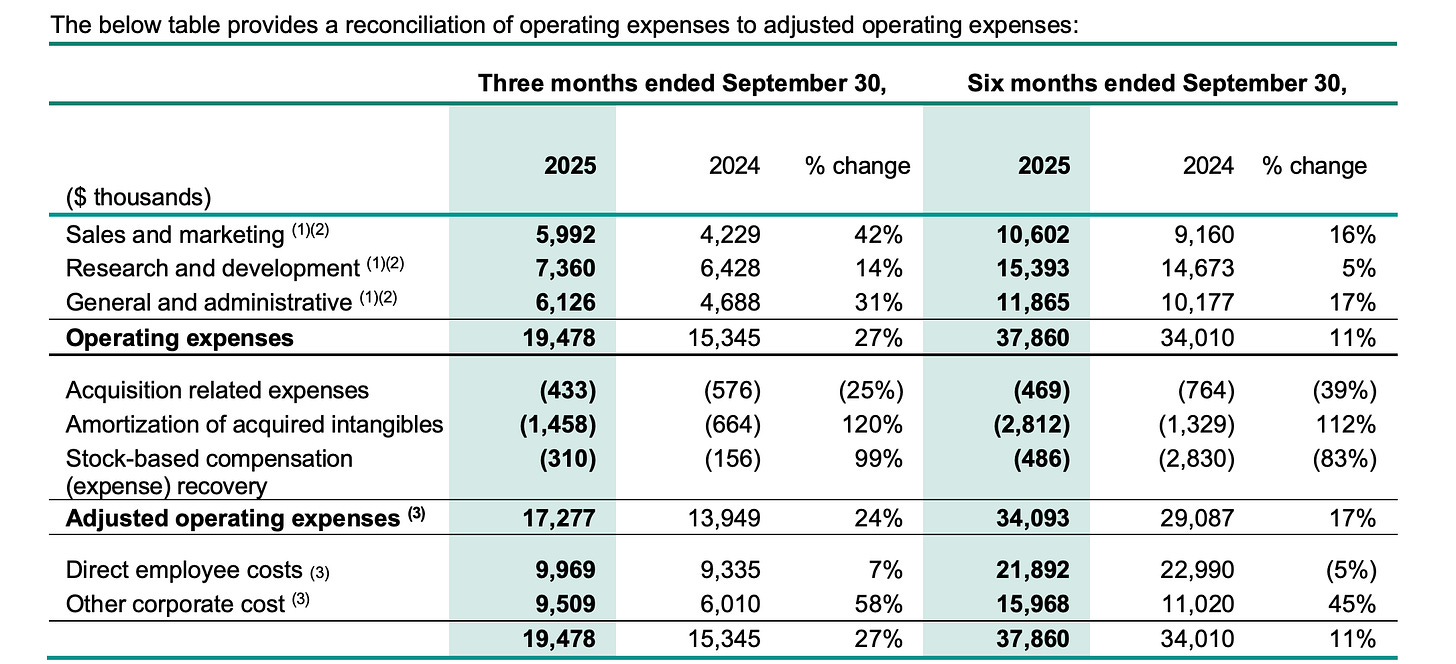

Still, there’s no denying that profitability has taken a step back. Operating expenses rose 27 percent year over year – mainly because of the integration of Bluware, Sharp Reflections, and the newly acquired SeisWare – while the higher-margin legacy business slowed.

Sales and marketing costs jumped 42 percent, R&D 14 percent, and G&A 31 percent.

On the cash-flow statement, the squeeze is visible. Free Cash Flow per share dropped from $0.07 to $0.02 as both lower funds from operations and higher capital expenditures (twice as high as in Q1) pulled cash conversion down. Stock-based compensation and integration costs added extra drag. For a company that used to throw off FCF margins of around 30 percent – almost effortlessly –, this reversal is uncomfortable, and you have to wonder how structural this change in the profitability profile really is.

So I believe the key question for investors is whether the lost revenue represents structural changes to the business. My sense is that it’s both cyclical headwinds and competitive pressure. The demand for high-fidelity simulation hasn’t disappeared – the pipeline Jain references for the second half supports that – but CMG’s competitive edge has narrowed.

1.2 Expert Perspective

A recent industry interview on InPractise (read parts of it here) captured this tension well and it’s a rather sobering read.

The expert, a former reservoir-simulation executive, compared CMG to “Nokia before smartphones.” His view: the technology is still scientifically sound but increasingly encased in dated infrastructure. CMG’s core solvers are written largely in Fortran, while competitors such as Rock Flow Dynamics’ tNavigator and SLB’s Eclipse or Petrel have modernized architectures that scale better across multi-core processors and cloud deployments.

He also pointed to a pricing handicap. Historically, one CMG license would cover only a handful of CPUs, so customers running on 64-core machines needed to stack multiple licenses – quickly making the total cost uncompetitive. tNavigator, by contrast, licenses per node and allows full core utilization. CMG has introduced a “Turbo” model to address this, but the perception gap lingers. In an environment where procurement teams benchmark everything, even a small usability or cost friction can push renewals toward rivals.

Add to that the execution risk of integrating three seismic acquisitions that each come with their own codebases, sales channels, and customer cultures, and it’s easy to see why the core feels diluted. The seismic assets are strategically logical – they broaden CMG’s relevance from pure reservoir modeling into upstream workflow integration – but the short-term effect is distraction. Until these pieces are unified under a cohesive commercial model, the company’s best-in-class status in simulation won’t automatically transfer to its newer verticals.

Put differently: CMG’s science remains first-rate, its relationships deep, and its new toolkit ambitious. But this quarter confirms that translating that foundation into a modern, scalable, and competitively priced platform is challenged by rivals and may take longer than investors hoped. The company can afford that delay – balance-sheet leverage is modest and topline growth and cash generation should rebound as renewals land in the second half of the year– yet market patience rarely matches management timelines.

2 – The Good

This is where it gets interesting:

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.