Navigating a Volatile Market: Why Now is a Stock Picker's Paradise

Why I'm Glad I'm Not a Passive Investor Right Now ...

Last week was one of the most volatile periods we've seen in recent times. The VIX volatility index soared into the high 30s, and CNN's Greed and Fear Index plunged into "extreme fear" territory.

Despite these alarming signals, the U.S. stock market ended the week up —a result few would have predicted at the outset. Most expected a sharp sell-off, yet the market held steady, underscoring a crucial lesson: predicting short-term market movements is nearly impossible.

However, I believe the recent volatility rollercoaster and the uncertainty about the economic outlook have highlighted a critical point — this is not a market where all stocks are destined to soar as we’ve witnessed during the zero-interest-rate environment of the 2010s. Instead, it's a stock picker’s market, one that rewards those with strong instincts, sharp research processes, and a willingness to dig deep and turn over a lot of rocks as Peter Lynch would’ve put it.

In this post, we'll explore why the current investing landscape is particularly favorable for selective investors by delving into three key topics:

The Yen “Carry Trade” and its broader market implications.

The increasing divergence in stock performance.

The current valuation of the S&P 500 and what it means for future expected returns.

1. The Yen Carry Trade: A Macro Event Creating Opportunity

Last Monday, the markets were rattled by what is known as the Yen carry trade that sent ripples through global stock indices.

Without getting into the nitty gritty details here, in short, the Yen Carry Trade refers to an investment strategy where investors borrow money in Japanese yen, typically at very low interest rates, and then convert the yen into a different currency such as the USD to invest in higher-yielding assets elsewhere, such as US bonds. The goal of the carry trade is to profit from the difference between the low cost of borrowing in yen and the higher returns from the foreign investments. This strategy works well when the interest rate differential between Japan and other countries is large, and when the yen remains relatively stable or weak against other currencies. However, it carries risks, particularly if the yen appreciates significantly, which can force investors to unwind their positions quickly, potentially leading to significant losses.

And this is what happened early last week: the Yen Carry Trade experienced a significant unwinding due to unexpected actions by the Bank of Japan (BOJ). The BOJ made a surprise tweak to its yield curve control (YCC) policy, allowing Japanese government bond yields to rise more than previously expected. This move signaled a potential shift away from its ultra-loose monetary policy, which had been a key driver of the Yen Carry Trade. Investors, who had borrowed cheaply in yen to invest in higher-yielding assets elsewhere, were caught off guard and began unwinding their positions to avoid potential losses from a rising yen and higher Japanese yields. The rapid unwinding of these trades led to a sharp appreciation of the yen and a sell-off in global assets that had been financed through the carry trade.

As a result, Japan's market saw a staggering 12% drop, …

… while the Nasdaq in the U.S. opened down 6%, with some of its constituents suffering even steeper declines.

As an investor, events like these should be seen as golden opportunities. Consider a company like Netflix—how does the unwinding of the Yen carry trade impact its core business operations? It doesn't (really). Yet, Netflix NFLX 0.00%↑ shares opened -6% lower than the previous day's close.

These kinds of macro-driven sell-offs, where the underlying business fundamentals remain intact, presents a chance to buy high-quality companies at discounted prices.

The key is preparation—having a well-curated watchlist and knowing the prices at which you’re willing to buy.

If you had such a watchlist and were prepared to pull the trigger last Monday, and found the courage to buy when others were waiting “for the dust to settle,” you might have snagged a long-term winner at an attractive entry point.

2. Stocks Moving Less in Sync: The Return of Stock Picking

One of the most significant trends we’re observing in the current investing landscape is that stocks are moving less in sync than they have in the past. This shift highlights the importance of stock picking in today’s market and it reminded me of a famous quote by Warren Buffett:

"Only when the tide goes out do you discover who’s been swimming naked."

In the zero-interest-rate environment of the past decade, most stocks were buoyed by cheap money, leading to a rising tide that lifted all boats. However, as central banks around the world have raised interest rates, the tide has gone out (metaphorically speaking), revealing which companies are truly robust and which were merely benefiting from the easy money environment.

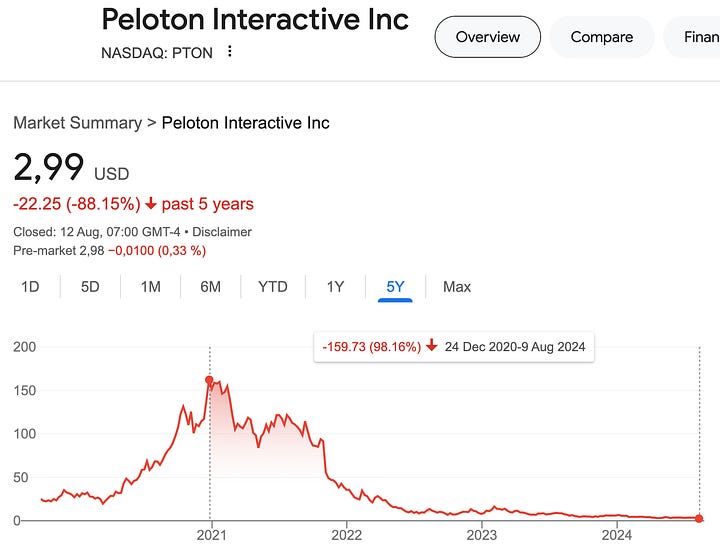

Over the last two years, we’ve seen many pandemic-era darlings get crushed as the market environment shifted.

Meanwhile, companies with solid business operations and healthy balance sheets have thrived, especially since the market bottomed in late 2022.

This divergence is particularly evident in the tech sector, where quality companies such as META 0.00%↑ and NVDA 0.00%↑ have started to shine, while weaker players have faltered.

During the ZIRP (Zero Interest Rate Policy) era, stocks across the board were growing in value, creating a false sense of security. But now, as we enter a period where there’s a bigger gap between winners and losers, the value of skilled stock picking is becoming increasingly apparent.

In such an environment, those with the ability to identify and invest in the winners, while avoiding the significant losers, will likely outperform the market.

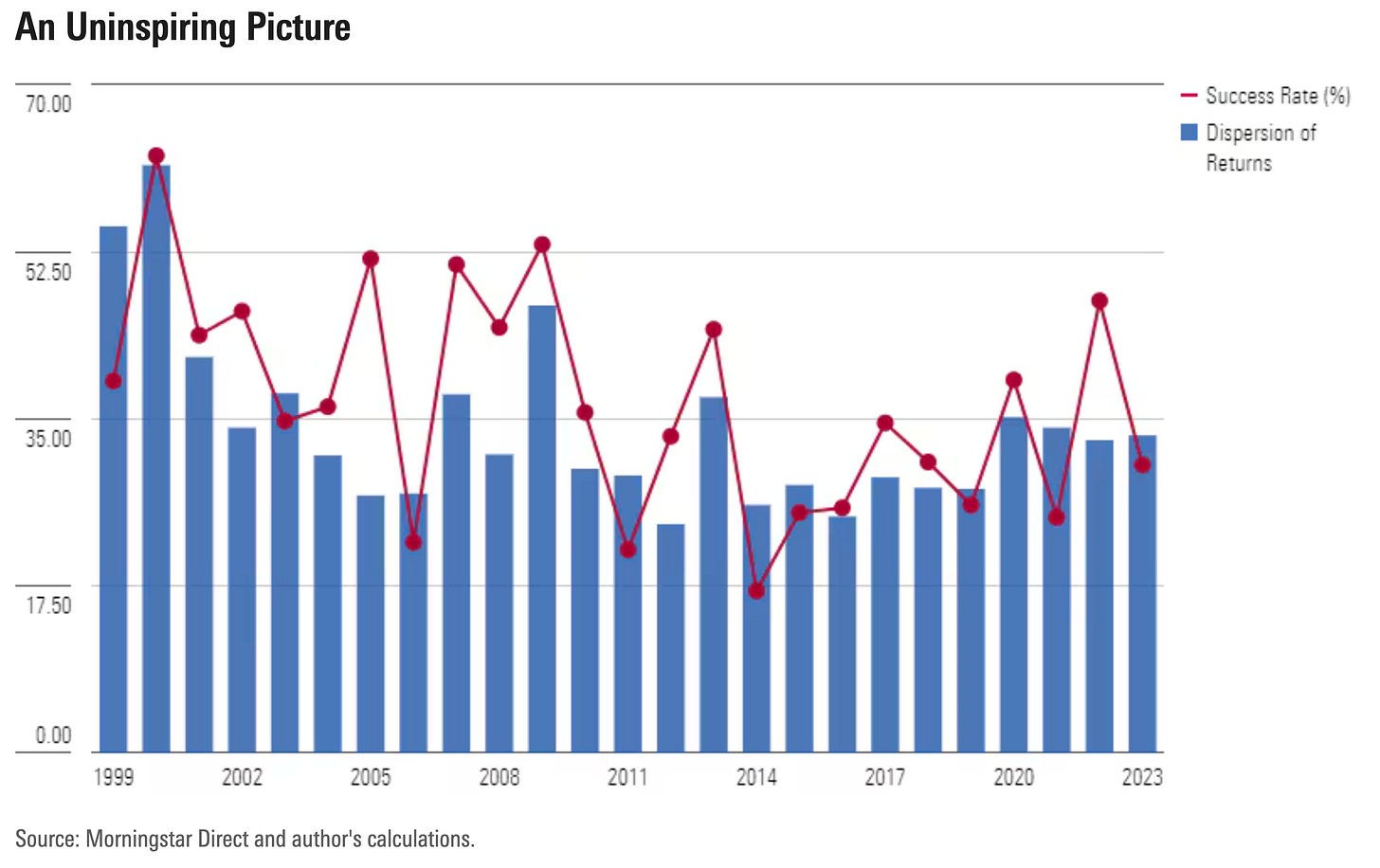

That said, despite this growing divergence, most active fund managers continue to underperform. A statistic from Jason Zweig of the Wall Street Journal highlights that only 18% of actively managed funds beat the S&P 500 in the first half of 2024.

And according to another Morningstar data point, over the past decade, only about 27% of fund managers have outperformed their benchmark index.

These numbers suggest that while stock picking opportunities are abundant, success is far from guaranteed and requires a disciplined approach, a long-term outlook, a business owner mindset, and the courage to step into the arena (i.e. buy stocks) when others are ducking away.

3. S&P 500 Valuation: Implications for Future Returns

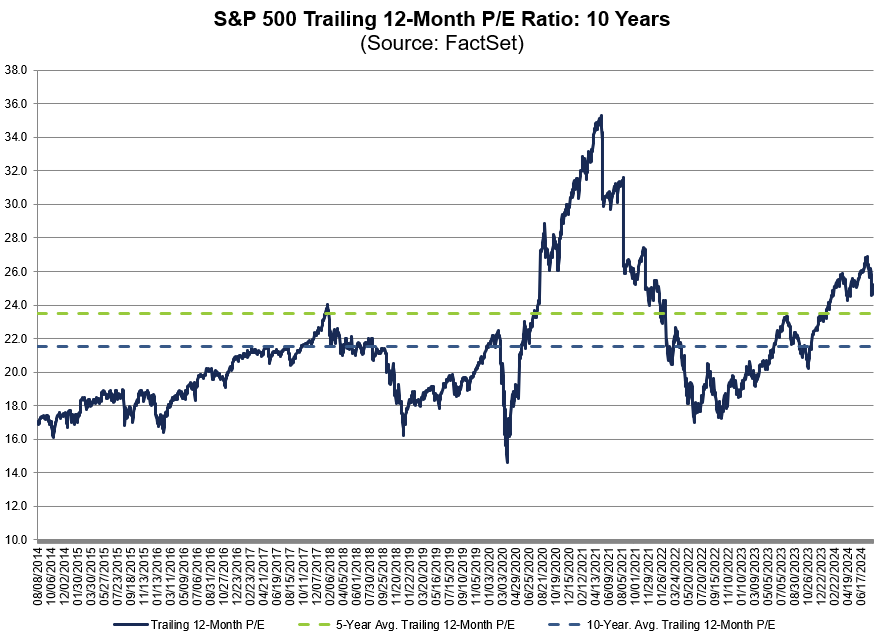

The current valuation of the S&P 500 also warrants a closer look. The trailing 12-month price-to-earnings (P/E) ratio is around 25x, which is above both the 5-year average of 23.5x and the 10-year average of 21.5x. This is well above the long-term historical median of around 15x, indicating that the market is expensive by historical standards.

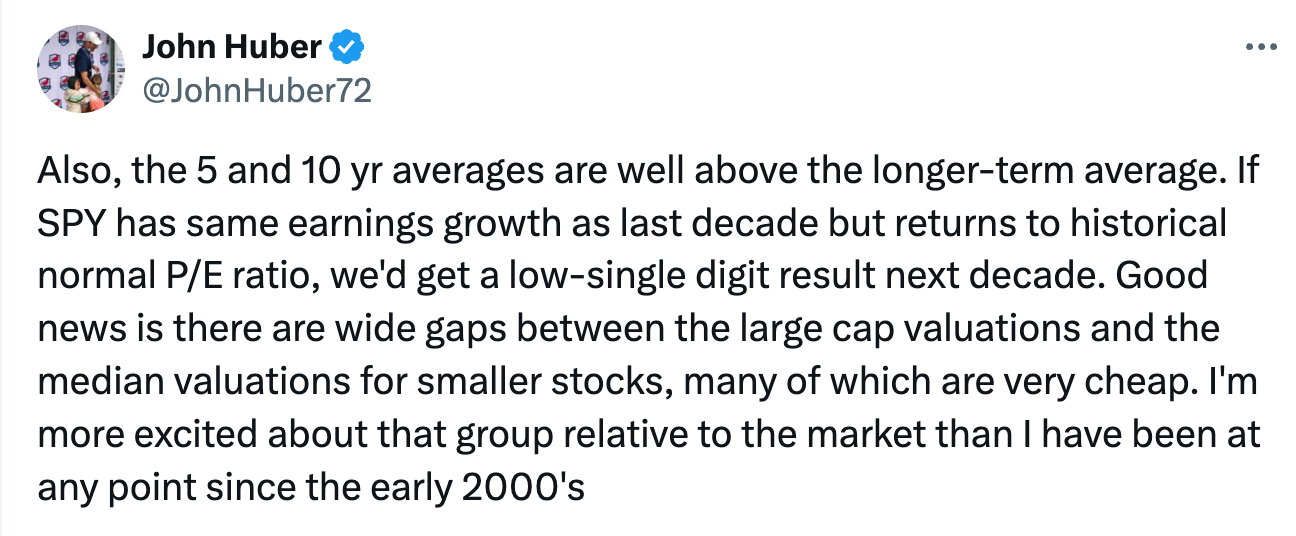

John Huber, an investor I respect greatly, recently highlighted on X (formerly Twitter) that if the S&P 500 were to revert to a more historically normal P/E ratio, it could lead to low single-digit returns over the next decade, even if earnings growth remains robust. This points to a potential headwind for the broad market, where even solid earnings growth might not translate into strong returns if multiples contract.

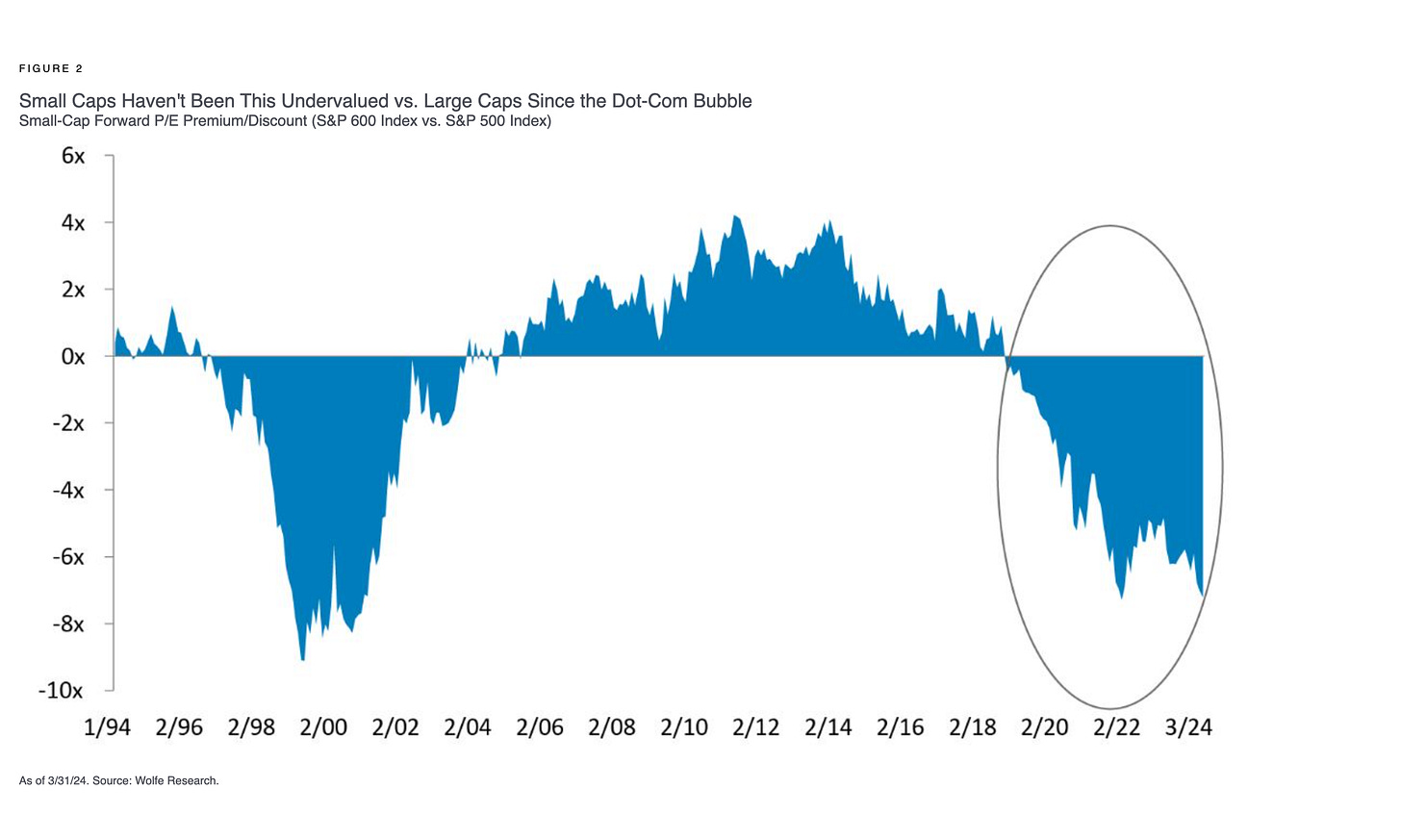

However, as Huber points out, there’s a silver lining—there’s a significant gap between large-cap valuations and those of smaller stocks, many of which are trading at much more attractive multiples …

4. The Case for Small-Cap Stocks

Huber even mentioned that he’s more excited about the opportunities in small caps now than he has been since the early 2000s. For individual investors, this should be music to their ears. The opportunity set among smaller companies is more compelling than it has been in years, presenting a chance to find undervalued gems. To support this thesis, let me highlight three aspects here:

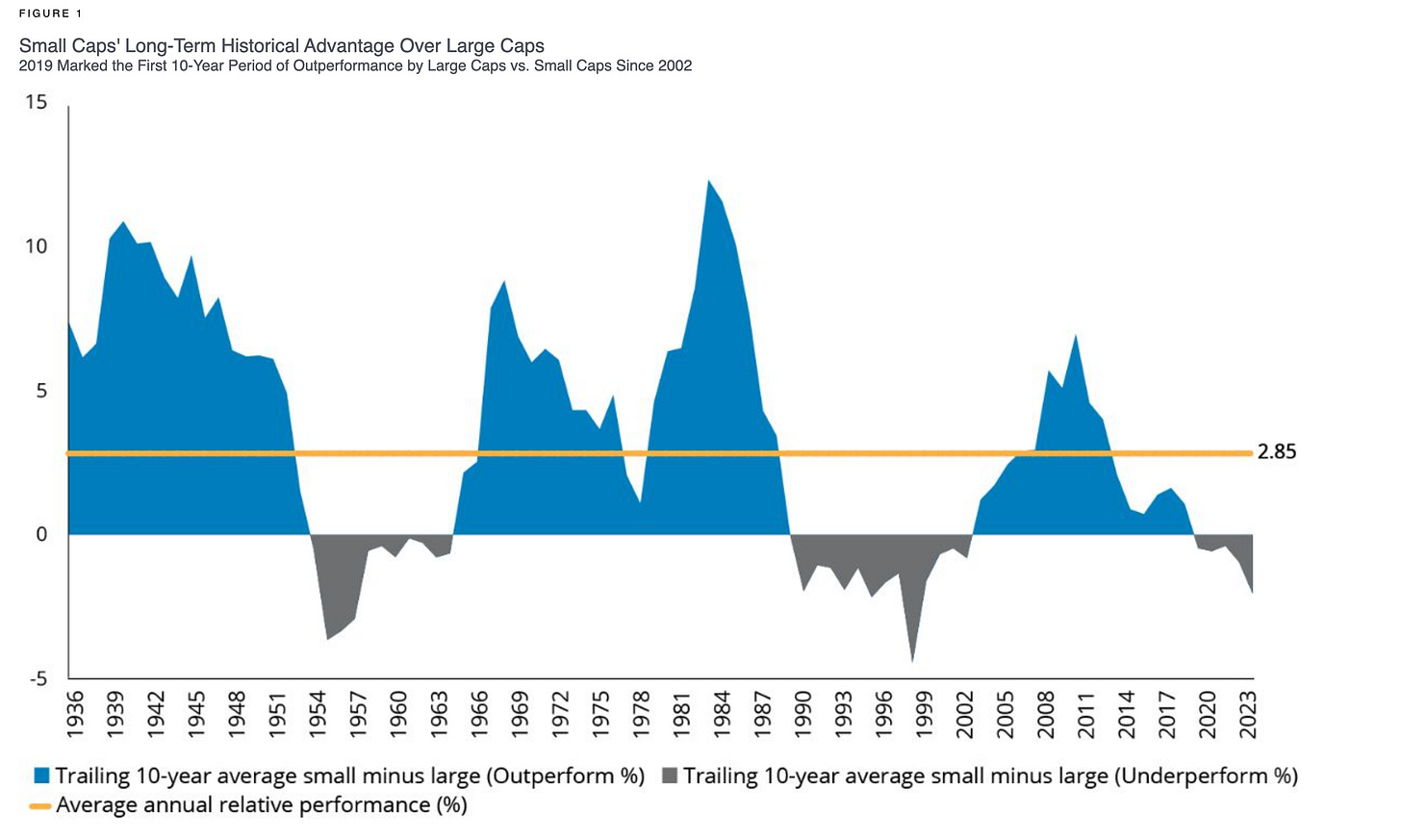

Small caps have been underperforming large caps for quite some time now.

(Source: Hartford Funds)

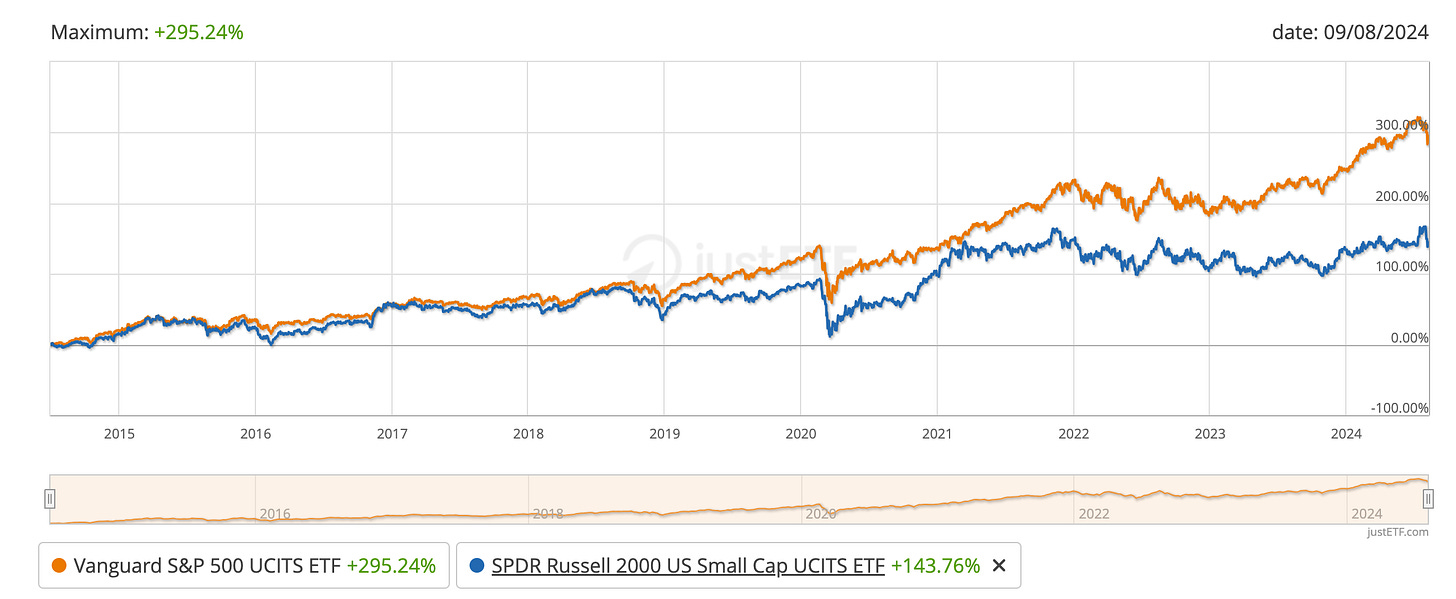

Consider the S&P’s performance vs. the Russel 2000’s performance for example:

Historically, small-cap stocks have outperformed their larger counterparts over the long term, and they are currently trading at relatively cheap multiples. The valuation gap between small caps and large caps is wider than it has been in years, creating a fertile hunting ground for value-oriented investors.

(Source: Hartford Funds)

Moreover, small-cap stocks often have less analyst coverage, leading to potential inefficiencies in their pricing. This lack of coverage means that high-quality small caps can sometimes be overlooked, allowing savvy investors to find bargains.

However, it's important to approach small caps with caution. Many companies in this space are not profitable—a significant percentage of the Russell 2000, for example, is currently unprofitable. This highlights the importance of thorough research and a disciplined approach to stock selection to find the (few) quality companies in the smaller cap universe.

For those just starting out, it might make sense to begin with blue-chip stocks—those with market caps above $100 billion—before gradually diversifying into mid-cap and small-cap stocks. Blue chips generally offer a safer introduction to the market, as they tend to be more stable and have more predictable earnings. However, as you gain experience and confidence in your stock-picking abilities, small caps can offer significant upside potential.

Final Thoughts

In conclusion, I believe the current market environment presents a unique set of challenges and opportunities to investors.

An increasing divergence in stock performance, coupled with attractive valuations in the small-cap space, makes this an ideal time for stock pickers.

However, navigating this landscape successfully requires more than just intuition—it demands a well-defined investment process, thorough research, and a rational temperament.

If you’re looking to develop your own investment framework and improve your stock-picking skills, consider checking out my mentoring program. It provides access to a wealth of resources, including systems, checklists, and spreadsheets, all designed to enhance your investment strategies and help you succeed in this stock picker’s market.