My Updated TSR Model for Valuing High-Quality Growth Companies

And how it forces clearer thinking about the future of any business

I sometimes get the sense that investors treat valuation like a formality.

Something you briefly glance at after you’ve fallen in love with a company. Something you tweak until the number looks reassuring – “Yes, that confirms my thesis.”

Yet the longer I invest, the more convinced I am that valuation is still the #1 factor that decides the outcome. It decides who really compounds at high returns – regardless of style (quality, GARP, special situations, etc.) – and who treads water.

It decides whether a brilliant business becomes a brilliant investment or a frustrating one. And most importantly, it decides whether your process is anchored in reality or drifting into a story that sounds good but doesn’t cash-flow its way into your future returns.

Why Valuation Still Matters – Even More Than Most Investors Think

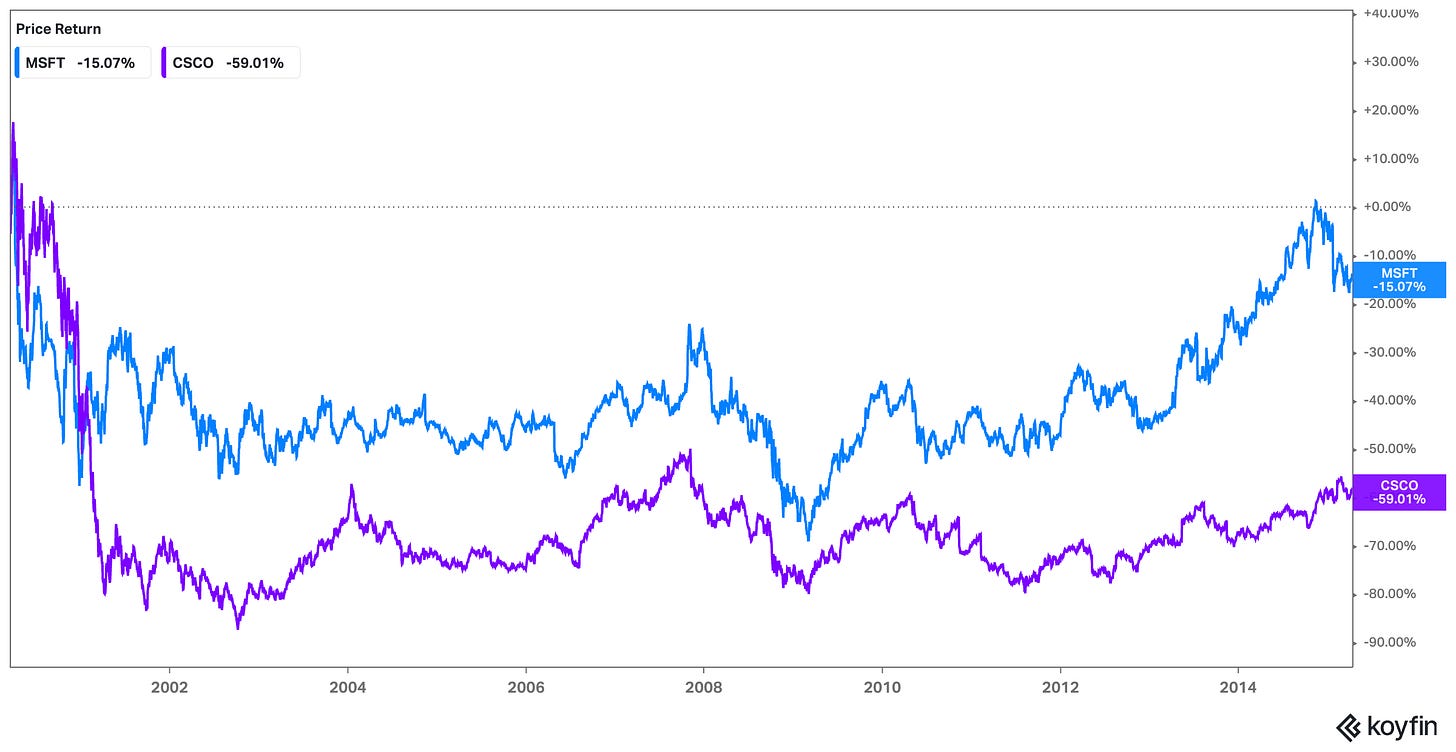

Underperformance often hides behind complicated explanations, but the core reasons tend to be simple. Some investors never want “value” in the first place and chase whichever narrative happens to sparkle that year. This year in particular, I see more and more investors give up on “value.” Others never built the skill to value a business. Still others know how to value companies but set hurdle rates that are far too low. In each case, the problem is the same. You can own world-class companies and still fall short if the price you paid assumed too much. Markets have shown this over and over again. Cisco and Microsoft in the early 2000s didn’t suddenly become weak businesses. Their stocks just needed years to grow into the expectations embedded in the price.

That reality shaped how I built my own valuation toolkit. Over time I experimented with different approaches, some simple, some unnecessarily complex, and eventually landed on a system that forces clarity instead of encouraging wishful thinking.

Valuation is imprecise by nature, but that doesn’t make it optional. If anything, it makes structure more important. You need a framework that turns intuition into explicit assumptions and narrative into numbers you can interrogate.

That is why my total shareholder return (TSR) model has become the backbone of how I analyze high-quality growth companies. It breaks returns into the actual mechanics that drive what a shareholder earns over time.

Earnings growth. Multiple changes. Share count dynamics. Dividends.

Once you see these pieces next to each other, valuation stops feeling abstract. It becomes a map. I wrote about this approach a while ago – read this post here:

I recently updated the model in two important ways. In the sections that follow below, I’ll walk you through these updates, show how they deepen the model, and explain why they’ve improve the quality of investment decisions.

This is where it gets interesting.

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.