My “Perception Change” Framework – Technical Analysis (Part 3)

Using price as feedback: quantitative and technical tools to spot perception changes

If you had asked me a few years ago whether technical analysis had a place in a fundamentally driven investment process, my answer would have been polite but skeptical.

I understood why traders used charts. I didn’t see why a long-term investor should care. But as discussed in the prior two parts, I noticed that prices increasingly started to move for reasons that had little to do with fundamentals.

“I never use valuation to time the market. I use liquidity considerations and technical analysis for timing. Valuation only tells me how far the market can go once a catalyst enters the picture to change the market direction.” - Stanley Druckenmiller

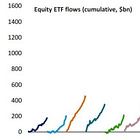

Parts 1 and 2 of this series were about diagnosing that shift. Market structure changed. The investor base changed. Perception became a dominant force in price formation. If that diagnosis is even roughly correct, then ignoring price entirely becomes an odd choice. Price is where all of those forces meet. Flows, positioning, fear, enthusiasm, constraints – they all express themselves through price before they show up cleanly anywhere else.

Price often tells the truth before the fundamentals do!

Consider what Druckenmiller said in this 2009 interview (~07:35 mark in the video below):

"If all the news is great and the stock's not acting well, get out...which is a pretty simple thing that for some reason analysts don't know."

What Druckenmiller is basically saying is that if fundamentals and news are strong (or weak) but the stock price isn't rising (or is falling), it signals the market knows something you don't (either negative (hidden risks) or positive). Price action often trumps analysis, as it reflects collective knowledge.

This is the lens through which I think about charts today. Not as predictors. Not as truth. But as an additional layer to consider. Price tells you how the market is reacting to information, not what the information objectively means.

For a fundamental investor, that distinction is crucial. Fundamentals tell you what a business might be worth. Price tells you how the market currently feels about that assessment – and how extreme that feeling has become.

There is also a very practical motivation. As I discussed in Part 1, there are only a few levers available to generate excess returns: security selection, position sizing, and timing. Most fundamental investors spend almost all their time on the first two. Timing is often dismissed as either impossible or irrelevant. In reality, it sits somewhere in between. You don’t need to be good at timing to be successful. But being systematically bad at it is costly.

This part of the series is about avoiding that cost. Not about calling tops and bottoms. Not about trading frequently. And certainly not about replacing business analysis with lines on a chart. It’s about using price behavior to improve decisions at the margin. Slightly better entries. Slightly better exits.

Fewer situations where you buy into accelerating negative perception or sell into the early stages of a positive shift.

Think of technical analysis here as a diagnostic tool. If fundamentals answer the question “what should happen,” and perception analysis helps explain “why the market might be wrong,” then price helps answer “when am I fighting the tape, and when am I aligning with it.” Used this way, charts don’t undermine a fundamental process. They finetune it.

So again, if Parts 1 and 2 were about understanding why mispricings exist and how perception changes, this part is about using quantitative tools to decide when to act – with humility, restraint, and a clear understanding of their limits.

Credits Where Credits Are Due

I also want to acknowledge Tiho Brkan, who taught me most of what I share in this piece. His thinking, practical frameworks, and generosity with knowledge have shaped the way I approach this topic, and many of the ideas here are a direct result of what I learned from him. Any clarity you find in this article is thanks in large part to his influence.

Part 1:

The full story starts here:

The rest of this post covers how timing can become an integral part of your investing process. If you’re serious about sharpening your investing edge, the full post (and all my previous premium content, including valuation spreadsheets, deep dives (e.g. well-known mid- and large caps such as LVMH, Duolingo, Meta, Edenred as well as more hidden gems such as Tiger Brokers, Digital Ocean, Ashtead Technologies, InPost, Timee, and MANY more) and powerful investing frameworks. is just a click away. Upgrade your subscription, support my work, and keep learning.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.