Meta just delivered one of its most impressive quarters in years. Revenue surged, margins widened, profits smashed expectations, and the market responded with thunderous applause.

If you only looked at the financial headlines or skimmed your feed on earnings day, you'd think the story was simple: Meta is firing on all cylinders, and Zuckerberg’s AI vision is already paying off.

But as an investor, I’ve learned to pay attention not just to what’s being said – but to what’s being missed. And in this case, the thing that stood out most to me wasn’t the strength of the quarter. It was the scale of the bet Zuckerberg is making next. Because while Wall Street cheered Meta’s performance, I found myself asking a different question: what if this is the last "easy" quarter for a long time?

The Quarter Wall Street Wanted: Big Beats, Big Cheers

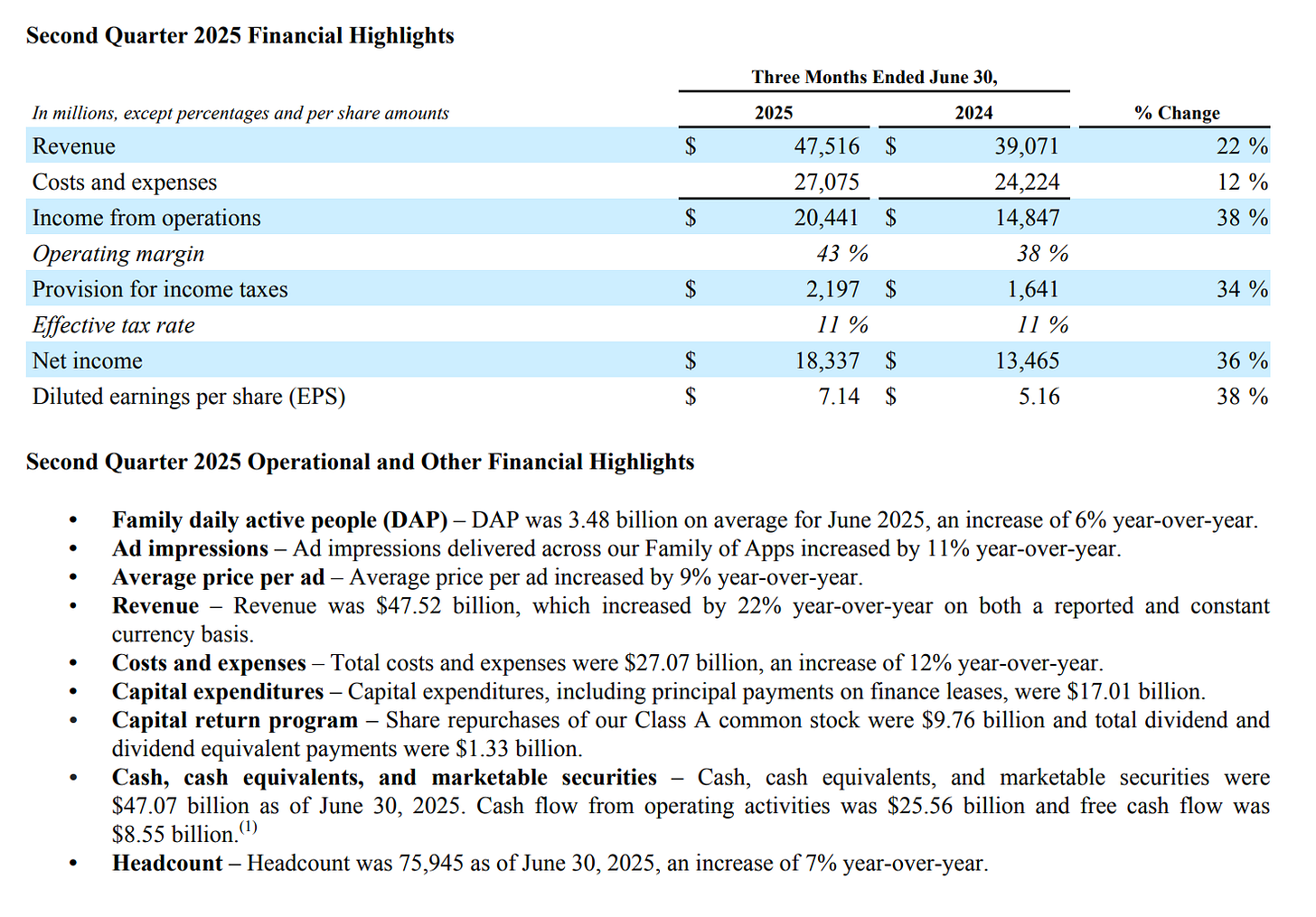

Meta's Q2 2025 was, on the surface, exactly what Wall Street wanted. If you just skimmed the headlines – or glanced at the sea of blue charts and “beats” flashing across your terminal – you’d think there’s nothing to critique. Revenue came in at $47.5 billion, up 22% year-over-year, comfortably above consensus. Net income surged 36% to over $18 billion, and diluted EPS jumped to $7.14, a full 38% increase. The operating margin? Back to a staggering 43%, up from 38% a year ago. This is the kind of margin expansion markets feast on – especially in a tech landscape where cost discipline has been the theme of the past 18 months.

Even user growth, long thought to be saturated, showed continued momentum. Meta’s Family daily active people metric hit 3.48 billion, up 6% year-over-year! That’s nearly half the planet logging into a Meta product daily – an absurd figure, and yet it keeps inching higher – at a relatively fast pace.

Advertisers seem happy, too. Ad impressions rose 11%, while the average price per ad climbed 9%. That’s the sweet spot you want to see if you're long Meta’s core business: more volume and higher pricing. Combine that with a still-stable 11% tax rate (European companies are envious …), and you have a business printing money at scale.

Unsurprisingly, the stock ripped higher. Analysts will be tripping over themselves to raise price targets. Commentators declared this quarter proof that Meta is entering a new golden era. Some even went as far as to suggest that this is the beginning of Meta’s second act – one driven by AI scale, operational excellence, and Zuckerberg’s newfound capital discipline.

And honestly? From a distance, it’s hard to argue with that. This wasn’t just a strong quarter – this was a flex. A statement. The kind that tells investors, “we’re still the ones setting the pace.”

But here’s the thing: when everyone is clapping, I find myself listening for the parts of the story that aren’t being told. And in this case, what’s not being talked about is exactly where my focus turns next.

But Beneath the Surface: A Cash-Burning, Capex-Hungry Beast Emerges

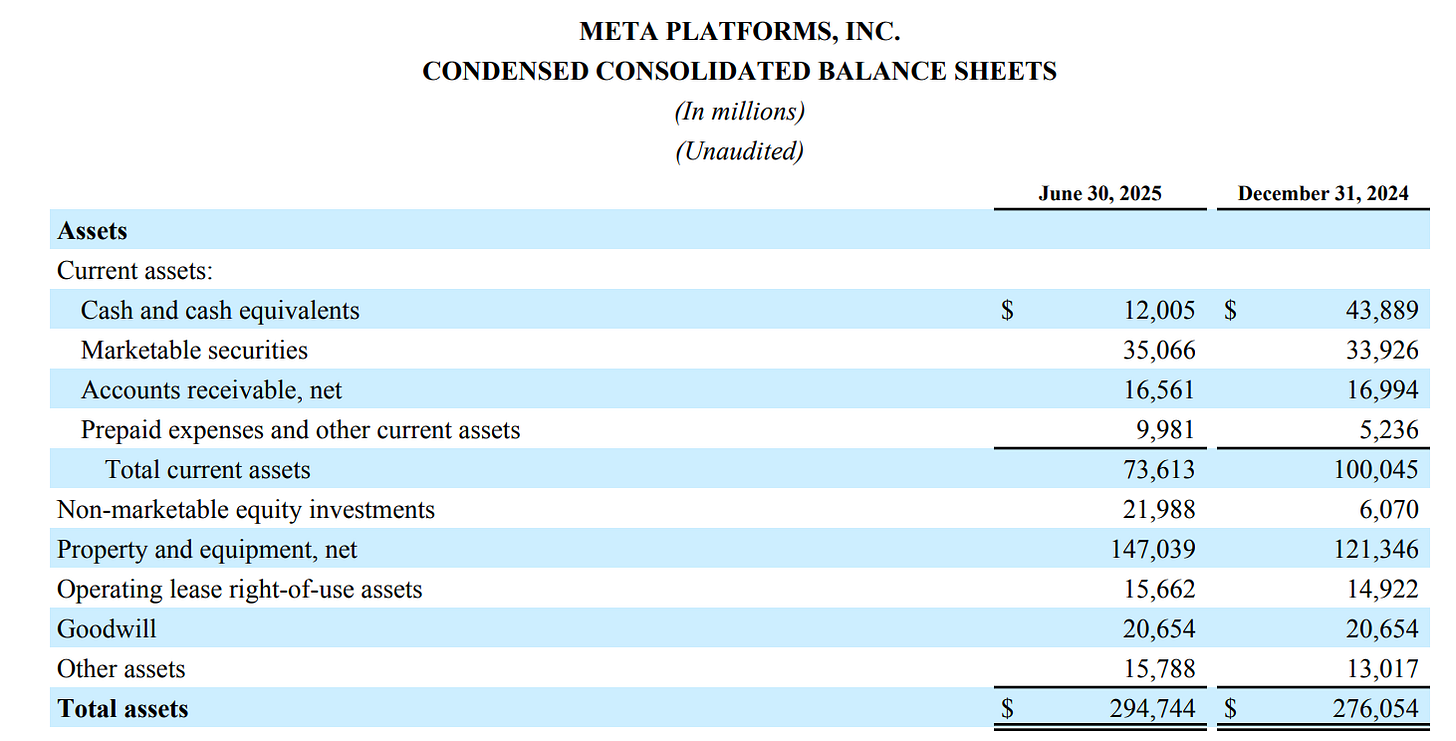

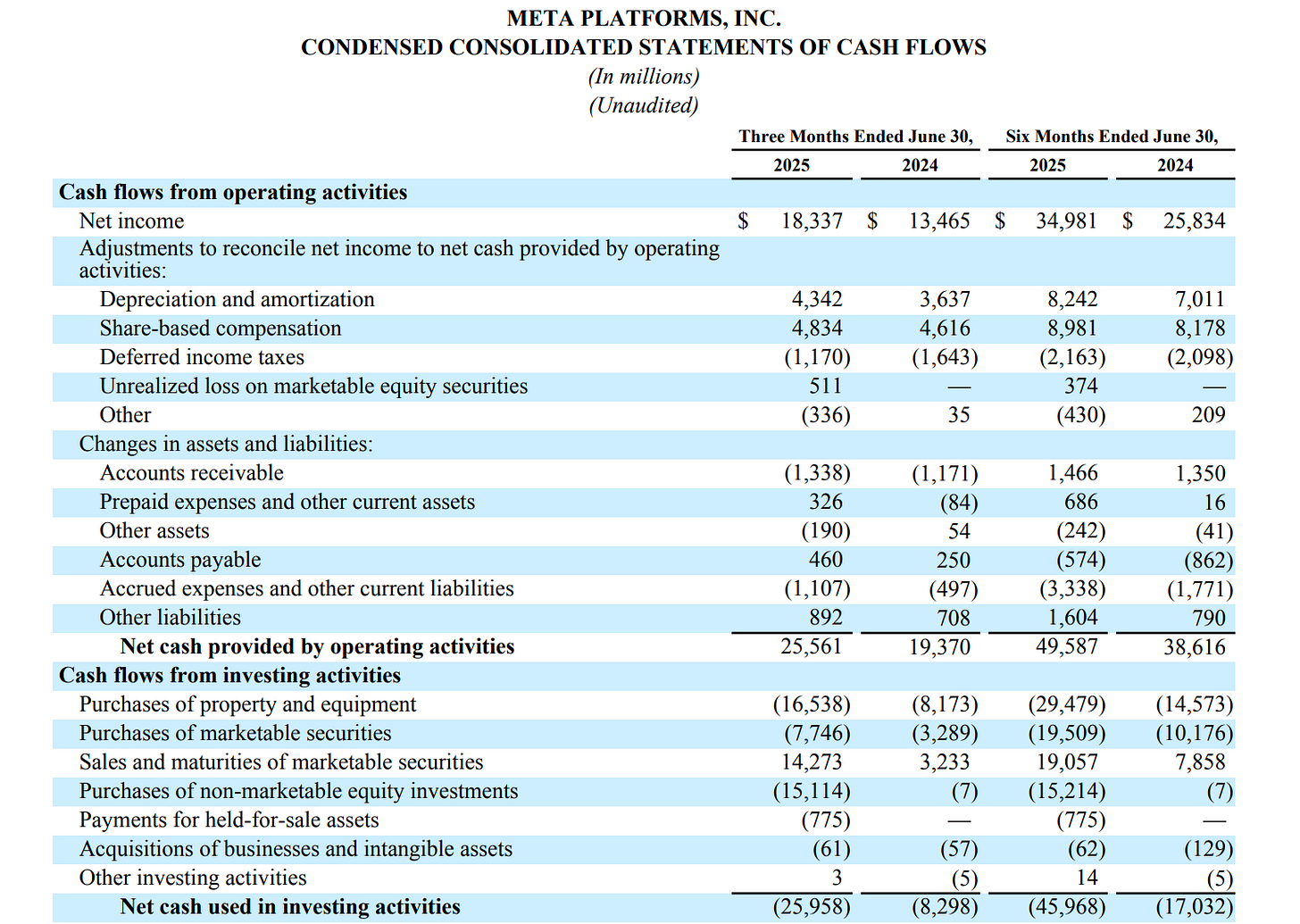

Here’s the part most investors didn’t notice – or maybe didn’t want to. While Meta was busy smashing earnings expectations and delivering jaw-dropping profitability metrics, its cash position quietly collapsed. Just two quarters ago, Meta was sitting on over $44 billion in cash and equivalents. That figure is now down to $12 billion.

Let that sink in. In the span of six months, Meta has burned through over $30 billion in cash. And it wasn’t because the business suddenly became unprofitable. Quite the opposite.

So where did all that money go?

The short answer: capex. The long answer: a full-blown, company-wide, all-in infrastructure buildout to support Meta’s AI ambitions.

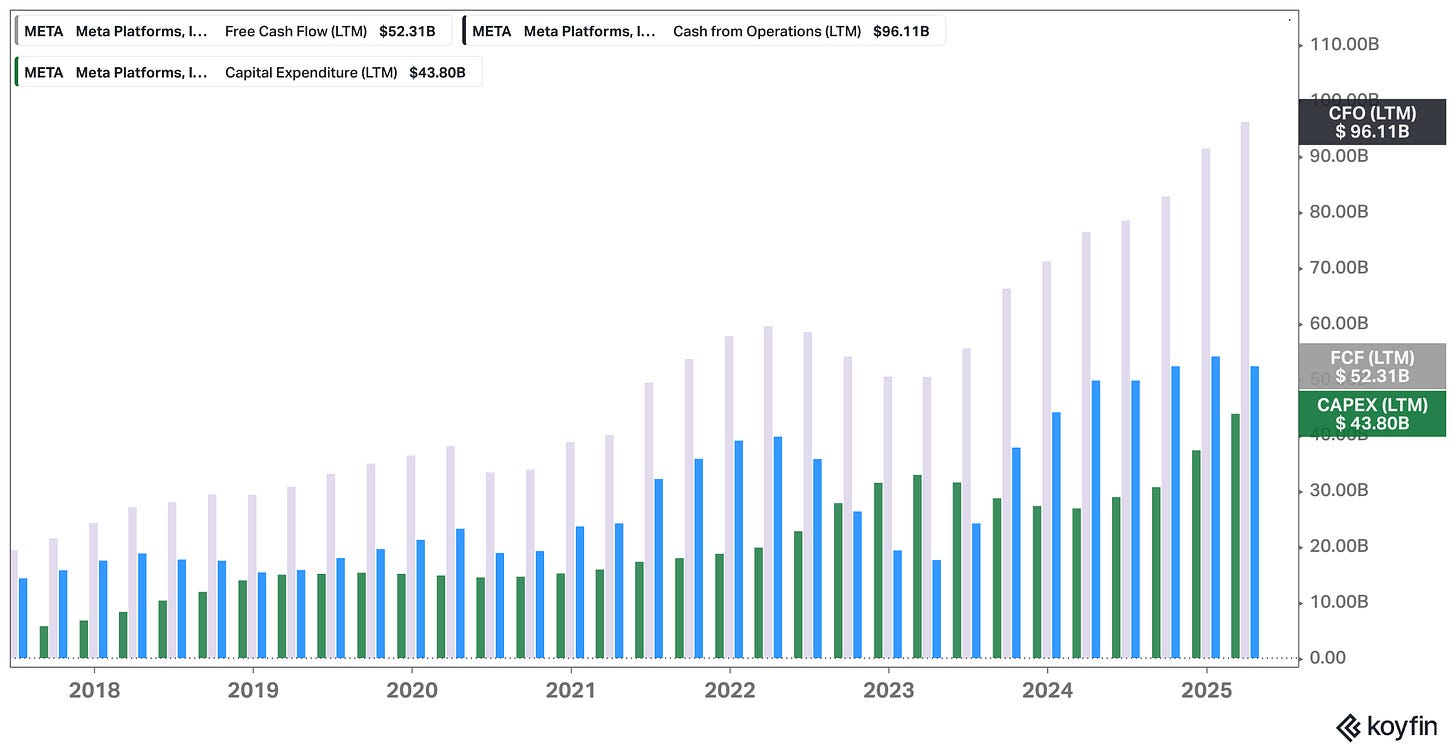

The company spent $29 billion on CapEx activities the past two quarters alone. Capital expenditures are exploding – not tapering. And if management’s guidance is any indication, we’re just getting started.

For full-year 2025, Meta now expects capital expenditures to land between $66 and $72 billion. That’s up $30 billion year-over-year at the midpoint – and we’re not even in 2026 yet. CFO Susan Li made it crystal clear on the call: expect another year of “similarly significant capital expenditure growth” next year. Internally, they’re planning for capex in the neighborhood of $100 billion in 2026 (consensus was $72B), driven by a sharp acceleration in server orders, data center construction, and the infrastructure required to train and deploy their own large language models.

“We certainly expect that we will finance some large, large share of [our FY 26 capex] ourselves. But we're also exploring ways to work with financial partners to co-develop data centers. We don't have any finalized transactions to announce, but we generally believe that there will be models here that will attract significant external financing to support large-scale data center projects that are developed using, you know, our ability to build world-class infrastructure, while providing us with flexibility should our infrastructure requirements change over time. So we are exploring many different paths."

In plain terms: Meta is pouring more money into the ground than ever before. These aren’t small R&D bets or incremental product expansions. These are multi-year, multi-billion-dollar commitments. Think AI chips, internal compute clusters, and the global logistics of running your own hyperscaler.

What’s striking isn’t just the scale of the investment – it’s the velocity. This ramp-up is happening so quickly that Meta’s free cash flow is already starting to look fragile. In Q2, Meta generated $25.6 billion in cash from operations… but burned $16.5 billion in CapEx. Despite a record quarter, the balance sheet is being drained to fund an aggressive infrastructure strategy. And the pace of that drain is only accelerating.

It’s easy to cheer when revenue and EPS go up. But if you're paying attention to how those earnings are being deployed – and how little of that cash is actually sticking – a very different picture starts to emerge.

Zuckerberg’s Second Moonshot: Betting the Farm (Again)

This isn’t the first time Mark Zuckerberg has gone all-in on a future the rest of the world wasn’t quite ready to believe in. Investors still remember the last one. Back in 2021 and 2022, Zuckerberg rebranded Facebook to Meta and plunged billions into what he called the next frontier of human connection: the metaverse.

It was audacious, highly speculative, and in hindsight… more than a little premature. The payoff never came. The hardware didn’t resonate, the use cases were fuzzy, and Reality Labs turned into a running punchline on earnings calls – a black hole for capital with no clear bottom.

That was the first moonshot. And now, here comes the second.

The scale of what Meta is building in AI makes the metaverse spend look almost quaint. This time, the vision is more grounded – at least on the surface. The company is building out one of the largest AI compute infrastructures in the world. They’re ordering servers by the tens of thousands, constructing data centers at a pace usually reserved for governments. Hiring engineers at breathtaking compensation levels – $1 billion in signing bonuses – NBA-superstar-like-salaries –, reportedly, for top AI talent. The capex number for 2026? Almost certainly north of $100 billion. Let me say that again: $100 billion in capital investment – within a single year; that’s the most recent quarter’s operating cash flow annualized.

This isn’t just a reinvestment cycle. This is a bet that Meta’s future depends on owning the stack: the infrastructure, the chips, the models, the inference capabilities – all of it. If the first wave of AI was about leveraging third-party models and renting capacity, the next wave is about control. And Zuckerberg wants that control.

There’s a strategic logic here, no doubt. The major hyperscalers – Microsoft, Google, Amazon – are integrating AI deeply into their ecosystems. Meta doesn’t have a cloud platform to monetize. It doesn’t sell developer tools or enterprise software. If it wants to capture the value of AI, it needs to bake it into its own products: Instagram, WhatsApp, Facebook, Messenger. And it needs to do so on its own infrastructure. That’s the thesis.

But here’s what makes me uneasy: we’ve seen this movie before.

Back then, the metaverse was also pitched as a long-term bet. A necessary evolution. Something that would take time, but eventually redefine Meta’s business. And while Zuckerberg might argue that Reality Labs was a strategic hedge and not a mistake, the results speak for themselves. Years of massive investment, and very little to show for it – at least on the Metaverse front (I understand that a lot of money also went into AI developments that helped Meta reposition considering the TikTok Threat and the ATT developments).

This new bet on AI could be different. It could be the one that hits. But the underlying psychology feels familiar: the belief that scale will create inevitability. That enough money, enough compute, and enough talent will give Meta an unbeatable edge. That if you build the infrastructure first, the payoff will eventually come.

Maybe it will. But if it doesn’t? If the returns lag… or don’t materialize at all… or if AI monetization proves harder than expected? Then we’re looking at another costly detour – only this time, one that threatens to stretch Meta’s cash flow, its balance sheet, and eventually, its valuation multiples.

This is the bet Zuckerberg is making. And like all moonshots, it comes with risk.

The question now is whether investors are fully pricing that risk in – or whether the glow of a perfect quarter has made them forget just how fast capital can evaporate?

Vision vs. Viability

It’s easy to get swept up in the narrative. Meta is printing money again. Its user base is somehow still growing. Margins are expanding. And the company is moving aggressively into what could be the most transformational technology platform since the internet itself. On the surface, it looks like a no-brainer: Meta’s AI investments aren’t a risk – they’re a strength.

But I’d argue the real risk isn’t about whether AI will be big. It’s about whether Meta’s approach to capital allocation is viable over time. There’s a difference between ambition and sustainability. And what we’re watching now is a company that’s rapidly transitioning from a lean, cash-rich ad machine into something much more capital-intensive and operationally complex.

Investors tend to celebrate ambition – especially when it’s wrapped in AI optimism. But the scale of Meta’s spending means this is no longer a story about optionality. It’s a story about commitment. A company can’t spend $100 billion per year on infrastructure and still pretend it's making “strategic bets.” This isn’t a hedge. It’s a transformation.

The math here matters. Even with $25 billion in quarterly operating cash flow, Meta is approaching a level of capital intensity that puts pressure on every other part of the financial stack. Free cash flow is already under strain. The balance sheet has been materially drained in just two quarters. And, maybe most importantly, management has already floated the idea of external financing to support data center buildouts – something unthinkable just a year ago.

"We certainly expect that we will finance some large, large share of [our FY 26 capex] ourselves. But we're also exploring ways to work with financial partners to co-develop data centers. We don't have any finalized transactions to announce, but we generally believe that there will be models here that will attract significant external financing to support large-scale data center projects that are developed using, you know, our ability to build world-class infrastructure, while providing us with flexibility should our infrastructure requirements change over time. So we are exploring many different paths."

The idea that Meta might need to tap the debt markets or bring in partners to co-develop infrastructure should raise a flag. Not because it’s inherently wrong – but because it signals that even a business of this scale can’t internally finance what it’s trying to build.

Of course, some will argue this is what strength looks like. That Meta can afford to spend like this precisely because it’s a dominant platform with huge cash flow and pricing power. And maybe they’re right. Maybe this is just what staying relevant looks like in the AI era: massive up-front investment, followed by years of monetization through better products, smarter ads, and sticky ecosystems.

But I’m not sure it’s that simple. Because when a company reinvests at this level, the bar for future returns gets a lot higher. The tolerance for delay gets shorter. And the margin of error gets thinner. Even a temporary misstep – a delay in monetization, a hardware stumble, a regulatory setback in Europe – could force painful decisions: either cut capex, tap new capital, or watch free cash flow turn negative again.

That’s the part of the story not getting much airtime right now. Everyone’s busy celebrating the results of Q2. Very few are paying attention to the trajectory of the balance sheet – or the growing disconnect between earnings growth and free cash generation.

I’m not calling for disaster. I’m not saying Zuckerberg is wrong to chase AI with everything he’s got. But I am saying this: when you zoom out, this quarter looks less like a financial triumph and more like the beginning of a much riskier phase for Meta’s business. One that could absolutely work – but one that demands a new lens for evaluating the company.

If you’re investing in Meta today, you’re not just betting on AI. You’re betting that the company can thread the needle between vision and viability. That it can spend tens of billions, maintain its cash flow profile, out-execute hyperscaler competition, and find monetization fast enough to keep the flywheel spinning.

I’m not convinced the market fully appreciates how delicate that balance has become.

Great to have a different point of view.

Good read