One of the most intriguing aspects of learning how to invest is that it rarely follows a clear or predictable pattern.

If you’ve ever tried to pick up a new language or learn a musical instrument, you’ve probably experienced a mixture of excitement, frustration, and occasional breakthrough moments that keep you moving forward.

Investing shares these highs and lows, but the stakes feel significantly higher because you are putting real money on the line.

This alone changes the emotional calculus and causes your learning curve to become not just about theoretical knowledge but also about how you respond psychologically to real gains and losses.

In this post, I’ll explore why investing is a personal and evolving journey, shaped by factors like your background, emotional resilience, your social circle, and much mire. I’ll delve into:

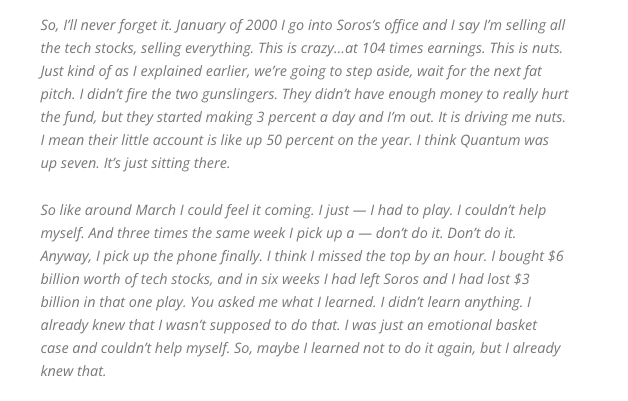

Why Each Investor’s Journey Is Unique: How starting points, financial resources, and personal networks create distinct pathways.

The Non-Linear Nature of Investing Knowledge: Understanding logarithmic and logistic growth patterns.

Key Phases of Development: How beginners, intermediates, and advanced investors learn, adapt, and refine their strategies.

The Role of Real-World Experience and Mentorship: Why weathering a market downturn and seeking guidance can accelerate your progress.

Perception vs. Reality: How we often misjudge our own competence and why that can be risky in investing.

Learning Curves in the Investing World

The concept of a “learning curve” in investing can be understood as the trajectory of how your knowledge, skills, and confidence develop over time.

It includes your ability to understand financial aidn investing concepts and remain emotionally steady in markets that can feel like a rollercoaster.

Perhaps more so than with other skills, the process of learning to invest is deeply intertwined with personal mindset, market conditions, and even luck.

No matter your age or background, it’s important to recognize that the learning journey in investing is less about hitting a “finish line” and more about nurturing a continuous process.

There is always something new to absorb, whether it’s related to business analysis, business valuation, portfolio management, or psychological biases. This means you’re never truly “done” learning.

“Ancora Imparo – I am still learning.” Michelangelo when he was 87 years

Instead, your curve flattens OR steepens at various stages of your trajectory in response to factors which we will discuss further down below.

If you allow yourself to embrace the fact that this journey has no endpoint and is highly personal, you set a healthier expectation and reduce the frustration that comes from not feeling like you need to “arrive” at some point.

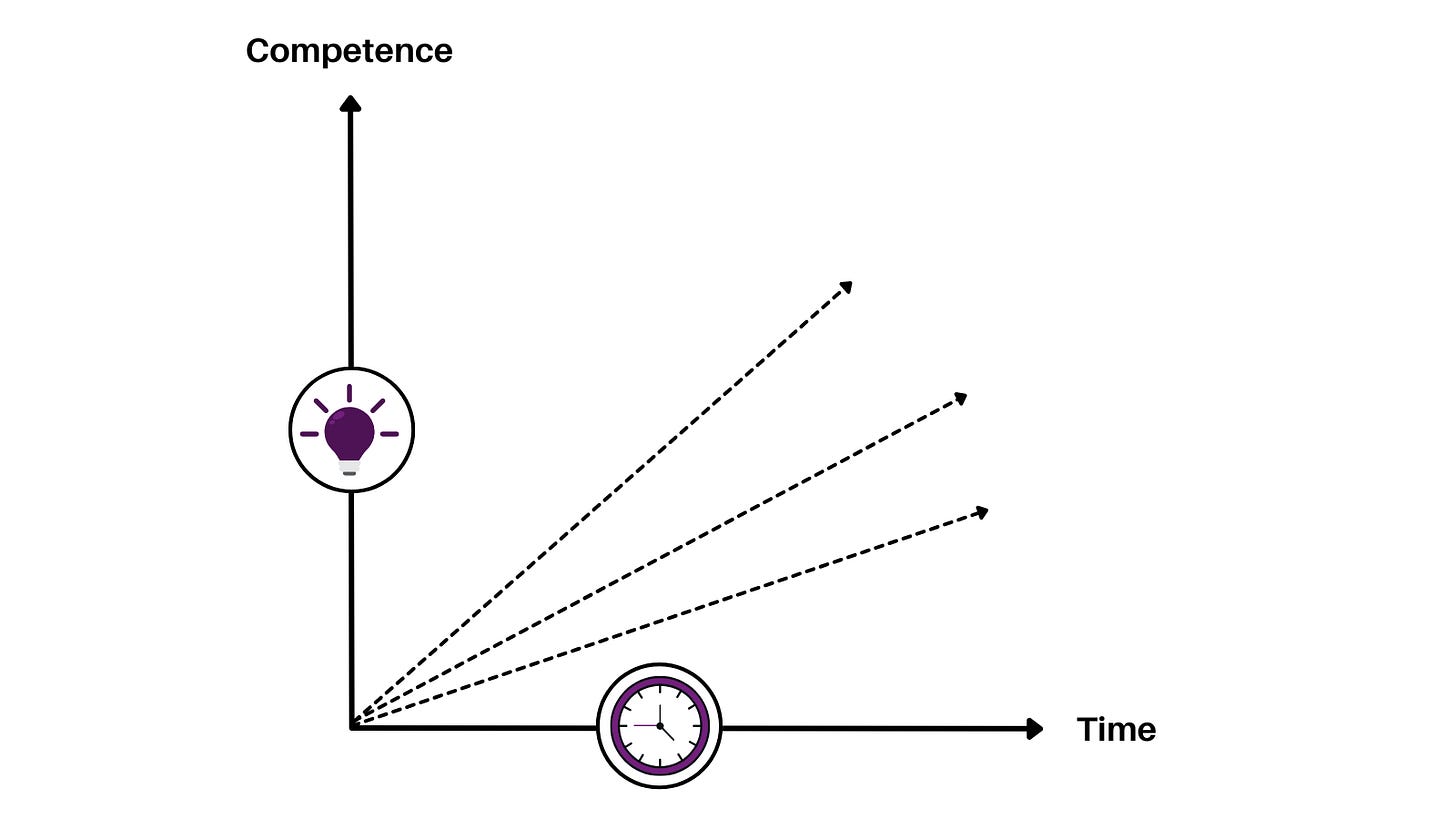

Even Druckenmiller couldn’t handle his emotions during the Dot Com mania: