Kering: A Deep Dive into the Underrated French Luxury Empire

A French luxury empire that few investors seem to follow has caught my attention: Kering. Although it owns several iconic brands—including Gucci, Yves Saint Laurent, and Bottega Veneta—many portfolio managers and individual investors seem to have left Kering off their radar, particularly as the company struggles with declining revenue in some regions and its stock has generated disappointing returns more recently.

In the paragraphs below, you will find a comprehensive exploration of Kering’s recent business performance, the brands under its umbrella, the competitive landscape, Kering’s financials, the relevance of new creative directions at Gucci, and the key risks and opportunities that lie ahead. My goal is that after reading this report, you will have gained a clearer picture of Kering’s position in the global luxury market.

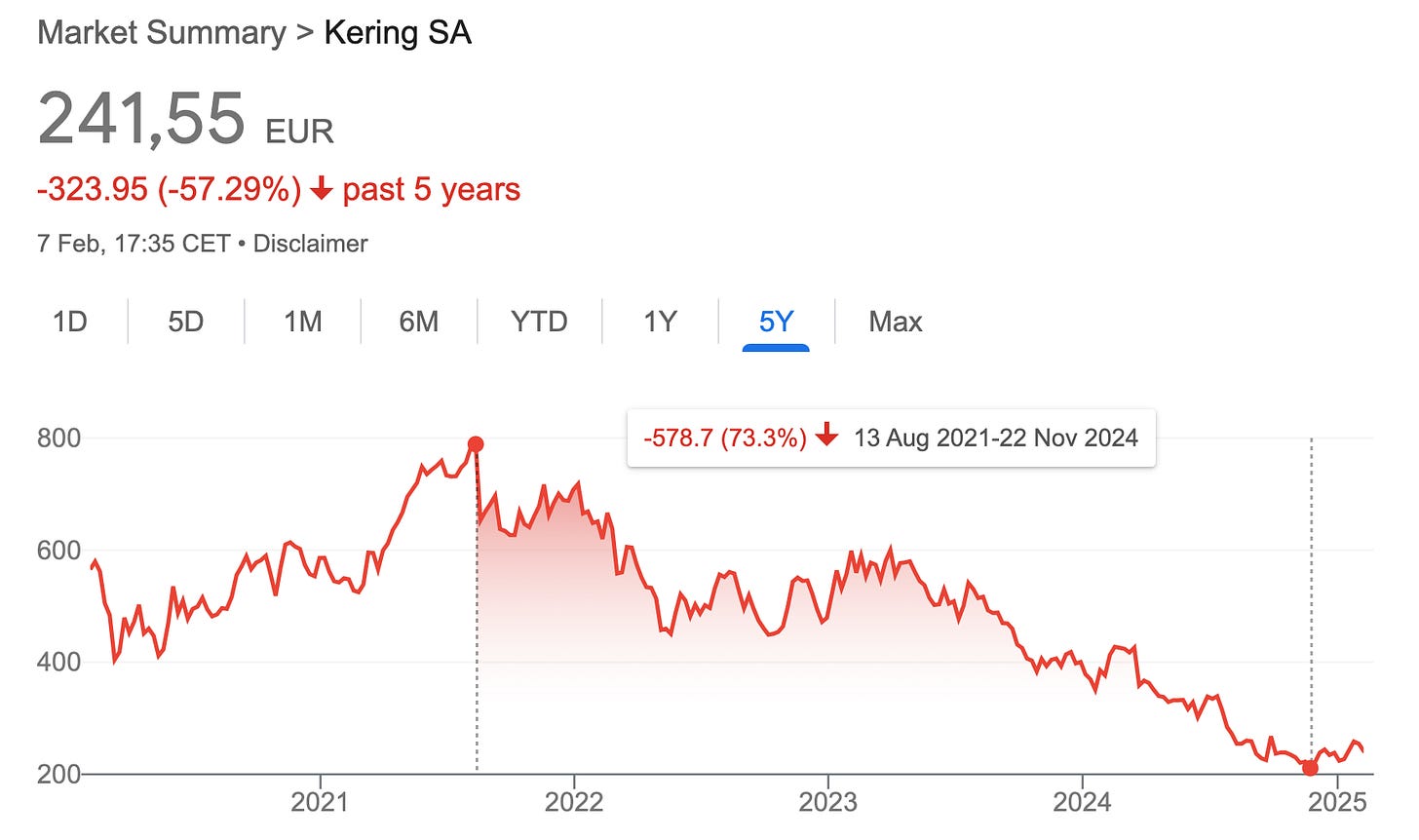

Kering’s Recent Stock Performance and Surprising Long-Term Returns

It may come as a shock to some that over the past five years, Kering’s share price has dropped by around 73% from its prior peak. At the time of this analysis, the stock is trading at 241€/share (down from €789), up 14% from the bottom.

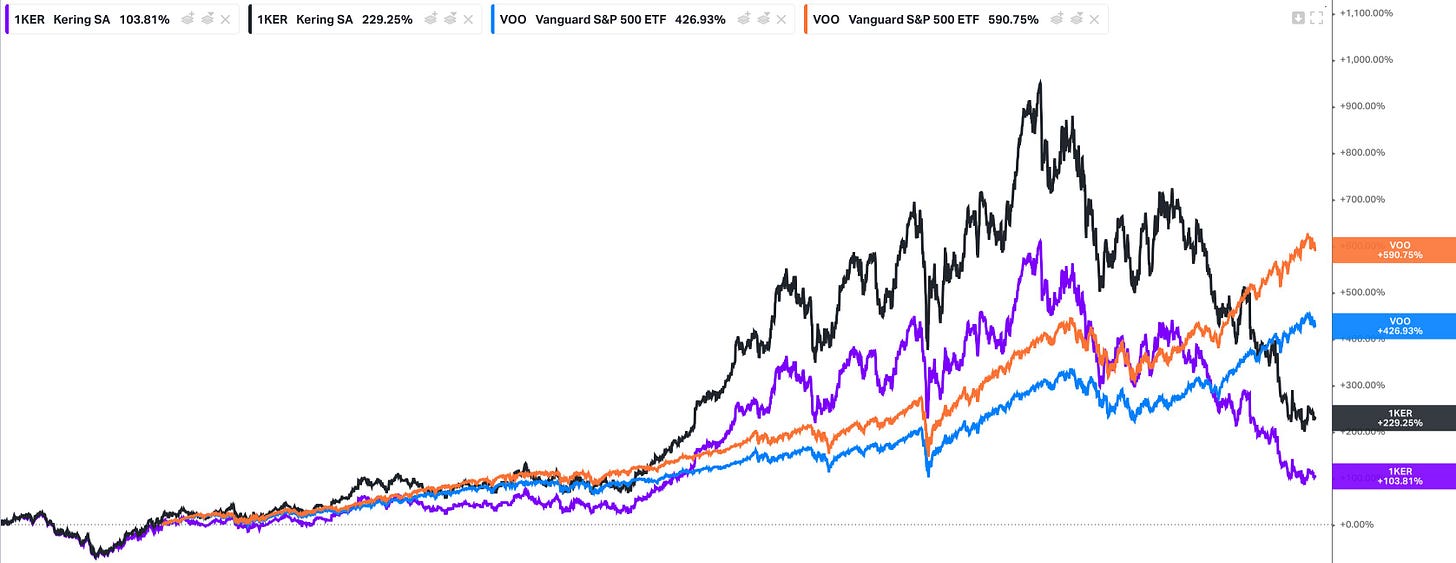

Looking further back—over about 25 years—its share price growth has also been less impressive than one might expect for a stable of powerful luxury brands.

When considering the total return picture, including dividends, the performance does improve somewhat, but it still falls short of what many might anticipate from such venerable brands.

One explanation is that Kering’s business model and brand collection have evolved dramatically over time—especially since 1999, when it first took a stake in Gucci, transforming from a diverse retail holding company (previously known as PPR) into a true multi-brand luxury conglomerate.

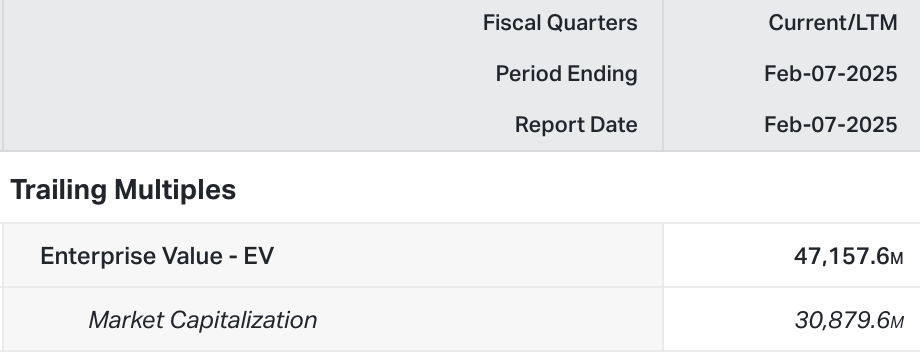

Nonetheless, the current market disappointment is evident. Given that Kering’s overall market capitalization now stands around €31 billion, but its enterprise value is significantly larger (due to considerable debt), investors are questioning whether the company can rekindle momentum and reclaim the lofty multiples that have propelled peers like LVMH and Hermès.

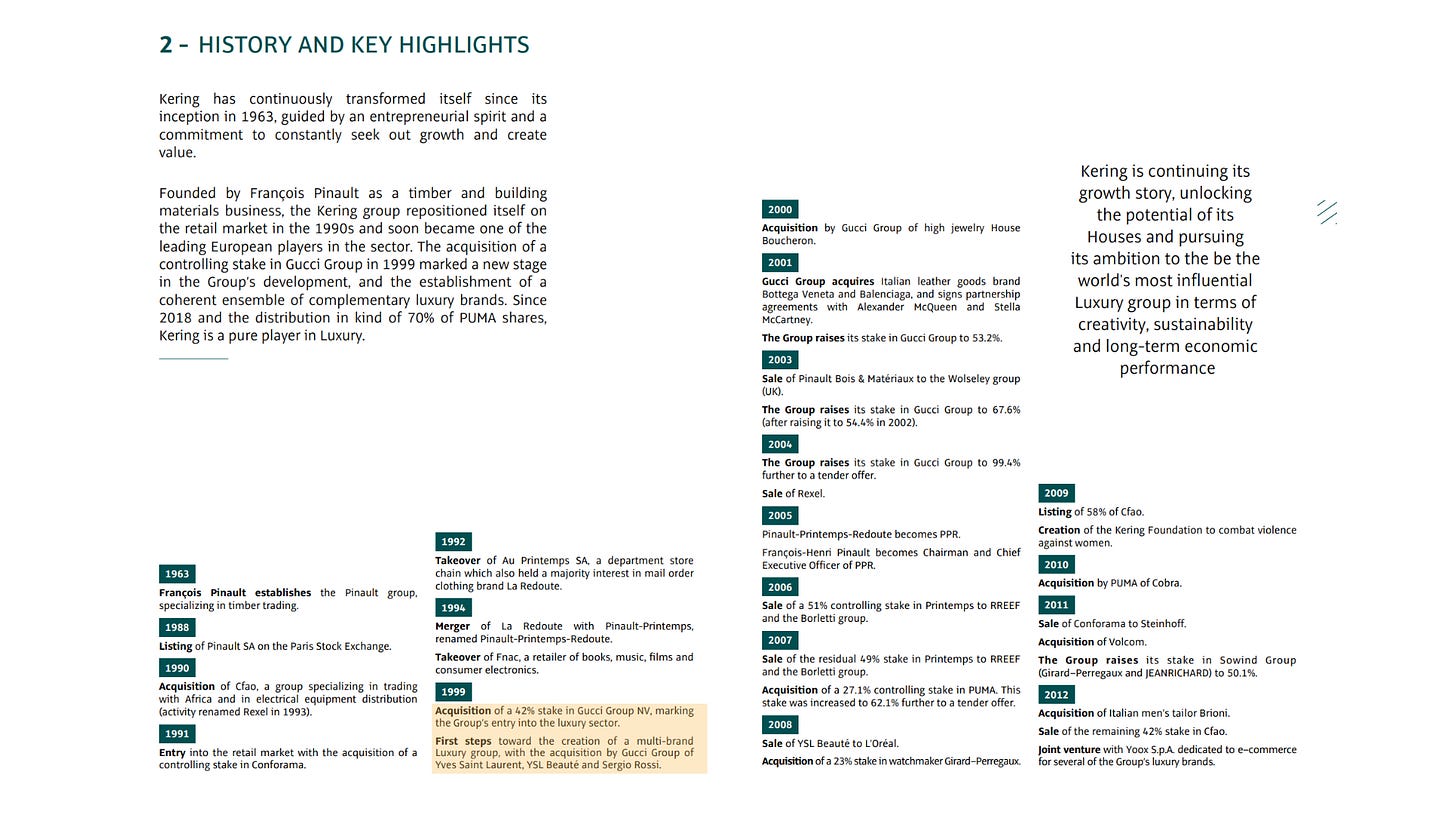

A Short History of Kering and Its Major Brands

Kering's origins trace back to 1963 as a timber trading company (Établissements Pinault), which later diversified into retail before shifting to luxury in 1999 with its Gucci stake. This strategic pivot from a retail conglomerate (Pinault-Printemps-Redoute) to a luxury powerhouse under François-Henri Pinault was more gradual than most realize.

Kering’s transformation began in earnest in 1999, when it purchased a stake in Gucci. Over the years, the group added other fashion houses, eventually narrowing its focus almost entirely to luxury.

The company’s renaming to Kering in 2013 was not just a cosmetic rebranding but a deliberate move to signal its commitment to the luxury sector. The name "Kering" stems from a Breton word meaning "home," symbolizing the group's heritage and long-term vision.

(Source: Kering Investor Relations)

Today, Kering is home to:

Gucci

Yves Saint Laurent

Bottega Veneta

Balenciaga

Alexander McQueen

Several other “houses” that cater to different luxury segments

Kering also acquired a 30% stake in Valentino at a 16x EBITDA multiple (fwiw this doesn’t strike me as paying a crazy-high price for a high-quality asset) …

… and recently purchased the renowned Creed fragrance house. These moves show a continued appetite for expanding its luxury ecosystem, though some analysts and market observers have raised concerns about overpaying for assets like Creed.

From a profitability standpoint, Gucci remains the company’s crown jewel, typically generating the highest share of revenue and an even larger share of profits. Over the last 12 months, Gucci’s operating margin sat around 25%, while Yves Saint Laurent’s margin was about 22%, and Bottega Veneta’s was around 14.5%. The other houses, grouped together, traditionally have lower margins but might offer a longer growth runway—especially as their brand identities continue to mature and attract new audiences.

(Source: Kering Investor Relations - text highlighting and author's comments added)

However, long-term success in the luxury sector demands carefully navigating the fine line between exclusivity and accessibility. More recently, my impression is that Gucci has faced scrutiny for allowing a level of discounting through certain wholesalers—something Hermès, Chanel, and many LVMH labels avoid.

This issue can erode a brand’s hard-earned exclusivity and reduce its pricing power. Consequently, a big part of Kering’s future hinges on restoring Gucci’s image to a status that commands premium prices without diluting brand cachet.