Deep Dive: Wix.com ($WIX)

Is Wix a Buy After the 50% Price Drop? How Wix May Paradoxically Become Stronger in the AI Era

As some of my long-term readers might remember, Wix has been a meaningful part of my investing journey. I first bought shares at around $80, added more below $60, and eventually sold earlier this year. Even though I missed the euphoric peak above $230 in January, my exit was still at a healthy profit. It was never a perfect trade – very few are – but it was a good outcome.

I sold largely for opportunity cost reasons. The valuation felt stretched, the value of cash seemed more than decent, and there were other ideas competing for my capital.

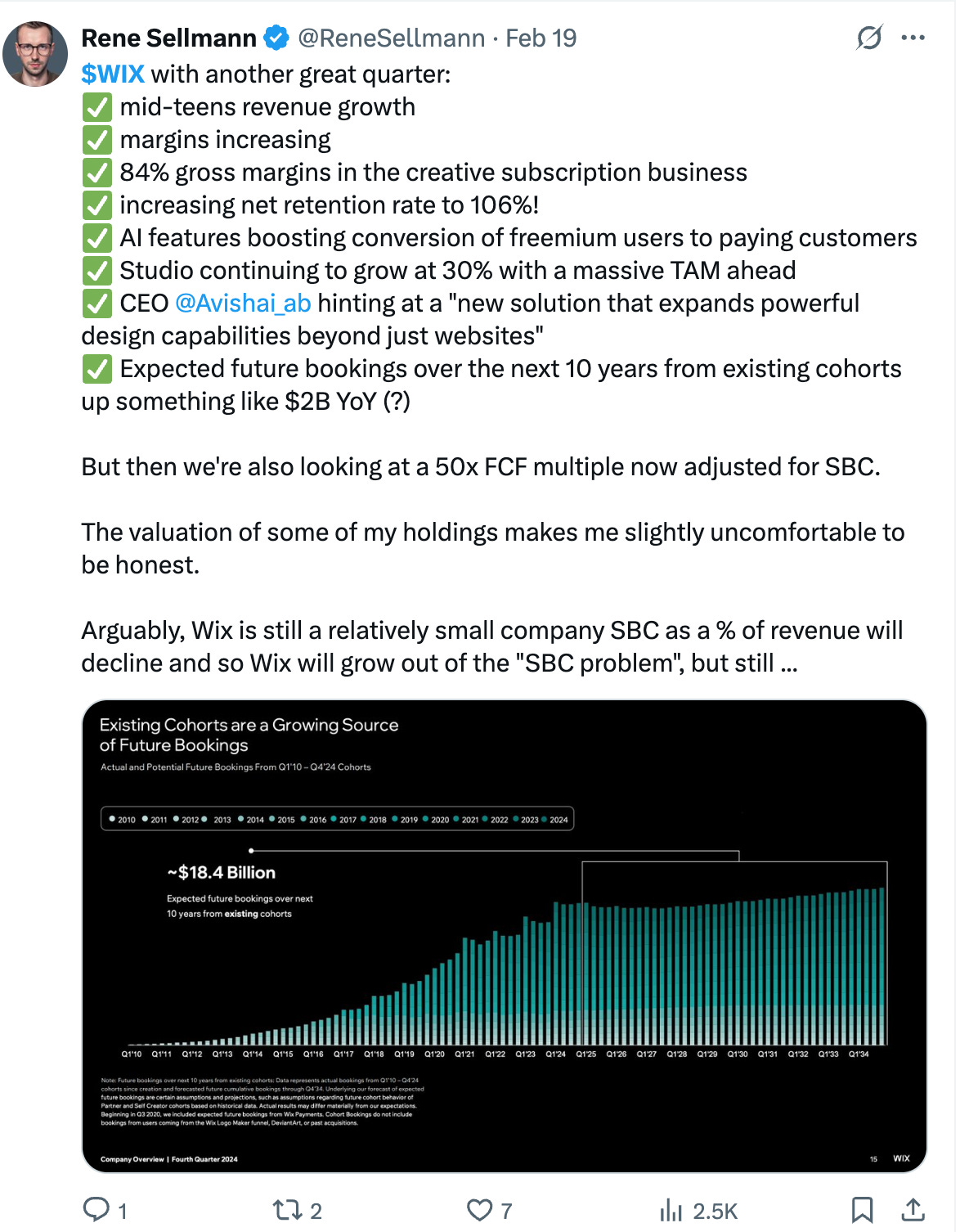

At the time, the fundamentals of the business were firing on all cylinders, which made it harder to part ways, especially in early 2025:

Fast forward to now, and the situation looks very different. Wix has lost nearly half its value since January. Part of that may be company-specific, but I believe much of it reflects a broader selloff in software and SaaS names.

The market’s narrative has shifted dramatically – the AI boom has fueled a belief that “AI will eat all software,” and anything that looks like a traditional SaaS tool has been punished. Wix hasn’t been spared.

The stock recently dipped to around $120, which caught my attention. After all, the fundamentals haven’t collapsed, and the core business still has considerable strengths. The question is whether the market has overcorrected and created an opportunity.

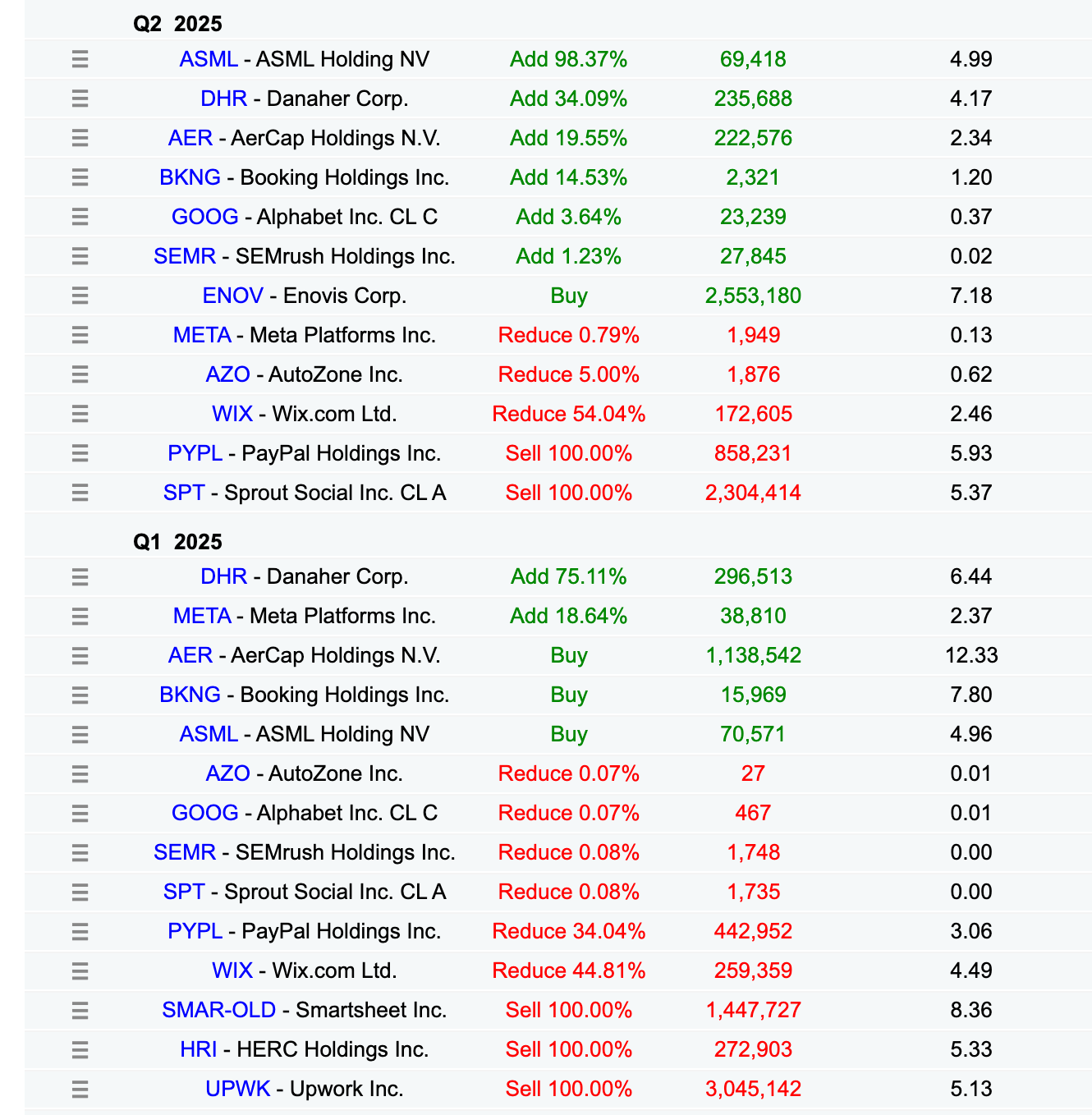

The decision to revisit Wix also comes with a bit of added intrigue: Pat Dorsey, the well-known investor who originally put Wix on my radar years ago (Dorsey first bought into Wix in 2018), has sold his entire position.

For a long time, Wix was one of his largest holdings, and he steadily built it up from 2018 onward. In Q1 and Q2 of this year, he exited completely. When a thoughtful investor like Dorsey, known for his work on moats and business quality, walks away, it forces you to ask hard questions. Is he seeing risks that the market has only started to price in? Or is this simply a case of opportunity cost, similar to my own decision earlier?

That’s the backdrop for this piece. The stock is down 50%, the narrative around SaaS and AI has shifted, and a respected long-term shareholder has sold out. One of my favorite “gurus” to track, Rob Vinall, still owns Wix as of Q2, though. Against that backdrop, I want to bring myself (and you) up to speed on the latest business developments, explore the elephant in the room – the AI disruption risk – and then run the numbers to see whether Wix makes sense at $120 a share.

Here’s the roadmap for today’s 5,000-word analysis:

Recent business performance – a breakdown of the last two quarters, focusing on revenue growth, segment dynamics (Creative Subscriptions, Business Solutions, Partners), profitability, and cash generation.

A Look at new strategic initiatives – the launch of Wixel as an AI-powered design platform and the acquisition of Base44 to expand into app development.

Management’s commentary – key insights from the Q1 and Q2 earnings call Q&A sessions —> the Wixel ambitions, the role of vibe coding, the resilience of the Partner ecosystem, and how AI is shaping the future of websites.

The AI disruption dilemma – an in-depth exploration of how AI could both threaten and enable Wix, and why complexity may turn out to be the company’s strongest moat.

Valuation and return potential – scenario analysis of Wix at $120/share, free cash flow assumptions, expected returns, and how margin of safety considerations shape the investment case.

This is where it gets interesting.

Become a paying subscriber to read the rest of this post and get access to all of my other research, including valuation spreadsheets, deep dives (e.g. LVMH, Edenred, Digital Ocean, or Ashtead Technologies), and powerful investing frameworks.

Annual members also get access to my private WhatsApp groups – daily discussions with like-minded investors, analysis feedback, and direct access to me.

Choose your level of commitment and unlock your next edge.

PS: Using the app on iOS? Apple doesn’t allow in-app subscriptions without a big fee. To keep things fair and pay a lower subscription price, I recommend just heading to the site in your browser (desktop or mobile) to subscribe.