Deep Dive: Alphabet ($GOOG)

Are We Witnessing the End of Google as We Know It in Real Time?

Google has long been the undisputed leader in search, but the landscape is shifting amid the rise of AI-driven alternatives.

Investors are split on whether Google’s search dominance is at risk in the long term. On one side, there’s a “code red” narrative – even Google’s management sounded internal alarms when ChatGPT surged in popularity. Former Google execs warned that an AI chatbot delivering answers directly could make users bypass Google’s ads. This camp fears that if people start relying on AI answers instead of Google Search, the core ad business could erode over time.

On the other side, many believe Google’s moat remains intact and that short-term worries are overblown. The threat from ChatGPT may be overstated and investors should expect Google will adapt and remain fine long-term.

The debate boils down to whether AI chatbots will fundamentally replace the “Google it” habit, or simply complement it.

User’s Search Behavior Is Indeed Evolving

The rapid rise of large language model (LLM) based search tools shows a genuine appetite for new ways to find information. OpenAI’s ChatGPT famously rocketed to 100 million users just two months after launch, making it the fastest-growing consumer app in history.

By late 2024, ChatGPT’s website was attracting around 3.7 billion visits a month – surpassing even Google Chrome’s visit count.

This implies people are using ChatGPT not just as a novelty, but as a regular tool for answers and research.

Other AI search assistants are growing too: for example, Perplexity AI, a chatbot-style search engine, amassed 15 million active users and a ~$50 million revenue run-rate within its first year. New entrants like Elon Musk’s “Grok” chatbot and Bing Chat (powered by GPT-4) are also attracting users by offering a conversational search experience with direct answers and cited sources.

We’re seeing users ask complex questions to ChatGPT or Perplexity – things they might have once broken into multiple Google queries – and getting a single synthesized answer.

This one-stop Q&A appeal is challenging Google’s traditional approach of returning a list of links.

Personally, I now use LLMs not only for creative searches (inspiration or brainstorming) that don't necessarily eat into Google's core business, but could actually expand Google's market because they are complementary searches. But I also do 98% of my information-based searches via LLMs; searches that could be highly monetized by Google's legacy advertising business. For example, just yesterday I "searched" for "How durable are lawn chairs with white polyester backs for outdoor use".

Additionally, younger users are even turning to social platforms for search. Nearly 40% of Gen Z now prefer TikTok or Instagram to search for local spots or advice, bypassing Google entirely. All these trends fuel a narrative that Google’s search franchise could be on the cusp of disruption.

Google’s Numbers Look Great Though!

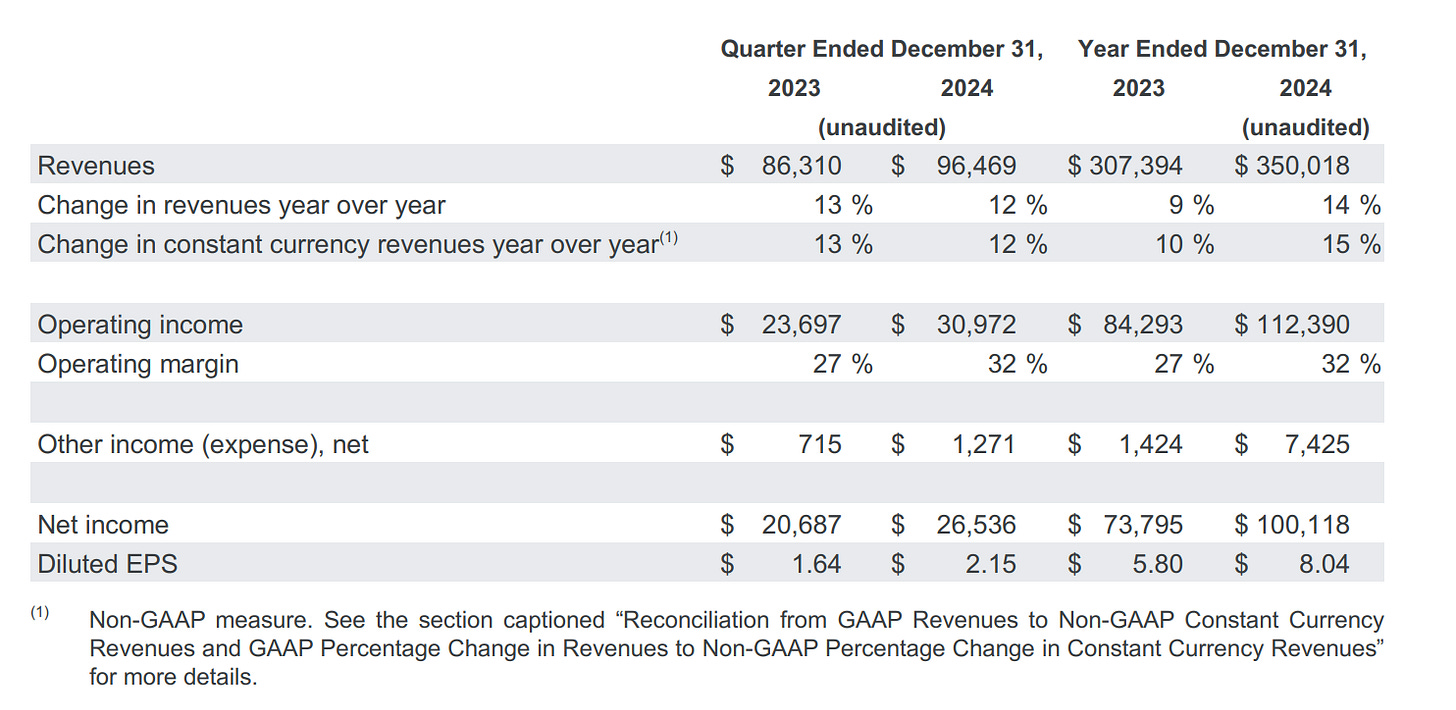

Despite these concerns, Google’s financial metrics remain remarkably strong, which underpins generally positive investor sentiment. In its latest earnings, Google’s core advertising business showed no signs of collapse.

Search advertising revenue continues to grow at a healthy clip – in Q4 2024, Google’s “Search & Other” ad revenue jumped to about $54 billion (up from $48 billion the year prior).

Overall Google Services revenue (which includes Search and YouTube ads) rose 10% year-over-year. Even as AI chat alternatives proliferated, Google’s usage and ad pricing held up, suggesting that advertisers and users haven’t abandoned the platform.

Profitability is also robust: Alphabet’s operating margins expanded to 32%, with net income up 28% year-over-year.

These solid results imply that advertisers still see Google as indispensable, and users are largely continuing their Googling habits for now. Many investors point to Google’s entrenched position – an ~91% global search market share – and its deep resources in AI as evidence the company can navigate the AI upheaval.

In short, is this was a dying business really looks like?

Google’s kingdom isn’t crumbling; at least not yet: it’s growing.

The question is whether today’s strong metrics can withstand the potential gradual erosion if user behavior keeps trending toward new paradigms.

Disclaimer: I still hold Google. It’s a 4.6% position in my portfolio as of today. The stock still trades at a below-market multiple, despite what I would argue is a better-than-average business overall. This valuation cushion is part of what keeps me invested. The risk-reward profile, for me, remains attractive, even though the risk side of the equation has clearly grown in recent years.

Probabilistic Thinking in Investing

Faced with these mixed signals, investors are wise to adopt a probabilistic mindset when evaluating Google’s future.