[FREE] Rob Vinall on Tariffs, EVs, and the Future of Investing in China

Postcards from the Frontlines

Every time Rob Vinall shares a new “postcard,” I read it like an earnings report from the world.

His latest dispatch, reflecting a multi-stop journey through China, Japan, and the US, is a window into business dynamics, geopolitical shifts, and cultural undercurrents that cannot show up in financial statements or spreadsheets – but matter a great deal to investors.

Vinall doesn’t write like a pundit – he writes like a thoughtful capital allocator with boots on the ground. His reflections are more than travel musings. They often foreshadow where the puck might be going.

So below, I’ll unpack seven of the most compelling insights from his latest post, adding some context with charts, etc., and occasionally some thoughts of my own.

1. Trade Wars Are Back – and They’re Dumber Than Ever

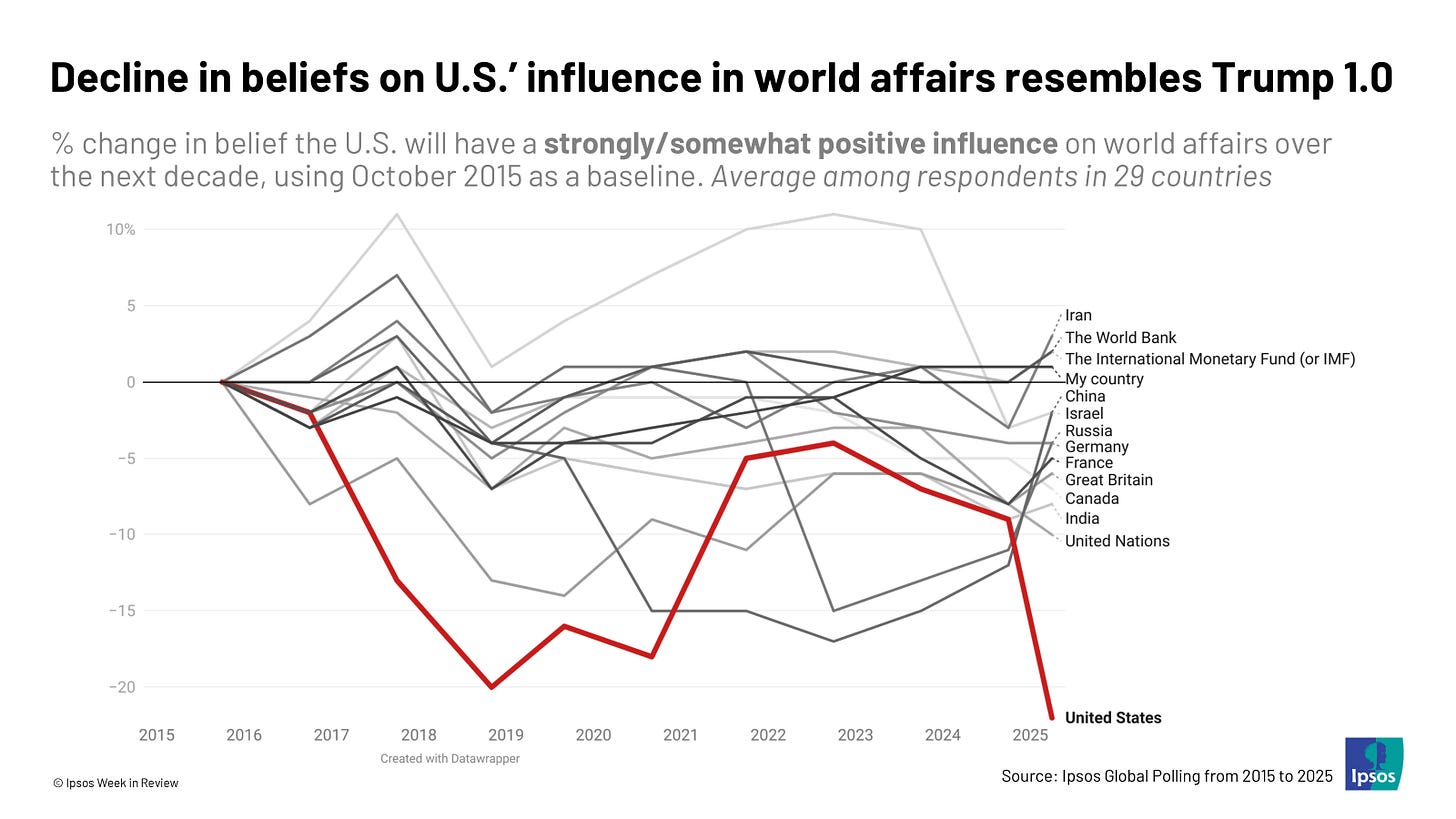

The return of tariffs in 2025 – triggered by what Trump called “Liberation Day” – has reignited uncertainty across global supply chains.

Vinall’s conversations with John Deere executives, an American agricultural and construction equipment manufacturer, highlight a deep contradiction: policies meant to support US industry are leading to investment paralysis.

Multinational businesses can’t plan – and without visibility, they won’t deploy capital.

Vinall puts it bluntly: the idea that we can weaponize trade without collateral damage is flawed. The last time we tried this on a global scale – in the 1930s – it didn’t end well.

Beyond the historical analogy, there's a more immediate risk: the assumption that the US can win a trade war simply because of its economic might underestimates how much leverage the rest of the world still holds.

Many American firms rely on imports for components, talent, and growth. If tariffs are designed to protect them, the actual effect may be to weaken their global competitiveness long term.

“The US has many of the world’s most successful international companies, so they have the most to lose from de-globalisation. And if US companies are insulated from global competitors, they will inevitably lose competitiveness over time.”

China, ironically, looks like a relative winner. Despite initial concerns, the country appears to have digested the first wave of tariffs, adjusted its fiscal and business strategy, and is emerging with more confidence. It is even taking up the mantle of free trade advocate, not out of altruism, but because it has learned to compete globally – and win.

Europe and Japan, meanwhile, find themselves uncomfortably reminded of their dependence on the US (more on this further down below). The mood in both regions – especially Japan – is one of quiet concern about a future where American support can no longer be taken for granted.

The investment takeaway? The trade war isn’t just a headline risk – it’s redrawing the lines of industrial policy and economic alignment. And the US may not be on the right side of this equation.

“If the US perhaps overestimated the extent of its leverage over China, my sense is that the opposite may be the case in the rest of the world.”

2. China’s Post-Covid Pivot Is Surprising – and Making China Investable Again?

Vinall’s commentary on China challenges the dominant narrative. While Western headlines often depict an increasingly closed and hostile China (which Vinall himself described in previous “postcards from China”), his 2025 experience paints a more nuanced picture. After years of draconian Covid controls and economic stagnation, China appears to be pivoting toward a more open and investor-friendly stance.

This shift isn’t just rhetorical. From President Xi’s meetings with business leaders to stories of foreign filmmakers being granted near-total creative freedom, the signs are there.

What’s behind it? Possibly a recognition that economic strength – especially innovation and entrepreneurship – is China’s most credible response to external pressure.

For investors, the implication is critical: the risk-reward tradeoff in China may be far more favorable than perceived. With Western sentiment still skeptical, this is fertile ground for contrarian bets.

“The newfound enthusiasm for business is likely due to the realisation that innovative companies and a thriving domestic economy are the best defence in a trade war. It is too early to say whether this change in direction is cyclical or secular. However, cycles can be self-reinforcing, and I hope the trend towards liberalisation continues.”

Before we dive back in, a quick note…

If you’re finding value here, the paid subscription gives you full access to the archive, portfolio updates, and mental models that sharpen your edge. The Premium plan adds direct access to me and the WhatsApp community—daily conversations, portfolio discucssions, and idea-sharing with thoughtful investors. This isn't just content—it's a toolkit for making better decisions. Choose your edge. A subscription pays for itself in a single avoided mistake.

3. No One’s Boycotting Disney – The Chinese Consumer Isn’t Turning Inward

Vinall’s visits to KFC and Disney Shanghai weren’t just family outings – they were boots-on-the-ground research. Despite political friction, American consumer brands in China seem to be thriving. This runs counter to the narrative that Chinese nationalism would drive a mass consumer rejection of Western products.

This insight matters. In a world obsessed with decoupling, real-world behavior tells a different story. Love for Western brands appears sticky – especially when those brands deliver joy, status, or convenience. That makes a difference when valuing companies like many of the fashion luxury houses, Coca-Cola, or Disney.

Western investors often forget: geopolitical friction doesn’t always translate into grassroots backlash. Chinese consumers aren’t boycotting American culture – they’re standing in line for it.

“Consumers in Canada and Europe reacted to the tariffs by cancelling travel to the US and boycotting US goods. How did Chinese consumers respond? […] They looked more like super fans to me.”

4. The West Is Losing the EV War – and It's Not Just About Subsidies

The most sobering part of Vinall’s trip might be what he saw on Chinese roads. EVs with green license plates vastly outnumber combustion engine vehicles. Didi rides nearly always arrived in EVs. What’s more, the innovation cycle is faster – with Chinese firms treating vehicles like consumer electronics, not traditional industrial products.

This reframing is crucial. It explains why companies like BYD, Nio, and Xiaomi are outpacing legacy Western automakers. They aren’t just swapping out powertrains – they’re rethinking the product from the ground up, using a smartphone mindset.

Tesla, once the disruptor, now risks falling behind – not because it’s failing, but because the pace of change has accelerated.

“Tesla… still sells, by and large, the same models as several years back. Its lineup looks increasingly tired compared to Chinese cars.”

And traditional OEMs? They might not survive the shift at all, especially without software DNA.

5. Japan Is Worried, Europe Should Be Too

Japan came across as quietly anxious in Vinall’s conversations. The trade war, and the broader strategic decoupling between China and the US, has exposed just how dependent Japan remains on the US – not just for exports, but for regional security.

The dynamic isn’t unique to Japan. Many countries in Europe are equally exposed. As Vinall notes, the reality dawning on policymakers is simple: if the US chooses to weaponize its alliances or demand more from its partners, the leverage is there. But that very act of leveraging it may accelerate the search for independence.

The implication for investors is that the post-WWII playbook – where the US underwrites the global order – might no longer hold. And that will ripple through trade flows, currency alignments, and capital markets.

“Overall, the main message I took away was that the trade war brought home to many Japanese how dependent they are on the US and how vulnerable they will be if US support is withdrawn. I suspect most European countries have drawn a similar conclusion.”

6. AI Is Booming in China – and Export Controls Might Be Backfiring

If the US hoped to slow China’s progress in AI by restricting chip exports, the effect may be the opposite. As Vinall writes, scarcity is forcing creativity. Chinese firms are adapting to limited hardware by improving software and optimizing existing architectures. That’s led to breakthroughs, such as Deepseek’s LLM innovations.

This mirrors an earlier dynamic: China’s Great Firewall in the 2000s, meant to limit Western influence, inadvertently created a thriving domestic internet economy. Now, export controls may be triggering the birth of a fully indigenous AI ecosystem.

“Today, the US is building a firewall around China to prevent the diffusion of AI and inadvertently fostering a domestic AI industry.”

This presents a double-edged sword for investors. On one hand, it means China’s AI momentum is real – and possibly investable. On the other hand, it implies that current US firms face long-term competitive risks that are still being priced as geopolitical tail risks rather than operational ones.

7. Chinese Companies Are Just… Better Now

Vinall’s visit to Xiaomi encapsulates something investors are still struggling to grasp: Chinese firms aren’t just cheaper – they’re better, more ambitious, and more vertically integrated – and fwiw this was also always my key takeaway from previous postcards from China written by Rob.

According to Vinall, Xiaomi, for example, now makes over 1,000 SKUs, including high-end home appliances and even EVs, sold through 2,000+ retail stores that resemble Apple Stores on steroids.

This is not about dumping overcapacity. It’s about business excellence – fast product cycles, relentless iteration, and an unmatched work ethic.

And while Western firms rely on regulatory protection (I’m looking at you EU legislators … ;-)) or legacy brand equity, Chinese firms are winning with execution.

That’s not to say Western firms are doomed. But as Vinall warns, absent customer lock-in or true IP, they’re likely to be outcompeted. Investors need to stop seeing China as a low-end manufacturing hub and start seeing it as a high-end, high-stakes rival.

“I am increasingly sceptical that high-end manufacturers in the West can compete with their Chinese counterparts unless they have significant customer lock-in. Many will go the same way as low-end manufacturers in the 2000s and fall by the wayside. One investor friend told me that the Head of BMW China spends most of his time trying to find a Chinese JV partner, tacitly acknowledging this reality.

This is not the end of the world for Western companies. There are plenty of areas where Western companies excel and Chinese companies do not. My lawyer friend told me that Western companies in China and Chinese companies overseas prefer to use international law firms due to the shortcomings of the Chinese legal system. Companies like Disney, LVMH and KFC are also thriving. Disney could and should triple the size of its theme park in Shanghai.”

Final Thoughts – See the World, See the Truth

Vinall closes with a powerful message: “The best investment opportunities arise when companies with great prospects are perceived as having poor ones. It is difficult to think of a place where this is so obviously the case as China today.”

That line stuck with me.

It’s easy to dismiss China, or to focus on the macro noise. But that’s not how fortunes are made. They’re made by digging into reality – and finding mispriced truths.

For me, these postcards are part field report, part forward-looking perspectives by an investor that thinks similarly to the way I do. And this one, in particular, suggests that the edge may lie exactly where most investors refuse to look.

Stay in the loop:

Subscribing is the best way to stay in the loop, sharpen your thinking, avoid costly mistakes, and build long-term success – and to show that this kind of long-term, no-hype investing content is valuable.

Thank you for your support!