Every so often, financial markets encounter a moment when everything seems to come unglued at once. Stocks plunge, bond yields spike, recession alarms ring, and investors scramble for explanations.

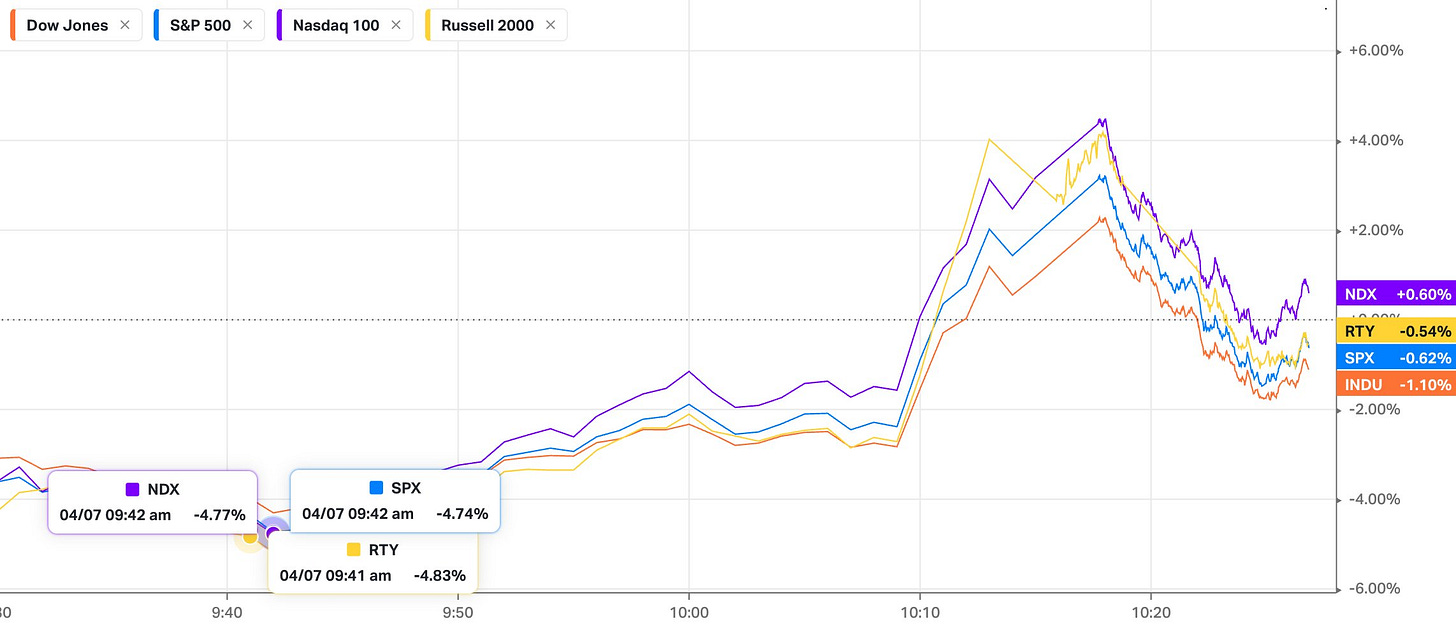

By now, everyone’s probably aware of the 2-day 10% decline of the S&P last week. This week started with the indices pretty much flat, but there was more going on under the hood. We saw broad stock market indices like the S&P ripping 9% in a matter of less than two hours before declining again 5% in a matter of minutes.

That’s not normal.

Similar movements could be observed in other markets:

In a recent appearance on CNBC’s Closing Bell, Jeffrey Gundlach—CEO, CIO, and Founder of DoubleLine Capital—commented on these movements and painted a sobering picture of where markets may be headed.